Market

XRP Price Faces 13% Correction As Investors Pull Back

XRP recently attempted to form a new all-time high (ATH) of $3.40 but failed, retreating to its current price of $3.15. This drop comes amid mounting bearish momentum on the charts.

Investors have further worsened the situation, with declining participation adding pressure to the altcoin’s performance.

XRP Is Facing Pressure

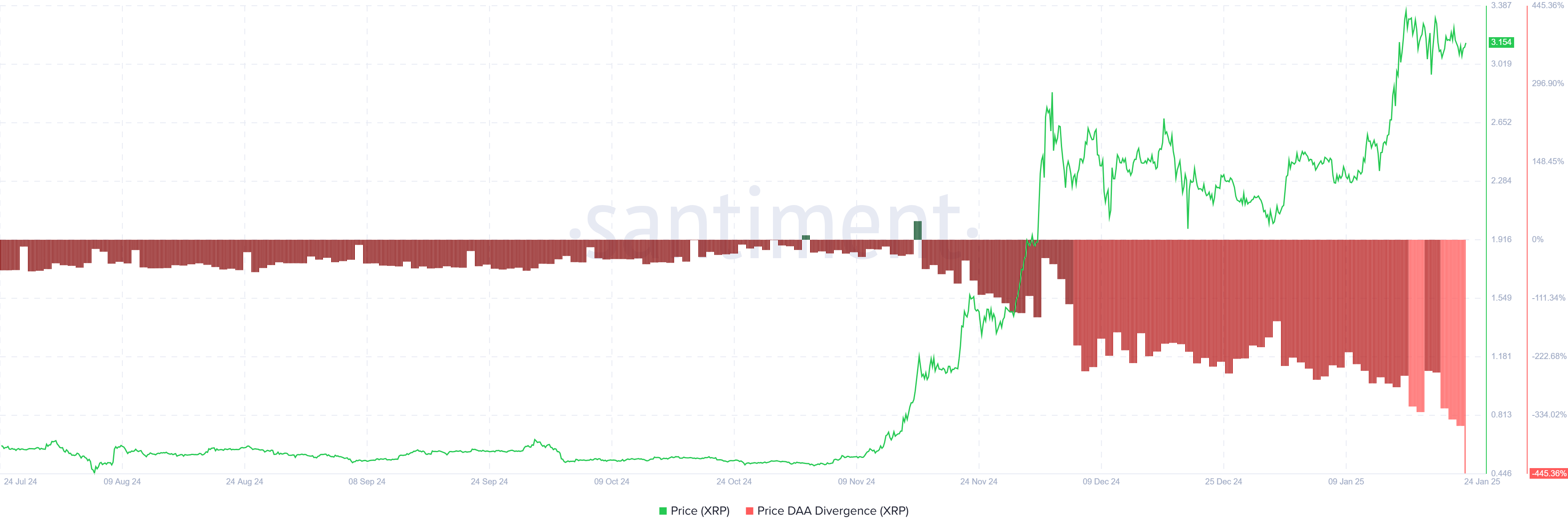

The Price Daily Active Addresses (DAA) Divergence is flashing a clear sell signal, reflecting a decline in investor activity on the XRP network. The reduced transaction volume is a cause for concern, as it highlights diminishing confidence in the altcoin. The presence of red bars on the DAA Divergence indicates a strong sell signal, warning investors of potential price drops.

If investors continue to pull back from network activity, XRP’s price could face increased selling pressure. The lack of strong transactional engagement weakens support levels, making the altcoin vulnerable to sharp corrections. Without renewed interest from participants, XRP’s recovery may remain limited in the short term.

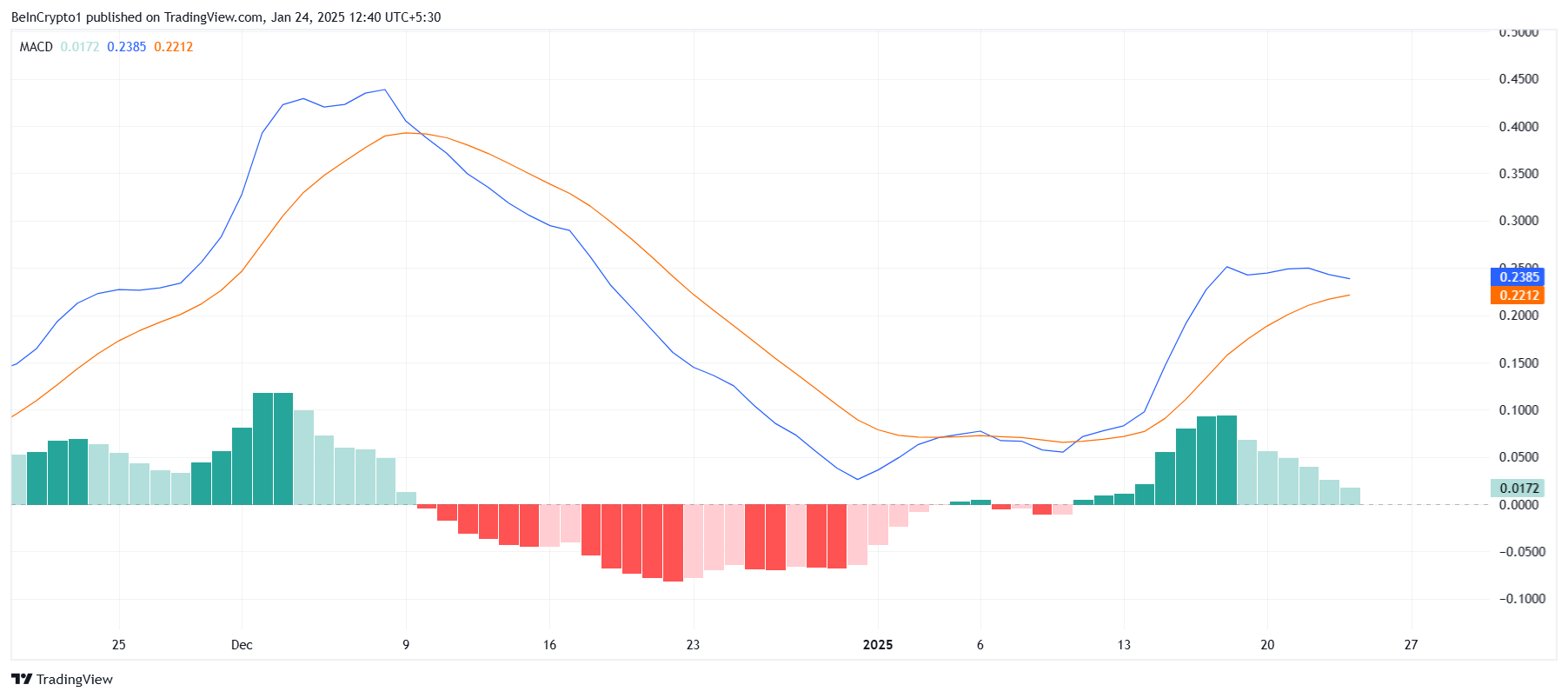

XRP’s macro momentum is signaling further downside risks. The Moving Average Convergence Divergence (MACD) is on the verge of a bearish crossover. This technical indicator suggests that selling momentum is overtaking buying pressure, raising concerns among traders.

Additionally, the histogram bars on the MACD are receding. A drop below the zero line would confirm that bearish momentum has firmly taken hold. This aligns with the broader market trend, which remains uncertain, compounding the challenges for XRP’s price action.

XRP Price Prediction: Breaking Highs

XRP is trading at $3.15 after reaching its ATH of $3.40 earlier this month. Despite several attempts to sustain a rally, the altcoin is struggling to maintain upward momentum. Bearish sentiment and declining investor activity continue to weigh on its price trajectory.

If the bearish factors persist, XRP could decline to its critical support level of $2.73, marking a 13% correction. Failure to hold this support could lead to further losses, potentially pushing the price down to $2.18. Such a drop would erase recent gains, reinforcing the bearish outlook.

On the flip side, if XRP manages to secure $2.73 as a strong support, it could regain its footing. A bounce from this level might enable the altcoin to breach the $3.40 ATH barrier. If successful, XRP could form new highs, effectively invalidating the bearish scenario and reigniting investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

IBIT Saw $1 Billion Inflows in Two Hours

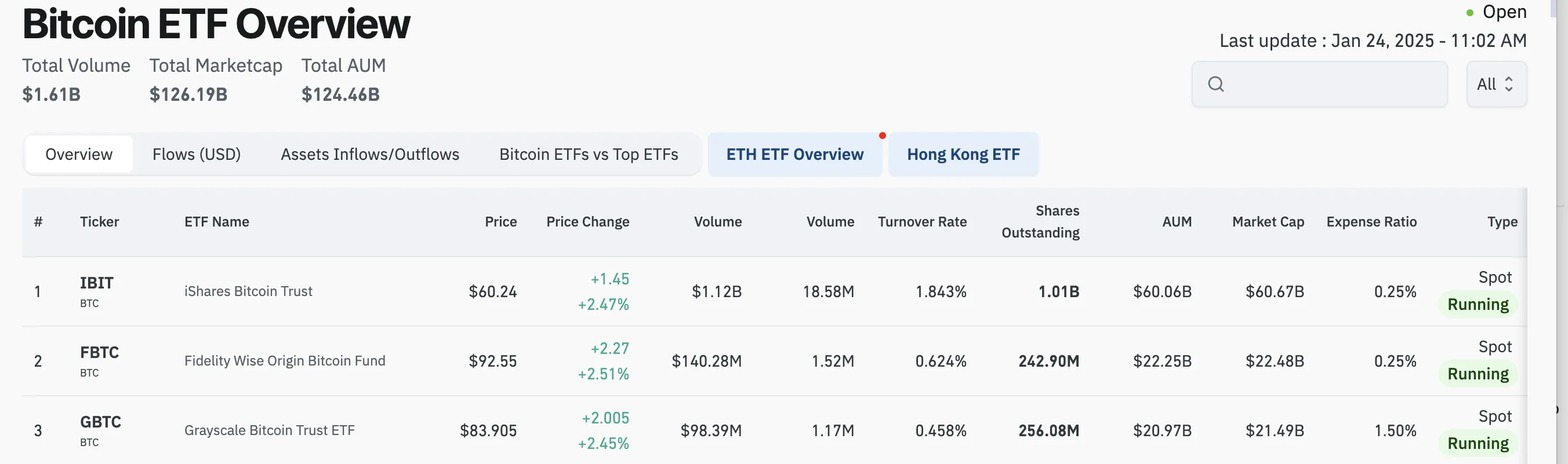

BlackRock’s spot Bitcoin ETF (IBIT) surpassed $1 billion in inflows in the first two hours of trading today. This comes despite record outflows earlier in the month, displaying the product’s dramatic recovery.

Bitcoin ETFs are still significantly ahead of Ethereum-based products, and analysts believe that they will continue dominating even if the SEC approves more altcoin ETFs.

BlackRock’s IBIT Rebounds in Force

IBIT, BlackRock’s Bitcoin ETF, has been performing exceptionally well over the last six months. Despite momentarily seeing record outflows earlier this January, it’s now on route to a strong recovery.

According to Coinglass data, the ETF saw over $1 billion in trading volume during today’s first two hours of trading.

As the above data shows, this rally isn’t isolated to BlackRock or IBIT. Instead, all the Bitcoin ETFs are performing well, likely because BTC has found a strong support level at $105,000.

There were several pro-crypto regulatory developments in the US yesterday. Most notably, the SEC overturned the controversial SAB 121 bulletin, which means banks can now custody Bitcoin without any hurdles. This positive move likely influenced retail investors to crowd the ETF market today.

Also, BlackRock CEO Larry Fink believes institutional adoption will push its value as high as $700,000. ETF analyst Eric Balchunas explained the discrepancy between Bitcoin and all other crypto products:

“The spot bitcoin ETFs quietly on fire to start year, with $4.2 billion in flows which is 6% of all ETF flows. Now at +$40 billion net since launch with AUM at $121 billion and return of 127%. For context, Ether ETFs are like +$130m YTD, which isn’t bad, but this why BTC is on another level and will utterly dominate this category,” he claimed.

Data from Arkham Intelligence also reveals that BlackRock acquired more than $600 million worth of Bitcoin yesterday, allowing it to generate more IBIT shares.

As a group, the ETF issuers have been consistently purchasing huge amounts of Bitcoin. Nonetheless, BlackRock clearly exceeds them in every category.

All things considered, this IBIT trade volume is just one factor in BlackRock’s current ETF success. The firm just released a version of IBIT for Canadian markets. Additionally, NASDAQ ISE recently lobbied the SEC to raise the options trading limits on IBIT.

In any event, BlackRock has once again proved that IBIT is one of the most successful ETFs of all time, not just in crypto. The Bitcoin ETFs have brought monumental inflows of capital to the crypto space, transforming the industry forever.

It may be unclear what the future will hold, but BlackRock has all the tools to respond to many unprecedented market factors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Long Term Potential Remains Extremely Bullish Possibility Of Price At $20

The XRP price is in the spotlight again, as a crypto analyst has shared his short—to long-term prediction for the third-largest altcoin. While the asset has experienced a series of bullish events that have driven its price to its current level, the analyst strongly believes that the cryptocurrency can jump even higher to reach $20.

XRP Long To Short Term Price Prediction

According to a crypto analyst identified as ‘XRP Meesku’ on X (formerly Twitter), the XRP price is gearing up to skyrocket to a new long-term ATH target of $20. The analyst’s bullish outlook for the token stems from its innovative potential, as advanced developments and technological advancements tend to drive price surges in a cryptocurrency.

Related Reading

Notably, the analyst revealed that there has been ongoing speculation that XRP could be pivotal in national banking. He highlighted that many discussions have arisen suggesting that the altcoin could be used as a potential base layer for the United States (US) banking system. If this happens, it could fuel significant growth and adoption for XRP, potentially positioning it as a “global asset that is gaining traction.” Moreover, it could trigger a price increase of $20 ATH for the altcoin.

In the mid-term time frame, XRP Meeksu predicts that the altcoin could potentially hit $8 first before attempting to break past its cycle top. He reveals that his optimistic outlook for XRP was influenced by factors such as new financial products like futures and the ongoing legal challenges with the US Securities and Exchange Commission (SEC). Based on his analysis, the crypto expert suggests that resolving these issues could spark a price rally.

Finally, the analyst shared a short-term price forecast for XRP, highlighting that altcoin is expected to experience significant volatility, leading to price fluctuations. Due to its sharp growth potential, he predicts a surge to $3.6 or higher was possible. Moreover, the X market expert mentioned the increase in significant liquidation trends, underscoring that traders may take a long position after being forced to close due to market fluctuations.

Bullish Factors Driving The Price Surge

While the XRP Meeksu shares his long- to short-term bullish prediction for the XRP price, the analyst also outlines several bullish activities that could drive a potential surge in the cryptocurrency. According to the crypto expert, the XRP market has seen a lot of activity lately, with the price stabilizing despite spikes in whale activity.

Related Reading

Looking at the asset’s past performances, the analyst mentions a notable transfer of $62 million to various crypto exchanges — a movement that could potentially be seen as a sell signal for strategic whale repositioning. Moreover, the CME Group has hinted at launching XRP futures, paving the way for institutional adoption and engagement in the cryptocurrency.

Furthermore, the analyst delved deeper into the lawsuit between Ripple and the SEC, highlighting discussions about potential settlements and the conclusion of the almost four-year legal battle. Despite the lawsuit drama, the crypto expert disclosed that XRP’s overall sentiment remains bullish as analysts project more growth in the future.

He revealed that XRP is showing signs of a price recovery and could soon hit new ATHs. Moreover, its community remains vibrant and active, sharing updates about ongoing scam threats, key events, and more.

Featured image from Adobe Stock, chart from Tradingview.com

Market

TRUMP, ELON Rally, SPX Trades In Green

The latter half of January is shaping up to be politically charged for meme coins, coinciding with Donald Trump’s return to the spotlight. Leading the pack this week is the Official Trump Token (TRUMP).

BeInCrypto has also analyzed two other standout meme coins that outperformed major players, offering insights for investors.

Official Trump (TRUMP)

TRUMP continues to dominate meme coins this week, driven by executive orders and announcements from US President Donald Trump. The token’s name association with Trump has amplified its popularity, attracting investor interest amid the politically charged environment.

The TRUMP token surged by an impressive 167% this week, briefly reaching a new all-time high of $79.34. The rally reflects heightened market enthusiasm, fueled by Trump’s polarizing actions and growing attention to politically-themed cryptocurrencies. However, the token has faced volatility since its peak.

Currently trading at $34.31, TRUMP aims to secure $45.07 as support to sustain its uptrend. Failing to hold this level could push the price down to $26.09 or lower, invalidating the bullish outlook.

Dogelon Mars (ELON)

Dogelon Mars gained significant traction this week due to its association with Elon Musk, now leading Trump’s Department of Government Efficiency (D.O.G.E.). This connection has bolstered the meme coin’s appeal among investors seeking opportunities tied to Musk’s influence in the cryptocurrency space.

ELON’s price surged 82%, reaching $0.0000003512 after successfully holding $0.0000002921 as a support level. This upward momentum positions the coin to target $0.0000004000, reflecting growing confidence in its potential for further gains.

Although price correction seems unlikely in the short term, unexpected sell-offs could push ELON below $0.0000002921. A drop to $0.0000002389 would erase recent gains and invalidate the bullish outlook.

SPX6900 (SPX)

SPX6900, a meme coin associated with the SPX 500 stock market index, has garnered significant attention among investors. The meme coin’s appeal lies in its association with stock market fluctuations, particularly amid heightened market interest since Donald Trump’s presidency. This connection positions SPX6900 as a unique asset in the crypto market.

The token surged by 28% recently, reaching an all-time high (ATH) of $1.77 before retracing to $1.30 at the time of writing. Despite the correction, SPX6900 remains a focal point for traders seeking to capitalize on its rapid price movements. Sustained momentum could lead to a recovery.

If SPX6900 holds its $1.23 support level, it could regain its upward trajectory and potentially surpass its previous ATH. However, losing this critical support might push the token down to $0.91, wiping out recent gains and undermining its bullish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoBinance Labs Rebrands to YZi as Changpeng “CZ” Zhao Returns

-

Market19 hours ago

Market19 hours agoVitalik Buterin Criticizes TRUMP and Political Meme Coins

-

Market23 hours ago

Market23 hours agoScammers Steal $857 Million Using TRUMP Meme Coin Frenzy

-

Bitcoin14 hours ago

Bitcoin14 hours agoNearly $4 Billion Bitcoin and Ethereum Options Expire Today

-

Bitcoin13 hours ago

Bitcoin13 hours agoRipple Challenges Strategic Bitcoin Reserve Plans

-

Market13 hours ago

Market13 hours agoWhat the Signs Say About Its Next Move

-

Regulation18 hours ago

Regulation18 hours agoUS SEC Rescinds Crypto Accounting Rule SAB 121 After Gensler’s Exit

-

Altcoin13 hours ago

Altcoin13 hours agoDogecoin Price Prepares For Monster Rally In Q1, Here’s The ATH Target