Market

US Bitcoin Spot ETFs Achieve All-Time High Inflows of $6.2 Billion

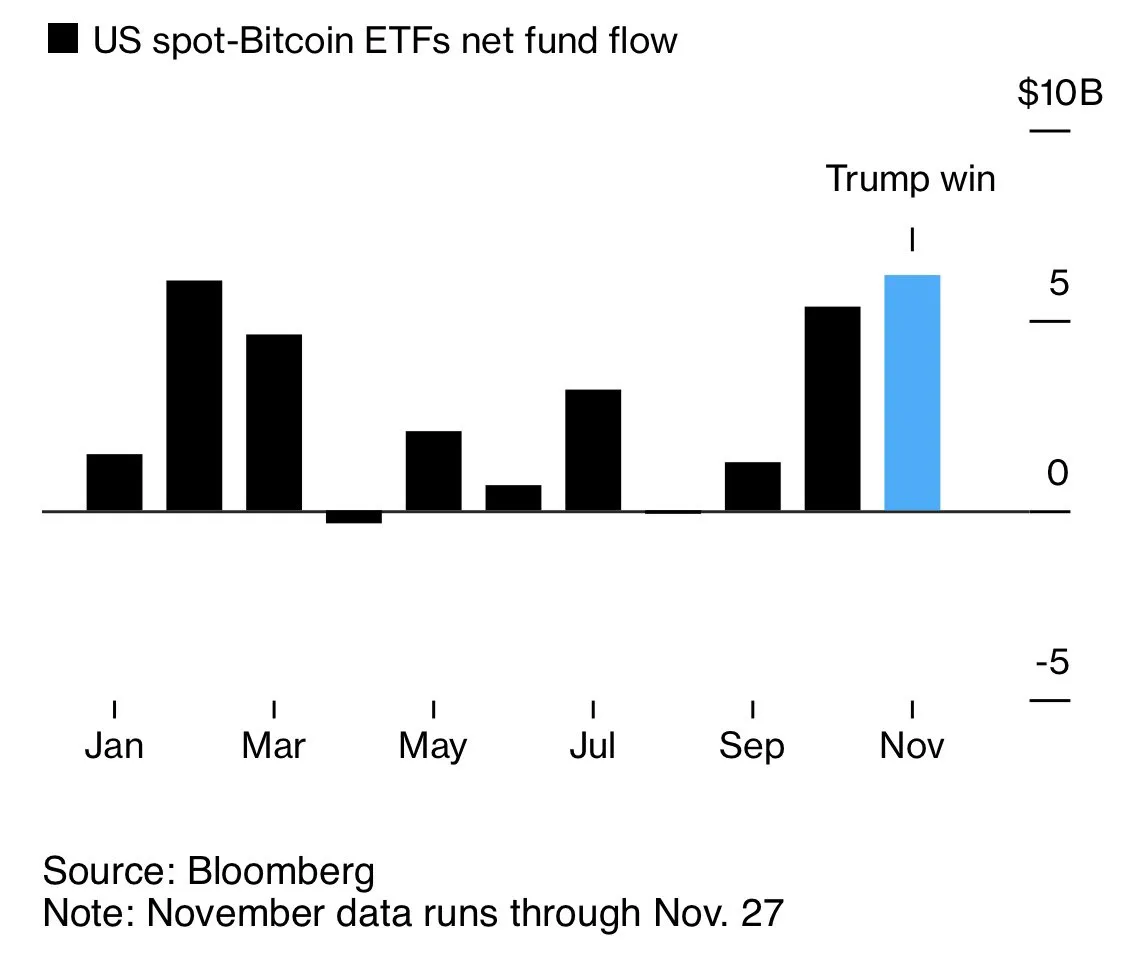

Bitcoin spot ETFs (exchange-traded funds) witnessed a landmark month in November, with net inflows surging to an unprecedented $6.2 billion. This financial instrument, which offers institutional investors indirect access to Bitcoin (BTC), broke the previous record set earlier this year.

The optimism driving this influx coincides with President-elect Donald Trump’s pro-crypto agenda, which has spurred investor confidence in digital assets and related financial products.

Political Winds Boost Bitcoin ETFs Past Key Milestones In November

Following the landmark approval of spot Bitcoin ETFs in January, the financial instruments have recorded a net $6.2 billion in combined netflows in November, according to data compiled by Bloomberg. With this, the US Bitcoin spot ETFs have breached the February peak of $6 Billion.

“Spot BTC ETFs set to break monthly inflow record… $6.2 billion so far in November. The previous high was $6 billion in February,” said Nate Geraci, president of The ETF Store.

Donald Trump’s electoral victory has been a critical catalyst for the record-breaking inflows. His administration has promised a favorable regulatory environment for cryptocurrencies, including reversing restrictive policies enacted during the Biden era.

The announcement of plans to establish a strategic Bitcoin reserve and appoint crypto-friendly regulators has further bolstered market sentiment. These drove Bitcoin close to the $100,000 threshold.

This optimism extends to spot Bitcoin ETFs, which saw their largest single-day inflow of $1.38 billion immediately following the election. BlackRock, a leader in the space, recorded over $1 billion in a single day, reflecting the significant interest from institutional investors seeking exposure to Bitcoin through regulated avenues.

Beyond record inflows, Bitcoin ETFs have also witnessed rapid accumulation of holdings, approaching 1 million BTC collectively. Analysts project that by year-end, these ETFs could surpass the estimated holdings of Bitcoin’s creator, Satoshi Nakamoto. Such a milestone would solidify their dominance in the market.

BlackRock’s iShares Bitcoin Trust (IBIT) stood out with its record-breaking volumes, recently surpassing gold-based ETFs in market traction. This shift signals a growing preference for digital assets among traditional investors. Other ETFs, such as those from Fidelity and Bitwise, have also experienced notable inflows, further expanding Bitcoin’s reach in mainstream finance.

Trump’s Policies Pave Way for ETF Expansion

Trump’s administration is expected to unlock further opportunities for crypto-based financial products. Already, crypto markets have seen options trading for Bitcoin ETFs. Recent approvals by the Options Clearing Corporation (OCC) have paved the way for the launch of options trading for Bitcoin ETFs. These developments provided investors with an additional tool to hedge and speculate on Bitcoin price movements.

Matt Hougan, Chief Investment Officer at Bitwise, described the developments in the space as potential game-changers. Specifically, they would allow institutional investors to enter the crypto space with greater confidence. This trend aligns with the broader institutional adoption of Bitcoin as a strategic asset amid favorable regulatory signals.

“A pro-crypto regulatory environment will provide air cover for institutional investors who have long wanted to allocate to the space. It’s a game-changer,” Hougan posted on X.

With ETFs playing a pivotal role in Bitcoin’s adoption, their continued growth could sustain BTC’s upward trajectory. Predictions suggest Bitcoin could reach new all-time highs, with some models targeting $117,000 if the current momentum persists. At the time of writing, BTC is trading for $96,390, a modest 0.64% gain since Friday’s session opened.

Meanwhile, the record inflows into US Bitcoin spot ETFs in November reflect a convergence of political and regulatory events with investor sentiment. Trump’s pro-crypto stance has reignited enthusiasm among investors, driving both price and adoption milestones.

As these ETFs grow in significance, they are reshaping the playing field of Bitcoin investing, positioning the pioneer crypto for broader acceptance in the financial system.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Reclaims Top DeFi Spot As Solana DEX Volume Drops

Ethereum (ETH) has regained its position as the leading blockchain for decentralized exchange (DEX) trading volume.

On this metric, Ethereum has effectively surpassed Solana (SOL) for the first time since September 2024.

Ethereum Surpasses Solana in DEX Trading Volume

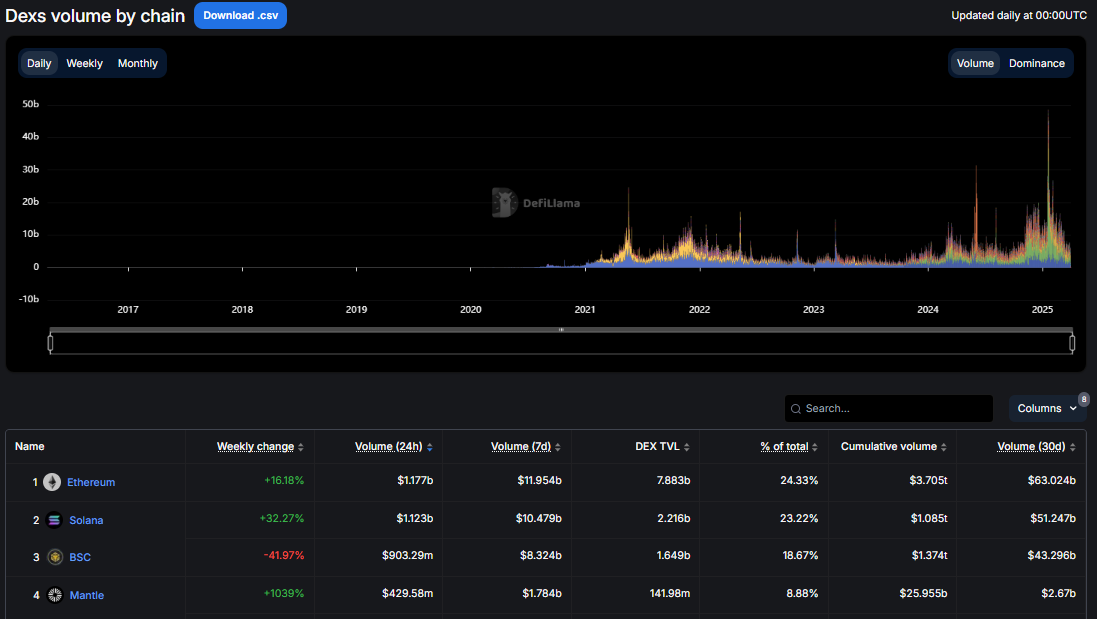

According to data from DefiLlama, Ethereum-based DEXs recorded approximately $63 billion in trading volume throughout March 2025. This traction saw Ethereum overtake Solana’s $51 billion during the same period.

The shift marks a significant moment in the ongoing competition between Ethereum and Solana in the decentralized finance (DeFi) ecosystem.

Solana had dominated the DEX space for months, bolstered by its low fees and high transaction throughput. Franklin Templeton noticed the trend and predicted Solana’s DeFi surge could rival Ethereum’s valuation.

“Solana DeFi valuation multiples trade on average lower than their Ethereum counterparts despite significantly higher growth profiles. This highlights an apparent valuation asymmetry between the two ecosystems,” read an excerpt in Franklin Templeton’s report.

However, recent declines in trading volume on key Solana-based platforms suggest a changing market dynamic. The drop in Solana’s DEX trading volume is closely tied to decreased activity on major platforms like Raydium (RAY) and Pump.fun.

Pump.fun, in particular, has seen a sharp decline in trading volume since the beginning of the year. Monthly volumes fell from a January peak of $7.75 billion to just $2.53 billion in March, representing a 67% drop.

Data on Dune shows that this downturn aligns with a slowdown in the platform’s token graduation rate, which has fallen from 0.8% to 0.65% per week.

The graduation rate reflects the percentage of new tokens reaching the $100,000 market capitalization threshold required to migrate from Pump.fun to the Raydium platform.

A lower graduation rate suggests fewer tokens are reaching this threshold, which is reducing overall trading activity on Solana’s DEX ecosystem.

Ethereum’s Strength in the DEX Market

While Solana’s DEX activity has faltered, Ethereum’s trading volume has remained resilient. This is likely bolstered by the strong performance of platforms like Uniswap (UNI) and Curve Finance (CRV).

In March, Uniswap alone facilitated over $30 billion in trading volume, significantly contributing to Ethereum’s overall market dominance.

Ethereum’s ability to reclaim the top spot is also attributed to its established infrastructure and network effects. Despite higher gas fees than Solana, Ethereum continues attracting high-value trades, institutional interest, and liquidity. These reinforce its position as the primary blockchain for DeFi activity.

Against this backdrop, industry analysts believe that while Solana is very competitive, it still has a long way to go before it can dethrone Ethereum.

Meanwhile, others say Ethereum’s resurgence may extend into the second quarter (Q2), driven by upcoming network upgrades and broader market trends.

“On-chain developments offer some hope for ETH…With Pectra now successfully deployed on the Holesky testnet and a mainnet upgrade expected in Q2, could we see a reversal of the downward ETH/BTC trend in the coming quarter?” analysts at QCP Capital noted.

The Pectra upgrade, once implemented on the Ethereum mainnet, is expected to improve scalability and efficiency, potentially boosting user adoption and trading activity.

Adding to the positive momentum, spot Ethereum ETFs (exchange-traded funds) saw net inflows on Monday, contrasting with net outflows from Bitcoin ETFs. This trend suggests growing investor confidence in Ethereum’s market position.

This shift in ETF flows could indicate a broader reallocation of capital within the crypto market, particularly as Ethereum strengthens its DeFi ecosystem and prepares for key upgrades.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Stock Plunges 30% in Worst Quarter Since FTX Collapse

Coinbase, the largest US crypto exchange, has recorded its worst quarter since the dramatic collapse of FTX in late 2022.

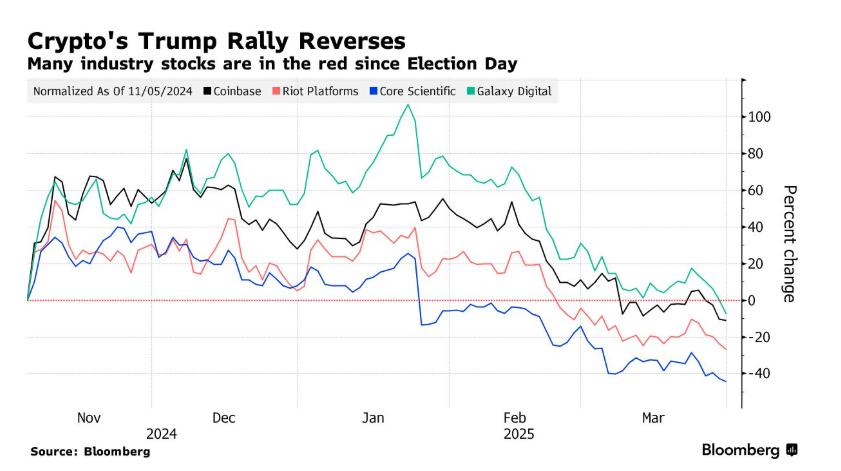

Coinbase’s stock (COIN) plummeted by 30% in Q1 2025, mirroring the steep losses seen across the broader crypto market.

Crypto Stocks and Assets Bleed Red in Q1

According to Bloomberg, the sharp decline has hit several other major crypto-related stocks as well. This includes Galaxy Digital, Riot Blockchain, and Core Scientific, all of which have experienced significant downturns.

Furthermore, the broader crypto market is facing tough times. Bitcoin, which has long been considered the bellwether of digital assets, has dropped by 10% this quarter. More dramatically, Ethereum (ETH) has seen a staggering 45% decline. These losses reflect a broader downturn in the crypto market, fueled by several macroeconomic factors.

Analysts point to the global uncertainty surrounding the US economy, including concerns over Trump’s tariffs and recession fears. This has resulted in a general “risk-off” mood among investors.

“In a risk-off mood, no asset is safe stocks, crypto, all get hit. It’s more about sentiment than fundamentals in those moments,” an investor commented on X.

While some point to these macroeconomic pressures as the primary cause, others argue that the market’s underperformance is more due to lingering fears of trade wars and broader geopolitical instability.

“Trump’s trade wars are driving markets into a panic. As much as he is doing for crypto, the macro market conditions are speaking louder – as bullish as the news is from the white house – His trash trade war is squelching any price surge,” another X user remarked.

Coinbase has been hit especially hard in this downturn. Coinbase’s revenue model is heavily reliant on altcoins and transaction volumes beyond Bitcoin. Hence, the overall market drop could have made a mark on the exchange’s stock prices. Moreover, the news comes as Coinbase users have collectively lost more than $46 million to scams in March.

While crypto has been in a freefall, other assets have fared much better. Gold, for example, has surged, posting its best quarter since 1986 as investors flock to safer assets amid the market turmoil. The shift toward traditional assets is particularly noticeable as the post-election crypto hype, which briefly boosted Bitcoin’s value to $109,000, begins to fade.

Despite the overall market challenges, some crypto-related firms have shown resilience. MicroStrategy, led by CEO Michael Saylor, remains in the green year-to-date, bolstered by its substantial Bitcoin holdings.

For now, the crypto market is left to weather the storm, with analysts continuing to scrutinize the interplay of macroeconomic factors and its impact on digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

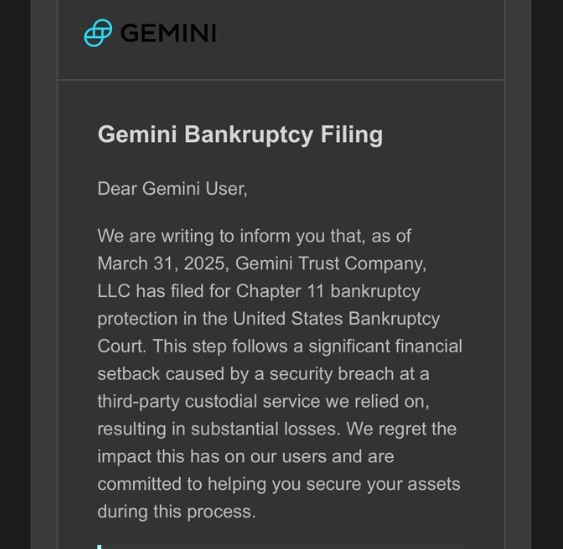

Fake Gemini Bankruptcy Emails Target Users

Crypto scams are surging as more people flock to digital currencies, with fraudsters exploiting the industry’s rapid growth to deceive investors.

Recently, numerous crypto users reported receiving fraudulent emails claiming that the Gemini exchange had filed for bankruptcy. Meanwhile, Coinbase Exchange has admitted that an employee illegally accessed user account information.

Gemini Exchange Addresses Bankruptcy Allegations

Multiple accounts highlighted the scam on social media, indicating that an email circulating falsely claims that Gemini has filed for bankruptcy. The email instructed users to withdraw to an Exodus wallet and provided a seed phrase.

These phishing emails, shared on April 1, urged recipients to withdraw their funds into a specified crypto wallet to protect their assets. This was an attempt to deceive users into transferring their cryptocurrencies to wallets controlled by scammers.

“Do not follow these directions. Please retweet to protect those that may have been doxxed and sent this email,” wrote Jason Williams, a contributor to Fox Business.

The deceptive emails alleged a substantial loss of $1.2 billion by Gemini Exchange. Understandably, some novice investors would heed this email and even move their assets to the address. After all, some victims of FTX Exchange contagion continue to pursue their funds even years after the incident.

“I got one also. It is better than your typical ‘Coin Base’ one, but still not quite there. Might fool a boomer though,” one X user remarked.

However, security experts advise users to always verify information through official channels, avoid clicking on unsolicited links, and refrain from sharing personal data. Gemini issued an official warning in response to the scam, acknowledging the threat against its users.

“We recently learned that some Gemini customers are being targeted with scam emails requesting users to transfer their crypto to outside wallets. Please be aware that Gemini will never request that you send crypto to outside wallets,” the exchange articulated.

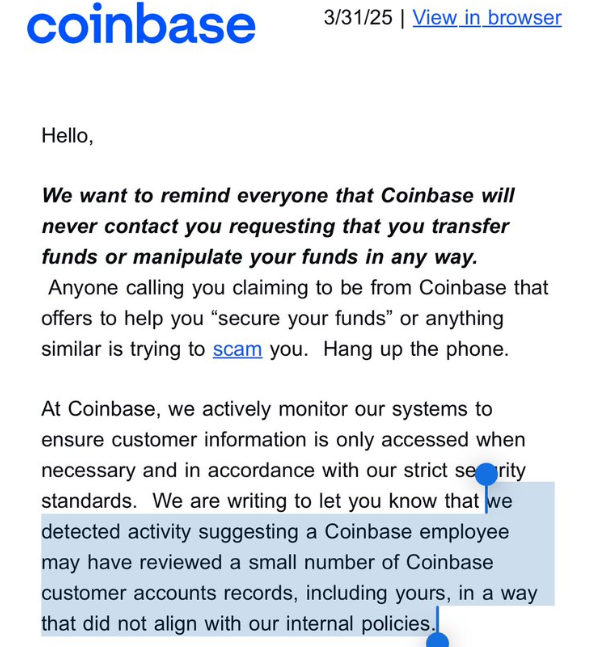

Coinbase Admits Employee Illegally Accessed User Account Data

Coinbase exchange acknowledged a privacy violation by one of its staff in a somewhat related development. Specifically, a customer service employee accessed user account information without authorization.

This breach has raised concerns about potential scams targeting Coinbase users. Mike Dudas, a crypto investor and co-founder at The Block, shared an email from Coinbase acknowledging the incident.

“That explains the fake Coinbase phishing emails and phone calls today,” he stated.

This breach coincides with reports of phishing attempts, as users have received fake emails and calls purporting to be from Coinbase. These incidents reflect a broader wave of crypto-related fraud.

Blockchain investigator ZachXBT reported that Coinbase users lost over $65 million to social engineering scams between December 2024 and January 2025.

“Coinbase did not detect it; I sent them the intel,” the blockchain investigated noted.

Additionally, crypto analyst Cobie suggested Kraken might be experiencing a similar issue. Per his post, a new attack may be budding, where attackers infiltrate customer service roles to exfiltrate data.

“Kraken also recently hit with this too. Maybe a new scheme from attackers (get a CS agent employee in, exfil data),” the analyst remarked.

Amidst these events, ZachXBT recently explained how to avoid crypto scams. He emphasizes the importance of conducting thorough research before engaging with new DeFi protocols, especially those forked from existing projects on newly launched EVM chains.

Additionally, he advises caution when dealing with projects with few credible followers, as these may indicate potential scams.

Therefore, it is imperative that users remain vigilant against sophisticated phishing scams and unauthorized data breaches.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum’s Price Dips, But Investors Seize The Opportunity To Stack Up More ETH

-

Market23 hours ago

Market23 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Regulation23 hours ago

Regulation23 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Market22 hours ago

Market22 hours agoPi Network Struggles, On Track for New All-Time Low

-

Bitcoin21 hours ago

Bitcoin21 hours agoStrategy Adds 22,048 BTC for Nearly $2 Billion

-

Market21 hours ago

Market21 hours agoBNB Breaks Below $605 As Bullish Momentum Fades – What’s Next?

-

Market17 hours ago

Market17 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar