Market

Top Cryptos Hitting ATHs on November 26

As overall crypto market activity slows, liquidations have reached $285.48 million in the past 24 hours, affecting 97,882 traders. However, defying the broader market trend, some altcoins have surged, hitting new all-time highs today.

BeInCrypto has identified three crypto tokens that hit all-time highs today, with Dolos the Bully (BULLY) leading the pack.

Dolos the Bully (BULLY)

Solana-based meme coin Dolos the Bully (BULLY) rocketed to a new all-time high today. The meme coin briefly traded at a peak of $0.23 before witnessing a pullback. As of this writing, BULLY trades at $0.20 and continues to enjoy a significant bullish bias.

Readings from its Super Trend indicator assessed on an hourly time frame confirm this. As of this writing, BULLY’s price rests above the green line of this indicator.

The Super Trend indicator measures the direction and strength of an asset’s price trend. It is displayed as a line on the price chart, with red indicating a downtrend and green signaling an uptrend. When the Super Trend line is below the asset’s price, it confirms an uptrend, suggesting bullish momentum is likely to continue.

If this bullish trend persists, BULLY’s price could reclaim its all-time high. However, should token selloffs commence, the meme coin’s value may drop below $0.19.

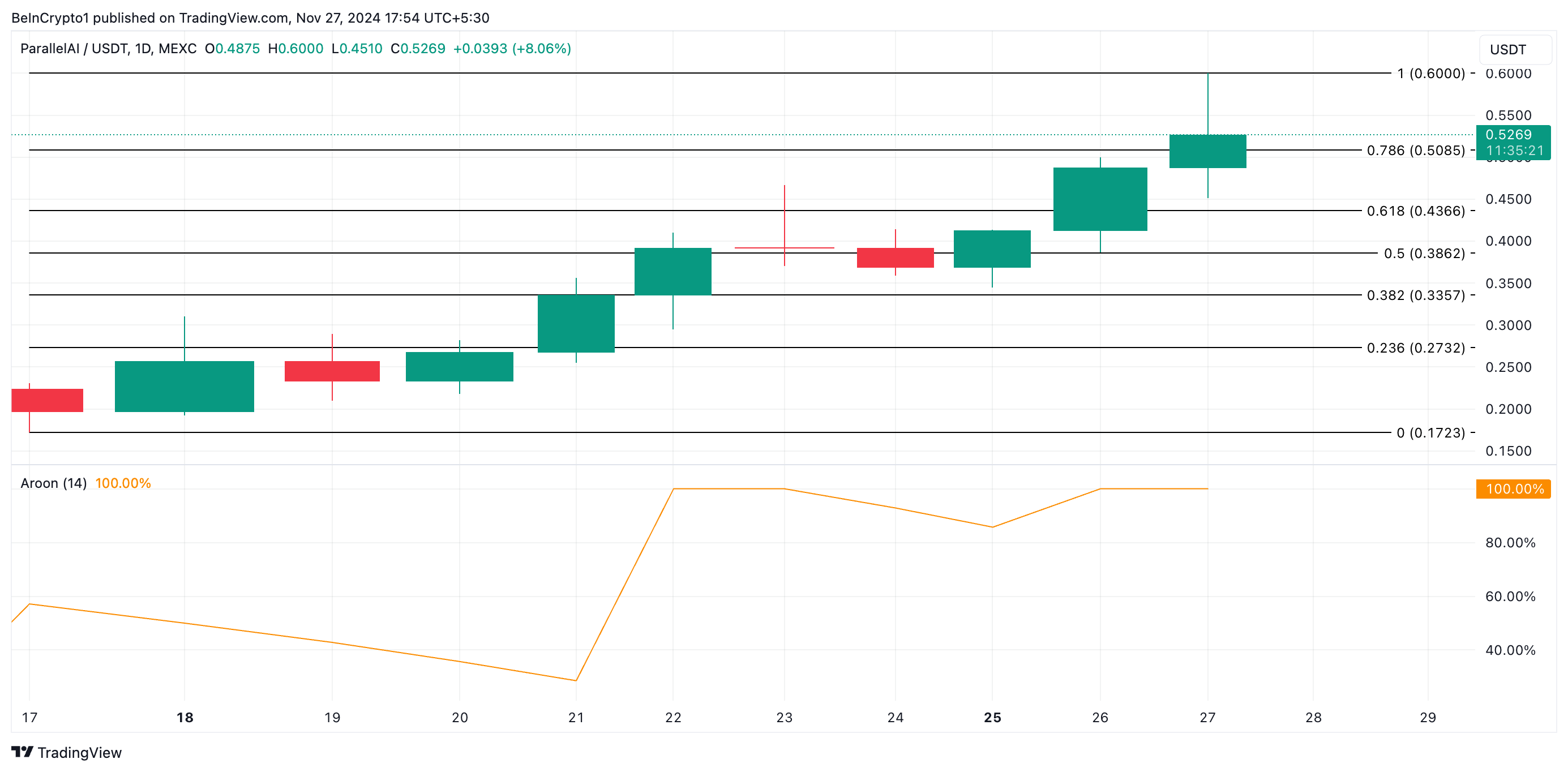

Parallel AI (PAI)

PAI currently trades at $0.52. It hit an all-time high of $0.60 today and witnessed a 14% pullback. Despite this, a rebound is possible as bullish pressure continues to strengthen. An assessment of PAI’s Aroon indicator confirms this bullish outlook. PAI’s Aroon Up Line is at 100% as of this writing.

The Aroon Indicator determines the strength and direction of an asset’s price trend by measuring the time since the asset’s highest high (Aroon Up) and lowest low (Aroon Down) within a set period. When the Aroon Up line is at 100%, a new high was recently achieved, signaling strong upward momentum and the potential continuation of a bullish trend.

If PAI witnesses a resurgence in buying pressure, its price will revisit its all-time high and attempt a rally beyond it. On the other hand, if selling activity gains momentum, the token’s price may drop toward $0.50. If the bulls fail to hold this level, PAI’s value may dip further to $0.43.

Stonks (STNK)

STNK hit an all-time high of $347.06 today but has since dropped 26%, trading at $263.67 as of this writing. The decline is attributed to a surge in profit-taking activity, which has exerted downward pressure on its price.

Analysis using the Fibonacci Retracement tool on an hourly chart shows that STNK has broken below the support at $268.01, signaling a strengthening of the downtrend. If new demand does not enter the market, its price could decline to $219.10.

On the other hand, if buying pressure increases, STNK may attempt a rally above $268.01, potentially climbing back toward its all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Bullishness Continues, Analyst Shoots For $1.9 With Next Leg-Up

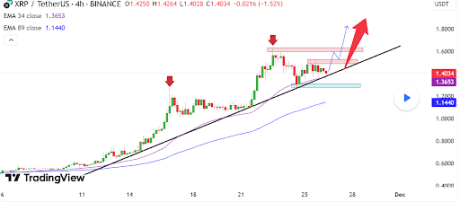

The XRP price is consolidating just below the $1.4 mark, but the technical structure continues to show bullish strength. Interestingly, XRP has been down by about 4.35% in the past 24 hours, reaching a 24-hour low of $1.296, according to Coinmarketcap data.

According to an XRP analysis on TradingView, the technical setup is still pointing to a continued price surge. The analysis suggests that XRP could soon rally further, with a near-term price target set at $1.90.

XRP Price Bullishness Continues

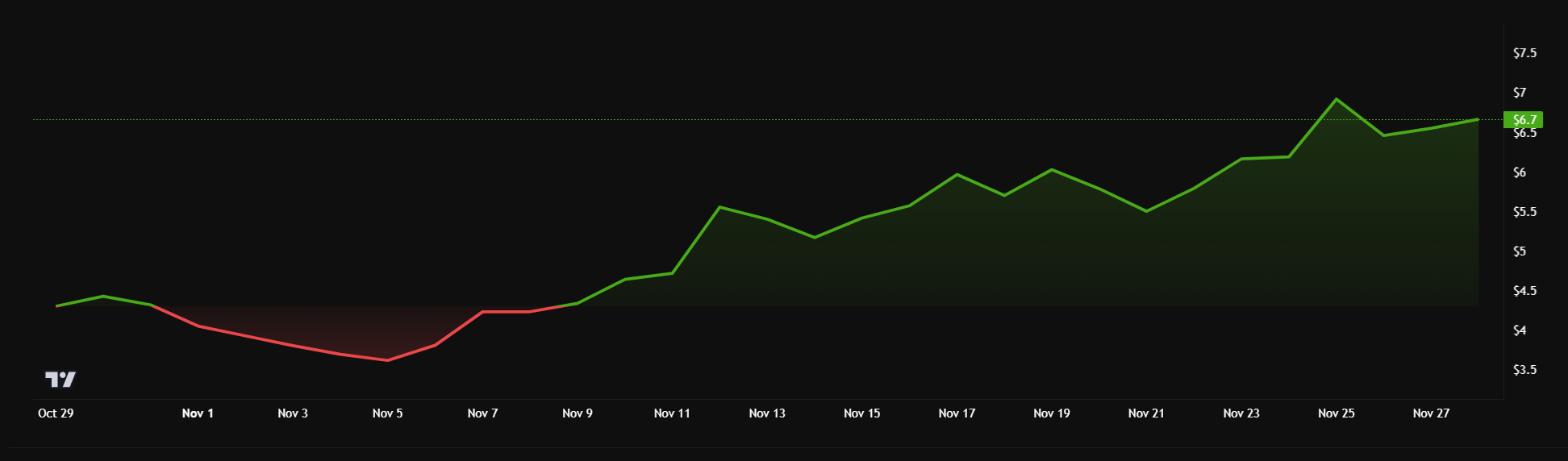

The XRP price surge earlier this month was very unprecedented. Particularly, the XRP price surged from a low of $0.4976 on November 3 to reach a three-year high of $1.6 on November 23. This translates to a 220% price increase in over 20 days.

Related Reading

However, since it reached this three-year high, XRP has entered a correction phase, retreating by almost 20%. Despite this price correction, XRP has largely traded above a main trendline that has propped up the price during the journey up.

As it stands, technical analysis shows that the XRP price is about to bounce off or break below this trendline, which could make or do its price trajectory from here. An adherence to this main trendline would see XRP bouncing up to the upside, much like it did on November 24. After bouncing up at this point, XRP continued from a low of $1.2775 to retest the $1.54 price level again on November 24.

Now, with the XRP price retesting this major trendline, the more bullish option is an immediate bounce to the upside. A break to the upside would see XRP resuming its uptrend up to the $1.9 price level. Keeping this in mind, the analyst emphasized critical price zones that could shape XRP’s trajectory in the coming sessions. The range between $1.520 and $1.620 has been identified as a crucial area where the price could encounter strong resistance in the coming sessions.

Related Reading

What’s Next For XRP?

At the time of writing, XRP is trading at $1.39 and is still trading around this main trend line. However, the price has yet to show a decisive bounce from this level. Particularly, current price action points to a continued consolidation in the past few hours.

While the XRP price continues to exhibit signs of bullishness, there exists the possibility of a break to the downside. This break to the downside would be highlighted by a daily close below $1.38. Should this occur, XRP is likely to extend its decline with a retest of the next significant support at $1.32.

Featured image created with Dall.E, chart from Tradingview.com

Market

How Did Long-Term Bitcoin Holders Reacted to BTC’s Rally?

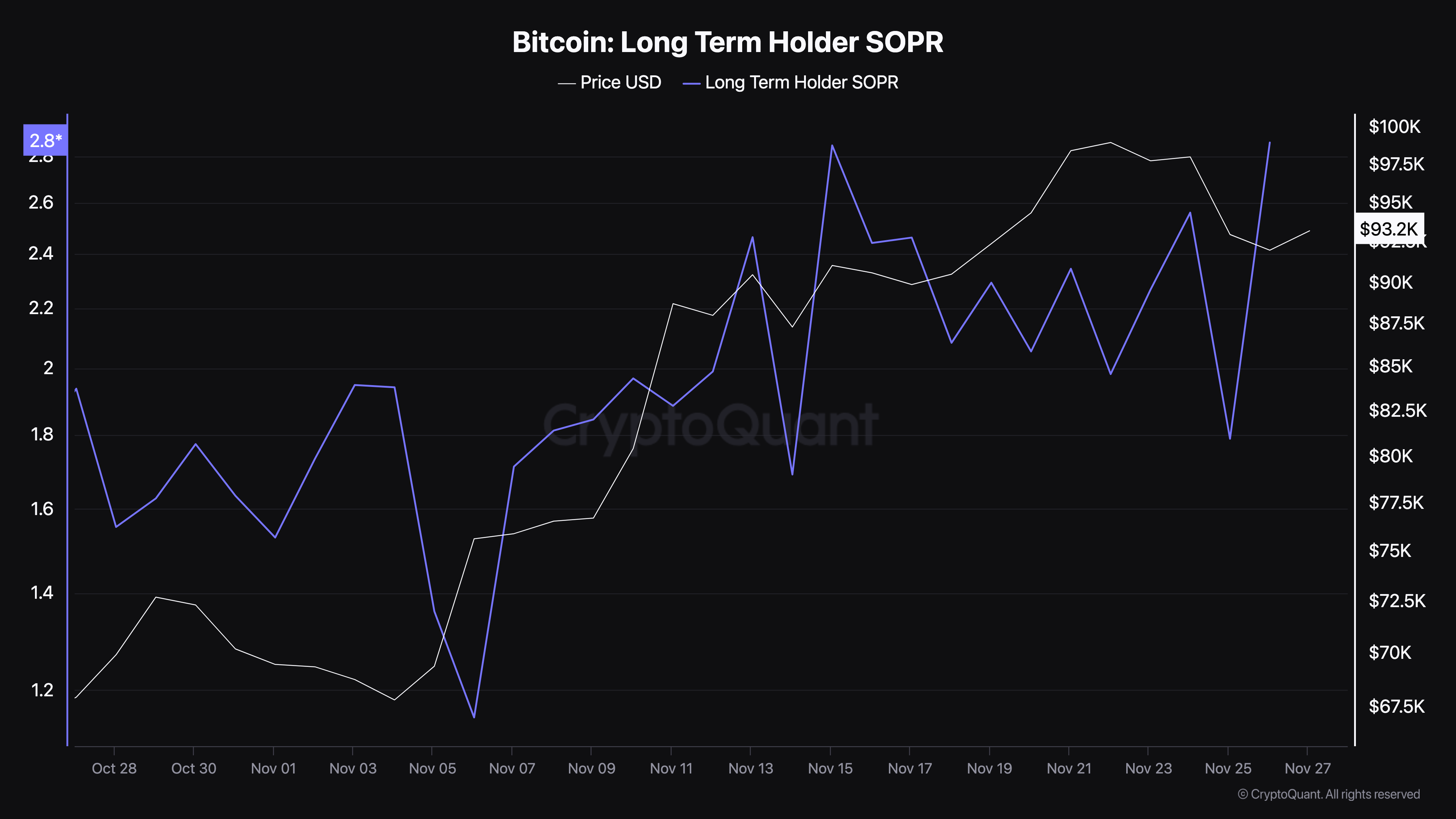

Long-term Bitcoin (BTC) holders have started taking profits since the cryptocurrency price attempted to reach $100,000. As a result, Bitcoin’s price has retraced to $93,000, affecting the value of the broader crypto market capitalization.

Is Bitcoin’s price rebounding? Short-term investors may want to know as this on-chain analysis examines the chances.

Activity Around Bitcoin Drops, Holders Book Gains

According to CryptoQuant, Bitcoin’s long-term profit output ratio has surged to 2.86. This ratio measures the activity of long-term investors who have held the coin for more than 155 days.

When the ratio is over 1, it means that these long-term Bitcoin holders are selling at a profit. On the other hand, if the profit output ratio is less than 1, it implies that holders are selling at a loss. Since the reading is higher, it indicates that these holders are booking profits from the recent price hike.

Besides that, it is noteworthy to mention that this profit-taking is the highest holders have taken since August 30. Should this continue, then BTC price risks falling below the $93,000 threshold.

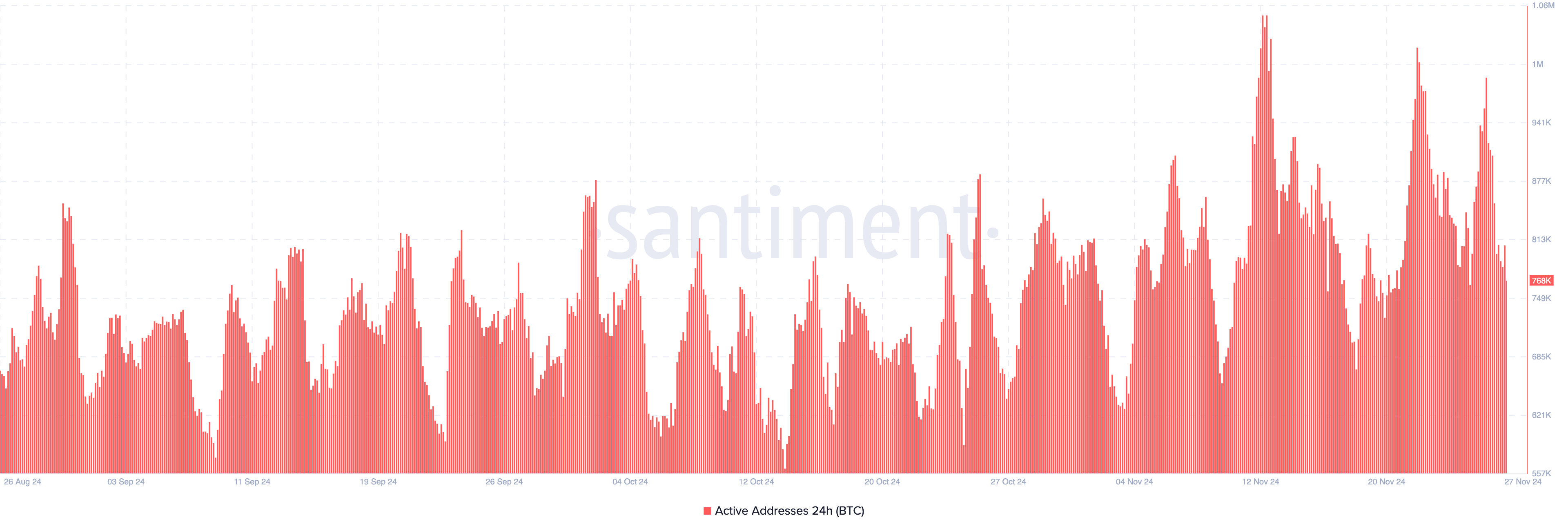

Beyond that, active addresses on the Bitcoin network have significantly decreased this week, which could spell trouble for the cryptocurrency’s price if the trend persists. Active addresses measure the number of unique addresses involved in transactions, reflecting user engagement with the blockchain.

When active addresses increase, it indicates growing network activity and adoption. Conversely, a decline suggests reduced participation.

On November 26, Bitcoin’s active addresses were nearly 1 million, showcasing significant traction. However, as of this writing, the figure has dropped to 768,000, a noticeable decline. If active address activity continues to wane, it may signal weakened market sentiment and could contribute to further price declines, as previously highlighted.

BTC Price Prediction: Time to Go Below $90,000?

On the daily chart, Bitcoin’s price has fallen below the dotted lines of the Parabolic Stop and Reverse (SAR) indicator. This technical tool identifies support and resistance levels.

Dotted lines below the price signal strong support, while lines above the price suggest resistance that could lead to a decline. Currently, Bitcoin faces the latter scenario.

If this resistance persists, BTC could drop to $84,640. However, if long-term holders reduce profit-taking, Bitcoin’s value might rise instead, potentially reaching $99,811.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

21Shares Launches Four New Crypto ETP Focusing on AI Tokens

Swiss wealth manager 21Shares has introduced four new crypto exchange-traded products in Europe, broadening its range of digital asset investment options.

The latest additions focus on AI and decentralized computing projects Pyth Network, Ondo, Render, and NEAR Protocol.

The asset manager is seeing an increased demand from institutional investors for next-gen decentralized technologies. The four tokens represent the firm’s extended entry into four distinct sectors: price oracles, asset tokenization, decentralized computing, and AI.

According to the announcement, investors in the NEAR ETP will be able to reinvest staking rewards directly into the product. NEAR’s proof-of-stake blockchain model supports network security through token staking, which generates yields for participants.

The new ETPs will be available for trading on exchanges in cities like Amsterdam and Paris. The firm has been constantly improving its crypto ETP offerings throughout Europe.

Earlier this week, 21Shares upgraded its Ethereum Core ETP to include staking capabilities. The product now operates under the name Ethereum Core Staking ETP and trades with the ticker ETHC.

“The 21Shares NEAR Protocol Staking ETP offers investors a regulated and transparent way to gain exposure to one of the most scalable smart-contract platforms, designed to simplify the complexity of crypto infrastructure while pushing the boundaries of decentralized AI integration,” the firm wrote on its press release.

This enhanced version offers investors the opportunity to earn staking rewards while maintaining exposure to Ethereum. It is listed on leading European exchanges, including the SIX Swiss Exchange, Deutsche Börse Xetra, and Euronext Amsterdam.

Increasing Activity in the Crypto ETP Market

21ShareThe crypto ETP market is experiencing a surge in activity. Bitwise recently rebranded its XRP ETP to “Bitwise Physical XRP ETP (GXRP)” following Ripple’s strategic investment. This product provides secure, physically backed XRP exposure for European investors.

Also, Bitwise launched its Aptos Staking ETP on the SIX Swiss Exchange, offering regulated access to Aptos staking in Europe.

Meanwhile, WisdomTree introduced an XRP-backed ETP across Germany, Switzerland, France, and the Netherlands. This product aims to attract investors with low-cost exposure to XRP’s spot price.

WisdomTree also filed for an XRP ETF in the US earlier this week. Trump’s re-election and the resignation of SEC chain Gary Gensler have renewed optimism about Ripple’s cryptocurrency.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoMetaverse Crypto Developments Boost Engagement in November

-

Regulation23 hours ago

Regulation23 hours agoDonald Trump Plans To Give CFTC Oversight of $3T Crypto Market

-

Market22 hours ago

Market22 hours agoKraken Closes NFT Marketplace Amid Market Challenges

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Says the Dogecoin Price Will Keep Outperforming Bitcoin While This Altcoin Aims for a 43,209% Rally

-

Regulation22 hours ago

Regulation22 hours agoUS Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

-

Market21 hours ago

Market21 hours agoSolana (SOL) Price Correction Threatens Death Cross Formation

-

Market24 hours ago

Market24 hours agoFairshake Raises $103 Million for Crypto Push in 2026 Midterms

-

Market20 hours ago

Market20 hours agoDogecoin (DOGE) Price Weakens as Bears Take Control