Market

How ADGM Plans to Make the UAE the Crypto Capital of the World

The Abu Dhabi Global Market (ADGM) has been making continuous strategic efforts to position the UAE as the crypto and blockchain capital of the world. The region’s regulatory clarity, streamlined process, and strategic position as a global financial hub have contributed to its success.

BeInCrypto spoke with Dmitry Fedotov, the Head of DLT Foundations at ADGM, to understand how its blockchain-friendly regulations have driven crypto giants to open offices in Abu Dhabi.

ADGM Poised to Accelerate Blockchain Adoption

Over the past few years, the UAE has emerged as a global leader in blockchain and Web3 adoption, creating a favorable environment for innovation and growth. The ADGM, a financial-free zone on Al Maryah Island in Abu Dhabi, has gained particular recognition for its blockchain-friendly regulatory framework.

The ADGM was established in 2013 by a Federal Decree. It functions as the city’s financial center and responds to an independent legal and regulatory framework. Its approach to Web3 innovation has attracted major players in the industry.

“ADGM positions itself as a global leader by taking such innovative steps, inspiring other jurisdictions to adopt forward-thinking solutions that redefine governance and engagement in emerging technologies,” Fedotov told BeInCrypto.

The UAE at large is experiencing a surge in crypto adoption as more businesses and users have adopted digital assets for transactions and investments.

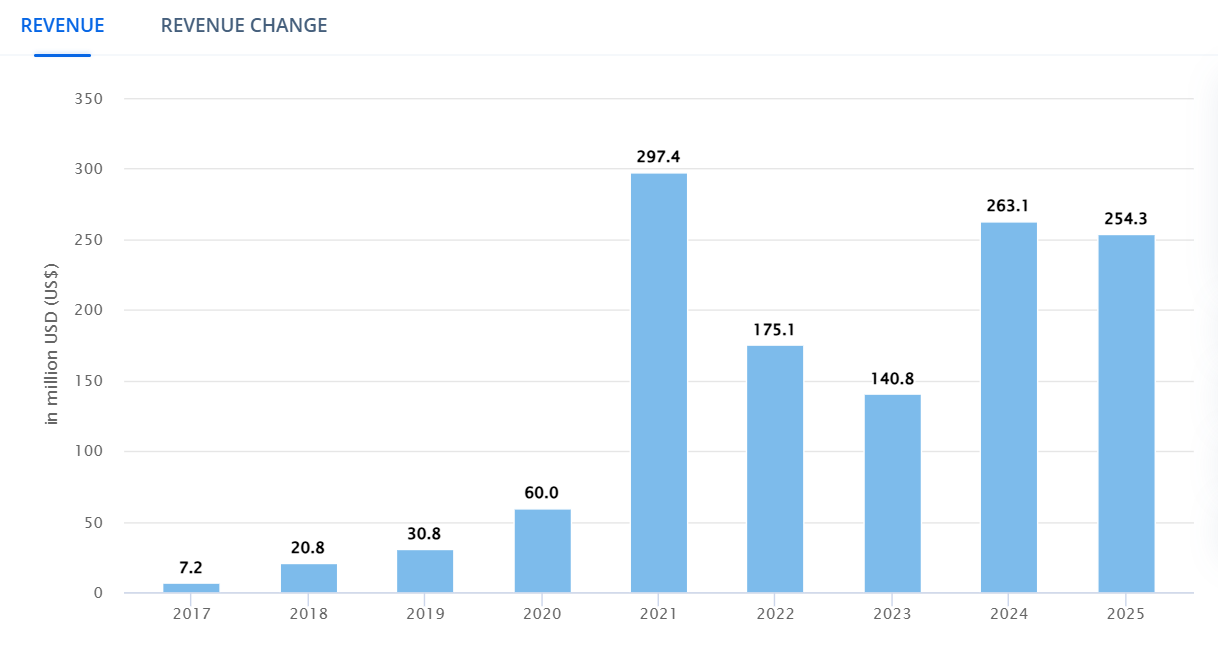

According to Statista, the number of users participating in the country’s crypto market will reach 3.78m users by 2025. Consequently, revenue rates are expected to remain high this year.

Meanwhile, the Aptos Foundation, a leading global blockchain entity, announced last month the opening of its new office in the ADGM.

The strategic move aims to drive regional partnerships, accelerate blockchain adoption, and expand the Aptos ecosystem. It also reinforces the UAE’s status as a hub for blockchain and Web3 innovation.

“Partnerships with industry leaders enhance our ecosystem’s credibility, while streamlined licensing processes make ADGM stand out compared to other financial hubs. These measures create a unique balance of growth opportunities and regulatory clarity,” Fedotov said.

Beyond Aptos, Chainlink Labs, TON, and Polygon Labs established their presence in ADGM to accelerate adoption in the Middle East.

However, for any crypto entity to pursue business endeavors in ADGM, it must first undergo a series of evaluations to determine whether it is eligible for operation.

Regulation of Virtual Asset Activities in ADGM

Over the years, the UAE has established notable regulatory clarity for the crypto industry. Before offering virtual asset services in the region, an entity must first gain an operating license from ADGM’s Financial Services Regulatory Authority (FSRA).

The FSRA defines a virtual asset as “a digital representation of value that can be digitally traded and functions as a medium of exchange, a unit of account, or a store of value, but does not have legal tender status in any jurisdiction.”

Virtual assets do not require a third party to create or interact with them. Because of this, they present a series of unique challenges for regulators worldwide.

In response, the FSRA considers seven key factors in determining whether a virtual asset meets these requirements. The factors include asset maturity, security, traceability and monitoring, exchange connectivity, type of distributed ledger, innovation and efficiency, and practical application.

More specifically, the FSRA evaluates whether there is sufficient client demand for the virtual asset. It also monitors whether controls are in place to manage its volatility and if the asset can withstand or respond to its specific risks and vulnerabilities.

Applicants also need to demonstrate whether the virtual assets help to solve a fundamental problem. Examples include meeting an unmet market need and determining whether they possess real-world, quantifiable functionality.

“This pioneering spirit ensures ADGM remains at the forefront of shaping the future of how regulators approach ever-evolving regulatory needs,” Fedotov said.

Tether’s USDT was one of the first companies to receive approval from Abu Dhabi’s FSRA to operate its stablecoin as an Accepted Virtual Asset on the ADGM. The approval reflects compliance with the region’s regulatory standards, paving the way for USDT’s inclusion in licensed financial services.

However, the Virtual Assets Framework is not the only one the ADGM has implemented to ensure regulatory compliance.

ADGM’s DLT Framework

In 2023, the ADGM established a framework to develop a worldwide standard for blockchain foundations, decentralized autonomous organizations (DAOs), and other Web3 entities.

Known as the Distributed Ledger Technology (DLT) Foundations Framework, this legislation allows the issuance of tokens and enables entities to employ diverse token governance strategies.

“ADGM offers regulatory clarity in a highly respectable jurisdiction based on the direct application of English Common Law with a supportive environment for innovation,” Fedotov said.

Before receiving approval, DLT Foundations must ensure compliance with all applicable laws, requirements, rules, and regulations set forth by the UAE, the Emirate of Abu Dhabi, and the ADGM.

To register a DLT Foundation in ADGM, applicants must provide a written charter signed by all of the founders and additionally sign a declaration of compliance. Applicants must also pay a series of initial registration fees and provide a copy of the whitepaper and tokenomics paper.

DLT Foundations must always have a registered office in the ADGM. They also need to demonstrate that they have substantial resources, experience, and personnel in the UAE.

“Initiatives like the DLT Foundations framework give blockchain-based organisations the opportunity to issue utility tokens and apply smart contracts for decentralised governance models,” Fedotov added.

Last month, ADGM registered TON as a DLT Foundation under its legal framework. This enabled a smoother operation and governance support for the decentralized organization.

TON aims to drive the adoption of its blockchain in the Middle East. ADGM’s comprehensive regulatory framework provides a supportive environment for the blockchain to do so via its DLT Foundation.

Balancing Innovation with Consumer Protection

To maintain its DLT Foundation status, the TON blockchain needs to continuously comply with a series of regulations, particularly developed to safeguard consumer security.

“ADGM’s DLT/blockchain framework aligns closely with global standards, focusing on key areas like combating financial crime, ensuring user protection, and promoting market integrity,” Fedotov told BeInCrypto.

The framework discloses that before granting a registration license, entities must provide evidence that they comply with laws related to anti-money laundering, anti-bribery, sanctions, export controls, consumer and data protection, and cybercrime prevention.

DLT Foundations must also conduct specific security audits on its data protection and security systems at least once per calendar year. Copies of the audits’ results must be sent to the registrar within two weeks of completion.

Like the DLT Foundations Framework, the Virtual Asset Framework requires the same degree of exhaustiveness to ensure user protection.

According to the legislation, “given the increased use of Virtual Assets as a medium for financial transactions, and their connectivity to the mainstream financial system through Virtual Asset and derivative exchanges and intermediaries, there is the increased potential of contagion risks impacting the stability of the financial sector.”

Consequently, the FSRA outlines in the virtual asset framework that applicants must mitigate risks related to anti-money laundering (AML), consumer protection, technology governance, ‘exchange-type’ activities, and custody.

Applicants also need to comply with FSRA’s AML rulebook and place controls regarding virtual asset wallets, private keys, risk management, and systems recovery.

Collaboration with the Financial Action Task Force

The ADGM and the different jurisdictions that comprise the UAE have also collaborated with the Financial Action Task Force (FATF) in developing its regulatory framework. This intergovernmental organization serves as a global anti-money laundering watchdog.

“Through partnerships with leading blockchain security companies, ADGM integrates international best practices. Collaborations with global regulatory bodies, and adoption of recommendations issued by the Financial Action Task Force (FATF), help establish benchmarks for the industry,” Fedotov said.

In February, the FATF announced that the UAE had been removed from its list of jurisdictions subject to enhanced due diligence or increased monitoring.

This action recognizes the UAE’s significant progress in addressing the FATF’s concerns regarding anti-money laundering and counter-terrorism financing measures.

“ADGM achieves this balance through a principle-based approach that establishes robust security and governance standards while granting companies the flexibility to innovate,” Fedotov added.

While ADGM welcomes responsible innovation within the digital asset sector, it is not intended to serve as a haven for entities that do not have a genuine commitment to regulatory compliance.

For instance, in October 2023, ADGM’s FSRA fined licensed money service provider Pyypl $486,000 for inadequate compliance with AML requirements.

Also, beyond an inclusive yet responsible framework, the ADGM has developed other pioneering initiatives that prioritize a forward-thinking approach to innovation.

Initiatives in Cutting-Edge Fields

Part of ADGM’s appeal to Web3 developers is its proactive approach to innovation.

“ADGM’s initiatives reflect its boldness and willingness to lead by being the first to explore uncharted territories,” Fedotov said.

Over the years, ADGM has launched several pilots that reflect this motivation.

“’Mediation in the Metaverse’ is a prime example, showcasing a groundbreaking approach to resolving disputes in virtual environments and highlighting ADGM’s ability to adapt to the rapidly evolving digital landscape,” he added.

In November 2022, the ADGM Arbitration Centre launched the Mediation in the Metaverse initiative. This pilot project leverages Web3 technology to create a virtual environment replicating the physical ADGM Arbitration Centre.

The immersive experience is accessible via desktop or mobile devices and aims to enhance participant engagement and improve the mediation process.

Since then, ADGM has broadened its endeavors.

“We are closely researching advancements in areas such as quantum computing, AI, autonomous transportation, robotics, and space technology to ensure our regulations support innovation in these cutting-edge fields,” Fedotov told BeInCrypto.

These efforts have already begun to materialize, attracting greater participation in ADGM’s crypto market and in the UAE at large.

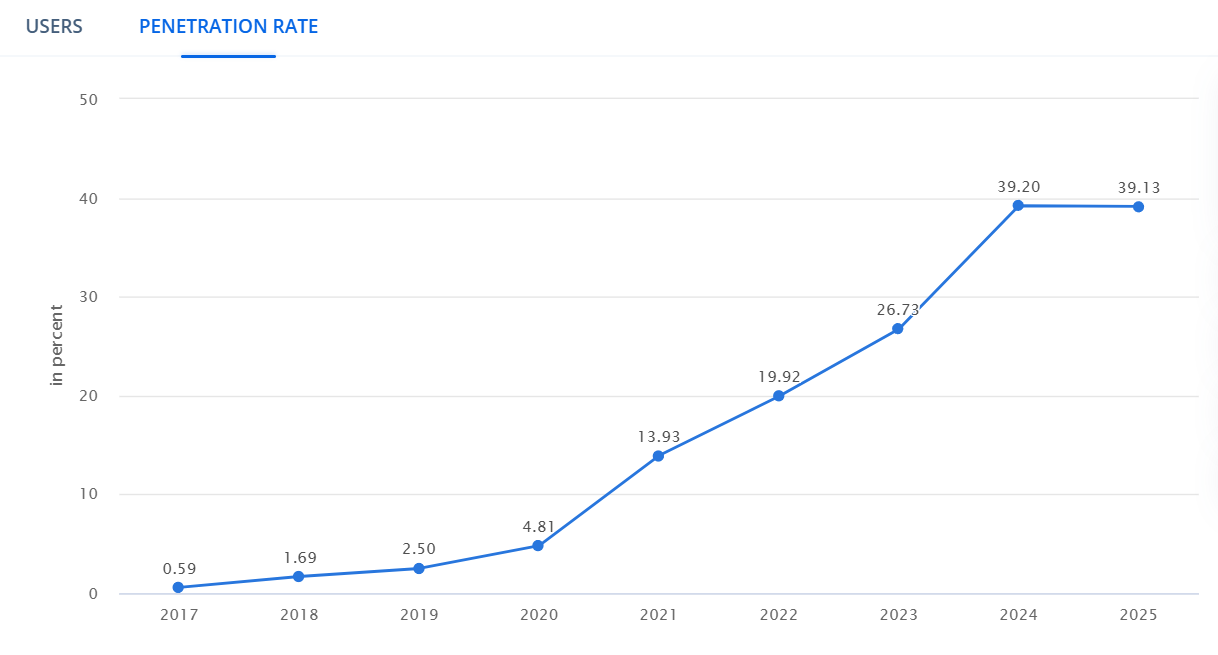

According to Statista, the country’s penetration rate will reach 39.13 in 2025. This calculation is based on key market indicators, such as GDP, consumer spending, population, internet penetration, smartphone penetration, credit card penetration, and online banking penetration.

Last month, the Hashgraph Group of the Hedera ecosystem announced that it had secured a fund management license from ADGM.

With its newly attained license, the Swiss-based technology and investment firm announced the launch of a $100 million global venture fund. The funding will go toward promising startups and enterprises leveraging artificial intelligence, blockchain/DLT, robotics, and quantum computing.

This forward-thinking approach is not only limited to the ADGM, however. Other cities in the UAE are also taking a similar road.

ADGM Mirrors Broader UAE Approach to Web3 Innovation

Overall, the UAE’s crypto and blockchain developments have been nothing short of surprising. The country is always looking to set a new benchmark for other global markets.

Last week, Dubai announced plans to construct a 17-story Crypto Tower by 2027, reflecting the city’s commitment to supporting the growth of the blockchain and Web3 sectors. This initiative will provide 150,000 square feet of leasable space for blockchain and digital asset firms.

According to local reports, the Crypto Tower itself will integrate blockchain technology, enabling features such as on-chain voting, shared resource management, and smart contract-based operations to automate bureaucratic processes.

The tower will provide nine floors of office space for crypto companies and allocate three floors to incubators, venture capital firms, and investment groups. There will also be one floor dedicated exclusively to AI initiatives.

“This forward-thinking approach ensures ADGM remains a secure, adaptable, and innovation-friendly hub,” said Fedotov.

With its supportive policies and a growing community of blockchain pioneers, ADGM’s vision of becoming a global leader in blockchain innovation seems well within reach.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Staking Cap Surpasses Ethereum, But Is This Sustainable?

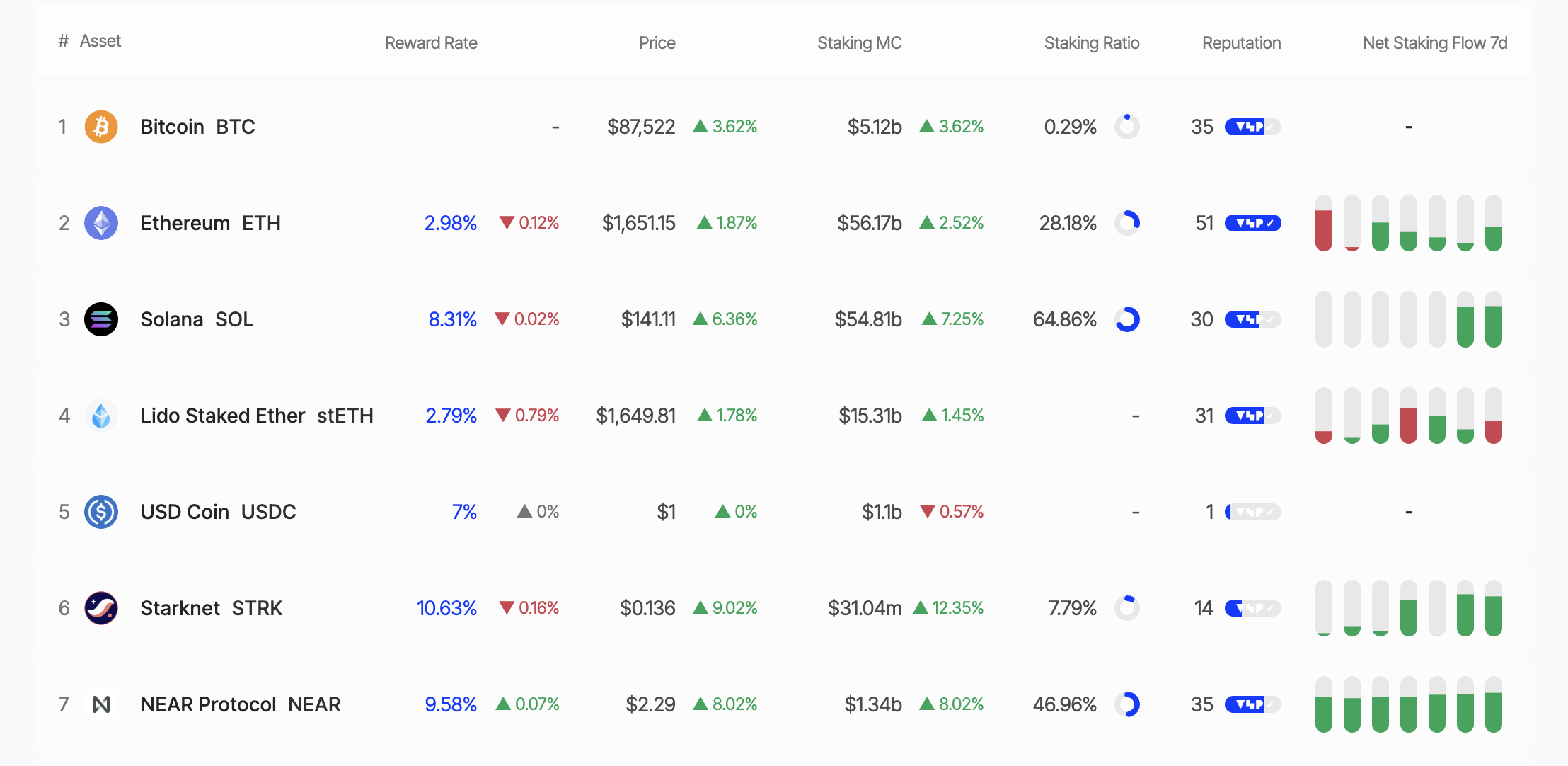

According to data from StakingRewards, Solana (SOL) has overtaken Ethereum (ETH) in staking market capitalization, reaching $53.15 billion compared to Ethereum’s $53.72 billion.

This milestone has sparked heated discussions across the social media platform X, raising the question: Is this a turning point for Solana, or merely a short-lived surge?

Solana Outpaces Ethereum As High Staking Yields Prove Appealing

Recent data reveals that 64.86% of Solana‘s total supply is currently staked, delivering an impressive annual percentage yield (APY) of 8.31%. In contrast, Ethereum has only 28.18% of its supply staked, with an APY of 2.98%.

This disparity highlights Solana’s growing appeal for investors seeking passive income through staking. Staking market capitalization is calculated by multiplying the total number of staked tokens by their current price. With SOL priced at $138.91 as of this writing, Solana has officially surpassed Ethereum in this metric.

However, Solana’s high staking ratio has sparked some controversy. Critics, such as Dankrad Feist on X, argue that Solana’s lack of a slashing mechanism (or penalties for validator violations) undermines the economic security of its staking model. With its slashing mechanism, Ethereum offers greater security, despite its lower staking ratio.

“It’s very ironic to call it ‘staking’ when there is no slashing. What’s at stake? Solana has close to zero economic security at the moment,” Dankrad Feist shared.

Increased Whale Activity Signals Caution

Meanwhile, recent moves by “whales” (large investors) have further fueled interest in Solana. On April 20, 2025, a whale unstaked 37,803 SOL (worth $5.26 million). Similarly, Galaxy Digital withdrew 606,000 SOL from exchanges over four days (April 15–19, 2025), concluding with 462,000 SOL.

Additionally, on April 17, 2025, a newly created wallet withdrew approximately $5.15 million worth of SOL from the Binance exchange. In the same tone, Binance whales withdrew over 370,000 SOL tokens valued at $52.78 million.

While some whales withdrew their SOL holdings, other large holders accumulated. Janover, a US-listed company, increased its Solana holdings to 163,651.7 SOL (worth $21.2 million) and partnered with Kraken exchange for staking on April 16, 2025.

These actions signal diverging plays from institutional investors and whales, as the Solana price fluctuates around key levels.

SOL Price Analysis: Opportunities and Challenges

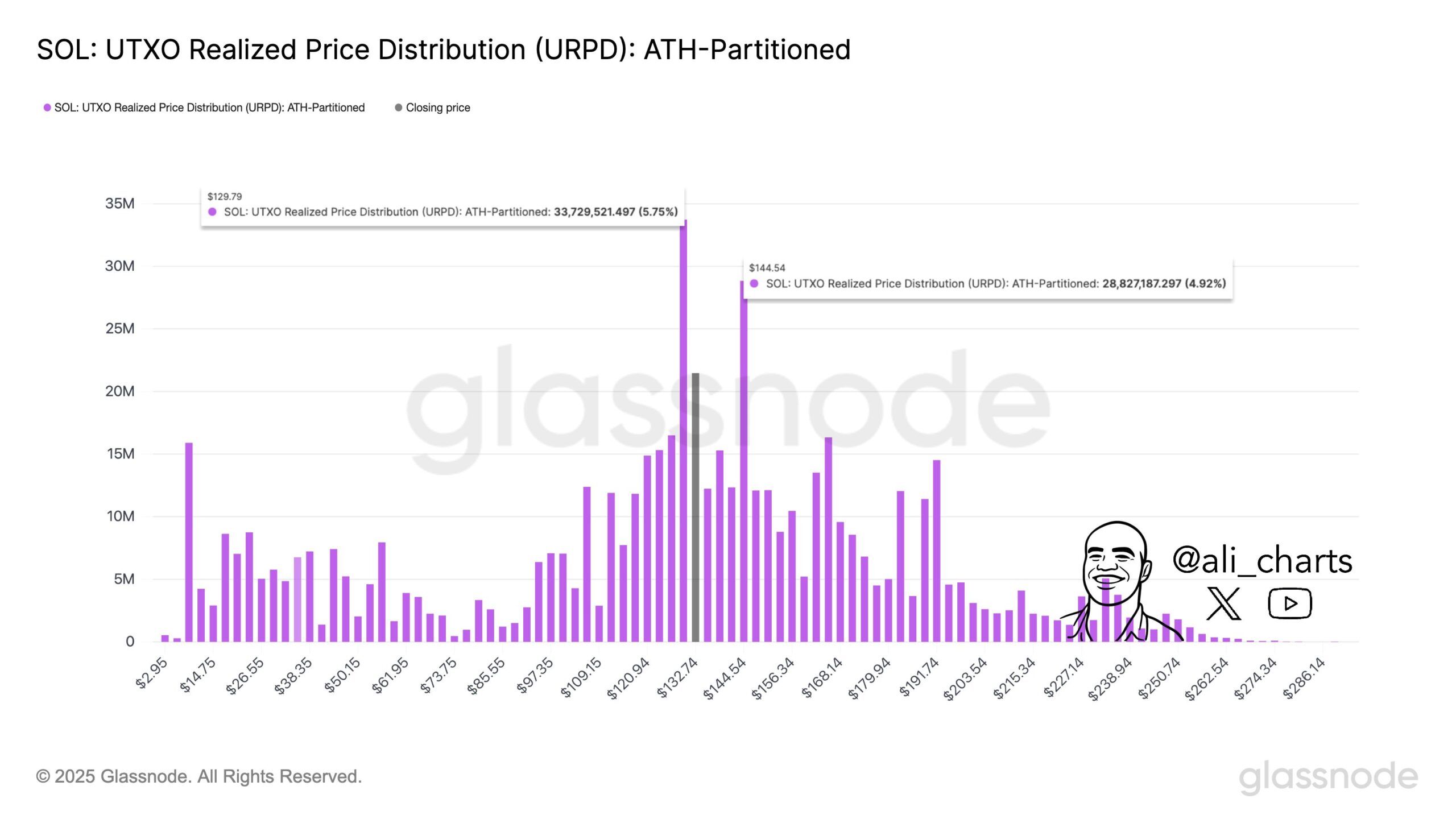

As of this writing, SOL was trading at $140.49, up 3.53% in the past 24 hours. Analysts highlight $129 as crucial support for the Solana price, with $144 presenting the key roadblock to overcome before Solana’s upside potential can be realized. Breaking above the aforementioned roadblock could propel SOL toward new highs.

Conversely, dropping below the $129 support level could trigger increased selling pressure. Nevertheless, SOL has shown a remarkable recovery, with a 14.34% increase over the past week.

Another factor to consider is the ongoing development of the Solana ecosystem. Key innovations include the QUIC data transfer protocol, the combination of Proof-of-History (PoH) and Proof-of-Stake (PoS), and the diversification of validator clients.

With these, Solana continues to enhance its performance and decentralization. Additionally, the launch of the Solang compiler, compatible with Ethereum’s Solidity, has attracted developers from the Ethereum ecosystem.

BeInCrypto also reported on Solana’s upcoming community conference, otherwise termed Solana Breakpoint. Key announcements from this event could provide further tailwinds for the SOL price.

Nevertheless, despite surpassing Ethereum in staking market capitalization, Solana faces significant challenges. Ethereum benefits from a more mature DeFi ecosystem, greater institutional trust, and enhanced security through its slashing mechanism.

To some, Ethereum’s lower staking ratio (28%) may be a deliberate strategy to reduce network pressure and ensure liquidity for DeFi applications.

In contrast, Solana’s high staking ratio (65%) could limit liquidity within its DeFi ecosystem. This raises the question of whether Solana can strike a balance between staking and the growth of its decentralized applications.

As Solana continues challenging Ethereum’s dominance, the crypto community remains divided. Is Solana’s rise a sustainable breakthrough, or just another wave of hype?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Clings to Support—Upside Break Could Trigger Rally

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a increase from the $1,550 zone. ETH is now rising and might attempt to recover above the $1,650 resistance.

- Ethereum started a fresh increase above the $1,580 and $1,600 levels.

- The price is trading above $1,600 and the 100-hourly Simple Moving Average.

- There was a break above a connecting bearish trend line with resistance at $1,590 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $1,650 resistance zone.

Ethereum Price Eyes Upside Break

Ethereum price remained stable above the $1,500 level and started a fresh increase, like Bitcoin. ETH traded above the $1,550 and $1,600 levels to enter a short-term positive zone.

There was a break above a connecting bearish trend line with resistance at $1,590 on the hourly chart of ETH/USD. The pair even cleared the $1,620 resistance. A high was formed at $1,644 and the price is stable above the 23.6% Fib retracement level of the upward move from the $1,566 swing low to the $1,644 high.

Ethereum price is now trading above $1,600 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,640 level. The next key resistance is near the $1,650 level. The first major resistance is near the $1,680 level.

A clear move above the $1,680 resistance might send the price toward the $1,720 resistance. An upside break above the $1,720 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $1,800 resistance zone or even $1,840 in the near term.

Downside Correction In ETH?

If Ethereum fails to clear the $1,650 resistance, it could start a downside correction. Initial support on the downside is near the $1,620 level. The first major support sits near the $1,605 zone and the 50% Fib retracement level of the upward move from the $1,566 swing low to the $1,644 high.

A clear move below the $1,605 support might push the price toward the $1,580 support. Any more losses might send the price toward the $1,550 support level in the near term. The next key support sits at $1,500.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,600

Major Resistance Level – $1,650

Market

Will Bittensor Surpass Bitcoin as a Store of Value? Expert Predicts

Barry Silbert, CEO of Digital Currency Group, has stated that Bittensor (TAO) has the potential to outperform Bitcoin (BTC) as a global store of value.

His comments come amid notable growth in the Bittensor network, with its subnet ecosystem market capitalization and the TAO token’s price on the rise.

Will Bittensor’s Decentralized AI Model Outperform Bitcoin’s Legacy?

In a recent interview with Raoul Pal, Silbert highlighted the growing influence of artificial intelligence (AI) in the crypto sector. According to him, Bittensor is at the forefront of this revolution, representing the “next big era for crypto.”

“You had the Bitcoin and the Ethereum and the NFTs, and you had the layer 2s and DeFi. I think this is the next big investment theme for crypto,” Silbert stated.

He went on to explain that Bittensor shares the same pioneering spirit as early Bitcoin. Still, its purpose extends beyond financial sovereignty.

“The boldest prediction that I could make for Bittensor is it could be a better version of Bitcoin as a global store of value,” he claimed.

He argued that instead of the $10 to $12 billion spent annually to secure the Bitcoin network, that same amount could be redirected toward incentivizing a global network of individuals working to solve major world problems. He envisions this money fostering innovation on a massive scale, with the potential to grow into a multi-billion-dollar ecosystem.

While acknowledging the value of securing the Bitcoin network, Silbert emphasized that Bittensor’s potential lies in its ability to harness this vast financial backing to address real-world challenges.

He noted that Bittensor operates on a similar economic model to Bitcoin, with halving mechanisms and decentralization, positioning it as a powerful contender in the quest for a more impactful and value-driven global network.

Silbert also noted that while plenty of decentralized AI projects have emerged, Bittensor has set itself apart. He referred to it as having reached “escape velocity.” This term is used to convey a project’s rapid growth and increasing market influence.

“99.9% of crypto tokens that are out there have no reason to exist and are worthless,” he added.

Market data reflects the growing enthusiasm for Bittensor. Notably, amid the ongoing volatility, TAO has fared well in comparison to the broader market, rising 32.1% in the last week. At press time, the altcoin was trading at $328, up 7.2% over the past day.

Additionally, TAO is currently the top trending cryptocurrency on CoinGecko, underlining its rising popularity among investors. Google Trends data further proves the growing interest in Bittensor. The search volume peaked at 100 at the time of writing.

Meanwhile, the Bittensor ecosystem is also seeing notable progress. The latest data indicated that the market capitalization of Bittensor’s subnet tokens more than doubled in April 2025.

It increased by 166%, rising from $181 million at the beginning of April to $481 million at press time. As reported by BeInCrypto, this growth follows a tripling of active subnets over the past year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market19 hours ago

Market19 hours ago1 Year After Bitcoin Halving: What’s Different This Time?

-

Market23 hours ago

Market23 hours agoMELANIA Crashes to All-Time Low Amid Insiders Continued Sales

-

Market20 hours ago

Market20 hours agoVOXEL Climbs 200% After Suspected Bitget Bot Glitch

-

Market18 hours ago

Market18 hours agoTokens Big Players Are Buying

-

Market24 hours ago

Market24 hours agoCharles Schwab Plans Spot Crypto Trading Rollout in 2026

-

Market17 hours ago

Market17 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Altcoin22 hours ago

Altcoin22 hours agoXRP Leads Crypto Shopping List For Latin America Ahead Of ETH, SOL—Report

-

Market21 hours ago

Market21 hours agoHow Token Launch Frenzy Is Delaying 2025 Altcoin Season