Bitcoin

Ripple Challenges Strategic Bitcoin Reserve Plans

Pierre Rochard, Vice President of Research at Riot Platforms, has alleged that Ripple poses the greatest challenge to establishing a Strategic Bitcoin Reserve (SBR).

According to Rochard, Ripple’s resistance stems from its vested interest in promoting central bank digital currencies (CBDCs), designed to operate on Ripple’s infrastructure.

Ripple’s Alleged Opposition to a Bitcoin Reserve

Rochard voiced his concerns on X (formerly Twitter), alleging that Ripple has been extensively lobbying against the SBR initiative. He accused the company of spending “millions” to influence politicians and derail the initiative.

“The biggest obstacle for the Strategic Bitcoin Reserve is not the Fed, Treasury, banks, or Elizabeth Warren. It’s Ripple/XRP,” Rochard’s post read.

He further alleged that Ripple had previously targeted Bitcoin mining during Joe Biden’s administration, asserting that the company aims to protect its marketing narratives and prioritize CBDCs built on its platform.

CBDCs are digital versions of a nation’s fiat currency. Unlike cryptocurrencies like Bitcoin (BTC), which operate on decentralized networks, CBDCs are centralized and controlled by a single authority, such as the nation’s central bank.

Notably, Ripple was quite active in CBDC development. In May 2023, the company launched a dedicated platform to offer assistance in issuing CBDCs and stablecoins.

Rochard suggested that Ripple had hoped former Vice President Kamala Harris would support the implementation of a US CBDC using Ripple’s technology. In the presidential campaign, Chris Larsen, co-founder of Ripple, publicly endorsed Harris.

Reports indicate Larsen contributed over $11 million to political action committees (PACs) supporting Harris. Meanwhile, Ripple CEO Brad Garlinghouse emphasized the company’s bipartisan approach to fostering crypto-friendly policies in the US.

However, Rochard claimed Ripple was caught off guard by Donald Trump’s presidential victory and subsequently intensified its lobbying efforts to influence US policy in its favor.

Trump has been a vocal critic of CBDCs, describing them as tools of “government tyranny.” During his campaign, Trump declared he would “never allow” a CBDC to take root.

On Thursday, he signed an executive order banning the creation and issuance of CBDCs in the United States.

In response to Rochard’s claims, Ripple CEO Brad Garlinghouse dismissed the accusations.

“Unless you are choosing to ignore the core tenets of the POTUS campaign (which aggressively supports American companies and technologies), our efforts are actually INCREASING the likelihood of a crypto strategic reserve (which includes Bitcoin) happening,” the CEO posted on X.

Rochard, however, maintained that any Strategic Bitcoin Reserve should exclusively involve Bitcoin.

“Wanting to add random “cryptos” is anti-SBR,” he stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

BOJ Rate Hike Impact:1929 Stock Market Crash Due for Bitcoin?

The Bank of Japan (BOJ) announced a historic 25 basis point (bp) hike, raising its benchmark lending rate to 0.5%, the highest since 2008.

Though widely anticipated, this move has traders and investors on the edge of their seats, bracing for its impact on Bitcoin and crypto markets in general.

BOJ’s Rate Hike and Global Financial Impacts

The BOJ’s decision marks the third rate hike since early 2024. This signals a shift in Japan’s monetary policy amidst persistently high inflation, projected to remain between 2.6% and 2.8% in 2025.

Accordingly, Japan’s economic growth forecasts have been revised downward, adding complexity to an already volatile financial environment. A stronger Japanese currency resulting from the rate hike could disrupt the yen carry trade.

In the carry trade strategy, investors borrow yen at low interest rates to invest in higher-yielding assets elsewhere. This unwinding could trigger a chain reaction in global liquidity, influencing risk assets, including cryptocurrencies, equities, and commodities.

Following the announcement, Bitcoin dropped 3% but is already attempting a recovery. Ethereum, Solana, Dogecoin, and Cardano also experienced corrections. The sentiment shift is likely tied to President Donald Trump’s executive order for a digital assets stockpile in the US.

The immediate correction suggests Bitcoin’s sensitivity to macroeconomic changes, with investors reducing their exposure to high-risk assets. Nevertheless, some analysts anticipate further downside for Bitcoin once the hype around systemic changes in the US fades.

“Bitcoin could experience a sharp 50% drop,” crypto analyst Financelancelot speculated.

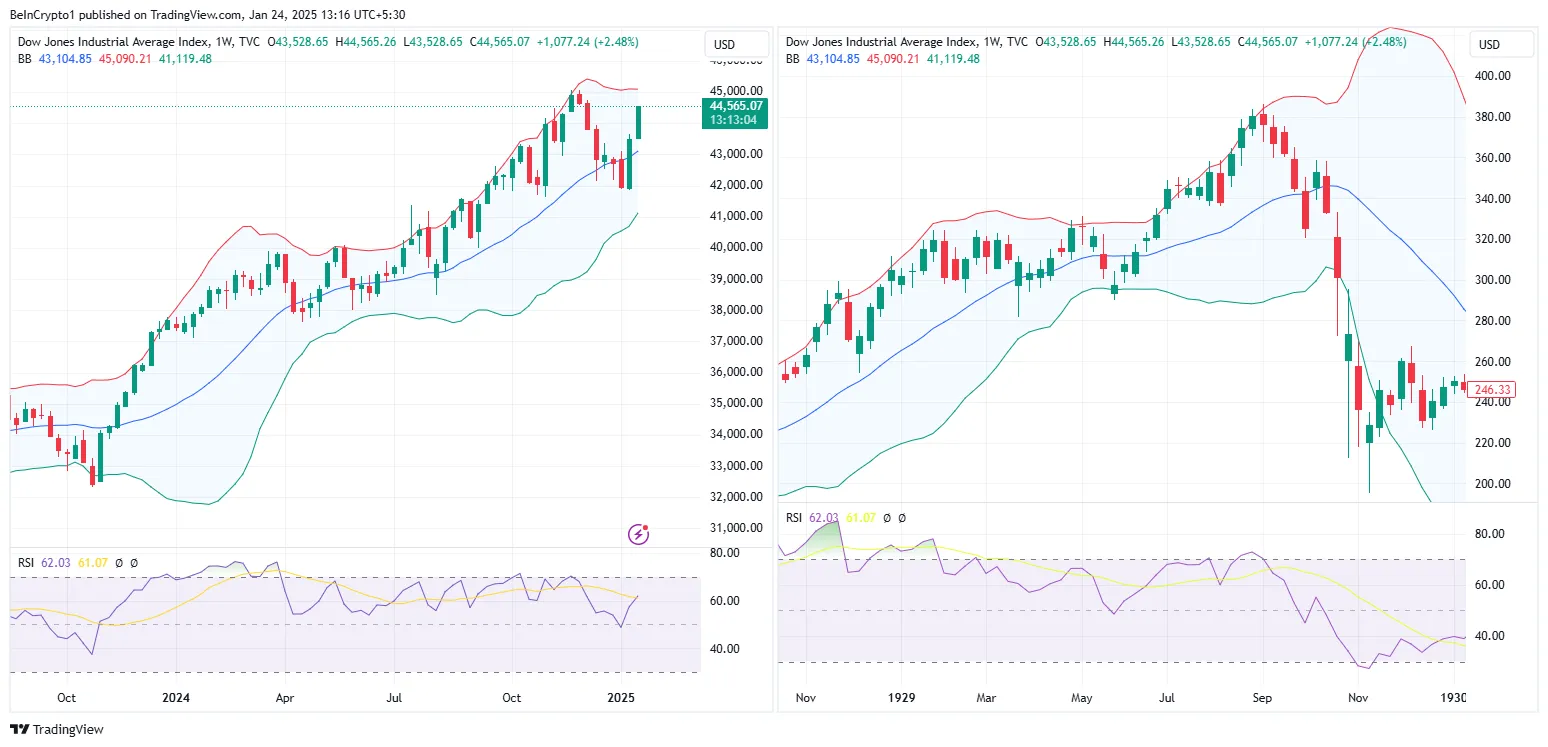

The analyst draws parallels to the 1929 stock market crash, which highlighted the dangers of speculative bubbles. They highlighted striking similarities in technical indicators like the Relative Strength Index (RSI), which currently mirrors those from 1929. With this, the analyst predicts a potential flash crash toward the end of January 2025.

According to Financelancelot, events like the expiration of VIX options and geopolitical tensions could amplify volatility. On the other hand, some voices in the crypto space, like @0xKiryoko, remain cautiously optimistic.

“…global markets are going to feel it. Crypto included. Solana ETFs and a pro-crypto president won’t matter in the short term if liquidity dries up,” she noted.

Meanwhile, the BOJ’s rate hike is not the only factor weighing on the crypto market. Global uncertainties, including US trade policies and geopolitical developments, are adding layers of complexity. Cypress Demanincor, another market analyst, pointed out that the Trump administration’s economic strategies are creating additional volatility.

“Everyone’s attention was on the Trump inauguration for the next major market move when the bigger force to consider is the BOJ interest rate hike,” he said.

As the BOJ’s rate hike takes effect, traders and investors should monitor its implications. Historically, such moves, where there is the reverse carry trade, have led to short-term sell-offs followed by periods of recovery.

“Same thing that happened July 31st, 2024. Short-lived sell pressure and discounted prices that last a few days depending on the size of the unwind. Last time it was about a week’s worth of sell pressure,” Demanincor added.

The current environment reflects the importance of caution and strategic planning for cryptocurrency investors. While the market may face imminent volatility, this could present opportunities to accumulate assets at discounted prices.

“I feel sorry for everyone that got shaken out of the markets over last couple of days because of BOJ concerns, and lack of Strategic Bitcoin Reserve news. You have to have a longer time frame in your mind if you want to be a successful investor. Patience will reward you. Remember, 10 days give us the most gains in the Bitcoin cycle. Good luck timing that,” one crypto investor remarked.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Nearly $4 Billion Bitcoin and Ethereum Options Expire Today

Crypto markets will witness nearly $4 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today.

Market watchers are particularly attentive to this event due to its potential to influence short-term trends through the volume of contracts and their notional value. Examining the put-to-call ratios and maximum pain points can provide insights into traders’ expectations and possible market directions.

Bitcoin and Ethereum Options Expiring Today

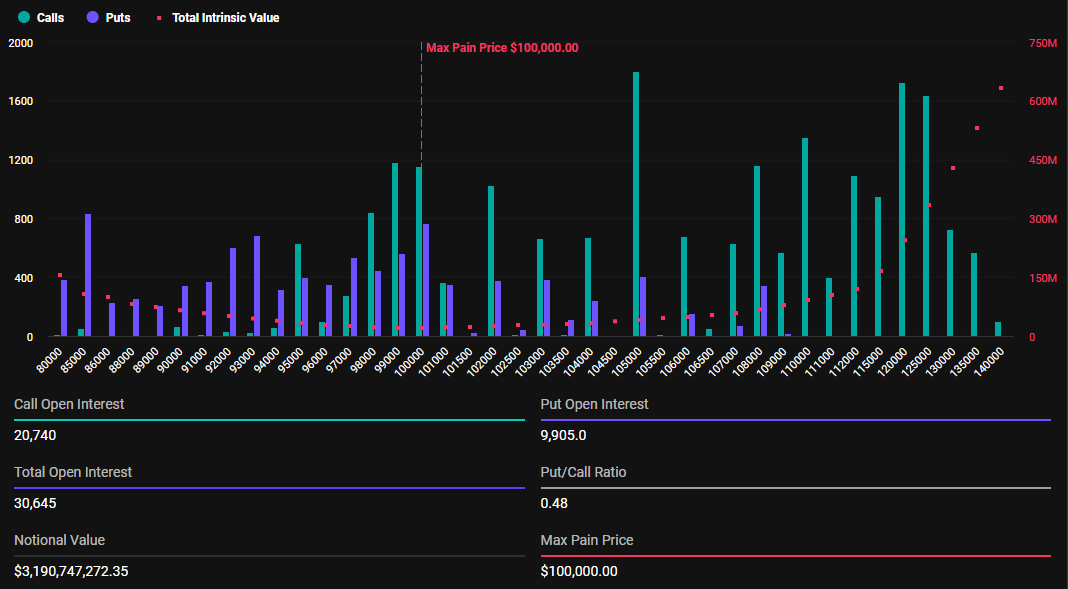

The notional value of today’s expiring BTC options is $3.19 billion. According to Deribit’s data, these 30,645 expiring Bitcoin options have a put-to-call ratio of 0.48. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $100,000. In crypto options trading, the maximum pain point is the price at which most contracts expire worthless. Here, the asset will cause the greatest number of holders’ financial losses.

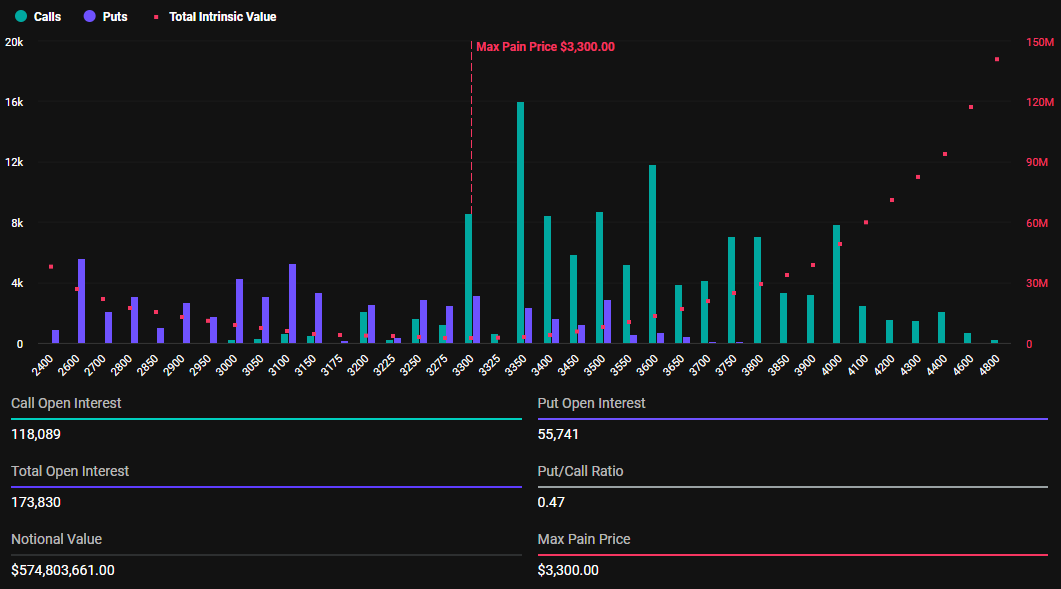

In addition to Bitcoin options, 173,830 Ethereum contracts are set to expire today. These expiring options have a notional value of $574.8 million and a put-to-call ratio of 0.47. The maximum pain point is $3,300.

The current market prices for Bitcoin and Ethereum are above their respective maximum pain points. BTC is trading at $103,388, while ETH sits at $3,305.

“BTC max pain ticks higher, while ETH traders position near key levels,” Deribit observed.

This suggests that if the options were to expire at these levels, it would generally signify losses for option holders.

The outcome for options traders can vary significantly depending on the specific strike prices and positions they hold. To assess potential gains or losses at expiration accurately, traders must consider their entire options position, along with current market conditions.

What the Expiring Contracts Mean for the Market

These expiring contracts come amid President Donald Trump’s executive order to create a digital asset stockpile in the US. If approved, this initiative could include a reserve capturing more crypto assets other than Bitcoin.

Beyond a digital asset stockpile, the president also established a cryptocurrency work group to develop a federal regulatory framework governing digital assets. The US SEC (Securities and Exchange Commission) has also repealed the SAB 121 policy, giving banks the green light to custody crypto.

These developments, coupled with the expiration of the BTC and ETH options, serve as bullish fundamentals that could inspire volatility. Analysts at CryptoQuant reveal an interesting investor outlook that shows comprehensive evaluation is essential before concluding.

“Is this the calm before an impending storm? The market continues to grind lower even after the SEC announced the establishment of a Crypto Regulatory Task Force. BTC has broken below $106,000 and is currently hanging by a thread around the $102,000 level,” the analysts wrote.

Further, the analysts observe increased interest in purchasing options contracts with a strike price of $95,000 for January. This could indicate that traders are seeking protection against potential downside risk as Bitcoin teases with a loss of momentum.

The shift in sentiment from a bullish to a more cautious attitude is attributed to the fluctuating market conditions.

Nevertheless, analysts expect the crypto market to remain range-bound until there is more clarity on how recent economic data, specifically the weak Consumer Price Index (CPI) reading, will impact the Federal Open Market Committee (FOMC) meeting scheduled for next week. This meeting could potentially influence the Fed’s upcoming policy decisions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

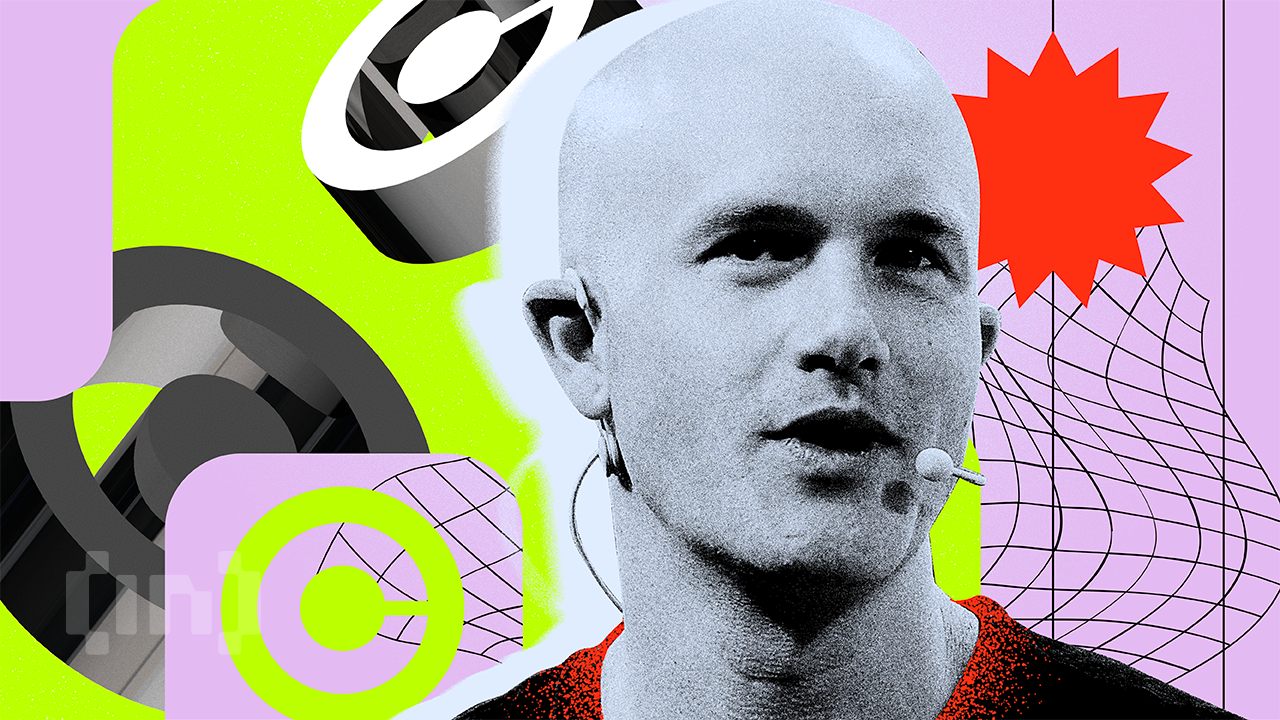

Bitcoin or Gold? Coinbase CEO Makes His Case

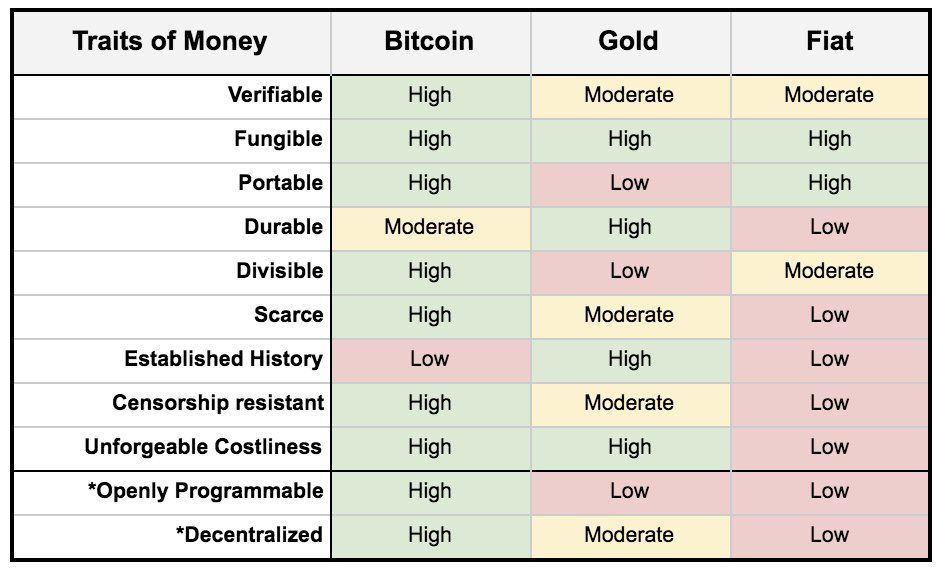

Brian Armstrong, CEO of Coinbase, has called Bitcoin a better form of money than gold, citing its scarcity, portability, divisibility, utility, and performance.

Armstrong’s comments followed the South African Reserve Bank (SARB) Governor Lesetja Kganyago’s opposition to establishing a Strategic Bitcoin Reserve (SBR). Kganyago argued against the notion, questioning Bitcoin’s strategic value as a government-held asset.

Coinbase CEO on Bitcoin vs. Gold

In a recent post on X (formerly Twitter), Armstrong elaborated on Bitcoin’s advantages over gold.

“Bitcoin is a better form of money. It has the decentralization and scarcity of gold, but better divisibility, portability, and (i think) even fungibility. It’s relatively harder to tell if gold is pure, or contains some lead in the middle of the bar,” Armstrong wrote.

He noted that Bitcoin’s market capitalization, approximately $2 trillion, represents 11% of gold’s market cap, which is around $18 trillion. The CEO expressed confidence that Bitcoin’s market cap could surpass gold within the next 5-10 years, eventually making Bitcoin reserves more significant than gold reserves.

Therefore, he argued that countries with gold reserves should consider allocating at least 11% of those reserves to Bitcoin.

“If the US leads here with a Strategic Bitcoin Reserve, I think many of the G20 will follow,” he added.

His detailed post followed the discussion at the World Economic Forum in Davos, where Kganyago expressed skepticism about governments holding Bitcoin reserves.

The SARB governor dismissed the idea of lobbying for a particular asset without strategic intent. Moreover, Kganyago emphasized gold’s historical precedence as a store of value.

“There is a history to gold, there was once a gold standard, currencies were pegged to gold. But if we now say Bitcoin, then what about platinum or coal? Why don’t we hold strategic beef reserves, or mutton reserves, or apple reserves? Why Bitcoin?,” Kganyago questioned.

He described the debate as a public policy issue that requires broader engagement, warning against industries pushing their products onto society.

In response, Armstrong highlighted Bitcoin’s track record as the best-performing asset over the last decade. He emphasized that governments should consider Bitcoin as a store of value and gradually increase their holdings over time.

“It might start with being 1% of their reserves but over time, it will come to be equal or greater than gold reserves,” Armstrong suggested.

Meanwhile, SBR continues to gain traction. States like Wyoming, Massachusetts, Oklahoma, and Texas have introduced bills to adopt Bitcoin as a strategic asset.

Furthermore, at least 15 US states, including Ohio and Pennsylvania, are actively considering measures to establish Bitcoin reserves. President Donald Trump also signed an executive order to create a “national digital asset stockpile.” This move has paved the way for a more formalized approach to integrating digital assets into the country’s financial strategy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoScammers Steal $857 Million Using TRUMP Meme Coin Frenzy

-

Market19 hours ago

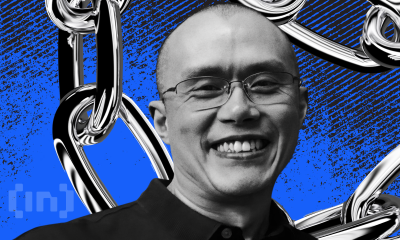

Market19 hours agoBinance Labs Rebrands to YZi as Changpeng “CZ” Zhao Returns

-

Market18 hours ago

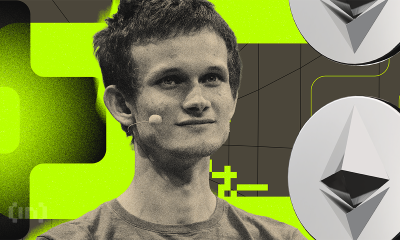

Market18 hours agoVitalik Buterin Criticizes TRUMP and Political Meme Coins

-

Bitcoin24 hours ago

Bitcoin24 hours agoBitcoin Won’t Topple the US Dollar, Goldman Sachs CEO Says

-

Market24 hours ago

Market24 hours agoLeading Altcoins on January 23: MANTRA, ANIME, and ELON

-

Market23 hours ago

Market23 hours agoADA Price Under Pressure with Death Cross Formation Ahead

-

Market21 hours ago

Market21 hours agoFARTCOIN Price Plummets After AI Agent Cashes Out $25M

-

Market20 hours ago

Market20 hours agoSOL Price Retreats 14.5% While Whales Hit New Peak