Market

Top Altcoins to Watch in December 2024: HYPE, FTM, and More

Historically, December has been a strong month for the crypto market, and December 2024 could follow that trend, particularly for altcoins. BeInCrypto has identified key altcoins to watch as the year comes to a close.

This list focuses on cryptocurrencies with major events in December that could impact their prices. While some altcoins lack such drivers, these standout picks are the ones to keep an eye on this month.

Hyperliquid (HYPE)

Top of the list of altcoins to watch in December 2024 is Hyperliquid (HYPE), the token of the Layer-1 blockchain that launched about one week ago. Since launch, HYPE’s price has increased by over 200% despite distribution rewards in airdrops to some of its early users.

At press time, HYPE’s price had risen to $9.51 despite not being listed on any Centralized Exchange (CEX). In most cases, when altcoins like this launch without a CEX, demand is higher, and hence, the price can increase.

Therefore, considering the millions in volume that HYPE is doing daily, its price is likely to rally in December, making it one of the 5 top altcoins to watch before the year closes.

Sui (SUI)

Market observers may not be surprised to see SUI ranked as one of the altcoins to watch in December 2024. Over the past few months, the token has consistently ranked among the best-performing cryptocurrencies, surging by 75% in the last 30 days.

The excitement around SUI stems largely from today’s scheduled $210 million token unlock. While such events often trigger volatility and increase supply, SUI has historically shown bullish price action in the weeks following an unlock.

Therefore, If history is any guide, SUI could deliver another strong performance this month. From a technical perspective, SUI’s price is trading above both the 20-day and 50-day Exponential Moving Average (EMA).

Typically, when the price is above this point, it means that the trend is bullish. Assuming it was below it, it would have indicated a bearish trend.

With SUI trading at $3.40, there is a chance it could climb above $4.40 in December 2024. However, if the token experiences high selling pressure, this might not happen. In that scenario, the price could decline to $2.38.

Fantom (FTM)

Without Fantom, the list of altcoins to watch in December 2024 would be incomplete. This is because the much-anticipated Sonic upgrade, which will enable increased throughput, will launch on Mainnet this month.

Ahead of the development, FTM’s price has hit the $1 mark, thanks to a 60% hike in the last 30 days. On the daily chart, the altcoin has formed an inverse head-and-shoulders pattern, which is a bearish to bullish reversal.

At press time, FTM trades at $1.03. However, with rising Bull Bear Power (BBP), which indicates that bulls are in control, the price might hit $1.14 in the short term.

Furthermore, the Sonic Mainnet launch in December 2024 could send the crypto toward $2 but could be invalidated if selling pressure rises.

Aptos (APT)

Aptos is another Layer-1 token worth monitoring in December. Similar to SUI, Aptos is scheduled for a token unlock valued at approximately $135 million this month.

Interestingly, Aptos and SUI share a common pattern: both often experience price increases following their token unlocks. If history is any indication, APT could close December with a positive return.

From a technical point of view, APT has formed an ascending triangle, which is bullish. This technical pattern suggests that the altcoin’s value might continue to increase as long as volume climbs and demand surges.

If that is the case, APT might rally toward $20 next month. However, traders should be on the lookout. If the supply shock is extreme, this might not happen, and APT could drop to $10.97.

Bonk (BONK)

Last on the list of altcoins to watch in December 2024 is Bonk, the most valuable meme coin on the Solana blockchain. BONK is on this list because of its planned token burn, which aims to reduce supply and, in turn, increase value.

Previously, BeInCrypto reported that BONK wants to burn 1 trillion tokens before Christmas. If this goal is achieved, the altcoin’s price might experience a significant rally.

While BONK’s price has recently dropped from its local high, the daily chart shows strong support at $0.0000043. Considering this outlook, the price might bounce from this point and probably rise to $0.000059 or higher.

On the flip side, if BONK holders book profits in December, this prediction might be invalidated, and the meme coin’s value might be $0.000035.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

GRASS Jumps 30% in a Week, More Gains Ahead?

GRASS has surged nearly 30% over the past week, with its market cap climbing back to $415 million and its price breaking above $1.70 for the first time since March 10.

This strong performance has been backed by bullish technical signals, including a consistently positive BBTrend and a rising ADX. However, with momentum indicators beginning to cool slightly, the next few days will be key in determining whether GRASS continues its rally or enters a period of consolidation.

GRASS BBTrend Remains Strong, But Is Slightly Declining

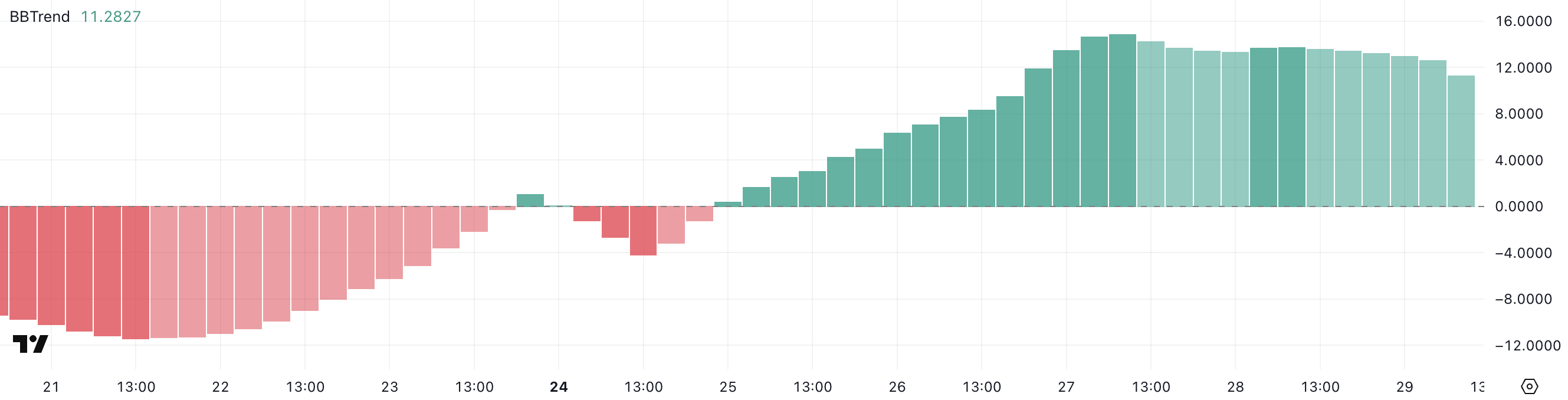

GRASS’s BBTrend is currently at 11.28, marking the fourth consecutive day in positive territory, after peaking at 14.85 two days ago.

The BBTrend (Bollinger Band Trend) indicator measures the strength of price trends by analyzing how far the price moves away from its moving average within Bollinger Bands.

Generally, values above zero indicate an uptrend, while values below zero suggest a downtrend. The higher the positive reading, the stronger the bullish momentum, whereas deep negative values reflect strong selling pressure.

With GRASS maintaining a BBTrend of 11.28, the token is still in an active uptrend, although slightly cooler than its recent peak.

Sustained positive BBTrend readings typically signal that buyers remain in control and that upward momentum could continue.

However, the slight pullback from 14.85 might suggest that momentum is starting to ease. If the BBTrend begins to decline further, it could be an early sign of consolidation or a possible reversal.

For now, GRASS appears to be holding onto bullish momentum, but traders should monitor any shifts in trend strength closely.

GRASS ADX Shows The Uptrend Is Getting Stronger

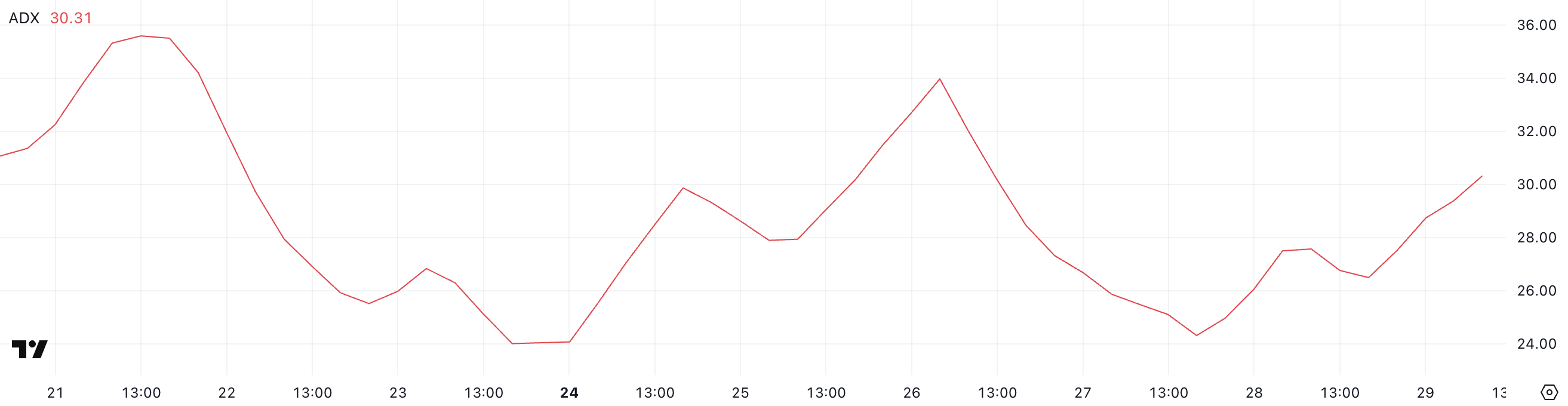

GRASS is currently in an uptrend, with its Average Directional Index (ADX) rising to 30.31 from 26.49 just a day ago, indicating a strengthening trend momentum.

The ADX is a widely used technical indicator that measures the strength of a trend, regardless of its direction, on a scale from 0 to 100.

Values below 20 suggest a weak or non-existent trend, while readings above 25 indicate that a trend is gaining traction.

When the ADX moves above 30, it typically signals that the trend is becoming well-established and may continue in the same direction.

With GRASS’s ADX now above the 30 threshold, the current uptrend appears to be gaining strength. This suggests that bullish momentum is firming up and that price action may continue favoring the upside in the near term.

As long as the ADX remains elevated or continues climbing, the trend is likely to sustain, attracting more interest from momentum traders.

However, if the ADX begins to plateau or reverse, it could signal a potential slowdown or consolidation phase ahead.

GRASS Could Form A New Golden Cross Soon

GRASS’s Exponential Moving Average (EMA) lines are showing signs of a potential golden cross, a bullish signal that occurs when a short-term EMA crosses above a long-term one.

If this crossover confirms, it could mark the beginning of a sustained uptrend. GRASS is likely to test the immediate resistance at $1.85 as some artificial intelligence coins start to recover good momentum.

Should bullish momentum from the past week persist, the token may push even higher toward $2.26 and eventually $2.56 or $2.79, possibly solidifying its position as one of the best-performing altcoins in the market.

However, if the trend fails to hold and sentiment shifts bearish, GRASS could pull back to retest the support at $1.63.

A break below this level might open the door to a deeper correction, potentially driving the price down to $1.22.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Vitalik Buterin Promotes Ethereum Layer 2 Roadmap

Ethereum co-founder Vitalik Buterin has introduced a new roadmap aimed at strengthening the security and finality of Layer 2 (L2) solutions.

His proposal introduces a flexible, multi-proof system designed to support Ethereum’s scalability while preserving its core principles of decentralization and trust minimization.

Ethereum’s New Layer 2 Roadmap

At the heart of Buterin’s technical framework is a “2-of-3” model. This system uses three different proof types—optimistic, zero-knowledge (ZK), and trusted execution environment (TEE) provers.

A transaction is finalized when any two of these agree, significantly reducing the risk tied to relying on a single-proof method. The model offers a pragmatic balance between speed, robustness, and decentralization.

Buterin emphasized the importance of diversification, especially as zero-knowledge systems mature. He warned that shared code among ZK rollups could cause bugs to propagate across implementations, raising systemic risk.

“This means that the finality of rollups can be as fast as zk proving (~<1hr for now) while protecting the system from soundness bugs in the zk system,” Wei Dai, a research partner at 1kxnetwork, explained.

Meanwhile, Buterin’s roadmap also lays out the requirements for what he calls “Stage 2 rollups.” These next-generation rollups would deliver near-instant confirmations, high finality, and strong resistance to failures—even in semi-trusted environments.

Importantly, they would still adhere to Ethereum’s 30-day upgrade delay, a rule that safeguards the network’s stability during transitions.

Buterin Makes Case for Open-Source Funding

Beyond scalability, Buterin is also advocating a cultural shift in how the crypto community approaches development funding.

In a separate blog post, he suggested shifting the focus from “public goods funding” to “open-source funding.”

His concern is that the phrase “public goods” has become politically and socially loaded, often used in ways that prioritize perception over impact.

“A big part of the reason why the term ‘public good’ is vulnerable to social gaming is precisely the fact that the definition of ‘public good’ is stretched so easily,” Buterin argued

He noted that public goods funding is vulnerable to social desirability bias. This often favors those who can navigate community politics over those who deliver meaningful value.

In contrast, open-source funding emphasizes transparency, collaboration, and the building of tools that genuinely benefit the broader ecosystem.

Buterin believes that the goal should not be to fund any open-source project indiscriminately but to support those that create maximum value for humanity.

This stance aligns with his broader vision of a sustainable, community-driven blockchain infrastructure.

Together, Buterin’s proposals could redefine both the technical direction of Ethereum’s scalability efforts and the philosophical foundations of its funding strategies—reinforcing the network’s long-term commitment to decentralization, security, and public benefit.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

US Senators Question Trump’s Involvement in USD1 Stablecoin

A coalition of US Senators is raising serious concerns about a potential conflict of interest involving President Donald Trump and an upcoming stablecoin project called USD1.

The digital asset, backed by World Liberty Financial (WLF), has drawn scrutiny due to Trump’s reported ties to the company behind it.

Warren-Led Group Flags Risks of Presidential Involvement in USD1 Approval

On March 28, a group of lawmakers led by Senator Elizabeth Warren sent a letter to the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

They asked both agencies to clarify how they plan to uphold regulatory integrity regarding the impending USD1 stablecoin.

The request comes as Congress considers the GENIUS Act, a bill that would grant the Fed and OCC broad authority over stablecoin regulation.

“The President of the United States could sign legislation that would facilitate his own product launch and then retain authority to regulate his own financial company,” they noted.

The Senators warned that allowing a sitting president to profit from a digital currency regulated by federal agencies under his influence poses a major threat to financial stability. They argue that such a situation is without precedent and could erode public trust in the regulatory process.

“The launch of a stablecoin directly tied to a sitting President who stands to benefit financially from the stablecoin’s success presents unprecedented risks to our financial system,” They argued.

The letter outlines scenarios where Trump could directly or indirectly influence decisions involving USD1.

For instance, the President could interfere with the OCC’s evaluation of the stablecoin’s application or discourage enforcement actions against WLF.

They also suggested that Trump could pressure the Federal Reserve to provide emergency financial support for USD1 during market volatility—support that may not extend to competing stablecoins.

“[Trump] could also attempt to direct the Fed to establish a master account at the central bank for WLF. He could intervene to deny such assistance to USD1’s competitors,” the lawmakers stressed.

In addition, the Senators noted that the GENIUS Act contains no conflict-of-interest provisions that would prevent Trump from using his office to benefit financially from the stablecoin’s success.

This absence of guardrails, they say, opens the door to regulatory favoritism and economic manipulation.

Considering this, the lawmakers demanded clarification on how the Fed and OCC would handle key issues. These include the approval process for USD1, the potential creation of liquidity support during crises, and WLF’s oversight of potentially unsafe business practices.

The agencies must submit their responses by April 11, 2025. The letter was signed by Senators Elizabeth Warren, Ron Wyden, Chris Van Hollen, Jack Reed, and Cory Booker.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation22 hours ago

Regulation22 hours agoSonic Labs To Abandon Plans For Algorithmic USD Stablecoin, Here’s Why

-

Market22 hours ago

Market22 hours agoCoinbase Users Lost $46 Million to Crypto Scams in March

-

Altcoin21 hours ago

Altcoin21 hours agoPiDaoSwap, Trump Media, & Grayscale

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Drops Charges Against Hawk Tuah Girl Hailey Welch

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

-

Regulation23 hours ago

Regulation23 hours agoFDIC Revises Crypto Guidelines Allowing Banks To Enter Digital Assets

-

Market23 hours ago

Market23 hours agoHBAR Faces Volatility After Price Failed To Cross The $0.20 Mark

-

Market24 hours ago

Market24 hours agoWhat to Expect from XRP Price in April 2025