Market

XRP Price Pauses Rally: Healthy Pullback or Reversal Ahead?

XRP price struggled to continue higher above the $3.30 level. The price is now correcting gains and might find bids near the $3.00 level.

- XRP price started a downside correction from the $3.30 zone.

- The price is now trading below $3.20 and the 100-hourly Simple Moving Average.

- There was a break below a connecting bullish trend line with support at $3.1450 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might start a fresh increase if it stays above the $3.00 support.

XRP Price Dips Again

XRP price managed to start a fresh increase from the $3.120 support zone, but upsides were limited compared to Bitcoin. The price was able to surpass the $3.250 level before the bears appeared.

A high was formed at $3.285 and the price recently started a downside correction. There was a move below the $3.20 support. The price dipped below the 50% Fib retracement level of the upward move from the $3.012 swing low to the $3.285 high.

Besides, there was a break below a connecting bullish trend line with support at $3.1450 on the hourly chart of the XRP/USD pair. The price is now trading below $3.20 and the 100-hourly Simple Moving Average.

It is now holding the 61.8% Fib retracement level of the upward move from the $3.012 swing low to the $3.285 high. On the upside, the price might face resistance near the $3.150 level. The first major resistance is near the $3.20 level.

The next resistance is $3.250. A clear move above the $3.250 resistance might send the price toward the $3.30 resistance. Any more gains might send the price toward the $3.4250 resistance or even $3.450 in the near term. The next major hurdle for the bulls might be $3.50.

More Losses?

If XRP fails to clear the $3.20 resistance zone, it could start another decline. Initial support on the downside is near the $3.120 level. The next major support is near the $3.00 level.

If there is a downside break and a close below the $3.00 level, the price might continue to decline toward the $2.880 support. The next major support sits near the $2.750 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $3.120 and $3.00.

Major Resistance Levels – $3.20 and $3.250.

Market

Why The Dogecoin Price Should Be On Your Radar

Recent developments suggest that crypto investors looking to catch the next quick 5x should be keeping an eye on the Dogecoin price. This is based on both technical and fundamental analysis, which proves that DOGE could record a 500% price surge from its current level.

Analyst Predicts 500% Surge For The Dogecoin Price

In an X post, crypto analyst Javon Marks predicted a 500% surge for the Dogecoin price, representing a 5x increase from its current level. The analyst explained that Dogecoin is back showing strength, and by its historical performance, DOGE can be set for an over 432% gain at the least from its current level.

Related Reading

Javon Marks further remarked that the Dogecoin price could rally above the 1.618 Fib extension, which is currently at $2.2. In line with this, the analyst added that market participants could still be early, considering that DOGE could witness a 5x price increase from its current level.

Crypto analyst Trader Tardigrade also recently predicted that the Dogecoin price could rally above $2. In an X post, the analyst stated that the meme coin had formed a bull flag on the 2-day chart. According to the analyst, this DOGE bull flag pattern puts a target of over $2 for the foremost meme coin.

The crypto analyst had previously predicted that the DOGE price could even rally as high as $8 if it mirrors the 2017 bull run. He added that DOGE could also reach $30 if it mirrors the 2021 bull run. These projections further prove that the foremost meme coin could at least record a 500% price surge from its current level. Crypto analyst Master Kenobi has also previously predicted that Dogecoin could rally to $2 in this cycle and top around $3.

Bullish Fundamentals Also Support A 5x Increase For DOGE

The Dogecoin price also boasts bullish fundamentals, which support a 5x increase from its current level. One of the fundamentals includes the potential launch of a Dogecoin exchange-traded fund (ETF) in the US. Asset manager Bitwise recently filed for a Dogecoin ETF in Delaware, indicating that an application with the US Securities and Exchange Commission (SEC) may be next.

Related Reading

Asset manager REX Shares, in collaboration with Osprey, already filed with the SEC to offer a Dogecoin ETF. This is bullish for the Dogecoin price, considering the amount of institutional funds that could flow into the DOGE ecosystem if the SEC approves these funds. There is also a huge likelihood that the SEC will approve these funds, considering the pro-crypto climate under Donald Trump’s administration.

It is also worth mentioning that there has been a huge accumulation trend among DOGE whales, which is also bullish for the Dogecoin price. IntoTheBlock data shows there has been a 41% spike in the meme coin’s large transactions, with $23.35 billion traded in the last 24 hours. Another bullish fundamental is Elon Musk’s Department of Government Efficiency (DOGE), which puts the foremost meme coin in the limelight.

At the time of writing, the DOGE price is trading at around $0.35, down almost 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from iStock, chart from Tradingview.com

Market

ETH Price Falls as Market Questions Future Outlook

Ethereum (ETH) price is showing bearish signals across multiple technical indicators as the leading smart contract platform faces mounting pressure. ETH is down more than 3% in the last 24 hours, as questions about its future are raised and competing chains like Solana continue to attract more attention.

ETH has declined almost 15% since reaching its 2025 peak on January 6. Technical analysis suggests further downside could be ahead, with key support levels being tested as momentum indicators point to weakening bullish sentiment.

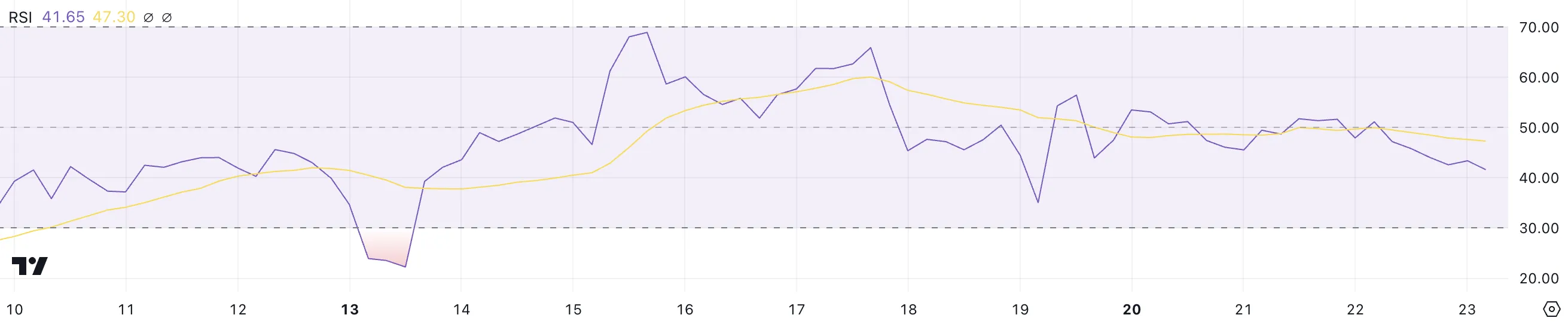

Ethereum RSI Is Currently Neutral and Going Down

The Ethereum RSI (Relative Strength Index) is currently sitting at 41.6, marking a significant drop from yesterday’s 51.1. After reaching an elevated level of 68 on January 15, the indicator has predominantly oscillated between 40 and 55, suggesting a period of moderate price momentum.

This recent decline below the midpoint of 50 indicates weakening bullish momentum, though not yet entering oversold territory.

RSI is a momentum oscillator that measures the speed and magnitude of price changes, typically using a 14-day period. The indicator operates on a scale of 0 to 100, with readings above 70 generally considered overbought and below 30 oversold. With ETH current RSI at 41.6, the asset is showing mild bearish momentum but remains in neutral territory.

While this could suggest a potential for further Ethereum decline in the short term, the moderate RSI reading doesn’t signal extreme conditions that would typically precede major price movements, suggesting a period of price consolidation may be more likely.

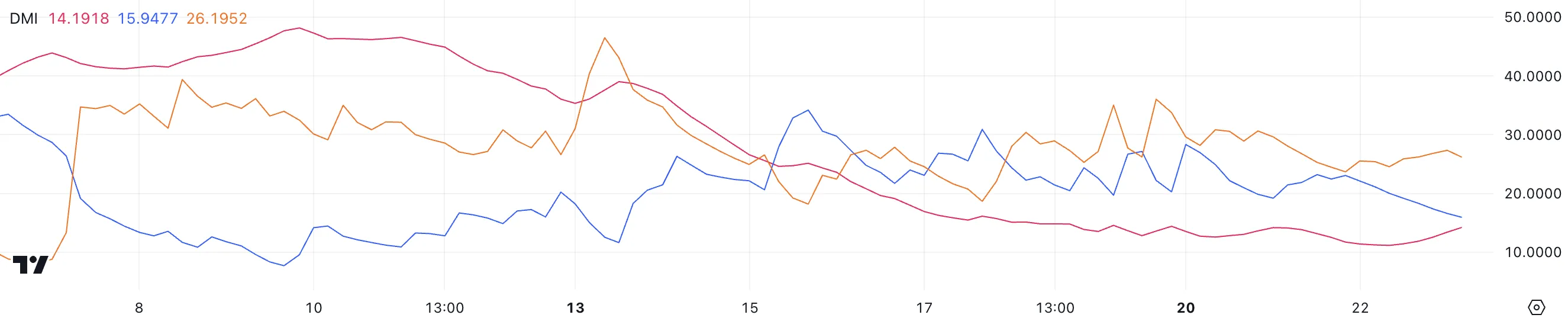

ETH DMI Shows a Weak Trend

Directional Movement Index (DMI) for Ethereum shows weak overall trend strength with an Average Directional Index (ADX) of 14.1, continuing its sub-20 reading since January 16.

The ADX, which ranges from 0 to 100, measures trend strength regardless of direction. Readings below 20 indicate a weak trend, ranging from 20 to 25 suggest an emerging trend, and above 25 signal a strong trend.

The current bearish signal is evident in the Positive Directional Indicator (+DI) falling to 15.94 from 23 while the Negative Directional Indicator (-DI) rose to 25.94 from 23.68.

With -DI crossing above +DI and exceeding 25, this suggests increasing selling pressure. However, the low ADX indicates the trend lacks strength despite ETH 3% decline in 24 hours. This combination typically suggests a weak downtrend that could either strengthen if ADX rises above 20, or continue ranging if ADX remains low.

ETH Price Prediction: Will Ethereum Fall Below $3,000?

Ethereum Exponential Moving Average (EMA) lines are displaying a bearish pattern, with shorter-period EMAs trading below longer ones, suggesting sustained downward momentum.

The immediate support level sits at $3,158, with a break below potentially triggering a decline to $2,927. Current price action near these levels indicates bears may be testing this crucial support zone.

A bullish reversal scenario would require Ethereum price to first overcome resistance at $3,334. If successful, key resistance levels await at $3,473 and $3,745.

However, the bearish EMA configuration suggests upward moves may face significant selling pressure until the shorter-term EMAs can cross above longer-term ones, indicating a trend shift.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Consolidates Near Key Levels: The Implications Of A Breakout

XRP is currently navigating a pivotal phase, trading within a well-defined consolidation range of $2.9 to $3.4. This narrow band reflects a balanced struggle between bullish optimism and bearish caution as neither side has yet mustered the strength to trigger a decisive price movement.

Historically, such periods of consolidation are often precursors to significant market shifts, making this a critical moment for XRP enthusiasts and traders alike. A breakout above the upper boundary at $3.4 will probably act as a bullish catalyst, indicating renewed momentum and attracting fresh buying interest.

Such a move may pave the way for XRP to target higher levels, fueling market confidence. However, a breakdown below the $2.9 support could spell trouble, inviting stronger selling pressure. With technical indicators and trading volumes offering mixed signals, all eyes are now on XRP’s price action to see whether it will deliver a breakout or succumb to a bearish reversal.

A Tug-Of-War Between XRP Bulls And Bears

A consolidation phase has emerged within the $2.9 to $3.4 range, showcasing a battle between bullish and bearish forces. The $2.9 level has proven to be a robust support, preventing further declines, while the $3.4 resistance acts as a key barrier to upward momentum. This tug-of-war highlights the indecision in the market, with traders closely watching for a breakout or breakdown to gauge the next significant price direction.

However, technical indicators are offering valuable insights into XRP’s consolidation phase such as the Relative Strength Index (RSI) suggesting a potential bearish breakout below the critical $2.9 support level. The RSI, currently dropping below the 50% threshold, reflects a weakening buying momentum.

If the RSI continues to dip toward oversold territory, it might indicate that bears might be gaining the upper hand, increasing the likelihood of a price drop below $2.9. A breakdown at this support level may trigger negative momentum, pushing the altcoin into a deeper retracement phase.

While consolidation phases often precede significant market moves, the RSI’s negative alignment warns traders to remain cautious as a failure to hold $2.9 could attract more sellers. Monitoring RSI movements alongside other technical indicators will be crucial in anticipating XRP’s next move amidst this uncertain phase.

The Importance Of Defending The $2.9 Support Level

Recent price action shows that the $2.9 support level is a critical threshold for XRP as bearish pressure looms. A decisive break below this level would result in increased selling pressure, driving the price down toward $1.9. This makes defending $2.9 a priority for the bulls since maintaining this level could provide the stability needed for a rebound.

Failure to hold $2.9 might also shake trader confidence, reinforcing pessimistic sentiment and extending XRP’s consolidation phase. It is advisable to monitor price action and volume near this key level as it might determine whether XRP remains resilient or submits to more downside risks.

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Predicts XRP Price Surge To $8, Here’s Why

-

Market19 hours ago

Market19 hours agoBitcoin and XRP Prices Steady as iDEGEN fires on all cylinders

-

Market18 hours ago

Market18 hours agoBitwise Files for Dogecoin ETF Amid Growing Meme Coin Interest

-

Market24 hours ago

Market24 hours agoEthereum Price Can Reach $3,500 On The Back Of These Factors

-

Market23 hours ago

Market23 hours agoWhy These Altcoins Are Trending Today — January 22

-

Market15 hours ago

Market15 hours agoHow ADGM Plans to Make the UAE the Crypto Capital of the World

-

Market22 hours ago

Market22 hours agoLido Founder Lomashuk Promotes Second Ethereum Foudnation

-

Market21 hours ago

Market21 hours agoNobody Kidnapped Ledger Co-Founder Eric Larchevêque