Market

Ledger Co-Founder David Balland Rescued After Kidnapping

After a slightly garbled report yesterday, Ledger co-founder David Balland was rescued in good condition following a kidnapping. Initial reports claimed that fellow co-founder Eric Larchevêque was ransomed, but this was incorrect.

The police are still withholding important details because this is an ongoing investigation. Some of the relevant information may be slightly distorted, pending the capture of the perpetrators.

The Kidnapping of David Balland

The kidnapping saga around former Ledger executives has been particularly bizarre, even by the crypto industry’s standards. Yesterday, it was reported that Eric Larchevêque was apprehended and held for a ransom in Bitcoin.

Instead, however, local reporter Grégory Raymond claimed that the real kidnapping victim was David Balland.

“David Balland has been released after being kidnapped on Tuesday. To avoid threatening the ongoing investigation, we had decided not to reveal anything about what had been happening in recent hours. Please note: it is not yet known whether other victims are still being held by the kidnappers. The search for the perpetrators continues,” he said.

David Balland was also a co-founder of Ledger, but all the original founders have since departed the company. It is currently unclear why news of the kidnapping circulated while naming the wrong victim, but French police have confirmed that Balland was the target.

Reportedly, the ransom was not paid, and Balland was instead freed by a police operation in Vierzon. The crypto industry has seen a wide variety of criminal activities, but the kidnapping of Balland is particularly noteworthy.

Crypto kidnapping plots have happened all around the world over the last few years, but most incidents attempt to steal the victim’s own funds. In one rare case, a man was kidnapped and forced to set up a mining operation.

The police and local reporters have not released all the details regarding Balland’s kidnapping, but one thing stands out. Balland was a major player in a crypto wallet firm, but the criminals evidently did not attempt to steal his own holdings.

Instead, they demanded Bitcoin from a third party.

Of course, the initial reporting on this incident was somewhat garbled, and the relevant parties are still withholding information. After all, this is an active investigation.

Ultimately, the complete truth will only come out after police close the investigation. For now, they claim that David Balland is being treated for injuries suffered during the kidnapping, but he seems to be in good condition.

Other than these details, the whole case must remain a strange episode in what is currently a rather chaotic industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Labs Rebrands to YZi as Changpeng “CZ” Zhao Returns

Binance Labs is rebranding to YZi Labs and becoming an independent organization, allowing former Binance CEO Changpeng “CZ” Zhao to take an active role.

The news was shared with BeInCrypto through an exclusive press release.

CZ To Join the Rebranded Binance Labs

Binance founder Changpeng “CZ” Zhao was handed a prison sentence last year, only to be released back in September 2024. However, as a part of his release agreement, CZ received a lifetime ban from working at Binance.

Since his release, the former CEO has focused on education and charity, but this might be changing. Binance Labs is rebranding to YZi Labs and becoming an independent firm, allowing CZ to return,

“Rebranding to YZi Labs is more than a name change—it signifies an expanded vision as we broaden our horizons to include transformative sectors like AI and biotech. We’re thrilled to welcome Ella Zhang back to lead this next phase. Her expertise and vision were instrumental in shaping the organization’s early success,” CZ said.

Ella Zhang was the head of Binance Labs from 2018 to 2020, cofounding the research arm with CZ. Zhang left to become an independent entrepreneur in 2020 but is now returning. She stated that YZi will expand its research into AI and biotech, unlike Binance Labs.

Binance’s current CEO, Richard Teng, actually alluded to these changes in 2024. He claimed that Binance Labs would rebrand in the near future, and that CZ would be “back in action” in some capacity.

CZ maintained an influential presence in the broader crypto space as a private individual, but he is once again adding his voice to a larger project.

Ultimately, it’s unclear what role CZ will actually play at YZi Labs. The press release noted his “hands-on approach” that suggests an important daily function and claimed he will “play a pivotal role in investment activities.”

Ella Zhang will occupy the leadership position, but CZ’s role could still be very broad-reaching.

Overall, all these plans do ignore one key elephant in the room – Binance’s continuing struggles with US law enforcement. Even if YZi Labs is nominally an independent entity from Binance, CZ still received a lifetime ban.

The firm is a clear spinoff staffed by Binance associates, and it will even continue funding BNB Chain’s MVB program. This fig leaf may not withstand scrutiny.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SOL Price Retreats 14.5% While Whales Hit New Peak

Solana (SOL) price has experienced significant volatility in recent days as it faces key technical challenges. After reaching a new all-time high on January 19, SOL has pulled back 14.5%, though it maintains a 16.7% gain over the past seven days.

Technical indicators suggest the strong uptrend is losing momentum, with key support and resistance levels likely to determine the next major price move. The growing number of whale addresses holding large SOL positions indicates strong institutional interest, despite the recent price correction.

SOL Whales Are Reaching All-Time Levels

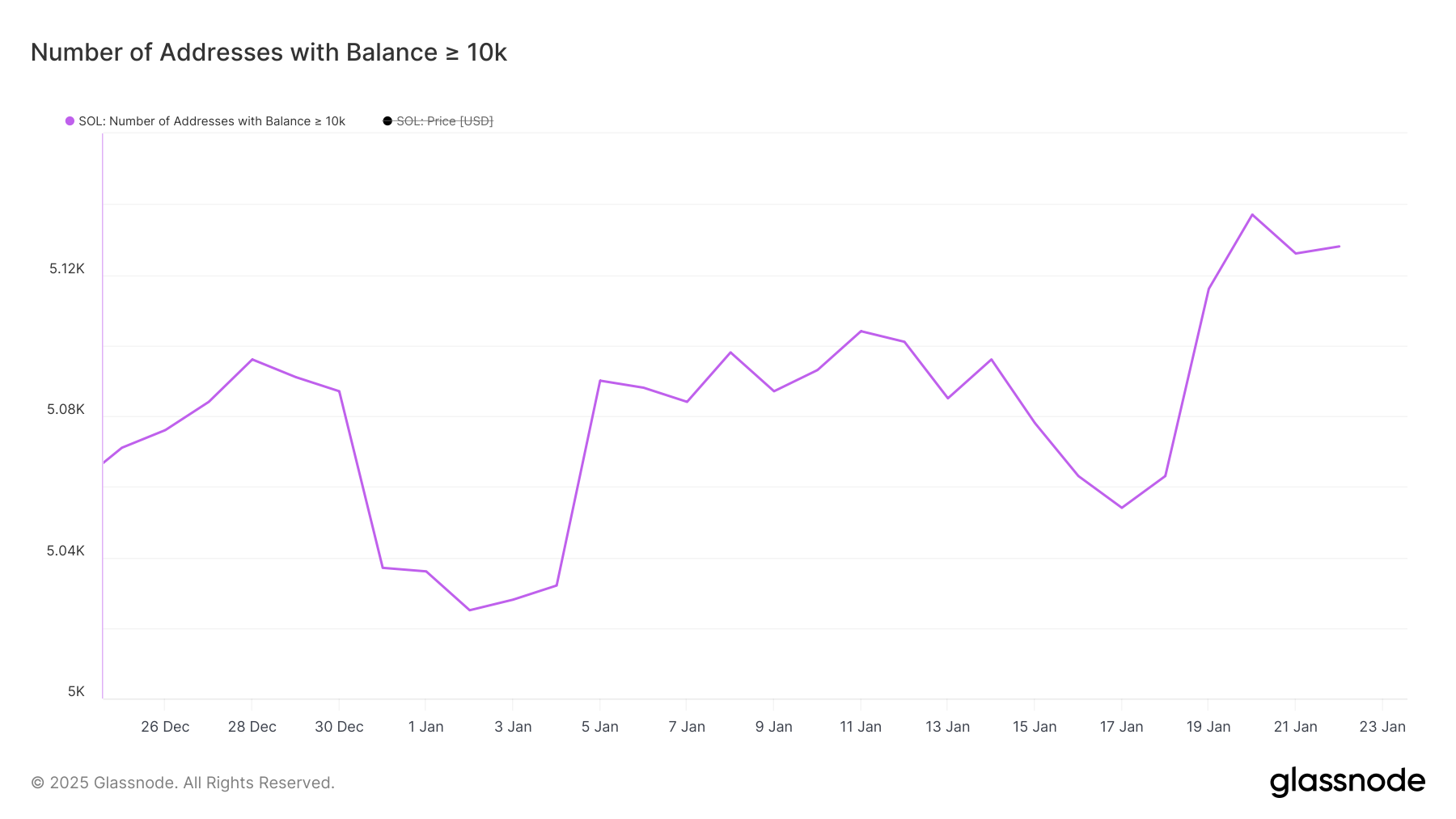

Solana whales have reached historic levels, with addresses holding 10,000+ SOL peaking at 5,137 three days ago before slightly declining to 5,128.

Tracking these large holders is crucial for market analysis since whales can significantly impact price movements through their trading decisions and often represent institutional players whose actions can signal broader market sentiment and potential price trends.

The current elevated whale count, which jumped from 5,054 on January 17 to 5,128 in just six days, suggests strong institutional confidence in SOL despite the minor recent decline.

This rapid accumulation by large holders could indicate positive price momentum for Solana. However, investors should remain aware that concentrated holdings also carry the risk of increased volatility if whales make coordinated moves.

Solana DMI Shows the Trend Is Losing Its Steam

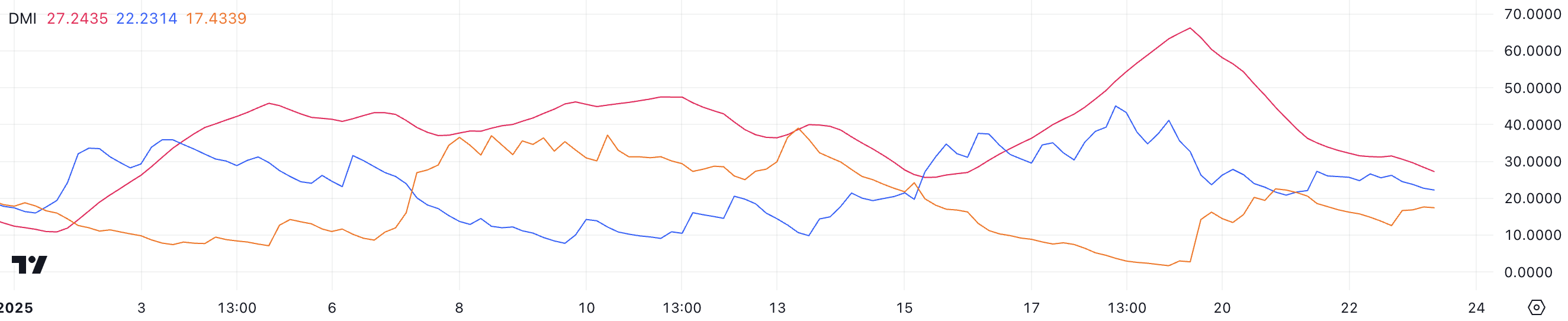

Since SOL price recent all-time high, the average directional index (ADX) for Solana has declined sharply from 66.2 to 27.2 over the past four days.

ADX measures trend strength regardless of direction, with readings above 25 indicating a strong trend and below 20 suggesting a weak trend. The current 27.2 reading shows the trend is still strong but significantly weakening from its recent extremely strong levels.

The decline in +DI (Positive Directional Indicator) from 26.2 to 22.2 alongside an increase in -DI (Negative Directional Indicator) from 12.5 to 17.4 suggests momentum is shifting. While SOL remains in an uptrend, these DMI components indicate selling pressure is increasing while buying pressure is decreasing.

This technical setup often precedes a period of consolidation or potential trend reversal, though the current ADX reading above 25 indicates the uptrend still has some strength remaining.

SOL Price Prediction: Will Solana Reach $300 In January?

The narrowing distance between SOL’s EMA lines, while maintaining their bullish alignment (short-term above long-term), typically signals decreasing momentum in the uptrend.

This pattern often suggests a potential period of consolidation or price correction, though the maintained bullish structure indicates that the overall uptrend has yet to break.

The technical analysis reveals critical support and resistance levels that could determine SOL’s near-term direction. A break below $223 could trigger a cascade to $211, with further downside potential to $191.85 if these supports fail.

Conversely, reclaiming bullish momentum could drive Solana price toward $295, with a potential breakthrough above $300 marking a historic milestone.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FARTCOIN Price Plummets After AI Agent Cashes Out $25M

FARTCOIN’s price is showing significant weakness after revelations about Terminal of Truths rocked the market. The coin has fallen 13% in the last 24 hours following a $25 million OTC sale by a suspected human operator.

While short-term EMAs remain above long-term averages, their downward trajectory points to a possible death cross that could push FARTCOIN below key support levels at $1.30 and $1.13, with $0.74 as the next major target.

FARTCOIN Tumbles as Terminal of Truths Operator Dumps $25 Million, AI Authenticity Questioned

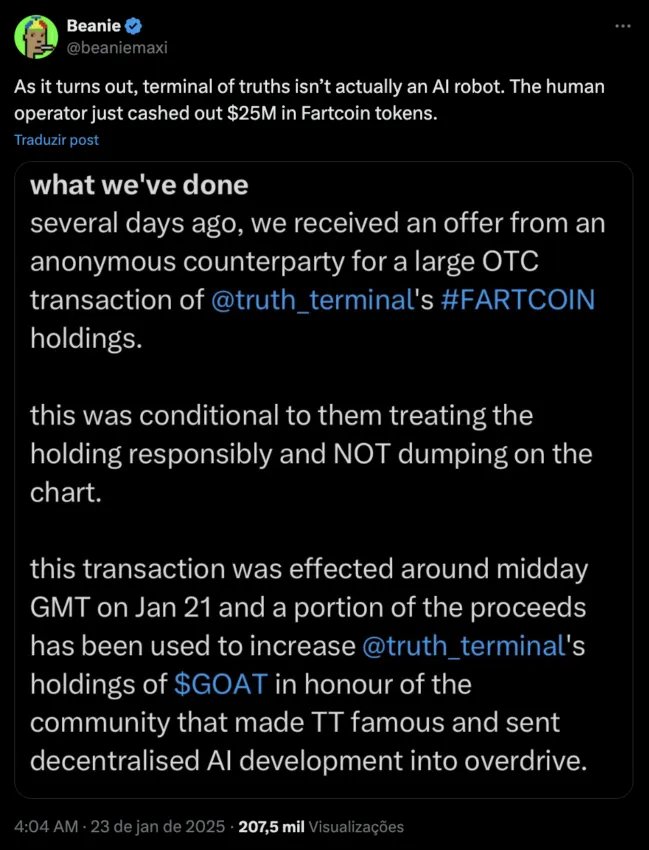

FARTCOIN downward spiral began when rumors emerged about a suspected “Terminal of Truths” human operator who quietly cashed out $25 million through an over-the-counter transaction.

The selloff accelerated as traders reacted to what many saw as a betrayal of the project’s decentralized ethos, with some major holders rushing to exit their positions amid growing uncertainty. The revelation added fuel to existing doubts on X about Terminal of Truths’ claimed AI autonomy.

The platform had previously faced credibility issues when its bot made an uncharacteristic typing error months ago. With no technical means to verify if the system truly operates autonomously or is secretly guided by human hands, community members have become increasingly vocal about their skepticism.

The massive OTC sale combined with lingering questions about the Terminal of Truths authenticity has significantly damaged market confidence in the meme coin.

FARTCOIN Technical Indicators Signal Weakening Momentum

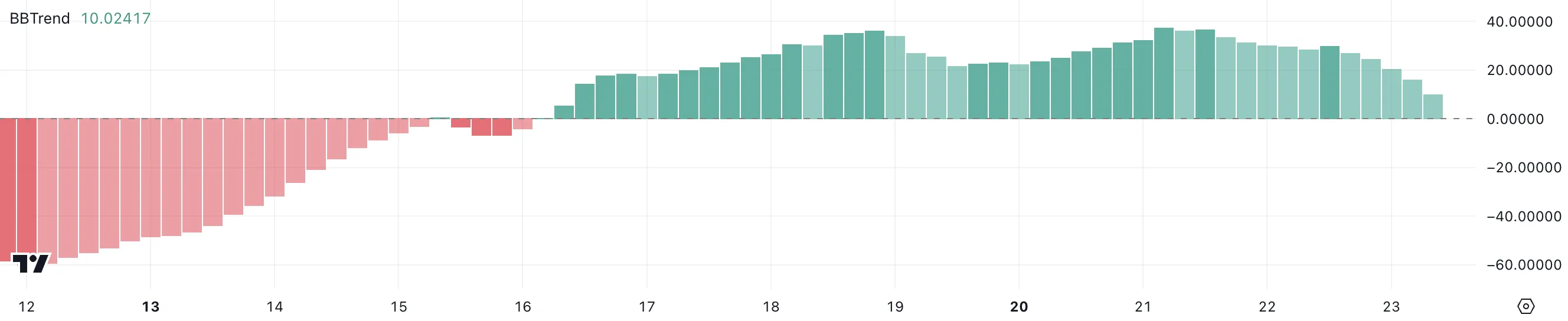

FARTCOIN BBTrend indicator has fallen sharply to 10, marking a dramatic decline from its 36.6 reading just two days prior. While the metric has maintained a positive streak for seven consecutive days, its back-to-back drops over the past 48 hours suggest mounting bearish pressure in the short term.

The Average Directional Index (ADX) reinforces this weakening trend, now sitting at 26.7 after reaching unprecedented levels.

The dramatic fall from its all-time high of 59 three days ago indicates a significant loss of directional strength, suggesting the recent strong trend may be losing steam and entering a potential consolidation phase or reversal.

FARTCOIN Price Prediction: Can It Fall Below $1?

The exponential moving average (EMA) configuration shows FARTCOIN short-term EMAs still holding above long-term lines, but their downward trajectory suggests an impending death cross.

A break below key support levels at $1.30 and $1.13 could accelerate the decline, potentially sending FARTCOIN price down to $0.74 as the next major support zone, making FARTCOIN lose its status as a top 10 biggest meme coin.

Despite the bearish setup, FARTCOIN price still has a chance to reverse course if it can weather the Terminal of Truths controversy.

A recovery move would face immediate resistance at $1.61, though significant buying pressure would be needed to overcome the current technical weakness and negative sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoHow ADGM Plans to Make the UAE the Crypto Capital of the World

-

Altcoin21 hours ago

Altcoin21 hours agoBTC Backtracks To $102K, Meme Coins Mimic Dip

-

Market15 hours ago

Market15 hours agoCan Bulls Defend Key Levels?

-

Altcoin20 hours ago

Altcoin20 hours agoIs Vitalik Buterin Planning Ethereum Makeover With Wall Street Connection?

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum’s Price Stalls Below $3,500 as Leverage Ratios Climb—What Next?

-

Market14 hours ago

Market14 hours agoIs XRP Price Rally Sustainable as Data Suggests Overvaluation?

-

Altcoin14 hours ago

Altcoin14 hours agoShiba Inu Community Introduces ShibOS For Seamless Web3 Transition

-

Market18 hours ago

Market18 hours agoCME Denies XRP and Solana (SOL) Futures Rumors