Market

Democrats Call for Ethics Probe on Trump Over Crypto Projects

US Representative Gerald Connolly has called for immediate action to address concerns about President Donald Trump’s financial entanglements, particularly in the crypto space.

In a letter, Connolly asked the House Oversight and Government Reform Committee to investigate potential conflicts of interest tied to Trump’s involvement in crypto ventures, which he argues could undermine presidential ethics and transparency.

Trump’s Meme Coin: A Threat to Transparency and National Security?

Connolly’s letter focuses on Trump’s role in launching World Liberty Financial (WLF), a crypto project inspired by Trump’s vision of financial independence.

According to reports, Justin Sun, the founder of Tron, has made significant investments in WLF. Connoly said Justin Sun is a foreign entrepreneur under investigation by the US SEC for alleged securities fraud related to his own crypto ventures.

Sun’s $30 million investment in WLF tokens reportedly allowed the platform to meet its revenue target, potentially funneling money directly to Trump and his family.

“The expanding scope of President Trump—and by extension The Trump Organization’s—financial entanglements and quid pro quo promises are troubling,” Connolly wrote.

He insists that the Oversight Committee must investigate these ventures under the provisions of the Presidential Ethics Reform Act. While WLF’s tokens do not offer a legitimate financial return, Connolly warns that they present an easy mechanism for individuals and foreign entities to gain favor with the Trump family.

Trump’s other crypto involvements added to the concerns surrounding WLF. Just days before his inauguration, Trump launched a meme coin called “TRUMP.”

The TRUMP token has already garnered a fully diluted valuation nearing $40 billion. The “Official Trump” token, launched last week, experienced a rapid surge of over 1,100%, rising from $6 to $75 within a few hours. However, as of writing, it is trading at around $37.93.

When asked about TRUMP at a recent conference, the President appeared uncertain about its details.

“I don’t know where it is. I don’t know much about it other than I launched it, other than it was very successful,” Trump said.

Moreover, Congresswoman Maxine Waters said the TRUMP meme coin “represents the worst of crypto.”

“Through his meme coin, Trump has created a way to circumvent national security and anti-corruption laws, allowing interested parties to anonymously transfer money to him and his inner circle,” Waters said in a January 20 statement.

She added that anyone around the world, including individuals who have been sanctioned by the US, can now trade and profit from TRUMP.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ETH Price Falls as Market Questions Future Outlook

Ethereum (ETH) price is showing bearish signals across multiple technical indicators as the leading smart contract platform faces mounting pressure. ETH is down more than 3% in the last 24 hours, as questions about its future are raised and competing chains like Solana continue to attract more attention.

ETH has declined almost 15% since reaching its 2025 peak on January 6. Technical analysis suggests further downside could be ahead, with key support levels being tested as momentum indicators point to weakening bullish sentiment.

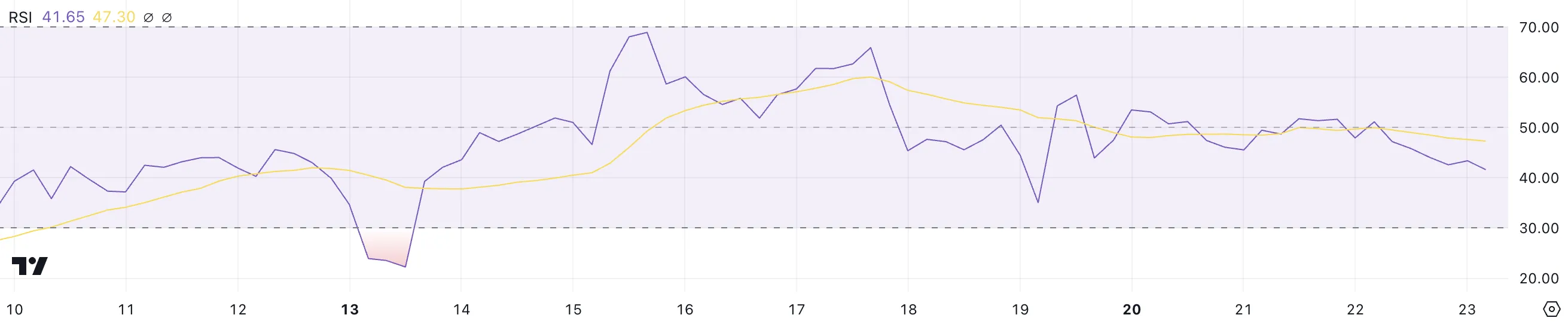

Ethereum RSI Is Currently Neutral and Going Down

The Ethereum RSI (Relative Strength Index) is currently sitting at 41.6, marking a significant drop from yesterday’s 51.1. After reaching an elevated level of 68 on January 15, the indicator has predominantly oscillated between 40 and 55, suggesting a period of moderate price momentum.

This recent decline below the midpoint of 50 indicates weakening bullish momentum, though not yet entering oversold territory.

RSI is a momentum oscillator that measures the speed and magnitude of price changes, typically using a 14-day period. The indicator operates on a scale of 0 to 100, with readings above 70 generally considered overbought and below 30 oversold. With ETH current RSI at 41.6, the asset is showing mild bearish momentum but remains in neutral territory.

While this could suggest a potential for further Ethereum decline in the short term, the moderate RSI reading doesn’t signal extreme conditions that would typically precede major price movements, suggesting a period of price consolidation may be more likely.

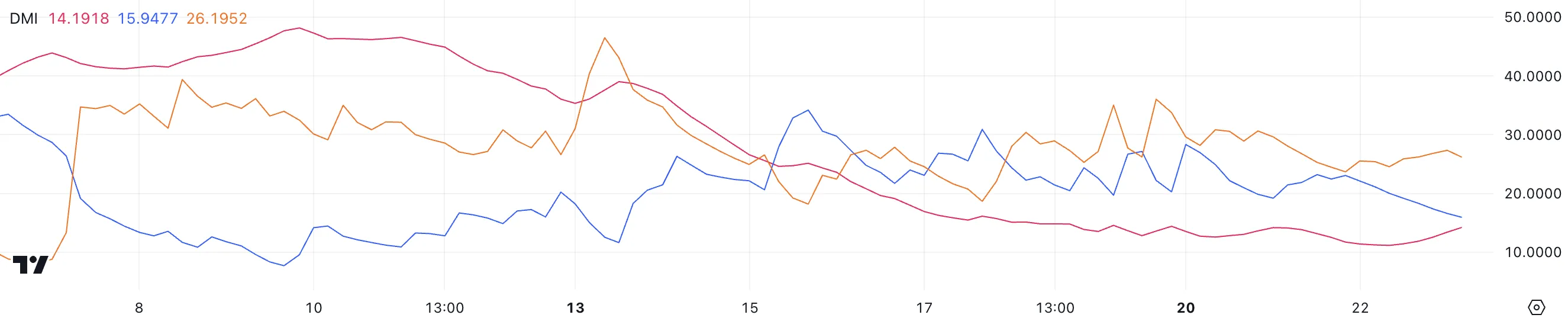

ETH DMI Shows a Weak Trend

Directional Movement Index (DMI) for Ethereum shows weak overall trend strength with an Average Directional Index (ADX) of 14.1, continuing its sub-20 reading since January 16.

The ADX, which ranges from 0 to 100, measures trend strength regardless of direction. Readings below 20 indicate a weak trend, ranging from 20 to 25 suggest an emerging trend, and above 25 signal a strong trend.

The current bearish signal is evident in the Positive Directional Indicator (+DI) falling to 15.94 from 23 while the Negative Directional Indicator (-DI) rose to 25.94 from 23.68.

With -DI crossing above +DI and exceeding 25, this suggests increasing selling pressure. However, the low ADX indicates the trend lacks strength despite ETH 3% decline in 24 hours. This combination typically suggests a weak downtrend that could either strengthen if ADX rises above 20, or continue ranging if ADX remains low.

ETH Price Prediction: Will Ethereum Fall Below $3,000?

Ethereum Exponential Moving Average (EMA) lines are displaying a bearish pattern, with shorter-period EMAs trading below longer ones, suggesting sustained downward momentum.

The immediate support level sits at $3,158, with a break below potentially triggering a decline to $2,927. Current price action near these levels indicates bears may be testing this crucial support zone.

A bullish reversal scenario would require Ethereum price to first overcome resistance at $3,334. If successful, key resistance levels await at $3,473 and $3,745.

However, the bearish EMA configuration suggests upward moves may face significant selling pressure until the shorter-term EMAs can cross above longer-term ones, indicating a trend shift.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Consolidates Near Key Levels: The Implications Of A Breakout

XRP is currently navigating a pivotal phase, trading within a well-defined consolidation range of $2.9 to $3.4. This narrow band reflects a balanced struggle between bullish optimism and bearish caution as neither side has yet mustered the strength to trigger a decisive price movement.

Historically, such periods of consolidation are often precursors to significant market shifts, making this a critical moment for XRP enthusiasts and traders alike. A breakout above the upper boundary at $3.4 will probably act as a bullish catalyst, indicating renewed momentum and attracting fresh buying interest.

Such a move may pave the way for XRP to target higher levels, fueling market confidence. However, a breakdown below the $2.9 support could spell trouble, inviting stronger selling pressure. With technical indicators and trading volumes offering mixed signals, all eyes are now on XRP’s price action to see whether it will deliver a breakout or succumb to a bearish reversal.

A Tug-Of-War Between XRP Bulls And Bears

A consolidation phase has emerged within the $2.9 to $3.4 range, showcasing a battle between bullish and bearish forces. The $2.9 level has proven to be a robust support, preventing further declines, while the $3.4 resistance acts as a key barrier to upward momentum. This tug-of-war highlights the indecision in the market, with traders closely watching for a breakout or breakdown to gauge the next significant price direction.

However, technical indicators are offering valuable insights into XRP’s consolidation phase such as the Relative Strength Index (RSI) suggesting a potential bearish breakout below the critical $2.9 support level. The RSI, currently dropping below the 50% threshold, reflects a weakening buying momentum.

If the RSI continues to dip toward oversold territory, it might indicate that bears might be gaining the upper hand, increasing the likelihood of a price drop below $2.9. A breakdown at this support level may trigger negative momentum, pushing the altcoin into a deeper retracement phase.

While consolidation phases often precede significant market moves, the RSI’s negative alignment warns traders to remain cautious as a failure to hold $2.9 could attract more sellers. Monitoring RSI movements alongside other technical indicators will be crucial in anticipating XRP’s next move amidst this uncertain phase.

The Importance Of Defending The $2.9 Support Level

Recent price action shows that the $2.9 support level is a critical threshold for XRP as bearish pressure looms. A decisive break below this level would result in increased selling pressure, driving the price down toward $1.9. This makes defending $2.9 a priority for the bulls since maintaining this level could provide the stability needed for a rebound.

Failure to hold $2.9 might also shake trader confidence, reinforcing pessimistic sentiment and extending XRP’s consolidation phase. It is advisable to monitor price action and volume near this key level as it might determine whether XRP remains resilient or submits to more downside risks.

Market

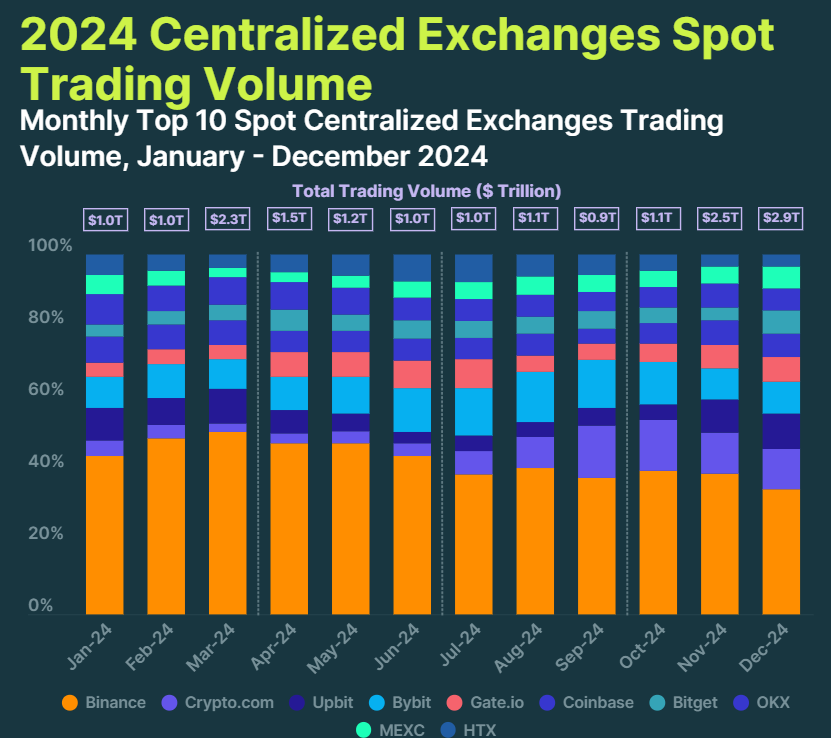

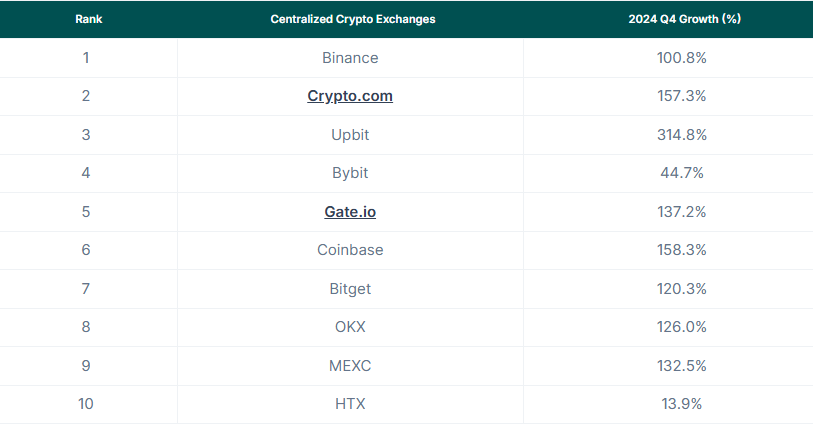

Top 10 Crypto CEXs See $6.4 Trillion Trading Volume in Q4 2024

According to a CoinGecko report, in Q4 2024, the overall trading volume of the top 10 crypto centralized exchanges (CEX) surged, with eight of them recording triple-digit percentage growth.

It was also found that the total trading volume for the top 10 exchanges in Q4 was $6.4 trillion, a 111.7% increase from the previous quarter.

Binance Maintains Dominance as Top CEX, Despite Declining Market Share

At the close of 2024, Binance remained the clear leader in the market, maintaining a dominant market share of 34.7%.

The CoinGecko report showed that in December alone, the exchange recorded a substantial spot trading volume of $1.0 trillion. This marked a slight increase of 2.3% from November’s $979.1 billion.

The achievement marked Binance’s second $1 trillion volume month in 2024. Over the course of the year, Binance’s dominance was even more pronounced, capturing 42.4% of the total volume among the top 10 exchanges, with $7.4 trillion traded compared to the $17.4 trillion in total volume for the group.

Despite its dominance, Binance has experienced a gradual loss of market share in 2024. Starting the year with a 44.1% share, it has seen a decline in its portion of the market since September, dipping below 40%.

“However, it is still the largest exchange by a large margin. For comparison, it had more trading volume than the next five largest exchanges combined in 2024 ($7.4 trillion vs. $6.6 trillion),” CoinGecko said.

Crypto.com emerged as the second-largest exchange by trading volume in December. It had an 11.2% market share and $322.3 billion in trading volume. This represents a significant increase of 12.7% from the previous month.

In Q4 2024, Crypto.com saw a sharp increase in volume. The volumes rose from $539.8 billion in the first three quarters of the year to $757.8 billion in the final quarter.

Upbit, which reclaimed its spot as the third-largest exchange in November 2024, continued its upward trajectory into December. The exchange recorded $282.7 billion in spot trading volume for the month, a notable 22% growth from November.

Upbit’s performance in Q4 was driven by a dramatic surge in volume following the declaration of martial law in South Korea on December 3. This led to a six-fold increase in daily volumes, reaching an average of $21 billion per day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoBitcoin and XRP Prices Steady as iDEGEN fires on all cylinders

-

Bitcoin24 hours ago

Bitcoin24 hours agoUS Bitcoin Revolution Begins, Senator Lummis Says

-

Market23 hours ago

Market23 hours agoEthereum Price Can Reach $3,500 On The Back Of These Factors

-

Market22 hours ago

Market22 hours agoWhy These Altcoins Are Trending Today — January 22

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Predicts XRP Price Surge To $8, Here’s Why

-

Market21 hours ago

Market21 hours agoLido Founder Lomashuk Promotes Second Ethereum Foudnation

-

Market20 hours ago

Market20 hours agoNobody Kidnapped Ledger Co-Founder Eric Larchevêque

-

Altcoin12 hours ago

Altcoin12 hours agoBTC Backtracks To $102K, Meme Coins Mimic Dip