Market

Alkimi Exchange CEO on Decentralized Ads and Data Ownership

In recent years, the advertising industry has faced growing criticism due to concerns around data privacy, fraud, and inefficiencies. Traditional digital advertising, particularly through intermediaries like Google and Facebook, has led to a lack of transparency for advertisers and publishers alike.

Ben Putley, CEO and Co-Founder of Alkimi Exchange, believes the digital advertising industry is long overdue for a change. Here, he breaks down how blockchain technology is reshaping advertising and why it’s time for the industry to evolve.

Alkimi Exchange is a blockchain-based decentralized advertising platform aimed at solving inefficiencies in the digital ad ecosystem. The platform leverages blockchain technology to eliminate intermediaries, reduce costs, and provide transparency in transactions between advertisers and publishers. It uses tokenized ad inventory and smart contracts to automate payments, ensuring efficiency and fraud prevention. Alkimi also empowers users with control over their data, allowing them to choose between sharing it for rewards or maintaining their privacy.

The Broken State of Advertising

At its core, digital advertising operates through intermediaries who profit by managing transactions between advertisers and publishers. These intermediaries — ad exchanges, supply-side platforms (SSPs), and demand-side platforms (DSPs) — not only inflate costs but also introduce vulnerabilities to fraud. Advertisers face an alarming $65 billion in global losses annually due to fraudulent activity, including bot-generated traffic and manipulated metrics.

“Advertisers are essentially pouring money into a system they can’t see or control. Fraud thrives in environments where transparency is missing. The lack of accountability also undermines trust, with advertisers unsure whether their spending translates into meaningful engagement or results,” Ben Putley explained.

Publishers are financially constrained under this system. Although they are responsible for creating the content that draws audiences and fuels the advertising ecosystem, they often see only a small portion of the ad revenue, as intermediaries claim a significant share. This leaves publishers with decreasing profits despite their critical role in the process.

Users fare no better. Most digital advertising platforms treat them as commodities, harvesting their data without consent and inundating them with poorly targeted or intrusive ads. This has led to a rise in ad blockers, with many users opting to avoid ads altogether rather than engage with an ecosystem they don’t trust.

“Users feel exploited, and they’re not wrong. They’re excluded from the value chain while their personal data fuels it,” he added.

Blockchain technology offers an elegant solution to many of these issues by introducing a transparent and decentralized framework for advertising. Unlike the current system, where transactions occur in a black-box environment, blockchain creates a public ledger where every impression, click, and transaction can be verified.

For advertisers, this transparency means real-time visibility into how budgets are being spent and assurance that their investments are reaching actual users rather than bots. For publishers, blockchain ensures they receive fair compensation, as payments are automated and verifiable. Every transaction is logged on a decentralized network, making it auditable and resistant to manipulation.

“Through the Ads Explorer, our proprietary tool, Alkimi provides complete transparency over every ad transaction. Every transaction on Alkimi is validated by a decentralized network of validators and stored on the Ethereum blockchain, ensuring that all spending is fully auditable and eliminating any ambiguity that is common in traditional systems,” Putley said.

The inefficiencies of the current advertising model stem largely from the reliance on intermediaries. These entities take significant cuts of the ad spend, leaving advertisers with higher costs and publishers with lower earnings. Research suggests that nearly half of an advertiser’s budget — around 47% — is absorbed by these fees.

“Decentralized platforms change the economics of advertising. By eliminating intermediaries, we’ve reduced fees to just 3-8%. That’s not just a marginal improvement — it’s transformative,” Putley shared.

This cost-saving benefits both advertisers and publishers. Advertisers can allocate more of their budgets to meaningful engagement, while publishers retain a larger share of the revenue, enabling them to invest in higher-quality content.

Smart contracts are a critical component of this system. These self-executing agreements automate payments between advertisers and publishers based on predefined conditions. For example, a smart contract might trigger payment only when a user interacts with an ad or makes a purchase.

“Smart contracts ensure fairness by removing the need for intermediaries. They execute transactions instantly and without bias, based entirely on the terms agreed upon. Smart contracts also add a layer of security, as they cannot be altered once deployed, providing an immutable and trustworthy system for all parties,” he noted.

But decentralization isn’t just about improving transparency and reducing costs — it’s also about empowering users. In the current model, users are passive participants, with no control over how their data is collected or used.

Blockchain flips this narrative, giving users the ability to decide how their data is shared and even rewarding them for their participation.

“Users should have the final say over their data. With decentralization, they can opt-in to share their information in exchange for rewards or keep their data private if they prefer,” Putley asserted.

This user-first approach not only respects privacy but also creates a more ethical and mutually beneficial system. Users who choose to share their data do so transparently and receive compensation, while advertisers gain access to more accurate and engaged audiences. According to Putley, it’s about building trust and creating a system where everyone feels like they’re benefiting.

Challenges to Adoption

Despite its potential, decentralized advertising faces several hurdles. One of the most significant barriers is the steep learning curve associated with blockchain technology.

Many advertisers and publishers are familiar with traditional systems and may hesitate to adopt a model they perceive as complex or unproven.

“The biggest challenge is overcoming inertia. People are naturally resistant to change, even when the benefits are obvious. At Alkimi, we’re addressing this by ensuring our platform is interoperable with existing ad technologies, making the transition as seamless as possible,” Putley said.

To address this, platforms must prioritize education and interoperability. Decentralized systems need to integrate seamlessly with existing workflows, reducing friction for advertisers and publishers making the transition.

Offline events, where Ben and his team showcased their approach, play an important role in driving adoption by demonstrating the practical applications of blockchain technology.

“It’s about making the abstract tangible. We’re showing people that decentralized advertising isn’t just an idea — it’s a working reality,” he noted.

Critics of blockchain often point to its energy consumption and scalability as potential drawbacks. However, advancements in technology have addressed many of these concerns.\

Utilizing Layer-2 scaling solutions helps decentralized platforms process high transaction volumes without the environmental costs associated with earlier blockchain models.

“Advertising is a high-volume industry. We’ve designed our platform to handle that scale efficiently while minimizing energy usage,” Ben acknowledged.

These improvements make decentralized systems more practical and position them as a greener alternative to traditional advertising, which accounts for a significant portion of global greenhouse gas emissions.

Alkimi’s Vision for the Future

As the advertising industry continues to evolve, the case for decentralization grows stronger. The current model is unsustainable, plagued by inefficiencies, distrust, and ethical shortcomings. Blockchain offers a path forward by addressing these challenges and creating a system built on transparency, efficiency, and fairness.

“We’re still in the early stages, but the momentum is there. Decentralization isn’t just a trend — it’s where the industry is heading,” Putley said.

The success of this shift will depend on continued innovation, particularly in making blockchain systems more accessible and scalable. Platforms must also focus on delivering measurable benefits to advertisers, publishers, and users alike.

For advertisers, this means better ROI and reduced costs. For publishers, it’s about fair compensation and sustainable revenue. And for users, it’s about choice, privacy, and respect.

“Ultimately, it’s about creating a system where everyone wins. That’s what decentralized advertising promises, and it’s what we’re working to deliver,” Ben concluded.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Whales Bought These 3 Coins Recently

Crypto whales bought Optimism (OP), Dogecoin (DOGE), and Worldcoin (WLD) in recent days. OP saw a rise in large holders despite being down 73% over the past year, while DOGE whale wallets climbed to a two-week high as meme coin sentiment shows signs of recovery.

WLD also attracted accumulation, even after a 19% drop in the last 30 days, with whales adding to their positions over the last four days. This shift in on-chain behavior suggests that some big players may be preparing for a potential rebound across these assets.

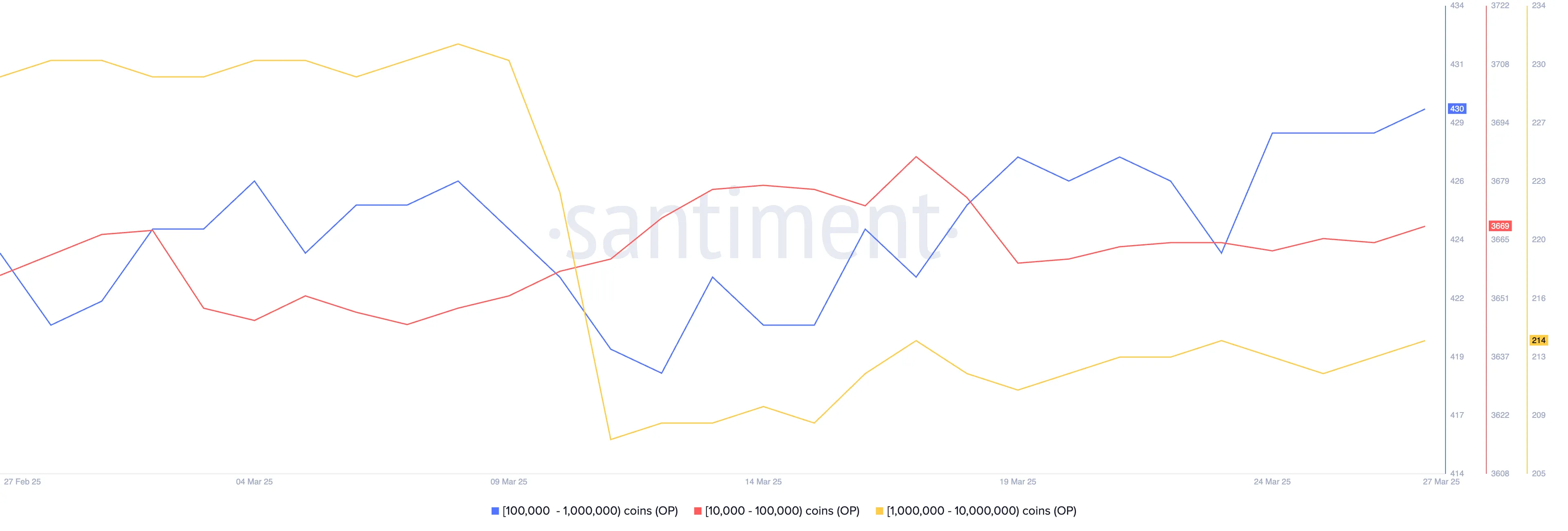

Optimism (OP)

Despite Optimism experiencing a prolonged downtrend and a nearly 73% drop over the past year, on-chain data reveals a subtle but notable shift: the number of wallets holding at least 10,000 OP has increased from 4,303 to 4,313 in the last five days.

This uptick suggests that some larger investors may be accumulating OP at lower prices, potentially positioning for a long-term reversal.

While OP has struggled to gain traction this cycle—remaining below the $2 mark since early January—this quiet accumulation could be an early sign of growing confidence among more seasoned holders.

If this accumulation translates into renewed bullish momentum, OP may attempt to reclaim key resistance levels, starting with $0.93.

A successful breakout could lead to a push toward $1.06, and if buying pressure accelerates, $1.20 becomes a reasonable upside target.

On the flip side, if selling pressure remains dominant and no meaningful shift in momentum occurs, OP could continue its slide, with $0.74 acting as a key support level. A break below that could send the price below $0.70, reinforcing the downtrend and keeping investors cautious in the near term.

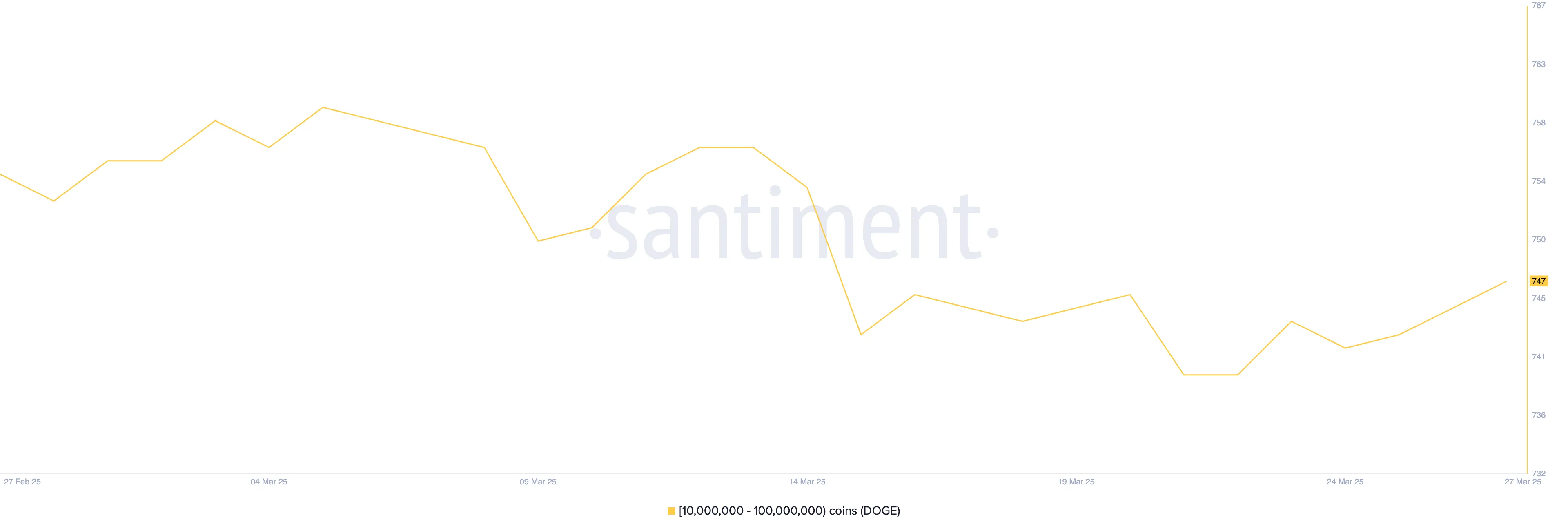

Dogecoin (DOGE)

Dogecoin, the largest meme coin by market cap, is seeing renewed interest from large holders. On-chain data reveals that crypto whales bought DOGE over the past week.

Specifically, the number of wallets holding between 10 million and 100 million DOGE rose from 740 to 747—the highest level in two weeks.

This suggests that big players may be positioning ahead of a potential rebound in the meme coin space, anticipating a shift in market sentiment. With DOGE historically responding strongly to meme coin hype, this uptick in whale activity could be a key early signal.

If momentum builds and meme coins stage a broader recovery, DOGE could be one of the biggest beneficiaries. A bullish breakout could send the price to test resistance around $0.19, and if that level is broken, further gains toward $0.22 and even $0.24 may follow.

However, if the current market correction deepens, DOGE may retest support at $0.16, with a possible drop to $0.143 if selling pressure increases.

For now, whale accumulation offers a promising sign—but price direction will likely hinge on whether broader meme coin momentum returns.

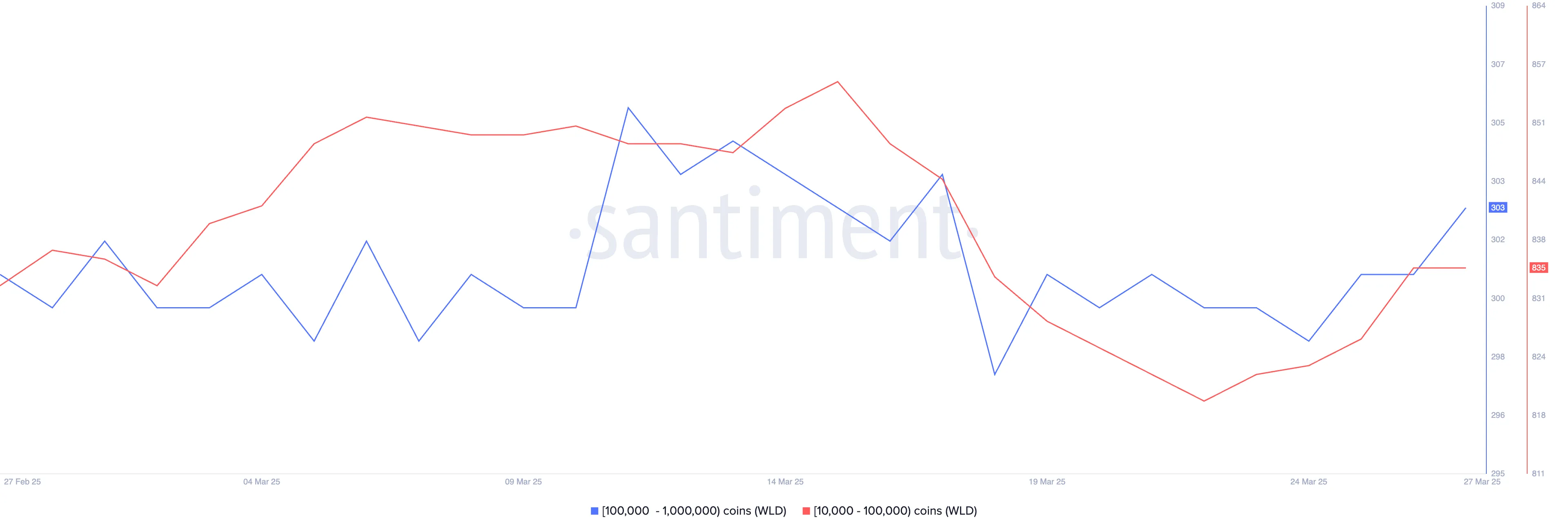

Worldcoin (WLD)

Worldcoin, once one of the most hyped AI-related cryptocurrencies, has struggled to maintain its momentum in recent months, with its price falling nearly 19% over the past 30 days.

Despite this decline, recent on-chain data shows that crypto whales have started accumulating WLD again. Over the last four days, the number of wallets holding between 10,000 and 1,000,000 WLD increased from 1,123 to 1,138.

This accumulation could signal growing confidence that WLD may soon find a bottom.

If buying momentum continues to build, WLD could attempt a short-term recovery. The first key resistance level is $0.91.

A breakout above that could fuel a stronger rally toward $1.25, helping Worldcoin regain some of its lost ground.

However, if bearish sentiment remains dominant, WLD may retest support at $0.80, and a break below that level could send it down further to $0.69.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump Pardons BitMEX Founders, Sparking Community Unease

President Trump just issued a pardon for BitMEX’s three founders, who pled guilty to money laundering charges in 2022. Unlike the case of Ross Ulbricht, there was no popular movement for these pardons, sparking community confusion.

Since the pardons went out, Sam Bankman-Fried’s Polymarket odds of receiving a pardon have skyrocketed. However, this has also created a sense of unease, especially with the rampant scams and frauds in crypto today.

Trump Issues BitMEX Pardons

BitMEX is a centralized exchange with a long history in the crypto space, but it has faced its share of controversies. In 2020, it was sued in the US for alleged money laundering.

Its founders, Arthur Hayes, Benjamin Delo, and Samuel Reed, pled guilty to violating the Bank Secrecy Act, but President Trump just pardoned all three in a shocking move.

Trump did little to publicize these pardons, as neither he nor any of the recipients have yet made a public statement regarding the move. These men only faced fines, probation, and house arrest, and all were completely free at the time. Arthur Hayes remains an influential commentator, but he has no further involvement with BitMEX.

To call this move unexpected would be an understatement. Trump has given other crypto-related pardons, like with Ross Ulbricht, to be fair.

However, Ulbricht’s case was a cause célèbre in the community. There were no corresponding vocal calls to issue BitMEX pardons, especially considering the founders’ light sentences.

In short, most of the crypto space’s reactions have been negative. At the time, even government crypto allies like “Crypto Mom” Hester Peirce supported the BitMEX arrests, and money laundering has never been popular in the space. The crypto community is struggling to find a clear motivation for Trump’s pardons other than outright corruption.

“My God, everything is for sale. I think he’ll pardon Sam Bankman-Fried,” said author Jacob Silverman.

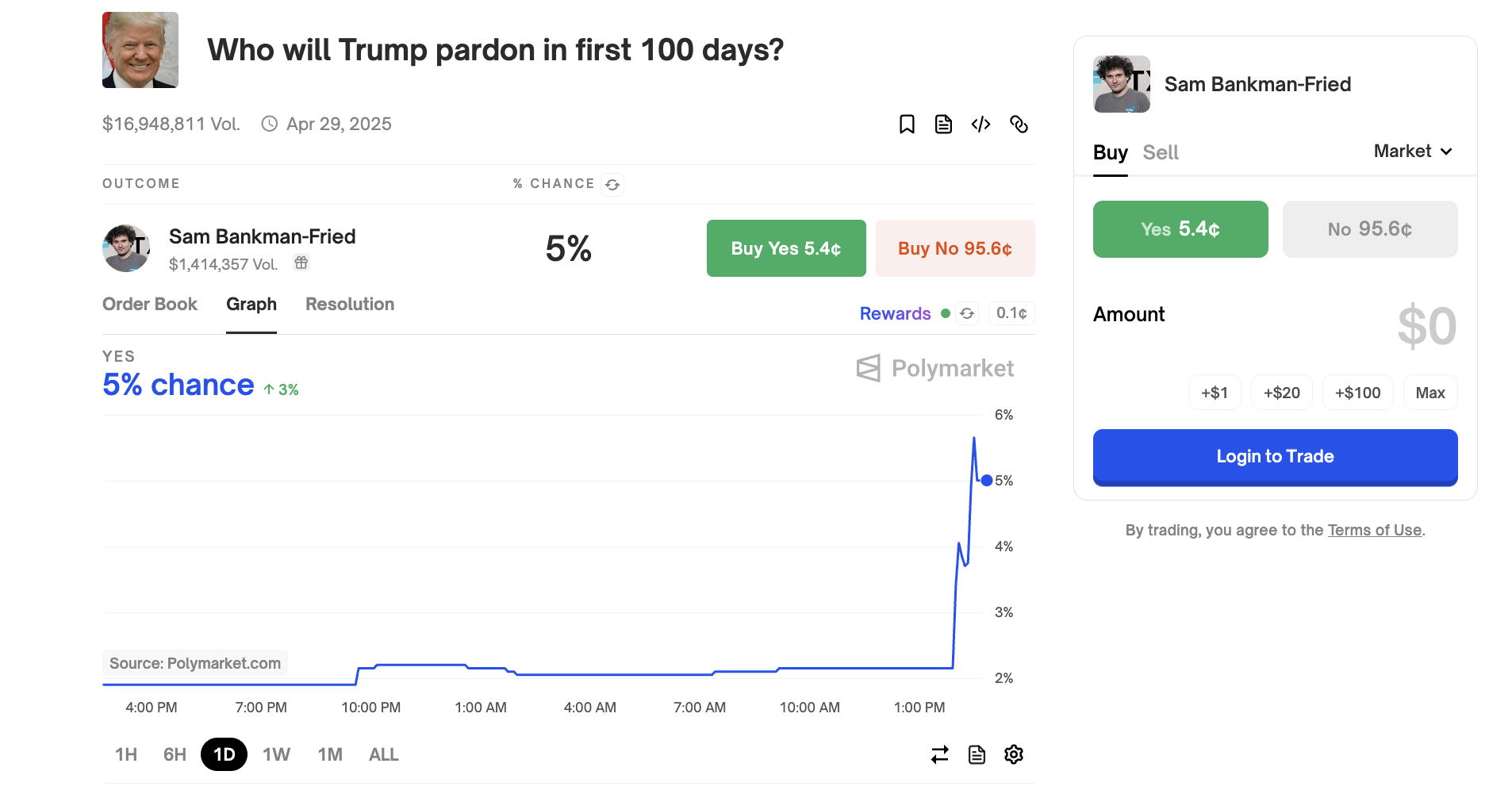

For the last few months, FTX mastermind Sam Bankman-Fried and his family have been lobbying President Trump for a pardon. The community mostly considered this possibility a long shot, especially because Bankman-Fried directly opposed Trump in the 2020 election. Since the BitMEX pardons, Bankman-Fried’s Polymarket odds have shot up:

In short, it doesn’t even look like this will be bullish for the markets. The crypto industry is in an unprecedented wave of scams, and some commentators worry that it could damage industry confidence. If Trump continues issuing pardons without a clear reason, it may embolden bad actors.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Users Lost $46 Million to Crypto Scams in March

According to ZachXBT, a Coinbase user lost $34.9 billion to scammers on Thursday, March 27. However, this is not an isolated trend, as Coinbase users have collectively lost more than $46 million to scams in March.

Scammers are targeting the exchange’s user base with a long track record of success. Coinbase customers should be on alert for social engineering attempts

Coinbase Scams are Growing Out of Control

Despite being one of the world’s largest crypto exchanges, Coinbase has been under scrutiny as its users are increasingly falling victim to scams. For over a year, sophisticated social engineering operations have been responsible for massive thefts.

According to ZachXBT, these scammers are showing no signs of stopping:

“It is suspected a Coinbase user was scammed yesterday for $34.9 million. After uncovering this theft, I noticed multiple other suspected thefts from Coinbase users in the past two weeks bringing the total stolen this month to $46 million+. Coinbase has not flagged any of the theft addresses from these victims in compliance tools,” he said via Telegram.

ZachXBT, a prominent crypto sleuth, has been persistently tracking scams against Coinbase users. Over the last few months, he’s identified several big crimes that relied on social engineering instead of outright hacks.

For example, last November, criminals posing as Coinbase Support managed to steal over $6.5 million.

This has reached the point where he claims that Coinbase is in a crisis of fraud and scams. Last month, ZachXBT estimated $150 million in annual losses, and he has now upgraded this to $300 million.

He hasn’t named any of his theories about the culprit or culprits. It could be an organized group, multiple independent actors, or other possibilities.

However, the exchange’s response to these events has been rather underwhelming. ZachXBT claimed that Coinbase has been downright passive about these huge scams, failing to warn users or cooperate with investigators.

In a recent social media post, he accused Coinbase of apathy towards these incidents:

“I have yet to see an incident where Coinbase flagged theft addresses. They are part of the problem, it shows they are not taking care of users,” he claimed.

Overall, given the increasing rate of these scams and the staggering amount of funds lost, Coinbase’s users should certainly be cautious about social engineering threats.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBinance To List MUBARAK, BROCCOLI, BANANAS31, and Tutorial

-

Market22 hours ago

Market22 hours agoHyperLiquid Responds to JELLY Crisis Amid Community Backlash

-

Market21 hours ago

Market21 hours agoBinance Alpha Lists Ghibli Meme Coins Amid ChatGPT Hype

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Cup And Handle Pattern Signals Recovery To $0.4, Here’s How

-

Market20 hours ago

Market20 hours agoWhy BTC Price Stayed Unchanged

-

Market19 hours ago

Market19 hours agoBitcoin Price Stalls at $88K—Can Bulls Overcome Key Resistance?

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Announces Vote To List Results, Set To List MUBARAK, BROCCOLI, TUT, BANANA

-

Market23 hours ago

Market23 hours agoOnyxcoin (XCN) Nears Oversold After a 30% Monthly Drop