Market

A Springboard for More Gains?

Ethereum price is holding gains above the $3,500 zone. ETH is consolidating and might soon aim for a move above the $3,600 resistance zone.

- Ethereum started a downside correction from the $3,685 zone.

- The price is trading above $3,520 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $3,600 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could restart its increase if it clears the $3,600 zone.

Ethereum Price Eyes Fresh Surge

Ethereum price remained supported above $3,250 and started a fresh increase beating Bitcoin. ETH was able to surpass the $3,500 and $3,550 resistance levels.

The bulls pumped the price above the $3,650 level. A high was formed at $3,688 and the price recently corrected some gains. There was a minor decline below the $3,650 and $3,620 levels. The price dipped below the 23.6% Fib retracement level of the upward wave from the $3,255 swing low to the $3,688 high.

Ethereum price is now trading above $3,520 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,600 level. There is also a connecting bearish trend line forming with resistance at $3,600 on the hourly chart of ETH/USD.

The first major resistance is near the $3,650 level. The main resistance is now forming near $3,680. A clear move above the $3,680 resistance might send the price toward the $3,750 resistance. An upside break above the $3,750 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,880 resistance zone or even $3,920.

More Losses In ETH?

If Ethereum fails to clear the $3,650 resistance, it could start another decline. Initial support on the downside is near the $3,540 level. The first major support sits near the $3,500 zone.

A clear move below the $3,500 support might push the price toward the 50% Fib retracement level of the upward move from the $3,254 swing low to the $3,688 high at $3,470. Any more losses might send the price toward the $3,400 support level in the near term. The next key support sits at $3,350.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,540

Major Resistance Level – $3,650

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

HBAR’s Futures Market Sees Bullish Spike

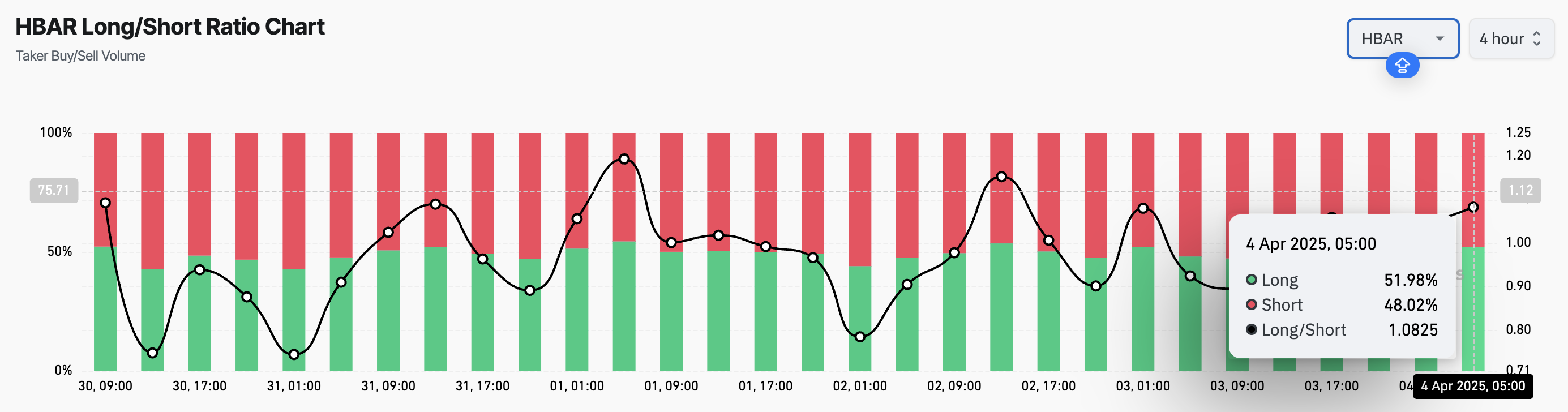

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

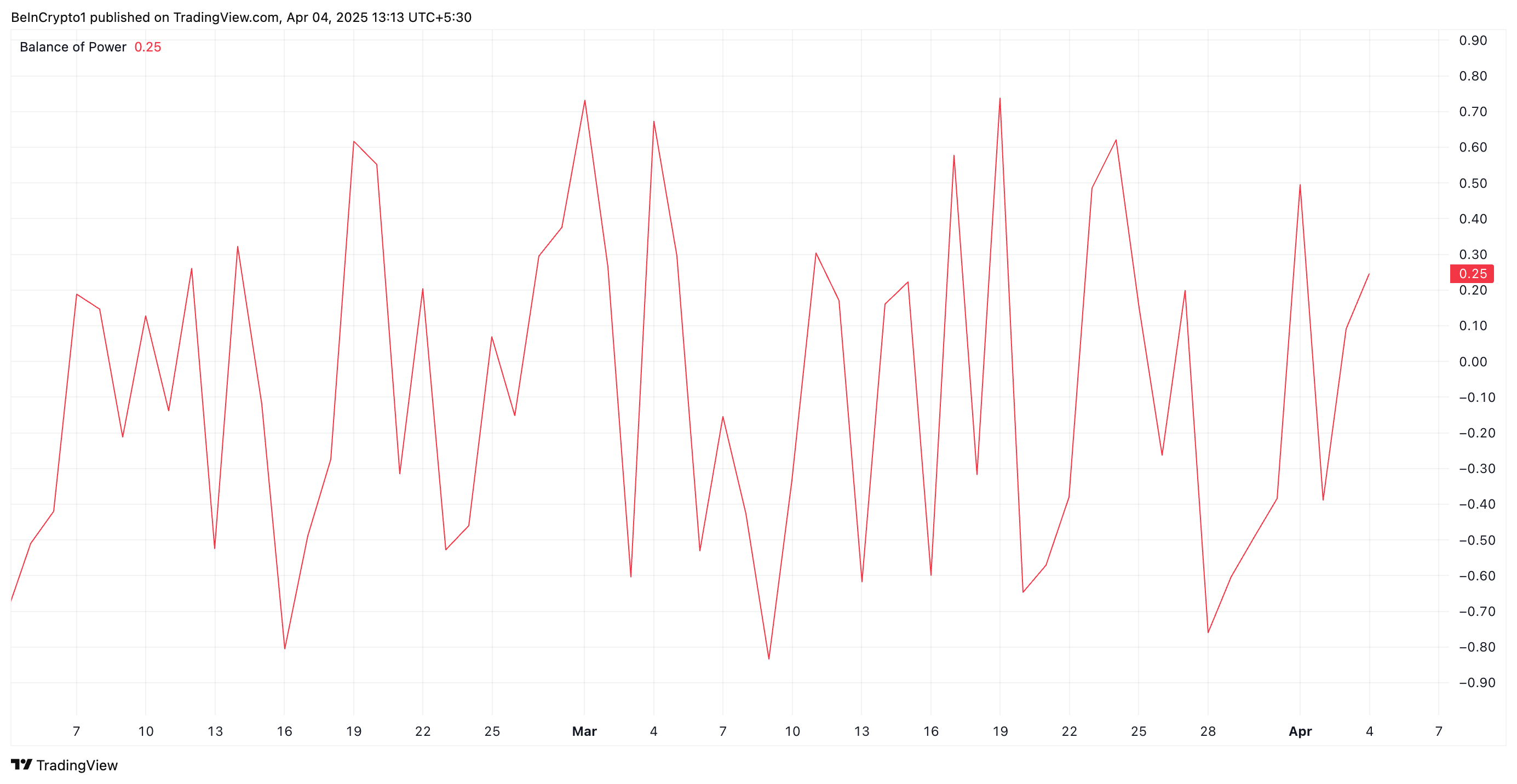

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin is Far From a Bear Market But not Altcoins, Analysts Claim

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding firm above $79,000 despite a sharp equities sell-off. Markets are bracing for the March NFP report and rising recession risks. With Fed rate cuts on the table and ETF inflows staying strong, all eyes are on what’s next for macro and crypto markets.

Is Bitcoin in a Bear Market?

The highly anticipated March U.S. non-farm payrolls (NFP) report is due later today, and it’s expected to play a key role in shaping market sentiment heading into the weekend.

“With the key macro risk event now behind us, attention turns to tonight’s non-farm payroll report. Investors are bracing for signs of softness in the U.S. labour market. A weaker-than-expected print would bolster the case for further Fed rate cuts this year, as policymakers attempt to cushion a decelerating economy. At the time of writing, markets are pricing in four rate cuts in 2025—0.25 bps each in June, July, September and December,” QCP Capital analysts said.

Traditional markets are increasingly pricing in a recession, with equities retreating sharply—a 7% decline overall, including a 5% drop just yesterday. This broad de-risking environment helps explain the current pause in crypto inflows.

On the derivatives front, QCP adds:

“On the options front, the desk continues to observe elevated volatility in the short term, with more buyers of downside protection. This skew underscores the prevailing mood – uncertain and cautious.”

However, they also note that “with positioning now light and risk assets largely oversold, the stage may be set for a near-term bounce.”

Bitcoin remains resilient despite market volatility, holding above $79,000 with strong ETF inflows and signs of decoupling from stocks and altcoins. According to Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau: “Bitcoin is nowhere near a bear market at this stage. The future of many altcoins, however, is more questionable.”

Chart of the Day

Chances of a US Recession in 2025 jumped above 50% for the first time, currently at 53%.

Byte-Sized Alpha

– Major ETF issuers are buying Bitcoin, with $220 million in inflows showing strong confidence despite volatility.

– Futures show bullish BTC sentiment, but options traders remain cautious, signaling mixed market outlook.

– Coinbase is launching XRP futures after Illinois lawsuit relief, signaling growing regulatory support for crypto.

– Despite Trump’s tariff-driven crash, analysts see potential for a Bitcoin rebound—though inflation may cap gains.

– The Anti-CBDC bill passed a key House vote, aiming to block Fed-issued digital currencies and protect privacy.

– Today at 11:25 AM, Fed Chair Jerome Powell will deliver a speech on the U.S. economic outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Price Recovery Next As Whales Buy 230 Million ADA

Cardano has experienced a tough period, with the failed price recovery and declining market conditions. However, the recent buying behavior of whales and the potential for a price surge suggest a change in momentum.

If Cardano (ADA) can break through the $0.70 level, it could signal the end of the bearish sentiment.

Cardano Whales Are Hopeful

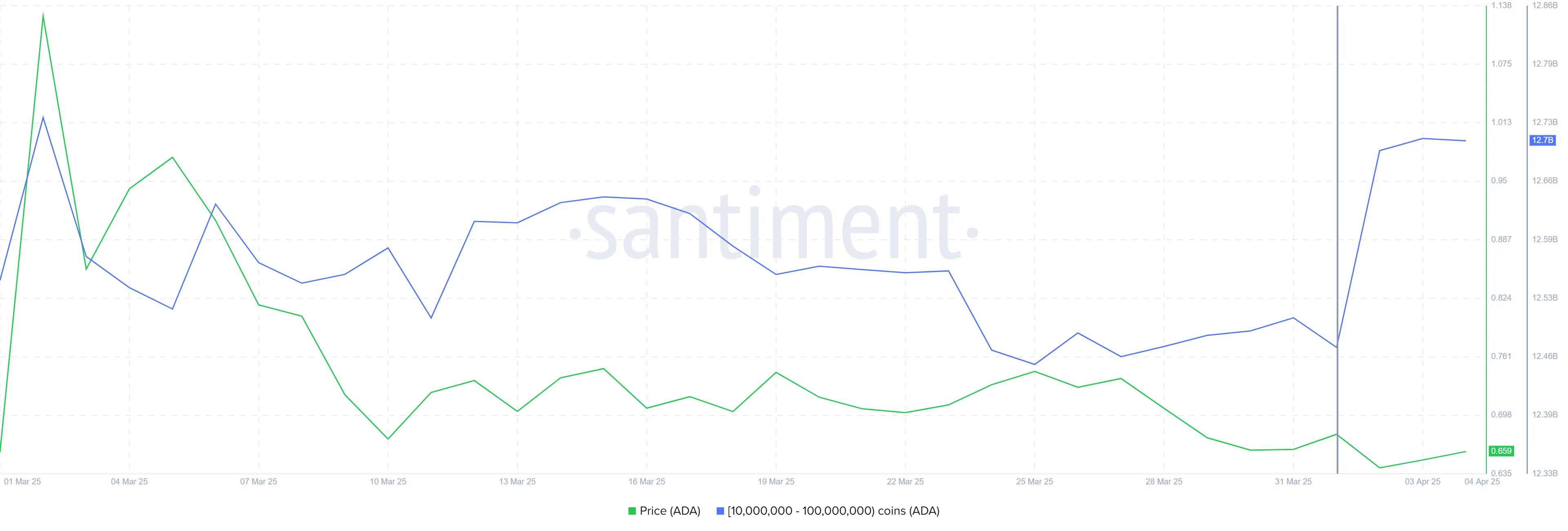

Over the past 72 hours, whales holding between 10 million and 100 million ADA have accumulated over 230 million ADA, valued at over $150 million at current prices. This shift from selling and staying neutral to accumulation indicates a shift in sentiment, with whales optimistic about ADA’s potential for Q2 2025. Their recent activity signals confidence in the altcoin’s recovery despite the recent market struggles.

Whale accumulation is often a bullish indicator as these investors have significant influence over the market. The accumulation is crucial, as it provides the support needed for ADA to break through resistance levels.

The liquidation map for Cardano shows that approximately $15 million in short contracts will expire as soon as ADA rises above the $0.70 level. This presents a key opportunity for the altcoin. Short-sellers may be forced to close their positions, which could lead to a short squeeze and drive the price higher.

Potential liquidation of short positions may create upward pressure, preventing further declines and allowing ADA to recover. The combination of whale accumulation and the looming liquidation of short contracts could provide Cardano with the momentum it needs to break free from its recent downtrend.

Can ADA Price Breach $0.70?

At the time of writing, Cardano’s price is at $0.65, holding above the crucial $0.62 support level. The altcoin has struggled in recent weeks, but the whale-buying activity offers hope for recovery. A breach of the $0.70 barrier could lead to further upward movement.

Should ADA successfully break through $0.70, it could gain the necessary momentum to continue its recovery. Flipping $0.77 into support would provide an additional boost, positioning Cardano to regain recent losses and possibly challenge higher resistance levels.

However, if Cardano fails to breach $0.70, the price may return to the $0.62 support level. Losing this support would invalidate the bullish outlook and send ADA to a lower level of $0.58, extending the ongoing decline.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role

-

Market22 hours ago

Market22 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market24 hours ago

Market24 hours agoTRUMP Token Hits Record Low Due To Liberation Day Tariffs

-

Regulation20 hours ago

Regulation20 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market23 hours ago

Market23 hours agoPi Network Price Falls To Record New Low Amid Weak Inflows

-

Market20 hours ago

Market20 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market19 hours ago

Market19 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market18 hours ago

Market18 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?