Market

Can Solana Meme Coin BULLY Price Continue to Rise After ATH?

Dolos The Bully (BULLY), a meme coin built on the Solana blockchain, has hit a new all-time high today. This milestone comes after BULLY’s price increased by over 700% within the last seven days.

With its market cap above $200 million, the meme coin holders may be wondering if the price can go higher. This analysis looks at the possibility.

Dolos The Bully Soars, Shows Bullish Potential

At press time, BULLY is trading at $0.23, marking a significant rise in its value. Over the last 24 hours, the meme coin surged by 72%, contributing to an impressive 700% increase over the past week. This meteoric rally indicates heightened interest and bullish momentum around BULLY in recent days.

For context, Dolos The Bully was created as a meme coin related to an AI language model built on the Llama 3.1 architecture. The token also embodies a persona that blends the cunning and trickery of Greek mythology with the sharp, fast-paced dynamics of crypto Twitter culture, similar to tokens like Goatseus Maximums (GOAT).

However, BULLY’s rapid gains often come with volatility. As such, the meme coin holders may need to monitor it closely for potential corrections.

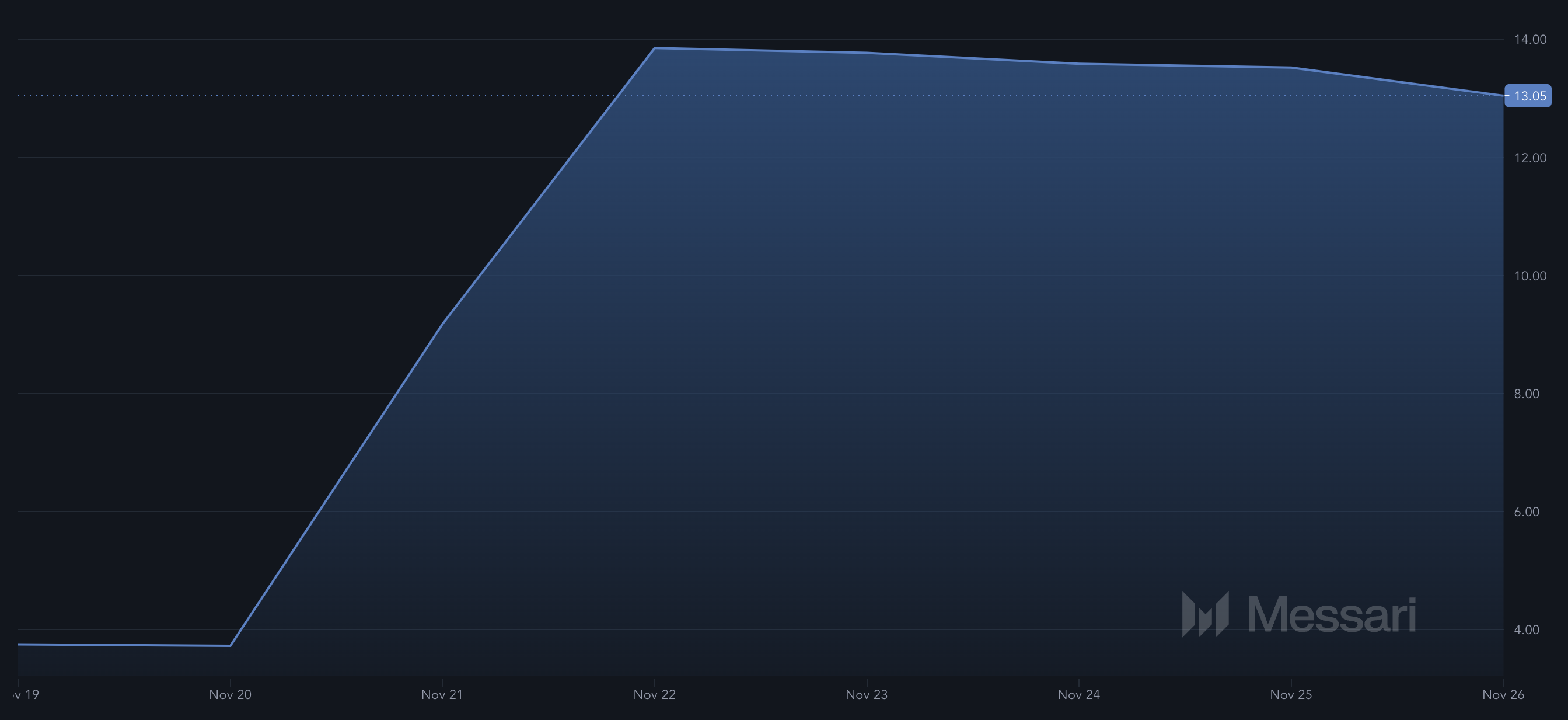

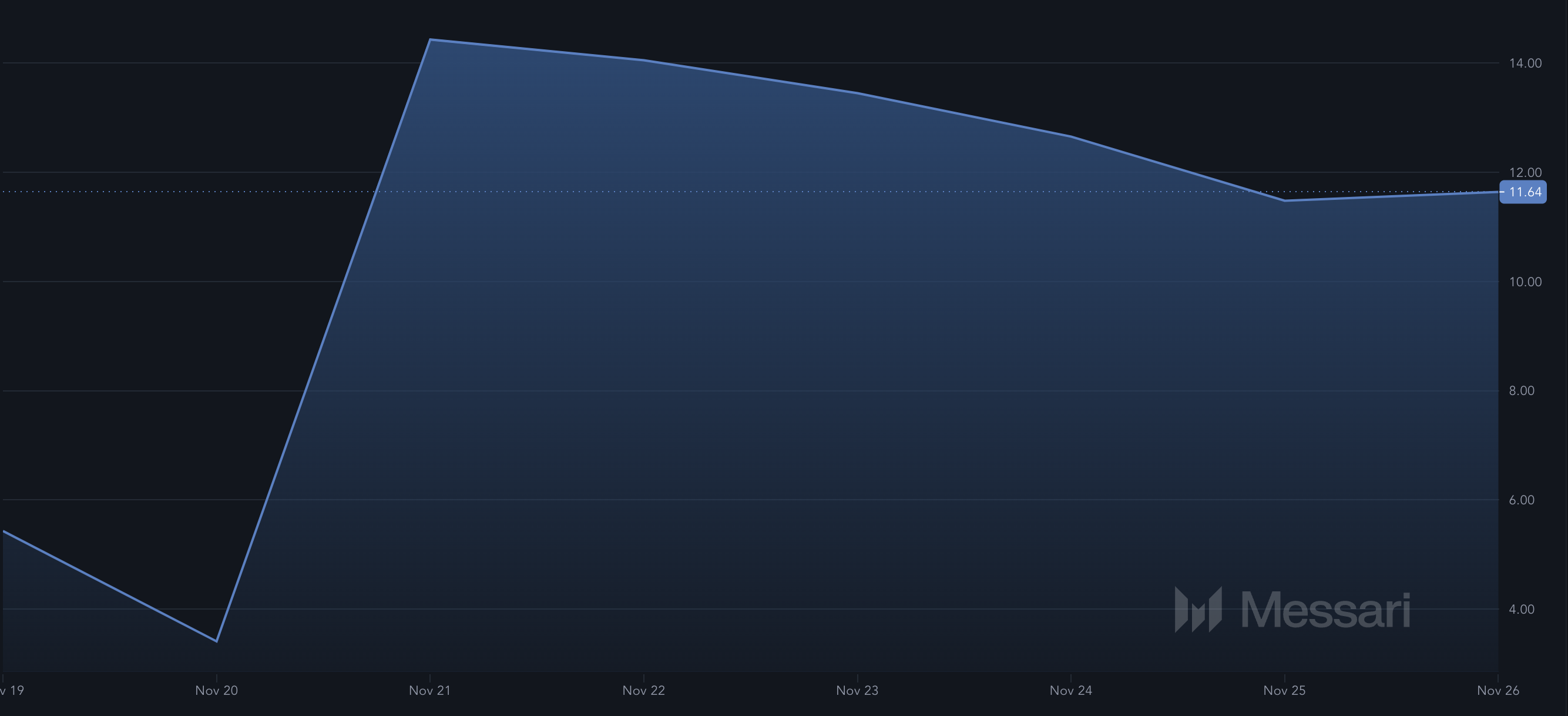

According to Messari, the volatility around BULLY has been rising since November 20. This suggests that massive buying pressure or selling pressure could lead to a quick rally or downturn.

Besides that, BULLY’s Sharpe Ratio has recently jumped, further supporting its upward price trajectory. This metric assesses an asset’s performance by factoring in the risk taken.

A positive Sharpe Ratio indicates that the reward from holding or trading the cryptocurrency outweighs the risk, suggesting favorable investment potential. Conversely, a negative Sharpe Ratio warns that the asset might not yield satisfactory returns relative to the risks involved.

For BULLY, the current positive Sharpe Ratio implies that the meme coin is likely to continue its price increase, provided the metric remains positive. This aligns with the recent 72% daily and 700% weekly surge, reflecting growing market confidence in the token.

BULLY Price Prediction: Higher Highs Next?

On the 4-hour chart, BULLY’s price has risen above the 20-day Exponential Moving Average (EMA). The EMA assesses if a cryptocurrency’s price is moving in an upward direction or in a downtrend.

When the indicator rises, the trend is bullish. But when it trends downwards, it is bearish. Since the Solana meme coin is above the 20 EMA (blue), it means that the price is likely to increase. If that remains the case, then the token’s value might climb toward $0.30.

However, if selling pressure rises, that might not be the case. In that scenario, BULLY could drop below $0.16.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This is WHy Tether Discontinued EURT Amid MiCA Regulations

Tether, the prominent stablecoin issuer, is discontinuing EURT because of the EU’s MiCA regulations. Nonetheless, the firm invested in other MiCA-compliant stablecoins and maintains revenue streams from the European market.

Several competitors have regarded MiCA as an opportunity to disrupt Tether’s EU stablecoin dominance, and the firm has conceded some of this contest.

Tether Reacts to MiCA

This morning, the prominent stablecoin Tether announced via social media that it would discontinue EURT, its Euro-backed asset. The company explained its decision via a blog post, adding that the firm had stopped minting the asset, and current holders would have one year to redeem EURT tokens.

“This decision aligns with our broader strategic direction, considering the evolving regulatory frameworks surrounding stablecoins in the European market. Until a more risk-averse framework is in place — one that fosters innovation and offers the stability and protection our users deserve — we have chosen to prioritize other initiatives,” the post claimed.

In other words, Tether chose this path for one clear reason: the impending Markets in Crypto Assets (MiCA) law in the European Union. MiCA will transform crypto regulations in the EU, and it will particularly rearrange stablecoin dynamics. Earlier in September, multiple large companies openly considered MiCA an opportunity to disrupt Tether’s European presence.

Competitors have already begun entering the EU market with MiCA-compliant stablecoins; the first of which launched in September. Schuman Financial, a company founded by former Binance EU executives, released its own asset yesterday. Other crypto sectors are also taking advantage of MiCA, with Revolut X expanding European trade operations earlier this month.

Still, although Tether has conceded part of this market, the death of EURT does not signal the end of Tether’s interests. The announcement was quite clear that Tether was a major investor in a MiCA-compliant stablecoin from Quantoz. Tether also promoted Hadron, its new solution designed to support issuers in creating and managing stablecoins.

In short, Tether is engaging in a calculated retreat from the European market, not an outright surrender. The company is maintaining several revenue streams in MiCA-compliant stablecoins and may reenter the space at a later date. For now, the company has considerable resources to address this problem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

$605 Support Sets The Stage For A New Rally

BNB has found its footing at the $605 support level, sparking optimism for a potential recovery. Following recent bearish pressure, the bulls appear to be regrouping, aiming to regain control and push the price higher. With key technical indicators signalling renewed buying interest, market participants are closely watching whether this support will serve as the launchpad for BNB’s next rally.

As BNB shows encouraging signs of revival, this article aims to delve into its rebound from the $605 support level and evaluate its capacity for a sustained recovery. By analyzing market trends, technical indicators, and key resistance levels, we seek to determine whether BNB is positioned for a fresh, bullish run or still faces the risk of renewed bearish pressure.

Technical Indicators Signal A Potential Rebound

On the 4-hour chart, BNB is currently exhibiting a steady upward trajectory despite trading below the 100-day Simple Moving Average (SMA). After rebounding strongly from the critical $605 support level, the asset is making strides to extend its gains, aiming toward the $635 resistance zone. A successful breach above the 100-day SMA could further validate its recovery, potentially opening the door to higher levels.

Also, the 4-hour Relative Strength Index (RSI) has rebounded to 42% from a low of 35%, signaling a resurgence in buying pressure and a shift toward a more bullish market sentiment. If the RSI rises and approaches 50%, it could confirm its upside movement, giving BNB the strength to push higher and test resistance levels.

Related Reading

BNB is showing strong upward movement on the daily timeframe, holding above the 100-day SMA after a rebound at the $605 support level. This has provided stability, enabling the cryptocurrency to advance toward the $635 resistance level. The price movement indicates a growing optimistic sentiment as BNB trades above key technical levels.

Furthermore, the daily RSI has risen above 50% after briefly dropping below it, signaling a shift to positive market sentiment. With bearish momentum subsiding, this suggests that buying pressure is stronger than selling pressure. If the RSI continues to rise, it could further support BNB’s upswing and strengthen the positive trend, possibly leading to a continued rally, targeting higher resistance levels.

Analyzing Key Resistance Targets For BNB Next Move

Following its rebound from the $605 support level, BNB is targeting the $635 resistance level, which could serve as a key obstacle. Should the cryptocurrency successfully break through this resistance, the next targets could be higher zones, such as the $724 level and beyond, signalling robust bullish momentum.

Related Reading

However, if BNB fails to break through the $635 resistance, it may indicate a potential consolidation or reversal, with the price falling toward the $605 support level. A successful break below this support could lead to more declines, targeting lower support levels.

Featured image from iStock, chart from Tradingview.com

Market

Which Are the Trending Altcoins Today? November 27

In the past 24 hours, several cryptocurrencies have made attempts to recover from recent losses, driving renewed interest in certain altcoins. Among the top trending altcoins today is a newly launched asset whose project recently introduced its Mainnet altcoin and has quickly gained traction in the market

Notably, the other two, according to CoinGecko, include a popular altcoin with a lot of market interest and a privacy-based cryptocurrency.

Vector Smart Gas (VSG)

Vector Smart Gas is a recently launched layer-1 network on the Ethereum blockchain that focuses on decentralized Finance (DeFi) and Real-World Asset (RWAs) tokenization. Its native token, VSG, is one of the altcoins trending today, mainly because of its price increase.

In the last 24 hours, VSG’s price has increased by 49% and cumulatively 550% in the last seven days. This development could also be linked to the notion that the token is trending on TikTok— making demand higher.

At press time, VSG’s price is $0.0044. Furthermore, the daily chart shows that the Moving Average Convergence Divergence (MACD) is positive, indicating that the momentum around the altcoin has remained bullish.

Should this remain the case, then VSG’s price might climb much higher. However, if momentum becomes bearish, that might not happen. Instead, the altcoin’s value could decline to the $0.0018 support.

Tornado Cash (TORN)

As mentioned above, Tornado Cash is a privacy-focused cryptocurrency that is part of the trending altcoins today. But besides that, Tornado Cash scored a very huge victory after a US appeal court ruled against the Treasury Department.

As a result, TORN’s price climbed by 396% in the last 24 hours. As of this writing, it is $17.86. According to the daily chart, the volume around the cryptocurrency has also surged, suggesting widespread interest in the token.

As long as the volume increases, the altcoin’s price could climb as high as $39.41. However, if the cryptocurrency holders take profits, this could change, and the altcoin might drop to $12.24.

Solana (SOL)

Last on the list is Solana, one of the best-performing altcoins of the last year. However, unlike TORN and VSG, SOL is not trending because its price has increased. In fact, the token’s value has hovered around $235 within the last 24 hours.

On the daily chart, the Parabolic Stop And Reverse (SAR) indicator has risen above SOL’s price. The Parabolic SAR is a technical indicator that spots support and resistance.

When the price is above the indicators, there is strong support, and the price can increase. But since it is below it, Solana’s price faces resistance. Should that remain the case, then SOL could drop to $219.63.

On the other hand, if the altcoin sees a rise in buying pressure, the trend might reverse. In that case, SOL could rise to $264.33.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation24 hours ago

Regulation24 hours agoMorocco reconsidering its crypto ban, drafting crypto regulations

-

Market20 hours ago

Market20 hours agoFantom (FTM) Price Gains Momentum as the Market Declines

-

Regulation17 hours ago

Regulation17 hours agoDonald Trump Plans To Give CFTC Oversight of $3T Crypto Market

-

Market16 hours ago

Market16 hours agoKraken Closes NFT Marketplace Amid Market Challenges

-

Market22 hours ago

Market22 hours agoWhat Are Ethereum Derivatives Traders Up to After ETH Decline?

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Says the Dogecoin Price Will Keep Outperforming Bitcoin While This Altcoin Aims for a 43,209% Rally

-

NFT21 hours ago

NFT21 hours agoKraken To Shut Down Its NFT Marketplace

-

Market21 hours ago

Market21 hours agoStellar (XLM) Price Weakens as Indicators Turn Bearish