Market

How Did Long-Term Bitcoin Holders Reacted to BTC’s Rally?

Long-term Bitcoin (BTC) holders have started taking profits since the cryptocurrency price attempted to reach $100,000. As a result, Bitcoin’s price has retraced to $93,000, affecting the value of the broader crypto market capitalization.

Is Bitcoin’s price rebounding? Short-term investors may want to know as this on-chain analysis examines the chances.

Activity Around Bitcoin Drops, Holders Book Gains

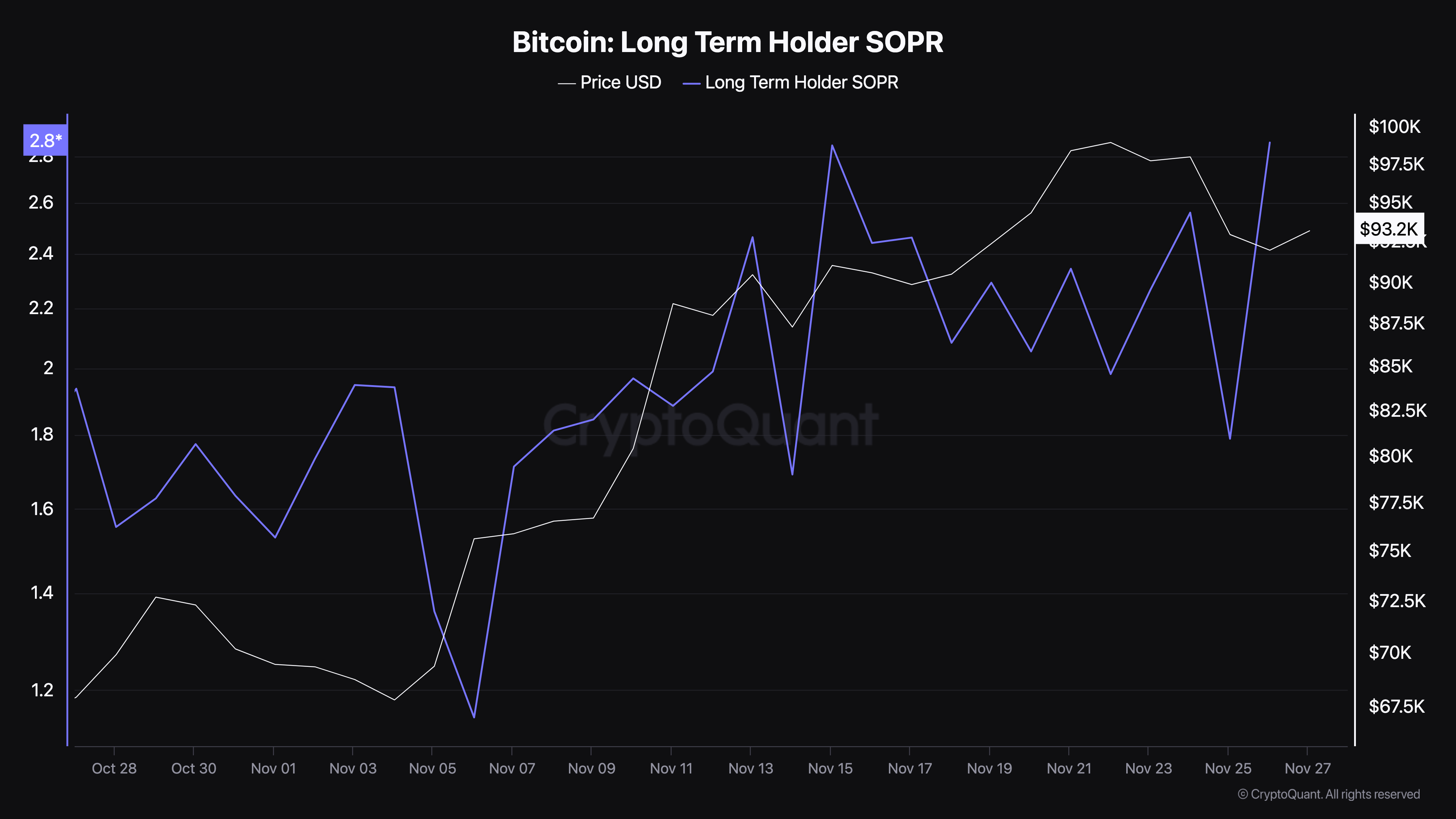

According to CryptoQuant, Bitcoin’s long-term profit output ratio has surged to 2.86. This ratio measures the activity of long-term investors who have held the coin for more than 155 days.

When the ratio is over 1, it means that these long-term Bitcoin holders are selling at a profit. On the other hand, if the profit output ratio is less than 1, it implies that holders are selling at a loss. Since the reading is higher, it indicates that these holders are booking profits from the recent price hike.

Besides that, it is noteworthy to mention that this profit-taking is the highest holders have taken since August 30. Should this continue, then BTC price risks falling below the $93,000 threshold.

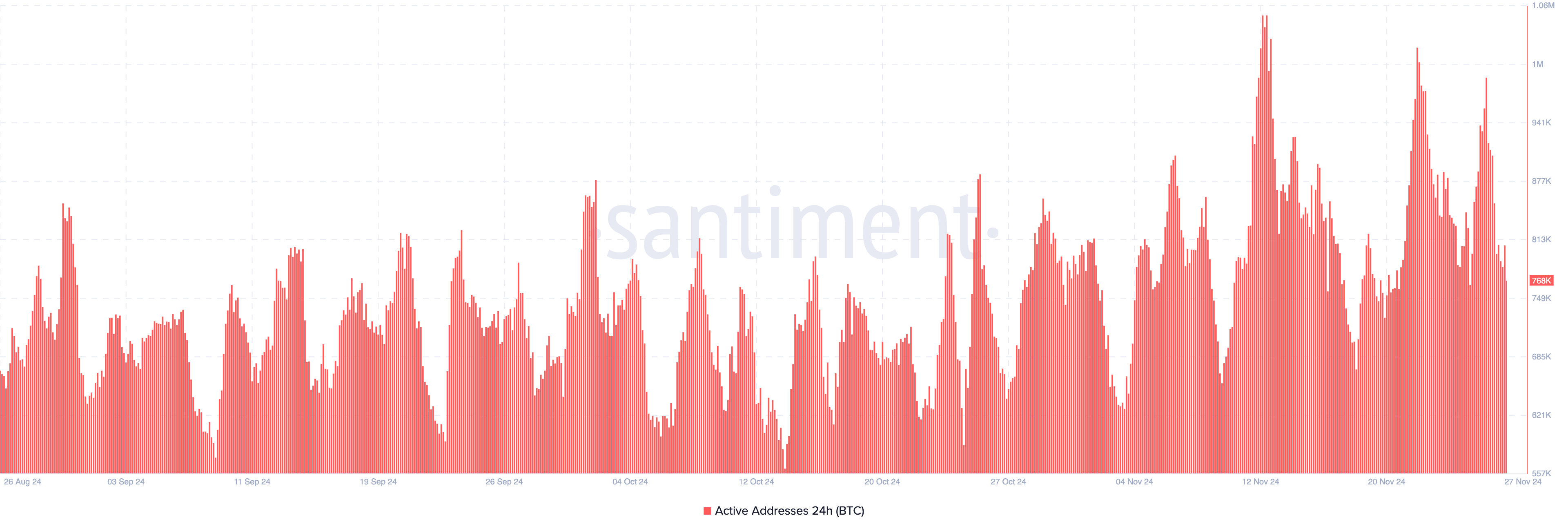

Beyond that, active addresses on the Bitcoin network have significantly decreased this week, which could spell trouble for the cryptocurrency’s price if the trend persists. Active addresses measure the number of unique addresses involved in transactions, reflecting user engagement with the blockchain.

When active addresses increase, it indicates growing network activity and adoption. Conversely, a decline suggests reduced participation.

On November 26, Bitcoin’s active addresses were nearly 1 million, showcasing significant traction. However, as of this writing, the figure has dropped to 768,000, a noticeable decline. If active address activity continues to wane, it may signal weakened market sentiment and could contribute to further price declines, as previously highlighted.

BTC Price Prediction: Time to Go Below $90,000?

On the daily chart, Bitcoin’s price has fallen below the dotted lines of the Parabolic Stop and Reverse (SAR) indicator. This technical tool identifies support and resistance levels.

Dotted lines below the price signal strong support, while lines above the price suggest resistance that could lead to a decline. Currently, Bitcoin faces the latter scenario.

If this resistance persists, BTC could drop to $84,640. However, if long-term holders reduce profit-taking, Bitcoin’s value might rise instead, potentially reaching $99,811.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

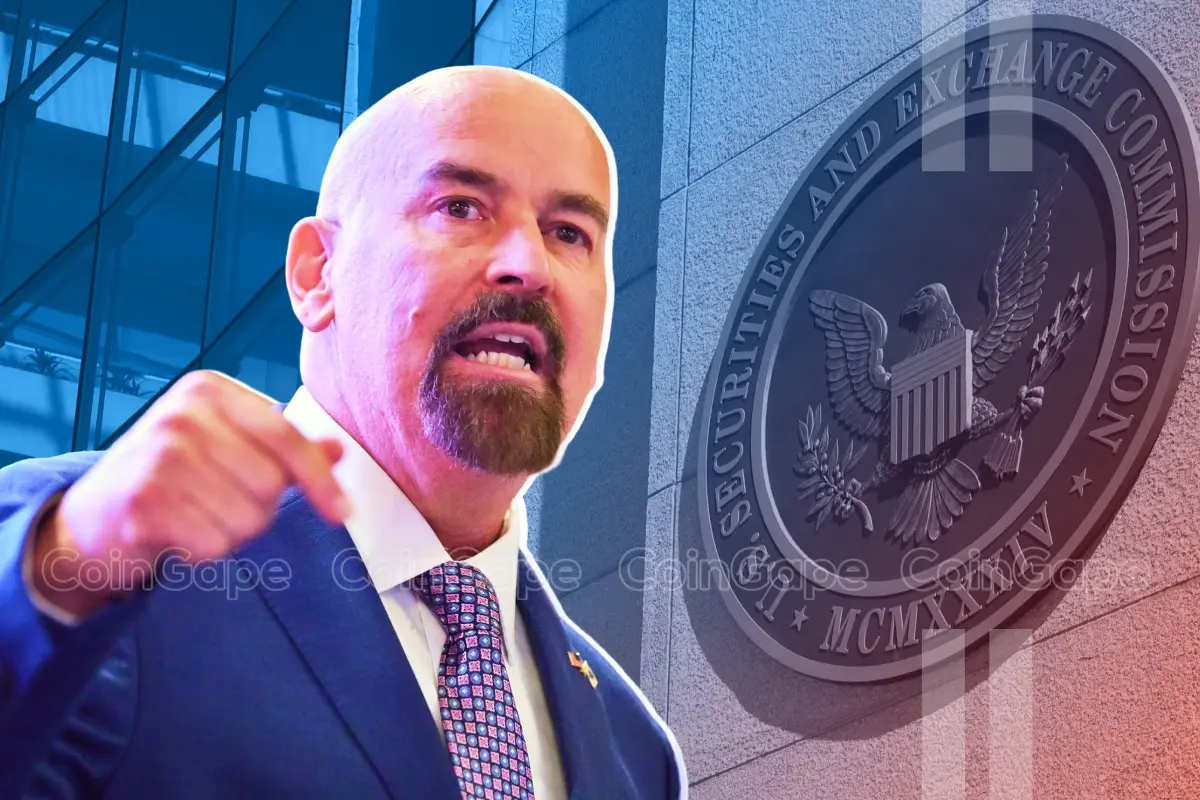

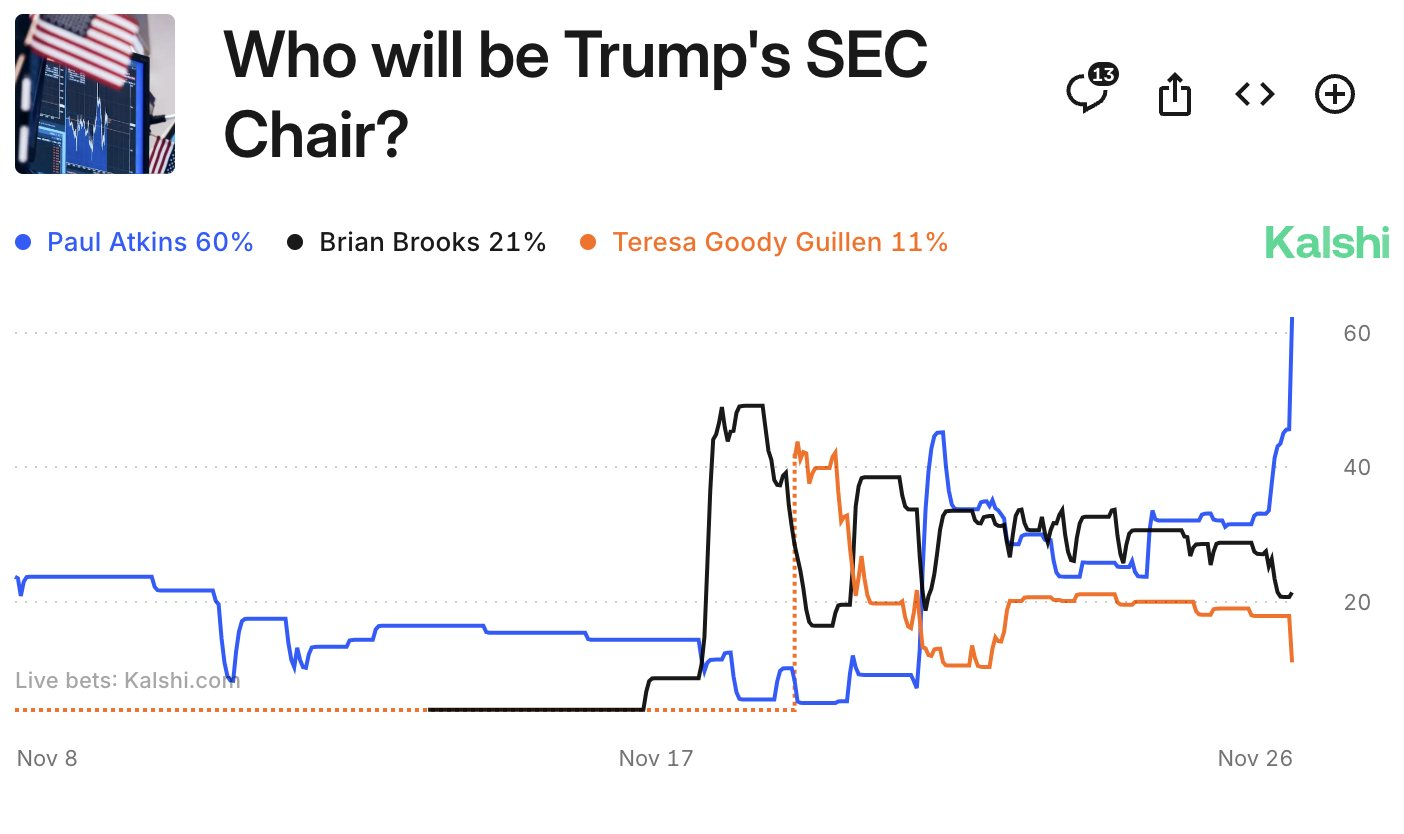

This is Why Paul Atkins Will Likely Lead Trump’s SEC After Gensler

President-elect Donald Trump reportedly interviewed Paul Atkins for the position of SEC Chair. Several reports claimed that Atkins is the current favorite for the role, boosting his prediction market odds.

Atkins previously served as the SEC Chair and pursued crypto advocacy in the private sector after his tenure concluded.

Paul Atkins: The Next SEC Chair?

According to a Bloomberg report, Trump is considering Atkins to be a leading candidate for this role. Since 2020, Atkins has been serving on the advisory board of the Chamber of Digital Commerce. He’s a known advocate for blockchain development and investments.

If selected, Atkins will replace Gary Gensler in late January once Trump takes office. The current SEC chair announced his impending resignation earlier this month while also defending his pessimistic perspective towards the crypto market.

“Atkins is someone who is not only crypto-savvy but possesses a deep understanding of the inner workings of the agency as both a former commissioner and staffer. Atkins is seen as being capable of establishing a pro-innovation agenda while returning the agency to a … standard many… feel was lost under… Gensler,” claimed Fox Business reporter Eleanor Terrett.

Donald Trump has sworn to support crypto through a sweeping plan of appointments and reforms in his upcoming administration. Although Trump plans to turn over much of the SEC’s jurisdiction over crypto to the CFTC, the SEC is nevertheless a vital component of crypto regulation. In this role, Atkins could significantly benefit the industry.

Terrett claimed that Atkins is currently the most likely candidate for the position, but this is not set in stone. Several other candidates, including those with SEC experience, are also in the funning. For example, “Crypto Mom” Hester Peirce is also a possible candidate, and she is a current SEC Commissioner under Gensler.

If nothing else, these rumors have proved credible in the past. As BeInCrypto reported earlier, Trump also nominated pro-crypto candidate Scott Bessent for the role of Treasury Secretary. If this buzz proves correct, Paul Atkins will lead a much friendlier SEC than Gensler’s.

Overall, it’s now becoming highly likely that the US will have a pro-crypto advocate as the SEC leader and its regulatory scrutiny of the industry will likely ease.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BitWise Files for 10 Crypto Index ETF as SEC Review Begins

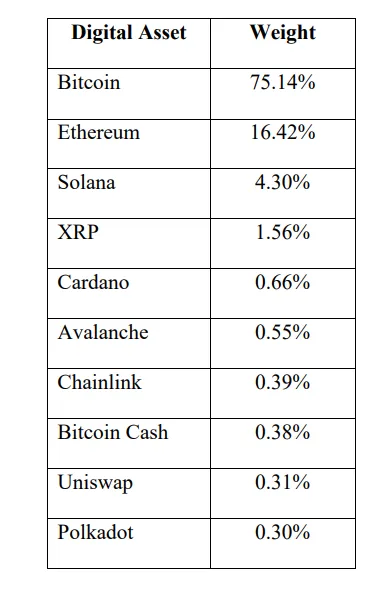

BitWise filed an application with the SEC to create an ETF based on its 10 Crypto Index Fund. If approved, this would be the most diversified and extended crypto ETF in the US market.

Earlier this week, BitWise also filed for a Solana ETF with the SEC, following the applications of Canary Capital, VanEck, and 21Shares

BitWise is Looking to Expand its Crypto ETF Offerings

According to the filing, the fund includes Bitcoin, Ethereum, Solana, XRP, Cardano, Avalanche, Chainlink, Bitcoin Cash, Polkadot, and Uniswap. BitWise has maintained this initial fund since 2018, correlating its value with the ten most highly valued cryptocurrencies.

“Remember when I was speculating that ADAs HUGE price movement was from someone purchasing ADA for an ETF? NYSE Arca just submitted a filing to the SEC to launch a Bitwise 10 Crypto Index Fund with Cardano as the fifth largest asset. I imagine Coinbase will follow, first of many,” influencer Big Pey posted on X (formerly Twitter).

BitWise joined the crypto ETF market earlier this year with its Bitcoin ETF (BITB). The firm was among the first ten applicants to file for an ETF with the SEC.

With the filing of this latest application, it seems like BitWise is looking to leverage the growing institutional appeal toward the broader crypto market. The firm also recently filed for an XRP exchange-traded product (ETP) in Europe.

The SEC officially acknowledged this submission, starting a countdown for the Commission to either reject or approve it. However, a deadline for deciding on this application has yet to be confirmed.

Overall, a new friendliness to the crypto industry is sweeping the US financial regulatory apparatus. Under Trump’s administration and a new SEC leader, the industry is likely to see more diverse ETFs being approved.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Is Why Ethereum Price May Evade Falling Below $3,000

Recently, Ethereum (ETH) showed signs of falling below $3,000 but held firm as bulls defended the altcoin.

Now trading at $3,480, here’s what could be next for ETH.

Ethereum Still Has More Room to Grow

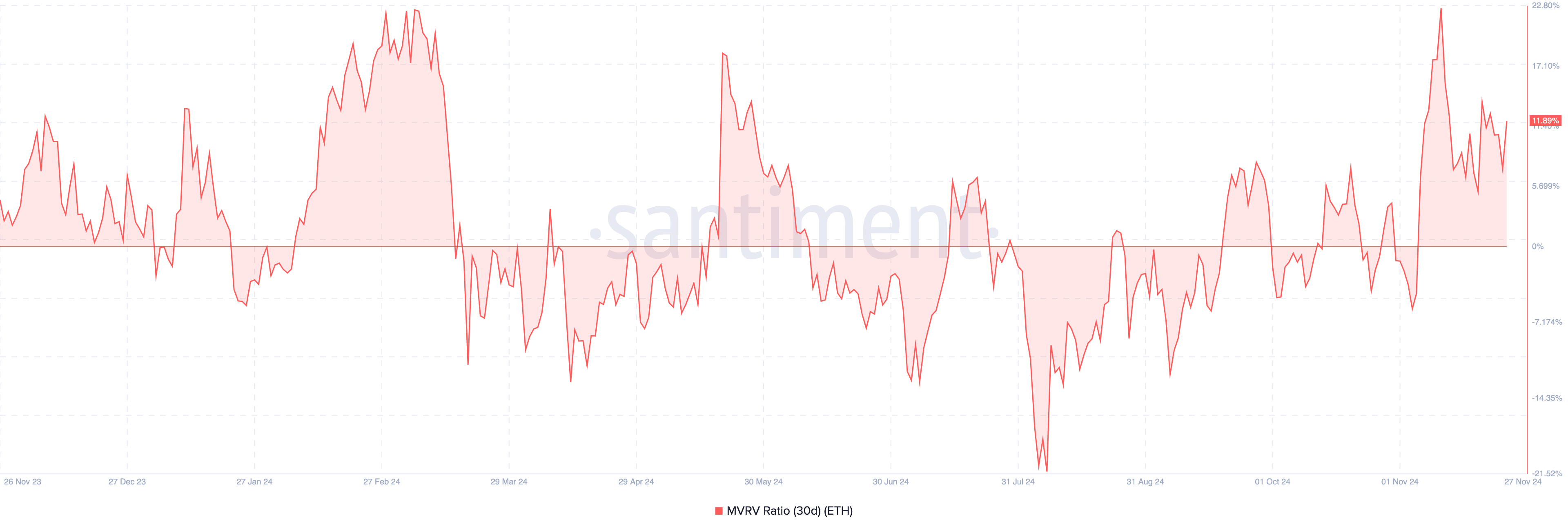

One metric that has consistently proven reliable for analyzing Ethereum is the Market Value to Realized Value (MVRV) ratio, a tool for assessing the profitability of holders and identifying potential market tops or bottoms. The MVRV ratio compares a cryptocurrency’s market value to its realized value, offering insights into whether the asset is overvalued or undervalued.

When the MVRV ratio rises, it indicates that more holders are in profit. However, if it climbs to an extreme high, it suggests the asset may be overvalued, increasing the risk of a price correction. Conversely, when the MVRV ratio declines, it points to reduced profitability.

If the ratio hits an extreme low, it signals undervaluation, which can present an attractive accumulation opportunity for investors. For ETH, the 30-day MVRV ratio has risen to 11.89%. However, this ratio is not close to the local top, which is usually around 18% and 22%. Therefore, this development suggests that Ethereum’s price.

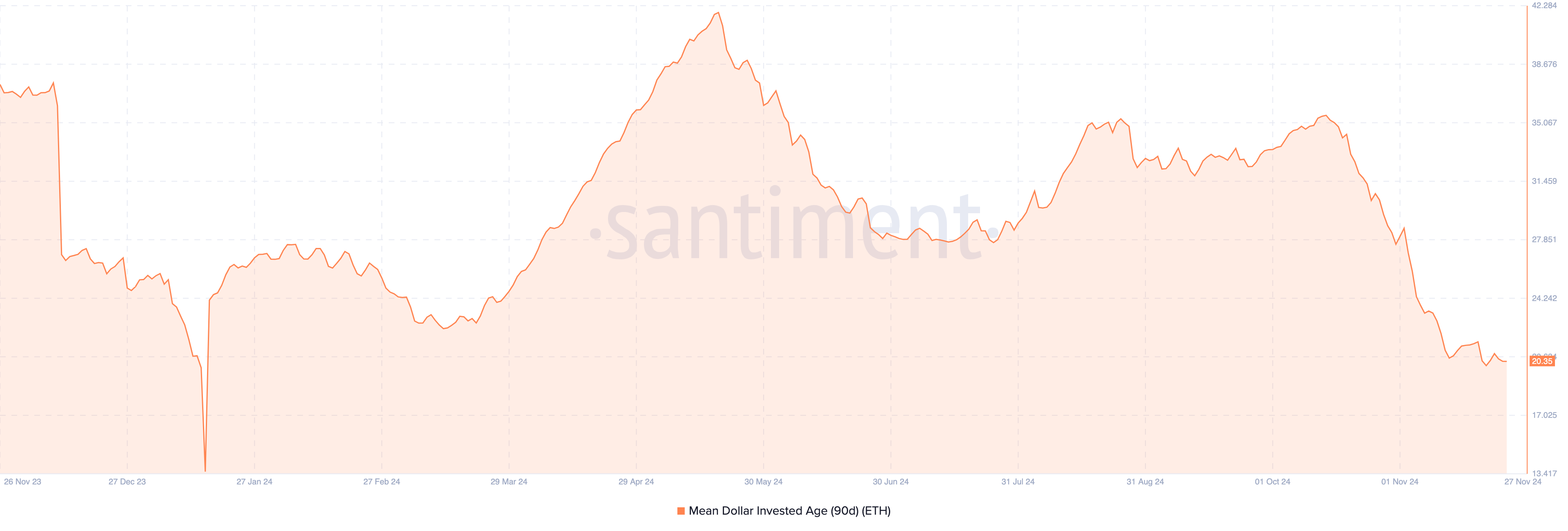

Beyond the MVRV ratio, the Mean Dollar Invested Age (MDIA) also suggests that Ethereum may avoid a further price drop. MDIA measures the average age of all coins on a blockchain, weighted by their purchase price.

A rising MDIA indicates that coins are becoming more stagnant, reducing the likelihood of a significant price surge.

Conversely, a declining MDIA suggests that previously dormant coins are moving, signaling increased trading activity, which is the case with ETH. If this trend persists, it could boost Ethereum’s chances of a price rally.

ETH Price Prediction: $4,000 Could Be Coming

On the daily chart, Ethereum’s price has formed an inverse head-and-shoulders pattern. This pattern typically emerges after a prolonged downtrend, signaling a potential sellers’ exhaustion point.

The pattern comprises three key parts: the left shoulder, which marks the first uptrend; the head, signaling the end of the downtrend; and the right shoulder, indicating the rebound.

With ETH trending in an uptrend, the cryptocurrency is likely to rise toward $4,000 in the short term. On the other hand, if selling pressure rises, this might change, and ETH could decline to $3,206.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoSolana (SOL) Price Correction Threatens Death Cross Formation

-

Market23 hours ago

Market23 hours agoDogecoin (DOGE) Price Weakens as Bears Take Control

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Reveals The ‘Truth’ Behind This Dogecoin Price Rally

-

Market21 hours ago

Market21 hours agoThis is Why Ren Protocol Faces Backlash After Binance Delisting

-

Altcoin21 hours ago

Altcoin21 hours agoBTC and Altcoins Decline, ALGO Soars 15%

-

Market20 hours ago

Market20 hours agoEthereum Price Maintains Strength at $3,250: Upside Ahead?

-

Altcoin19 hours ago

Altcoin19 hours agoGrayscale Opens Private Placements in XRP, SOL, XLM and 15 Other Trusts

-

Market19 hours ago

Market19 hours agoTornado Cash Sanctions Overturned; TORN Token Spikes 400%