Market

Zircuit, HashKey, Kima Network, & More

This week, several cryptocurrency projects are gearing up for their Token Generation Events (TGEs). These events mark the launch of a project’s tokens, offering traders and investors a chance to get in early on promising ventures.

TGEs often draw attention and boost liquidity, making them key moments for both developers and participants. Here’s a look at the most anticipated TGEs happening this week.

Zircuit (ZRC)

Zircuit, an EVM-compatible zero-knowledge rollup, held its TGE on November 25 at 10:00 a.m. UTC. Planned exchange listings include Bybit, MEXC, Gate.io, and KuCoin, with these platforms already confirming the listings on X (formerly Twitter).

The project emphasizes community ownership, allocating 21% of its tokens to community initiatives.

“Proud to be the most community-owned L2: 21% allocated for community airdrops, 12.45% claimable, no requirements to claim, 13.08% for future community initiatives, 12-month cliff for team and investors,” Zircuit said.

Notably, Zircuit has garnered attention from major players like Binance and crypto researchers, who are optimistic about its potential, especially amid the recent recovery in Ethereum’s ecosystem tokens.

RWA Inc. (RWA)

This tokenization ecosystem raised $1.18 million in private fundraising and $800,000 during its public token offering. With a valuation of $10 million, the TGE also happened on November 25 at 10:00 a.m. UTC, followed by listings on KuCoin, Gate.io, and MEXC.

The project boasts strong community support, with its fundraising rounds selling out in record time. Over 20,000 participants joined the public sale, signaling high investor confidence.

“Our Launch raise was a huge success. We raised 800,000 USD across Decubate, Eesee, and Ape Terminal, in record time! With over 20,000 combined participants, only the Decubate raise made it out of the GA round where the remainder of the allocation sold out in under a minute! It seems the community is feeling more than a little bullish about,” RWA Inc. shared on X.

HashKey (HSK)

HashKey, a comprehensive digital asset financial services provider, will host its TGE on November 26 at 10:00 a.m. UTC. Listings will follow on HashKey Exchange, KuCoin, BingX, and Gate.io.

The project, with a valuation of $1.2 billion and after a $100,000 public token offering raise, promises long-term ecosystem growth. It aims to do this by capping its supply at 1 billion tokens and allocating 20% of net profits to token buybacks every quarter.

“Designed for use across all HashKey businesses Capped supply at 1,000,000,000 (1 billion) HSK. Native and gas tokens for HashKeyChain are Not sold through private or public sales for fundraising, ensuring the long-term growth of the ecosystem HashKeyGroup will use 20% of its net profit to purchase the circulated HSK every quarter,” HashKey said.

Kima Network (KIMA)

As a cross-ecosystem money transfer protocol, Kima Network has raised $11.2 million in private fundraising and $940,000 in its public offering. The TGE is scheduled for November 26 at 1:00 p.m. UTC, with a Gate.io listing soon after.

The project, incubated by ChainGPT, operates across 10 blockchains and boasts over 800,000 unique testnet wallets. It is backed by major industry players like Mastercard’s FinSec Innovation Lab and Outlier Ventures. Its ecosystem includes over 200 integrated dApps, which suggests its potential for widespread adoption.

“ChainGPT Pad investors who participated in the KIMA Private Round will be able to claim their tokens via a claim portal. Token Claim Time: 1:30 PM UTC, 26 November,” ChainGPT said.

World of Dypians (WOD)

World of Dypians, an MMORPG available on Epic Games, plans its TGE for November 27 at 11:00 a.m. UTC. The project has raised $5.3 million in private funding and $850,000 publicly, with a valuation of $42 million. Post-TGE, listings on KuCoin and Gate.io are expected.

Backed by significant names like BNB Chain, Manta Network, and Core, the game is also leveraging community engagement through campaigns such as the $5,000 Gate.io Startup Voting Campaign.

“Big companies are supporting World of Dypians, they can see the project is the real deal,” one user on x said.

Plena Finance (PLENA)

Plena is the first Crypto Super App to use Account Abstraction technology for over three years — more than a year before Vitalik Buterin wrote his paper on this tech. It combines the ease of a centralized application with full custody of assets. Utilizing advanced account abstraction technology eliminates the need for its users to hold native tokens and have prior blockchain knowledge.

This makes it easy for them to perform complex transactions. Beyond trading, Plena incorporates social networking and smart investment tools like chatting, sharing market insights, and Dollar-Cost Averaging, offering a secure, social, and sophisticated platform for community engagement and profitability.

The crypto super app powered by account abstraction technology will launch its tokens on November 27 at noon UTC. The project, valued at $25 million, raised $6.3 million privately and $500,000 publicly. Gate.io will host its initial listing, and the project has already engaged its community through airdrop campaigns.

Major (MAJOR)

Major, a P2E game integrated with Telegram, has scheduled its TGE for November 28 at noon UTC. Following the TGE, the game will be listed on Bybit, KuCoin, OKX, and Bitget. With its unique gameplay and task-driven reward system, Major has captured the attention of early adopters.

Along with the TGE, the project will also integrate Wallet in Telegram, where users will be able to buy, sell, and transfer the MAJOR crypto with zero fees.

“Major of Telegram arrives in Wallet in Telegram on November 28! Get ready to receive, exchange, and send MAJOR to your friends on Telegram for free! Stay tuned – we will let you know when you can claim MAJOR on Wallet,” Wallet in Telegram announced.

Shieldeum (SDM)

Shieldeum, an AI-powered decentralized physical infrastructure network (DePIN), is preparing for its TGE on November 28 at 1:00 p.m. UTC. The project raised $1.8 million in private rounds and $415,000 publicly, with a valuation of $9 million. Listings will follow on KuCoin, MEXC, Gate.io, and PancakeSwap.

With projects like Zircuit and HashKey debuting their tokens, the top TGEs this week may cause significant activity in the cryptocurrency market. Each TGE offers unique opportunities for investors and enthusiasts to engage with novel blockchain solutions. As these tokens debut on prominent exchanges, market watchers will keenly observe their performance and broader implications for the crypto ecosystem.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Altcoins GOAT, SUI, POPCAT Face Post-Peak Declines

Altcoins like GOAT, SUI, and POPCAT have faced notable shifts in momentum following their recent peaks. GOAT, which hit an all-time high of $1.37, has declined 25.42% over the past week, falling out of the top 10 meme coin rankings.

SUI, after reaching $3.94, has dropped 7.56%, slipping below a $10 billion market cap and trailing behind altcoins like Bitcoin Cash and Chainlink. Meanwhile, POPCAT has seen a sharp 21.00% decline from its $2.08 high, signaling potential further corrections as bearish technical patterns emerge.

GOAT

GOAT price has seen a significant decline, dropping 25.42% in the past week and falling below its $1 billion market cap. After reaching an all-time high of $1.37 on November 17, the altcoin’s momentum has cooled.

Once ranked among the top 10 meme coins by market cap, it is now 12th, losing places to MOG and MEW.

If bullish momentum returns, GOAT could test resistance at $1.23, potentially surpassing its previous high of $1.37. However, EMA lines indicate a prevailing downtrend.

Should this continue, the coin might test support at $0.69, and if that level fails to hold, prices could fall as low as $0.419.

SUI

SUI hit its all-time high of $3.94 on November 17 but has since entered a downward trend, falling 7.56% over the past week.

The altcoin recently dropped below a $10 billion market cap, slipping behind other rising altcoins like Bitcoin Cash (BCH) and Chainlink (LINK). The coin recently faced a two-hour outage, but its price didn’t fall as much as many expected, staying above $3.

EMA lines suggest SUI is in a downtrend, with short-term lines nearing a bearish cross below long-term ones. If this continues, SUI could test support at $3.09, with a potential drop to $2.2 if the lower level fails to hold.

However, renewed bullish momentum could see SUI challenge its all-time high of $3.94 and possibly test $4, pushing its market cap to $11.5 billion for the first time.

POPCAT

POPCAT reached an all-time high of $2.08 roughly one week ago but has since seen a sharp decline, falling 21.00% in the last seven days.

This drop has been accompanied by bearish signals, with its shortest-term EMA lines crossing below the longest ones, forming a death cross. This technical pattern suggests growing selling pressure and potential for further downside.

If the correction continues, POPCAT could test support at $1.17, with a possibility of falling as low as $0.9 if the lower support fails.

However, a reversal in momentum could see POPCAT rise to test $1.82, and if this resistance is broken, it may return to the $2 mark, potentially setting a new all-time high.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Price Faces Critical Levels After 193% Surge

Cardano (ADA) price climbed 193.65% over the last 30 days and 37.82% in the past week. Despite this impressive rally, indicators suggest that ADA’s uptrend may be losing steam. The ADX, which measures trend strength, has dropped from over 60 to nearly 45, signaling weakening momentum even as the uptrend remains intact.

With whale accumulation stabilizing and prices approaching key EMA levels, ADA faces a critical moment that could lead to either a test of its highest price since 2021 or a potential 48% correction if bearish pressure grows.

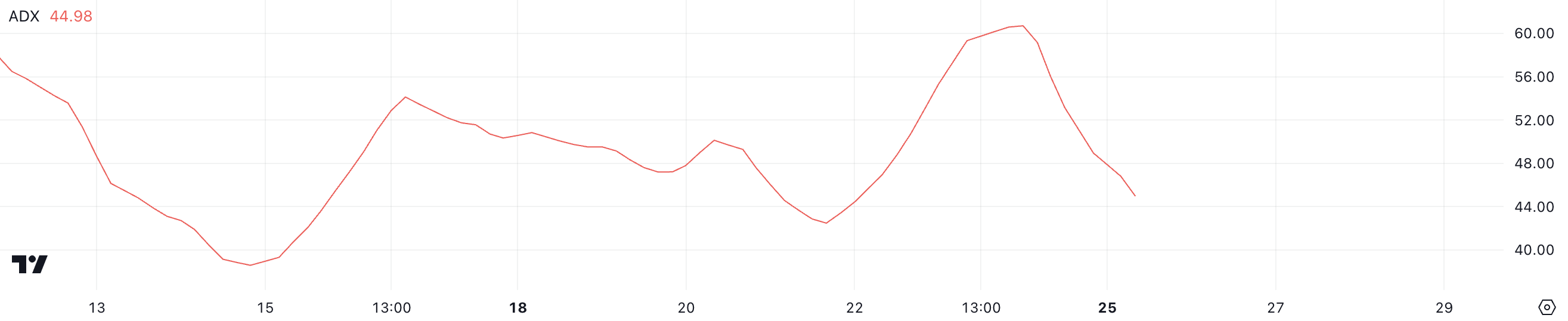

ADA Uptrend Appears to Be Losing Steam

Cardano ADX currently sits at nearly 45, having declined from over 60 just a few days ago. The ADX, or Average Directional Index, measures the strength of a trend, with values above 25 indicating a significant trend and values above 40 suggesting a very strong one.

Although an ADX of 45 still reflects strong momentum, the drop from 60 signals a weakening in the trend’s intensity, even if the direction remains unchanged.

Currently, ADA is in an uptrend, supported by its directional indicators. The decline in ADX suggests that while the uptrend remains strong, the bullish momentum has begun to lose some of its strength. If the ADX continues to drop, it could indicate that the current uptrend may flatten or reverse if selling pressure grows.

However, with an ADX still well above 25, the trend remains meaningful, and Cardano price is likely to retain its bullish bias for the near term unless further weakening occurs.

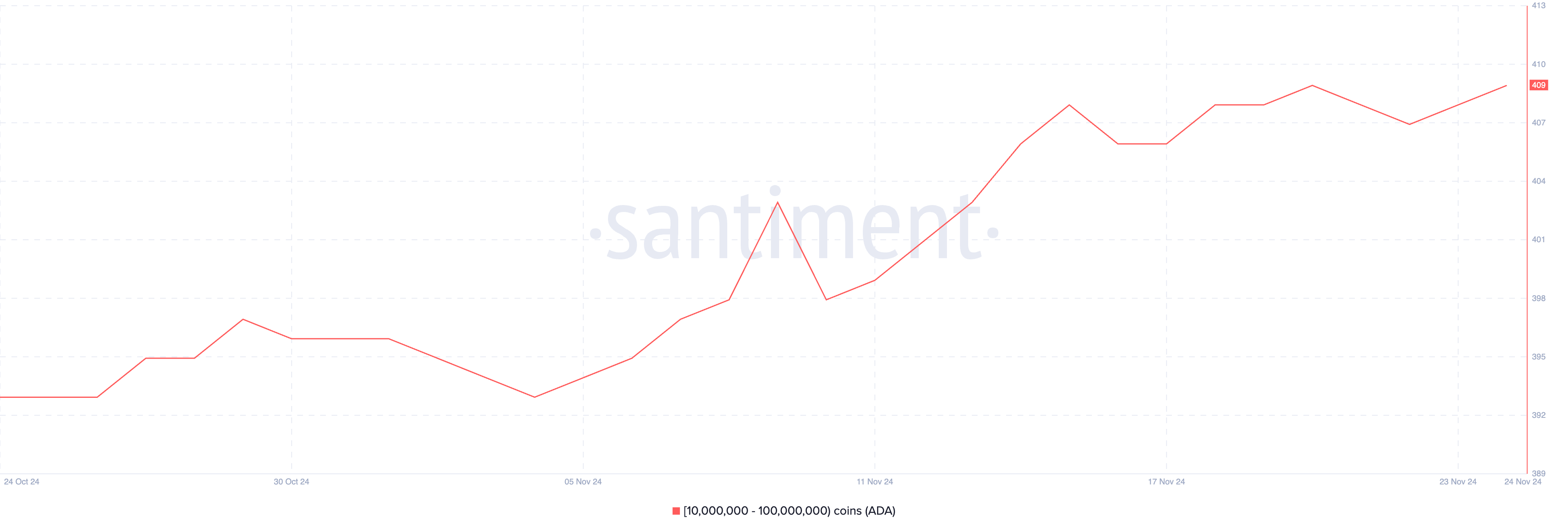

Cardano Whales Stopped Accumulating

Whales began accumulating Cardano heavily starting November 10, with the number of wallets holding between 10,000,000 and 100,000,000 ADA increasing from 398 to 408 by November 15. Tracking whale activity is crucial because these large holders often have the power to influence market trends significantly.

Their buying behavior can indicate growing confidence in the asset and potentially fuel price surges, while their selling may trigger downward pressure.

Since November 15, the number of these whale wallets has stabilized, hovering between 407 and 409. This consistent accumulation suggests that whales are holding onto their positions, reflecting a neutral to bullish sentiment.

If whales maintain their holdings without significant additions or reductions, ADA price may experience less volatility, with the market awaiting new catalysts for the next directional move.

ADA Price Prediction: Highest Price Since 2021 Or a Strong Correction?

Cardano EMA lines continue to reflect a bullish setup, with short-term lines positioned above long-term ones. However, the current price is no longer significantly above the short-term EMA lines, indicating that the bullish momentum has weakened.

This proximity suggests that the uptrend is losing strength, and the ADA price is approaching a critical point where it could either rebound or dip below these lines, signaling a potential trend shift.

If the uptrend regains strength, ADA price could test levels above $1.155, potentially reaching $1.16, its highest price since March 2021. However, as indicated by the declining ADX, the current uptrend is losing intensity, increasing the likelihood of a reversal.

Should the trend turn bearish, ADA’s closest support lies at $0.519, which would represent a significant 48% correction from current levels.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

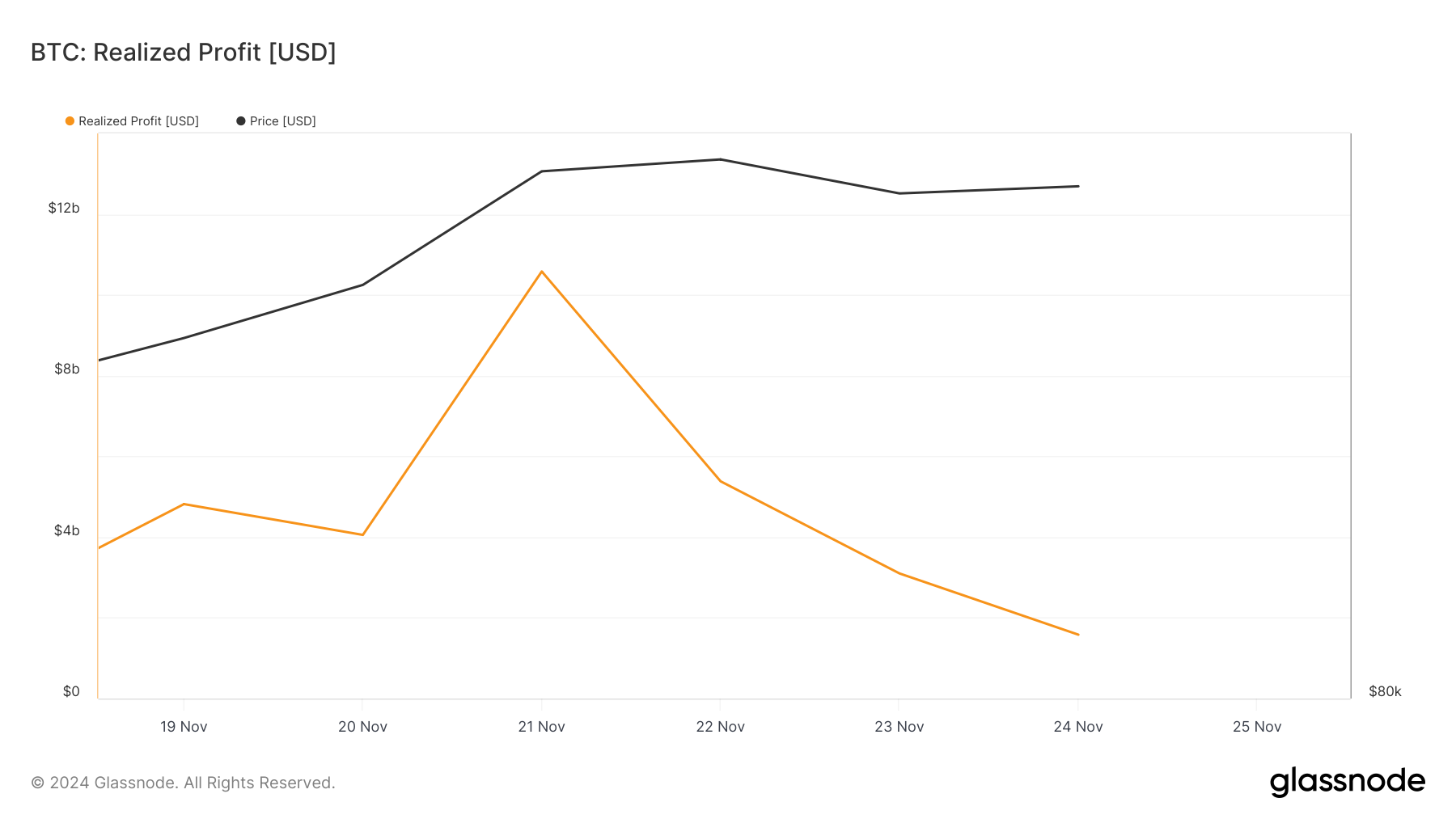

How Bitcoin Realized Profits May Impact BTC Price

Since November 21, Bitcoin (BTC) has hovered near the $100,000 mark but hasn’t hit it, with BeInCrypto attributing this to increased realized profits.

Recent data shows that profit-taking activity has slowed. What does this mean for Bitcoin’s price?

Bitcoin Holders Step Back from Booking Gains

Data from Glassnode shows that Bitcoin realized profits surged to $10.58 million on Thursday, November 21. However, as of this writing, the value has dropped to $1.58 million, a $9 million difference.

As the name implies, realized profit is the value of coins sold after their price has increased. Therefore, when this metric rises, it becomes challenging for the cryptocurrency’s price to continue its rally.

However, since the realized profit has dropped, most BTC holders have halted selling in large volumes. If this trend continues, Bitcoin’s price could bounce and probably rise to the $100,000 milestone.

This sentiment is further supported by the Coins Holding Time metric, which tracks how long a cryptocurrency has been held without being transacted or sold.

When the Coins Holding Time decreases, it means holders of a particular crypto are selling. If this continues, the trend becomes bearish. However, over the last seven days, BTC Coins Holding Time has increased by 65%.

This increment reinforces the bias by the Bitcoin realized profit that selling pressure has decreased. Interestingly, IT Tech, an analyst on CryptoQuant, agrees with the thesis that Bitcoin might continue to climb.

“The green bars showing STH selling in profit have yet to reach levels seen during the previous $72,400 peak. This suggests that profit-taking pressure hasn’t peaked, leaving room for further upward movement in price,” IT Tech said.

BTC Price Prediction: $102, 500 Seems Close

On the daily chart, BTC continues to trade within an ascending channel, suggesting that it has the potential to climb higher.

BeInCrypto also observed that the Supetrend indicator has remained bullish. The Supertrend is a technical indicator used to spot the direction in which an asset moves.

If the red part of the indicator is above the price, the trend is downward, and the price can decrease. However, since the green area is below the price, the value might rise above $99,780. If that were the case, Bitcoin’s price might climb to $102,500.

On the other hand, if Bitcoin realized profits surge again, this might not happen. Instead, the value could decline to $84,466.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin8 hours ago

Altcoin8 hours agoWhy Is Ethereum Up Today? Will It Hit $10,000?

-

Altcoin14 hours ago

Altcoin14 hours agoSuper Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

-

Market13 hours ago

Market13 hours agoHarmful Livestreams Prompt Ban Calls

-

Market24 hours ago

Market24 hours agoWhy Ethereum Price May Fall Under $3,000

-

Bitcoin23 hours ago

Bitcoin23 hours agoBitcoin Bull Saylor Hints at Expanding MicroStrategy’s Holdings

-

Market22 hours ago

Market22 hours agoBitcoin ETFs Could Overtake Gold ETFs by End of The Year

-

Market16 hours ago

Market16 hours agoEthereum Price Poised for Gains: $3,600 Within Reach?

-

Altcoin16 hours ago

Altcoin16 hours agoBTC and Major Altcoins Pullback, SAND Soars 60%