Market

Which Are the Top DePIN Altcoins to Watch in December 2024?

As November ends and December 2024 begins, investors are likely to shift their focus toward portfolio rebalancing or exploring new altcoin opportunities. The Decentralized Physical Infrastructure Network (DePIN) narrative is gaining attention, making it a key sector to watch. Here are some top DePIN altcoins to keep an eye on.

In this analysis, BeInCrypto discusses five top DePIN altcoins to watch next month, highlighting why these cryptos may garner a lot of attention in the market. They include Filecoin (FIL), Arweave (AR), Grass (GRASS), io.net (IO), and NetMind Token (NMT).

Filecoin (FIL)

Filecoin, which has a market capitalization of $3.44 billion, tops the list of DePIN altcoins to watch in December. For an altcoin that lost a chunk of its value during the second and third quarters, Filecoin has shown strength within the last 30 days.

Over this mentioned period, the price has increased by 56.22%. However, it is still largely down from its all-time high, suggesting that it still has more room to grow.

From a technical point of view, the Awesome Oscillator (AO), which measures momentum, has continued to remain in the positive region. Typically, when the AO is negative, momentum is bearish.

But when it is positive, it is bullish, which is the case with FIL. If this remains the case, the altcoin’s price might climb to $6.50 within the first few days in December. However, if momentum turns bearish, that may not happen, and Filecoin could drop to $4.96.

Arweave (AR)

Second on the list of the top DePIN coins to watch is Arweave, a project focused on a decentralized storage network. Over the last seven days, AR’s price has increased by 20.98%, making it one of the best-performing altcoins in the top 100.

At press time, the token’s price is $21.13. The daily chart shows that the altcoin hit this price due to the formation of an inverse head-and-shoulders pattern.

This pattern is a bearish to bullish reversal that was validated after AR bottomed at $133. However, the token currently faces resistance at $22.05 but could help AR breach this obstacle.

Should this happen, the Arweave’s price could climb to $24.57 in the short term. If buying pressure increases, this might be higher. However, if bears have the upper hand, the price could decrease to $18.96.

Grass (GRASS)

In October, BeInCrypto named GRASS one of the top DePIN altcoins to watch in November. Interestingly, the recently launched project did not disappoint, climbing by 300% within the last 30 days.

Currently, GRASS’ price is $3.48 and has been hitting lower highs (LH) on the 4-hour chart. Due to this price movement, the altcoin’s value could likely hit a new all-time high in December, surpassing $3.90 in the process.

If that happens, then it might not be out of place to see GRASS at $5. On the flip side, if the altcoin loses this bullish momentum, this prediction might not come to pass. Instead, it could decrease to $2.81.

io.net (IO)

Another DePIN altcoin to watch in December is io.net, which prides itself on being the world’s largest decentralized AI computing network. Within the last 30 days, IO’s price has increased by 65.13% while trading at $2.93.

On the daily chart, IO’s price has risen above the 20-day Exponential Moving Average (EMA). This position means that the trend around the altcoin is bullish, and the price might continue to climb.

If the token continues to hold this position, its value could rise above $4 in December. On the other hand, if interest in IO drops, the prediction might be invalidated, and the token could decline below $2.

NetMind Token (NMT)

The top DePIN altcoins to watch will be incomplete without mentioning NetMind Token, which is a token built on the BNB Chain. Today, NMT’s price is $3.76, while its trading volume has increased by 350% in the last 24 hours.

This surge in volume indicates rising interest in the token. NMOR’s value has increased by 76.10% since yesterday. Between September 25 and November 5, NetMind Token’s price dropped from $3.89 to $1.29.

But since then, bulls have been pushing the value higher. In December, the altcoin’s price is likely to go higher. If that is the case, the cryptocurrency could climb above $5.

But if profit-taking rises, this might not happen. Instead, NMT’s price could drop to $2.72.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Vulnerable To Falling Below $2 After 18% Decline

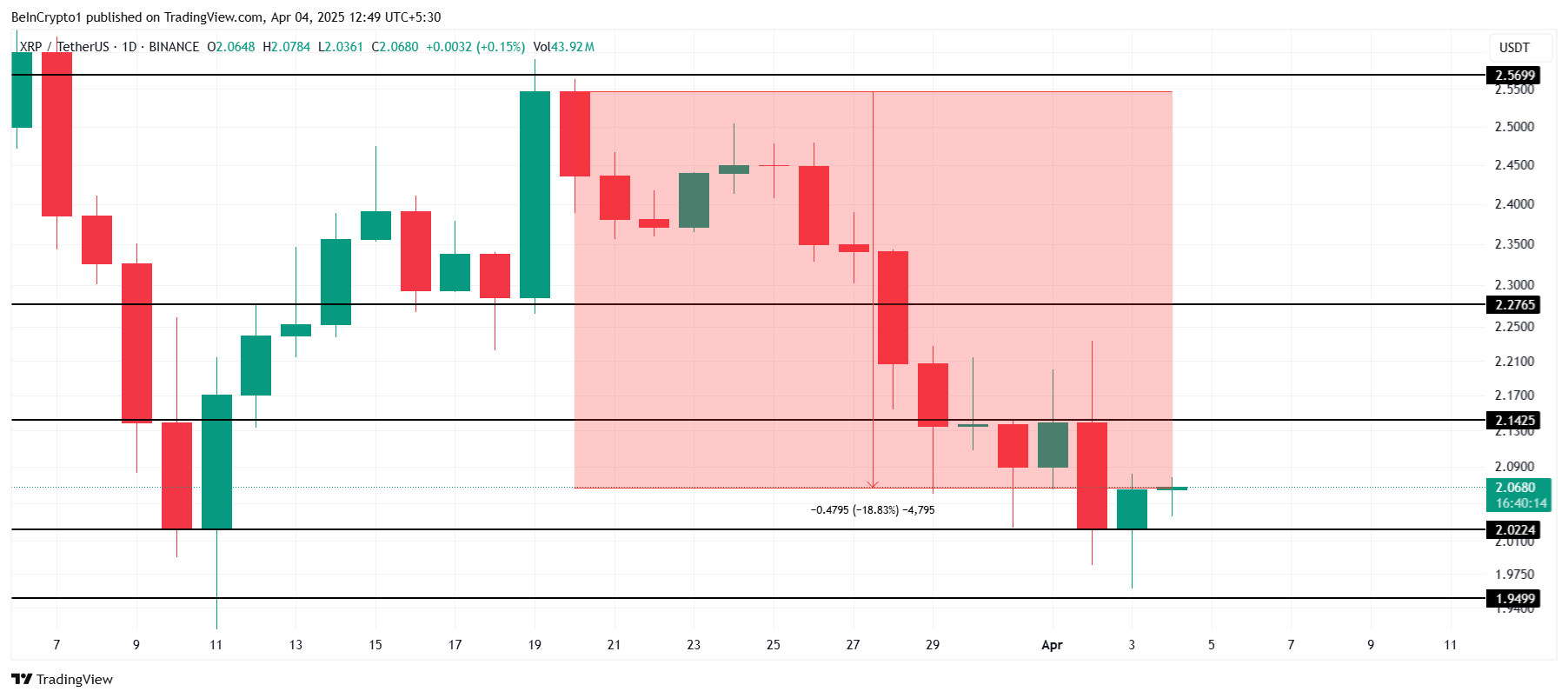

XRP has faced a significant correction in recent weeks, resulting in an 18% decline in the altcoin’s price. As a result, XRP is currently struggling to maintain upward momentum, with investors losing confidence.

This recent slump has raised concerns about the asset’s future, especially as certain XRP holders begin to sell their positions, increasing bearish pressure.

XRP Investors Are Pulling Back

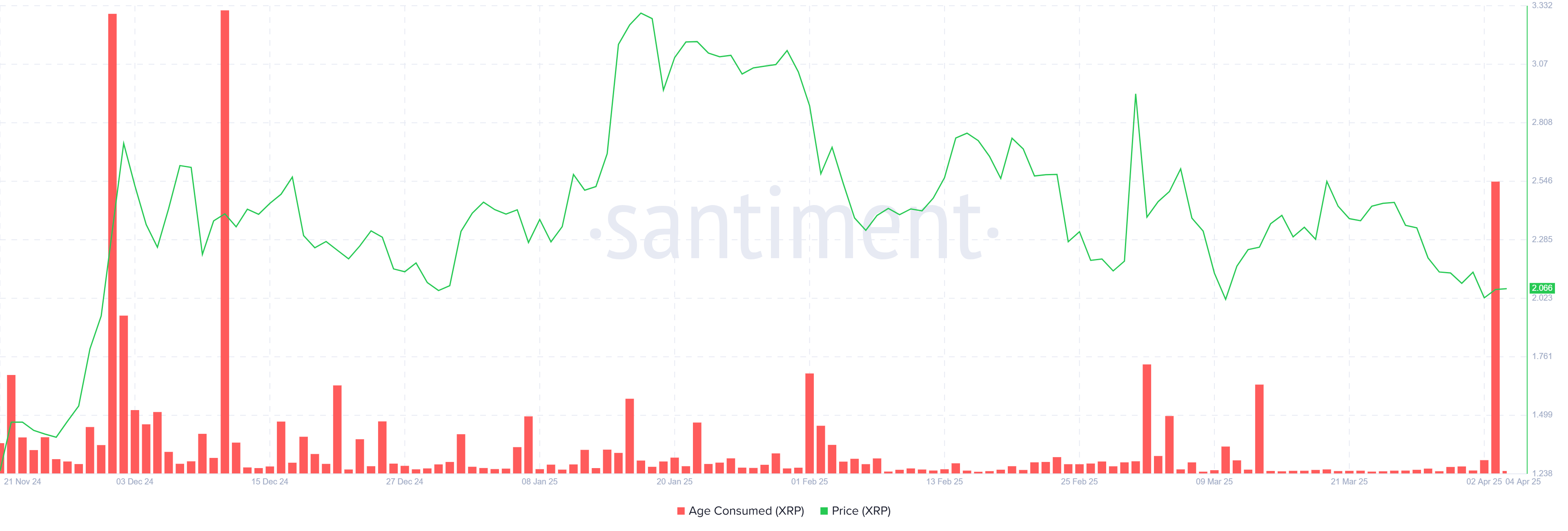

The recent downturn in XRP’s price has triggered a sharp spike in the “Age Consumed” metric. This indicator tracks the movement of coins from long-term holders (LTHs) and has reached its highest level in over four months. The increase suggests that LTHs, who have been holding XRP for extended periods, are now losing patience.

This selling behavior may be driven by the lack of price recovery and the overall weak market conditions that have not improved. These holders appear to be attempting to limit their losses by liquidating their positions, which in turn increases the downward pressure on XRP’s price. This mass selling from LTHs further compounds the challenges for XRP, as their decision to sell is often seen as a sign of waning confidence in the cryptocurrency.

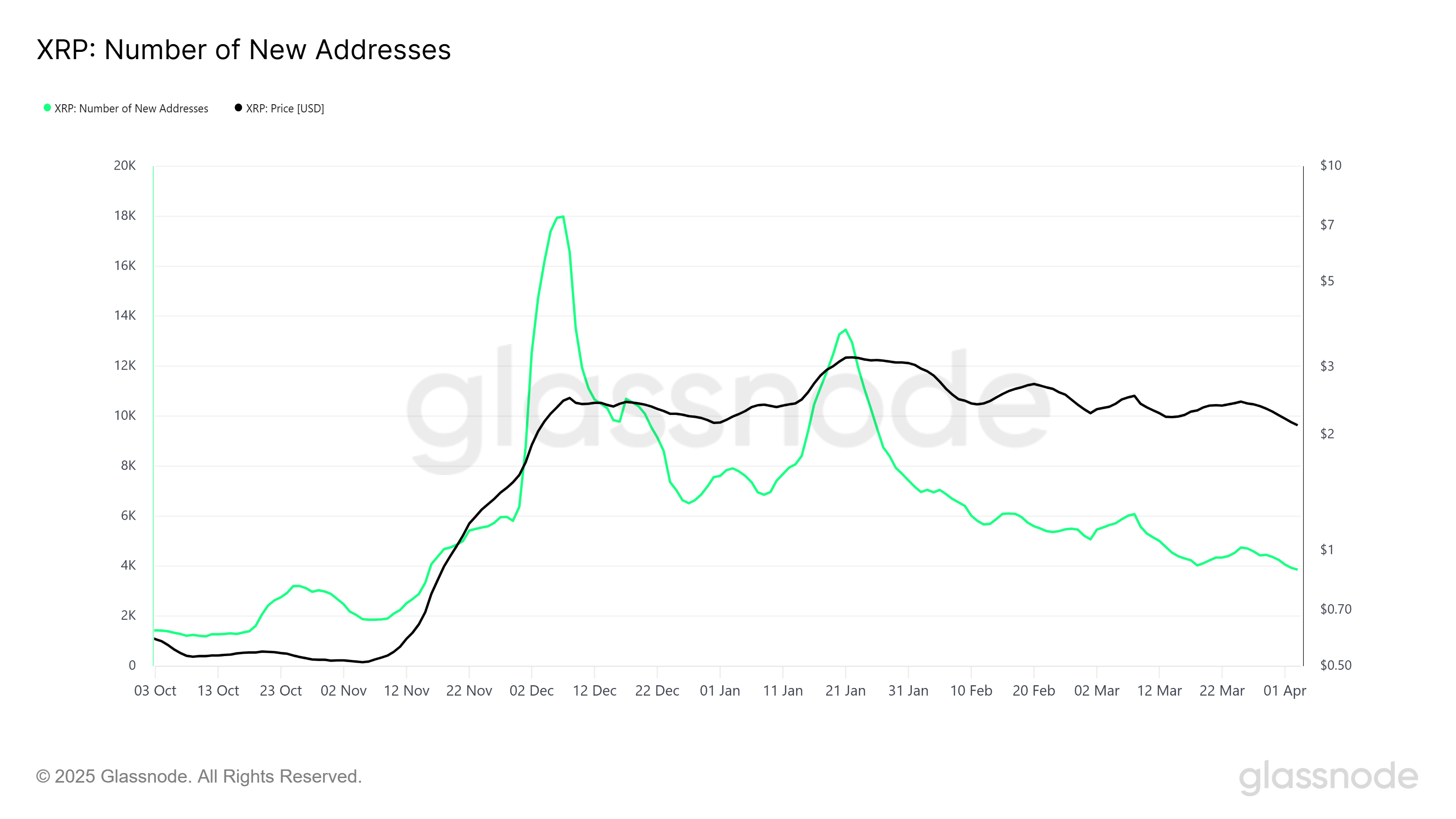

XRP’s market momentum appears to be weakening, as evidenced by the recent decline in the number of new addresses. The metric tracking new addresses has fallen to a five-month low, suggesting that XRP is struggling to attract new investors. This lack of fresh interest signals growing skepticism within the broader market, with potential investors hesitant to buy into an asset that has failed to deliver strong price action.

The drop in new addresses reflects a broader trend of reduced market traction and the lack of conviction from buyers. When combined with the selling pressure from LTHs, it creates a challenging environment for XRP to regain bullish momentum

XRP Price Needs A Boost

XRP’s price is currently holding at $2.06, just above the key support level of $2.02. If it manages to stabilize and break through the immediate resistance at $2.14, there could be a potential rebound, taking XRP higher.

However, with the continued weakness in market sentiment and the aforementioned bearish cues, XRP remains vulnerable to further declines. If the support of $2.02 fails, the price could drop further to $1.94, extending the 18% decline noted in the last two weeks.

If XRP manages to reclaim the $2.14 level and holds above it, the price could make its way toward $2.27. Breaching this level would invalidate the bearish outlook, signaling a potential recovery and restoring investor confidence in the cryptocurrency.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Futures Traders Lead the Charge as Buying Pressure Grows

Hedera Foundation’s recent move to partner with Zoopto for a late-stage bid to acquire TikTok has sparked renewed investor interest in HBAR, driving a fresh wave of demand for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling growing confidence in HBAR’s future price performance.

HBAR’s Futures Market Sees Bullish Spike

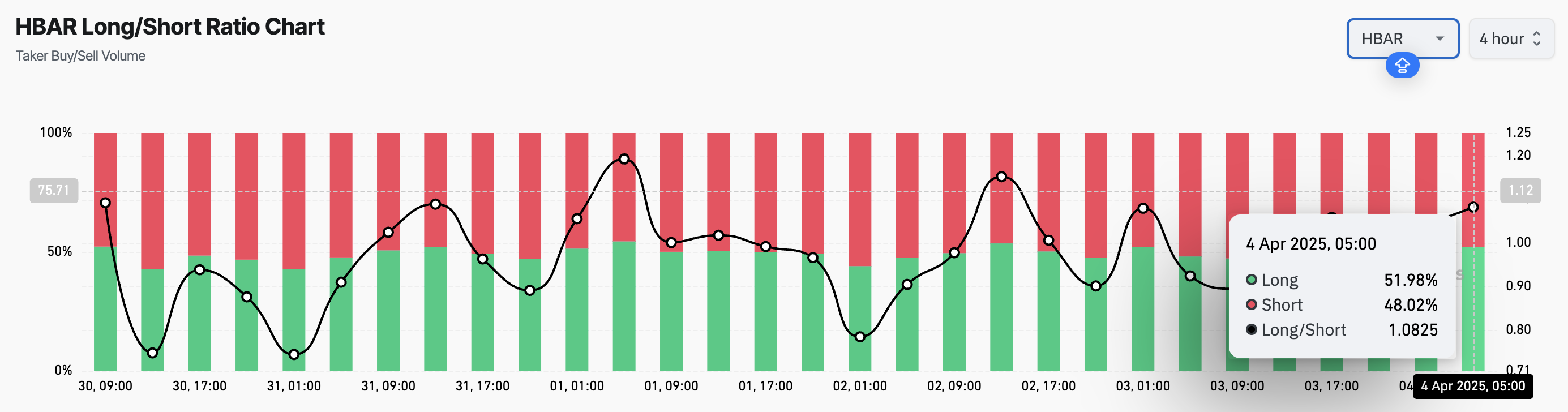

HBAR’s long/short ratio currently sits at a monthly high of 1.08. Over the past 24 hours, its value has climbed by 17%, reflecting the surge in demand for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) in the market.

When the long/short ratio is above one like this, more traders are holding long positions than short ones, indicating bullish market sentiment. This suggests that HBAR investors expect the asset’s price to rise, a trend that could drive buying activity and cause HBAR’s price to extend its rally.

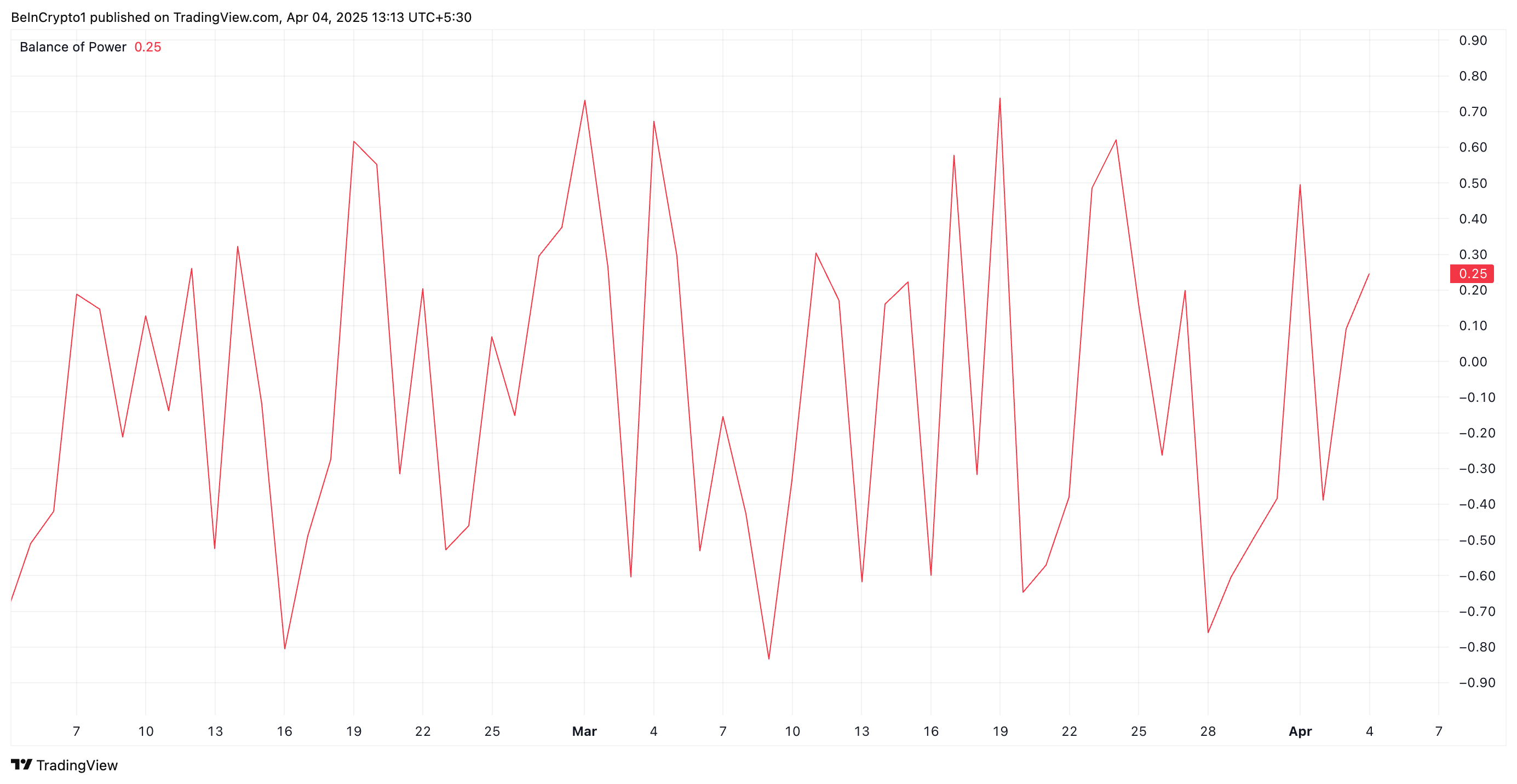

Further, the token’s Balance of Power (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures buying and selling pressure, is above zero at 0.25.

When an asset’s BoP is above zero, buying pressure is stronger than selling pressure, suggesting bullish momentum. This means HBAR buyers dominate price action, and are pushing its value higher.

HBAR Buyers Push Back After Hitting Multi-Month Low

During Thursday’s trading session, HBAR traded briefly at a four-month low of $0.153. However, with strengthening buying pressure, the altcoin appears to be correcting this downward trend.

If HBAR buyers consolidate their control, the token could flip the resistance at $0.169 into a support floor and climb toward $0.247.

However, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could resume its decline and fall to $0.129 in that scenario.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin is Far From a Bear Market But not Altcoins, Analysts Claim

Welcome to the US Morning Crypto Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee to see how Bitcoin is holding firm above $79,000 despite a sharp equities sell-off. Markets are bracing for the March NFP report and rising recession risks. With Fed rate cuts on the table and ETF inflows staying strong, all eyes are on what’s next for macro and crypto markets.

Is Bitcoin in a Bear Market?

The highly anticipated March U.S. non-farm payrolls (NFP) report is due later today, and it’s expected to play a key role in shaping market sentiment heading into the weekend.

“With the key macro risk event now behind us, attention turns to tonight’s non-farm payroll report. Investors are bracing for signs of softness in the U.S. labour market. A weaker-than-expected print would bolster the case for further Fed rate cuts this year, as policymakers attempt to cushion a decelerating economy. At the time of writing, markets are pricing in four rate cuts in 2025—0.25 bps each in June, July, September and December,” QCP Capital analysts said.

Traditional markets are increasingly pricing in a recession, with equities retreating sharply—a 7% decline overall, including a 5% drop just yesterday. This broad de-risking environment helps explain the current pause in crypto inflows.

On the derivatives front, QCP adds:

“On the options front, the desk continues to observe elevated volatility in the short term, with more buyers of downside protection. This skew underscores the prevailing mood – uncertain and cautious.”

However, they also note that “with positioning now light and risk assets largely oversold, the stage may be set for a near-term bounce.”

Bitcoin remains resilient despite market volatility, holding above $79,000 with strong ETF inflows and signs of decoupling from stocks and altcoins. According to Nic Puckrin, crypto analyst, investor, and founder of The Coin Bureau: “Bitcoin is nowhere near a bear market at this stage. The future of many altcoins, however, is more questionable.”

Chart of the Day

Chances of a US Recession in 2025 jumped above 50% for the first time, currently at 53%.

Byte-Sized Alpha

– Major ETF issuers are buying Bitcoin, with $220 million in inflows showing strong confidence despite volatility.

– Futures show bullish BTC sentiment, but options traders remain cautious, signaling mixed market outlook.

– Coinbase is launching XRP futures after Illinois lawsuit relief, signaling growing regulatory support for crypto.

– Despite Trump’s tariff-driven crash, analysts see potential for a Bitcoin rebound—though inflation may cap gains.

– The Anti-CBDC bill passed a key House vote, aiming to block Fed-issued digital currencies and protect privacy.

– Today at 11:25 AM, Fed Chair Jerome Powell will deliver a speech on the U.S. economic outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoBinance Managed 94% of All Crypto Airdrops and Staking Rewards

-

Market19 hours ago

Market19 hours agoWormhole (W) Jumps 10%—But Is a Pullback Coming?

-

Altcoin19 hours ago

Altcoin19 hours agoAltcoin Season Still In Sight Even As Ethereum Struggles To Gain Upward Momentum

-

Market23 hours ago

Market23 hours agoPi Network Price Falls To Record New Low Amid Weak Inflows

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Acknowledges Fidelity’s Filing for Solana ETF

-

Market21 hours ago

Market21 hours agoXRP Battle Between Bulls And Bears Hinges On $1.97 – What To Expect

-

Market20 hours ago

Market20 hours agoRipple Shifts $1B in XRP Amid Growing Bearish Pressure

-

Market18 hours ago

Market18 hours agoBinance’s CZ is Helping Kyrgyzstan Become A Crypto Hub