Altcoin

XRP Whales Move 139M Coins As Ripple Case Near Potential End

XRP whales have taken action to shuffle over 100 million coins on Friday, setting off waves of speculation among traders and investors globally. As the Ripple Labs vs U.S. EC lawsuit reaches a potential end, these transactions have sparked substantial intrigue over the firm’s native coin’s future movements. Simultaneously, XRP price continues to pump, with the asset even surpassing BNB in terms of market cap.

XRP Whales Move Over 100M Coins, Ripple Case End Looms?

According to data from Whale Alert on November 29, two XRP whales have moved heavy amounts of the token. Per the data, rBJ.. moved 104.39 million coins, worth $167 million, to another unknown wallet, rhD. Subsequently, another whale address, rBE.. moved 35 million coins worth $52.28 million to another address, rsX. Altogether, these transactions ignited a speculative buzz as the company’s lawsuit against the U.S. SEC saw waves turning in favor of the American blockchain payments company.

Notably, the American blockchain payments company’s lawsuit against the SEC saw new turns, primarily in favor of XRP. Former CFTC Chairman Chris Giancarlo told FOX Business that the “new SEC will drop the appeal,” mirroring optimism in light of Donald Trump’s reelection. Pro-XRP Lawyers Bill Morgan, Fred Rispoli and Jeremy Hogan also proclaimed that the appeals will likely get dismissed or withdrawn. Overall, the XRP whale transactions amid these legal maneuvers have gained significant traction among industry participants globally.

On the other hand, the court has granted the motion to amend the order pertaining to judgment and stay in the XRP lawsuit, per the latest California district court filing in the re Ripple Labs Inc litigation. Both parties in the lawsuit collectively agreed that there was no specific reason to delay the judgment in the lawsuit, given class claims were resolved. Meanwhile, the plaintiff has requested the court for an “express finding in an amended judgment” primarily to avoid any further delay in the final judgment.

Ripple’s Coin’s Price Continues To Rally

At the time of reporting, XRP price soared 13% over the past day to reach $1.65. Its intraday low and high were $1.43 and $1.68, respectively. Notably, the token’s 24-hour trading volume witnessed a 50% uptick in value to $9.88 billion. The rising movement, as the lawsuit against the SEC nears its potential end, has ignited significant among traders and investors globally. It’s also noteworthy that the token flipped BNB in terms of market cap, boasting a valuation of $94.39 billion.

Meanwhile, a recent XRP price analysis by CoinGape Media revealed that the coin surged past a five-year resistance level in market dominance. This bullish trend has further ignited sentiments of a $10 target ahead for the coin. Market watchers continue to monitor the token, expecting further gains imminent.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Tron Sharpe Ratio Shoots High-Risk Signal, Price Crash Soon?

Data shows the Tron Sharpe Ratio has observed a rapid increase into a territory that has proven to be bearish for TRX’s value in the past.

Sharpe Ratio Could Imply Tron Is Overheated Now

As explained by an analyst in a CryptoQuant Quicktake post, the 180-day of the Tron Sharpe Ratio is now flashing a red alert. The “Sharpe Ratio” here refers to an indicator that compares the returns of a given asset with its risk.

Its value is calculated as the difference between the asset’s expected return and the risk-free rate of return, divided by the volatility. This metric tells us whether the returns of the commodity are worth the risk involved with it.

Below is the chart shared by the quant that shows the trend in the 180-day version of the Sharpe Ratio for Tron over the last few years:

The value of the metric seems to have been sharply going up in recent days | Source: CryptoQuant

As the above graph shows, the 180-day Tron Sharpe Ratio has recently observed some rapid growth and reached what has historically been the ‘red’ zone.

In the chart, the quant has highlighted the instances of the metric breaching into this region during the last few years. TRX appears to have generally hit some top whenever the indicator’s value has risen this high.

Tron is now inside this same high-risk zone once again, but it’s possible that the coin may not immediately hit a top, as the indicator is still at a lower level than during some of the tops. The analyst cautions, however, saying:

While TRX may continue its upward trend in the short term, holding positions in a high-risk zone like this can be detrimental. The potential for gains becomes limited compared to the increased likelihood of a sharp pullback, making this an unfavorable situation for long-term strategies.

It remains to be seen how the cryptocurrency price will develop from here on out, considering the trend that has emerged in its 180-day Sharpe Ratio.

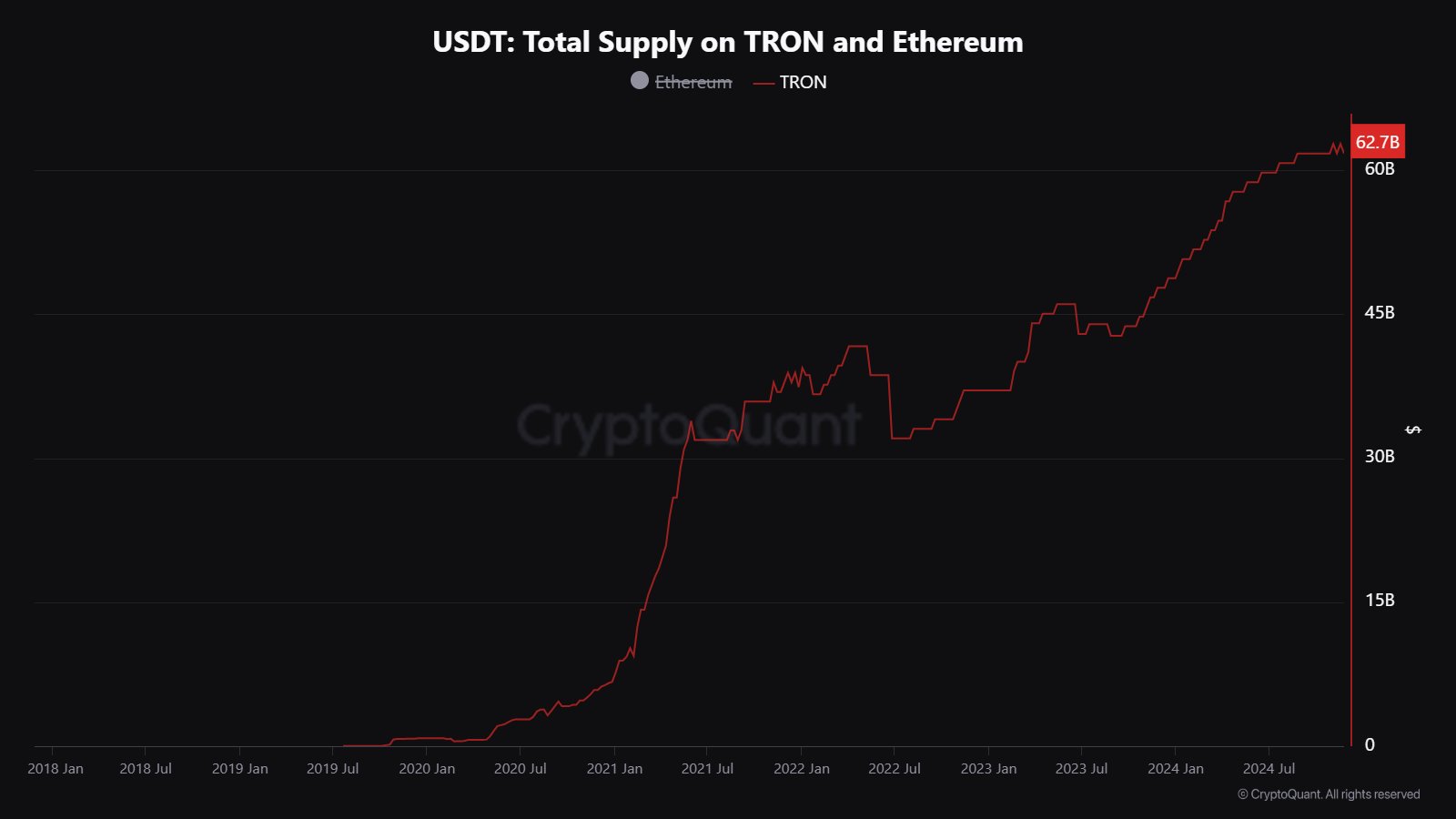

In some other news, the supply of Tether’s stablecoin, USDT, has recently witnessed considerable Tron network growth, as CryptoQuant community analyst Maartunn pointed out in an X post.

The value of the metric appears to have been sharply going up recently | Source: @JA_Maartun on X

The USDT supply on Tron has gone from $47.75 billion to $65.7 billion over the past year, representing an increase of more than 37%. This rise naturally shows how interest in using the stablecoin has increased on the network.

TRX Price

Tron broke through the $22 level a few days ago, but it appears the asset has since witnessed a cooldown in bullish momentum, as its price is now floating around $20.

Looks like the price of the coin has observed considerable growth over the last few weeks | Source: TRXUSDT on TradingView

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com

Altcoin

Binance Expands Leverage For Terra Luna Perpetual Trading

LUNC News: The world’s largest crypto exchange Binance has increased leverage by four times for Terra (LUNA) trading. The move comes as the exchange extended support for the Terra Luna community amid the bankruptcy of Terraform Labs. LUNA, LUNC and USTC prices all jumped amid the massive buying sentiment in the broader crypto market.

Binance Offering Four Times Leverage on Terra Luna Trading

In an official announcement by Binance, the crypto exchange revealed updated leverage and margin tiers of LUNA2USDT. The exchange has increased leverage and reduced maintenance margin rate, coming as major news for the broader LUNC community.

The changes were exclusively made for traders looking to take a position of 0 to 5000, 5000 to 25,000, and 25,000 to 100,000. The exchange increased leverage from 11-20x to 51-75x for a position of 0 to 5000, indicating support for Terra Luna price rally.

Also, Binance announced changes in XEMUSDT, ORBSUSDT, LOOMUSDT, LUNA2USDT, QNTUSDT, CHRUSDT, and JOEUSDT USD-M perpetual contracts.

LUNC News: Massive Bullish Momentum Signals

Terra (LUNA), LUNC, and USTC show massive bullish momentum as prices move above support levels. The community also seeks another major token burns from wallets related to beleaguered Terraform Labs and Luna Foundation Guard (LFG).

Terra (LUNA) price trades at $0.502, up 5% in the last 24 hours and 45% in a month. The 24 hour low and high are $0.4746 and $0.5036, respectively. Derivatives trading activity is on the rise amid Binance’s changes to leverage, as per Coinglass data.

Meanwhile, LUNC price has jumped 6% today and 33% this month. The price currently trades at $0.0001221, with a 24-hour high of $0.0001234. USTC price has climbed 10% in a month. Trading volume has increased by 15% in the last few hours.

Total LUNC futures open interest has surpassed the 100 billion mark, up more than 10% in the last 24 hours. 1000LUNC futures open interests on Binance and Bybit have climbed over 9% in the last 24 hours, indicating buying activity among traders.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Whale Moves 1.1 Billion DOGE, Is Rally To $1 Starting?

Dogecoin News: A Dogecoin whale transaction has caught the attention of the crypto community, fueling speculation about a potential price rally. Over 1.1 billion DOGE, worth more than $445 million, were transferred across three transactions involving unknown wallets. Such large-scale movements often hint at accumulation by major investors, signaling bullish sentiment.

This development has reignited discussions about Dogecoin’s trajectory, with many questioning whether the token is positioning itself for a significant breakout. Speculation is growing that DOGE could soon edge closer to the long-anticipated $1 milestone.

Dogecoin News: Whale Transfers 1.1 Billion DOGE Tokens

A notable shift in Dogecoin’s market activity has occurred as a whale moved a staggering 1.1 billion DOGE tokens across three transactions, drawing significant attention from the crypto community. According to Whale Alert, the largest of these transfers involved a massive 500 million DOGE, valued at over $202 million.

Additionally, two smaller transfers of 300 million DOGE each, worth about $121 million, were also carried out. Such large-scale transfers by a single entity typically signal major movements within the market, often linked to accumulation by whales or institutional players.

🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 500,000,000 #DOGE (202,294,187 USD) transferred from unknown wallet to unknown wallethttps://t.co/ptPuiBe8ax

— Whale Alert (@whale_alert) November 29, 2024

This whale activity indicates that major investors might be positioning themselves for potential future gains. The scale of the transfers highlights significant interest in top meme coins, likely driven by expectations of an upward price movement. With these transfers, whales could be seeking to secure their positions before any anticipated bullish trends, which could drive demand in the market.

On-chain data from Blockchair data reveals the wallet currently holds 600 million DOGE, making it one of the top 20 largest Dogecoin holders. This accumulation trend, alongside recent high-value transfers, points to continued bullish sentiment within the Dogecoin ecosystem. The growing number of high-value transfers into personal wallets could be an indicator of a potential price surge, with whales strengthening their positions in anticipation of future market movements.

DOGE price is currently trading at $0.412, reflecting a 4% daily increase, 7% weekly growth, and a staggering 143% monthly surge. Its 24-hour trading volume stands at $4 billion, with a low of $0.3922 and a high of $0.4144. With a market cap of $61 billion, Dogecoin remains the seventh-largest cryptocurrency by market value.

Despite a 41% drop in derivative volume and a 58% decline in options volume reported by Coinglass, market sentiment remains strong. Some analysts believe DOGE could hit $1 in the near term, driven by sustained demand and market momentum. Notably, a popular crypto analyst has gone further, predicting DOGE price rise to $4.20 in the ongoing bull cycle, citing DOGE’s historic 500% rally since August.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market21 hours ago

Market21 hours agoThe next Pepe with a potential for 1,000% gains

-

Market19 hours ago

Market19 hours agoThe Biggest Names in Blockchain in 2024 Revealed

-

Market24 hours ago

Market24 hours agoWill OORT Price Continue to Rise After CZ’s Post?

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Eyes $3,900 – Key Resistance Break Could Spark A Surge

-

Market23 hours ago

Market23 hours agoRWA Altcoins to Watch This December

-

Altcoin23 hours ago

Altcoin23 hours agoEthereum SuperTrend Signal That Led To 120% Price Surge In 2023 Has Returned, Why ETH Could Reach $7,500

-

Market22 hours ago

Market22 hours agoLess Than 5% Away From Historic $100K

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is The Worldcoin Price Up 20% Today, Rally To Continue?

✓ Share: