Altcoin

US Court Grants SEC’s Request for Extended Briefing in Binance Case

Binance Lawsuit: A district court has granted the U.S. Securities and Exchange Commission’s (SEC) motion to file an omnibus brief in response to the lawsuit dismissal. The motion came in response to requests by Binance, Changpeng Zhao and Binance US to dismiss the amended complaint. The court’s decision on the dismissal of the complaint is still pending.

US SEC Can Extend the Briefing in Binance Lawsuit

The US SEC had requested permission to exceed the typical page limit under local rules, citing the complexity of the motions, which involve multiple legal arguments. Judge Amy Jackson approved the request, allowing the SEC to submit a combined response that will not exceed 70 pages. This extension grants the SEC additional space to address the legal points raised by both sets of defendants in the ongoing Binance lawsuit, per the district court filing.

The dismissal motions filed by Binance Holdings Limited, Changpeng Zhao, and BAM Trading Services Inc., currently stand null and void as of now. The defendants had filed separate motions to dismiss the SEC’s amended complaint in early November. Binance argued the overlapping of legal arguments across SEC’s collective 90-page submissions.

However, the SEC stated that it would consolidate all responses into a single document to promote judicial efficiency and avoid duplication across separate filings. While Local Rule 7(e) allows 45 pages per response brief, the SEC will now be able to provide a combined response following the court order.

The SEC’s response is due by December 4. Both Binance and BAM have indicated they do not oppose the SEC’s request. Last month, the U.S. District Court issued a scheduling order extending the Binance lawsuit to 2026.

BNB Coin Hitting Fresh All-Time High Soon?

While the rest of the crypto market has delivered a massive surge following the Donald Trump victory, Binance’s native BNB Coin hasn’t shown much movement due to the recent order in lawsuit. However, the BNB bulls are holding the line at the crucial support level of $600.

As of press time, the BNB price is 1.5% down at $620 with its market cap slipping under $90 billion. But BNB reversed the trajectory after retesting the support at $600 earlier today hinting the path ahead to a new all-time high.

$BNB giving great risk reward on this re-test. LONG. pic.twitter.com/HUFNlJrOtl

— 𝙋𝘼𝙉𝙄𝘾 (@panicselling) November 27, 2024

If the current market trend persists, analysts expect BNB Coin (BNB) to rally 150% from here as reported by CoinGape. The BNB derivatives data shows that the open interest remains flat at $911 million while options trading volume surged 47% to $1.15 million. Also, in the recent pullback, the BNB long liquidations have surged past $2.16 million, per the Coinglass data.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Cardano Price Can Clinch $1 As It Eyes Bounce From New Support Zone

While predictions for Cardano to $1 may seem like a far cry, a cryptocurrency expert has injected new life into the claims. Cardano’s price is headed below 50 cents in search of a new support zone that can serve as a springboard to reach new highs.

Cardano Price Can Still Clinch $1 Despite Price Slump

Market technician Jonathan Carter in an analysis on X predicts that Cardano’s price can reclaim the $1 price point in the coming months. According to Carter, the recent ADA correction will not be a hindrance for Cardano’s price to reach $1.

ADA has lost a jarring 13% over the last week and trades at $0.64 in an unremarkable week for the cryptocurrency. On the daily charts, prices have generally moved sideways, underscoring a lack of investor enthusiasm.

For Carter, Cardano’s recent decline has seen it fail to stay above the $0.65 support level. The analyst opined that a downtrend is the offing for the Cardano price that could see a new support zone of $0.59. Carter says the new $0.59 support zone will hurl Cardano price to reach $1.

“Despite the long correction, the price still has a chance to bounce off this support and rise towards $1,” said Carter. “Otherwise, we will fall to the lower border of the broadening wedge.”

While some investors are eyeing an ADA bounce to $0.70, a plausible play will be a slump below $0.60 before the start of a rally.

A Slew Of Positives For ADA

Despite the pervading negative sentiment around ADA price, the cryptocurrency has a wave of positive fundamentals going for it. Cardano price spiked following Charles Hoskinson’s confirmation of Ripple’s RLUSD on ADA.

Furthermore, Charles Hoskinson reveals that Cardano will play a major role in Bitcoin decentralized finance (DeFi) application. In more positive technicals, Cardano price is forming a cyclical pattern from 2024 that can send prices to astronomical proportions in May.

While the prediction pegged prices at $2.5, optimists say ADA price to $10 is not a crazy hypothesis. The report cites present solid fundamentals and ADA’s over 1,000% spike to set its all-time high back in 2021 as pointers for the seismic rally to $10.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Expert Reveals XRP Price Could Drop To $1.90 Before Rally To New Highs

Crypto analyst CasiTrades has provided a roadmap for the XRP price, revealing what could happen before the altcoin reaches a new all-time high (ATH). Based on her analysis, XRP could still witness a price decline before it potentially rallies past its current ATH of $3.4.

XRP Price Could Drop To $1.9 Before Rally To New Highs

In an X post, CasiTrades stated that in the event of a deeper flush, the XRP price could wick down to $1.90, suggesting that the altcoin could visit this low before it rallies to new highs. She believes XRP will ideally hold above this $1.90 and avoid dropping to new lows.

The crypto expert noted that the next move is critical. She claimed that if XRP gets that flush with bullish RSI divergence, it could mark the bottom before the altcoin rockets into Wave 3. However, CasiTrades warned that a break below $1.90 could force a reset of the entire new trend count.

Meanwhile, there is still the possibility that the XRP price might not drop to as low as $1.90. CasiTrades stated that $1.95 is the prime target, with subwaves heavily aligning there and a drop to $1.90 only likely to occur in the event of a deeper flush.

It is worth mentioning that US President Donald Trump recently announced reciprocal tariffs on all countries, a move which is set to ignite a global trade war and is bearish for XRP and the broader crypto market. As such, this development could be what sparks the deeper flush and send the altcoin to as low as $1.90.

A Drop To $1.4 Is Also The Cards

In an X post, crypto analyst Brandon asserted that the XRP price is about to have a massive breakout, to the downside. His accompanying chart showed that XRP could drop to as low as $1.4.

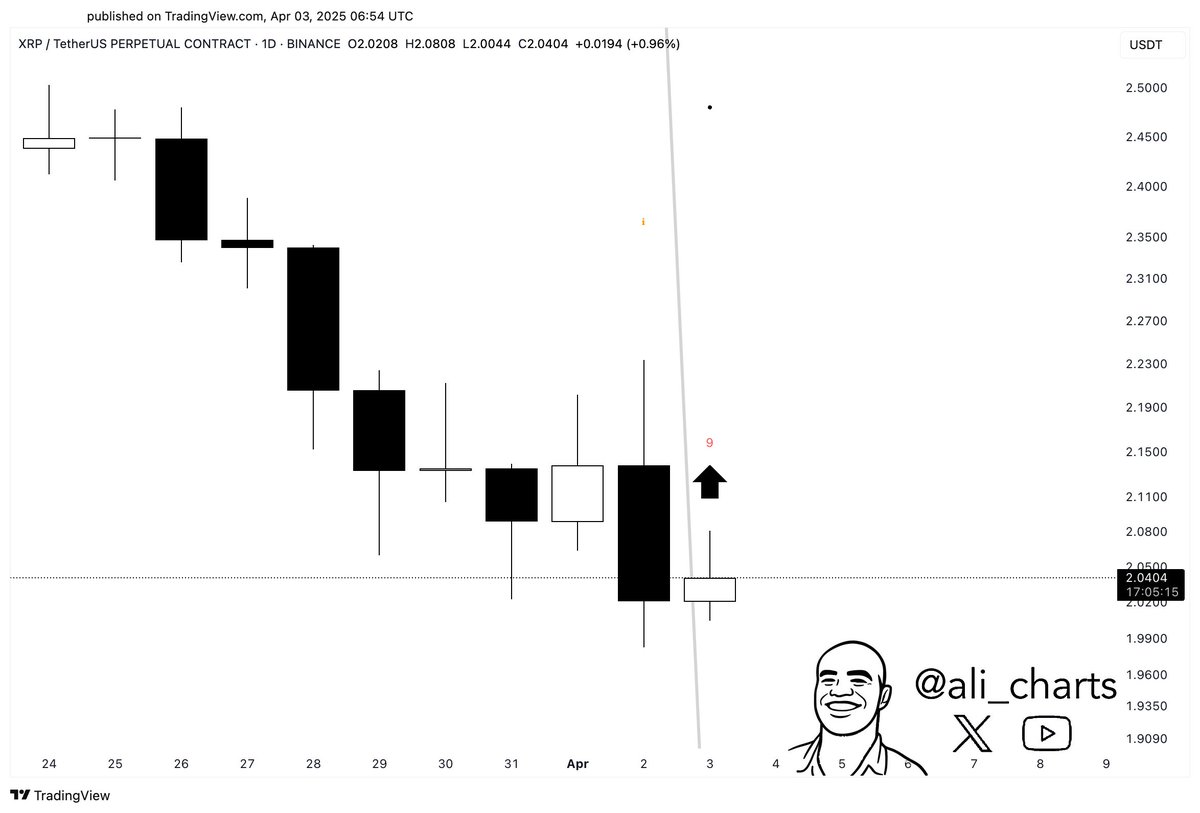

On the other hand, crypto analysts such as Ali Martinez have provided a bullish outlook for the XRP price. In an X post, he stated that XRP could be setting up for a rebound. The analyst further remarked that the altcoin is holding above $2 while the TD Sequential flashes a buy signal.

Crypto analyst Javon Marks also recently predicted that Ripple’s coin could surge 44x and reach as high as $99. He alluded to the 2017 bull run as the reason why he is confident that the altcoin could record such a parabolic rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Here’s Why Is Shiba Inu Price Crashing Daily?

Shiba Inu price is on a strong bearish trend, with price indicators recording losses in all time frames. The highly popular meme token now threatens to add an additional zero to its value if the current bear run continues for much longer. Even with Shibarium, SHIB’s layer-2, reaching the milestone of 1 billion transactions recently, the token’s price has not responded positively to this milestone.

Falling Shiba Inu Price Affects Holder Profitability

According to current data, SHIB is down 4.6% in the past 24 hours, 14.7% over seven days and a substantial 54.9% over the past year.

The current context for the SHIB price appears tough for the majority of investors. Based on on-chain analytics, 62% of SHIB investors are at the moment in a loss, while merely 34% are in profit and 4% are breaking even as per IntoTheBlock data.

SHIB has fallen 85.9% from its all-time high of $0.00008616 on October 28, 2021, over three years ago. This extended period of decline has made many of the investors who bought during the bull run in 2021 underwater on their holdings.

The token reflects a high ownership concentration with 74% of SHIB owned by major holders. The concentration may be behind price volatility. This is due to the fact that the moves by the large holders tend to have disproportionate impacts on the market. Major volume trading in the last week has hit $184.02 million which indicates sustained activity even as the price goes down.

Shibarium Milestone Fails To Reverse Trend

Despite Shiba Inu’s layer-2 scaling solution, Shibarium recently achieved a major milestone of 1 billion transactions. However, this accomplishment has not translated into positive price action for SHIB. This disconnect between ecosystem development and token price shows the current market’s focus on overall trends rather than project-specific achievements.

Shibarium is a key component of the Shiba Inu ecosystem that focuses on reducing transaction fees, increasing processing speed, and enabling more advanced applications within the SHIB ecosystem.

The continued negative price action despite reaching such a substantial transaction milestone raises questions about what catalysts might eventually reverse SHIB’s downward trend.

Will Shiba Inu Token Burns Aid In Price Pump?

The Shiba Inu community has historically highlighted token burns as one possible method of driving scarcity and price support. Recent burn behavior has been spotty and inadequate to have any real effect on the enormous Shiba Inu token supply.

After a recent spike in burn rate of more than 12,000%, the last 24 hours have seen the burn rate decline by 60%. During this period, only 37.6 million SHIB tokens were removed from circulation as per Shibburn data.

Token burns continue to be a mainstay narrative among the SHIB community. However, the volume of burning has to rise in order to have an effect on the token’s supply that can be measured. The 17.88% hike in trading volume in the last 24 hours to $311.14 million gives some indications of market action. This potentially could be being driven by the larger holders stockpiling at lower prices.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market21 hours ago

Market21 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market23 hours ago

Market23 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market17 hours ago

Market17 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Market20 hours ago

Market20 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K

-

Altcoin19 hours ago

Altcoin19 hours agoVanEck Seeks BNB ETF Approval—Big Win For Binance?

-

Market13 hours ago

Market13 hours agoBitcoin’s Future After Trump Tariffs

-

Ethereum17 hours ago

Ethereum17 hours agoEthereum Trading In ‘No Man’s Land’, Breakout A ‘Matter Of Time’?

✓ Share: