Market

Is BONK Rally In Jeopardy? Technical Indicators Confirm Weakness

BONK is facing mounting bearish pressure as technical indicators signal growing weakness in the market. After a brief attempt to stabilize, the token appears to be losing momentum dropping again toward the $0.00004002 for another test, with key metrics pointing to further downside. As BONK navigates these challenging conditions, speculations are on whether the meme coin can reclaim its footing or if deeper losses are inevitable.

This analysis dives into BONK’s current market performance under bearish conditions, highlighting the technical indicators that signal potential weakness. Furthermore, we will assess the likelihood of a recovery or a continuation of BONK’s downward trajectory by analyzing critical support levels, market trends, and the broader outlook,

Technical Indicators Signal Growing Weakness For BONK

On the 4-hour chart, BONK exhibits negative sentiment, trading below the 100-day Simple Moving Average (SMA) as it trends downward toward the $0.00004002 support level. A continued descent to this support suggests that selling pressure is intensifying, and if the support fails to hold, the asset could experience more declines.

Also, an analysis of the 4-hour chart reveals that the Relative Strength Index (RSI) has now declined to the 44% level following a previous attempt to rally, which peaked at 49% before losing strength. A declining RSI, particularly as it remains below the neutral 50% level, indicates that bearish momentum is building. If the RSI continues to dip, it could further validate the downtrend, potentially leading to more significant price drops as selling pressure intensifies.

Related Reading

On the daily chart, the meme coin displays notable downward movement, highlighted by a bearish candlestick with a strong rejection wick that has emerged after a failed recovery attempt. The inability to sustain an upside direction implies a lack of buyer confidence and a prevailing negative sentiment in the market. As BONK aims at the $0.00004002 support level, the pressure from sellers could intensify, raising concerns about the possibility of a breakdown.

Finally, the 1-day RSI shows increasing negative pressure on the cryptocurrency, with the signal line dropping sharply from the overbought zone to 56%. This decline marks a shift in momentum, indicating that buying strength is weakening and selling pressure is rising. Should the RSI continue to fall, it could signal sustained pessimistic sentiment and declines for BONK.

Bounce Back Or Further Decline?

Two potential scenarios are likely as BONK faces bearish pressure: a bounce back or further decline. If the meme coin can hold the critical $0.00004002 support level and attract renewed buying interest, it could spark a recovery, possibly reversing the current downtrend and pushing the price to the $0.00006247 resistance range and beyond.

Related Reading

However, if selling pressure persists and BONK fails to sustain the $0.00004002 support level, a deeper decline may follow, with the price potentially dropping to lower support zones, including $0.00002962, $0.00002320, and below.

Featured image from X, chart from Tradingview.com

Market

Will OORT Price Continue to Rise After CZ’s Post?

OORT (OORT), a cryptocurrency rooted in Artificial Intelligence (AI), has seen its price surge 85% over the past week. This jump followed a post by former Binance CEO Changpeng Zhao, who highlighted AI’s potential impact within the BNB Greenfield ecosystem.

Following the altcoin’s reaction, sentiment around it has turned bullish. But why did this happen, and will OORT price continue to rise? This analysis reveals all there is to know about it.

OORT Rises After CZ Speaks on AI in BNB Greenfield

On November 27, Zhao, popularly known as CZ, posted on X (formerly Twitter). He noted that AI should often be used on-chain. In the post, CZ noted that this could foster low transaction costs globally while offering the BNB Greenfield for data storage during the process.

“AI tagging (or AI data in general) is well fitted to be done on-chain. Harness low-cost labor globally without geographic bias, (micro) pay them instantly in crypto. BNB Chain Greenfield provides the storage capacity. More tooling still needs to be built. Let’s build them,” Zhao wrote.

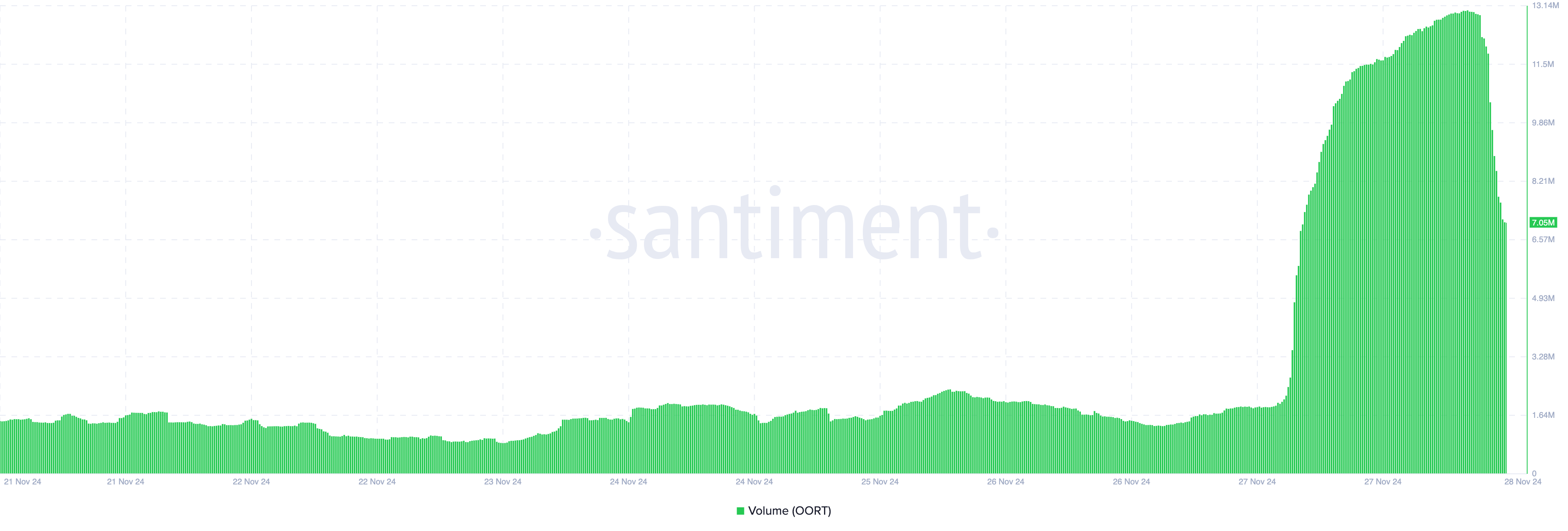

Minutes after development, the price of AI coin OORT skyrocketed from $0.10 to $0.85. For context, OORT is the native token of a decentralized AI technology project that partnered with BNB Greenfield as a storage provider earlier this year in March

This dramatic price surge may be tied to OORT’s integration with the BNB Greenfield, a decentralized storage platform hosted on the BNB Chain. Beyond the price hike, the development drove the AI-themed altcoin’s volume to $13 million, signifying increased interest in it.

However, as of this writing, the price has dropped to $0.15 while the volume has also decreased to $7.05 million.

OORT Price Prediction: Rebound to $0.20 Possible

The daily OORT/USD chart reveals that the Bull Bear Power (BBP) has moved into positive territory, indicating that buyers (bulls) currently hold the upper hand over sellers (bears).

When BBP is negative, bears dominate, often leading to price declines. However, in this case, the bulls’ strength suggests a potential rebound in OORT’s price, with data also suggesting that it could correlate strongly with BNB’s price.

If buying pressure persists, the Fibonacci retracement indicator suggests that the altcoin could climb to $0.20. Conversely, if interest in the AI coin wanes, the price may decline to $0.11. Instead, the value could drop to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

$1.7 Million Stolen, User Withdrawals Suspended

XT.com, a Seychelles-based crypto exchange handling over $3.4 billion in daily trading volume, has experienced a suspected hack involving $1.7 million.

Since then, the platform has suspended all customer withdrawals.

Blockchain security firm PeckShield revealed that the attacker had already converted the stolen funds into 461.58 Ether. XT.com initially said withdrawals were suspended due to wallet upgrades and maintenance.

However, the exchange has since acknowledged the incident and stated that user funds were not affected. XT.com also assured users that withdrawal services would gradually resume starting tomorrow, November 29.

“Today, XT detected an abnormal transfer from our platform wallet. Rest assured, this will not affect our users. We always maintain reserves 1.5x greater than user assets to ensure maximum security. Our team is investigating, and we remain committed to protecting your assets,” the exchange posted on X (formerly Twitter).

Founded in 2018, XT.com allows trading for more than 1,000 cryptocurrencies. According to CoinGecko data, it’s the 21st largest centralized exchange based on daily trading volume.

“The amount involved in this incident is approximately 1 million USDT across 12 different currencies. These assets are owned by the platform and will not in any way harm the interests of our customers or users,” XT.com said in official statement.

Crypto Hacks Are Not Slowing Down

Cyber attacks continue to be a major pain point for the crypto industry. Despite notable advancements in smart contract security and increasing crypto adoption, hacks continue to rack up millions every year.

By September 2024, cybercriminals had stolen $2.1 billion from the industry. This is significantly higher than the $1.6 billion stolen throughout 2023. The overvall value by the end of 2024 will be much higher.

In October, blockchain lender Radiant Capital suffered its second major attack of the year, losing over $50 million in a multi-chain exploit. Hackers compromised a private key, enabling them to drain user assets through automated wallet functions.

Back in July, one of India’s largest exchanges, WazirX, suffered a $235 million breach. The exchange even offered a $23 million bounty for the hacker to return the funds but in no vain.

WazirX customers are yet to receive reimbursement for their lost funds. Recently, the Indian police arrested an individual who was linked to the hack. However, the wider investigation remains open.

The latest XT.com hack shows yet again how vulnerable centralized exchanges are to the growing cyber threats.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hidden Altcoins Gems For December

November was marked by Bitcoin reaching a new all-time high, with other coins like Solana and SUI following its lead. Although the altcoins season may not be here yet, as BTC continues to dominate the charts, projects like Virtual Protocol (VIRTUAL), Pyth Network (PYTH), and Raydium (RAY) are showcasing impressive growth.

VIRTUAL has surged 71.29% in the last seven days, driven by the narrative about artificial intelligence coins. Meanwhile, PYTH and RAY are capitalizing on ecosystem dominance and utility, with both tokens gaining significant traction and highlighting the expanding potential of DeFi and blockchain technology.

Virtual Protocol (VIRTUAL)

Recently achieving a new all-time high, VIRTUAL broke past the $1 billion market cap and solidified its position as a rising star in the artificial intelligence altcoins narrative.

The coin has surged 161.75% in the past month, driven by growing interest in AI-focused blockchain projects. As the AI coin narrative continues to gain traction, VIRTUAL’s momentum suggests there could still be significant upside potential.

This recent surge has propelled VIRTUAL to become the fifth-largest AI coin by market cap. It now ranks behind RENDER, TAO, FET, and WLD while surpassing AKT.

Pyth Network (PYTH)

Pyth (PYTH), the native token of Pyth Network, has risen 27.14% over the past 30 days, reflecting renewed interest in the blockchain oracle for market data. While PYTH reached an all-time high of $1.15 on March 16, 2024, its price remains roughly 60% below that level.

The network’s TVL has grown to $520 million from $408 million last month. That shows progress but is still far below its record $1.37 billion in March.

If PYTH maintains its current momentum, it could break through the $0.49 resistance and test $0.55 or even $0.60 in the near term. Its oracle business could also be positively impacted by altcoins season.

Raydium (RAY)

Raydium (RAY) has emerged as the most dominant decentralized exchange globally, surpassing platforms like Uniswap and PancakeSwap in fees generated.

Over the past 30 days, Raydium has brought in over $200 million in fees, outperforming major projects like Jito, Solana, Ethereum, Circle, and Uniswap, second only to Tether. Raydium could continue growing as meme coins become more relevant in the crypto ecosystem.

RAY is currently up 61.40% in the past month and an astounding 1,345.81% in the past year, though it remains 67.87% below its all-time high from 2021.

Given Raydium’s dominance and rapid growth, the token’s recent performance could signal the beginning of an even stronger upward trajectory as altcoins season is just getting started.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation22 hours ago

Regulation22 hours agoVancouver mayor proposes Bitcoin as city reserve asset for stability

-

Market18 hours ago

Market18 hours agoThis is Why Paul Atkins Will Likely Lead Trump’s SEC After Gensler

-

Altcoin11 hours ago

Altcoin11 hours agoSHIB Burn Rate Spikes 4500%, Shiba Inu Coin To Set Go Parabolic?

-

NFT10 hours ago

NFT10 hours agoBitBasel + VESA

-

Market21 hours ago

Market21 hours agoXRP Price Bullishness Continues, Analyst Shoots For $1.9 With Next Leg-Up

-

Market20 hours ago

Market20 hours agoThis Is Why Ethereum Price May Evade Falling Below $3,000

-

Market19 hours ago

Market19 hours agoBitWise Files for 10 Crypto Index ETF as SEC Review Begins

-

Regulation19 hours ago

Regulation19 hours agoPro-XRP Lawyer John Deaton Endorses Paul Atkins as Potential SEC Chair