Market

Stellar (XLM) Price Return to $0.70 Could Be Postponed for Now

Stellar (XLM) price has surged over 400% in the last 30 days, marking one of the most significant rallies in November. After reaching $0.63, its highest price since 2021, XLM now faces potential consolidation as its trend indicators show signs of weakening.

Despite this, the uptrend remains intact, supported by strong market interest and bullish sentiment. If XLM can regain its momentum, it may target $0.70 next, continuing its remarkable ascent.

XLM Current Trend Is Losing Its Strength

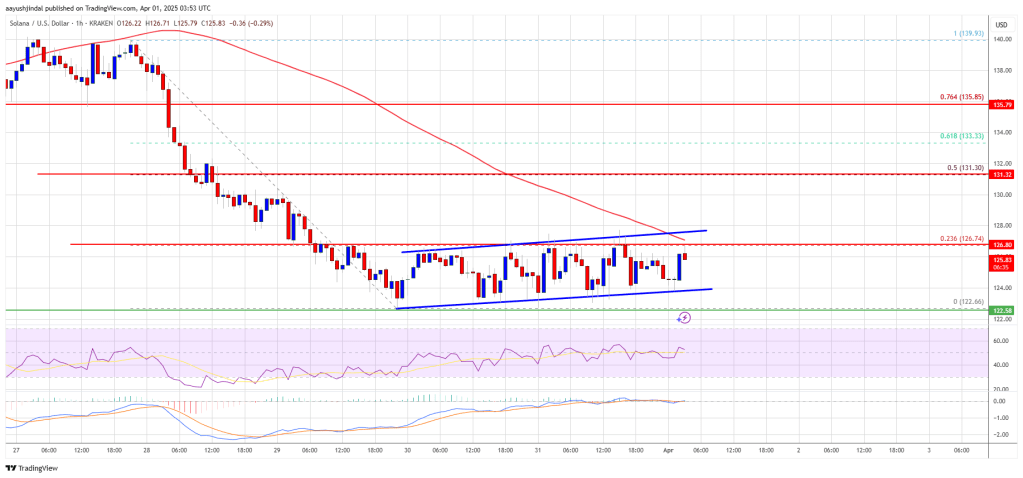

Stellar DMI chart indicates an ADX of 23.6, down significantly from over 40 just two days ago, suggesting weakening trend momentum. The ADX, or Average Directional Index, measures the strength of a trend on a scale of 0 to 100 without indicating its direction. Values above 25 signal a strong trend, while values below 20 suggest a weak or no trend.

Although XLM price remains in an uptrend, the declining ADX reflects diminishing momentum, hinting at potential consolidation or a slowdown in the bullish movement.

With the positive directional indicator (D+) at 24.7 and the negative directional indicator (D-) at 14.9, XLM’s uptrend still shows a clear bullish bias. The higher D+ value highlights that buying pressure is currently outpacing selling pressure, supporting the continuation of the uptrend.

However, for the trend to regain strength, the ADX would need to climb back above 25, signaling stronger momentum. Until then, Stellar price may see more modest gains or a period of consolidation.

Stellar CMF Has Been Negative for 3 Days

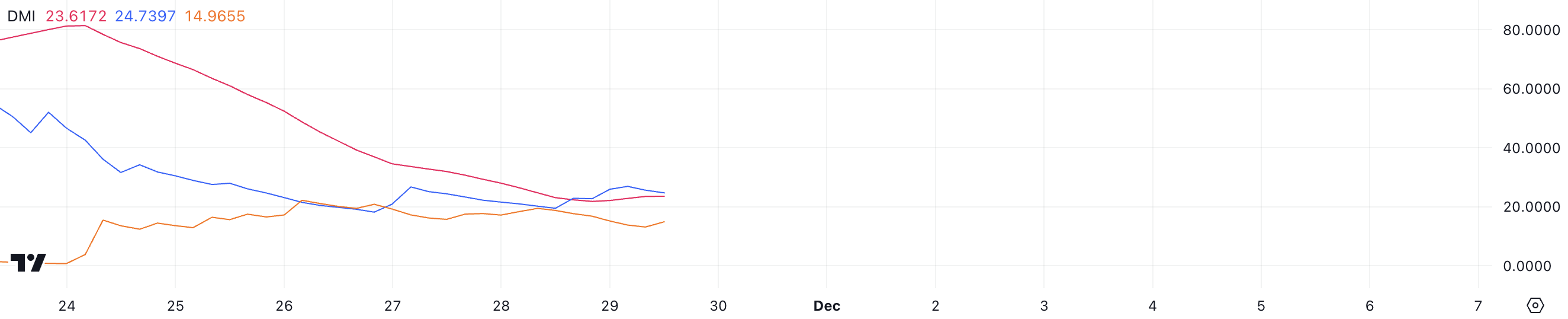

XLM’s CMF currently stands at -0.16, marking a sustained negative trend since November 26 after being positive for four consecutive days. The CMF, or Chaikin Money Flow, measures capital inflows and outflows over a given period, with values above 0 signaling buying pressure and values below 0 indicating selling dominance.

A negative CMF value suggests that selling activity has outweighed buying, which could slow the current uptrend.

At -0.16, Stellar CMF indicates moderate selling pressure, potentially limiting its recent bullish momentum. While this value reflects a shift in sentiment, it remains less severe than more extreme negative levels seen during stronger corrections.

If the CMF trends further downward, it could signal a weakening uptrend and increase the likelihood of a price pullback. Conversely, if it returns to positive territory, it would reaffirm growing buying pressure and support continued price gains.

XLM Price Prediction: Can It Reach $0.7 In December?

Stellar price recently achieved $0.63, its highest price since 2021, showcasing impressive bullish momentum. XLM is up 433.84% in the last 30 days.

If the current uptrend regains strength, XLM price could retest this resistance level and potentially rise to $0.70, representing a 37% increase from current levels.

However, if the uptrend fails to sustain and selling pressure increases, XLM price could face a reversal. In this scenario, the token may test its key support at $0.41, a significant level to maintain its medium-term bullish outlook.

A failure to hold this support could signal a deeper correction and diminish the recent positive momentum.

The post Stellar (XLM) Price Return to $0.70 Could Be Postponed for Now appeared first on BeInCrypto.

Market

Solana (SOL) Holds Steady After Decline—Breakout or More Downside?

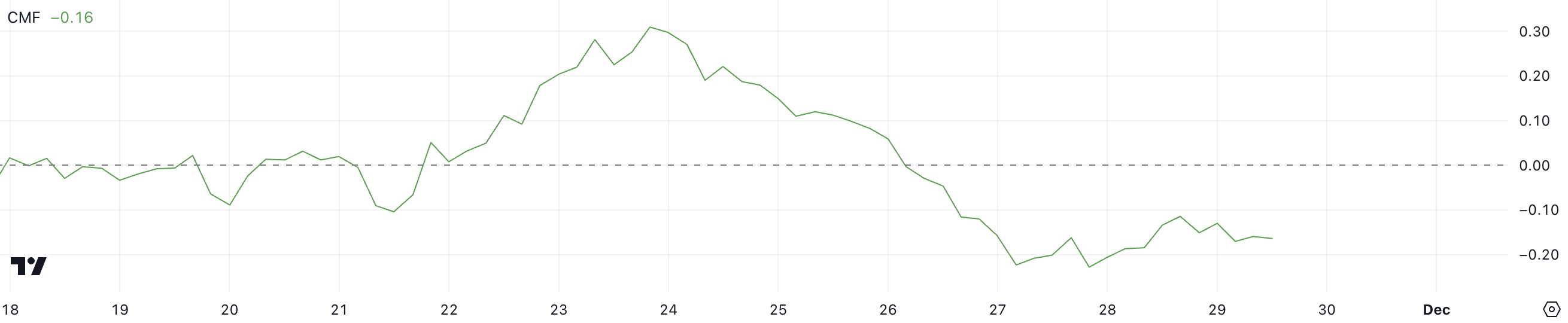

Solana started a fresh decline below the $132 support zone. SOL price is now consolidating and might struggle to recover above the $126 resistance.

- SOL price started a recovery wave from the $122 support zone against the US Dollar.

- The price is now trading below $130 and the 100-hourly simple moving average.

- There is a key rising channel forming with support at $124 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if the bulls clear the $126 zone.

Solana Price Faces Resistance

Solana price started a fresh decline below the $135 and $132 levels, like Bitcoin and Ethereum. SOL even declined below the $125 support level before the bulls appeared.

A low was formed at $122.64 and the price recently started a consolidation phase. There was a minor increase above the $125 level. The price tested the 23.6% Fib retracement level of the downward move from the $140 swing high to the $122 low.

Solana is now trading below $126 and the 100-hourly simple moving average. There is also a key rising channel forming with support at $124 on the hourly chart of the SOL/USD pair.

On the upside, the price is facing resistance near the $126 level. The next major resistance is near the $128 level. The main resistance could be $132 or the 50% Fib retracement level of the downward move from the $140 swing high to the $122 low.

A successful close above the $132 resistance zone could set the pace for another steady increase. The next key resistance is $136. Any more gains might send the price toward the $142 level.

Another Decline in SOL?

If SOL fails to rise above the $128 resistance, it could start another decline. Initial support on the downside is near the $124 zone. The first major support is near the $122 level.

A break below the $122 level might send the price toward the $115 zone. If there is a close below the $115 support, the price could decline toward the $102 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bearish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $124 and $122.

Major Resistance Levels – $128 and $132.

Market

Ethereum Price Faces a Tough Test—Can It Clear the Hurdle?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started another decline and traded below the $1,850 level. ETH is now consolidating and facing key hurdles near the $1,850 level.

- Ethereum struggled to continue higher above the $1,980 resistance level.

- The price is trading below $1,860 and the 100-hourly Simple Moving Average.

- There was a break above a connecting bearish trend line with resistance at $1,810 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,850 and $1,880 resistance levels to start a decent increase.

Ethereum Price Attempts Recovery

Ethereum price failed to continue higher above $2,050 and started another decline, like Bitcoin. ETH declined below the $1,880 and $1,850 support levels.

It tested the $1,765 zone. A low was formed at $1,767 and the price recently started a short-term recovery wave. The price climbed above the $1,800 resistance. There was a move above the 23.6% Fib retracement level of the downward move from the $2,033 swing high to the $1,767 low.

There was also a break above a connecting bearish trend line with resistance at $1,810 on the hourly chart of ETH/USD. Ethereum price is now trading below $1,860 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $1,850 level. The next key resistance is near the $1,860 level. The first major resistance is near the $1,900 level and the 50% Fib retracement level of the downward move from the $2,033 swing high to the $1,767 low.

A clear move above the $1,900 resistance might send the price toward the $2,000 resistance. An upside break above the $2,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,850 resistance, it could start another decline. Initial support on the downside is near the $1,800 level. The first major support sits near the $1,780 zone.

A clear move below the $1,780 support might push the price toward the $1,765 support. Any more losses might send the price toward the $1,710 support level in the near term. The next key support sits at $1,665.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,850

Market

Top 3 Made in USA Coins to Watch In April

Made in USA coins continue to try a rebound, with Solana (SOL), RENDER, and Jupiter (JUP) standing out as key names to watch in April. Despite recent price corrections, each of these tokens plays a major role in high-growth areas like DeFi, AI, and blockchain infrastructure.

Solana has seen its price dip, but ecosystem activity remains strong; RENDER is riding the wave of AI demand despite market turbulence; and Jupiter is showing solid usage metrics even as its token struggles. Here’s a closer look at the technical and fundamental setups for each of these standout U.S.-based projects.

Solana (SOL)

Solana has faced a notable price correction over the past week, with its value dropping nearly 13%. If this bearish momentum continues, the token could be on track to retest the critical support level at $120.

A breakdown below that could see SOL sliding further toward the $112 mark.

Despite the recent downturn, Solana remains one of the most relevant Made in USA coins and continues to show impressive usage metrics. PumpFun, for example, generated nearly $9 million in revenue over the past 24 hours, second only to Tether.

After a short period when BNB led the DEX volume race, Solana seems to be regaining traction—its decentralized exchange volume has surged by 128% in just seven days, reaching $18 billion and surpassing both Ethereum and BNB.

If this recovery in momentum persists, SOL could target a move toward the $131 resistance level. A successful breakout there could open the door to further gains toward $136 and potentially $147.

RENDER

RENDER, one of the most prominent U.S.-based cryptocurrencies with a focus on artificial intelligence, has seen its price decline nearly 11% over the past seven days.

This drop reflects the broader correction that has impacted many AI-related tokens in recent months.

However, new developments in the AI infrastructure space may provide a catalyst for a potential rebound, especially as the limitations of centralized systems become clear.

If bullish momentum returns to the AI sector, RENDER could look to challenge the resistance at $3.47, and a successful breakout might open the door for a rally toward $4.21.

However, if the current correction deepens, the token could fall to test the $3.14 support level. A breakdown there may trigger further losses, potentially dragging RENDER down to $2.83 or even $2.52—its lowest level in recent weeks.

Jupiter (JUP)

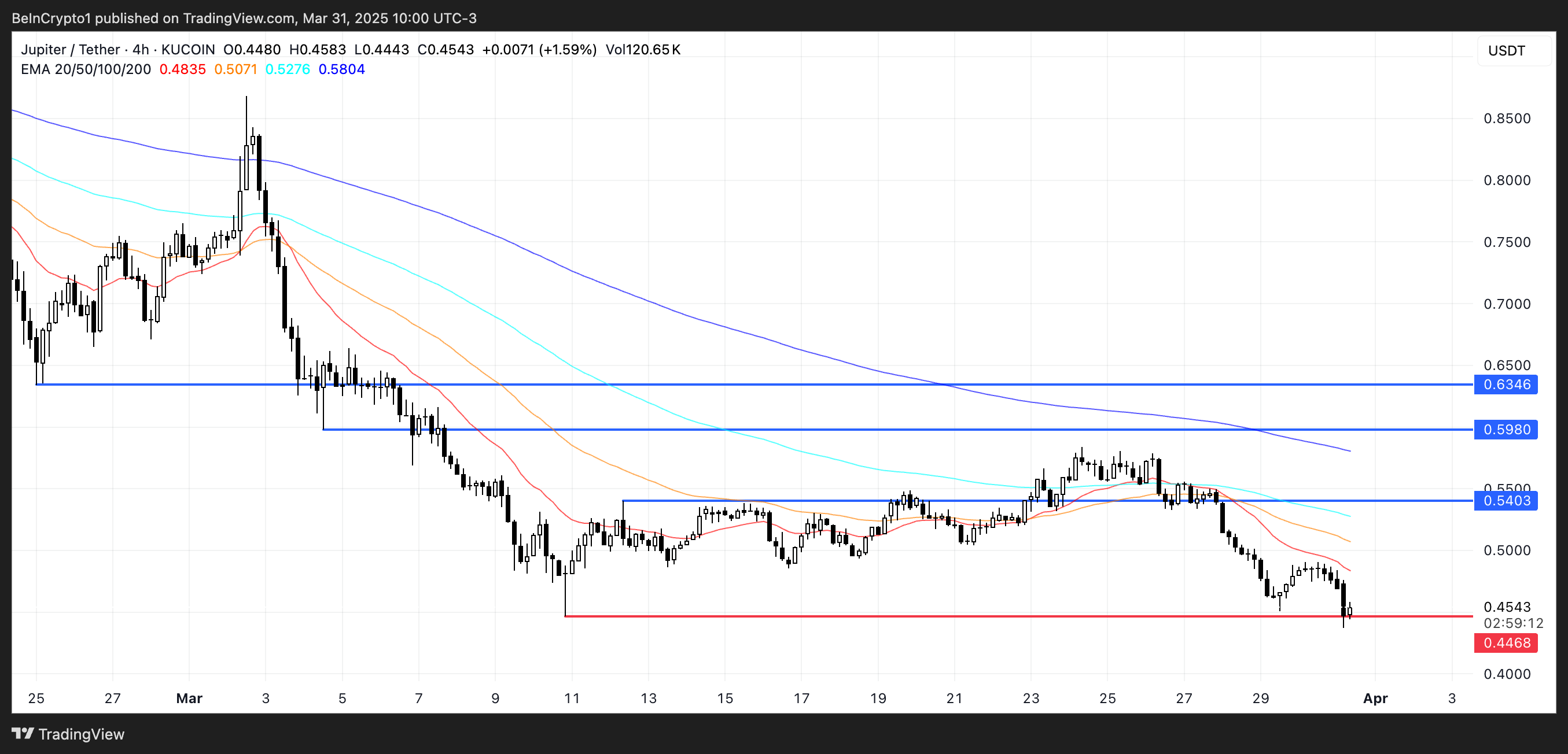

Despite Solana’s recent struggles, Jupiter—its leading DEX aggregator—is demonstrating impressive strength in terms of activity.

In the last 24 hours, Jupiter ranked as the fourth-highest protocol in crypto by fee generation, collecting nearly $2.5 million.

Only Tether, PumpFun, and Circle managed to outperform it, highlighting the platform’s growing relevance within the Solana ecosystem even during periods of broader market weakness.

However, JUP, Jupiter’s native token, hasn’t mirrored this positive momentum. Its price has dropped over 21% in the past week, being one of the worst performers among the biggest Made in USA coins. It has remained below the $0.65 mark for three consecutive weeks.

With JUP now hovering dangerously close to a key support at $0.44, a breakdown could see the token dip below $0.40 for the first time ever.

Still, if market sentiment shifts and momentum returns, JUP could begin climbing again—first testing resistance at $0.54, then potentially moving toward $0.598 and even $0.63 if bullish pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoDon’t Fall for These Common Crypto Scams

-

Bitcoin13 hours ago

Bitcoin13 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market12 hours ago

Market12 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Altcoin17 hours ago

Altcoin17 hours ago$33 Million Inflows Signal Market Bounce

-

Market22 hours ago

Market22 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market15 hours ago

Market15 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Regulation14 hours ago

Regulation14 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Bitcoin20 hours ago

Bitcoin20 hours agoUS Macroeconomic Indicators This Week: NFP, JOLTS, & More