Altcoin

GameFi, Metaverse Crypto Sectors Lead With 100% Sandbox (SAND) Price Rally

The GameFi and Metaverse sectors have taken charge of the next leg of the crypto market rally with The Sandbox (SAND) price gaining almost 100% in the last 2 days. Apart from SAND, other market players like Decentraland (MANA), Gala (GALA), and Axie Infinity (AXS) have also staged strong gains over the past week.

The Sandbox (SAND) Price Revives GameFi, Metaverse Sectors

Metaverse platform The Sandbox has registered strong network activity with its native token SAND price gaining more than 100% in the last few days. As a result, it managed to outperform other top altcoins like XRP and Cardano.

Furthermore, on-chain metrics show that the SAND price rally can continue further. As per the CryptoQuant data, the daily transaction count for SAND has surged to 11,597 reaching the highest in the last seven days.

The surge in SAND’s transaction count shows that investors are bullish on the asset’s recent surge thereby signaling higher demand and participation. Furthermore, there’s also a surge in the exchange withdrawal transactions that hints at a bullish momentum ahead. It shows that long-term investors are moving SAND off the exchanges hinting at increased confidence in the asset.

On the technical chart, SAND price has given a breakout from the downward-trending pattern eyeing the next target of $1.40. Thus, investors are eyeing for another 75-80% rally ahead.

$SAND Breaking out , Ready for next leg-up🚀#Altseason pic.twitter.com/YVxrQtXl70

— Wallstreet Queen (@wsqofficial) November 24, 2024

MANA, GALA, and AXS Join the Party

Apart from The Sandbox (SAND) price rally, other GameFi and Metaverse tokens like Decentraland (MANA), Gala (GALA), and Axie Infinity (AXS) have also joined the party gaining 25-50% over the past week.

With more than 67% gains on the weekly chart, the MANA price is currently trading at $0.70 with its market cap crossing $1.3 billion. If the bulls manage to sustain past the $0.70 resistance, they can take MANA to $1.30 with another 100% gains in the making.

$MANA army, ready for a comeback?!📈🚀 pic.twitter.com/DCFSCKLXX4

— Solberg Invest (@SolbergInvest) November 24, 2024

Similarly, Axie Infinity (AXS) price is up 42% on the weekly chart and currently trading at $8.13 levels. Also, the daily trading volume for AXS has shot by 28% surging past more than $1.02 billion.

Axie Infinity, developed by Vietnam-based Sky Mavis, is a blockchain-based game that uses a “play-to-earn” model, enabling players to earn cryptocurrency through gameplay. The AXS price has bounced back after a double-bottom formation. As per the technical chart, the next subsequent targets for AXS could be $28, $45, and $69.

$axs is forming a possible double bottom structure. these are my targets for $axs coin pic.twitter.com/x36t11TNXk

— Vinci | DEEK (@Vince26king) November 24, 2024

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Why Is Ethereum Up Today? Will It Hit $10,000?

The Ethereum (ETH) price has taken a strong lead gaining 5% over the last 24 hours and crossing past $3,500 levels while Bitcoin consolidates around $98,500. The attention shifts to ETH as BTC faces stiff resistance at the $100K milestone.

Following ETH’s gains, other altcoins like Ripple’s XRP, Cardano (ADA), Avalanche (AVAX), have reversed their trajectory for strong gains. The ETH/BTC pair will be crucial to monitor to decide the future course of action ahead.

Ethereum Futures Open Interest Hits Fresh All-Time High

Velte Lunde, Head of Research at K33, reports that the open interest in CME’s ether futures has nearly doubled since the recent election, reaching all-time highs. For the past few days, Ether futures premiums have even surpassed those of Bitcoin. This marks a significant shift in market dynamics.

Ethereum has largely underperformed the rest of the altcoin space during the crypto market rally following Donald Trump’s victory. After surging to $3,400 earlier this month, the ETH price retraced to taking support at $3,000 levels, amid Ethereum whale dumping.

However, it bounced back from those lows jumping 14% over the past week with surging Ethereum futures open interest. Popular on-chain analyst Maartum also reported that Ether has experienced a notable change, with a net inflow of more than 10,000 ETH. A total of 115,000 ETH was deposited, while 105,000 ETH was withdrawn.

This is a much healthier and positive shift after months of net outflows. If this trend continues, it could reduce the overall availability of ETH in the market, potentially impacting price dynamics, noted the analyst.

ETH Price to Hit $10,000?

The ETH Price is showing major strength on the technical chart, overcoming the resistance of $3,375. Crypto analysts and participants consider $4,000 as the first target for Ethereum. Meanwhile, notable analysts have also shared targets of $6,500 by the end of Q2 2025.

As per the Coinglass data, the Ether open interests surged by 5.74% to $21.73 billion. Also, the 24-hour liquidations have shot up to $47.5 million of which $24.47 million are in short liquidations and $23 million in long liquidations.

Also, crypto analyst Michael van de Poppe noted that ETH price is yet to break upwards, highlighting the need for the cryptocurrency to surpass a critical resistance level. According to him, ETH/BTC must break the 0.036 mark and convert it into support before a potential upward move. Once this happens, Ethereum price rally to $10K will kickstart soon.

#Ethereum didn’t break upwards yet.

It needs to break 0.036 BTC and flip that level for support.

Once that happens, I’m assuming that the #Altcoins will go way higher. pic.twitter.com/A8R2HKj1qw

— Michaël van de Poppe (@CryptoMichNL) November 25, 2024

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Futures OI Tops $2.50B As Ripple Whales Buy Over 250M Coins

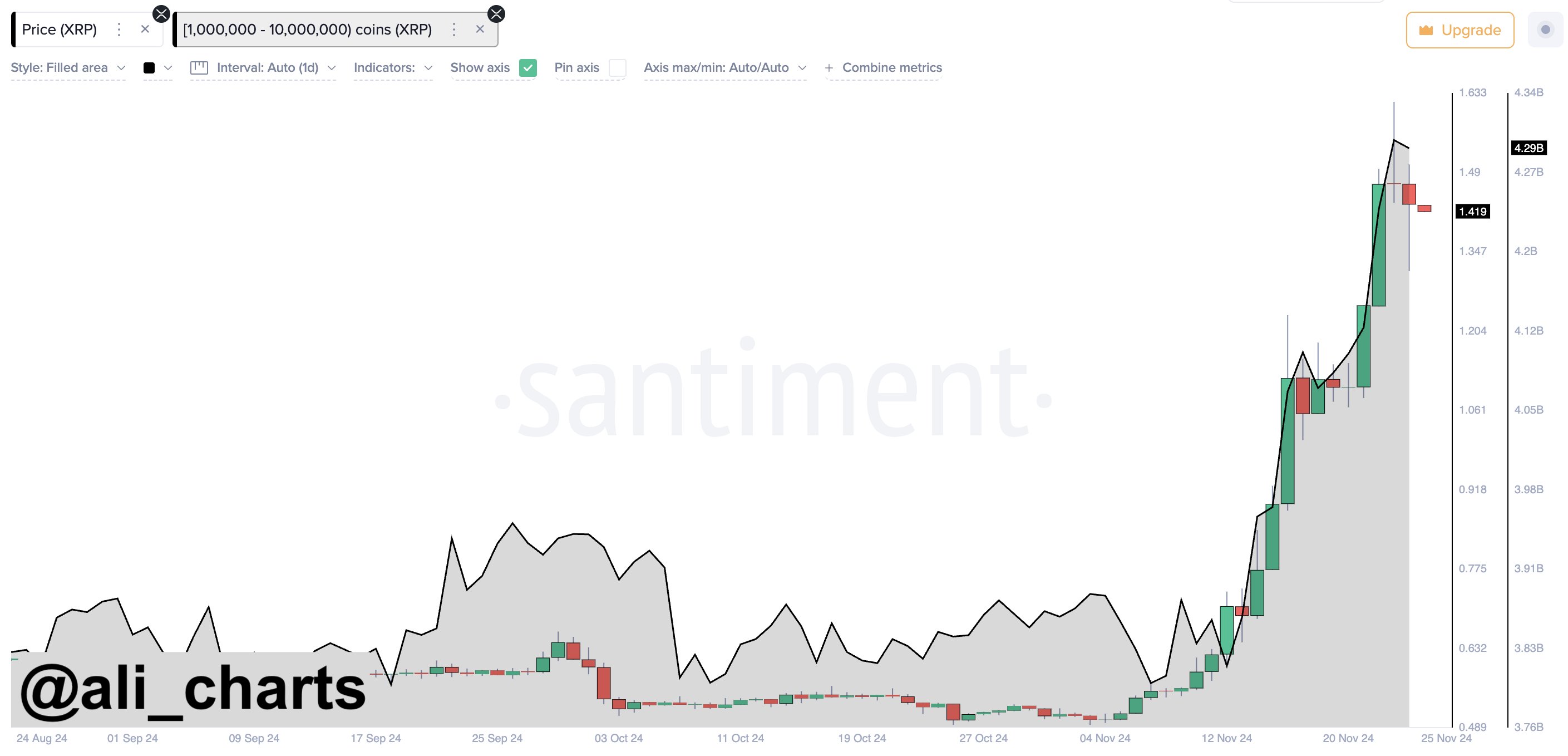

XRP News: Ripple whales have purchased millions of XRP in the last few weeks triggering a massive 200% rally this month. XRP price saw a 10% correction last weekend, but on-chain data revealed that whales have bought more than 250 million during the dip. Is a rally to $20 ahead as XRP futures open interest surpassed $2.50 billion?

Whales Accumulation Triggers Bullish News for XRP

Ripple whales purchased more than 250 million XRP over the weekend, according to on-chain data platform Santiment. It follows as whales moved to buy the dip after a recent selloff of XRP during the weekend.

Popular trader Ali Martinez signaled that the Ripple whales are bullish on a further rally in XRP price. The significant transactions indicate confidence in XRP or strategic accumulation. Traders must watch for potential market moves and legal resolutions of crypto lawsuits.

Whale Alert reported multiple XRP tokens transactions, including a transaction of 149,000,000 tokens worth $227 million transferred from crypto exchange Bybit to a wallet. Also, a whale accumulated 20 million XRP from South Korean exchange Upbit.

In addition, on-chain data reported 58,333,326 XRP valued at $87 million transferred from Binance to a whale wallet.

As CoinGape reported earlier, whales are accumulating the tokens massively amid bullish sentiment. Donald Trump’s win in US presidential election and US SEC Chair Gary Gensler’s resignation have fueled sentiment for the potential end of the Ripple lawsuit.

Rally Continues As Open Interests Hit Over $2.50 Billion

Ripple’s token saw a correction over the weekend but whales buying the dip came as major news for XRP investors. The recent dip came from South Korean investors. However, analysts have given a target of $2 and a long-term price target of $20 amid various bullish news for XRP.

Total XRP futures open interests have now surpassed $2.50 billion, hitting a new high. The futures OI increased to 1.59 billion XRP worth $2.50 billion amid massive buying seen on Binance and Bybit, as per Coinglass data.

XRP price has jumped 4% in the last few hours, with the price currently trading at $1.51. The 24-hour low and high are $1.31 and $1.54, respectively. Furthermore, the trading volume has increased by 24% in the last 24 hours, indicating a rise in interest among traders.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Binance Expands Offerings For CATI, HBAR, OM & These Crypto Sparking Optimism

Leading crypto exchange Binance has again sparked market optimism surrounding certain tokens, revealing enhanced offerings for investors on Monday. Notably, the exchange added new trading pairs for CATI, HBAR, OM, FDUSD, RAY, and TAO to its stockpile of offerings, magnetizing traders and investors globally. Meanwhile, with the tokens witnessing a highly turbulent movement, market watchers speculate about the potential impact of the enhanced listings on prices ahead.

Binance Expands Trade Offerings For CATI, HBAR, OM, & These 3 Tokens

In an official Binance announcement dated November 25, the crypto exchange revealed that it is adding new USDC-pegged cross and isolated margin pairs for CATI, HBAR, OM, FDUSD, RAY, and TAO. Per the exchange’s announcement, this mover is meant to enhance users’ trading experience and provide more stable and low-risk options for margin traders.

Notably, the exchange added in its announcement that users should refer to the latest margin data on the platform to stay informed of the most updated marginal assets and further information on specific limits, collateral ratios, and rates. Nevertheless, the enhanced offering paves the way for further trader and investor interaction with the asset, sparking optimism about future movements. Usual market sentiments convey optimism as one of the top crypto exchanges further expands support for the mentioned tokens.

Intriguingly, CoinGape Media reported the same tokens to be eyeing additional gains ahead as Binance also revealed another important update on them, enhancing market support with new trading pairs.

How Are The Tokens Performing?

Despite the enhanced trade offerings, the mentioned coins have witnessed a turbulent intraday movement, which is in sync with the broader market trend. Catizen (CATI) price slipped 4% over the past day, whereas it gained 15% weekly to reach $0.5599. Its intraday low and high were $0.5029 and $0.5947, respectively. Coinglass data pointed out a 1% increase in the cat-themed crypto’s futures OI to $56.29 million.

Simultaneously, Hedera (HBAR) price cracked 5% over the past day and gained 22% weekly to rest at $0.1445. Its intraday low and peak were $0.1365 and $0.1529, respectively. Coinglass data sparked slight concerns over the coin’s movements ahead as its futures OI slipped 11% to $139.17 million today.

Besides, MANTRA (OM) price tanked 11% in the past 24 hours and plunged 11% weekly to reach $3.68, raising uncertain investor sentiments despite the enhanced offerings by the leading crypto exchange. The coin’s 24-hour low and high were $3.53 and $3.85, respectively. MANTRA’s futures OI, per Coinglass data, was down 7% to $192.19 million.

RAY price soared 5% over the past day and 13% weekly to reach $6.34. The coin’s 24-hour low and high were $5.70 and $6.46, respectively. However, the token’s futures OI slipped 0.05% to $16.16 million, per Coinglass data.

Lastly, Bittensor (TAO) price tanked 2% over the past day, whereas it gained 7% weekly to trade at $529. The token’s 24-hour low and high were $487.63 and $542.81, respectively. Bittensor’s futures OI slipped 2% to $212.13 million today. Overall, despite the crypto exchange’s enhanced trade offerings, market watchers remain apprehensive over future movements amid the broader market’s recent turbulent action.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Bitcoin23 hours ago

Bitcoin23 hours agoAI Company Invests $10 Million In BTC Treasury

-

Market23 hours ago

Market23 hours agoIs the XRP Price Decline Going To Continue?

-

Bitcoin21 hours ago

Bitcoin21 hours agoSenator’s Bold Proposal To Replenish US Reserves

-

Market20 hours ago

Market20 hours agoCan the SAND Token Price Rally Be Sustained?

-

Bitcoin19 hours ago

Bitcoin19 hours agoBitcoin Whales Remain Determined, $3.96 Billion Worth Of BTC Gobbled Up In 96 Hours

-

Altcoin7 hours ago

Altcoin7 hours agoSuper Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

-

Market19 hours ago

Market19 hours agoCantor Fitzgerald Deepens Tether Ties With 5% Stake Acquisition

-

Market6 hours ago

Market6 hours agoHarmful Livestreams Prompt Ban Calls

✓ Share: