Market

SEC Unlikely to Approve in 2024

According to recent revelations, the odds of the US SEC (Securities and Exchange Commission) approving a Solana ETF (exchange-traded fund) anytime soon have diminished significantly.

Fox Business correspondent Eleanor Terrett reported that the SEC has already notified at least two of the five firms filing for Solana spot ETFs that their applications would be rejected.

Solana ETF Approval Chances are Extremely Low

According to Terrett, the SEC has notified at least two of the five prospective issuers that it will reject their 19b-4 filings for the SOL spot ETFs.

“The consensus here, I’m told, is that the SEC won’t entertain any new crypto ETFs under the current administration,” Terrett wrote.

This development comes as a sharp reversal from earlier optimism. Just days ago, reports suggested that negotiations for Solana ETFs were progressing well and that approval could be within reach.

However, the SEC’s latest signals suggest that the regulatory agency remains hesitant to expand crypto-related ETFs beyond Bitcoin and Ethereum, the only digital asset ETFs currently approved in the US.

Solana is among several altcoins whose ETF applications remain in limbo. Alongside Solana, applications for XRP, HBAR, and Litecoin ETFs are also under review.

Filing a 19b-4 form, which sets the timeline for the SEC’s review process, is a crucial step in this journey. However, Bloomberg Intelligence’s James Seyffart pointed out that several applicants have not reached this stage, as indicated by deadlines marked “N/A.”

Bitwise, Canary Capital, and Grayscale recently made headlines with their Solana ETF filings. Meanwhile, VanEck and 21Shares collaborated on a submission to Cboe, signaling widespread institutional interest in the Solana ecosystem.

Despite this momentum, a lack of regulatory clarity continues to weigh on the market, with Solana ETF approval odds reportedly plummeting to just 3% three months ago.

Many view a SOL-based ETF as a natural next step in Solana’s maturation, enabling broader investor access and liquidity. The SEC’s stringent stance, however, reflects the challenges of achieving this milestone under the current regulatory framework. With numerous applications already rejected or pending without clear timelines, the Solana ETF debate exemplifies the broader struggle between innovation and oversight in the crypto industry.

Political and Regulatory Shifts Could Change Things

The SEC’s resistance to broadening crypto ETF approvals reflects the current administration’s cautious approach to digital assets, spearheaded by Chair Gary Gensler. However, political and leadership changes could shift this dynamic.

President-elect Donald Trump has expressed a pro-crypto stance that some experts believe could pave the way for more accommodating policies. Analysts suggest a Trump administration might foster a more favorable regulatory environment for digital assets, especially with a crypto-friendly SEC chair like Paul Atkins.

This change could reignite optimism for Solana and other altcoin ETFs that are currently stalled.

“The greatest Solana win coming from the new Trump Presidency will be our long-awaited ETF in 2025 or 2026. No surprise, the incredible VanEck team will lead the charge here with support from 21Shares and Canary Capital,” said Dan Jablonski, head of growth at news and research firm Syndica.

Despite regulatory hurdles, Solana continues to demonstrate strong ecosystem growth. As of this writing, SOL is trading for $239.47, a modest 1.37% gain on the day. The blockchain is celebrated for its high throughput and low transaction costs, which have attracted institutional interest.

Following the appointment of a new SEC chair ahead of Gensler’s resignation and as Trump’s inauguration nears, the potential for significant regulatory shifts looms large. These developments could usher in a new era of crypto acceptance, opening doors for Solana and other altcoin ETFs. Until then, however, the path to approval remains fraught with uncertainty.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is a Drop Below $0.92 Inevitable?

Cardano’s recent sideways price action has led to a surge in demand for short positions among futures traders.

As the coin’s momentum slows, traders are increasingly betting on a price decline, signaling a bearish sentiment toward ADA.

Cardano Traders Bet on a Price Decline

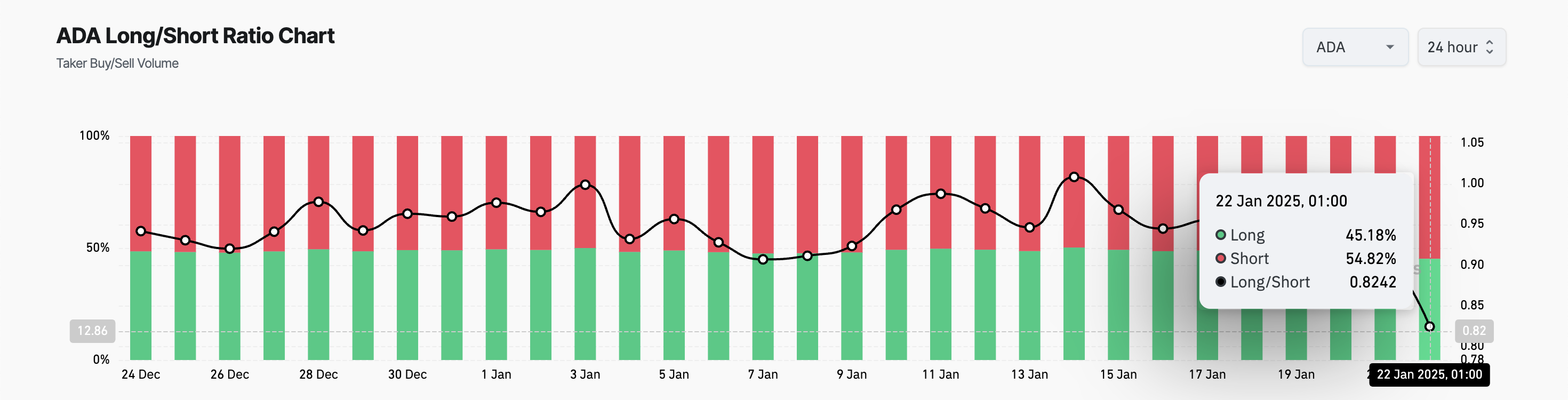

According to Coinglass, ADA’s Long/Short Ratio is at a monthly low of 0.82, indicating a high demand for short positions.

An asset’s Long/Short Ratio compares the number of its long (buy) positions to short (sell) positions in a market. As with ADA, when the ratio is below one, more traders are betting on the price falling (shorting) rather than rising. If short sellers continue to dominate, this can increase the downward pressure on the asset’s price.

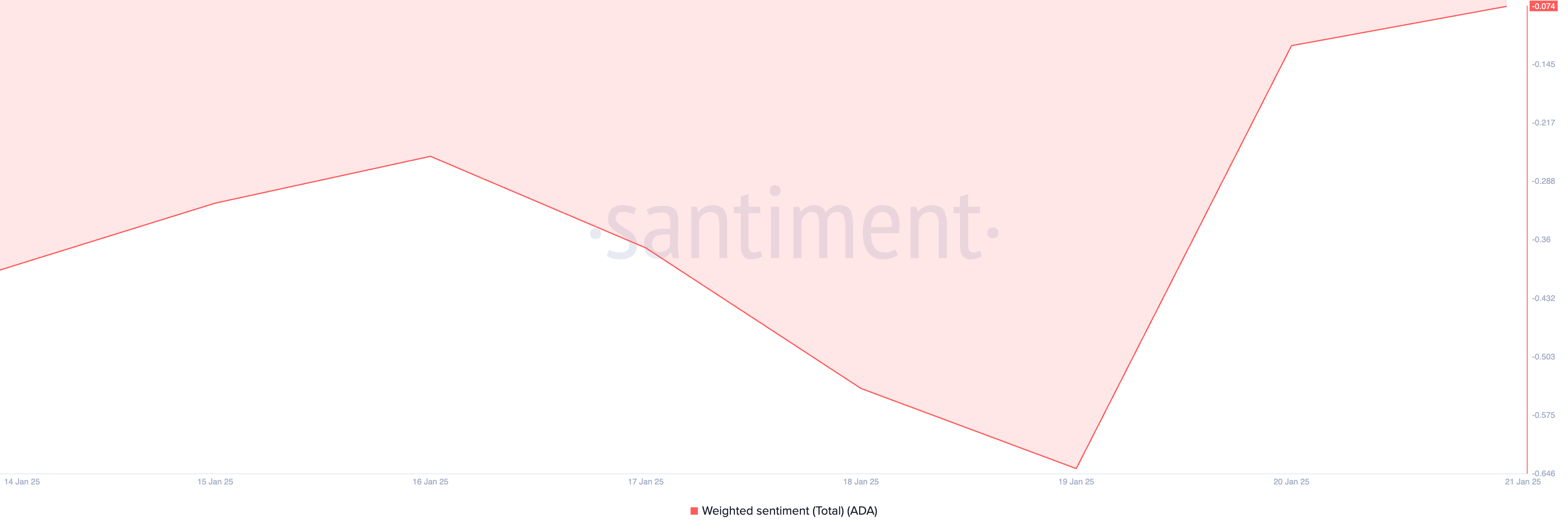

Additionally, ADA’s Weighted Sentiment remains negative, currently standing at -0.074, reinforcing the bearish outlook for the altcoin.

Weighted Sentiment gauges the overall market bias by analyzing the volume and tone of social media mentions. A negative value signals growing skepticism among investors, often leading to reduced trading activity and downward pressure on the asset’s price.

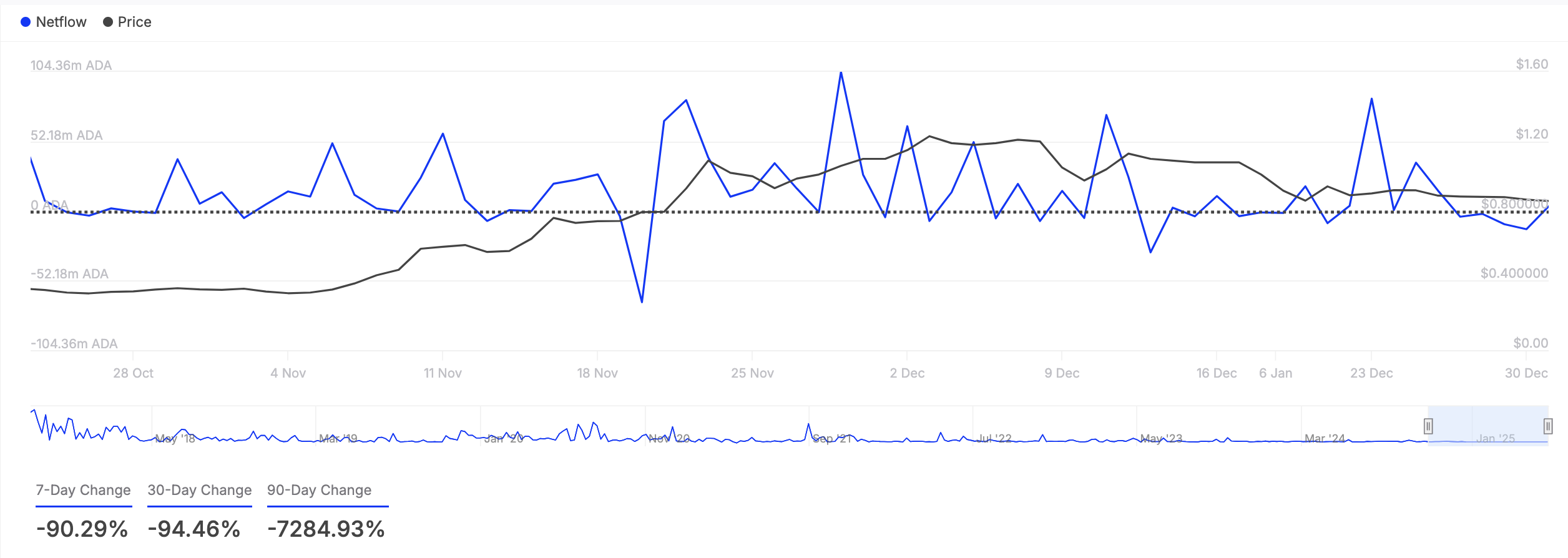

Notably, ADA whales have reduced their trading activity over the past week, with the coin’s large holders’ netflow dropping by 90.29%, according to IntoTheBlock.

Large holders, defined as addresses holding more than 0.1% of an asset’s circulating supply, play a significant role in market movements. A decline in their netflow indicates reduced buying activity, adding to the downward pressure on ADA’s price.

ADA Price Prediction: Recovery to $1 or Decline to $0.80?

ADA is currently trading at $0.98, hovering just above its support level of $0.90. If bearish pressure intensifies, the price may test this support. A failure to hold at $0.90 could see ADA’s decline extend further, potentially dropping to $0.80.

Conversely, if buying activity resurges, ADA’s price could stabilize above the $1 mark.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will It Smash Another ATH?

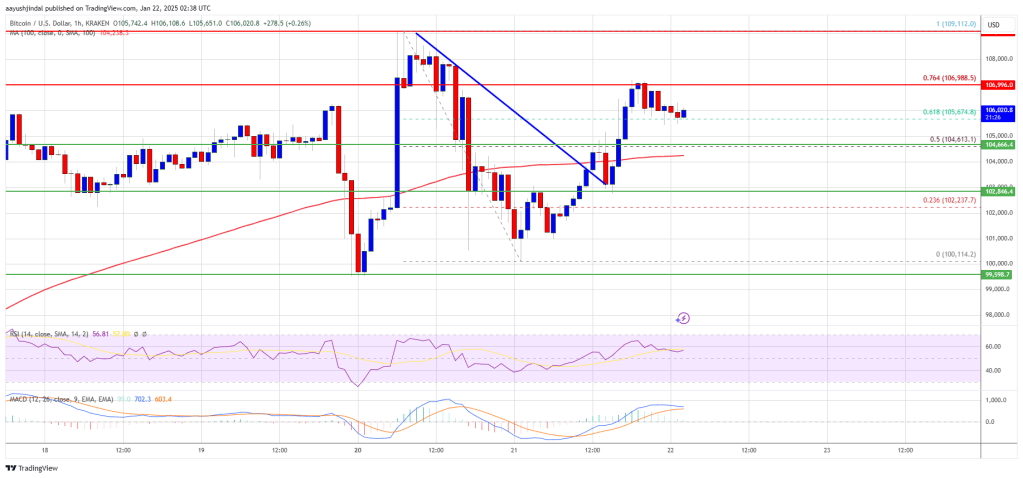

Bitcoin price started a fresh increase above the $104,000 zone. BTC is consolidating above $105,000 and might aim for a new all-time high.

- Bitcoin started a decent increase above the $102,500 resistance zone.

- The price is trading above $104,500 and the 100 hourly Simple moving average.

- There was a break above a connecting bearish trend line with resistance at $104,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $103,500 support zone.

Bitcoin Price Regains Traction

Bitcoin price started a decent upward move above the $102,500 zone. BTC was able to climb above the $103,500 and $104,000 levels.

The bulls even pushed the price above the $105,000 level. Besides, there was a break above a connecting bearish trend line with resistance at $104,000 on the hourly chart of the BTC/USD pair. The pair surpassed the 50% Fib retracement level of the downward move from the $109,112 swing high to the $100,114 low.

Bitcoin price is now trading above $104,500 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $107,000 level. It is close to the 76.4% Fib retracement level of the downward move from the $109,112 swing high to the $100,114 low.

The first key resistance is near the $107,500 level. A clear move above the $107,500 resistance might send the price higher. The next key resistance could be $109,000.

A close above the $109,000 resistance might send the price further higher. In the stated case, the price could rise and test the $110,000 resistance level and a new all-time high. Any more gains might send the price toward the $112,500 level.

Downside Correction In BTC?

If Bitcoin fails to rise above the $107,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $104,500 level. The first major support is near the $103,500 level.

The next support is now near the $102,800 zone. Any more losses might send the price toward the $100,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $104,500, followed by $103,500.

Major Resistance Levels – $107,000 and $108,500.

Market

Trump’s $500 Billion Stargate Venture Sparks AI Crypto Boom

AI tokens surged on Wednesday after President Donald Trump unveiled a new joint venture to invest up to $500 billion in artificial intelligence infrastructure.

The partnership involves major players such as OpenAI, Oracle, and SoftBank and will form a new entity called Stargate.

Market Focuses on AI Coins as Trump’s Stargate Initiative Gains Traction

The Stargate Project will invest $500 billion over the next four years, building new AI infrastructure in the US. The venture will focus on developing crucial data centers and the electricity generation required to power the AI sector.

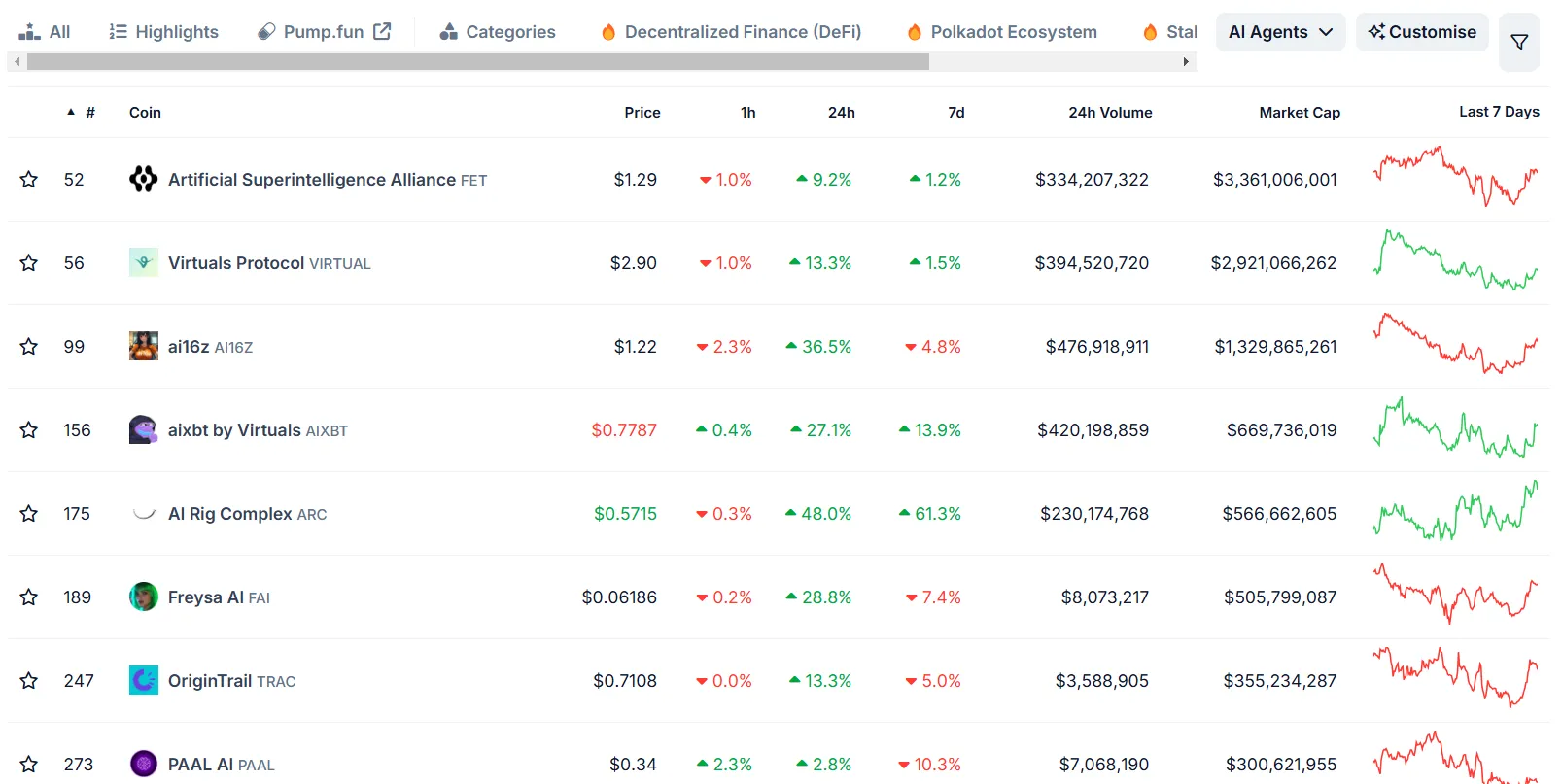

The announcement has already had a noticeable impact on the broader market, particularly in AI-related cryptocurrencies. Following the news, the market capitalization of AI tokens surged by 9%, reaching $45.83 billion at press time, according to CoinGecko.

In fact, the market cap of AI agent tokens alone rose by 13% to hit $14.9 billion.

AI agent tokens, such as Virtuals Protocol, AIXBT, and AI16Z, saw impressive gains. Virtuals Protocol rose by over 13% in the past 24 hours, while AI16Z experienced a remarkable 36% increase. AIXBT token rose by 27% over the same period.

The surge in AI tokens reflects a broader shift in market interest as investors move capital towards more “sentient” tokens.

“Capital is rotating back from static memes to sentient coins,” AI researcher S4mmy commented on Twitter.

The analyst added that Fartcoin and AIXBT are sustaining their “mindshare dominance,” but face declining market caps after a heated run. Commenting on Virtuals Protocol, he said it continues to solidify its position as a backbone of the Agentic infrastructure.

Moreover, analyst CyrilXBT said he believes “AI will create generational wealth in 2025.”

“People said Bitcoin was a joke. People said AI agents are a gimmick. Guess what else they’ll say? ‘Why didn’t I listen when generational wealth was staring me in the face?,” CyrilXBT commented.

The shift towards AI is particularly interesting, given the trend of investments a few days back. Capital was flowing into Donald Trump-related tokens, such as TRUMP and MELANIA, which have seen significant volatility.

However, BeInCrypto reported that smart money traders are now focusing on AI tokens after the hype around TRUMP faded. According to data from Nansen, a substantial amount of VIRTUAL, FARTCOIN, and AIXBT tokens are held by smart money.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation19 hours ago

Regulation19 hours agoActing SEC Chair Uyeda announces new crypto task force

-

Ethereum14 hours ago

Ethereum14 hours agoETH breaks $3,900 as Bitcoin spikes past $103k

-

Regulation21 hours ago

Regulation21 hours agoTether’s market capitalisation slips as MiCA regulations kick in

-

Regulation17 hours ago

Regulation17 hours agoTurkey rolls out new crypto AML regulations

-

Market16 hours ago

Market16 hours agoBitcoin price analysis: economic headwinds push price lower

-

Market13 hours ago

Market13 hours agoTop 4 altcoins to buy before the market fully recovers

-

Regulation13 hours ago

Regulation13 hours agoBitpanda becomes first European firm to secure Dubai VARA in-principle approval

-

Blockchain21 hours ago

Blockchain21 hours agoJordan Adopts Blockchain Policy To Propel Government Into The Future