Market

What Are the Most Talked-About Altcoins Today, November 29?

For weeks, altcoins have hinted at a potential breakout, with signs they may soon outperform Bitcoin (BTC), which has dominated the market for most of the year. However, not all the most talked-about altcoins trending today have seen price gains in the last 24 hours.

While some have shown strong performance, others have lagged behind. According to CoinGecko, today’s top trending altcoins include Hyperliquid (HYPE), (VIRTUAL), and Vector Smart Gas (VSG).

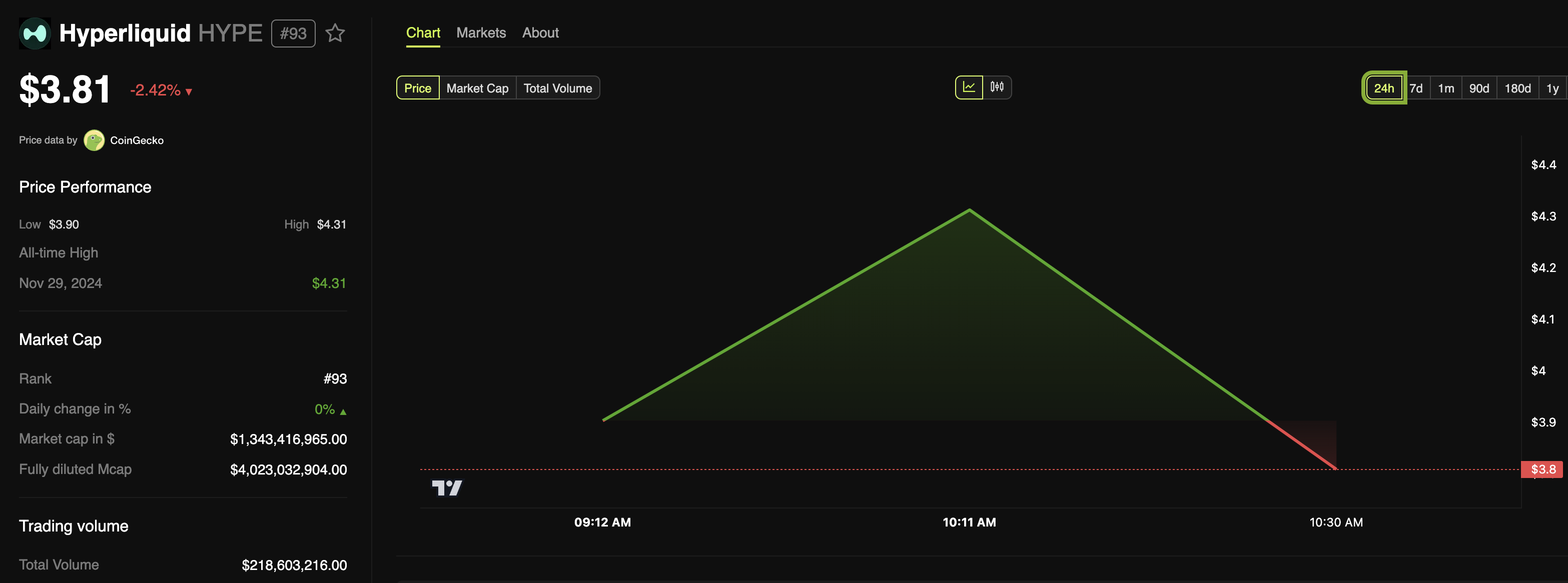

Hyperliquid (HYPE)

Hyperliquid is a Layer-1 blockchain that facilitates trading on its decentralized perpetual exchange and has a native token with the ticker “HYPE.” HYPE is one of the top altcoins trending today. Basically, it has its Token Generation Event (TGE) today and airdropped some tokens to its early users.

According to the project, the airdropped tokens represent 31% of its total supply, which equals 310 million tokens. At press time, HYPE’s price trades around $3.81 and has yet to be listed on any centralized exchange.

However, there is speculation that HYPE might soon be listed on tier-1 and tier-2 exchanges. If this happens, the trading volume might increase, and the price is likely to jump.

Virtuals Protocol (VIRTUAL)

Virtuals Protcol is a project operating on the Base network, focusing on Artificial Intelligence (AI) and the Metaverse narrative. VIRTUAL, its native cryptocurrency, is one of the most talked-about altcoins trending today because its price has increased by 50% in the last 24 hours.

This development is similar to the recent hike in the prices of Metaverse tokens, including The Sandbox (SAND) and Decentraland (MANA). As of this writing, VIRTUAL’s price is $1.36.

The daily chart shows that the Moving Average Convergence Divergence (MACD) reading has increased, indicating bullish momentum around the cryptocurrency. If this continues, the price could rally above $1.56.

On the other hand, if the hype around Metaverse tokens subsides and selling pressure increases, this might not happen. Instead, VIRTUAL’s value could drop to $0.52.

Vector Smart Gas (VSG)

Like Hyperliquid, Vector Smart Gas (VSG) is not listed on any centralized exchange. The token, which is built on Ethereum, was among the trending altcoins on November 27. Its appearance on the list again suggests that interest in the token is still present.

However, unlike the last time, VSG’s price did not increase but has seen a 13.50% decrease in the last 24 hours. This decline could be linked to rising selling pressure which the volume on the daily chart showed has increased.

Should this remain the case, then VSG’s price might drop from $0.0057 to $0.0037. However, if buying pressure increases, this might not be the case. In that scenario, the altcoin could bounce to $0.0071.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Newly Launched Cryptos to Watch In December 2024

UBC, launched four days ago, has gained over 18,000 holders but saw its market cap drop by 45% in the last day, settling at $34 million. Similarly, $1, launched five days ago, experienced a sharper decline of 65%, with its market cap falling to $8.7 million despite attracting nearly 60,000 holders.

JAK, themed around animated video coins, drew over 24,000 holders in under three days but suffered an 80% correction, reducing its market cap to $3.4 million. All three tokens currently have neutral RSI levels, suggesting room for potential recovery if buying sentiment returns.

Universal Basic Compute (UBC)

Universal Basic Compute (UBC), launched just four days ago, has quickly gained attention. With over 37,000 daily transactions and more than 18,000 holders, it is one of the most successful newly launched coins this week, especially in the Solana ecosystem.

However, its market cap has dropped 45% in the past 24 hours, falling from $48 million to $34 million, reflecting significant selling pressure after its initial surge.

UBC’s RSI currently stands at 45, signaling neutral momentum. This indicates that while the token is not overbought or oversold, it may be consolidating after the recent correction.

If UBC regains bullish momentum, it could retest its $50 million market cap, representing a potential 47% price increase from current levels.

just buy $1 worth of this coin ($1)

The $1 coin, launched on Solana five days ago, has quickly gained attention, attracting nearly 60,000 holders and recording 81,000 transactions in the past 24 hours.

Despite this activity, the coin has faced significant selling pressure, with its market cap dropping sharply by 65% in the last day, falling from nearly $15 million to $8.7 million.

With an RSI of 43, $1 is currently in a neutral zone, neither overbought nor oversold. This suggests the token could be stabilizing after the steep correction.

If buying pressure returns, $1 could reclaim the $10 million market cap and potentially retest its previous high of $15 million, signaling a strong recovery from recent losses.

Jak (JAK)

The JAK token has gained traction by leveraging the popularity of animated video-themed meme coins. It has attracted over 24,000 holders in under three days.

Despite its fast rise, JAK has seen a sharp correction, with its market cap dropping over 80% from $6.2 million to $3.4 million.

JAK is still seeing strong activity, with more than 90,000 daily transactions reflecting continued market interest. Its RSI currently sits at 53, signaling neutral momentum.

This level suggests that while selling pressure has eased after the steep decline, the coin is neither overbought nor oversold. That leaves room for a potential recovery if buying sentiment increases.

The post 3 Newly Launched Cryptos to Watch In December 2024 appeared first on BeInCrypto.

Market

What Crypto Whales Are Buying for December 2024: FTM Leads

Whales consistently play a significant role in shaping crypto market prices, making it worthwhile to track their buying activity for potential gains.

In this analysis, BeInCrypto highlights the top altcoins that whales are accumulating. For December, these include Fantom (FTM), Dogecoin (DOGE), and Optimism (OP).

Fantom (FTM)

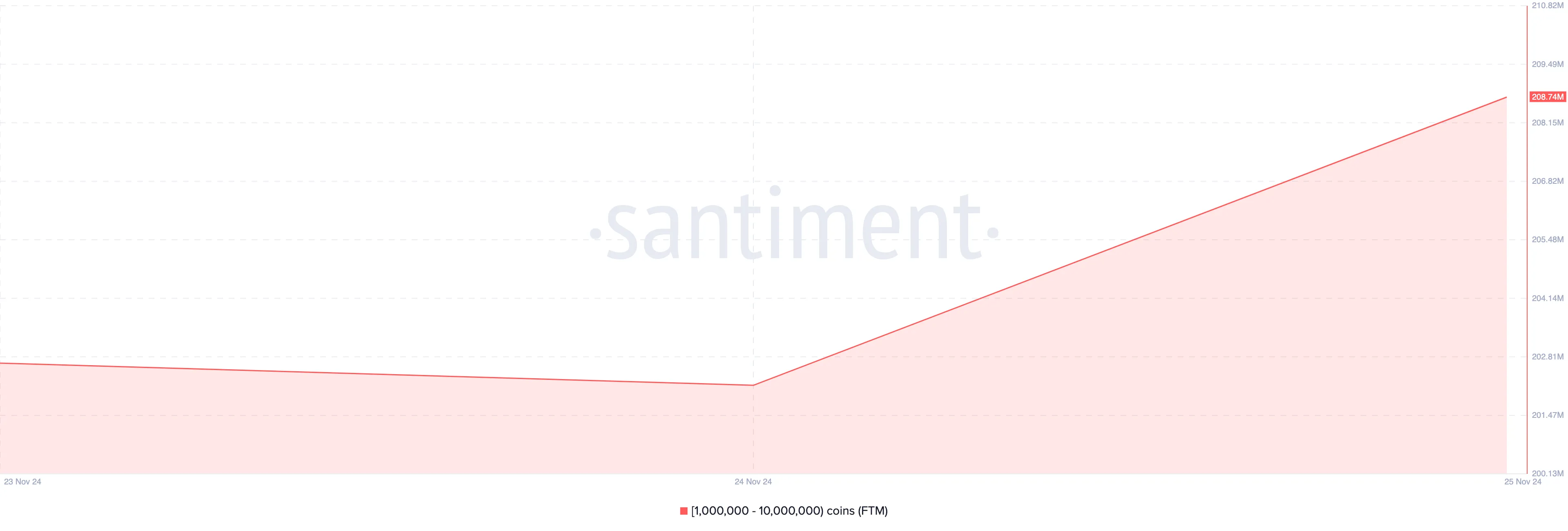

FTM, the token of Layer-1 blockchain Fantom, tops the list of altcoins that crypto whales are buying for December. According to our findings, whales are buying this token largely because of the upcoming final transition from Fantom to Sonic, whose Shard snapshot is expected to take place on December 1.

According to Santiment, the balance of wallet addresses holding 1 million to 10 million FTM was about 202 million on November 24. But today, it has increased to 208.74 million, suggesting that whales could be gearing up for a notable FTM rally.

If that continues, then Fantom’s price could climb toward $2 in December 2024. However, if these stakeholders decide not to continue accumulating, that might not happen, and FTM might drop below $1.

Dogecoin (DOGE)

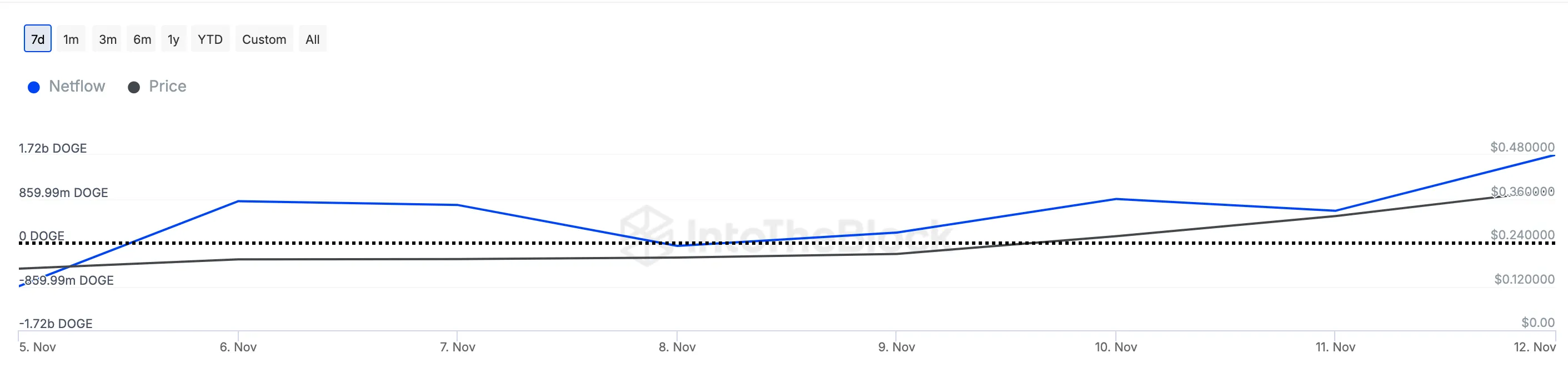

Like previous months, Dogecoin is again on the list of coins that crypto whales are buying for potential gains in December. According to IntoTheBlock, the large holders’ netflow has increased from its value some days back.

This netflow measures the difference between the value of coins that whales bought and sold. When it is negative, whales are selling more coins.

Some days back, the coins held by whales were about 642 million. But as of this writing, it has risen to 1.72 billion, indicating that whales have accumulated over $1 billion worth of DOGE within the last few days.

If they continue to buy, Dogecoin’s price might continue to rise as December comes. If not, the cryptocurrency’s value could shrink.

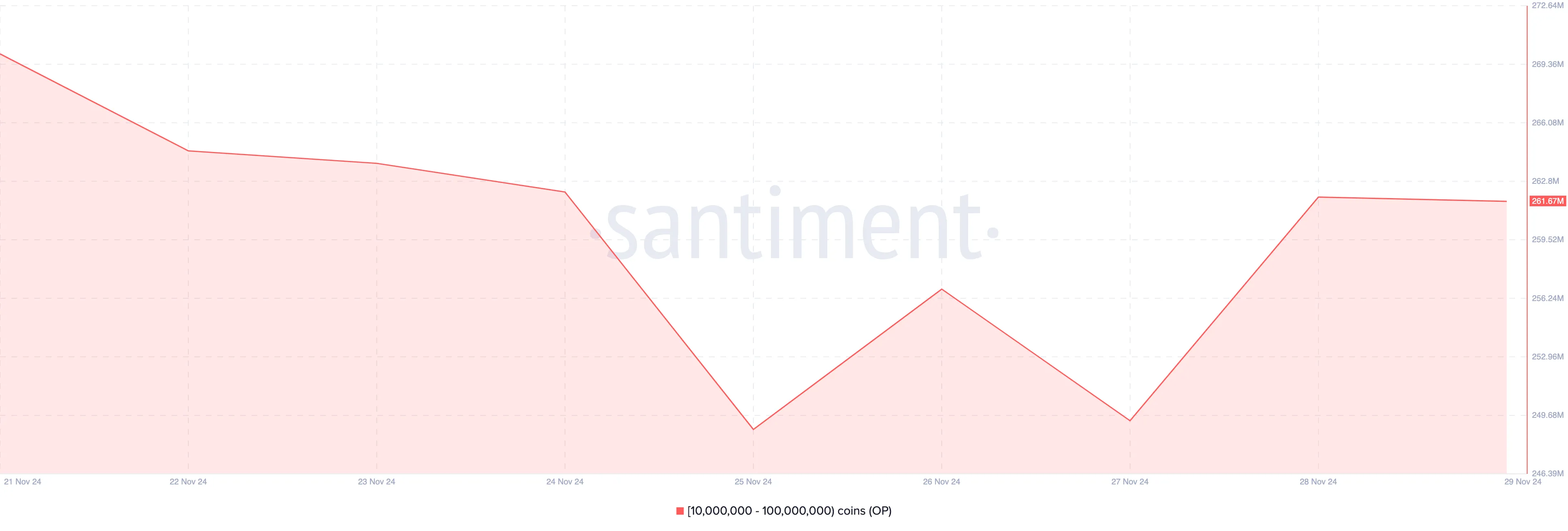

Optimism (OP)

Optimism, the Layer-2 project built on Ethereum, is another project that crypto whales are buying. While OP does not have any major development going on, it appears that the sentiment that ETH’s price could climb in December is one of the reasons whales are buying.

Historically, when Ethereum’s price increases, OP rises by a more significant figure. According to Santiment, the balance of addresses held by wallets holding 10 million to 100 million OP tokens has increased significantly.

If this trend continues, then OP’s price might experience a notable rally in December, with possible targets at $4. However, investors might need to watch out. Should crypto whales stop buying, this might not happen. Instead, OP could drop below $2.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why FET Whales May Push Its Price To $2?

Artificial Superintelligence Alliance (FET) has been on an uptrend, gaining 31% over the past week. This rally is driven by increased whale accumulation, indicating heightened interest from large-scale investors.

FET’s double-digit price surge has brought it near the upper boundary of the horizontal channel it has traded within since June. The key question is whether this momentum will trigger a breakout above this critical resistance level.

FET Whales Drive Rally

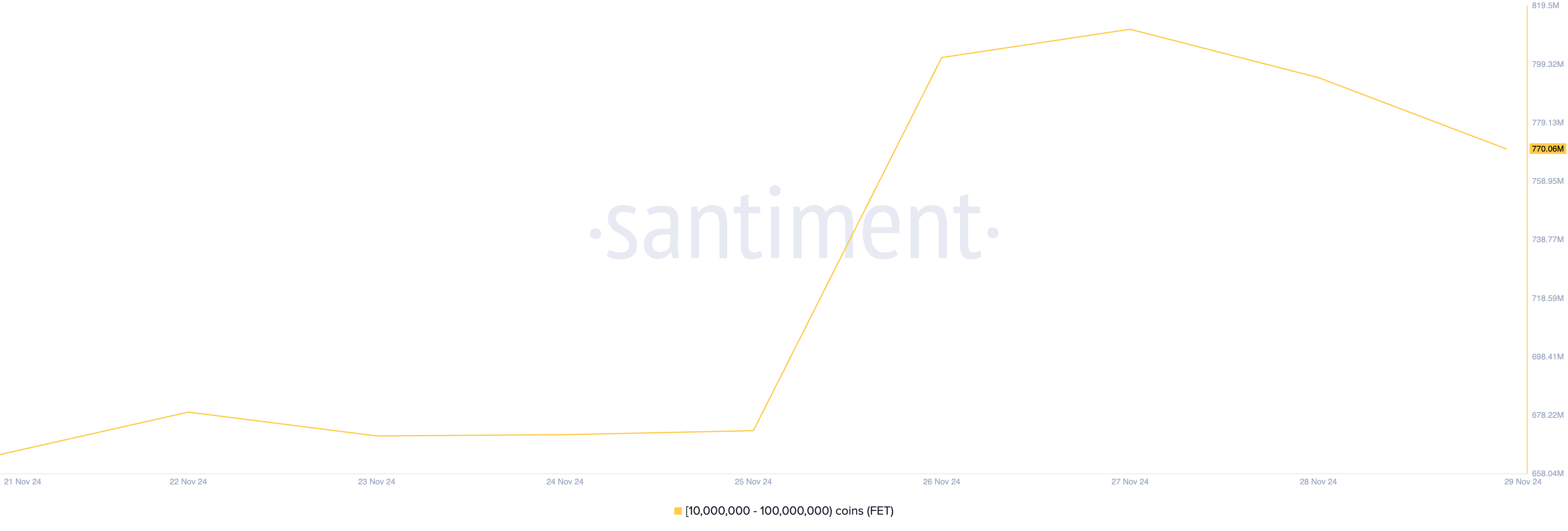

BeInCrypto’s analysis of FET’s on-chain performance has revealed a significant rise in whale accumulation over the past week. Data from Santiment reveals that, in the past seven days, whale addresses holding between 10 million and 100 million FET tokens have collectively purchased 106 million tokens valued at $174 million at current market prices.

When whales accumulate more coins, it signals confidence in the asset’s future value. This heightened demand often influences retail interest, which increases buying pressure and drives up the asset’s price.

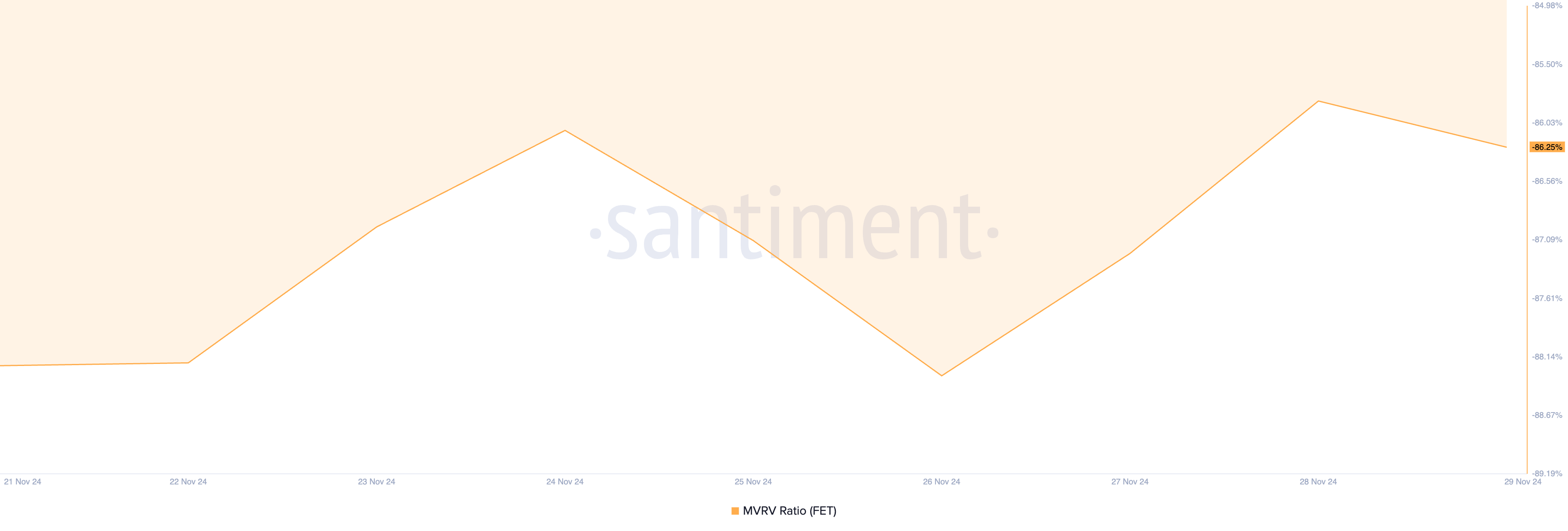

This surge in whale accumulation is largely attributed to FET’s undervalued status, as indicated by its negative market value to realized value (MVRV) ratio. Santiment reports that FET’s current MVRV ratio stands at -86.25%.

The MVRV ratio compares an asset’s market capitalization to the total value of coins purchased at their realized price, offering insights into whether the asset is overvalued or undervalued relative to its historical cost basis.

Historically, investors view negative MVRV ratios as a buying opportunity, recognizing that the asset trades below its historical acquisition cost and may rebound. This expectation of a rebound has led FET whales to increase their holdings in recent days.

FET Price Prediction: A Rally Above $2 Is Possible

On a daily chart, FET has traded within a horizontal channel since June. This channel is formed when an asset’s price fluctuates between parallel support and resistance levels, indicating a period of consolidation or range-bound trading. Since June, FET has faced resistance at $1.72 and has found support at $1.09.

At press time, FET trades at $1.63, attempting to break above the upper line of this channel. If successful, this will propel its price to trade at $2.09. Conversely, a failed attempt to breach resistance will send FET’s price toward support at $1.35.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoThe next Pepe with a potential for 1,000% gains

-

Market19 hours ago

Market19 hours agoThe Biggest Names in Blockchain in 2024 Revealed

-

Market24 hours ago

Market24 hours agoWill OORT Price Continue to Rise After CZ’s Post?

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum Eyes $3,900 – Key Resistance Break Could Spark A Surge

-

Market23 hours ago

Market23 hours agoRWA Altcoins to Watch This December

-

Altcoin23 hours ago

Altcoin23 hours agoEthereum SuperTrend Signal That Led To 120% Price Surge In 2023 Has Returned, Why ETH Could Reach $7,500

-

Market22 hours ago

Market22 hours agoLess Than 5% Away From Historic $100K

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is The Worldcoin Price Up 20% Today, Rally To Continue?