Market

Altcoins GOAT, SUI, POPCAT Face Post-Peak Declines

Altcoins like GOAT, SUI, and POPCAT have faced notable shifts in momentum following their recent peaks. GOAT, which hit an all-time high of $1.37, has declined 25.42% over the past week, falling out of the top 10 meme coin rankings.

SUI, after reaching $3.94, has dropped 7.56%, slipping below a $10 billion market cap and trailing behind altcoins like Bitcoin Cash and Chainlink. Meanwhile, POPCAT has seen a sharp 21.00% decline from its $2.08 high, signaling potential further corrections as bearish technical patterns emerge.

GOAT

GOAT price has seen a significant decline, dropping 25.42% in the past week and falling below its $1 billion market cap. After reaching an all-time high of $1.37 on November 17, the altcoin’s momentum has cooled.

Once ranked among the top 10 meme coins by market cap, it is now 12th, losing places to MOG and MEW.

If bullish momentum returns, GOAT could test resistance at $1.23, potentially surpassing its previous high of $1.37. However, EMA lines indicate a prevailing downtrend.

Should this continue, the coin might test support at $0.69, and if that level fails to hold, prices could fall as low as $0.419.

SUI

SUI hit its all-time high of $3.94 on November 17 but has since entered a downward trend, falling 7.56% over the past week.

The altcoin recently dropped below a $10 billion market cap, slipping behind other rising altcoins like Bitcoin Cash (BCH) and Chainlink (LINK). The coin recently faced a two-hour outage, but its price didn’t fall as much as many expected, staying above $3.

EMA lines suggest SUI is in a downtrend, with short-term lines nearing a bearish cross below long-term ones. If this continues, SUI could test support at $3.09, with a potential drop to $2.2 if the lower level fails to hold.

However, renewed bullish momentum could see SUI challenge its all-time high of $3.94 and possibly test $4, pushing its market cap to $11.5 billion for the first time.

POPCAT

POPCAT reached an all-time high of $2.08 roughly one week ago but has since seen a sharp decline, falling 21.00% in the last seven days.

This drop has been accompanied by bearish signals, with its shortest-term EMA lines crossing below the longest ones, forming a death cross. This technical pattern suggests growing selling pressure and potential for further downside.

If the correction continues, POPCAT could test support at $1.17, with a possibility of falling as low as $0.9 if the lower support fails.

However, a reversal in momentum could see POPCAT rise to test $1.82, and if this resistance is broken, it may return to the $2 mark, potentially setting a new all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How Did UPCX Lose $70 Million in a UPC Hack?

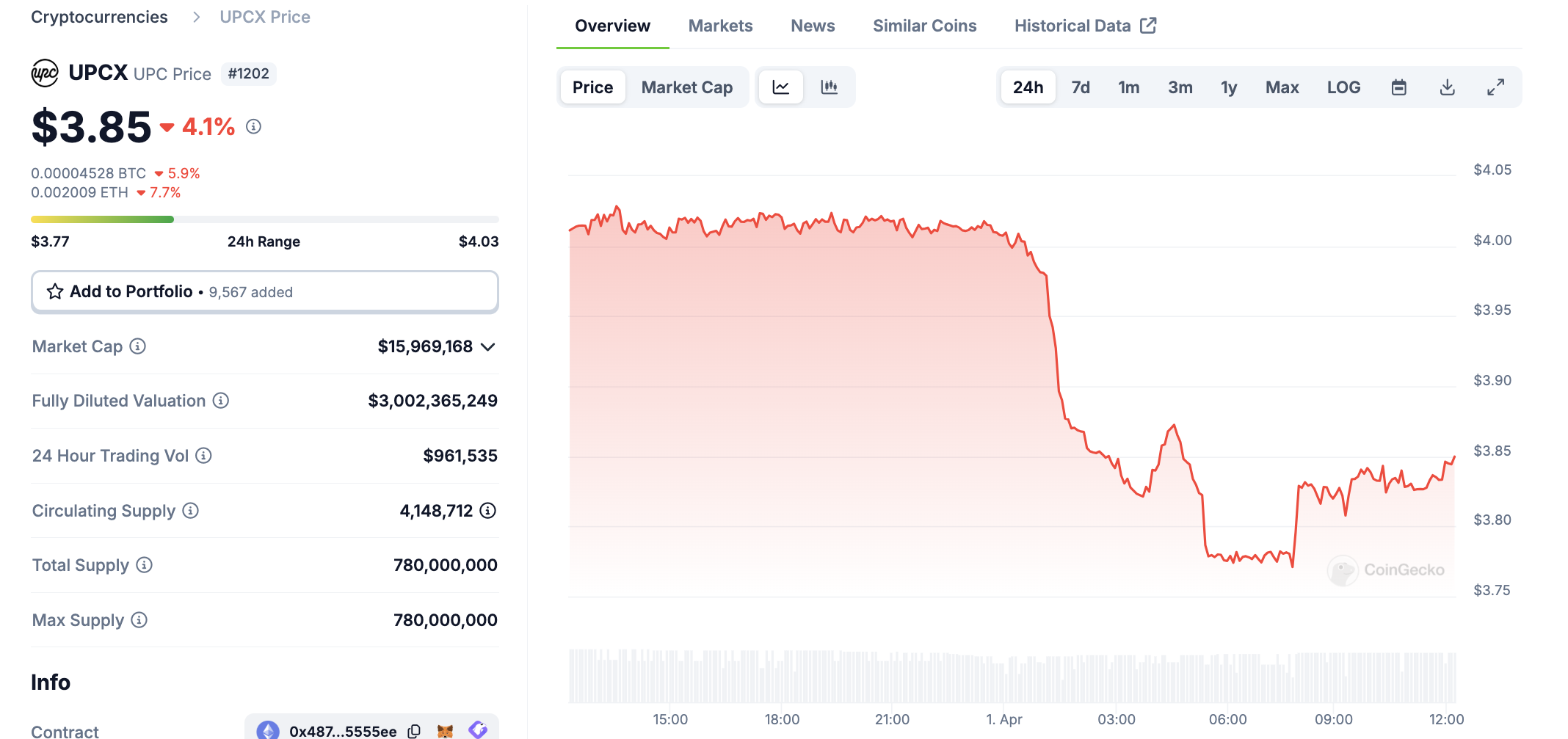

UPCX suffered a major hack today, with 18.4 million UPC tokens stolen from its management accounts. This amounts to about $70 million dollars, and the price of UPC fell drastically.

The hackers stole more UPC than is currently circulating in the markets and haven’t offloaded any assets yet. It is unclear who did this or how they will be able to secure their gains in other assets.

UPCX Suffers Major Hack

Cyvers, a crypto security firm that has tracked and uncovered several major crimes, identified a serious hack this morning. Multiple suspicious transactions took place involving UPCX’s management account, and the firm acknowledged suspicious activity. UPCX didn’t go into great detail, only describing a few security measures, but Cyvers showed the extent of the hack:

“It appears that someone gained access to the address 0x4C….3583E, upgraded the ‘ProxyAdmin’ contract, and executed the ‘withdrawByAdmin’ function, resulting in the transfer of 18.4 million UPC (approximately $70 million) from three different management accounts,” Cyvers claimed via social media.

UPCX is an open-source crypto payment system, and this hack may represent a serious blow to the company. According to CoinGecko data, the hackers stole significantly more UPC tokens than are currently available, which is around 4 million. Naturally, this caused the price to drop significantly, in an immediate drop of over 4%:

Although a $70 million hack will certainly damage UPCX individually, it’s unclear if it will actually impact the broader market much. The largest hack in crypto history took place a little over a month ago, and the community is still assessing the fallout. Meanwhile, UPCX is comparatively tiny; less than 10,000 X users viewed its post admitting to the security breach.

Since the UPCX hack took place, the recipient account hasn’t moved any of its UPC tokens. Indeed, it may be difficult for the perpetrator to convert these assets into usable fiat in the first place. If the hackers stole nearly 5x the amount of UPC tokens in circulation, any attempt to liquidate them will crash UPC’s token price even further.

Ultimately, the UPCX hack is strange for several reasons. Despite a large dollar amount, it hasn’t attracted a huge amount of buzz or impacted the market outside UPC. Hopefully, further analysis will identify the perpetrators, and possibly freeze the assets. Otherwise, the threat of a future sale could hamper UPC’s recover for the foreseeable future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Struggles to Break Out as Bear Trend Fades

Ethereum (ETH) enters the week with mixed signals as traders brace for tomorrow’s “Liberation Day” tariff announcement, a potential macro catalyst that could impact risk assets. While the BBTrend indicator remains deeply negative, it’s beginning to ease, hinting at a possible slowdown in bearish momentum.

On-chain data shows a slight uptick in whale accumulation, suggesting cautious optimism from large holders. Meanwhile, Ethereum’s EMA setup shows early signs of a trend reversal, but the price still needs to break key resistance levels to confirm a shift in direction.

ETH BBTrend Is Easing, But Still Very Negative

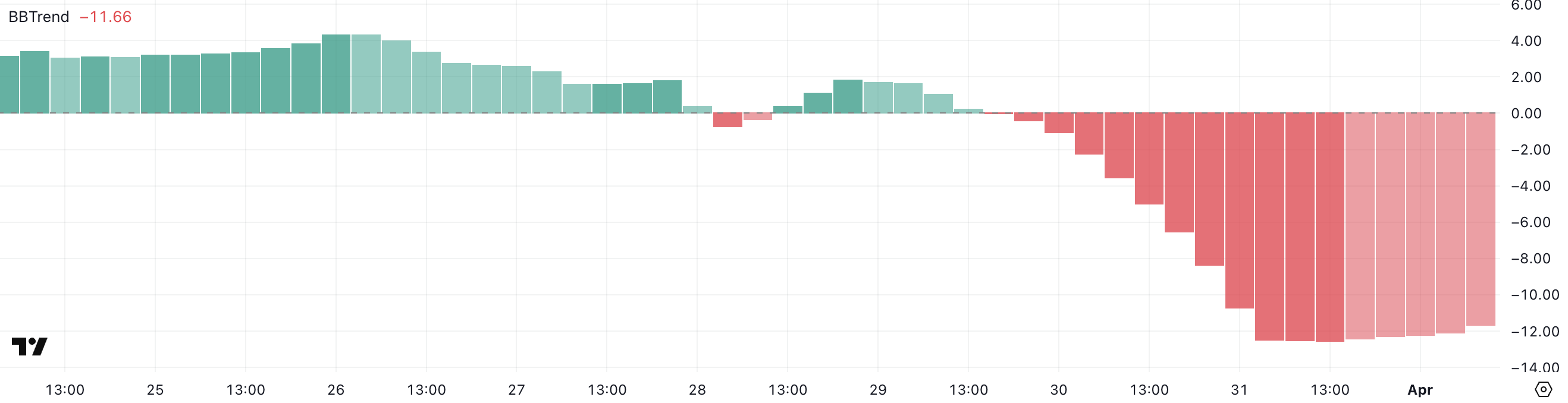

Ethereum’s BBTrend indicator is currently reading -11.66, slightly improved from -12.54 the day before, but still in negative territory for the second consecutive day.

The Bollinger Band Trend (BBTrend) measures the strength and direction of a trend based on how price interacts with the upper and lower Bollinger Bands.

A positive BBTrend suggests bullish momentum, with the price expanding toward the upper band, while a negative BBTrend indicates bearish momentum, with the price leaning toward the lower band. Typically, a value beyond 10 is considered a strong trend signal, making the current -11.66 reading a sign of continued downside pressure.

The persistent negative BBTrend suggests that Ethereum remains in a short-term bearish phase, with sellers still dominating the price action.

While yesterday’s slight uptick hints at a potential slowing of downward momentum, the indicator remains well below the neutral zone, meaning any reversal is still unconfirmed, despite Ethereum flipping Solana in DEX trading volume for the first time in 6 months.

Traders may interpret this as a warning to stay cautious, especially if ETH continues hugging the lower Bollinger Band. For now, price action remains fragile, and any bounce will need to be supported by a decisive shift in volume and sentiment to signal a meaningful reversal.

Ethereum Whales Are Accumulating Again

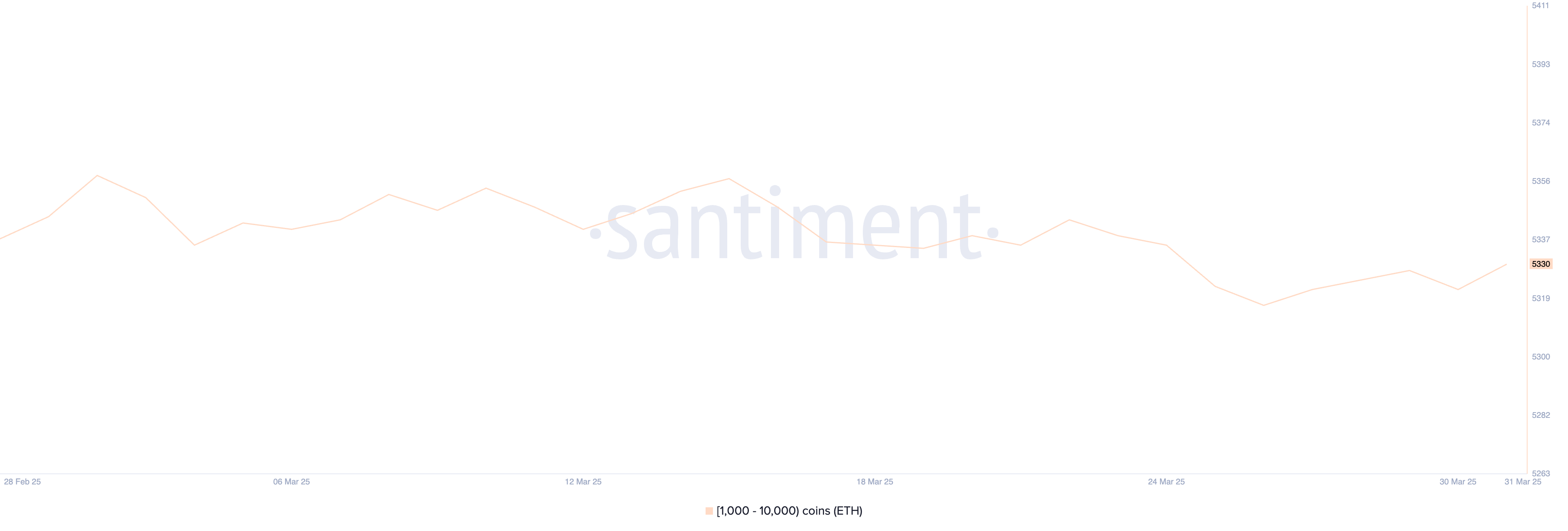

The number of Ethereum whales—wallets holding between 1,000 and 10,000 ETH—has ticked up slightly, rising from 5,322 to 5,330 in the past 24 hours.

While this is a modest increase, whale activity remains one of the most closely watched on-chain metrics, as these large holders often influence market direction. Whales’ accumulation can signal growing confidence in Ethereum’s medium—to long-term prospects, especially during periods of price uncertainty or consolidation.

Conversely, a decline in whale addresses typically suggests weakening conviction or profit-taking.

Although the recent uptick is a positive sign, it’s important to note that the current number of Ethereum whales is still below the levels observed in prior weeks.

This means that while some large holders may be re-entering the market, the broader whale cohort has yet to fully commit to an accumulation phase.

If the upward trend in whale numbers continues, it could support a bullish shift in sentiment and price. However, for now, the data points to cautious optimism rather than a decisive reversal.

Will Ethereum Break Above $2,100 Soon?

Ethereum’s EMA lines are showing early signs of a potential trend reversal, with price action attempting to break above key short-term averages.

If Ethereum price can push through the resistance at $1,938, it may signal the start of a broader recovery, potentially targeting the next resistance levels at $2,104, and if momentum builds—especially with supportive macro catalysts—increasing toward $2,320 and even $2,546.

On the flip side, if Ethereum fails to maintain its upward push and bearish momentum resumes, the focus will shift back to downside levels.

The first key support sits at $1,823; a break below that could expose Ethereum to further losses toward $1,759.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Megadrop Launches KernelDAO

Binance Megadrop has announced its fourth project – KernelDAO (KERNEL), a restaking protocol supporting three key tokens Kernel, Kelp, and Gain.

Introduced in 2024, Binance Megadrop is a token launch platform that provides users with early access to promising crypto projects before their official listing.

KernelDAO and Binance Megadrop: Overview

KernelDAO is a restaking protocol that allows users to repurpose staked assets (such as ETH or BNB) to participate in other protocols, maximizing yield. The protocol launched its mainnet in December 2024.

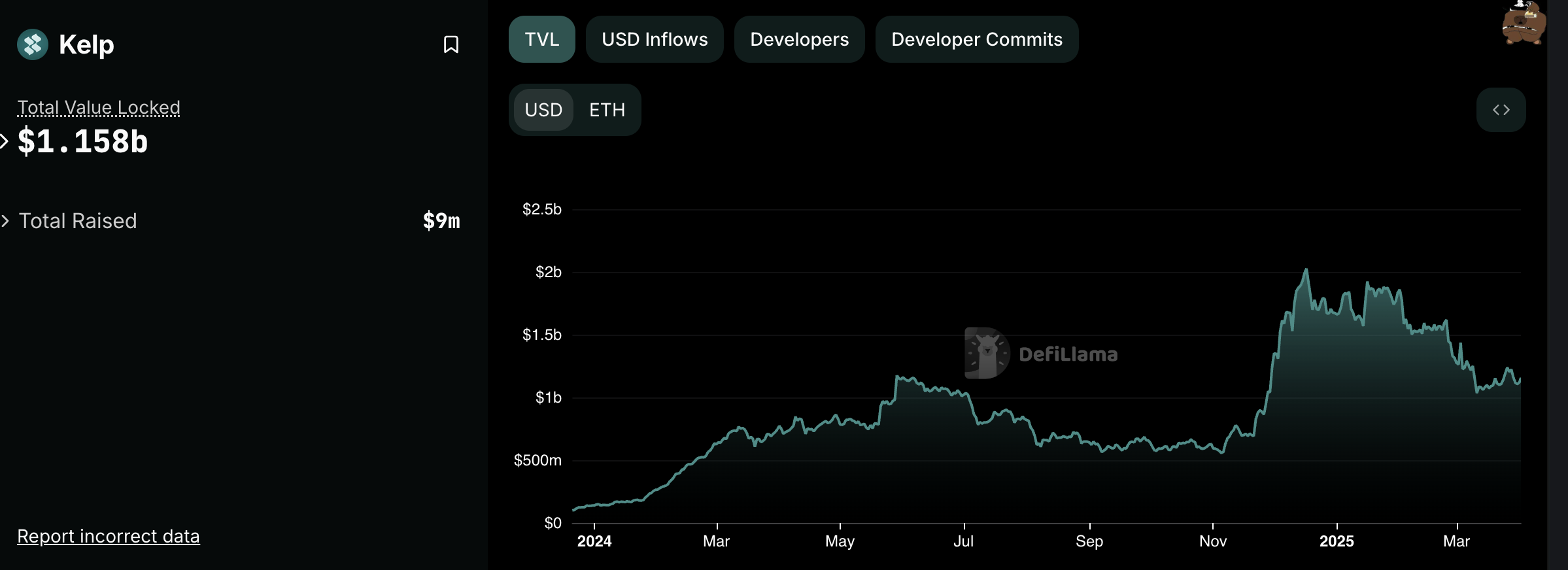

The KernelDAO Megadrop event kicks off on April 1, 2025, and lasts for 20 days, rewarding participants with KERNEL tokens. Kelp, a KernelDAO component, manages over $1.15 billion in Total Value Locked (TVL) across 10 blockchains, including Ethereum and BNB Chain.

KernelDAO has a maximum supply of 10 billion KERNEL tokens. Binance has allocated 40 million KERNEL (4% of the total supply) for participants. Upon listing on Binance, the initial circulating supply will be 162,317,496 KERNEL (16.23% of the total supply).

After the Megadrop event, KERNEL will be listed on Binance Spot with trading pairs such as KERNEL/BTC, KERNEL/USDT, and KERNEL/BNB.

KernelDAO is the fourth project on Binance Megadrop, following Lista (LISTA) and Xai (XAI). Previously, Binance Labs invested in Kernel to build recovery infrastructure on the BNB Chain.

Binance’s inclusion of KernelDAO could contribute to the growth of the restaking sector. According to DeFiLlama, the total TVL of restaking protocols surpassed $15 billion in early 2025, with EigenLayer and Kelp leading the market.

With 40 million KERNEL tokens distributed through Megadrop, many participants may sell immediately after receiving their tokens, potentially creating downward price pressure. Additionally, increasing competition from protocols like EigenLayer could pose challenges for KernelDAO.

Additionally, not all projects listed on Binance have performed impressively. In 2024, Binance-listed tokens all fell, with 29 out of 30 tokens posting significant losses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoHedera (HBAR) Bears Dominate, HBAR Eyes Key $0.15 Level

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum May Have To Undo This Death Cross For Bull’s Return

-

Market23 hours ago

Market23 hours agoBlackRock’s Larry Fink Thinks Crypto Could Harm The Dollar

-

Market22 hours ago

Market22 hours agoCoinbase Tries to Resume Lawsuit Against the FDIC

-

Altcoin22 hours ago

Altcoin22 hours agoCharles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

-

Market20 hours ago

Market20 hours agoThis is Why PumpSwap Brings Pump.fun To the Next Level

-

Market19 hours ago

Market19 hours agoCardano (ADA) Whales Hit 2-Year Low as Key Support Retested

-

Market24 hours ago

Market24 hours agoXRP Bears Lead, But Bulls Protect Key Price Zone