Market

The Biggest Names in Blockchain in 2024 Revealed

As an industry, blockchain has consistently outperformed expectations. Currently, it’s poised to reach $248.9 billion over the next 5 years, driven by a staggering 65.5% compound annual growth. This explosive expansion stems from the technology’s innate ability to reshape a vast array of industries via the tenets of decentralization, transparency, and security.

The Potential of Blockchain

A number of key developments have accelerated not just the growth of blockchain, but also its integration into the mainstream. Support from other Big Tech sectors like gaming and fintech has raised the profile of decentralized currencies, in turn bringing the networks that power them to the fore.

This has made some very significant changes. In the gaming industry, for example, the emergence of new platforms and gaming experiences, from Bitcoin casino websites to play-to-earn titles, has pushed the utility of blockchain as much as it has opened access to cryptocurrencies for the average consumer. Cryptocurrencies have enormous potential when being used in the casino world – not least because of the security boost that they offer – and many enthusiastic gamers have moved toward using these for all sorts of online gaming fun, whether it’s slots, poker, blackjack, or something else. This is just one example of how blockchain is changing industries from top to bottom.

Moreover, the application of blockchain to fintech has given rise to DeFi – the decentralized finance sector, which is having a revolutionary impact on financial systems across the globe. It’s transforming digital ownership via non-fungible tokens (NFTs) and digital assets. Alongside all that, blockchain is being increasingly integrated into traditional banking methods.

And as a result of such advancements? Well, a diverse set of companies are now harnessing the potential of blockchain — in some genuinely innovative ways. In this article, we’ll explore those heavy-hitting blockchain companies that are pioneering a unique approach to demonstrating the versatility of this technology, underscoring its pivotal role in the future of international business.

Key Takeaways

- Major blockchain developments include GameFi, decentralized finance (DeFi), NFTs, smart contracts, and integration into traditional sectors like banking and logistics. These trends showcase technology’s ever-growing role in transparency and efficiency.

- A diverse group of companies is leading blockchain innovation, from computing giants creating new digital asset ecosystems to start-ups focusing on decentralized data management and peer-to-peer transactionality.

- With blockchain advancing so rapidly, businesses from across all industries can stay competitive by harnessing its potential to establish secure and efficient operational systems.

Blockchain Companies to Know

Here’s a round-up of the core blockchain companies to know as we head into 2025. While some exclusively operate in the blockchain space, you might recognize a few household names who are leading the charge when it comes to utilizing and advancing blockchain tech.

RIOT Platforms Inc.

Exchange: Nasdaq

Mining is an essential component of the decentralized ecosystem, being critical to Bitcoin and leading blockchain networks. Riot Platforms has been a top player in the crypto mining space since its launch in 2000, and now offers solutions across engineering and data center hosting. Often rated as a Wall Street Strong Buy, the company maintains investments in Verady, Coinsquare, and Tess.

Ripple

Known among gamers and traders for the XRP token, Ripple is actually a powerhouse company in the decentralized technology sector.

Having developed its blockchain network over a decade, Ripple is well positioned as a company delivering products that enable businesses, governments, and financial institutions to tokenize and manage value. Transparency and cost-efficiency are at the center of the blockchain’s offering, which has seen it attract a client base including American Express and BMO.

Coinbase Global, Inc.

Exchange: Nasdaq

The US’ largest cryptocurrency exchange by trading volume, Coinbase is another multi-faceted blockchain company. It’s got a whole suite of products for retail and institutions. Founded in 2012 by Bryan Armstrong, the company is headquartered in San Francisco and incorporates Coinbase Pro, Coinbase Wallet, and USD Coin.

Coinbase’s profile has received a substantial boost this year due to playing a crucial role in the brokerage of spot Bitcoin ETFs.

Binance Holdings Inc

Who hasn’t heard of Binance at this point? Globally recognized, this blockchain ecosystem has developed a comprehensive suite of decentralized products that include the largest digital asset exchange. Founded by Changpeng Zhao in 2017, Binance’s mission is to provide the “core infrastructure services for organizing the world’s crypto.”

Crypto insiders will already be familiar with its currencies: Binance Coin (BNB) and BinanceUSD (BUSD). While it was first launched on the Ethereum chain, BNB has since migrated to the company’s own proprietary network, the BNB Chain, indicating its industry-leading position in the blockchain and crypto space.

IBM

Exchange: NYSE

The multi-national computing giant is well established in the Big Tech space. For decades, its extensive suite of cognitive solutions and cloud platform have powered industries, enterprises, and individuals across the globe – not a bad record!

With a 100+ year history in spearheading innovation, IBM has long been at the forefront of pushing the capabilities of human-tech interaction. It’s therefore not super surprising that it’s been one of the largest names to embrace blockchain and now provides extensive solutions to build blockchain systems across a diverse spectrum of industries, from supply chain management to food product sourcing.

Market

Dogecoin (DOGE) Bleeds Further—Fresh Weekly Lows Test Investor Patience

Dogecoin started a fresh decline from the $0.180 zone against the US Dollar. DOGE is consolidating and might struggle to recover above $0.1680.

- DOGE price started a fresh decline below the $0.1750 and $0.170 levels.

- The price is trading below the $0.1680 level and the 100-hourly simple moving average.

- There was a break below a key bullish trend line forming with support at $0.170 on the hourly chart of the DOGE/USD pair (data source from Kraken).

- The price could extend losses if it breaks the $0.1550 support zone.

Dogecoin Price Dips Again

Dogecoin price started a fresh decline after it failed to clear $0.180, like Bitcoin and Ethereum. DOGE dipped below the $0.1750 and $0.1720 support levels.

There was a break below a key bullish trend line forming with support at $0.170 on the hourly chart of the DOGE/USD pair. The bears were able to push the price below the $0.1620 support level. It even traded close to the $0.1550 support.

A low was formed at $0.1555 and the price is now consolidating losses. There was a minor move above the 23.6% Fib retracement level of the downward move from the $0.180 swing high to the $0.1555 low.

Dogecoin price is now trading below the $0.170 level and the 100-hourly simple moving average. Immediate resistance on the upside is near the $0.1650 level. The first major resistance for the bulls could be near the $0.1680 level. It is near the 50% Fib retracement level of the downward move from the $0.180 swing high to the $0.1555 low.

The next major resistance is near the $0.1740 level. A close above the $0.1740 resistance might send the price toward the $0.180 resistance. Any more gains might send the price toward the $0.1880 level. The next major stop for the bulls might be $0.1950.

Another Decline In DOGE?

If DOGE’s price fails to climb above the $0.170 level, it could start another decline. Initial support on the downside is near the $0.160 level. The next major support is near the $0.1550 level.

The main support sits at $0.150. If there is a downside break below the $0.150 support, the price could decline further. In the stated case, the price might decline toward the $0.1320 level or even $0.120 in the near term.

Technical Indicators

Hourly MACD – The MACD for DOGE/USD is now losing momentum in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for DOGE/USD is now above the 50 level.

Major Support Levels – $0.1600 and $0.1550.

Major Resistance Levels – $0.1680 and $0.1740.

Market

Bitcoin & Ethereum Options Expiry: Can Prices Stay Stable?

The crypto market is set to see $2.58 billion in Bitcoin and Ethereum options expire today, a development that could trigger short-term price volatility and impact traders’ profitability.

Of this total, Bitcoin (BTC) options account for $2.18 billion, while Ethereum (ETH) options represent $396.16 million.

Bitcoin and Ethereum Holders Brace For Volatility

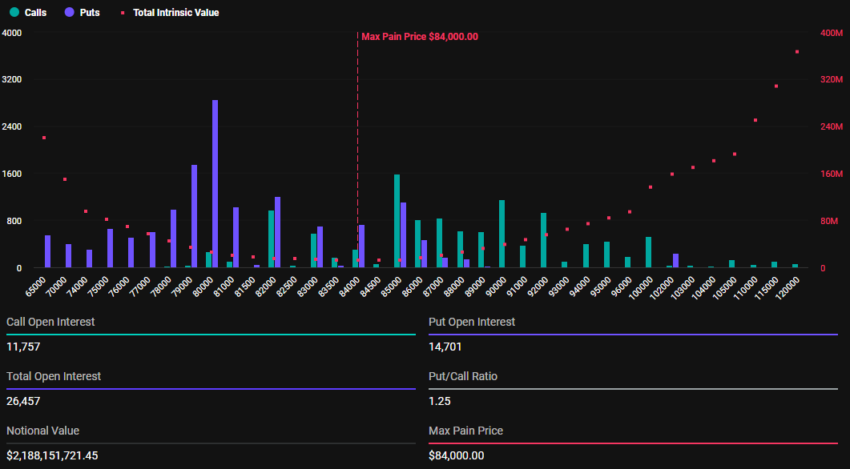

According to data on Deribit, 26,457 Bitcoin options will expire today, significantly lower than the first quarter (Q1) closer, where 139,260 BTC contracts went bust last week. The options contracts due for expiry today have a put-to-call ratio 1.25 and a maximum pain point of $84,000.

The put-to-call ratio indicates a higher volume of puts (sales) relative to calls (purchases), indicating a bearish sentiment. More traders or investors are betting on or protecting against a potential market drop.

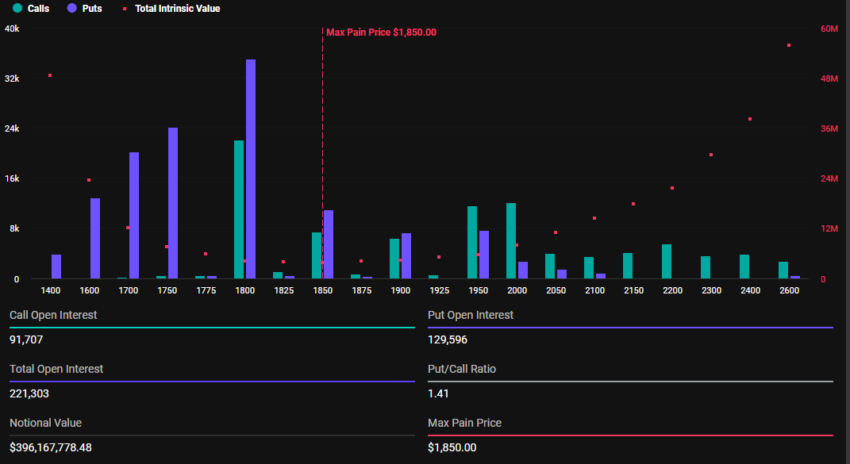

On the other hand, 221,303 Ethereum options will also expire today, down from 1,068,519 on the last Friday of March. With a put-to-call ratio of 1.41 and a max pain point of $1,850, the expirations could influence ETH’s short-term price movement.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC was trading at $82,895 as of this writing, whereas ETH was exchanging hands for $1,790.

This suggests that prices might rise as smart money aims to move them toward the “max pain” level. Based on the Max Pain theory, options prices tend to gravitate toward strike prices where the highest number of contracts, both calls and puts, expire worthless.

Nevertheless, price pressure on BTC and ETH will likely ease after 08:00 UTC on Friday when Deribit settles the contracts. However, the sheer scale of these expirations could still fuel heightened volatility in the crypto markets.

“Where do you see the market going next? Deribit posed.

Elsewhere, analysts at Greeks.live explain the current market sentiment, highlighting a bearish outlook. This adds credence to why more traders are betting on or protecting against a potential market drop.

Bearish Sentiment Grips Markets

In a post on X (Twitter), Greeks.live reported a predominantly bearish sentiment in the options market. This follows US President Donald Trump’s tariff announcement.

BeInCrypto reported that the new tariffs constituted a 10% blanket rate and 25% on autos. While this fell short of market expectations, it was still perceived as a negative development, sparking widespread concern among traders.

According to the analysts, options flow reflected this pessimism, with heavy put buying dominating trades.

“Trump’s tariffs are viewed as severe trade disruption… The market’s initial positive reaction with a price spike to $88 was seen as gambling/short covering, followed by a sharp reversal as reality set in about economic impacts. Options flow remains heavily bearish, with traders noting significant put buying, including “700 79k puts for end of April,” wrote Greeks.live analysts.

Traders snapping up 700 $79,000 puts for the end of April signals expectations of a sustained downturn. According to the analysts, the consensus among traders points to continued volatility, with a potential “bad close” below $83,000 today, Friday, April 4. Such an action would erase the earlier pump entirely.

Meanwhile, many traders are adopting bearish strategies, favoring short calls or put calendars. Shorting calls is reportedly deemed the most effective approach in the current climate.

Therefore, while the market’s initial reaction to Trump’s tariffs was a mix of hope and reality, the reversal reflects the broader economic fallout from Trump’s policies. As traders brace for choppy conditions, the bearish outlook in options trading paints a cautious picture for the days ahead.

Global supply chain disruptions and economic uncertainty remain at the forefront of market concerns.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Battle Heats Up—Can Bulls Turn the Tide?

XRP price started a fresh decline below the $2.050 zone. The price is now consolidating and might face hurdles near the $2.10 level.

- XRP price started a fresh decline below the $2.120 and $2.050 levels.

- The price is now trading below $2.10 and the 100-hourly Simple Moving Average.

- There is a short-term declining channel forming with resistance at $2.0680 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might extend losses if it fails to clear the $2.10 resistance zone.

XRP Price Attempts Recovery

XRP price extended losses below the $2.050 support level, like Bitcoin and Ethereum. The price declined below the $2.00 and $1.980 support levels. A low was formed at $1.960 and the price is attempting a recovery wave.

There was a move above the $2.00 and $2.020 levels. The price surpassed the 23.6% Fib retracement level of the downward move from the $2.235 swing high to the $1.960 low. However, the bears are active below the $2.10 resistance zone.

The price is now trading below $2.10 and the 100-hourly Simple Moving Average. On the upside, the price might face resistance near the $2.070 level. There is also a short-term declining channel forming with resistance at $2.0680 on the hourly chart of the XRP/USD pair.

The first major resistance is near the $2.10 level. It is near the 50% Fib retracement level of the downward move from the $2.235 swing high to the $1.960 low. The next resistance is $2.120.

A clear move above the $2.120 resistance might send the price toward the $2.180 resistance. Any more gains might send the price toward the $2.2350 resistance or even $2.40 in the near term. The next major hurdle for the bulls might be $2.50.

Another Decline?

If XRP fails to clear the $2.10 resistance zone, it could start another decline. Initial support on the downside is near the $2.00 level. The next major support is near the $1.960 level.

If there is a downside break and a close below the $1.960 level, the price might continue to decline toward the $1.920 support. The next major support sits near the $1.90 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $2.00 and $1.960.

Major Resistance Levels – $2.10 and $2.120.

-

Market22 hours ago

Market22 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Altcoin24 hours ago

Altcoin24 hours agoVanEck Seeks BNB ETF Approval—Big Win For Binance?

-

Market20 hours ago

Market20 hours ago10 Altcoins at Risk of Binance Delisting

-

Market19 hours ago

Market19 hours agoEDGE Goes Live, RSR Added to Roadmap

-

Market18 hours ago

Market18 hours agoBitcoin’s Future After Trump Tariffs

-

Altcoin23 hours ago

Altcoin23 hours agoBinance Issues Key Announcement On StakeStone TGE; Here’s All

-

Altcoin22 hours ago

Altcoin22 hours agoMovimiento millonario de Solana, SOLX es la mejor opción

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?