Market

This is Why Bitget Considers Entering US Market

In a recent interview, Bitget CEO Gracy Chen claimed that the crypto exchange was considering entering US markets. Chen cited a friendlier US regulatory market under Trump’s upcoming term, but difficulties remain nonetheless.

She also expressed interest in a partnership to help clear US regulatory hurdles, but nothing concrete has materialized.

Bitget to Enter the US Market?

Chen, an influential figure in the crypto industry, discussed these possible decisions in a recent interview. According to Coingecko data, Bitget is currently the 7th largest centralized exchange in terms of daily trading volume. Entering the US could potentially boost its market share.

While the US is one of the biggest markets for crypto, most international exchanges have difficulties accessing it. Binance’s US branch, for example, received a major fine last year.

However, since Donald Trump’s election, the calculus has changed. Trump promised to enact a series of pro-crypto government reforms, which has helped enable a major bull market in the industry. He has already appointed a Crypto Czar and a new pro-crypto SEC Chair. These decisions have started reflecting an impending regulatory shift in the US crypto industry.

Meanwhile, Bitget already saw explosive growth this year, and the current bull market has elevated its token (BGB) even further. The token reached an all-time high over the weekend, gaining nearly 400% this year.

Now that the firm is profiting off this hype, its leadership sees a golden opportunity to expand. Still, Chen was quite clear that this path isn’t confirmed. Bitget attempted to enter US markets in 2022, and abandoned the effort in light of extensive compliance requirements. These obstacles haven’t gone away:

“We are revisiting a US strategy, although we have not decided on anything yet. If we had a local partner who has many of those licenses already, then we could do a joint venture, for example. So we don’t need to go through all the applications. We might take that approach, but it’s not decided yet,” Chen claimed.

Even under a friendlier federal administration, state-level agencies may prove to be a big headache. Additionally, the exchange has suffered compliance issues recently, receiving a rebuke from Japanese regulators last month. A partnership may ease some of these difficulties.

Ultimately, Chen was noncommittal about the US as a possible Bitget expansion target. The firm has consciously tried to harness industry buzz for new expansions, launching a new token listing portal in November after several competitors were wrapped in a scandal. Chen’s comments here may be a similar tactic for arousing interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Strategy’s 12% YTD Yield and $555M Acquisition

Welcome to the US Morning Crypto News Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see what experts say about Bitcoin’s (BTC) price amid recovery efforts. The status of Bitcoin as a hedge against inflation and economic uncertainty is progressively becoming questionable, with institutional influence adding to the concerns.

Can Strategy’s $555 Million BTC Purchase Send Bitcoin Past $90,000?

Michael Saylor, the chairman of Strategy (formerly MicroStrategy), revealed the firm’s latest Bitcoin purchase, comprising 6,556 BTC tokens worth approximately $555.8 million. With this, the firm has attained a Bitcoin yield of 12.1% year-to-date (YTD) in 2025.

“MSTR has acquired 6,556 BTC for ~$555.8 million at ~$84,785 per bitcoin and has achieved BTC Yield of 12.1% YTD 2025. As of 4/20/2025, Strategy holds 538,200 BTC acquired for ~$36.47 billion at ~$67,766 per bitcoin,” Saylor shared.

Strategy uses the Bitcoin Yield YTD to measure the BTC holdings per share increase. This model has been a key part of their financial strategy firm since their first Bitcoin purchase in August 2020.

This acquisition aligns with a bullish market sentiment for Bitcoin, which is steadily nearing the $90,000 milestone, as the recent US Crypto News indicated.

Despite a mild recovery in Bitcoin prices this week, up by over 3% in the last 24 hours, it is worth noting that Bitcoin is highly sensitive to economic indicators.

Similarly, the global market is highly sensitive to monetary policies set by major economies, particularly the US. BeInCrypto contacted Paybis founder and CEO Innokenty Isers for insights on the current market outlook, particularly for Bitcoin.

“Given the strong concentration of investors in technology stocks, shifts in trade policies and government interventions that influence key indices like the Nasdaq Composite create ripple effects across financial markets,” Isers told BeInCrypto.

According to the Pybis executive, since the US Presidential inauguration, the outlook of Bitcoin has changed from a trusted hedge against inflation to a more risk-on asset.

“With its relatively higher volatility, risk-averse investors may favor alternative inflation hedges instead of Bitcoin,” he added.

Iners expressed cognizance of the longer stretch of the trade war and the potential inflation that will emerge. Based on this, he noted that capital allocation to Bitcoin as a hedge against economic instability might be reduced.

Strategy’s Stock Premium Narrows as Bitcoin Hype Cools

Meanwhile, Strategy has seen a significant shift in its stock valuation dynamics over the past year. Saylor recently revealed that as of Q1 2025, over 13,000 institutions and 814,000 retail accounts held MSTR directly.

“An estimated 55 million beneficiaries have indirect exposure through ETFs, mutual funds, pensions, and insurance portfolios,” Saylor added.

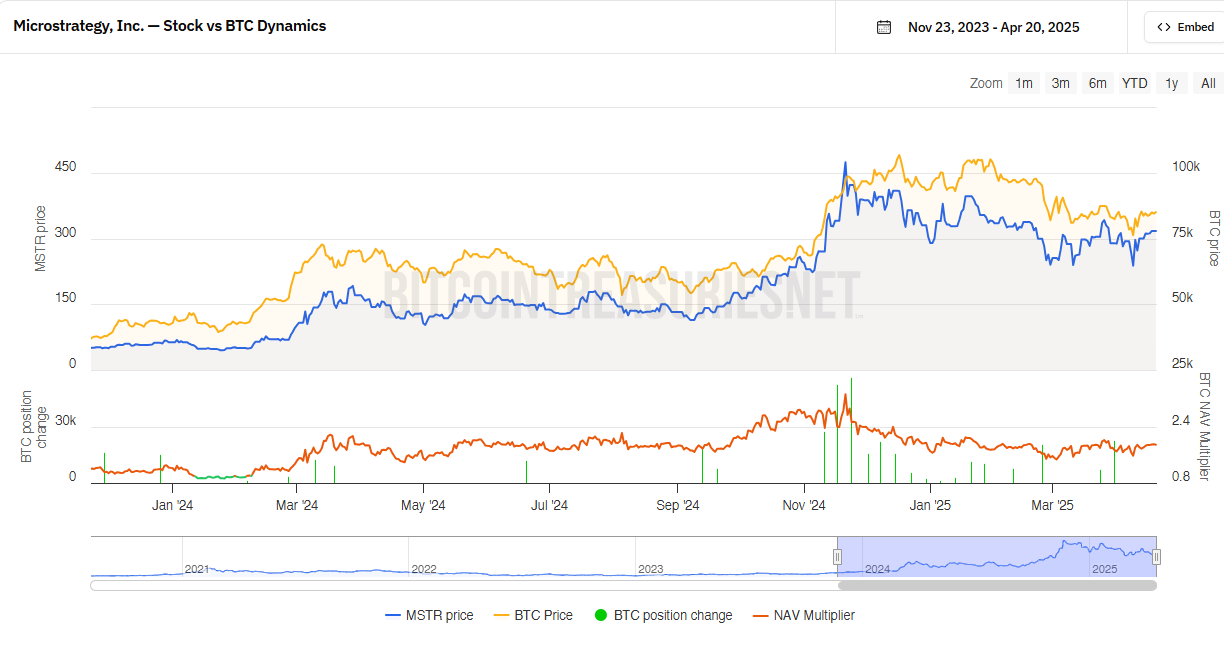

According to data on Bitcointreasuries.net, the premium investors once paid for exposure to its Bitcoin holdings has notably narrowed.

Specifically, the NAV multiplier, a measure of how much the stock trades above the value of Strategy’s Bitcoin assets, has decreased compared to last year. This indicates that MSTR is now trading closer to the actual value of its Bitcoin reserves.

In 2024, investors were willing to pay a substantial premium for MSTR shares, driven by Bitcoin’s hype and MicroStrategy’s aggressive accumulation strategy.

“I don’t know if buying strategy equity is a good idea for the government. The stock would just pump, and it’s likely trading at a premium over NAV with a higher risk profile. Also, I believe the gov will find it difficult to find institutions that would be willing to sell their BTC in large quantities,” an analyst said recently.

The shrinking NAV multiplier suggests a more cautious market sentiment. Analysts believe this reflects a shift toward valuing MicroStrategy based on its fundamentals rather than speculative Bitcoin enthusiasm.

This suggests a maturing market approach to the company’s unique investment strategy.

Chart of the Day

This chart shows how Strategy’s stock price (blue) moves with Bitcoin price (orange). When Bitcoin goes up, MicroStrategy usually follows, but it swings even more.

However, the NAV multiplier has narrowed compared to last year, meaning MicroStrategy’s stock is now trading closer to the actual value of its Bitcoin holdings.

Last year, investors paid a bigger premium for exposure to MSTR, but that gap has shrunk. This suggests a more cautious sentiment or a shift toward valuing the company based on fundamentals rather than just Bitcoin hype.

Byte-Sized Alpha

- Bitcoin ETFs saw modest $15 million inflows, a shift from the previous $713 million outflows, but the smallest influx of 2025, signaling cautious investor sentiment.

- XRP’s futures market shows a bullish shift with long positions exceeding short bets, signaling potential price increases.

- Accumulation signals from whale activity and consolidation at $0.60 indicate a possible rally for Pi Network, despite concerns about the lack of exchange listings and use cases.

- Solana surpasses Ethereum in staking market cap with $53.15 billion, driven by higher staking yield and 65% of supply staked.

- Bitcoin whales accumulated 53,652 BTC worth $4.7 billion in a month, pushing the price to $87,463, but long-term holder profits hit a two-year low.

- PlanB criticizes Ethereum as centralized and pre-mined, citing PoS, tokenomics, and a flexible supply as key red flags.

- Decentraland’s (MANA) price has surged over 10% in 24 hours, hitting a two-month high of $0.31.

Crypto Equities Pre-Market Overview

| Company | At the Close of April 17 | Pre-Market Overview |

| Strategy (MSTR) | $317.20 | $323.49 (+1.98%) |

| Coinbase Global (COIN) | $175.03 | $175.85 (+0.46%) |

| Galaxy Digital Holdings (GLXY.TO) | $15.36 | $15.12 (-1.41%) |

| MARA Holdings (MARA) | $12.66 | $12.83 (+1.34%) |

| Riot Platforms (RIOT) | $6.49 | $6.52 (+0.54%) |

| Core Scientific (CORZ) | $6.61 | $6.59 (-0.27%) |

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PI Token Price Faces Bearish Pressure, Risking a Drop to $0.40

PI has been on a steady downtrend since February 26, shedding 72% of its value as bearish sentiment continues to weigh on the token.

Bearish pressure continues to mount on the PI token, suggesting that it may be poised to enter a new phase of decline.

PI Network Risks Fresh Decline

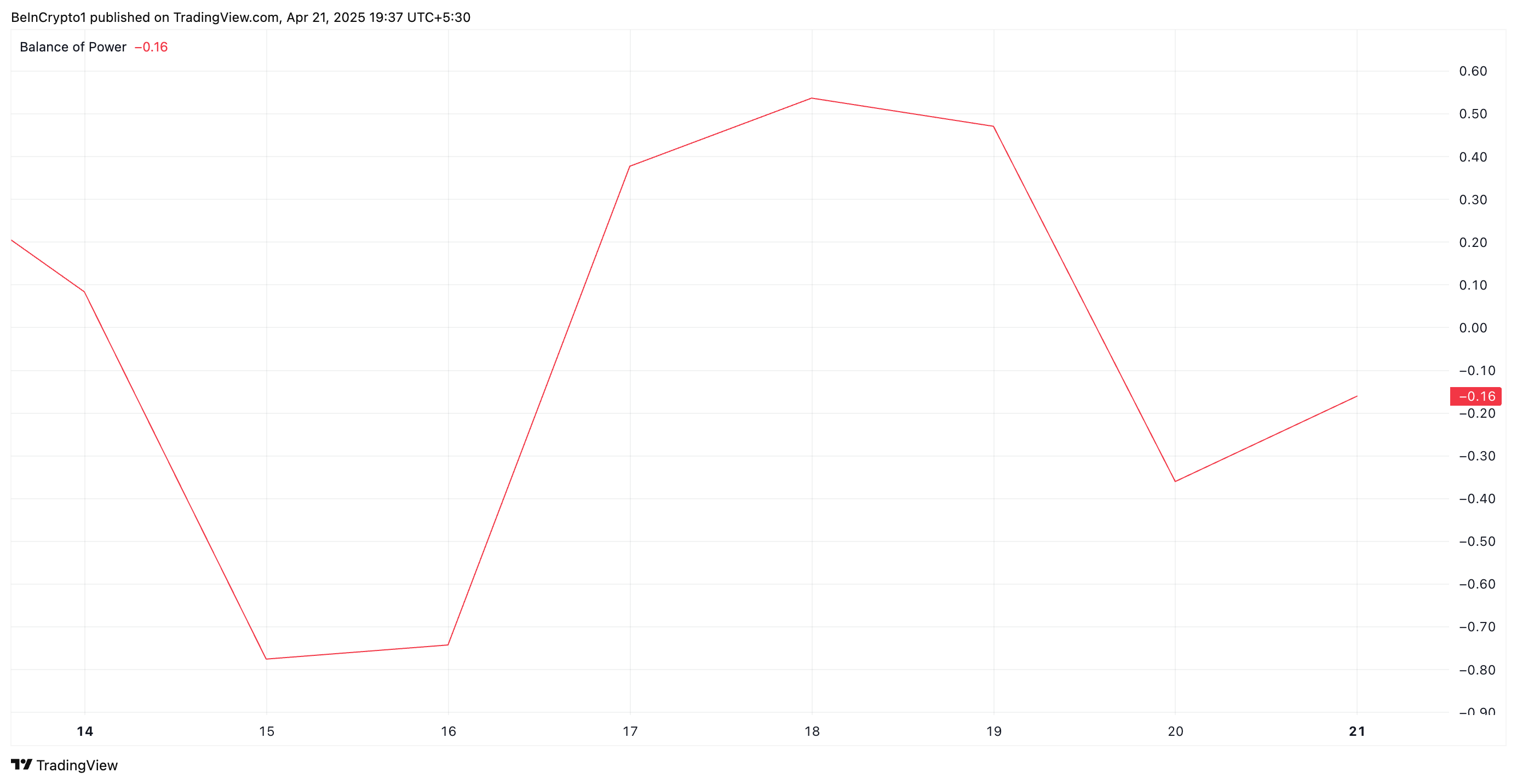

An assessment of the PI/USD one-day chart reveals that token holders remain steadfast in their distribution. At press time, PI’s Balance of Power (BoP) is negative, reflecting the selling pressure in the market.

The BoP indicator measures the strength of buying versus selling pressure by comparing the close price to the trading range within a given period. When BOP is negative like this, it indicates that sellers are dominating the market, suggesting downward pressure on the asset’s price.

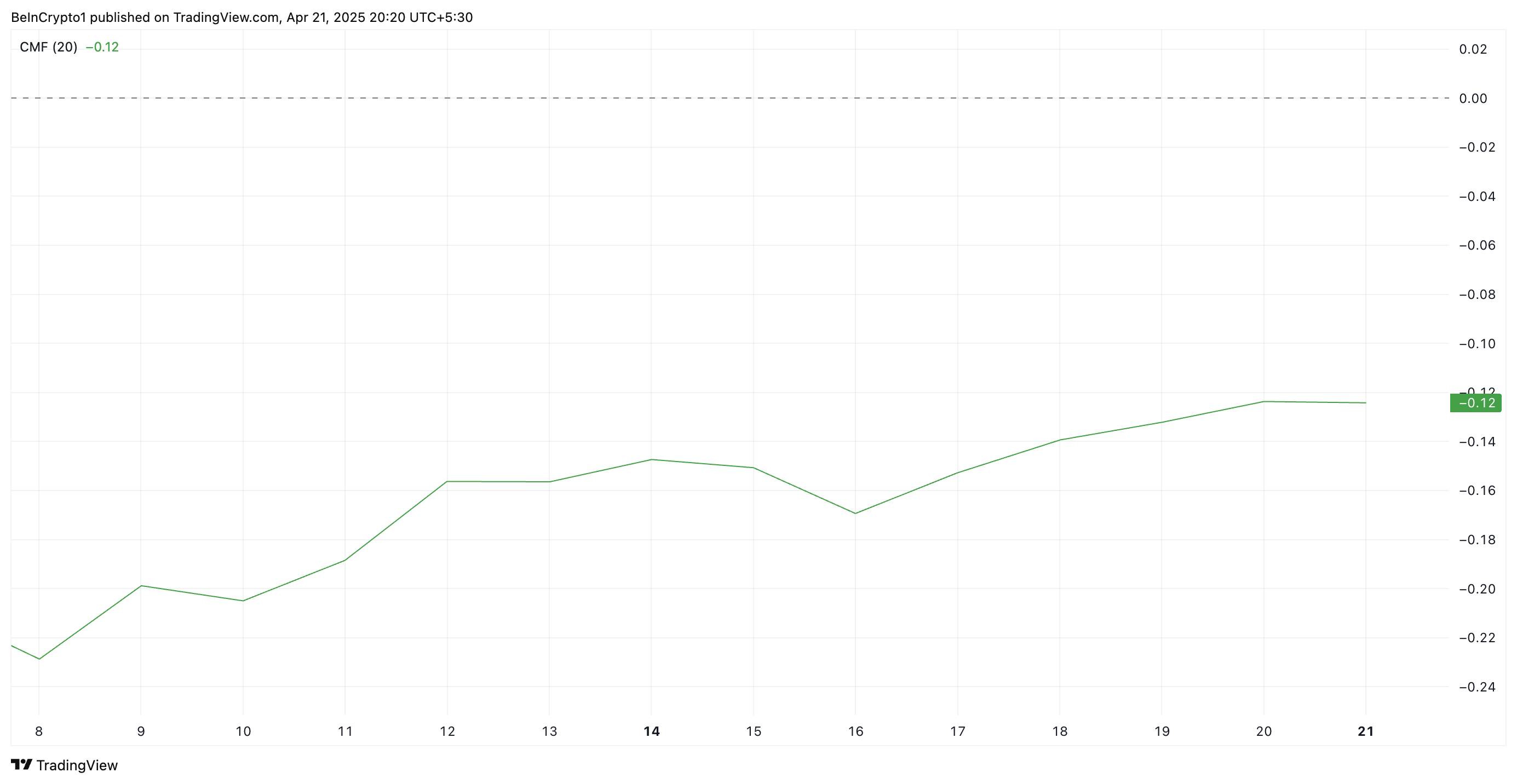

Further, the setup of PI’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, this is below the central line at -0.12.

The CMF indicator measures an asset’s buying and selling pressure. A negative CMF reading suggests that the asset is experiencing more selling pressure than buying pressure. This means PI traders are distributing rather than accumulating. This signals bearish sentiment and confirms the downward momentum in the token’s price.

Sellers Tighten Grip on PI, But Recovery to $1.01 Still on the Table

At press time, PI trades at $0.63, below the dynamic support formed above it at $0.93 by its Super Trend indicator.

The Super Trend indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price trades below the Super Trend line like this, it signals a bearish trend and hints at potential decline. If PI’s decline strengthens, it could revisit its all-time low of $0.40.

However, if demand returns to the PI market, its price could break above the resistance at $0.86 and surge to $1.01.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Circle, BitGo, and Others Eye Bank Charters in US

With support from Trump’s White House and easing regulations, firms like Circle and BitGo are pursuing becoming full-fledged financial institutions.

Reports indicate a new wave of crypto companies knocking on the once-closed doors of the American banking system. This time, someone is listening.

Crypto Firms Seek Bank Charters as Wall Street’s Doors Reopen

After years of being sidelined, crypto companies are coming back, this time through the front door of the US banking system.

Citing sources familiar with the matter, the Wall Street Journal revealed that several major players, including Circle and BitGo, are preparing to apply for bank charters or financial licenses.

Traditional banks are also responding to the shift. US Bancorp is re-launching its crypto custody program via NYDIG, while Bank of America (BofA) said it would issue its stablecoin once the legal framework is in place.

Even global giants are watching closely. A consortium including Deutsche Bank and Standard Chartered is evaluating how to expand crypto operations into the US.

While details remain scarce, the interest signals that crypto is no longer just a niche but a competitive frontier.

These firms reportedly aim to operate with the same legitimacy and access as traditional lenders. This includes holding deposits, issuing loans, and launching stablecoins under regulatory supervision.

The timing is not random. A sharp pivot in federal policy, driven by President Trump’s pledge to make the US a Bitcoin superpower, has reopened regulatory pathways once shut after the FTX collapse.

In parallel, Congress is advancing stablecoin legislation requiring issuers to secure federal or state licenses.

The push for bank status comes amid a broader effort to legitimize crypto within US finance. Earlier this year, regulators rolled back key restrictions. Among them, the SEC’s controversial SAB 121, which had blocked banks from holding crypto on behalf of clients.

Meanwhile, Federal Reserve (Fed) Chair Jerome Powell affirmed that banks could serve crypto customers provided proper risk management strategies exist.

In another regulatory green light, the Office of the Comptroller of the Currency (OCC) clarified that banks can offer stablecoin and custody services. However, this is provided they comply with established banking rules.

These signals have emboldened crypto firms previously kept at arm’s length. Anchorage Digital, the only US crypto-native firm with a federal bank charter, says the regulatory lift is massive but worth it.

“It hasn’t been easy… the whole gamut of regulatory and compliance obligations that banks have can be intertwined with the crypto industry,” Anchorage CEO Nathan McCauley reportedly admitted.

McCauley cited tens of millions in compliance costs. Nevertheless, Anchorage has since collaborated with BlackRock, Cantor Fitzgerald, and Copper for high-profile custody and lending programs.

BitGo, which will reportedly custody reserves for Trump-linked stablecoin USD1, is nearing a bank charter application.

Circle, the issuer of USDC, is also pursuing licenses while fending off competition, just like Tether. This is a traditional finance (TradFi) venture into stablecoins.

The firm delayed its IPO this month, citing market turmoil and financial uncertainty. However, insiders say regulatory clarity remains a top priority.

Firms like Coinbase and Paxos are exploring similar routes, considering industrial banks or trust charters to expand their financial offerings legally.

At the policy level, venture firm a16z has called on the SEC to modernize crypto custody rules for investment firms, reflecting the industry’s hunger for clarity and parity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoTokens Big Players Are Buying

-

Market23 hours ago

Market23 hours agoDogecoin Defies Bullish Bets During Dogeday Celebration

-

Bitcoin11 hours ago

Bitcoin11 hours agoUS Economic Indicators to Watch & Potential Impact on Bitcoin

-

Altcoin22 hours ago

Altcoin22 hours agoExpert Predicts Pi Network To Reach $5 As Whales Move 41M Pi Coins Off Exchanges

-

Market21 hours ago

Market21 hours agoWill XRP Break Support and Drop Below $2?

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin LTH Selling Pressure Hits Yearly Low — Bull Market Ready For Take Off?

-

Bitcoin17 hours ago

Bitcoin17 hours agoHere Are The Bitcoin Levels To Watch For The Short Term

-

Market13 hours ago

Market13 hours agoBitcoin Price Breakout In Progress—Momentum Builds Above Resistance