Market

Top 10 Crypto CEXs See $6.4 Trillion Trading Volume in Q4 2024

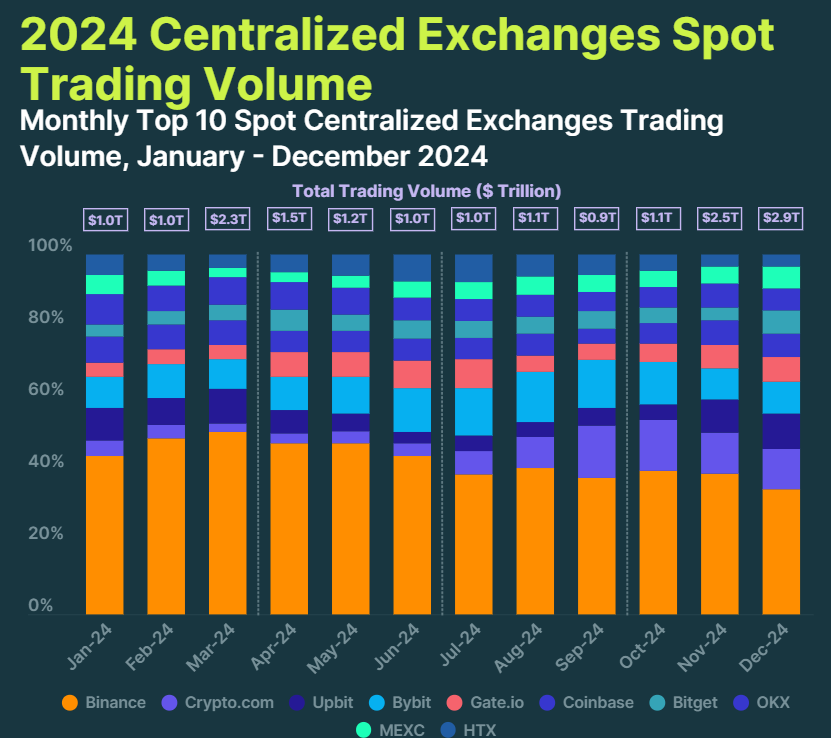

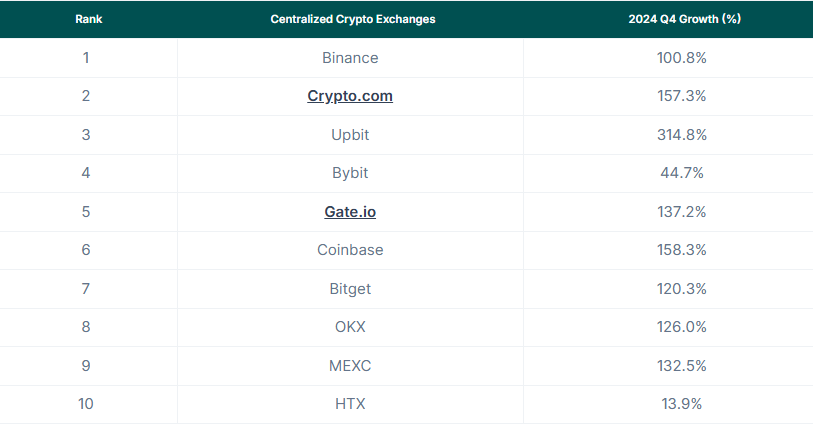

According to a CoinGecko report, in Q4 2024, the overall trading volume of the top 10 crypto centralized exchanges (CEX) surged, with eight of them recording triple-digit percentage growth.

It was also found that the total trading volume for the top 10 exchanges in Q4 was $6.4 trillion, a 111.7% increase from the previous quarter.

Binance Maintains Dominance as Top CEX, Despite Declining Market Share

At the close of 2024, Binance remained the clear leader in the market, maintaining a dominant market share of 34.7%.

The CoinGecko report showed that in December alone, the exchange recorded a substantial spot trading volume of $1.0 trillion. This marked a slight increase of 2.3% from November’s $979.1 billion.

The achievement marked Binance’s second $1 trillion volume month in 2024. Over the course of the year, Binance’s dominance was even more pronounced, capturing 42.4% of the total volume among the top 10 exchanges, with $7.4 trillion traded compared to the $17.4 trillion in total volume for the group.

Despite its dominance, Binance has experienced a gradual loss of market share in 2024. Starting the year with a 44.1% share, it has seen a decline in its portion of the market since September, dipping below 40%.

“However, it is still the largest exchange by a large margin. For comparison, it had more trading volume than the next five largest exchanges combined in 2024 ($7.4 trillion vs. $6.6 trillion),” CoinGecko said.

Crypto.com emerged as the second-largest exchange by trading volume in December. It had an 11.2% market share and $322.3 billion in trading volume. This represents a significant increase of 12.7% from the previous month.

In Q4 2024, Crypto.com saw a sharp increase in volume. The volumes rose from $539.8 billion in the first three quarters of the year to $757.8 billion in the final quarter.

Upbit, which reclaimed its spot as the third-largest exchange in November 2024, continued its upward trajectory into December. The exchange recorded $282.7 billion in spot trading volume for the month, a notable 22% growth from November.

Upbit’s performance in Q4 was driven by a dramatic surge in volume following the declaration of martial law in South Korea on December 3. This led to a six-fold increase in daily volumes, reaching an average of $21 billion per day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Price Under Pressure with Death Cross Formation Ahead

Cardano (ADA) price is showing increasing bearish momentum across multiple technical indicators as the ninth-largest cryptocurrency by market cap faces mounting pressure. ADA is down 12% in the last seven days and more than 4% in the last 24 hours, with its market cap now at $33 billion, though it maintains its position as a top-10 cryptocurrency in ninth place.

Multiple technical indicators suggest the downward pressure could continue, with ADX showing strengthening bearish momentum and whale accumulation remaining below recent peaks. The potential formation of a death cross in EMA lines adds to the bearish outlook, though key support levels could provide temporary relief.

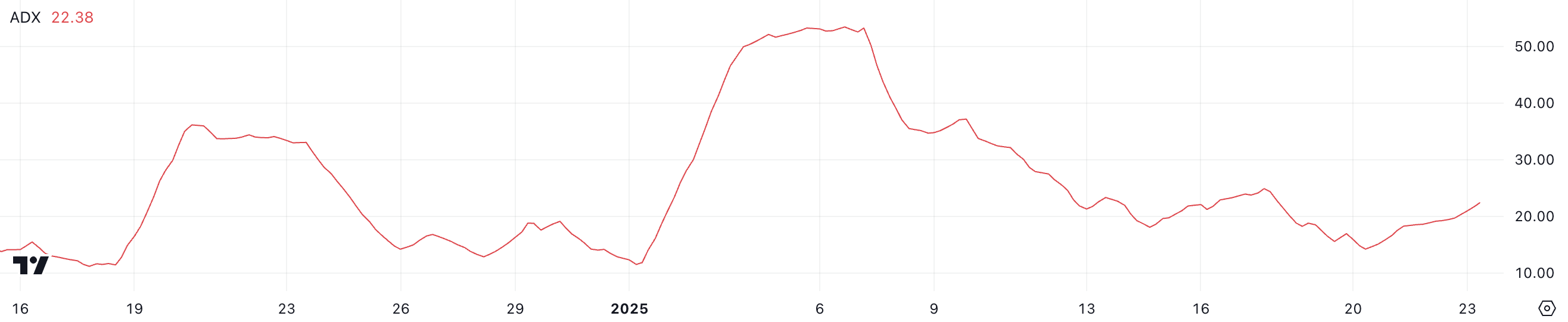

Cardano Downtrend Is Getting Stronger

Cardano Average Directional Index (ADX) has shown notable strengthening, rising from 14.2 to 22.3 in just two days.

This sharp increase in ADX, which measures trend strength regardless of direction on a 0-100 scale, suggests the current trend is gaining momentum as it moves from a weak trend zone (below 20) into an emerging trend zone (20-25).

With ADA price in a downtrend and ADX rising above 20, this indicates the bearish momentum is likely strengthening. An ADX climbing from weak (14.2) to moderate trend strength (22.3) while price moves lower typically confirms increasing selling pressure.

However, since ADX hasn’t yet crossed above 25 (strong trend threshold), the downtrend may still be in its early stages of development.

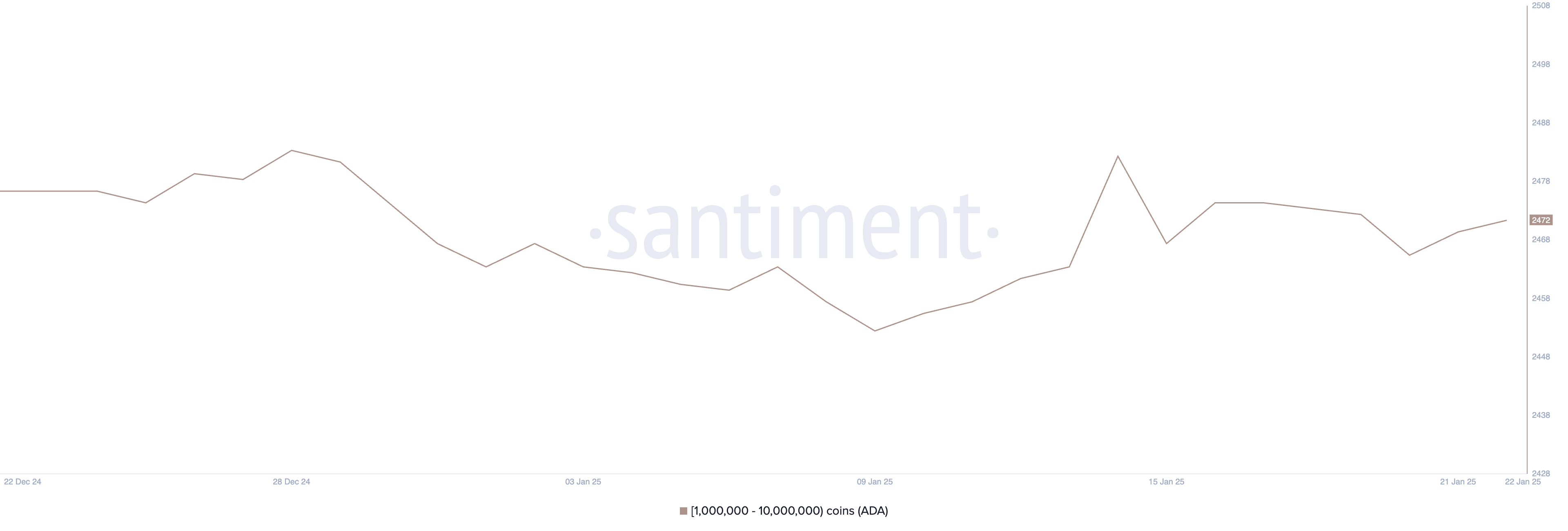

ADA Whales Are Recovering

The number of Cardano whale addresses holding between 1 and 10 million ADA has slightly increased from 2,466 to 2,472 in the past three days, though it remains below the January 14 peak of 2,483 addresses.

Whale accumulation patterns often provide insight into potential price movements. These large holders can significantly influence the market through their trading decisions and typically have sophisticated market analyses informing their positions.

The current whale metrics present a mixed signal for ADA price outlook. While the recent uptick in whale addresses suggests some renewed accumulation interest at current prices, the number remains below mid-January levels.

This pattern of whales slightly increasing positions but staying below recent peaks could indicate cautious accumulation rather than strong conviction, suggesting large holders may be testing current price levels rather than showing aggressive buying sentiment.

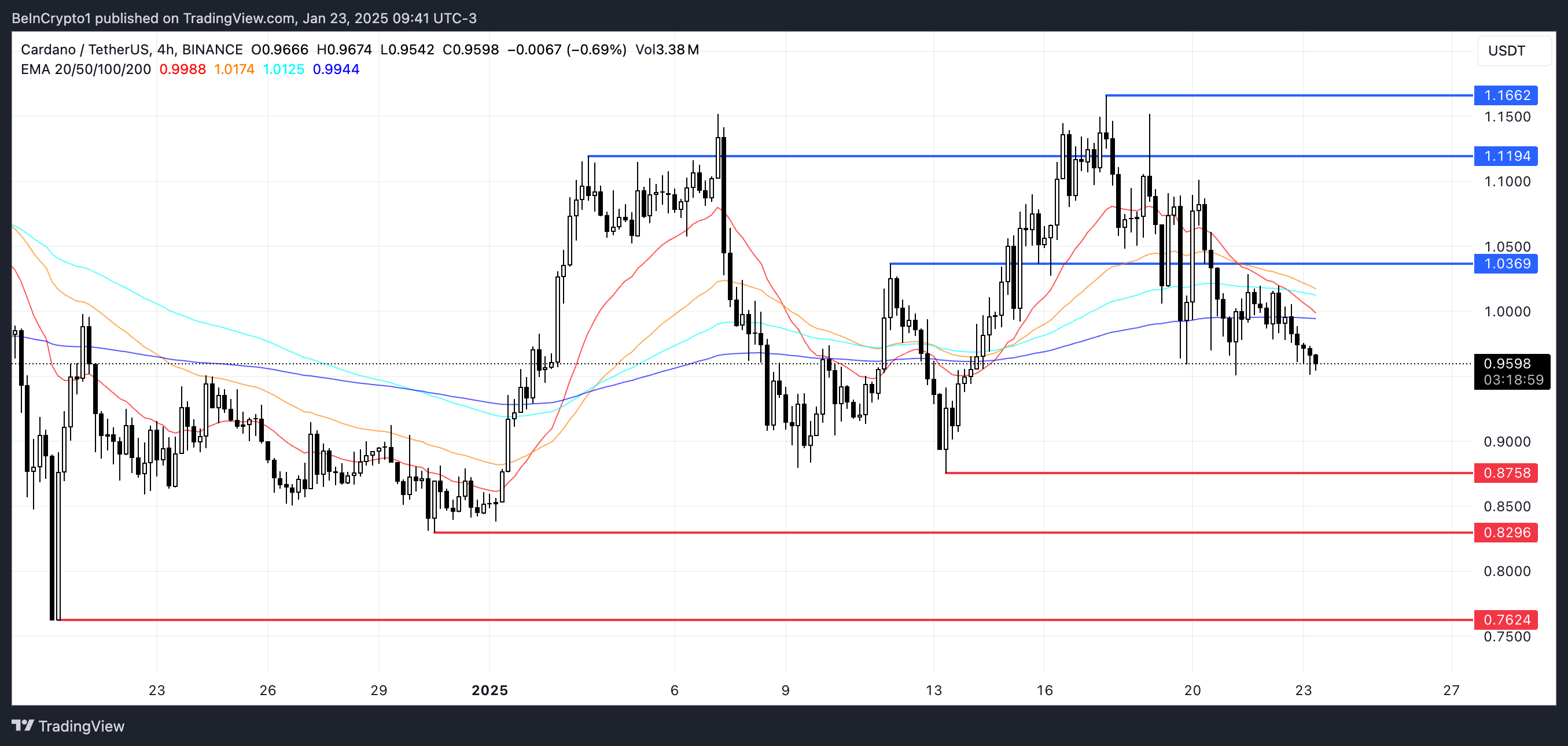

ADA Price Prediction: A Further 20% Correction?

Cardano Exponential Moving Average (EMA) lines suggest an imminent death cross, with shorter-term averages potentially crossing below longer-term ones.

This bearish technical pattern could trigger a cascade of support tests at $0.87, $0.829, and potentially $0.76, representing a significant 20% downside risk for Cardano price.

A bullish reversal scenario would first need to overcome resistance at $1.03. Further upside targets exist at $1.11 and $1.16, offering potential 21% gains for Cardano price.

However, the looming death cross suggests any upward movement may face significant resistance until the EMA lines show bullish realignment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Leading Altcoins on January 23: MANTRA, ANIME, and ELON

Altcoins are showing diverse movements across different sectors, with OM, ANIME, and ELON each representing distinct market narratives.

While Real-World Asset player OM maintains steady growth with a $3.49 billion market cap and fresh institutional validation, newcomer ANIME faces early volatility despite backing from the Azuki team. Meanwhile, meme coin ELON capitalizes on political sentiment, doubling in value amid Trump-related speculation.

Mantra (OM)

OM is one of the most relevant altcoins in the Real-World Assets (RWA) space, with a market cap of $3.49 billion. Its price is up 3.5% in the last 24 hours. It recently welcomed Ledger as a validator, signaling institutional confidence in its ecosystem.

Technical analysis shows strong upside potential for OM, with key resistance levels at $3.68, $3.89, and $3.98. A break above $3.68 could trigger increased momentum toward these higher targets.

On the other hand, support at $3.567 is fundamental for Mantra to maintain good momentum. If that support is lost, it could spark a downtrend, pushing the OM price down as the competition with other RWA altcoins intensifies.

Animecoin (ANIME)

ANIME is the native token of anime.xyz, a project backed by Azuki, one of the most successful NFT collections during the previous bull market. The platform aims to “revolutionize anime fandom by creating a decentralized creative network for its billion-strong global community“.

Despite significant initial interest, ANIME experienced substantial volatility in its early trading hours.

The coin’s market capitalization stands at $350 million, though it has declined 40% from its launch price in just six hours. It currently has over 10,000 unique holders and roughly 13,000 transactions recorded.

Dogelon Mars (ELON)

Dogelon Mars (ELON), a meme coin referencing Elon Musk, is surging with Donald Trump now in office. Musk’s perceived support of Trump has drawn fresh attention to Musk-themed coins, driving interest.

ELON broke out of weeks of sideways trading on January 19, doubling in value within hours to hit its highest point since 2022.

A pullback could see ELON test support at $0.0000001735. However, continued momentum could push prices toward $0.00000047, with the potential to reach $0.00000050 if the uptrend holds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ledger Co-Founder David Balland Rescued After Kidnapping

After a slightly garbled report yesterday, Ledger co-founder David Balland was rescued in good condition following a kidnapping. Initial reports claimed that fellow co-founder Eric Larchevêque was ransomed, but this was incorrect.

The police are still withholding important details because this is an ongoing investigation. Some of the relevant information may be slightly distorted, pending the capture of the perpetrators.

The Kidnapping of David Balland

The kidnapping saga around former Ledger executives has been particularly bizarre, even by the crypto industry’s standards. Yesterday, it was reported that Eric Larchevêque was apprehended and held for a ransom in Bitcoin.

Instead, however, local reporter Grégory Raymond claimed that the real kidnapping victim was David Balland.

“David Balland has been released after being kidnapped on Tuesday. To avoid threatening the ongoing investigation, we had decided not to reveal anything about what had been happening in recent hours. Please note: it is not yet known whether other victims are still being held by the kidnappers. The search for the perpetrators continues,” he said.

David Balland was also a co-founder of Ledger, but all the original founders have since departed the company. It is currently unclear why news of the kidnapping circulated while naming the wrong victim, but French police have confirmed that Balland was the target.

Reportedly, the ransom was not paid, and Balland was instead freed by a police operation in Vierzon. The crypto industry has seen a wide variety of criminal activities, but the kidnapping of Balland is particularly noteworthy.

Crypto kidnapping plots have happened all around the world over the last few years, but most incidents attempt to steal the victim’s own funds. In one rare case, a man was kidnapped and forced to set up a mining operation.

The police and local reporters have not released all the details regarding Balland’s kidnapping, but one thing stands out. Balland was a major player in a crypto wallet firm, but the criminals evidently did not attempt to steal his own holdings.

Instead, they demanded Bitcoin from a third party.

Of course, the initial reporting on this incident was somewhat garbled, and the relevant parties are still withholding information. After all, this is an active investigation.

Ultimately, the complete truth will only come out after police close the investigation. For now, they claim that David Balland is being treated for injuries suffered during the kidnapping, but he seems to be in good condition.

Other than these details, the whole case must remain a strange episode in what is currently a rather chaotic industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin and XRP Prices Steady as iDEGEN fires on all cylinders

-

Market22 hours ago

Market22 hours agoBitwise Files for Dogecoin ETF Amid Growing Meme Coin Interest

-

Market21 hours ago

Market21 hours agoUSDC Liquidity Reaches Highest Point Since February 2023

-

Market19 hours ago

Market19 hours agoHow ADGM Plans to Make the UAE the Crypto Capital of the World

-

Altcoin17 hours ago

Altcoin17 hours agoBTC Backtracks To $102K, Meme Coins Mimic Dip

-

Ethereum11 hours ago

Ethereum11 hours agoEthereum Leverage Ratio Continues Sharp Rise: What It Means

-

Market16 hours ago

Market16 hours agoDemocrats Call for Ethics Probe on Trump Over Crypto Projects

-

Market11 hours ago

Market11 hours agoCan Bulls Defend Key Levels?