Market

This is Why the US Government Moved $1.92 Billion in Bitcoin

The US government moved $1.92 billion of Bitcoin into new wallets, $963 million of which went immediately to Coinbase. These assets came from the Silk Road seizure, so the US can legally sell them all.

Community members are concerned that President Biden is attempting to sell off the US supply before Trump’s inauguration, hampering his plans to create a Bitcoin Reserve.

The US Bitcoin Reserve

According to data from the on-chain intelligence platform Arkham, the US government moved Bitcoin worth $1.92 billion into new wallets on Monday, November 2. These assets were split into two new wallets, one of which subsequently moved $963 million in BTC to Coinbase.

These bitcoins came from Silk Road seizures, which the US government can legally sell, prompting fears of a massive dump:

“Is the government planning to sell Bitcoin before Trump takes office? Outgoing administrations should not undermine the incoming President, as the people have already voted them out,” said Carl B. Menger, an industry commentator.

Specifically, industry rumors fear that President Joe Biden is using his lame-duck period to deliberately hamstring President-elect Donald Trump. As a campaign promise, Trump swore to create a US Bitcoin Reserve, beginning with the federal government’s substantial holdings.

The US is currently one of the largest BTC holders due to its continuous crackdown on illegal entities and dark web criminal groups. These holdings can potentially help Trump establish a national Bitcoin reserve when he takes office in January without taking significant additional funds from the economy.

However, even though Trump won the election, crypto analysts have theorized that Biden could use his remaining time in power to sell off much of the US Bitcoin supply. This would hinder Trump’s ability to create a Reserve. Worryingly, Biden has used this strategy in other policy sectors, giving billions to Ukraine to forestall Trump from changing US policy.

Nonetheless, the crypto community does not seem overly concerned. Four months ago, the US government prepared to sell $600 million in Bitcoin, and markets plunged. Yet, BTC recovered and entered a bullish phase following increased institutional funding.

Similarly, since these transfers were first publicized, the price of Bitcoin declined slightly. However, its value began rising shortly afterward. So, long-term HODLers are still confident in Bitcoin’s bullish prospects despite any liquidation rumors. This is evident in the actions of public firms, as MicroStrategy and MARA have still continued to purchase more BTC.

Regardless of these events, Trump will likely create a Reserve with whatever Bitcoin remains in federal custody. Also, it will be extremely difficult for Biden to sell it all by January. Besides, several corporate whales are on standby to purchase these assets themselves.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Toncoin (TON) Price Climbs Higher as Exchange Supply Declines

Toncoin (TON) price has surged 45.45% over the last 30 days. The RSI remains near overbought territory, and recent outflows from exchanges highlight reduced selling pressure, suggesting growing confidence among holders.

EMA lines further reinforce the bullish trend, with the price staying well above short-term averages. If TON maintains its upward trajectory, it could break the $7.198 resistance and aim for $8 in December, but a reversal might test support levels at $6.6 and $5.6.

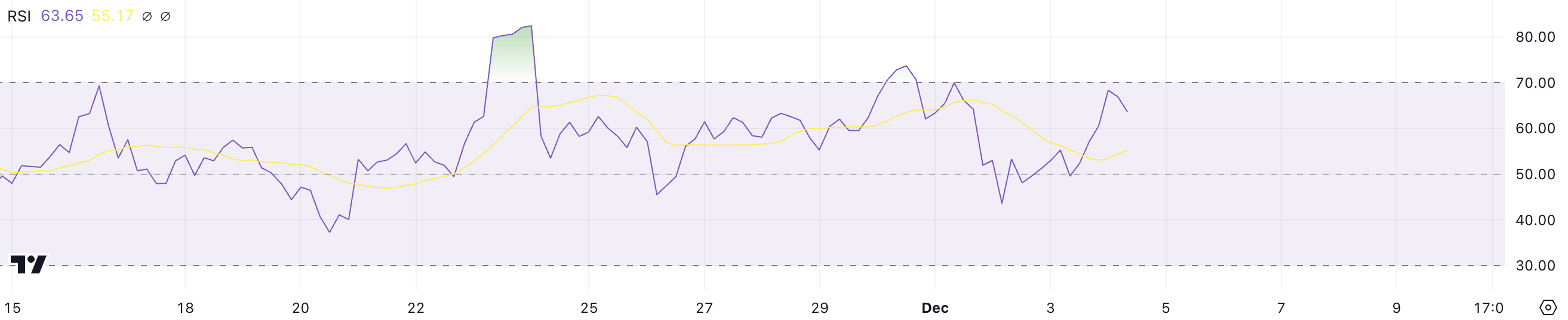

TON RSI Is Still Close to 70

TON RSI recently almost touched the overbought threshold of 70 before retreating to its current level of 63. This pullback suggests that buying momentum has slightly weakened but remains relatively strong, as the RSI is still in bullish territory.

The current reading reflects a market where buyers maintain a slight edge, though it’s unclear if the momentum is enough to push prices significantly higher without further buying pressure.

The RSI (Relative Strength Index) measures the speed and magnitude of price movements, with values above 70 signaling overbought conditions and below 30 indicating oversold levels. TON’s RSI at 63 suggests it is still in a favorable position for potential upside.

If it rises back above 70, as it did at the end of November, TON price could regain momentum and test levels above $7.2, signaling another bullish breakout.

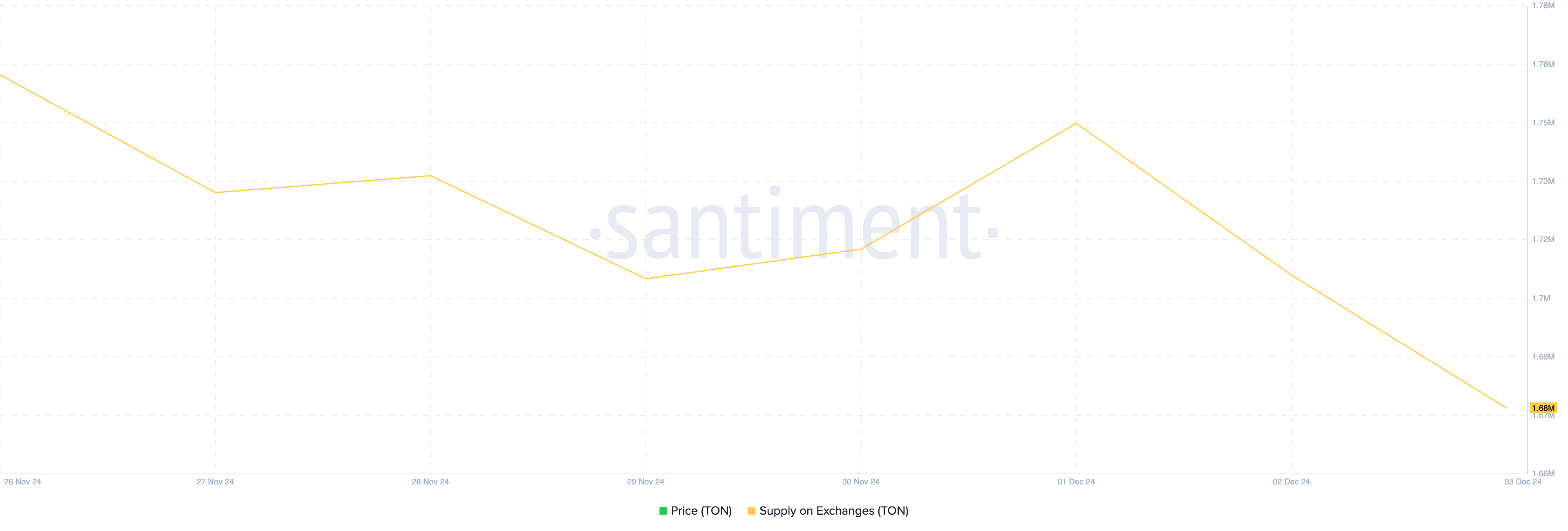

Toncoin Supply on Exchanges Dropped In The Last 3 Days

TON’s Supply on Exchanges has decreased to 1.68 million, down from 1.75 million on December 1. This decline indicates that holders have withdrawn approximately 800,000 TON from exchanges over the past three days.

Such a significant outflow suggests reduced selling pressure and a potential shift toward long-term holding or staking.

Supply on exchanges reflects the amount of a token readily available for trading. A high supply is often seen as bearish, as it implies users might be preparing to sell.

Conversely, a decline in exchange supply, like the current trend for TON, is typically bullish, as it signals accumulation and confidence in the coin’s future performance. If this trend continues, it could support upward price movement as selling liquidity diminishes.

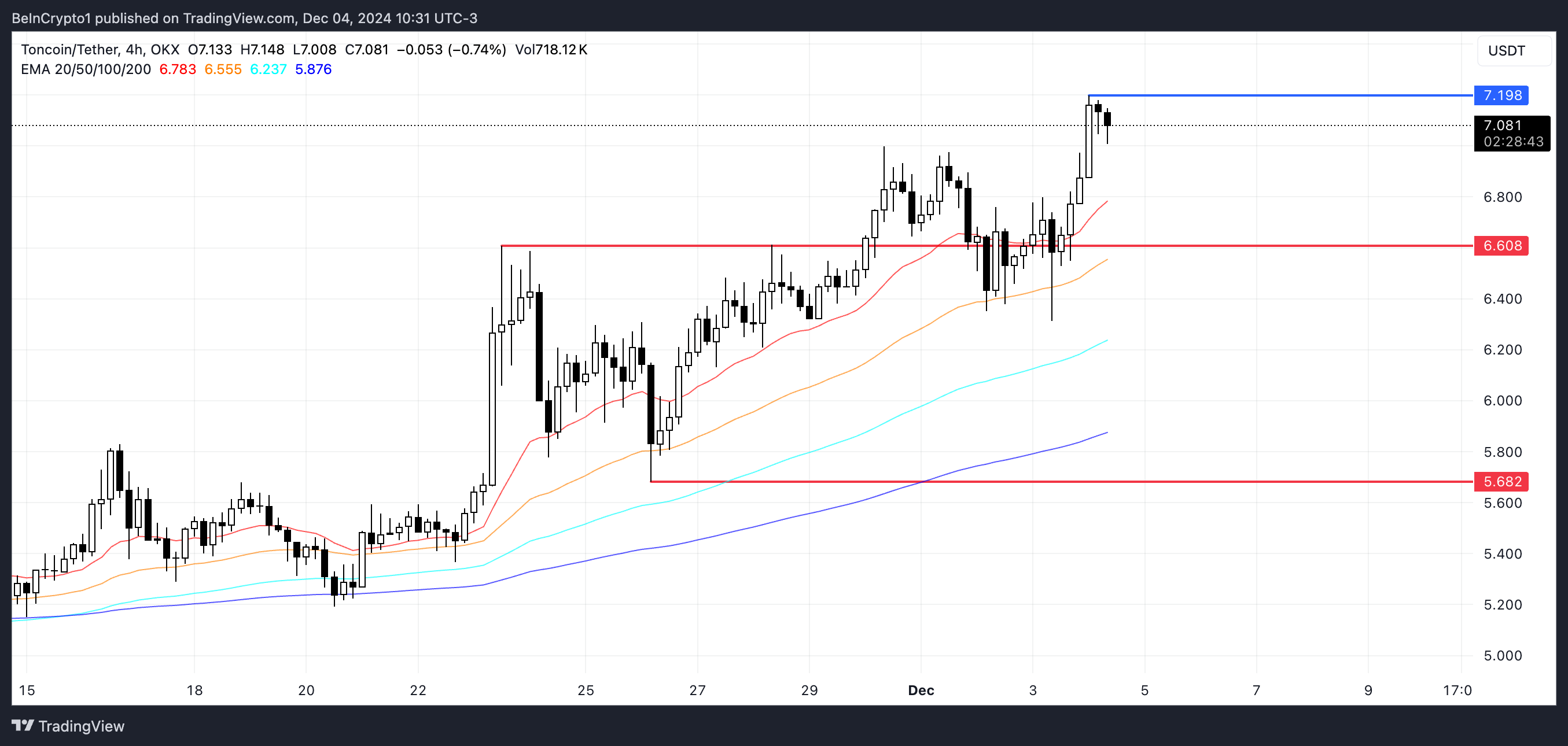

TON Price Prediction: Can It Reach $8 In December?

TON EMA lines remain bullish, with short-term lines positioned above long-term ones and the price trading well above the short-term averages.

This alignment indicates strong upward momentum, reinforcing the current bullish trend. As long as the price stays above these lines, the trend is likely to persist.

If TON sustains its uptrend and breaks the $7.198 resistance, it could extend its rally and potentially test $8 in December, a level not seen since June 2024.

Conversely, if the uptrend reverses and a downtrend emerges, TON price may first test the $6.6 support, with a deeper correction possibly pushing it down to $5.6.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Suggests a Pause Before the Next Rally

Solana (SOL) price is currently 12% below its all-time high, which was reached on November 22. Despite this recent pullback, SOL remains one of the year’s top performers, boasting an impressive 275.85% gain year-to-date.

Recent technical indicators, including the BBTrend, DMI, and EMA lines, suggest the market may be entering a consolidation phase. This could set the stage for SOL to test key support and resistance levels as it seeks its next major move.

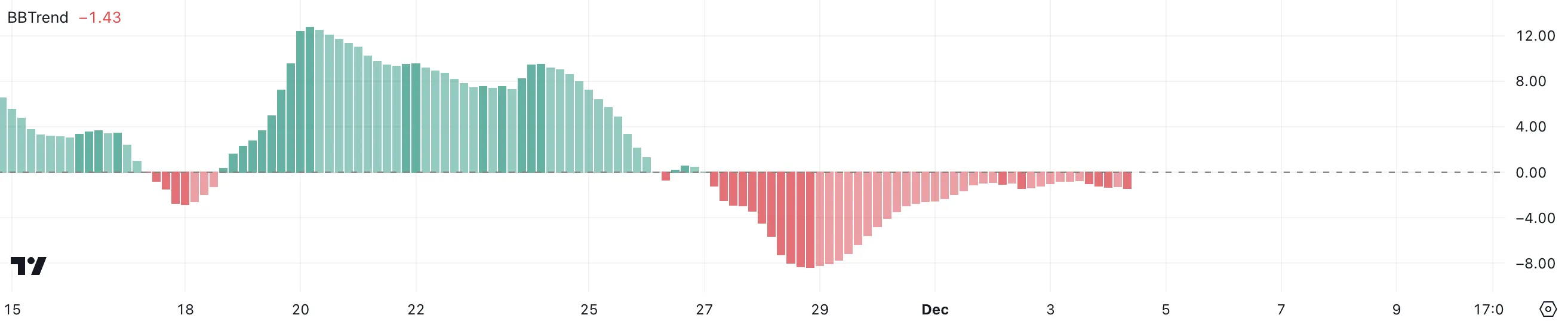

SOL BBTrend Is Negative, But Far from Its Peak

SOL’s BBTrend is currently at -1.43, recovering from its peak negative level of -8.34 on November 28. Although it has remained negative since November 27, this less extreme reading suggests SOL may be entering a consolidation phase.

SOL price could now stabilize within a narrower range as the bearish pressure appears to be easing.

BBTrend measures price momentum relative to Bollinger Bands, with negative values indicating downward pressure and positive values signaling upward trends.

Solana current BBTrend level, while still negative, is far less bearish than its previous lows. This may reflect a transition phase, where the market is pausing to decide its next major move.

Solana Trend Isn’t Strong

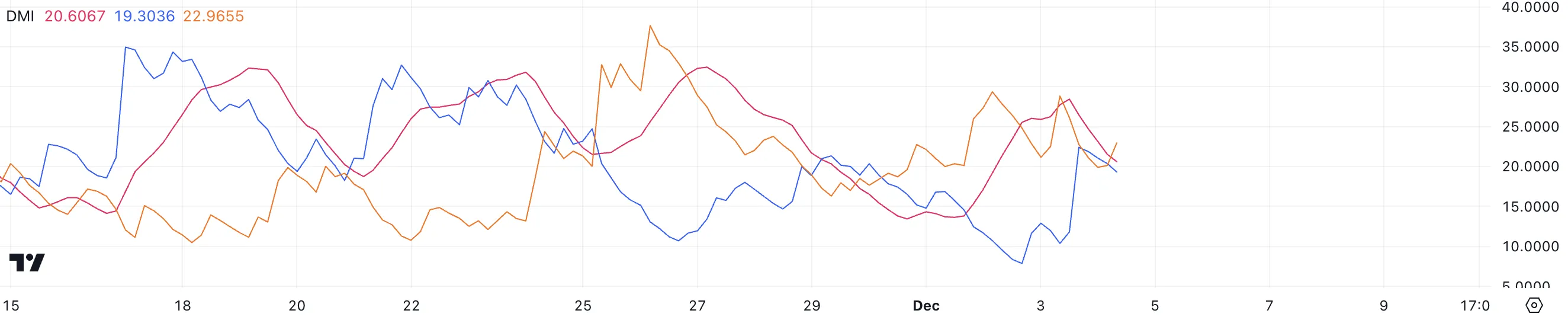

SOL’s DMI chart indicates that its ADX has dropped to 20.6, down from nearly 30 just a day ago. This decline suggests weakening trend strength, potentially signaling reduced market momentum.

Meanwhile, the D+ is at 19.3 and the D- is slightly higher at 22.9, implying a slight bearish advantage as sellers maintain control over buyers.

The ADX (Average Directional Index) measures trend strength, regardless of direction. Values above 25 indicate a strong trend, while values below suggest a weak or consolidating market.

With D+ representing buying pressure and D- selling pressure, SOL current DMI readings highlight a market still leaning bearish but with less conviction, suggesting potential for consolidation or a shift in momentum.

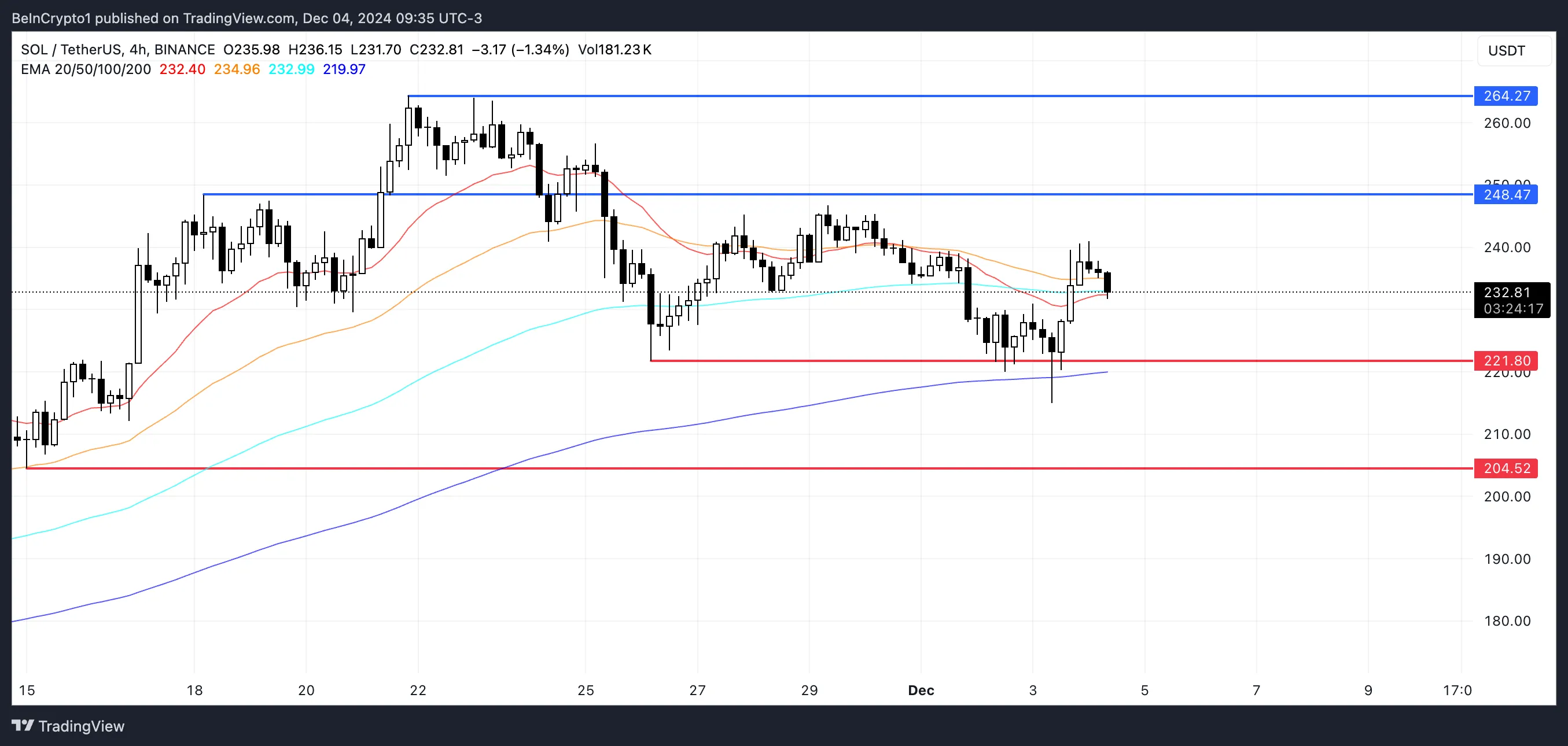

SOL Price Prediction: A Consolidation Before Trying New All-Time High?

Solana EMA lines recently displayed a bearish signal as a short-term line crossed below a long-term line. However, the narrow gap between the lines suggests consolidation rather than a strong downtrend.

This could indicate a pause in market direction as traders await further cues.

If a downtrend develops, SOL price might test support at $221, with a further drop to $204 if this level fails. On the other hand, a recovery could push Solana toward a key resistance at $248.

Breaking this level could open the path to retesting its previous all-time high near $264.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoins Trending Today List: BERT, Koma Inu, HYPE

It’s altcoin season, and as expected, many non-Bitcoin cryptocurrencies will be on the radar of several traders. Due to this shift in momentum, the altcoin trending today’s list comprises tokens whose prices have all surged in the last 24 hours.

These surges could be linked to rising demand and significant trading volumes. According to CoinGecko, the top three trending altcoins include Bertram The Pomeranian (BERT), Koma Inu (KOMA), and Hyperliquid (HYPE).

Bertram The Pomeranian (BERT)

On Monday, BERT was part of the trending altcoins. During that period, the token saw notable market interest as ex-Binance CEO Changpeng Zhao interacted with the project’s handle on X (formerly Twitter).

Today, BERT is trending because its price has significantly increased. In the last 24 hours, the meme coin’s value has increased by 35% and trades at $0.12. From a technical point of view, the 4-hour chart shows an increase in the Bull Bear Power (BBP).

When this BBP falls, it means bears are dominant, and the price might decrease. But since the indicator is in the positive region, it means the Solana meme coin could experience a continued upswing.

If that is the case, the altcoin’s value could rise to $0.18 in the short term. However, if selling pressure rises, this might not happen. Instead, BERT could decline to $0.072.

Koma Inu (KOMA)

Another token on the list of altcoins trending today is Koma Inu, a meme coin built on the BNB Chain. KOMA is trending because its price has increased 71% in the last 24 hours, coincidentally with the day BNB’s price broke its previous all-time high.

On the 4-hour chart, Koma Inu has formed a golden cross. A golden cross happens when the shorter Exponential Moving Average (EMA) rises above the longer one. As seen below, the 20 EMA (blue) has crossed over the 50 EMA (yellow).

As such, KOMA’s price could climb to $0.086 as long as it breaks above the overhead resistance at $0.073. On the other hand, if the token fails to rise past the hurdle, the price might tumble to $0.063.

Hyperliquid (HYPE)

Since its launch, Hyperliquid has appeared on the altcoins trending today list several times, mainly due to its price. Today, it is no different, as HYPE’s price has continued to climb since the Token Generation Event (TGE).

Over the last 24 hours, HYPE’s price has increased 43.40% to $12.95. Its 24-hour trading volume has also surpassed $270 million, indicating notable interest in the token.

Should the volume and price continue to rise, HYPE could get closer to $15. On the flip side, if selling pressure rises, this might not happen, and the altcoin might decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market15 hours ago

Market15 hours agoHedera (HBAR) Price Surges 721%, Surpassing $13B Market Cap

-

Market20 hours ago

Market20 hours agoMartial Law Spurs Volatility in South Korea’s Crypto Market

-

Market13 hours ago

Market13 hours agoThis Is Why DMM Bitcoin Closes After $305 Million Hack

-

Market19 hours ago

Market19 hours agoSUI Price Nears All-Time High After 97% Monthly Surge

-

Market11 hours ago

Market11 hours agoWill Cardano Whales Continue to Sell Ahead of Token Unlock?

-

Altcoin11 hours ago

Altcoin11 hours agoPepe Coin Whales Accumulation Signals 7x Gains For PEPE Looms

-

Market21 hours ago

Market21 hours agoFantom (FTM) Price Gains Strength From Bullish Market Trends

-

Market14 hours ago

Market14 hours agoEthereum Price Holds Steady, $4K Remains The Goal