Market

Tornado Cash Sanctions Overturned; TORN Token Spikes 400%

A US federal appeals court struck down sanctions imposed by the Treasury Department on Tornado Cash. This popular crypto-mixing service enables users to anonymize their cryptocurrency transactions through smart contracts.

The ruling, delivered by the Fifth Circuit Court of Appeals, marks a significant victory for decentralized technology proponents and privacy advocates. At the same time, it reignites debates about how to regulate the use of blockchain tools in connection with criminal activities.

Treasury Department’s Sanctions Against Tornado Cash Overturned

The Treasury’s Office of Foreign Assets Control (OFAC) had sanctioned Tornado Cash in 2022. According to the agency, the platform was a key tool for illicit actors, including North Korea’s Lazarus Group, to launder stolen funds.

However, the court ruled that OFAC overstepped its authority. It emphasized that the immutable smart contracts underpinning Tornado Cash cannot be considered property under the International Emergency Economic Powers Act (IEEPA).

The appellate court’s decision hinged on the nature of Tornado Cash’s smart contracts. These are autonomous lines of code designed to function without human intervention.

These contracts, deployed on the Ethereum blockchain, are unalterable and accessible to anyone. The court found that such contracts do not meet the legal definition of “property” because they cannot be owned, controlled, or restricted.

“The immutable smart contracts at issue are not property because they are not capable of being owned,” the court wrote.

The court further noted that while sanctions might block certain individuals from using Tornado Cash, the technology’s decentralized nature ensures that no one, including North Korean hackers, can be entirely prevented from accessing it. Paul Grewal, Coinbase’s Chief Legal Officer, hailed the ruling.

“This is a historic win for crypto and all who cares about defending liberty…These smart contracts must now be removed from the sanctions list and US persons will once again be allowed to use this privacy-protecting protocol. Put another way, the government’s overreach will not stand… No one wants criminals to use crypto protocols, but blocking open source technology entirely because a small portion of users are bad actors is not what Congress authorized. These sanctions stretched Treasury’s authority beyond recognition, and the Fifth Circuit agreed.” Grewal wrote on X (formerly Twitter),

Grewal also emphasized the importance of distinguishing between tools and their misuse. Of note, Coinbase, a leading cryptocurrency exchange, was among the entities that sued the government over the sanctions.

Broader Implications for Crypto Regulation

The ruling exposes the challenges of applying existing legal frameworks to decentralized technologies. Crypto-mixing services like Tornado Cash occupy a legal gray area, prompting calls for scrutiny by US lawmakers.

They are neither traditional financial (TradFi) institutions nor entities capable of being controlled by a central authority. Critics of the ruling argue that it could embolden bad actors to exploit blockchain technology further.

“If you think Tornado Cash has been used by good people for worthwhile purposes then make your case…If privacy protects good people it’s good, if it protects bad people it’s bad. The vast majority of people that Tornado Cash has protected are doing bad,” one user on X quipped.

Some lawmakers have previously pressed the Treasury to adopt stricter measures against crypto mixers. In 2022, members of Congress highlighted concerns about their role in facilitating money laundering and funding terrorism. A bipartisan push aimed to ensure that tools like Tornado Cash, often associated with criminal networks, face regulatory scrutiny.

However, privacy advocates argue that targeting the tools rather than the actors undermines the principles of decentralization and privacy. Bill Hughes, a lawyer at ConsenSys, applauded the court’s nuanced understanding of the issue but highlighted a key issue. He cautioned that regulatory risks remain.

“This does NOTmean that the rest of Tornado Cash is out of bounds for Treasury/OFAC too. The issue was about smart contracts with no admin key,” Hughes wrote.

This means that the court’s decision does not shield Tornado Cash from other legal challenges, particularly those concerning its founders. As BeInCrypto reported, they face accusations of facilitating money laundering. Moreover, the broader debate over how to regulate decentralized technologies remains unresolved.

Following the ruling, however, Tornado Cash’s native token, TORN, is up almost 400% to trade for $17.63 as of this writing.

This surge reflects investor optimism about the protocol’s potential resurgence and its implications for decentralized finance (DeFi) projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

$14 Billion in Bitcoin and Ethereum Options Set to Expire Today

Today, approximately $14.21 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are due to expire.

Market watchers are particularly attentive to this event because it has the potential to influence short-term trends through the volume of contracts and their notional value.

$14.21 Billion Bitcoin and Ethereum Options Expiring

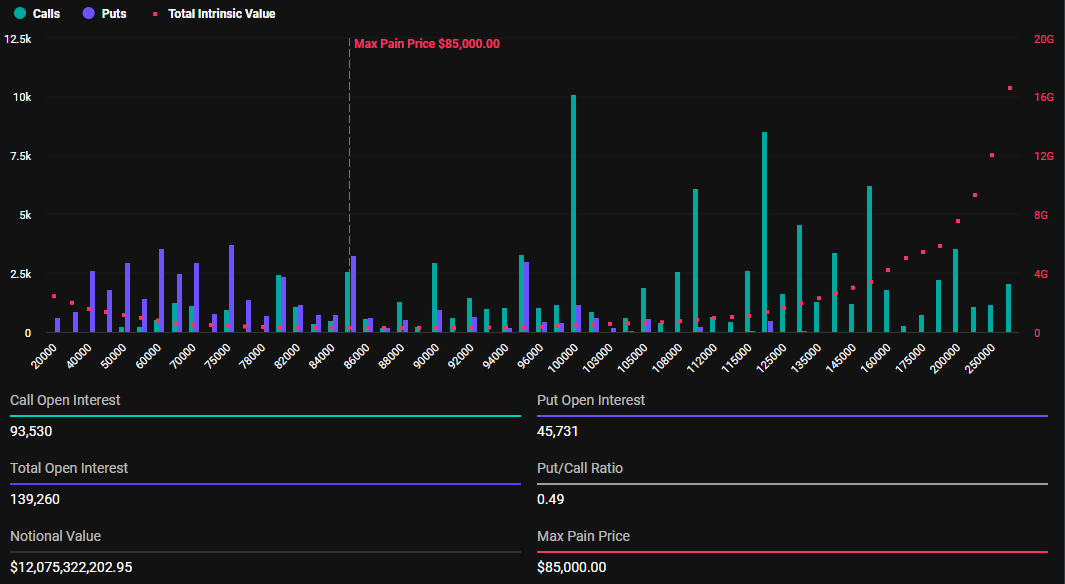

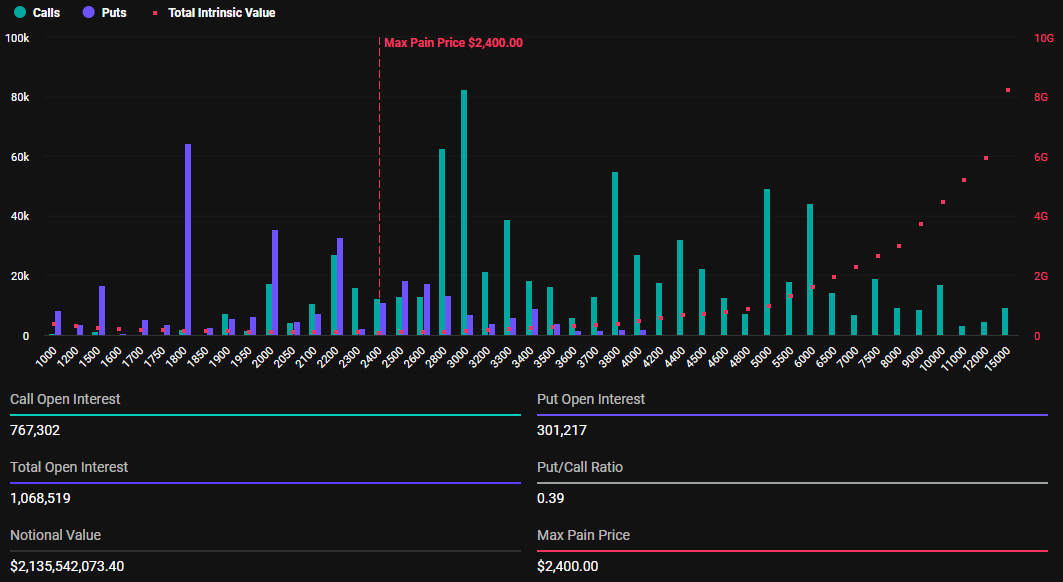

The notional value of today’s expiring BTC options is $12.075 billion. According to Deribit’s data, these 139,260 expiring Bitcoin options have a put-to-call ratio of 0.49. This ratio suggests a prevalence of purchase options (calls) over sales options (puts).

The data also reveals that the maximum pain point for these expiring options is $85,000. The maximum pain point is the price at which the asset will cause the greatest number of holders’ financial losses.

In addition to Bitcoin options, 1,068,519 Ethereum options contracts are set to expire today. These expiring options have a notional value of $2.135 billion, a put-to-call ratio of 0.39, and a maximum pain point of $2,400.

The number of today’s expiring Bitcoin and Ethereum options is significantly higher than last week. BeInCrypto reported that last week’s expired BTC and ETH options were 21,596 and 133,447 contracts, respectively. In the same tone, they had notional values of $1.826 billion and $264.46 million, respectively.

This notable difference comes as this week’s expiring options are for the month and the quarter, with this being the last Friday of March. Deribit options expiry happens on Fridays because it aligns with traditional financial (TradFi) market practices and provides a consistent schedule for traders.

In many global markets, including equities and derivatives, expiration dates for options contracts are commonly set for the end of the trading week—often Friday—to standardize timing and facilitate settlement processes.

Deribit adopted this convention to maintain familiarity for traders transitioning from TradFi to crypto markets and to ensure liquidity and market activity peak at a predictable time.

“Tomorrow is not just any Friday; it’s one of the biggest expiries of the year. Over $14 billion in BTC and ETH options are set to expire at 08:00 UTC. How do you think Q1 will wrap?” Deribit posed in a Thursday post.

Implied Volatility Heading Into Quarterly Options Expiry

Indeed, today’s options expiry concludes the first quarter (Q1) in options expirations. As this happens, analysts at Deribit, a cryptocurrency derivatives exchange, observe the implied volatility (IV) curves for BTC and ETH, showing market expectations of price swings.

Specifically, Bitcoin’s curve indicates a strong bias toward higher prices (upside skew) as calls are priced much higher than puts. On the other hand, Ethereum’s flatter volatility curve suggests less directional bias but still reflects elevated volatility. This hints at anticipated price movement around the expiry date of the $14.21 options.

“Chart 1 – $BTC: BTC showing some serious upside skew, calls priced way higher. Chart 2 – $ETH: ETH’s curve is flatter, but volume is still elevated across the board. Both markets signal anticipation of movement into or post-expiry,” Deribit noted.

This suggests that both Bitcoin and Ethereum markets anticipate movement into or post-expiry. Elsewhere, analysts at Greeks.live shed light on current market sentiment, citing a cautiously bearish outlook dominating investors’ perspective for Bitcoin.

Specifically, they suggest that most traders anticipate a retest of lower price levels around $84,000–$85,000. Bitcoin trading for $85,960 as of this writing indicates a potential downward move in the short term.

However, some traders observe that Bitcoin is stuck in a tight, range-bound trading pattern, implying limited volatility unless a breakout occurs. Against this backdrop, Greeks.live highlights key technical levels.

“Key resistance levels being watched are 88,400 where significant passive selling was observed, and potential support at 77,000 which one trader called the definite bottom,” the analysts wrote.

Greeks.live analysts also observe that Implied Volatility is under pressure due to the quarterly delivery, noting significant deviations in the IV Mark. This suggests opportunities for traders to exploit these fluctuations through manual or automated strategies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Struggles—Is Another Breakdown on The Horizon?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

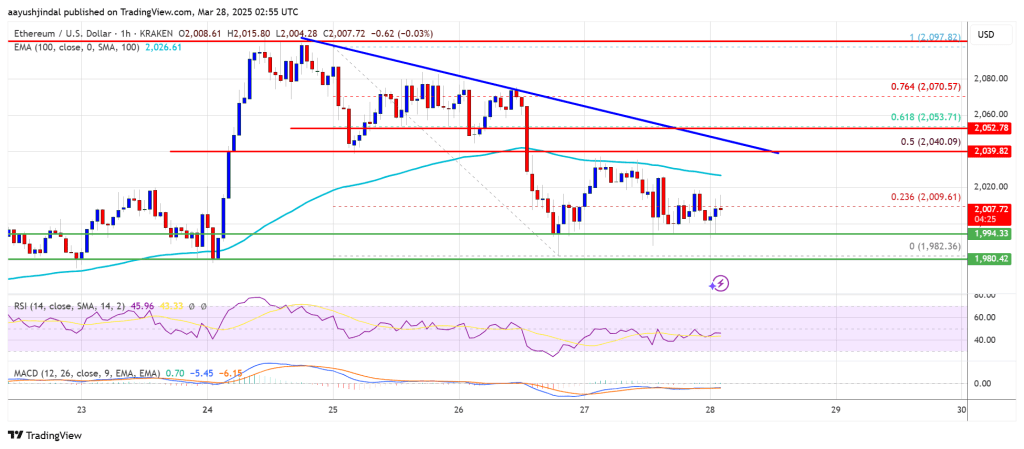

Ethereum price remained supported above the $1,980 level. ETH is now consolidating and remains at risk of a downside break.

- Ethereum struggled to continue higher above the $2,050 resistance level.

- The price is trading below $2,020 and the 100-hourly Simple Moving Average.

- There is a connecting bearish trend line forming with resistance at $2,040 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $2,040 and $2,100 resistance levels to start a decent increase.

Ethereum Price Dips Again

Ethereum price failed to continue higher above $2,100 and corrected some gains, like Bitcoin. ETH declined below the $2,040 and $2,020 support levels.

It tested the $1,980 zone. A low was formed at $1,982 and the price recently attempted a fresh upward move. There was a move above the $2,020 level. The price tested the 50% Fib retracement level of the recent decline from the $2,098 swing high to the $1,982 low.

Ethereum price is now trading below $2,020 and the 100-hourly Simple Moving Average. There is also a connecting bearish trend line forming with resistance at $2,040 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $2,040 level. The next key resistance is near the $2,050 level and the 61.8% Fib retracement level of the recent decline from the $2,098 swing high to the $1,982 low. The first major resistance is near the $2,095 level.

A clear move above the $2,095 resistance might send the price toward the $2,150 resistance. An upside break above the $2,150 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,250 resistance zone or even $2,320 in the near term.

Downside Break In ETH?

If Ethereum fails to clear the $2,040 resistance, it could start another decline. Initial support on the downside is near the $2,000 level. The first major support sits near the $1,980 zone.

A clear move below the $1,980 support might push the price toward the $1,880 support. Any more losses might send the price toward the $1,820 support level in the near term. The next key support sits at $1,750.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,980

Major Resistance Level – $2,040

Market

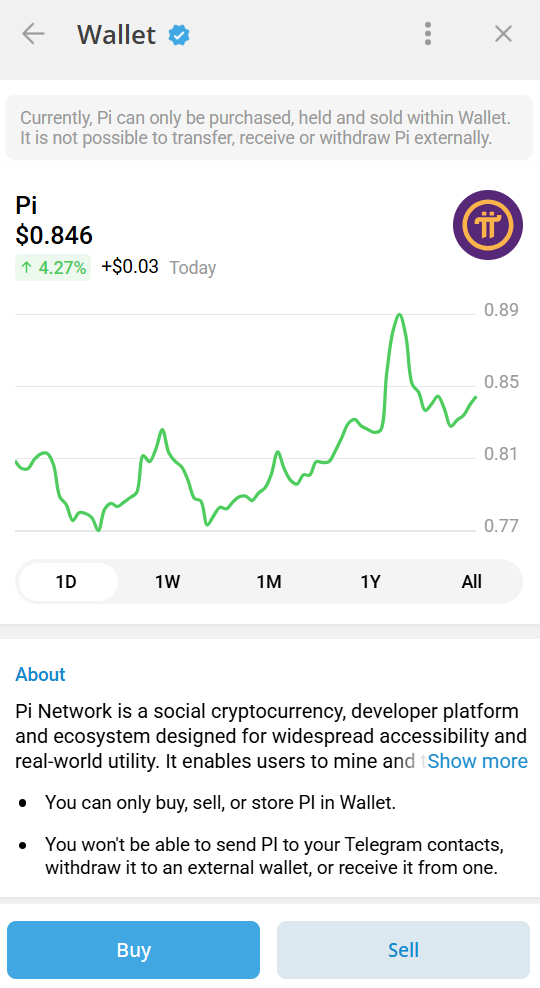

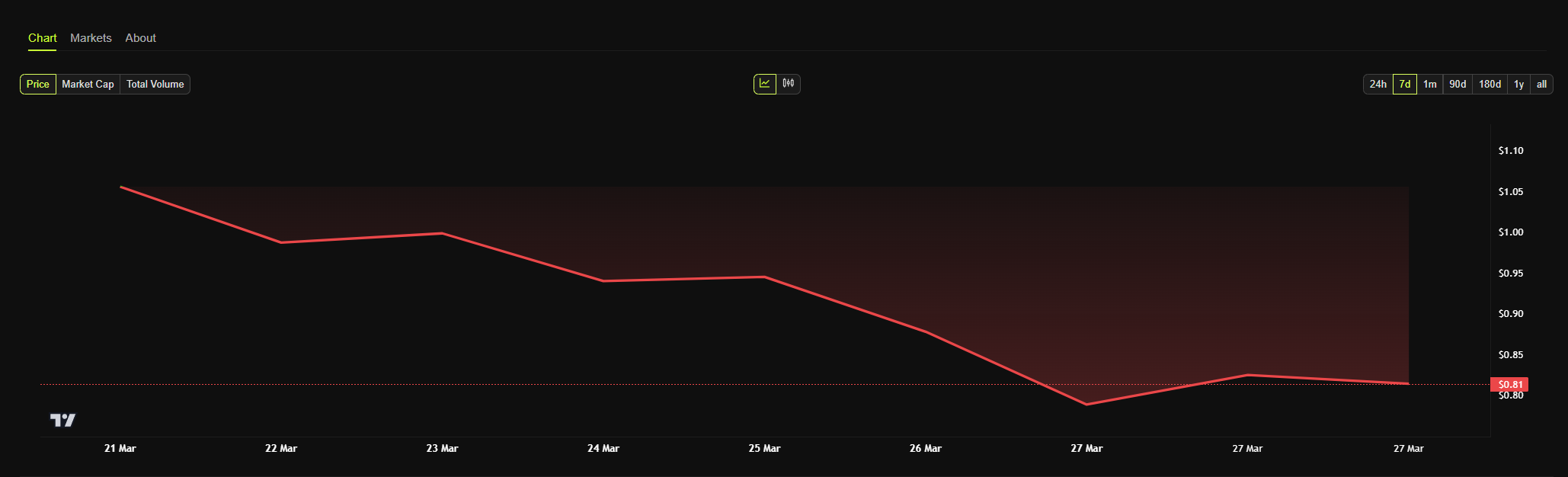

Pi Network Integrates With Telegram’s Crypto Wallet

Pi Network is now integrated with Telegram’s crypto wallet, potentially giving it access to a massive new customer base. Telegram CEO Pavel Durov claims that the messaging app has reached over 1 billion monthly users in 2025.

This means that Telegram users will now be able to buy PI through the app’s integrated crypto wallet. While it certainly boosts the token’s visibility, Pi Network still lacks listing from tier-1 exchanges like Binance and Coinbase, which could improve its credibility in the market.

Pi Network is On the Telegram Wallet

PI made an explosive entry into the crypto market, surging nearly 100% in its first week and hitting a peak of $2.92 on February 27. However, the altcoin has seen continuous liquidations since then. Scrutiny from the big exchanges is delaying major listings, and demand is drying up in a big way.

Yet, today’s Telegram integration provides some optimism for the PI community.

Integration into Telegram’s crypto wallet is a particularly useful development for Pi Network for a few reasons. Telegram’s CEO, Pavel Durov, was released this month after being arrested in August 2024. Now that he’s resumed his activities, he posted notable statistics about the platform’s user base:

“Telegram now has significantly over 1 billion monthly active users, becoming the second most popular messaging app in the world (excluding the China-specific WeChat.) User engagement is also rising, [and] our revenue growth has exploded. We are just getting started,” Durov claimed via Telegram.

In other words, Pi Network is now able to reach one billion Telegram users at a time when the average user spends 41 minutes on the platform daily. This could potentially be a huge pool of new customers, and Pi fans are calling it a “historic step toward mass adoption of decentralized finance.”

However, it’s important to note that Telegram’s crypto functionality, while growing in usage, remains largely underutilized. Despite today’s announcement, the PI price has remained over 25% down in the past week. This reflects declining consumer interest in the project.

Major crypto exchanges like Binance and Coinbase may be dragging their feet with Pi Network, but Telegram has its own substantial user base. If the project can convince a decent chunk of these users to invest, it would be huge.

If it cannot, however, then Pi Network’s losing streak may continue for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoPepe Coin Whale Bags 500M Tokens; PEPE Price Breakout Ahead?

-

Altcoin19 hours ago

Altcoin19 hours agoLinear Finance Ceases Operations As ‘Notice Of Closure’ Announced

-

Bitcoin21 hours ago

Bitcoin21 hours agoWill Bitcoin’s Rally Continue or Just Be a Temporary Surge?

-

Market15 hours ago

Market15 hours agoPaul Atkins Reveals $6 Million in Crypto Exposure

-

Market21 hours ago

Market21 hours agoXRP Price Rejected at Resistance—Are Bears Taking Control?

-

Altcoin21 hours ago

Altcoin21 hours agoLawyer Reveals Ripple SEC SEC Case End Timeline

-

Market20 hours ago

Market20 hours agoCourt Delays Upbit Business Restriction Imposed by FIU

-

Market19 hours ago

Market19 hours agoKiloEx TGE Debuts on Binance Wallet and PancakeSwap