Market

Can ETH Price Reach New ATH?

In the past 30 days, Ethereum’s (ETH) price has surged by 33%, fueling speculation about the cryptocurrency’s potential to hit new highs. While it seems unlikely as this month draws to a close, analysts’ Ethereum December prediction could bring in more gains for holders.

BeInCrypto explores these forecasts, uncovering the key drivers behind the bullish sentiment surrounding ETH.

Analyst Bullish on Ethereum, but Give Conditions

According to Juan Pellicer, Senior Researcher at IntoTheBlock, Ethereum’s December prediction could see the cryptocurrency hit a new all-time high. However, in his opinion, Pellicer said that this would only come to pass if ETH could break through $4,000.

Besides that, the researcher mentioned that ETH could closely follow Bitcoin’s performance in this case, indicating that large holders’ accumulation and retail participation could be key to the potential.

“The outlook for Ethereum closely mirrors Bitcoin’s positive trajectory, with significant potential for an end-of-year rally that could gather even more momentum if it successfully breaks through the previous $4,000 ATH. Our on-chain analysis is looking at trends in accumulation by large holders, which would indicate spot buys from both institutional and retail investors,” Pellicer told BeInCrypto.

But as of this writing, Ethereum’s large holders’ netflow has decreased, suggesting that whales are no longer accumulating as much as they were some days back. If this continues, ETH’s price could find it challenging to reach $4,000 next month.

On the other hand, if these holders begin to accumulate again, this might change, and the Ethereum December prediction could end up being bullish.

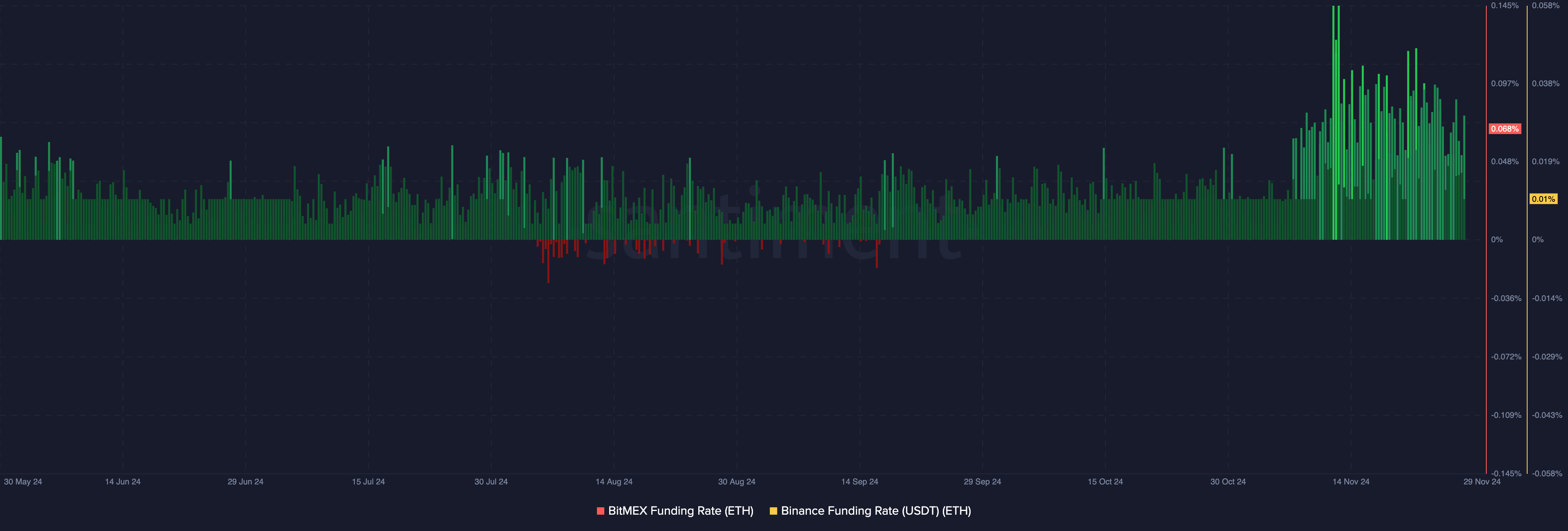

For Brian Quinlivan, Lead Analyst at Santiment, one key metric to monitor is Ethereum’s funding rate on BitMex and Binance. The funding rate shows if longs (buyers) are dominating shorts (sellers) in the derivatives market.

When it is positive, longs have the upper hand. But if it is negative, shorts do. As of this writing, the funding rates on both exchanges are highly positive. This indicates that longs are dominant, and most traders expect ETH’s price to increase in December.

However, Quinlivan believes the metric needs to stay relatively neutral so that Ethereum’s price can catch BTC.

“But with the longs dominating the shorts on these top exchanges, it means that a significant climb here would be overcoming a lot of odds. Historically, we need funding rates to stay neutral or even lean toward shorting in order to justify future major rises,” the analyst told BeInCrypto.

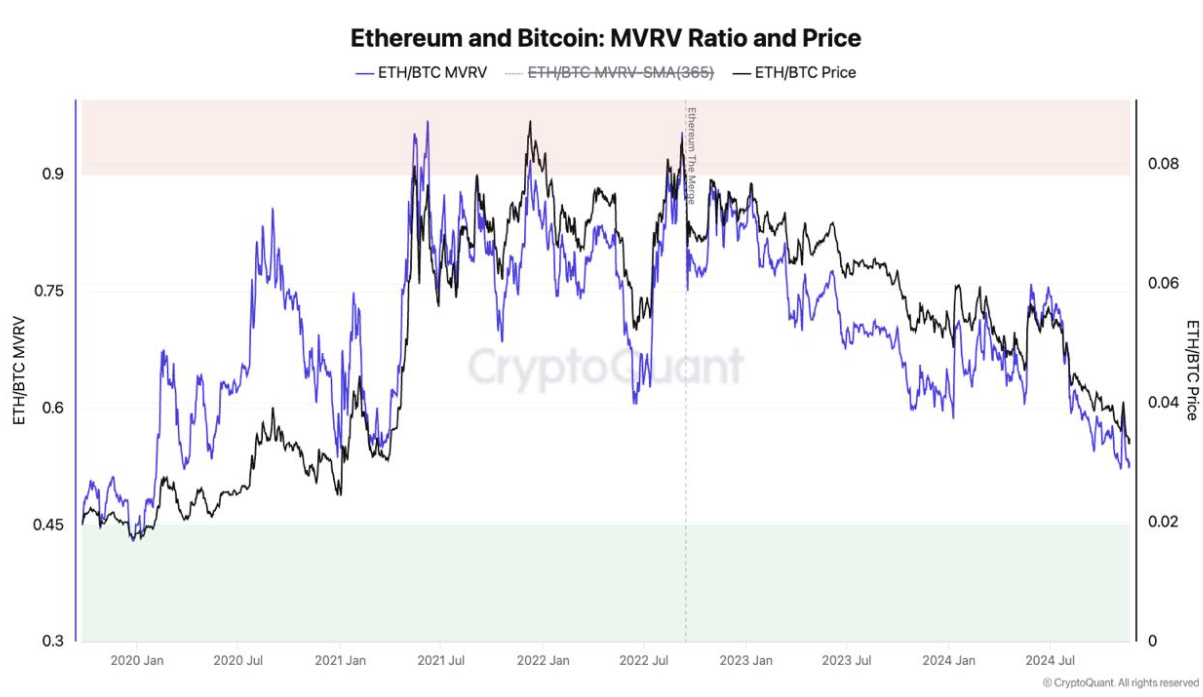

Another analyst who spoke to BeInCrypto about ETH’s potential next month is Julio Moreno, Head of Research at CryptoQuant. Using the Market Value to Realized Value (MVRV) ratio, Moreno says ETH is approaching an undervalued state relative to BTC.

The MVRV ratio is a key metric that shows if an asset is undervalued or overpriced.

Based on the image above and historical data, Moreno suggests that ETH may soon replicate its price action from February 2020, a period that marked the beginning of its rise to an all-time high in 2021.

“Currently, the relative valuation of ETH against Bitcoin (violet line in the chart) is approaching extreme undervalued territory (green area). The last time that ETH was this undervalued against Bitcoin was back in February 2020.” Moreno said in the conversation with BeInCrypto.

ETH Price Prediction: 4,000 or More on the Table

From a technical perspective, Ethereum has formed a bull flag on the daily chart. The bull flag pattern features a sharp rise, often referred to as the “flagpole,” followed by a tight, rectangular consolidation phase known as the “flag.”

This formation typically indicates an upcoming breakout, during which the price rests and gathers strength before making an upward move. As seen above, ETH’s price has broken out of the consolidation phase.

While it has faced resistance around $3,600, it is likely to bounce again. If this happens, Ethereum’s December prediction could see the value rise above $4,000. However, if the cryptocurrency faces selling pressure, the trend might change, and ETH could drop to $3,003.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why BTC Price May Touch $100,000 in December

Bitcoin (BTC) has faced a slight setback in its recent upward trajectory, struggling to rally to the highly anticipated $100,000 price mark. The cryptocurrency has been consolidating below this mark for the past few days, leaving investors speculating about its near-term price movement.

However, a number of prominent crypto analysts remain optimistic about Bitcoin’s prospects in December. This analysis explores some of their forecasts.

Bitcoin May Climb Above $100,000, Analysts Say

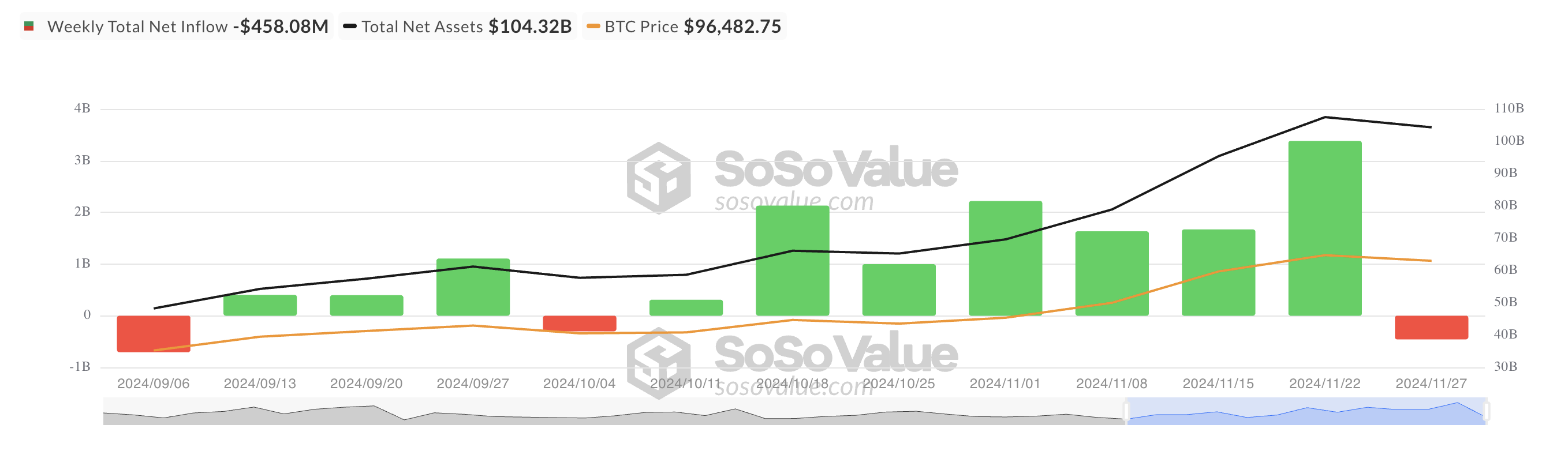

According to Juan Pellicer, a Senior Researcher at IntoTheBlock, December will be bullish for Bitcoin. This bullish bias will be propelled by “unprecedented institutional demand through Bitcoin ETF inflows,” which will drive the coin’s price above $100,000.

“We are observing a highly bullish scenario for Bitcoin as we approach December, primarily driven by unprecedented institutional demand through Bitcoin ETF inflows. This surge in institutional participation, coupled with a noticeable easing of macroeconomic pressures, positions BTC favorably for a $100K breakout. The current market structure suggests strong accumulation phases,” the analyst told BeInCrypto.

Interestingly, BTC ETFs have recorded net outflows this week for the first time in two months. According to SoSoValue, outflows from these funds have totaled $458 million. This decline comes on the heels of a significant drop in BTC’s price, which saw it trading as low as $92,000 earlier this week. This price pullback may have prompted institutional investors to pull funds from these ETFs in response to the market shift.

Nevertheless, another analyst, Brian Quinlivan, Lead Analyst at Santiment, has predicted a bullish December for Bitcoin. According to Quinlivan, Bitcoin whales will drive this growth if they continue to accumulate the king coin.

“Bitcoin’s key stakeholders (10+ BTC wallets) have accumulated 63,922 more BTC in November alone, worth $6.06B. Even with the top hitting on Friday, they haven’t slowed down their accumulation pace whatsoever. This should be considered a positive sign that this mild dip is simply a mini retracement designed to shake out weaker hands and traders who bought at $98K/$99K,” Quinlivan said.

BTC Price Prediction: This Support Floor Is Key

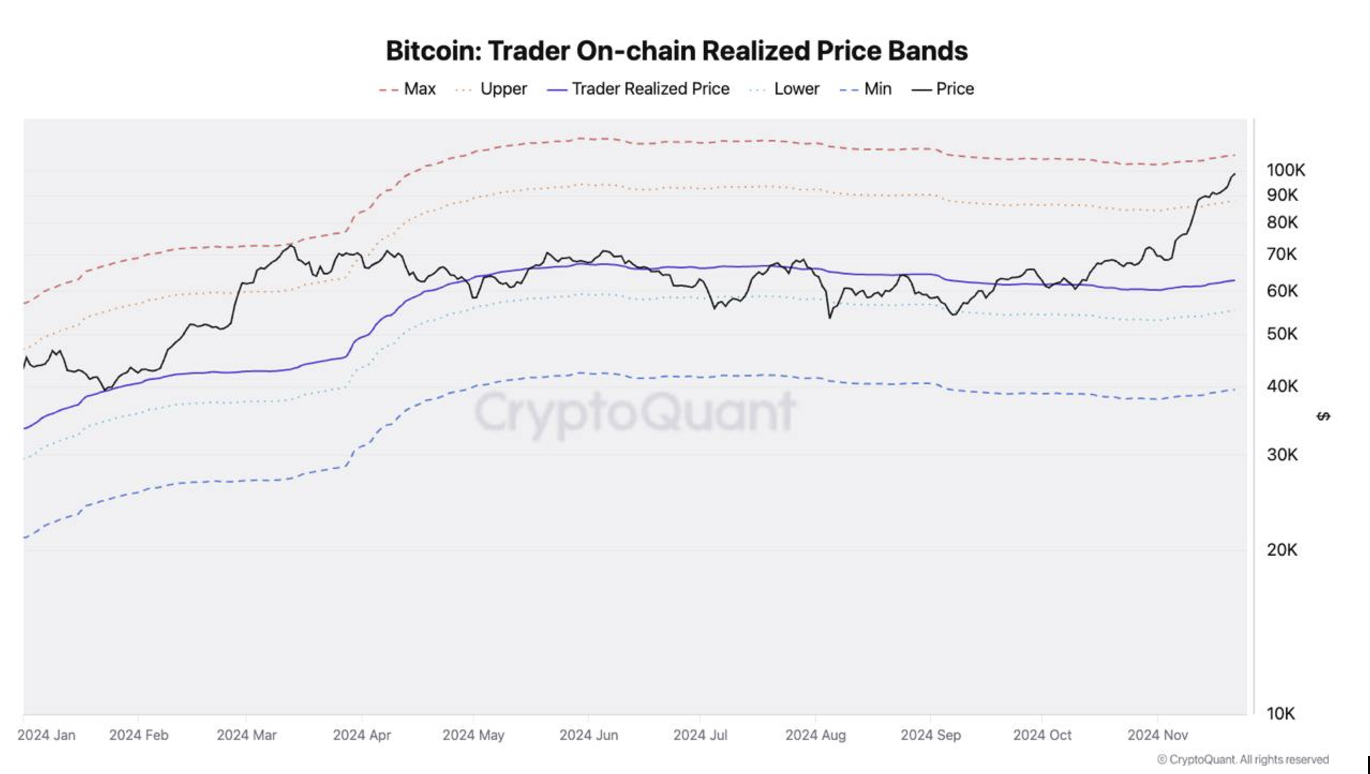

However, while also acquiescing that Bitcoin’s price may rally above $100,000 in December, Julio Moreno, Head of Research at CryptoQuant, noted that the coin may face a short-term resistance at $105,000.

According to Moreno, an assessment of BTC’s on-chain realized price bands revealed that the price band near $105,000 (max band) was a significant resistance level back in March when Bitcoin briefly reached $74,000. This historical resistance may now influence the coin’s future price action.

This means that once BTC’s price nears this max band around $105,000, it may witness a pullback.

Bitcoin currently trades at $96,795. For the $100,000 predictions to materialize, the coin has to reclaim its all-time high of $99,588, which has become a resistance level, and flip it into a support floor. If this happens, the coin may rally above $100,000 in December.

On the other hand, if selling pressure spikes, BTC’s price may decline toward $88,986, invalidating the analysts’ bullish projections.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What Are the Most Talked-About Altcoins Today, November 29?

For weeks, altcoins have hinted at a potential breakout, with signs they may soon outperform Bitcoin (BTC), which has dominated the market for most of the year. However, not all the most talked-about altcoins trending today have seen price gains in the last 24 hours.

While some have shown strong performance, others have lagged behind. According to CoinGecko, today’s top trending altcoins include Hyperliquid (HYPE), (VIRTUAL), and Vector Smart Gas (VSG).

Hyperliquid (HYPE)

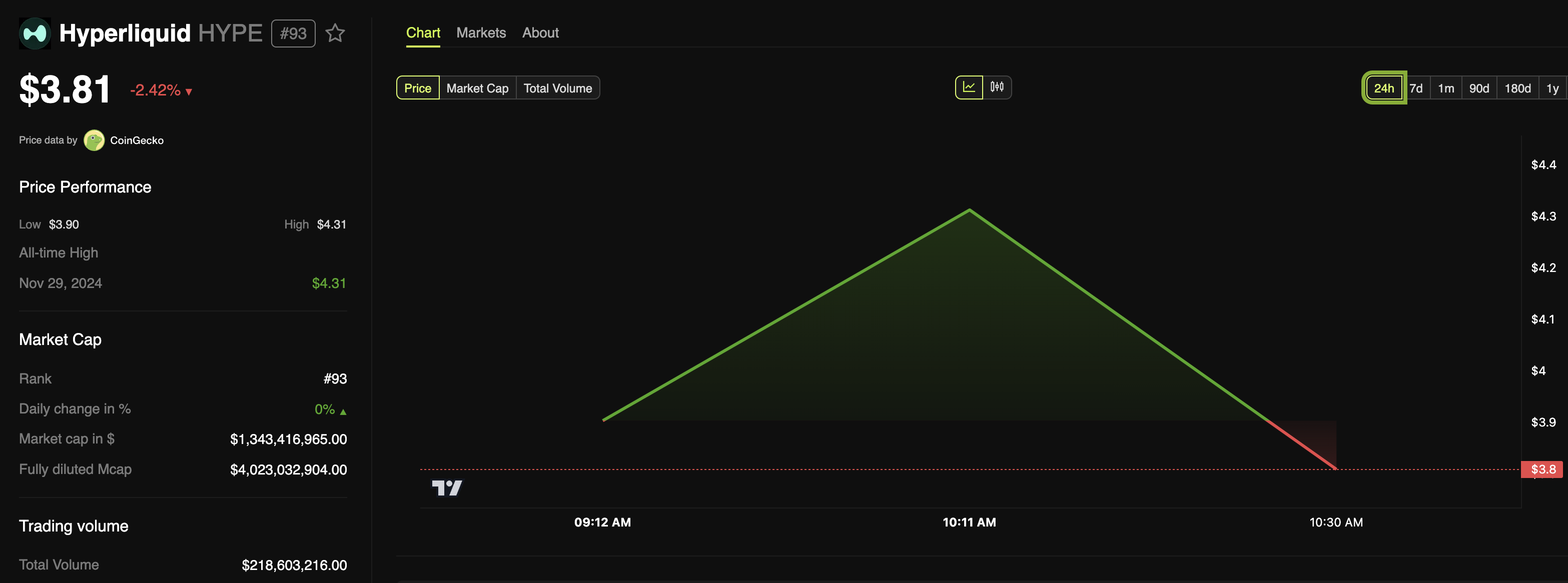

Hyperliquid is a Layer-1 blockchain that facilitates trading on its decentralized perpetual exchange and has a native token with the ticker “HYPE.” HYPE is one of the top altcoins trending today. Basically, it has its Token Generation Event (TGE) today and airdropped some tokens to its early users.

According to the project, the airdropped tokens represent 31% of its total supply, which equals 310 million tokens. At press time, HYPE’s price trades around $3.81 and has yet to be listed on any centralized exchange.

However, there is speculation that HYPE might soon be listed on tier-1 and tier-2 exchanges. If this happens, the trading volume might increase, and the price is likely to jump.

Virtuals Protocol (VIRTUAL)

Virtuals Protcol is a project operating on the Base network, focusing on Artificial Intelligence (AI) and the Metaverse narrative. VIRTUAL, its native cryptocurrency, is one of the most talked-about altcoins trending today because its price has increased by 50% in the last 24 hours.

This development is similar to the recent hike in the prices of Metaverse tokens, including The Sandbox (SAND) and Decentraland (MANA). As of this writing, VIRTUAL’s price is $1.36.

The daily chart shows that the Moving Average Convergence Divergence (MACD) reading has increased, indicating bullish momentum around the cryptocurrency. If this continues, the price could rally above $1.56.

On the other hand, if the hype around Metaverse tokens subsides and selling pressure increases, this might not happen. Instead, VIRTUAL’s value could drop to $0.52.

Vector Smart Gas (VSG)

Like Hyperliquid, Vector Smart Gas (VSG) is not listed on any centralized exchange. The token, which is built on Ethereum, was among the trending altcoins on November 27. Its appearance on the list again suggests that interest in the token is still present.

However, unlike the last time, VSG’s price did not increase but has seen a 13.50% decrease in the last 24 hours. This decline could be linked to rising selling pressure which the volume on the daily chart showed has increased.

Should this remain the case, then VSG’s price might drop from $0.0057 to $0.0037. However, if buying pressure increases, this might not be the case. In that scenario, the altcoin could bounce to $0.0071.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

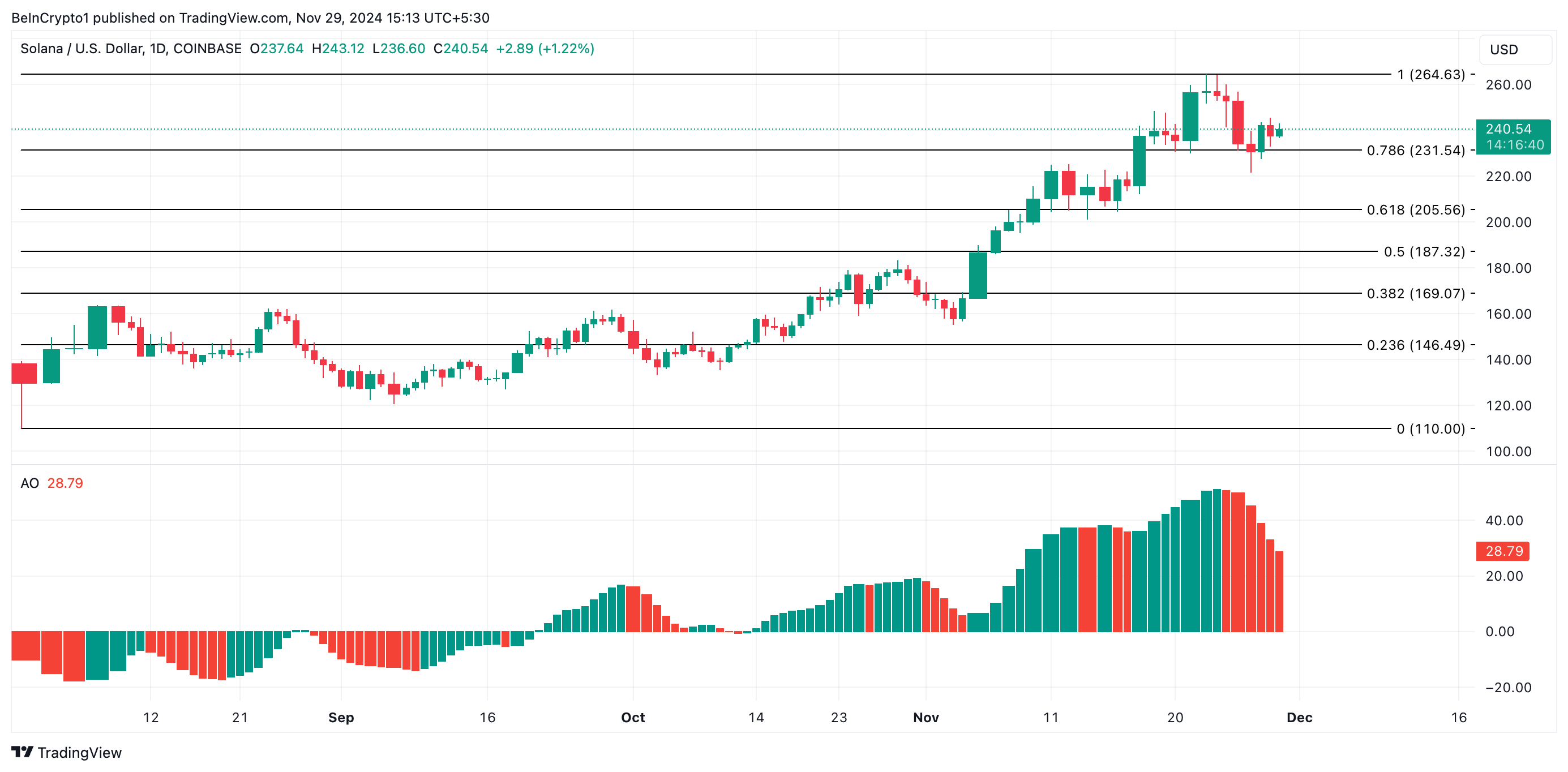

Solana’s Price Drop Triggers $64 Million in Long Liquidations

Solana (SOL) has been in a downward spiral over the past week. Since reaching a new all-time high of $264.63 on November 22, SOL has encountered a surge in selling pressure. This has caused its price to drop by almost 10% in the past seven days.

This decline has led to an uptick in long liquidations in the SOL futures market. With strengthening bearish sentiments, Solana long traders may face more losses. Here is why.

Solana’s Market Activity Faces Decline

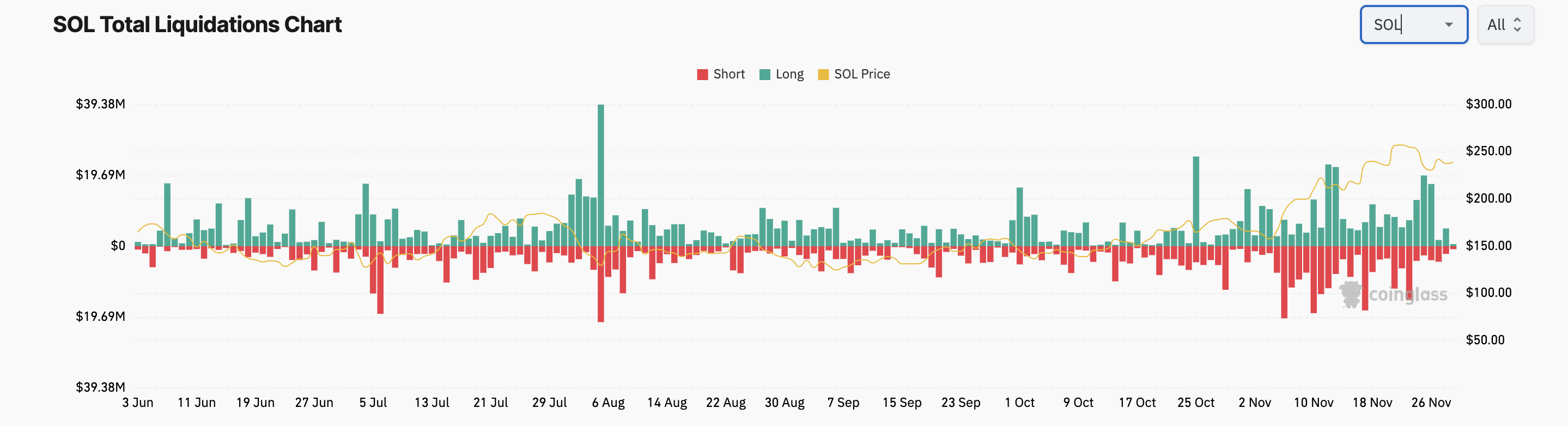

Over the past week, SOL’s 8% price drop has wiped out $64 million in long positions from its derivatives market.

Long liquidations occur when traders who have opened positions in favor of a price rally are forced to sell the asset at a lower price to cover their losses as the price falls. This happens when the asset’s price decreases beyond a certain level, forcing traders with long bets to exit the market.

This is a bearish signal for SOL because as Solana long traders attempt to avoid further losses to their investments, their selling pressure can increase and contribute to further downward movement in the market.

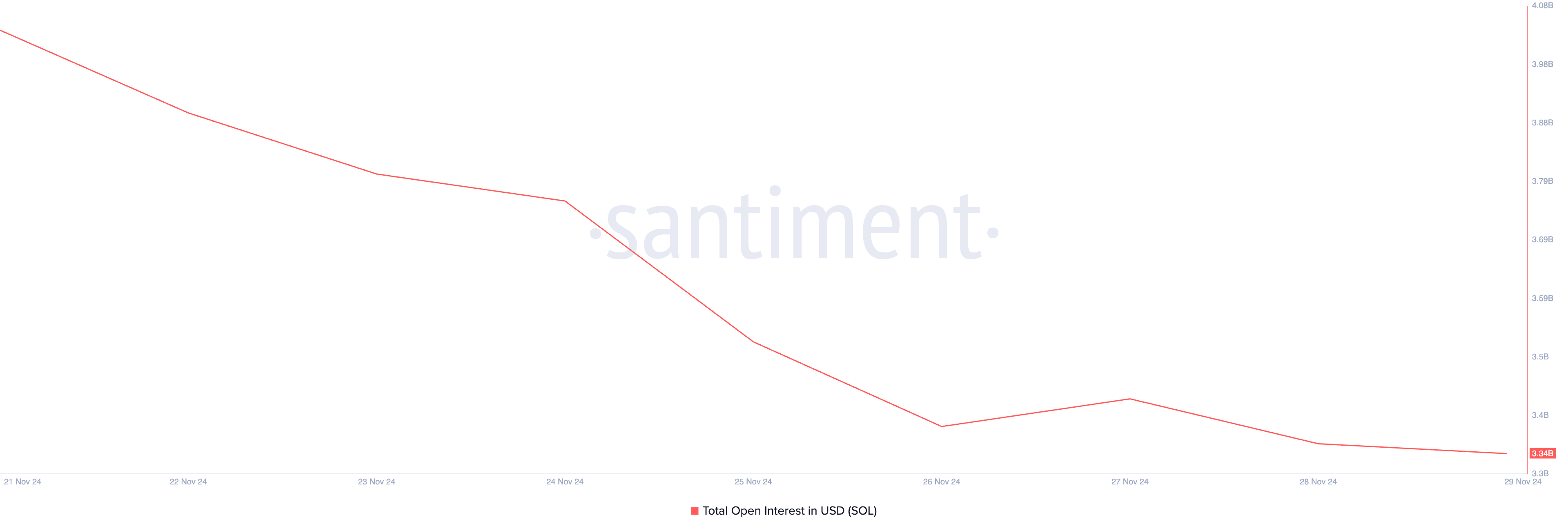

Notably, the decline in SOL’s price has led to a significant drop in activity in its derivatives market. This is reflected in the coin’s open interest, which currently rests at a weekly low of $3.34 billion.

Open interest refers to the total number of outstanding contracts (futures or options) that have not been settled or closed. When open interest drops during a price decline, traders are closing their positions. This indicates reduced market participation and a lack of conviction in the asset’s positive price movement.

SOL Price Prediction: Bears Dominate the Market

Solana’s Awesome Oscillator confirms the uptick in bearish bias toward the coin. As SOL’s price records a decline over the past week, the indicator has returned red histogram bars.

The Awesome Oscillator identifies an asset’s price trends and potential reversal points. When it returns red bars, it indicates that the shorter-term momentum is weaker than the longer-term momentum, suggesting a possible bearish trend or a decline in bullish momentum.

If selling activity gains more momentum, SOL’s price will break below the crucial support level, formed at $231.54. A dip below this price point will send SOL’s price downward to $205.56.

On the other hand, if buying pressure gains momentum, SOL’s price will climb toward its all-time high of $264.63.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoThe next Pepe with a potential for 1,000% gains

-

Market22 hours ago

Market22 hours agoHidden Altcoins Gems For December

-

Market15 hours ago

Market15 hours agoThe Biggest Names in Blockchain in 2024 Revealed

-

Market23 hours ago

Market23 hours agoCan Shiba Inu Coin Holders Push SHIB Price Higher?

-

Altcoin23 hours ago

Altcoin23 hours agoIs Altcoin Season Here? Analysts Share Key Insights

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Price On The Verge Of Repeating 2017-2021 Cycle Breakout, Target Above $20,000

-

Market21 hours ago

Market21 hours ago$1.7 Million Stolen, User Withdrawals Suspended

-

Altcoin21 hours ago

Altcoin21 hours agoHow High Can Shiba Inu Price Climb If Bitcoin Hits $100,000?