Market

XRP Price Targets $1.60 Breakout: Is The Bull Run Back?

XRP price is rising and gaining pace above the $1.480 zone. The price is showing positive signs and might soon aim for a breakout above the $1.60 level.

- XRP price is eyeing a fresh increase above the $1.5850 resistance zone.

- The price is now trading above $1.520 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $1.4450 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might gain momentum if it clears the $1.600 resistance.

XRP Price Starts Fresh Increase Above $1.50

XRP price remained supported near the $1.400 zone. It formed a base and recently started an upward move like Bitcoin and like Ethereum. There was a move above the $1.420 and $1.4350 resistance levels.

There was a break above a key bearish trend line with resistance at $1.4450 on the hourly chart of the XRP/USD pair. The pair was able to clear the $1.50 level. There was a clear move above the 61.8% Fib retracement level of the downward move from the $1.6339 swing high to the $1.2594 low.

The price is now trading above $1.50 and the 100-hourly Simple Moving Average. It is also above the 76.4% Fib retracement level of the downward move from the $1.6339 swing high to the $1.2594 low.

On the upside, the price might face resistance near the $1.5850 level. The first major resistance is near the $1.600 level. The next key resistance could be $1.6350. A clear move above the $1.6350 resistance might send the price toward the $1.6650 resistance. Any more gains might send the price toward the $1.680 resistance or even $1.6920 in the near term. The next major hurdle for the bulls might be $1.70.

Another Pullback?

If XRP fails to clear the $1.600 resistance zone, it could start a downside correction. Initial support on the downside is near the $1.500 level. The next major support is near the $1.480 level.

If there is a downside break and a close below the $1.480 level, the price might continue to decline toward the $1.4550 support. The next major support sits near the $1.400 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $1.5000 and $1.4800.

Major Resistance Levels – $1.6000 and $1.6350.

Market

This is Why PumpSwap Brings Pump.fun To the Next Level

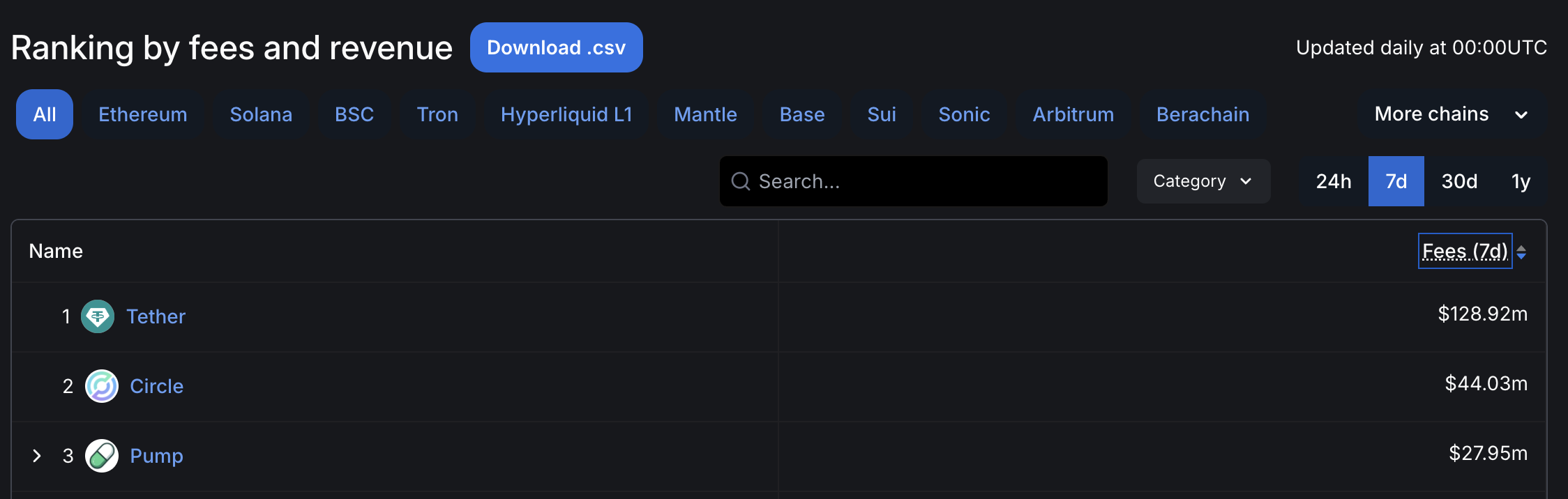

Since launching PumpSwap, token launchpad Pump.fun has resumed its position as a top-level protocol by fees and revenue. It saw over $2.62 billion in volume in less than two weeks, signifying high market interest.

Nonetheless, the meme coin sector as a whole has been more volatile than usual lately. PumpSwap is an attractive new option, but it still needs to stand the test of time.

Pump.fun Surges with PumpSwap

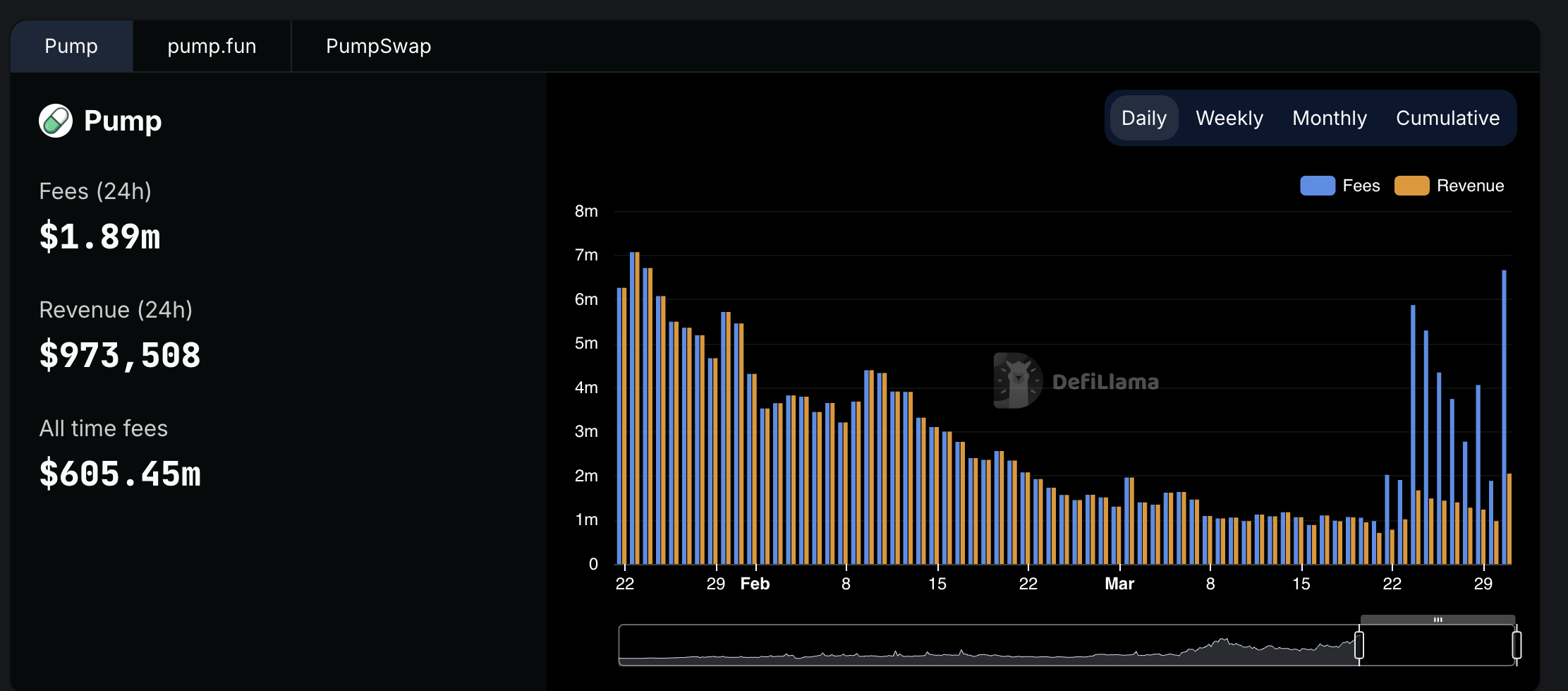

Pump.fun, a prominent meme coin creation platform, recently suffered some difficulties in the market. Facing lawsuits and criticism from the industry, the platform’s revenue had been declining in 2025. However, since launching PumpSwap, Pump.fun’s income has rebounded, making it one of the largest protocols by fees and revenue.

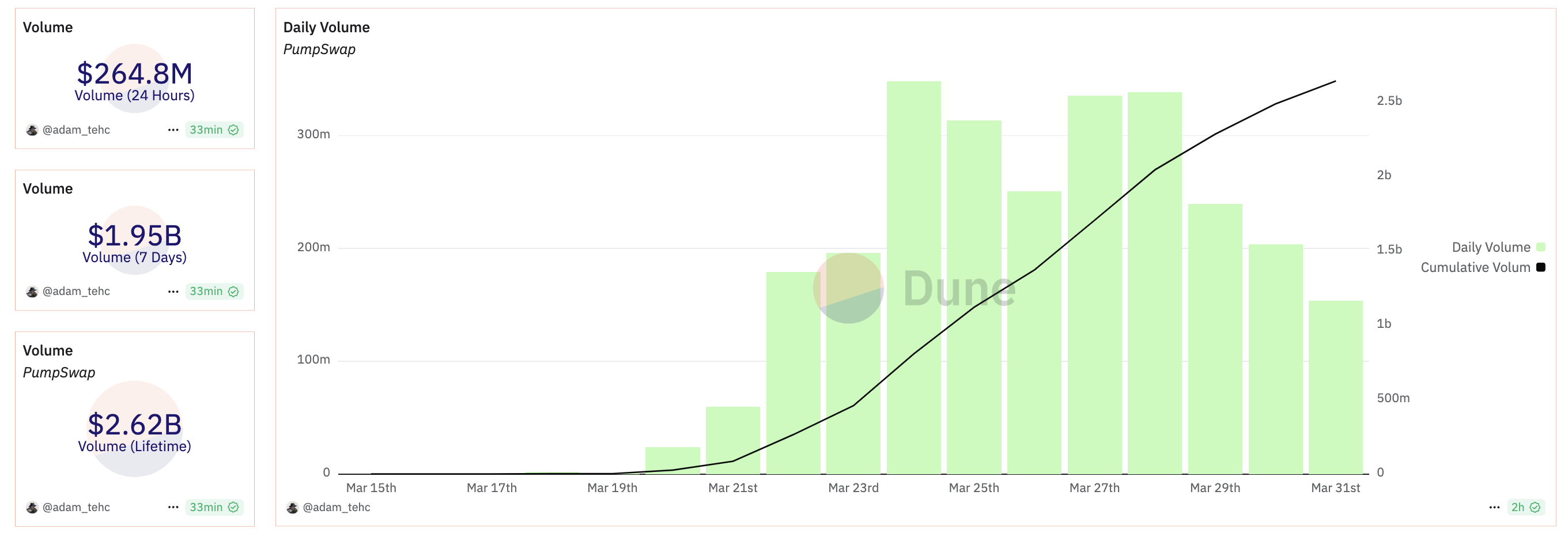

PumpSwap is a decentralized exchange on Solana’s blockchain, and it has grown very quickly since its launch less than two weeks ago. It has already managed over $2.62 billion in trade volume, although its daily volume fell over the weekend. Pump.fun’s cofounder spoke highly about PumpSwap, calling it a “crucial step that will help grow the ecosystem.”

Pump.fun’s overall revenues were declining before it launched PumpSwap, and they have since jumped back up. However, it’s important to not overstate the new exchange’s success. The exchange’s total fees collected have skyrocketed compared to Pump.fun, but the actual revenue growth has been comparatively small.

Still, these low fees also have significant advantages. Demand seems to be drying up in the meme coin sector, but Pump.fun faces stiff competition in the form of firms like Raydium, using low fees as a competitive edge. It has also promised things like revenue sharing with token creators to promote ecosystem growth.

Ultimately, the meme coin market as a whole is full of uncertainty. PumpSwap has been able to keep Pump.fun competitive as a top-level platform in this space, giving it a welcome reprieve. The real challenge will come in determining long-term viability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

Hedera (HBAR) is under pressure, down roughly 13.5% over the past seven days, with its market cap holding at around $7 billion. Recent technical signals point to growing bearish momentum, with both trend and momentum indicators leaning heavily negative.

The price has been hovering near a critical support zone, raising the risk of a breakdown below $0.15 for the first time in months. Unless bulls regain control soon, HBAR could face further losses before any meaningful recovery attempt.

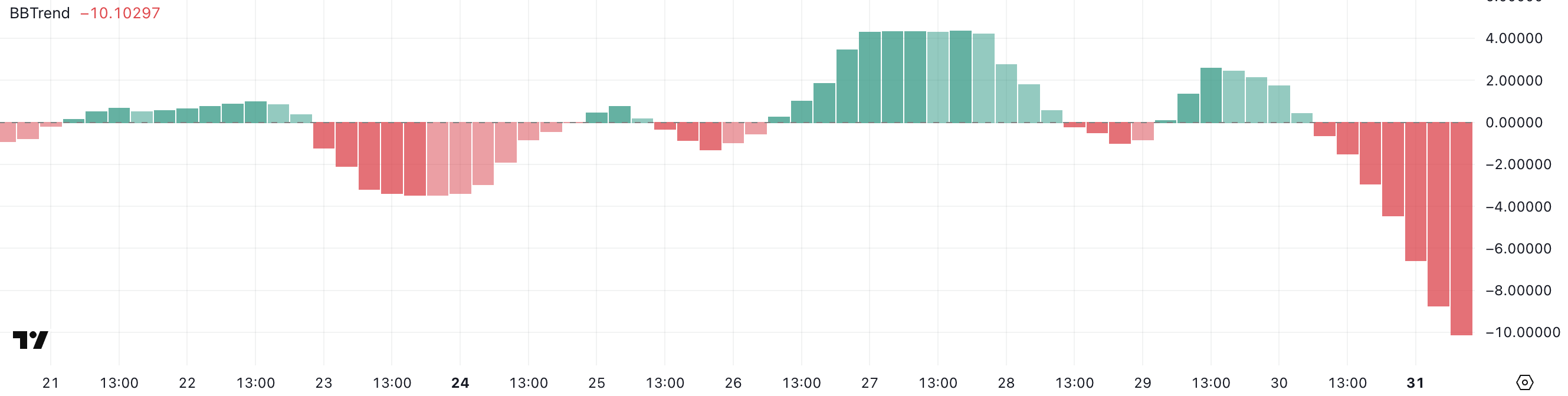

HBAR BBTrend Has Been Turning Heavily Down Since Yesterday

Hedera’s BBTrend indicator has dropped sharply to -10.1, falling from 2.59 just a day ago. This rapid decline signals a strong shift in momentum and suggests that HBAR is experiencing an aggressive downside move.

Such a steep drop often reflects a sudden increase in selling pressure, which can quickly change the asset’s short-term outlook.

The BBTrend, or Bollinger Band Trend, measures the strength and direction of a trend using the position of price relative to the Bollinger Bands. Positive values generally indicate bullish momentum, while negative values point to bearish momentum.

The further the value is from zero, the stronger the trend. HBAR’s BBTrend is now at -10.1, signaling strong bearish momentum.

This suggests that the price is trending lower and doing so with increasing strength, which could lead to further downside unless buyers step in to slow the momentum.

Hedera Ichimoku Cloud Paints a Bearish Picture

Hedera’s Ichimoku Cloud chart reflects a strong bearish structure, with the price action positioned well below both the blue conversion line (Tenkan-sen) and the red baseline (Kijun-sen).

This setup indicates that short-term momentum is clearly aligned with the longer-term downtrend.

The price has consistently failed to break above these dynamic resistance levels, signaling continued seller dominance.

The future cloud is also red and trending downward, suggesting that bearish pressure is expected to persist in the near term.

The span between the Senkou Span A and B lines remains wide, reinforcing the strength of the downtrend. For any potential reversal to gain credibility, HBAR would first need to challenge and break above the Tenkan-sen and Kijun-sen, and eventually push into or above the cloud.

Until then, the current Ichimoku configuration supports a continuation of the bearish outlook.

Can Hedera Fall Below $0.15 Soon?

Hedera price has been hovering around the $0.16 level and is approaching a key support at $0.156.

If this support fails to hold, it could open the door for further downside, potentially pushing HBAR below the $0.15 mark for the first time since November 2024.

However, if HBAR manages to reverse its current trajectory and regain bullish momentum, the first target to watch is the resistance at $0.179.

A breakout above that level could lead to a stronger rally toward $0.20 and, if momentum continues, even reach $0.215. In a more extended bullish scenario, HBAR could climb to $0.25, signaling a full recovery and trend reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Tries to Resume Lawsuit Against the FDIC

Coinbase asked a DC District Court if it could resume its old lawsuit against the FDIC. Coinbase sued this regulator over Operation Choke Point 2.0 and claimed that it’s still refusing to release relevant information.

Based on the information available so far, it’s difficult to draw definitive conclusions. The FDIC maintains that it responded to its opponents’ questions truthfully, though it has shown delays in the past.

Coinbase vs the FDIC

Coinbase, one of the world’s largest crypto exchanges, has been in a few fights with the FDIC. The firm has been pursuing the FDIC over Operation Choke Point 2.0 for months now, and has achieved impressive results. Despite this, however, Coinbase is asking the DC District Court to resume its litigation against the regulator:

“We’re asking the Court to resume our lawsuit because the FDIC has unfortunately stopped sharing information. While we would have loved to resolve this outside of the legal system – and we do appreciate the increased cooperation we’ve seen from the new FDIC leadership – we still have a ways to go,” claimed Paul Grewal, Coinbase’s Chief Legal Officer.

The FDIC has an important role in US financial regulation, primarily dealing with banks. This gave it a starring role in Operation Choke Point 2.0, hampering banks’ ability to deal with crypto businesses. However, it recently started a pro-crypto turn, releasing tranches of incriminating documents and revoking several of its anti-crypto statutes.

Grewal said that he “appreciated the increased cooperation” from the FDIC but that the cooperation stopped weeks ago. According to Coinbase’s filing, the FDIC hasn’t sent any new information since late February and claimed in early March that the exchange’s subsequent requests were “unreasonable and beyond the scope of discovery.”

On one hand, the FDIC has previously been slow to make relevant disclosures in the Coinbase lawsuit. On the other hand, Operation Choke Point 2.0 sparked significant tension within the industry, and a determined group is now aiming to significantly weaken the regulatory bodies involved.

Until the legal battle continues, it’ll be difficult to make any definitive statements. The FDIC will likely have two weeks to respond to Coinbase’s request.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market20 hours ago

Market20 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market17 hours ago

Market17 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market11 hours ago

Market11 hours ago3 Altcoins to Watch in the First Week of April 2025

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Is ‘Completely Dead’ As An Investment: Hedge Fund

-

Market10 hours ago

Market10 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Market16 hours ago

Market16 hours agoThis Is How Dogecoin Price Reacted To Elon Musk’s Comment

-

Regulation10 hours ago

Regulation10 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All