Market

Will OORT Price Continue to Rise After CZ’s Post?

OORT (OORT), a cryptocurrency rooted in Artificial Intelligence (AI), has seen its price surge 85% over the past week. This jump followed a post by former Binance CEO Changpeng Zhao, who highlighted AI’s potential impact within the BNB Greenfield ecosystem.

Following the altcoin’s reaction, sentiment around it has turned bullish. But why did this happen, and will OORT price continue to rise? This analysis reveals all there is to know about it.

OORT Rises After CZ Speaks on AI in BNB Greenfield

On November 27, Zhao, popularly known as CZ, posted on X (formerly Twitter). He noted that AI should often be used on-chain. In the post, CZ noted that this could foster low transaction costs globally while offering the BNB Greenfield for data storage during the process.

“AI tagging (or AI data in general) is well fitted to be done on-chain. Harness low-cost labor globally without geographic bias, (micro) pay them instantly in crypto. BNB Chain Greenfield provides the storage capacity. More tooling still needs to be built. Let’s build them,” Zhao wrote.

Minutes after development, the price of AI coin OORT skyrocketed from $0.10 to $0.85. For context, OORT is the native token of a decentralized AI technology project that partnered with BNB Greenfield as a storage provider earlier this year in March

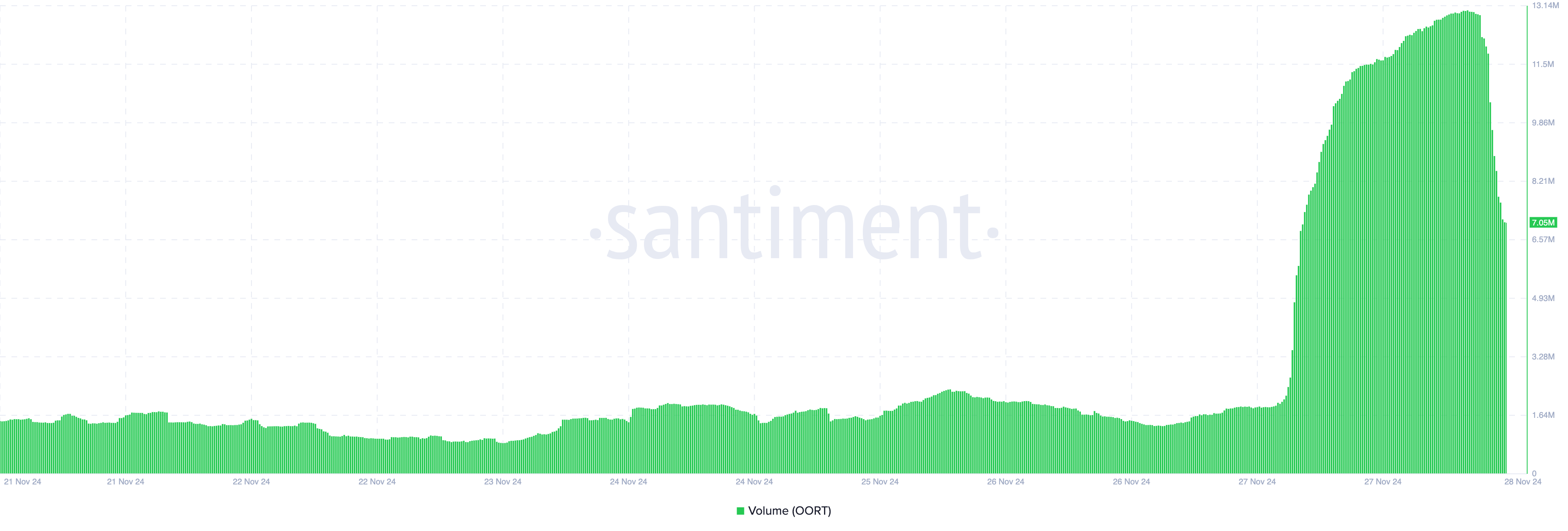

This dramatic price surge may be tied to OORT’s integration with the BNB Greenfield, a decentralized storage platform hosted on the BNB Chain. Beyond the price hike, the development drove the AI-themed altcoin’s volume to $13 million, signifying increased interest in it.

However, as of this writing, the price has dropped to $0.15 while the volume has also decreased to $7.05 million.

OORT Price Prediction: Rebound to $0.20 Possible

The daily OORT/USD chart reveals that the Bull Bear Power (BBP) has moved into positive territory, indicating that buyers (bulls) currently hold the upper hand over sellers (bears).

When BBP is negative, bears dominate, often leading to price declines. However, in this case, the bulls’ strength suggests a potential rebound in OORT’s price, with data also suggesting that it could correlate strongly with BNB’s price.

If buying pressure persists, the Fibonacci retracement indicator suggests that the altcoin could climb to $0.20. Conversely, if interest in the AI coin wanes, the price may decline to $0.11. Instead, the value could drop to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Holders Buy Heavily as Price Nears October 2023 Levels

Ethereum has experienced a challenging month and a half, with its price nearing a 17-month low at $1,802 at the time of writing. Despite this ongoing downtrend, which nearly sent ETH into a bear market, key investors have remained optimistic.

As Ethereum approaches these significant levels, many market participants believe that a price rebound could be on the horizon.

Ethereum Investors Capitalize On Low Prices

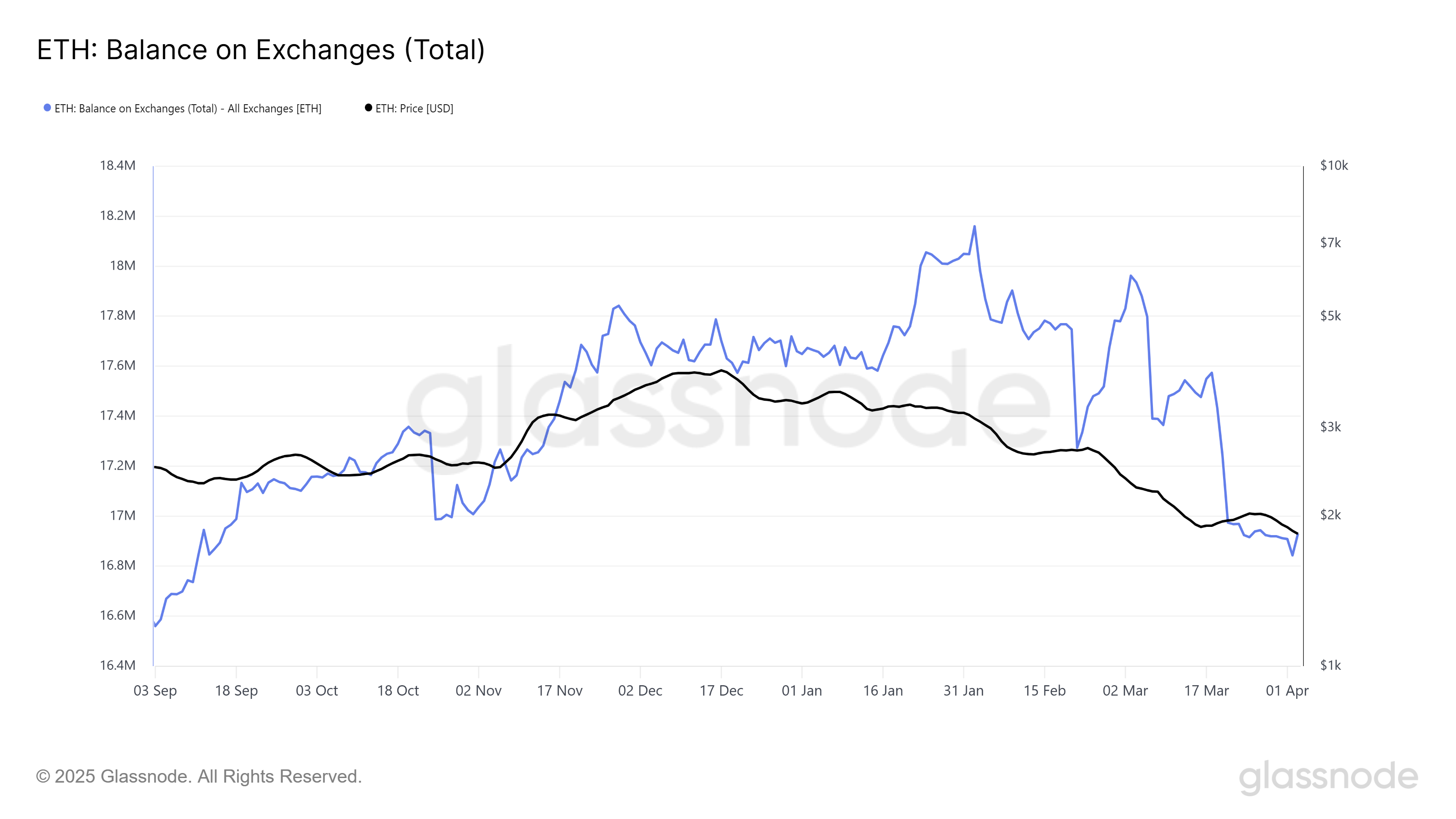

Ethereum’s supply on exchanges has dropped to a six-month low, indicating that investors are increasingly holding their assets off the market. This drop in exchange supply is often seen as a bullish sign because it suggests that long-term holders (LTHs) are accumulating more ETH at these low price levels, anticipating future price appreciation.

These investors are not willing to sell, demonstrating strong conviction in Ethereum’s long-term value. The decrease in exchange balances also indicates less short-term trading activity. This suggests that many investors are waiting for the price to rebound before making any moves.

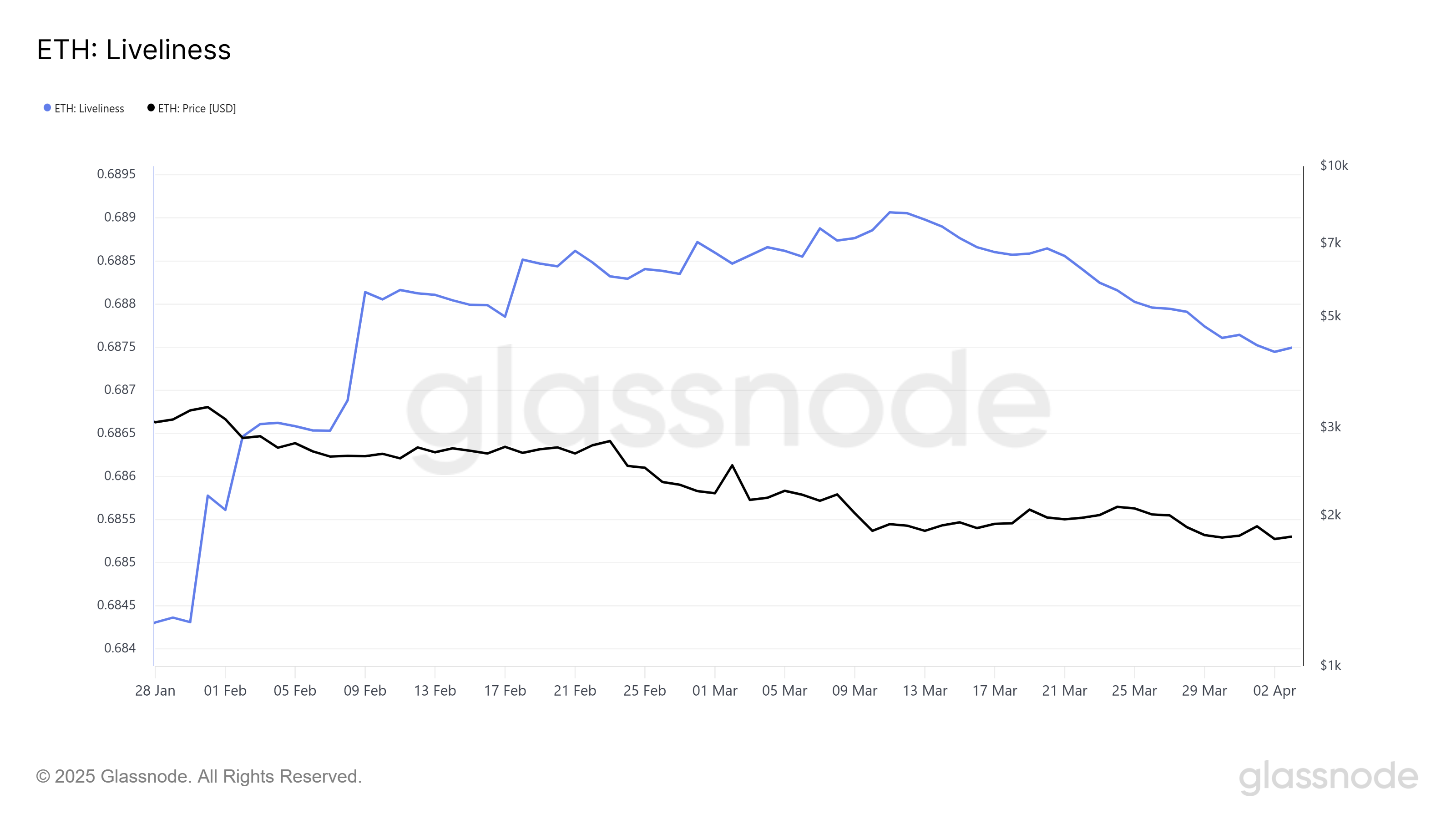

Over the past month, Ethereum’s Liveliness indicator has declined, signaling that the selling pressure is weakening. Liveliness measures the activity of long-term holders, and a decline generally points to accumulation rather than selling.

This drop reflects the growing sentiment among Ethereum’s long-term investors, who are increasing their holdings and expecting the price to recover in the future. The decline in Liveliness suggests that many are confident in Ethereum’s fundamentals and are less concerned about short-term fluctuations.

This accumulation phase suggests that Ethereum’s market sentiment may be shifting. The confidence of LTHs—who hold significant influence over the asset’s price—could lead to a strong upward momentum once the market conditions improve.

ETH Price Needs A Nudge

Ethereum is currently trading at $1,802, just below the resistance level of $1,862. The price has been stuck under this barrier for six weeks, continuing the downtrend that has defined much of the recent price action. However, if Ethereum can break above $1,862, it could signal the end of the downtrend and the start of a price recovery.

Given the current market sentiment and accumulation by key holders, it is possible that Ethereum will continue to gain upward momentum. If Ethereum successfully breaks through the $1,862 resistance, it could move toward the $2,000 mark, regaining some of the losses from the previous weeks.

On the other hand, should the bearish sentiment intensify, Ethereum’s price may dip further toward its 17-month low of $1,745. Failure to secure support at this level could lead to even greater losses. This could extend the recent downtrend and leave many investors exposed to a prolonged bearish market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PENDLE Token Outperforms BTC and ETH with a 10% Rally

PENDLE has surged by 10% in the past 24 hours, making it the market’s top gainer during this period. The altcoin has even outperformed major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

With buying activity still underway, the PENDLE token is poised to extend its uptrend in the short term.

PENDLE Soars 43% After March Lows

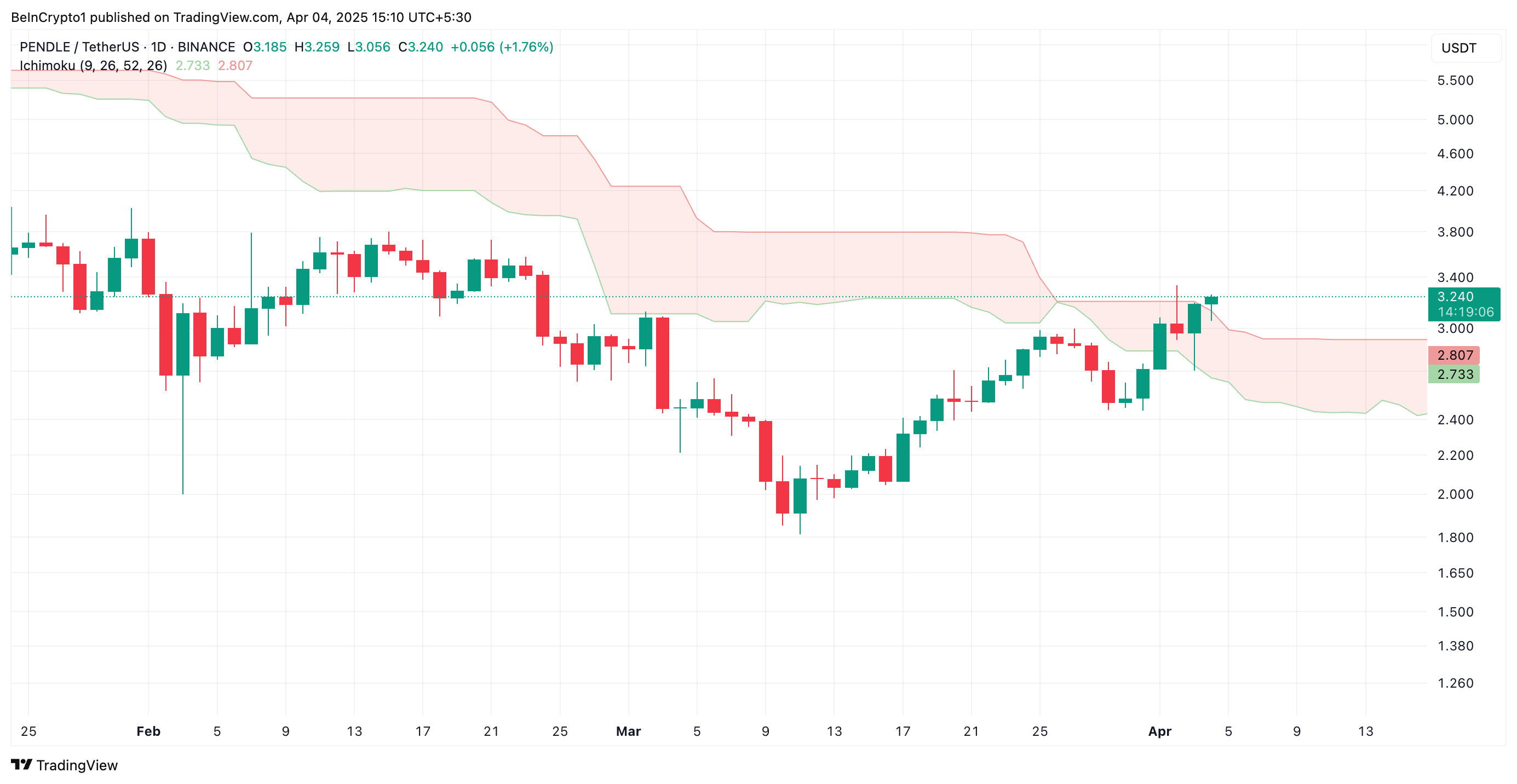

PENDLE cratered to a seven-month low of $1.81 on March 11. As sellers got exhausted, the token’s buyers regained dominance and drove a rally. Trading at $3.24 at press time, PENDLE’s value has since climbed 43%.

The double-digit surge in the altcoin’s price has pushed it above the Leading Spans A and B of its Ichimoku Cloud indicator. They now form dynamic support levels below PENDLE’s price at $2.73 and $2.80, respectively.

The Ichimoku Cloud tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset trades above the leading spans A and B of this indicator, its price is in a strong bullish trend. The area above the Cloud is considered a “bullish zone,” indicating that market sentiment is positive, with PENDLE buyers in control.

This pattern suggests that the token’s price could continue to rise, with the Cloud acting as a support level if prices pull back.

In addition, PENDLE currently trades above its Super Trend indicator, confirming the likelihood of extended gains.

The Super Trend indicator tracks the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, changing color to signify the trend: green for an uptrend and red for a downtrend.

If an asset’s price is above this line, it signals bullish momentum in the market. In this scenario, this line represents a support level that will prevent the price from any significant dips. For PENDLE, this is formed at $2.34.

PENDLE Holds Above Key Trendline

Since its rally began on March 11, PENDLE has traded above an ascending trendline. This pattern forms when a series of higher lows connect, indicating that the price of an asset is consistently rising over time.

It represents a bullish trend, showing that PENDLE demand exceeds supply, with buyers pushing prices higher.

This trendline acts as a support level. With the token’s price bouncing off the trendline, it signals that the asset is in an uptrend and likely to continue. In this scenario, PENDLE could rally to $3.60.

However, if selloffs commence, the PENDLE token could lose some of its recent gains and fall to $3.06.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will the SEC Approve Grayscale’s Solana ETF?

Grayscale has submitted a registration statement with the SEC to convert its Grayscale Solana Trust (GSOL) into an ETF listed on NYSE Arca.

Despite the filing, prediction markets remain unconvinced about the chances of approval.

Is a Solana ETF Approval Still Unlikely for Q2?

On Polymarket, odds for a Solana ETF approval in the second quarter of 2025 stand at just 23%. Broader expectations for any 2025 approval are at 83%, down from 92% earlier this year.

The decline reflects regulatory delays. In March, the SEC extended review timelines for several ETF applications tied to Solana, XRP, and other altcoins.

This pattern suggests the agency may be holding off on decisions until a permanent chair takes over. Mark Uyeda, currently serving as interim chair, has not signaled a shift in stance.

Paul Atkins, Trump’s nominee to lead the agency, appeared before the Senate last week. Lawmakers questioned his involvement in crypto-related businesses, adding further uncertainty around future approvals.

Grayscale’s latest filing excludes staking, which could speed up the review process. The SEC has previously objected to staking features in ETF proposals.

When spot Ethereum ETFs moved forward last year, Grayscale, Fidelity, and Ark Invest/21Shares all removed staking components to align with the SEC’s expectations at the time.

Under Gary Gensler’s leadership, the SEC expressed concern that proof-of-stake protocols could fall under securities law. Asset managers adjusted their applications accordingly to move forward.

Following approvals for spot Bitcoin and Ethereum ETFs, several firms aim to expand their offerings to include other cryptocurrencies. They plan to offer access through traditional brokerage accounts without requiring direct asset custody.

Solana remains a strong contender due to its growing futures market in the US and a more favorable regulatory environment. Analysts view it as one of the next likely approvals if the SEC opens the door to more altcoin ETFs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin23 hours ago

Altcoin23 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market23 hours ago

Market23 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub

-

Market16 hours ago

Market16 hours agoBitcoin Price Still In Trouble—Why Recovery Remains Elusive

-

Altcoin22 hours ago

Altcoin22 hours agoHere’s Why Is Shiba Inu Price Crashing Daily?

-

Market22 hours ago

Market22 hours agoCrypto Market Mirrors Nasdaq and S&P 500 Amid Recession Fears

-

Altcoin21 hours ago

Altcoin21 hours agoExpert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

-

Bitcoin20 hours ago

Bitcoin20 hours agoWhy ETF Issuers are Buying Bitcoin Despite Recession Fears