Market

Can Bulls Defend Key Levels?

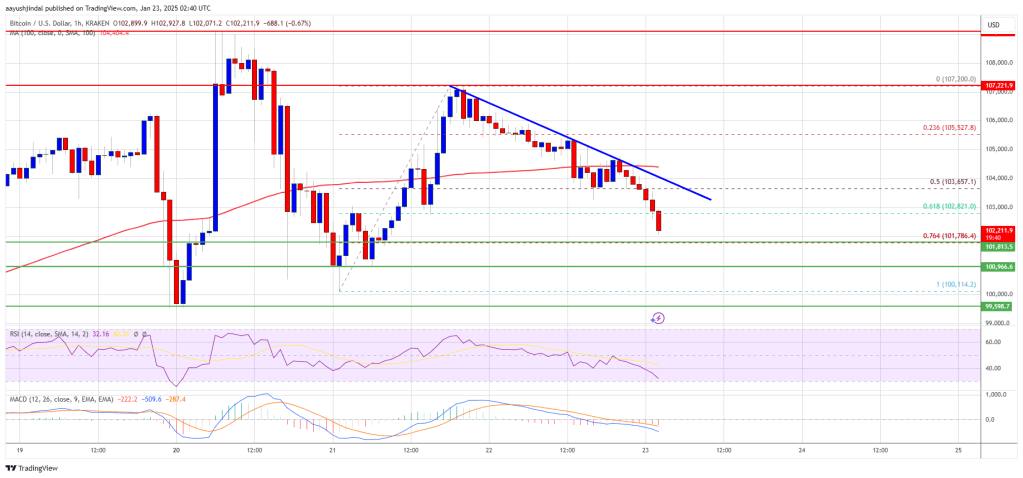

Bitcoin price struggled to clear the $107,200 resistance zone. BTC is correcting gains and might revisit the $100,000 support zone.

- Bitcoin started a downside correction from the $107,200 zone.

- The price is trading below $104,500 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance at $103,650 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $100,500 support zone.

Bitcoin Price Dips Again

Bitcoin price started a decent upward move above the $103,500 zone. BTC was able to climb above the $104,500 and $105,000 levels.

The bulls even pushed the price above the $106,000 level. However, the bears were active near the $107,200 zone. A high was formed at $107,200 and the price is now correcting gains. There was a move below the $105,000 level.

There was a move below the 50% Fib retracement level of the upward move from the $100,114 swing low to the $107,200 high. Bitcoin price is now trading below $104,500 and the 100 hourly Simple moving average.

On the upside, immediate resistance is near the $103,000 level. The first key resistance is near the $103,500 level. There is also a key bearish trend line forming with resistance at $103,650 on the hourly chart of the BTC/USD pair. A clear move above the $103,650 resistance might send the price higher. The next key resistance could be $104,500.

A close above the $104,500 resistance might send the price further higher. In the stated case, the price could rise and test the $107,200 resistance level and a new all-time high. Any more gains might send the price toward the $112,500 level.

More Losses In BTC?

If Bitcoin fails to rise above the $104,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $101,750 level or the 76.4% Fib retracement level of the upward move from the $100,114 swing low to the $107,200 high. The first major support is near the $100,500 level.

The next support is now near the $100,000 zone. Any more losses might send the price toward the $88,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $101,650, followed by $100,500.

Major Resistance Levels – $103,650 and $104,500.

Market

Leading Altcoins on January 23: MANTRA, ANIME, and ELON

Altcoins are showing diverse movements across different sectors, with OM, ANIME, and ELON each representing distinct market narratives.

While Real-World Asset player OM maintains steady growth with a $3.49 billion market cap and fresh institutional validation, newcomer ANIME faces early volatility despite backing from the Azuki team. Meanwhile, meme coin ELON capitalizes on political sentiment, doubling in value amid Trump-related speculation.

Mantra (OM)

OM is one of the most relevant altcoins in the Real-World Assets (RWA) space, with a market cap of $3.49 billion. Its price is up 3.5% in the last 24 hours. It recently welcomed Ledger as a validator, signaling institutional confidence in its ecosystem.

Technical analysis shows strong upside potential for OM, with key resistance levels at $3.68, $3.89, and $3.98. A break above $3.68 could trigger increased momentum toward these higher targets.

On the other hand, support at $3.567 is fundamental for Mantra to maintain good momentum. If that support is lost, it could spark a downtrend, pushing the OM price down as the competition with other RWA altcoins intensifies.

Animecoin (ANIME)

ANIME is the native token of anime.xyz, a project backed by Azuki, one of the most successful NFT collections during the previous bull market. The platform aims to “revolutionize anime fandom by creating a decentralized creative network for its billion-strong global community“.

Despite significant initial interest, ANIME experienced substantial volatility in its early trading hours.

The coin’s market capitalization stands at $350 million, though it has declined 40% from its launch price in just six hours. It currently has over 10,000 unique holders and roughly 13,000 transactions recorded.

Dogelon Mars (ELON)

Dogelon Mars (ELON), a meme coin referencing Elon Musk, is surging with Donald Trump now in office. Musk’s perceived support of Trump has drawn fresh attention to Musk-themed coins, driving interest.

ELON broke out of weeks of sideways trading on January 19, doubling in value within hours to hit its highest point since 2022.

A pullback could see ELON test support at $0.0000001735. However, continued momentum could push prices toward $0.00000047, with the potential to reach $0.00000050 if the uptrend holds.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ledger Co-Founder David Balland Rescued After Kidnapping

After a slightly garbled report yesterday, Ledger co-founder David Balland was rescued in good condition following a kidnapping. Initial reports claimed that fellow co-founder Eric Larchevêque was ransomed, but this was incorrect.

The police are still withholding important details because this is an ongoing investigation. Some of the relevant information may be slightly distorted, pending the capture of the perpetrators.

The Kidnapping of David Balland

The kidnapping saga around former Ledger executives has been particularly bizarre, even by the crypto industry’s standards. Yesterday, it was reported that Eric Larchevêque was apprehended and held for a ransom in Bitcoin.

Instead, however, local reporter Grégory Raymond claimed that the real kidnapping victim was David Balland.

“David Balland has been released after being kidnapped on Tuesday. To avoid threatening the ongoing investigation, we had decided not to reveal anything about what had been happening in recent hours. Please note: it is not yet known whether other victims are still being held by the kidnappers. The search for the perpetrators continues,” he said.

David Balland was also a co-founder of Ledger, but all the original founders have since departed the company. It is currently unclear why news of the kidnapping circulated while naming the wrong victim, but French police have confirmed that Balland was the target.

Reportedly, the ransom was not paid, and Balland was instead freed by a police operation in Vierzon. The crypto industry has seen a wide variety of criminal activities, but the kidnapping of Balland is particularly noteworthy.

Crypto kidnapping plots have happened all around the world over the last few years, but most incidents attempt to steal the victim’s own funds. In one rare case, a man was kidnapped and forced to set up a mining operation.

The police and local reporters have not released all the details regarding Balland’s kidnapping, but one thing stands out. Balland was a major player in a crypto wallet firm, but the criminals evidently did not attempt to steal his own holdings.

Instead, they demanded Bitcoin from a third party.

Of course, the initial reporting on this incident was somewhat garbled, and the relevant parties are still withholding information. After all, this is an active investigation.

Ultimately, the complete truth will only come out after police close the investigation. For now, they claim that David Balland is being treated for injuries suffered during the kidnapping, but he seems to be in good condition.

Other than these details, the whole case must remain a strange episode in what is currently a rather chaotic industry.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

$37 Million Stolen and Withdrawals Suspended

Singapore-based cryptocurrency exchange Phemex is investigating suspicious transactions involving its hot wallets, as identified by security firm Cyvers.

Over $37 million in digital assets, including Bitcoin, Ethereum, and TRON, were reportedly affected across multiple chains.

Phemex Suspends Withdrawals

Phemex has confirmed the incident and temporarily halted withdrawals. Cyvers noted over 125 suspicious transactions on the hot wallets.

The exchange stated that its cold wallets—holding the majority of users’ funds—remain secure and unaffected.

These wallets are fully transparent and verifiable, as the exchange emphasized.

“More than 125 suspicious transactions moving funds from Phemex hot wallets to new wallets on different chains such as Ethereum, Polygon, Binance, Optimism, Polygon, Base, Avalanche, Bitcoin, Tron, Solana, and probably more. Some of the tokens and stablecoins have already been swapped to avoid freezing,” Cyvers Co-founder & CTO, Meir Dolev told BeInCrypto.

Phemex is one of the largest crypto exchanges in Singapore. According to CoinGecko data, the exchange has a daily market volume of over $177 million and nearly a million monthly traffic.

“Phemex and the development team apologize for the disruption. Our mission to provide a seamless and trusted trading environment remains firm. We are working on a compensation plan, which will be announced soon,” Phemex announced on X (formerly Twitter).

The broader cryptocurrency market has faced increased security challenges this year. Reports show that losses from hacks have reached $2.15 billion in 2024, with scams contributing an additional $834.5 million. This represents a 15% rise in losses compared to 2023.

High-profile incidents involving platforms like WazirX, Radiant Capital, and DMM Bitcoin have exposed vulnerabilities in multisig wallets and DeFi protocols.

Additionally, scammers are increasingly exploiting professional platforms like LinkedIn to target crypto users.

Recent reports highlight how attackers use legitimate tools, such as video conferencing platforms and detailed job offers, to gain victims’ trust before executing their schemes.

Other platforms have also faced scrutiny over potential security issues. Hyperliquid, a decentralized exchange, recently saw $60 million in USDC outflows. This was driven by rumors of a breach linked to North Korea’s Lazarus Group.

The company denied any hack but acknowledged suspicious activity involving ETH deposits and withdrawals.

The surge in crypto adoption has made security an increasingly critical priority for the industry. Access control failures, such as private key compromises, remain a significant threat.

Strengthening protections and developing proactive measures are vital as the crypto space continues to expand and attract new users.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoBitcoin and XRP Prices Steady as iDEGEN fires on all cylinders

-

Market21 hours ago

Market21 hours agoBitwise Files for Dogecoin ETF Amid Growing Meme Coin Interest

-

Market20 hours ago

Market20 hours agoUSDC Liquidity Reaches Highest Point Since February 2023

-

Market18 hours ago

Market18 hours agoHow ADGM Plans to Make the UAE the Crypto Capital of the World

-

Altcoin16 hours ago

Altcoin16 hours agoBTC Backtracks To $102K, Meme Coins Mimic Dip

-

Market14 hours ago

Market14 hours agoXRP Price Pauses Rally: Healthy Pullback or Reversal Ahead?

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Is Ready For The Next Big Move – Analyst Shares Bullish Target

-

Market13 hours ago

Market13 hours agoCME Denies XRP and Solana (SOL) Futures Rumors