Market

Vitalik Buterin Criticizes TRUMP and Political Meme Coins

Ethereum co-founder Vitalik Buterin posted a cautionary screed about TRUMP, political meme coins, and the current state of the crypto industry.

He noted that Gensler left a regulatory loophole in differentiating governance tokens from securities, which has ushered in a wave of bad actors.

Buterin vs TRUMP: Fighting for Crypto’s Future

Vitalik Buterin, the co-founder of Ethereum, has displayed a growing anxiety about TRUMP and other political meme coins. In a lengthy social media post, Buterin highlighted a long-form vision of the crypto industry, claiming that “we have been entering a new order” for the last year.

He noted that crypto’s institutional acceptance has allowed bad actors to flourish:

“Now is the time to talk about the fact that large-scale political coins cross a further line: they are not just sources of fun, whose harm is at most contained to mistakes made by voluntary participants, they are vehicles for unlimited political bribery, including from foreign nation states,” Buterin claimed.

For Buterin, the launch of TRUMP was a watershed moment. Nearly 94% of tokens are held by 40 wallets, and scammers have already stolen close to $1 billion, leveraging the hype around TRUMP and MELANIA.

Typically, US Presidents cannot conduct private business in office. Therefore, Trump’s meme coin has created huge concerns, even outside the crypto industry.

However, Buterin did not lay all the blame upon Trump or any other high-profile meme coin issuer. He noted that former SEC Chair Gary Gensler created a loophole in securities laws by designating governance tokens as a potentially separate concept.

In Buterin’s view, Gensler “must never be christened as a hero, even among crypto skeptics,” due to this loophole.

The former SEC chair was widely criticized and despised by the crypto industry for his regulatory crackdowns, even after approving a Bitcoin ETF. Gensler never provided regulatory clarity or closed down the loopholes in current regulations.

However, with the benefit of hindsight, Buterin claims that crypto’s response of “part compliance, part rebellion” led directly to TRUMP. Still, he does see a way forward.

“There is a bright future of capital allocation mechanisms that can be built. Potentially, we can come up with ways to ensure alignment with community wishes as well as safeguarding important values like privacy, security, open standards and open source. Acceleration is coming either way; it is our task to choose the brightest possible vector,” he finished.

Buterin noted that the entire DeFi community has a responsibility to educate newcomers about long-term fulfillment and wealth-building, return towards honest token-based fundraising, and proactively defend the space against this self-destructive market logic.

He suggested a “techno-optimist” d/acc or “defensive acceleration” philosophy to move forward.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

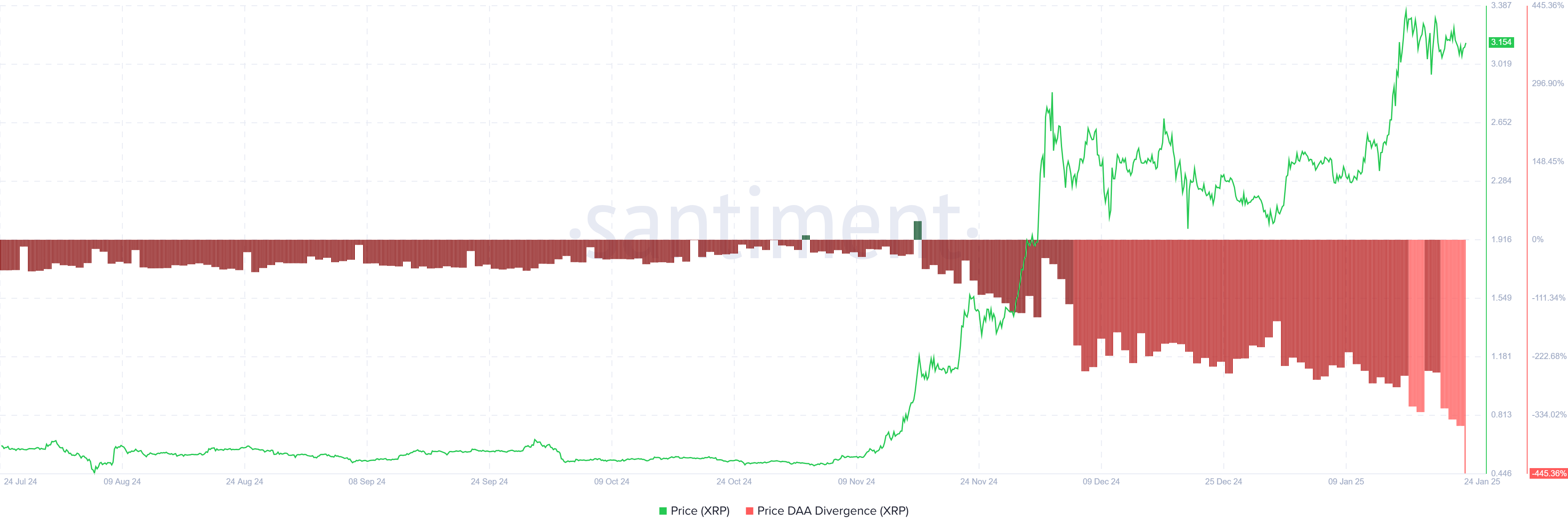

XRP Price Faces 13% Correction As Investors Pull Back

XRP recently attempted to form a new all-time high (ATH) of $3.40 but failed, retreating to its current price of $3.15. This drop comes amid mounting bearish momentum on the charts.

Investors have further worsened the situation, with declining participation adding pressure to the altcoin’s performance.

XRP Is Facing Pressure

The Price Daily Active Addresses (DAA) Divergence is flashing a clear sell signal, reflecting a decline in investor activity on the XRP network. The reduced transaction volume is a cause for concern, as it highlights diminishing confidence in the altcoin. The presence of red bars on the DAA Divergence indicates a strong sell signal, warning investors of potential price drops.

If investors continue to pull back from network activity, XRP’s price could face increased selling pressure. The lack of strong transactional engagement weakens support levels, making the altcoin vulnerable to sharp corrections. Without renewed interest from participants, XRP’s recovery may remain limited in the short term.

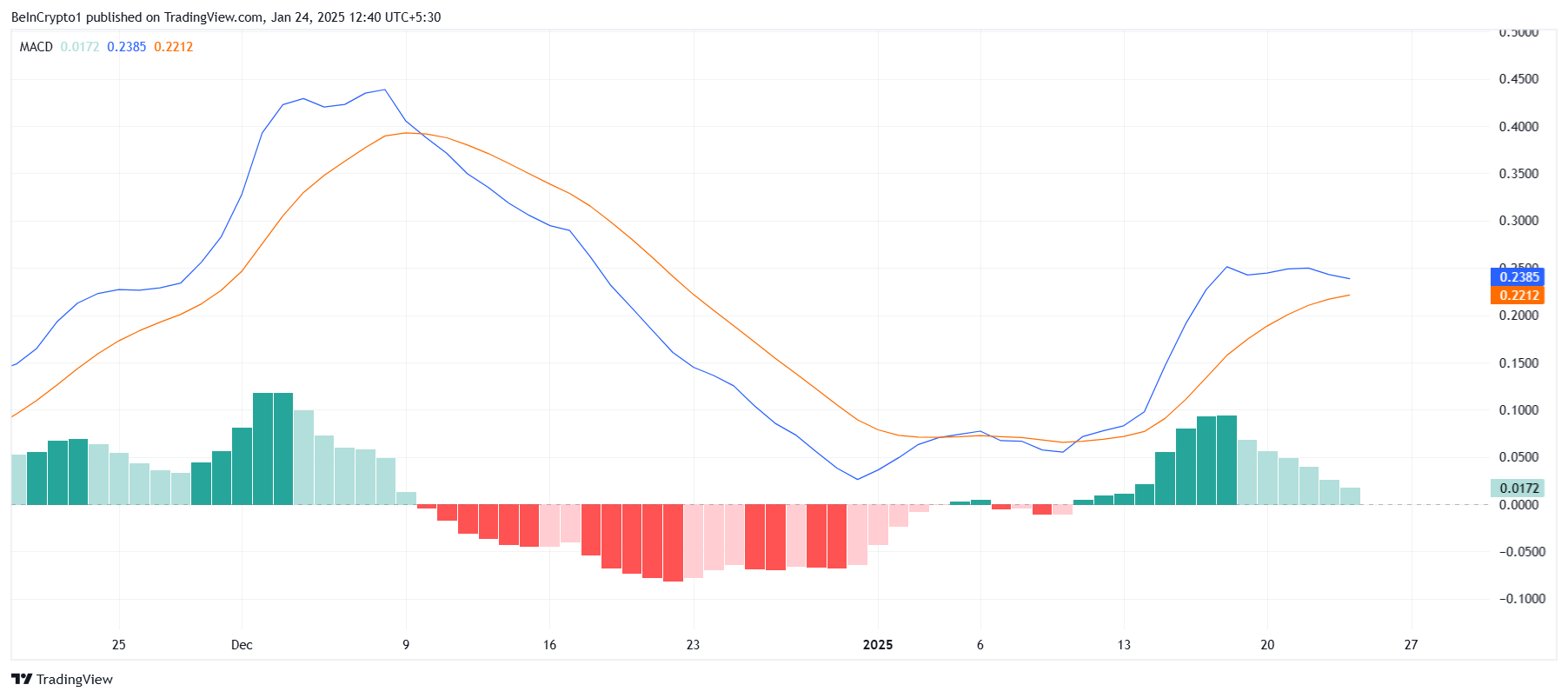

XRP’s macro momentum is signaling further downside risks. The Moving Average Convergence Divergence (MACD) is on the verge of a bearish crossover. This technical indicator suggests that selling momentum is overtaking buying pressure, raising concerns among traders.

Additionally, the histogram bars on the MACD are receding. A drop below the zero line would confirm that bearish momentum has firmly taken hold. This aligns with the broader market trend, which remains uncertain, compounding the challenges for XRP’s price action.

XRP Price Prediction: Breaking Highs

XRP is trading at $3.15 after reaching its ATH of $3.40 earlier this month. Despite several attempts to sustain a rally, the altcoin is struggling to maintain upward momentum. Bearish sentiment and declining investor activity continue to weigh on its price trajectory.

If the bearish factors persist, XRP could decline to its critical support level of $2.73, marking a 13% correction. Failure to hold this support could lead to further losses, potentially pushing the price down to $2.18. Such a drop would erase recent gains, reinforcing the bearish outlook.

On the flip side, if XRP manages to secure $2.73 as a strong support, it could regain its footing. A bounce from this level might enable the altcoin to breach the $3.40 ATH barrier. If successful, XRP could form new highs, effectively invalidating the bearish scenario and reigniting investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What the Signs Say About Its Next Move

Ethereum price is consolidating above the $3,180 support. ETH must clear the $3,350 resistance zone to start a fresh increase in the near term.

- Ethereum started a fresh increase from the $3,180 support zone.

- The price is trading above $3,250 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $3,280 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start another increase if it stays above the $3,220 support level.

Ethereum Price Breaks Resistance

Ethereum price started a decent upward move from the $3,180 level, beating Bitcoin. ETH was able to surpass the $3,220 and $3,250 resistance levels.

There was a break above a key bearish trend line with resistance at $3,280 on the hourly chart of ETH/USD. The pair even surpassed $3,300 and tested $3,350. A high was formed at $3,346 and the price is now moving lower. There was a move below the $3,320 and $3,300 support levels.

The price dipped below the 23.6% Fib retracement level of the upward move from the $3,181 swing low to the $3,346 high. Ethereum price is now trading above $3,250 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $3,350 level. The first major resistance is near the $3,370 level. The main resistance is now forming near $3,450.

A clear move above the $3,450 resistance might send the price toward the $3,500 resistance. An upside break above the $3,500 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,550 resistance zone or even $3,580 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $3,350 resistance, it could start another decline. Initial support on the downside is near the $3,260 level. The first major support sits near the $3,220.

A clear move below the $3,220 support might push the price toward the $3,180 support. Any more losses might send the price toward the $3,120 support level in the near term. The next key support sits at $3,050.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,250

Major Resistance Level – $3,350

Market

Senator Warren Demands Investigation Into Trump Meme Coins

In a letter to US regulators, Senator Elizabeth Warren and Representative Jake Auchincloss expressed serious concerns over the TRUMP and MELANIA meme coins launched by President Donald Trump and First Lady Melania Trump.

These coins, which were introduced shortly before Trump’s inauguration, have raised alarm bells regarding their potential for conflicts of interest, market manipulation, and foreign influence.

Warren Warns of Market Manipulation and Foreign Influence

The TRUMP coin has already experienced extreme price fluctuations, skyrocketing from under $10 to $75 before crashing back to $32.44 at press time. Similarly, the MELANIA coin has followed the same volatile trajectory.

Senator Warren highlighted the risks posed to consumers who invest in these meme coins. The coins are primarily driven by internet trends and are known for their unpredictable, speculative nature.

One of the most significant concerns is the potential for these coins to be used as tools for foreign influence. Warren pointed out that anyone can purchase these coins. Thus, raising the risk that foreign governments or individuals could use them to indirectly funnel money to the Trump family.

This scenario could undermine US national security and raise ethical questions.

“Anyone, including the leaders of hostile nations, can covertly buy these coins, raising the specter of uninhibited and untraceable foreign influence over the President of the United States, all while President Trump’s supporters are left to shoulder the risk of investing in TRUMP and MELANIA,” the letter said.

Warren also warned that these coins could result in significant financial harm for investors. The Trump family’s massive ownership stake means they stand to profit immensely while leaving other investors to shoulder the risks.

Additionally, Warren criticized the lack of transparency and consumer protections. The terms and conditions of the TRUMP and MELANIA coins include disclaimers that absolve the issuers of any responsibility for fraud.

The senator also urged regulators to investigate these coins, pressing the SEC, CFTC, and other relevant agencies to address the risks associated with meme coins.

Specifically, she has asked whether these products might violate federal securities or commodities laws. Warren also questioned how the authorities plan to monitor and regulate the coins in the future.

Separately, Elizabeth Warren also penned an open letter to Department of Government Efficiency (DOGE) Chair Elon Musk. She proposed ways the federal government could cut wasteful spending.

“My recommendations would reduce spending on wasteful programs and contracts, would cut out unfair loopholes and giveaways to the wealthiest Americans, would make the government more efficient and effective, and would save taxpayers at least $2 trillion over the next decade,” she wrote.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoTop 10 Crypto CEXs See $6.4 Trillion Trading Volume in Q4 2024

-

Market24 hours ago

Market24 hours agoWill Bitcoin Hit $700,000? BlackRock Weighs In

-

Market21 hours ago

Market21 hours agoCathie Wood Doubts TRUMP Meme Coin’s Utility

-

Market16 hours ago

Market16 hours ago$37 Million Stolen and Withdrawals Suspended

-

Altcoin21 hours ago

Altcoin21 hours agoBitwise Files for $DOGE ETF, Don’t Miss $FLOCK’s Presale End

-

Market15 hours ago

Market15 hours agoLedger Co-Founder David Balland Rescued After Kidnapping

-

Market19 hours ago

Market19 hours agoXRP Consolidates Near Key Levels: The Implications Of A Breakout

-

Market14 hours ago

Market14 hours agoLeading Altcoins on January 23: MANTRA, ANIME, and ELON