Market

PEPE Price Slows Down as Metrics Indicate Corrections

PEPE’s price hit a new all-time high on November 13, after it was listed on Coinbase. It has been up 105% in the past month, though it’s down nearly 10% in the last seven days. Indicators like RSI and MVRV suggest further corrections could occur as bullish momentum weakens.

A potential death cross in the EMA lines could push PEPE to key supports at $0.0000139 or lower. However, a trend reversal could see PEPE testing resistances at $0.0000228 and aiming for a new all-time high at $0.000030.

PEPE Isn’t Oversold Yet

PEPE RSI has fallen to 38.8 from 60 in the last three days, indicating weakening bullish momentum. The RSI, or Relative Strength Index, measures price momentum on a scale of 0 to 100, with values above 70 signaling overbought conditions and below 30 indicating oversold levels.

The drop reflects growing selling pressure, but the current RSI suggests PEPE is not yet oversold.

At 38.8, PEPE’s RSI is near a key level, as it hasn’t dropped below 30 since November 3. This suggests the price may stabilize soon if historical patterns hold. The recent drop didn’t change the fact that PEPE is the 3rd biggest meme coin in the market, below DOGE and SHIB.

However, if the RSI dips further below 30, it could trigger stronger bearish momentum and lead to further price corrections.

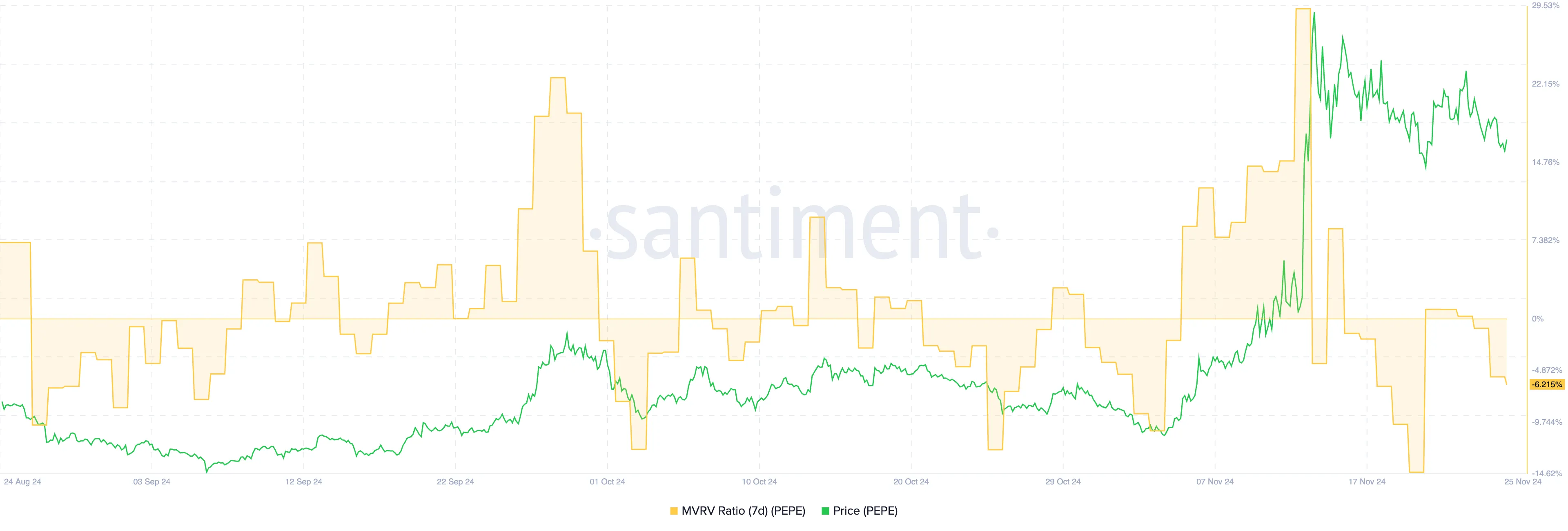

PEPE MVRV Ratio Shows The Correction Could Continue

PEPE’s 7-day MVRV ratio is currently at -6.2%, signaling that recent holders are, on average, at a slight unrealized loss. The MVRV, or Market Value to Realized Value ratio, measures the profit or loss of holders based on the token’s market value relative to the price they paid.

Negative MVRV levels such as this suggest reduced selling pressure since holders are less likely to sell at a loss.

Historically, PEPE has seen strong price recoveries when its 7-day MVRV dropped below -9.7%, indicating the potential for further correction before another upward surge.

This pattern suggests that while the current MVRV level hints at consolidation, a deeper dip could create conditions for a bullish rebound. If the MVRV trends lower, it may set the stage for renewed accumulation and a fresh price recovery.

PEPE Price Prediction: New All-Time Highs May Be Postponed For Now

PEPE’s EMA lines show a bearish signal, with a potential death cross-forming, where short-term EMA lines cross below long-term ones.

If this pattern materializes, it could trigger further corrections. PEPE price will likely test support at $0.0000139 and $0.0000108. Should selling pressure intensify, PEPE could fall to $0.0000077.

On the other hand, if market confidence returns and the trend reverses, PEPE price could challenge resistances at $0.0000228 and $0.000026.

Breaking above these levels could push PEPE price toward $0.000030, setting a new all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

Hedera (HBAR) is under pressure, down roughly 13.5% over the past seven days, with its market cap holding at around $7 billion. Recent technical signals point to growing bearish momentum, with both trend and momentum indicators leaning heavily negative.

The price has been hovering near a critical support zone, raising the risk of a breakdown below $0.15 for the first time in months. Unless bulls regain control soon, HBAR could face further losses before any meaningful recovery attempt.

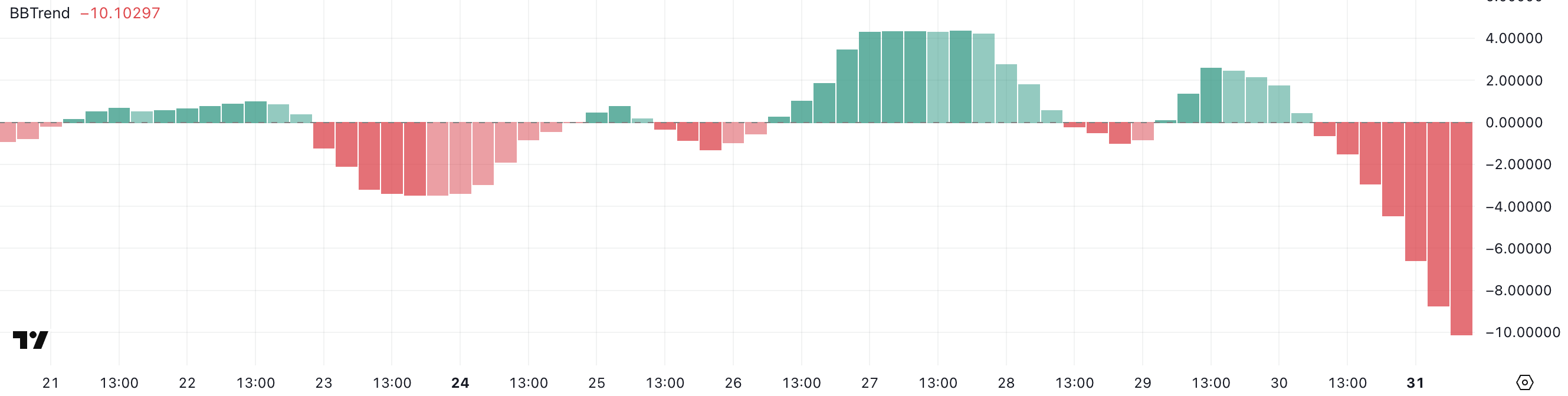

HBAR BBTrend Has Been Turning Heavily Down Since Yesterday

Hedera’s BBTrend indicator has dropped sharply to -10.1, falling from 2.59 just a day ago. This rapid decline signals a strong shift in momentum and suggests that HBAR is experiencing an aggressive downside move.

Such a steep drop often reflects a sudden increase in selling pressure, which can quickly change the asset’s short-term outlook.

The BBTrend, or Bollinger Band Trend, measures the strength and direction of a trend using the position of price relative to the Bollinger Bands. Positive values generally indicate bullish momentum, while negative values point to bearish momentum.

The further the value is from zero, the stronger the trend. HBAR’s BBTrend is now at -10.1, signaling strong bearish momentum.

This suggests that the price is trending lower and doing so with increasing strength, which could lead to further downside unless buyers step in to slow the momentum.

Hedera Ichimoku Cloud Paints a Bearish Picture

Hedera’s Ichimoku Cloud chart reflects a strong bearish structure, with the price action positioned well below both the blue conversion line (Tenkan-sen) and the red baseline (Kijun-sen).

This setup indicates that short-term momentum is clearly aligned with the longer-term downtrend.

The price has consistently failed to break above these dynamic resistance levels, signaling continued seller dominance.

The future cloud is also red and trending downward, suggesting that bearish pressure is expected to persist in the near term.

The span between the Senkou Span A and B lines remains wide, reinforcing the strength of the downtrend. For any potential reversal to gain credibility, HBAR would first need to challenge and break above the Tenkan-sen and Kijun-sen, and eventually push into or above the cloud.

Until then, the current Ichimoku configuration supports a continuation of the bearish outlook.

Can Hedera Fall Below $0.15 Soon?

Hedera price has been hovering around the $0.16 level and is approaching a key support at $0.156.

If this support fails to hold, it could open the door for further downside, potentially pushing HBAR below the $0.15 mark for the first time since November 2024.

However, if HBAR manages to reverse its current trajectory and regain bullish momentum, the first target to watch is the resistance at $0.179.

A breakout above that level could lead to a stronger rally toward $0.20 and, if momentum continues, even reach $0.215. In a more extended bullish scenario, HBAR could climb to $0.25, signaling a full recovery and trend reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Tries to Resume Lawsuit Against the FDIC

Coinbase asked a DC District Court if it could resume its old lawsuit against the FDIC. Coinbase sued this regulator over Operation Choke Point 2.0 and claimed that it’s still refusing to release relevant information.

Based on the information available so far, it’s difficult to draw definitive conclusions. The FDIC maintains that it responded to its opponents’ questions truthfully, though it has shown delays in the past.

Coinbase vs the FDIC

Coinbase, one of the world’s largest crypto exchanges, has been in a few fights with the FDIC. The firm has been pursuing the FDIC over Operation Choke Point 2.0 for months now, and has achieved impressive results. Despite this, however, Coinbase is asking the DC District Court to resume its litigation against the regulator:

“We’re asking the Court to resume our lawsuit because the FDIC has unfortunately stopped sharing information. While we would have loved to resolve this outside of the legal system – and we do appreciate the increased cooperation we’ve seen from the new FDIC leadership – we still have a ways to go,” claimed Paul Grewal, Coinbase’s Chief Legal Officer.

The FDIC has an important role in US financial regulation, primarily dealing with banks. This gave it a starring role in Operation Choke Point 2.0, hampering banks’ ability to deal with crypto businesses. However, it recently started a pro-crypto turn, releasing tranches of incriminating documents and revoking several of its anti-crypto statutes.

Grewal said that he “appreciated the increased cooperation” from the FDIC but that the cooperation stopped weeks ago. According to Coinbase’s filing, the FDIC hasn’t sent any new information since late February and claimed in early March that the exchange’s subsequent requests were “unreasonable and beyond the scope of discovery.”

On one hand, the FDIC has previously been slow to make relevant disclosures in the Coinbase lawsuit. On the other hand, Operation Choke Point 2.0 sparked significant tension within the industry, and a determined group is now aiming to significantly weaken the regulatory bodies involved.

Until the legal battle continues, it’ll be difficult to make any definitive statements. The FDIC will likely have two weeks to respond to Coinbase’s request.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

Larry Fink, CEO of BlackRock, claimed in a recent letter that Bitcoin and crypto could damage the dollar’s international standing. If investors treat Bitcoin as an inflation hedge to the dollar, it could precipitate serious trouble.

However, he was also adamant that the industry offers a lot of advantages, particularly through tokenization.

Larry Fink Sees Opportunity in Crypto

BlackRock is the leading Bitcoin ETF issuer in the US, and its CEO Larry Fink has long been bullish on Bitcoin. However, as Fink described in his most recent Annual Chairman’s Letter to investors, crypto’s best interest doesn’t always align with TradFi or the dollar.

“The US has benefited from the dollar serving as the world’s reserve currency for decades. But that’s not guaranteed to last forever. By 2030, mandatory government spending and debt service will consume all federal revenue, creating a permanent deficit. If the US doesn’t get its debt under control… America risks losing that position to digital assets like Bitcoin,” he said.

To be clear, Fink insisted that he supports crypto and listed some practical problems that he believes it can solve. He expressed a particular interest in asset tokenization, claiming that a digital-native infrastructure would improve and democratize the TradFi ecosystem.

Despite these advantages, Fink recognizes the danger that crypto can present to the US economy if not properly managed. He addressed the longstanding practice of using crypto to hedge against inflation, a wise practice for many assets.

However, if a wide swath of investors think Bitcoin is more stable than the dollar, it would threaten USD’s status as the world reserve currency. A scenario like that would be very dangerous to all of TradFi, and Fink has a particular interest in protecting BlackRock. Such an event would doubtlessly impact crypto as well.

“Decentralized finance is an extraordinary innovation. It makes markets faster, cheaper, and more transparent. Yet that same innovation could undermine America’s economic advantage if investors begin seeing Bitcoin as a safer bet than the dollar,” Fink added.

He didn’t offer too many specific solutions to this growing problem, but Fink isn’t the only person concerned with the issue. President Trump recently suggested that stablecoins could promote dollar dominance worldwide. Even if the dollar is seen as unstable, its adoption within a rapidly growing global industry like stablecoins could help reinforce its strength and relevance.

Of course, there are also drawbacks to Trump’s plan. Larry Fink acknowledged a possible threat from crypto, but continues to espouse its utility. Its benefits are too good to ignore.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoCardano Price Eyes Massive Pump In May Following Cyclical Patern From 2024

-

Market20 hours ago

Market20 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market19 hours ago

Market19 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market17 hours ago

Market17 hours agoDogecoin (DOGE) Bulls In Trouble—Can They Prevent a Drop Below $0.15?

-

Bitcoin10 hours ago

Bitcoin10 hours agoBTC Price Rebound Likely as Long-Term Holders Reenter Market

-

Market16 hours ago

Market16 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Market10 hours ago

Market10 hours ago3 Altcoins to Watch in the First Week of April 2025

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Is ‘Completely Dead’ As An Investment: Hedge Fund