Market

Warren, Gensler Tried to ‘Unlawfully Kill’ Crypto

Coinbase CEO Brian Armstrong and technology billionaire Elon Musk have accused prominent political figures, including Senator Elizabeth Warren and SEC Chair Gary Gensler, of orchestrating a “mass debanking” campaign targeting the technology and cryptocurrency sectors during the Biden administration.

Their remarks follow revelations about secretive actions that allegedly resulted in the closure of bank accounts for dozens of tech entrepreneurs without notice or recourse.

Crypto Leaders Strong Rebuke of the Biden Administration

In a post on X (formerly Twitter), Armstrong labeled the debanking incidents as “unethical and un-American.” He pointed fingers at Warren and Gensler, accusing them of attempting to “unlawfully kill” the cryptocurrency industry.

Brian Armstrong argued that such actions contributed to the Democratic Party’s loss in the recent election. The Coinbase executive cautions the party to distance itself from Warren if it seeks political recovery.

He also revealed that Coinbase is using Freedom of Information Act (FOIA) requests to uncover the full scope of the issue, raising questions about potential legal violations.

“We’re still collecting documents via FOIA requests, so hopefully the full story emerges of who was involved and whether they broke any laws. Warren and Gensler tried to unlawfully kill our entire industry, and it was a major factor in the Dems losing the election,” Armstrong stated.

Armstrong’s remarks amplified a controversy shared by Elon Musk, who was known for his advocacy of free speech and innovation. The SpaceX CEO referenced a Joe Rogan interview with Marc Andreessen, co-founder of Andreessen Horowitz.

“Did you know that 30 tech founders were secretly debanked?” Musk remarked.

In the interview, Andreessen alleged that 30 tech founders were “secretly debanked,” describing it as an exercise of “silent government power.” This raises attention to the lack of transparency and warns of broader implications for freedom and innovation.

Custodia Bank’s Caitlin Long Joins the Criticism

Caitlin Long, founder and CEO of Custodia Bank, also weighed in, sharing her personal experience with repeated debanking. Custodia, a pro-crypto bank, has faced regulatory hurdles, culminating in layoffs attributed to the Federal Reserve’s delays in granting the institution a master account. Long’s ongoing lawsuit against the Fed seeks to address these challenges, with oral arguments scheduled for January 21, 2025.

“Yes—debanked repeatedly, in my company’s case (Custodia Bank). Keep an eye on our pending lawsuit against the Fed. Oral argument is scheduled for Jan 21 (the day after Inauguration Day),” Long commented.

The allegations come amid broader concerns over regulatory overreach in the crypto space. Warren and Gensler have been vocal critics of the industry, and the SEC, under Gensler’s leadership, has pursued multiple enforcement actions against crypto firms. Critics argue these measures stifle innovation and disproportionately target emerging technologies.

Custodia Bank’s struggles, among others like Consensys, reflect the challenges facing crypto-friendly financial institutions. The fallout from these allegations could reshape the relationship between the tech sector and US policymakers.

Brian Armstrong’s assertion that these actions contributed to the Democrats’ electoral losses highlights the political risk of alienating the tech and crypto communities. Additionally, Long’s lawsuit could set a precedent for how courts address claims of regulatory overreach.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Experts Raise Red Flags Over Finances

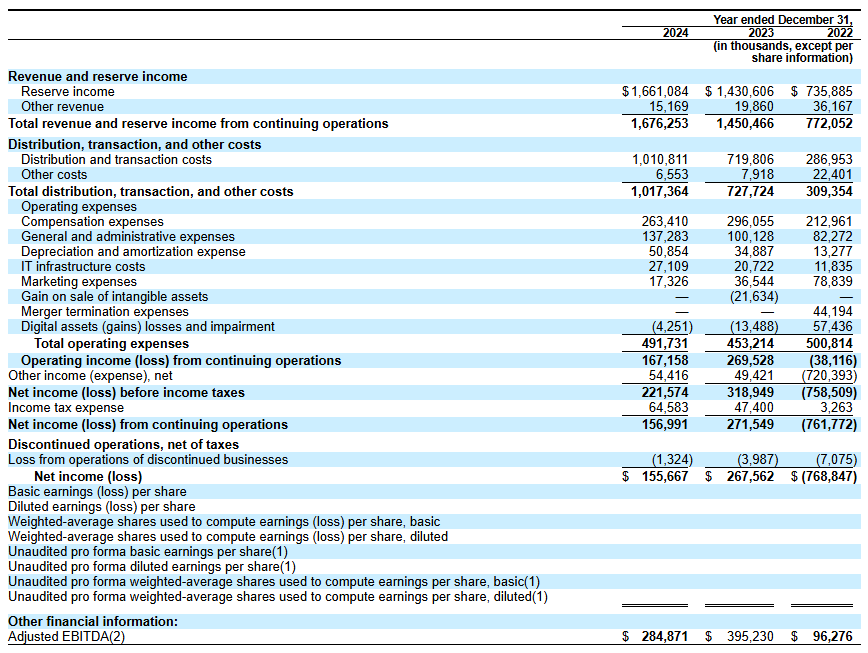

Circle’s initial public offering (IPO) filing has raised concerns among industry experts, who are sounding alarms over the company’s financial health, distribution costs, and valuation.

While the move marks a significant step toward mainstream financial integration, experts’ skepticism casts doubt on the company’s long-term prospects.

Analysts Highlight Red Flags With Circle IPO

On April 1, BeInCrypto reported that Circle had filed for an IPO. The company plans to list its Class A common stock on the New York Stock Exchange (NYSE) under “CRCL.”

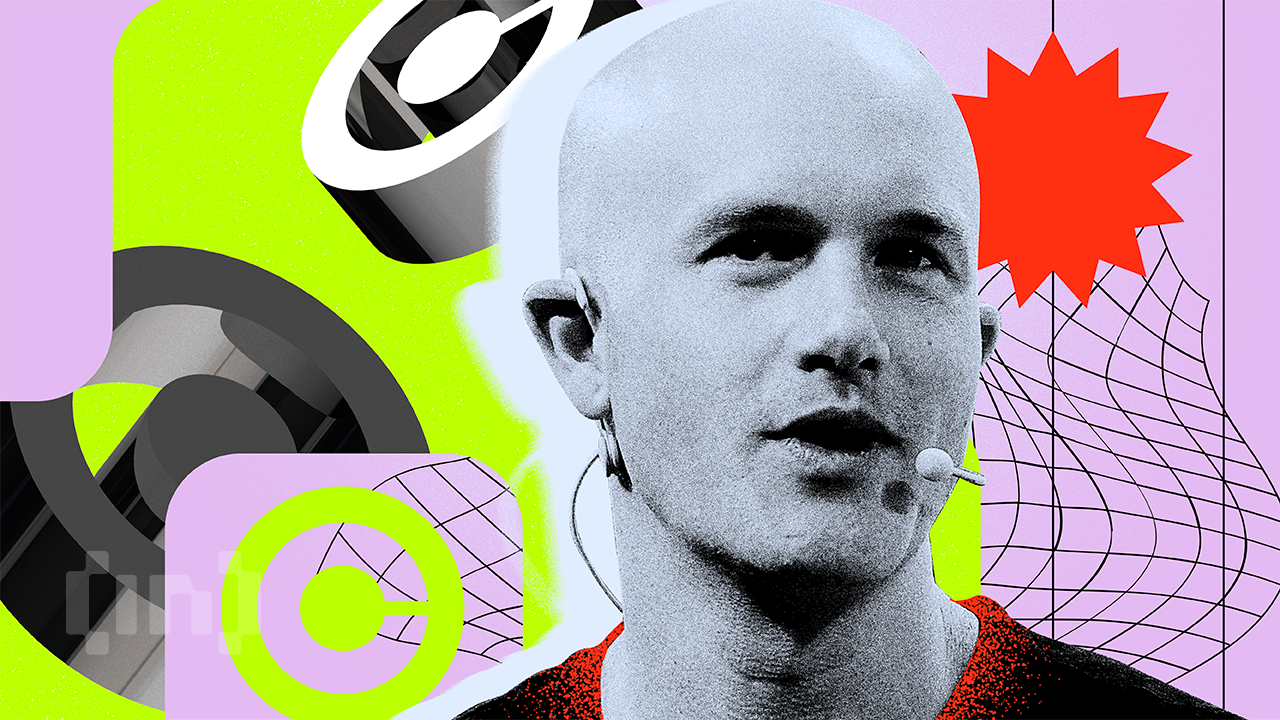

Circle’s IPO filing reveals revenue of $1.67 billion in 2024, a notable increase from previous years. However, a closer examination of the company’s financials has uncovered some challenges.

Matthew Sigel, Head of Digital Assets Research at VanEck, noted that revenue increased 16% year over year. Yet, at the same time, the company reported a 29% decrease in EBITDA year over year, indicating a decline in operational profitability. Additionally, net income fell by 42%, reflecting a significant drop in overall profitability.

Sigel pointed out four factors contributing to the decline in these financial metrics. He explained that the company’s rapid expansion and new service integrations negatively impacted net income.

Furthermore, the discontinuation of services like Circle Yield reduced other revenue streams. This, in turn, exacerbated the decline in profitability.

“Costs related to restructuring, legal settlements, and acquisition-related expenses also played a role in the decline in EBITDA and net income, despite overall revenue growth,” Sigel added.

Importantly, he focused on Circle’s increased distribution and transaction costs. Sigel revealed that the cost rose due to higher fees paid to partners like Coinbase and Binance.

A related post by Farside Investors on X (formerly Twitter) shed further light on these expenses.

“In 2024, the company spent over $1 billion on “distribution and transaction costs,” probably much higher than Tether as a % of revenue,” the post read.

This prompts speculation that Circle may be overspending to maintain its market share in the competitive stablecoin sector. The company’s historical performance further fuels skepticism.

Farside Investors added that in 2022, Circle recorded a staggering $720 million loss. Notably, the year was marked by significant turmoil in the crypto industry, including the high-profile collapses of FTX and Three Arrows Capital (3AC).

This suggests that Circle may be vulnerable to market shocks. Thus, it calls into question the company’s risk management capabilities—especially in the inherently volatile crypto market.

“The gross creation and redemption numbers are a lot higher than we would have thought for USDC. Gross creations in a year are many multiples higher than the outstanding balance,” Farside Investors remarked.

In addition, analyst Omar expressed doubts about Circle’s $5 billion valuation.

“Nothing to love in the Circle IPO filing and no idea how it prices at $5 billion,” he questioned.

He drew attention to several concerns, including the company’s gross margins being severely impacted by high distribution costs. The analyst also pointed out that the deregulation of the US market is poised to disrupt Circle’s position.

Additionally, Omar stressed that Circle spends over $250 million annually on compensation and another $140 million on general and administrative costs, raising questions about its financial efficiency. He also noted that interest rates—core income drivers for Circle—will likely decline, presenting additional challenges.

“32x ’24 earnings for a business that just lost its mini-monopoly and facing several headwinds is expensive when growth structurally challenged,” Omar said.

Ultimately, the analyst concluded that the IPO filing was a desperate attempt to secure liquidity before facing serious market difficulties.

Meanwhile, Wyatt Lonergan, General Partner at VanEck, shared his predictions for Circle’s IPO, outlining four potential scenarios. In the base case, he forecasted that Circle would capitalize on the stablecoin narrative and secure key partnerships to drive growth.

In a bear case, Lonergan speculated that poor market conditions might lead to a Coinbase buyout.

“Circle IPOs, the market continues to tank, Circle stock goes with it. Poor business fundamentals cited. Coinbase swoops in to buy at a discount to the IPO price. USDC is all theirs at long last. Coinbase acquires Circle for something close to the IPO price, and they never go public,” Lonergan claimed.

Lastly, he outlined a probable scenario where Ripple bids up Circle’s valuation to a staggering $15 to $20 billion and acquires the company.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Approaches Resistance—Will It Smash Through?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave above the $1,850 level. ETH is now consolidating and facing key hurdles near the $1,920 level.

- Ethereum started a recovery wave above $1,820 and $1,850 levels.

- The price is trading above $1,860 and the 100-hourly Simple Moving Average.

- There is a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,900 and $1,920 resistance levels to start a decent increase.

Ethereum Price Starts Recovery

Ethereum price managed to stay above the $1,750 support zone and started a recovery wave, like Bitcoin. ETH was able to climb above the $1,820 and $1,850 resistance levels.

The bulls even pushed the price above the $1,880 resistance zone. There was a move above the 50% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low. However, the bears are active near the $1,920 zone.

Ethereum price is now trading above $1,850 and the 100-hourly Simple Moving Average. There is also a connecting bullish trend line forming with support at $1,860 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,900 level. The next key resistance is near the $1,920 level and the 61.8% Fib retracement level of the downward wave from the $2,032 swing high to the $1,767 low.

The first major resistance is near the $1,970 level. A clear move above the $1,970 resistance might send the price toward the $2,020 resistance. An upside break above the $2,020 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,050 resistance zone or even $2,120 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,920 resistance, it could start another decline. Initial support on the downside is near the $1,860 level and the trend line. The first major support sits near the $1,845 zone.

A clear move below the $1,845 support might push the price toward the $1,800 support. Any more losses might send the price toward the $1,765 support level in the near term. The next key support sits at $1,710.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,860

Major Resistance Level – $1,920

Market

Bitcoin Price Bounces Back—Can It Finally Break Resistance?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $83,500 zone. BTC is now consolidating and might struggle to settle above the $85,500 zone.

- Bitcoin started a decent recovery wave above the $83,500 zone.

- The price is trading above $83,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $84,500 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it stays above the $83,500 zone.

Bitcoin Price Starts Recovery

Bitcoin price managed to stay above the $82,000 support zone. BTC formed a base and recently started a decent recovery wave above the $82,500 resistance zone.

The bulls were able to push the price above the $83,500 and $84,200 resistance levels. The price even climbed above the $85,000 resistance. A high was formed at $85,487 and the price is now consolidating gains above the 23.6% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

Bitcoin price is now trading above $83,500 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $84,550 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $85,200 level. The first key resistance is near the $85,500 level. The next key resistance could be $85,850. A close above the $85,850 resistance might send the price further higher. In the stated case, the price could rise and test the $86,650 resistance level. Any more gains might send the price toward the $88,000 level or even $88,500.

Another Decline In BTC?

If Bitcoin fails to rise above the $85,500 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $84,500 level and the trend line. The first major support is near the $83,500 level and the 50% Fib retracement level of the upward move from the $81,320 swing low to the $85,487 high.

The next support is now near the $82,850 zone. Any more losses might send the price toward the $82,000 support in the near term. The main support sits at $80,500.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $84,500, followed by $83,500.

Major Resistance Levels – $85,200 and $85,500.

-

Ethereum24 hours ago

Ethereum24 hours ago$2,300 Emerges As The Most Crucial Resistance

-

Bitcoin18 hours ago

Bitcoin18 hours ago$500 Trillion Bitcoin? Saylor’s Bold Prediction Shakes the Market!

-

Market23 hours ago

Market23 hours agoCFTC’s Crypto Market Overhaul Under New Chair Brian Quintenz

-

Altcoin23 hours ago

Altcoin23 hours agoA Make or Break Situation As Ripple Crypto Flirts Around $2

-

Market20 hours ago

Market20 hours agoBitcoin Price Battles Key Hurdles—Is a Breakout Still Possible?

-

Bitcoin19 hours ago

Bitcoin19 hours agoBig Bitcoin Buy Coming? Saylor Drops a Hint as Strategy Shifts

-

Altcoin16 hours ago

Altcoin16 hours agoWill XRP, SOL, ADA Make the List?

-

Market22 hours ago

Market22 hours agoXRP Bulls Fight Back—Is a Major Move Coming?