Market

SEC Secures Record $8.2 Billion in 2024 Financial Remedies

The US Securities and Exchange Commission (SEC) achieved $8.2 billion in financial remedies during its 2024 fiscal year, marking a significant milestone despite fewer enforcement actions.

The agency reported that it filed 583 cases this year, reflecting a 26% decrease compared to 2023. However, substantial financial penalties, particularly from high-profile cases like Terraform, drove remedies to record levels.

Terraform Labs Responsible for 56% of SEC’s Enforcement Penalties

The SEC’s enforcement report highlighted that the $4.5 billion penalty from Terraform Labs made up 56% of the year’s total financial remedies. This case, tied to the 2022 Terra/Luna collapse, resulted in the largest monetary judgment ever secured by the SEC after a trial.

Terraform Labs and its CEO, Do Kwon, were found liable for defrauding investors during the Terra/Luna collapse in 2022. The SEC described the incident as one of the most significant securities fraud cases in its history. The collapse, which destabilized the crypto market, resulted in significant losses for investors, prompting heightened regulatory scrutiny.

Beyond Terraform, the SEC settled with crypto-friendly bank Silvergate Capital for misleading disclosures about its compliance programs related to crypto clients, including FTX. BarnBridge DAO also faced charges for failing to register its structured crypto assets as securities.

In addition to enforcement, the SEC highlighted its investor protection efforts. It distributed $345 million to harmed investors this year, bringing its total to over $2.7 billion since 2021.

The agency also processed 45,130 tips, complaints, and referrals in 2024, including 24,000 whistleblower submissions. Whistleblower awards reached $255 million, underscoring the SEC’s reliance on public collaboration to identify and penalize wrongdoing.

The outgoing SEC Chair Gary Gensler emphasized that these actions emphasizes the agency’s commitment to protecting investors.

“The Division of Enforcement is a steadfast cop on the beat, following the facts and the law wherever they lead to hold wrongdoers accountable,” Gensler added.

Despite the SEC’s achievements, critics have voiced concerns about its enforcement strategy. Miles Jennings, head of decentralization at a16z crypto, argued that large financial penalties might not address systemic issues in the financial markets.

“The SEC measures its success in the amount of fines collected from enforcement actions. While large fines can serve as a visible deterrent and provide a measurable benchmark for activity, they don’t reflect whether the SEC is achieving its core mission of preventing misconduct in financial markets,” he stated.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why BTC Miners Are Selling Their Coins

Bitcoin miners have been actively reducing their holdings in recent weeks as the coin’s price continues to hover below the critical $100,000 mark. At press time, the leading coin trades at $98,535, noting a 1% decline from its all-time high of $99,860 recorded during Friday session.

As the BTC market begins to trend sideways, its miners may be prompted to further distribute their holdings for profit or to offset growing mining costs.

Bitcoin Miners Sell Their Holdings

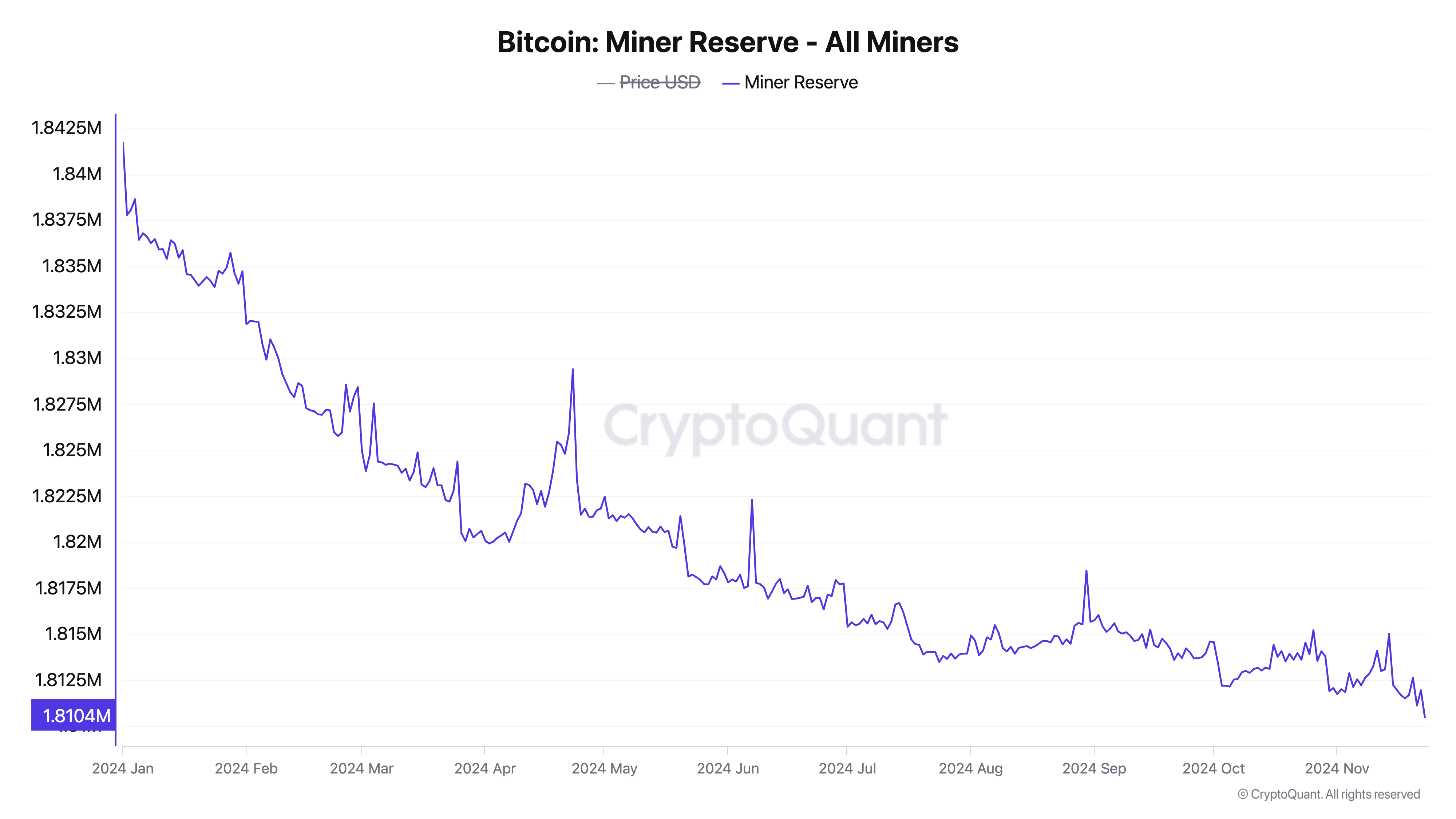

According to CryptoQuant’s data, Bitcoin’s miner reserve has fallen to its lowest level since the beginning of the year. As of this writing, it sits at 1.81 million BTC.

This metric tracks the number of coins held in miners’ wallets. It represents the coin reserves miners have yet to sell. A decline in the BTC miner reserve indicates that miners on the Bitcoin network are distributing their coins either to take profits or to cover mining-related costs.

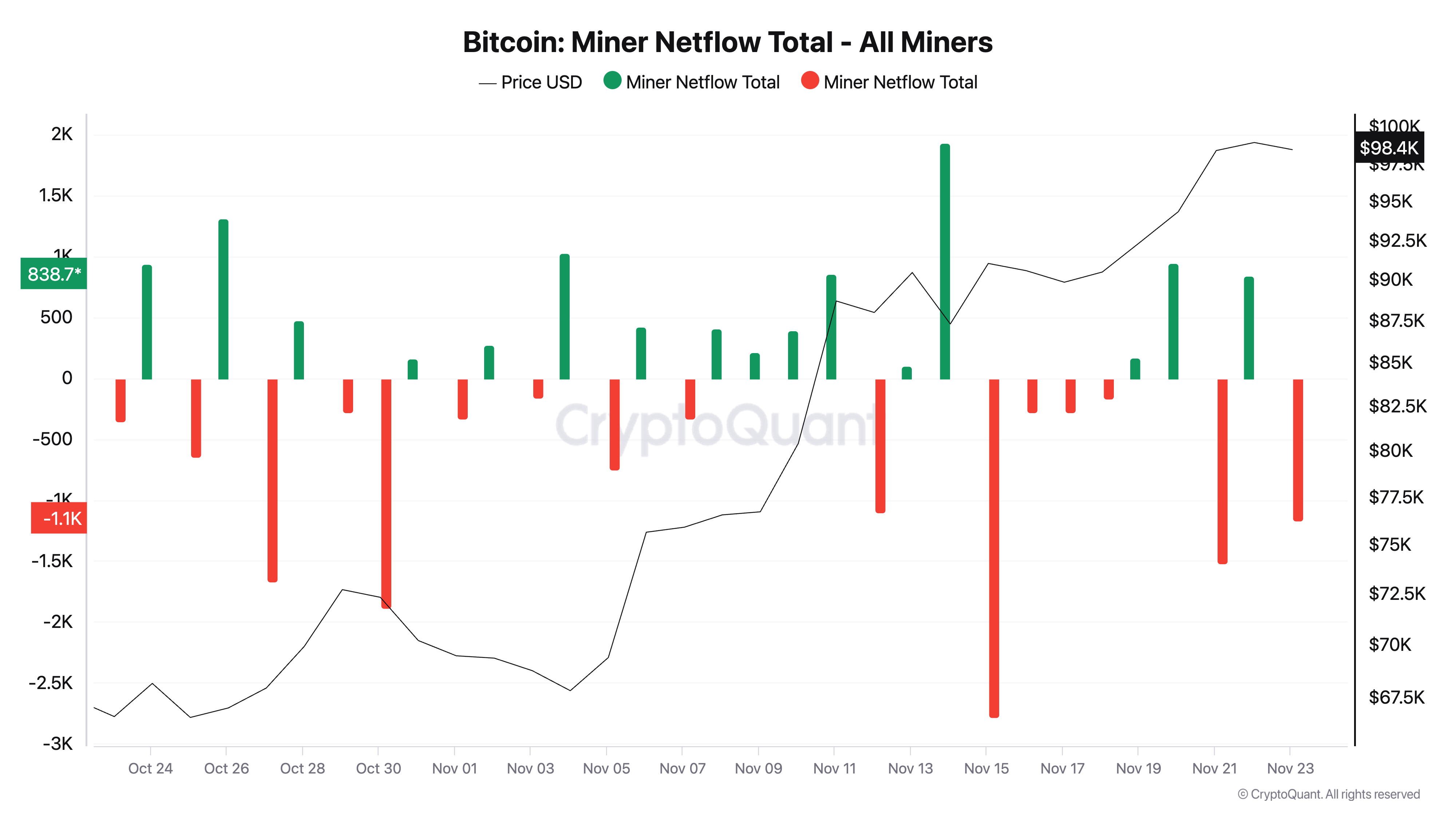

Moreover, readings from BTC’s miner netflow confirm the daily trend of coin sell-offs by the network’s miners. As of this writing, the metric’s value is negative at -1,172 BTC.

Miner netflow refers to the net amount of Bitcoin that miners are buying or selling. It is calculated by subtracting the amount of Bitcoin miners are selling from the amount they are buying. When it is negative, it indicates that miners are selling more coins than they are buying. This is often a bearish signal and a precursor to a short-term downward trend in the coin’s price.

BTC Price Prediction: The Bulls Remain in Control

While BTC miners have added to the coin’s selling pressure over the past few weeks, the bullish bias toward the king coin remains significant. This is reflected in the positioning of the dots that make up its Parabolic Stop and Reverse (SAR) indicator. As of this writing, these dots rest below BTC’s price.

The Parabolic SAR identifies an asset’s trend direction and potential reversal points. When its dots are positioned under the asset’s price, it suggests a bullish trend. Traders interpret this as a signal to go long and exit short positions.

If this trend persists, BTC’s price will reclaim its all-time high of $99,860 and may rally past the $100,000 psychological barrier. On the other hand, a spike in profit-taking activity will invalidate this bullish outlook. If buying pressure weakens, BTC’s price may drop to $88,986.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Sees Surge in Meme Coin Activity and Rising Fees

The Solana blockchain is witnessing a surge in activity due to a growing frenzy around meme coins.

This wave of enthusiasm has boosted network usage and pushed transaction fees to their highest levels in over a year.

Solana Meme Coin Hype Drives Network Fees and Adoption

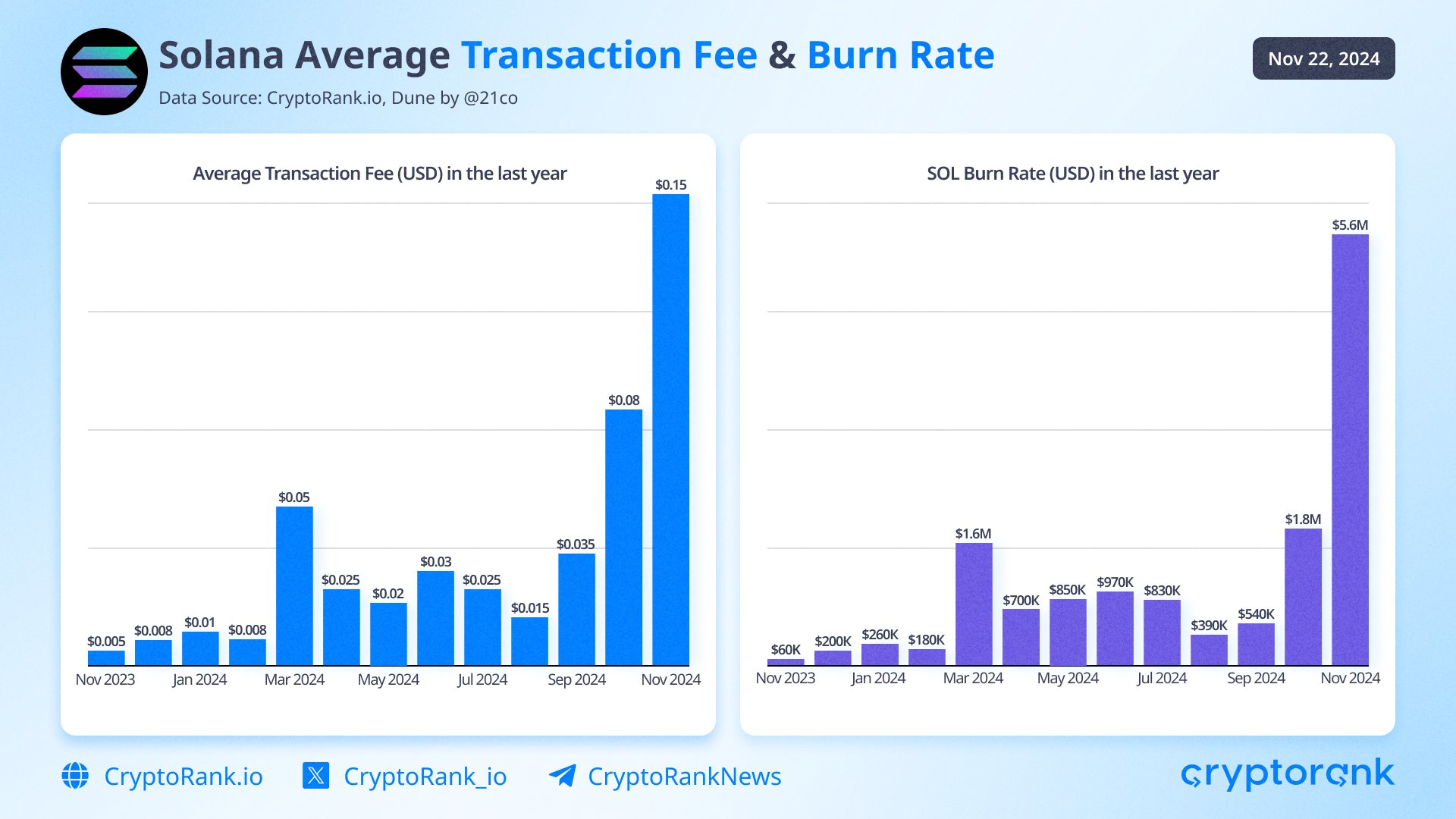

Recent weeks have seen meme coin activity rebound, fueled by a broader crypto rally led by major assets like Bitcoin. This resurgence has significantly increased transaction volumes on Solana, leading to higher fees. According to Cryptorank, Solana’s transaction fees reached $0.15 this month, doubling October’s $0.08 and marking the highest level in a year.

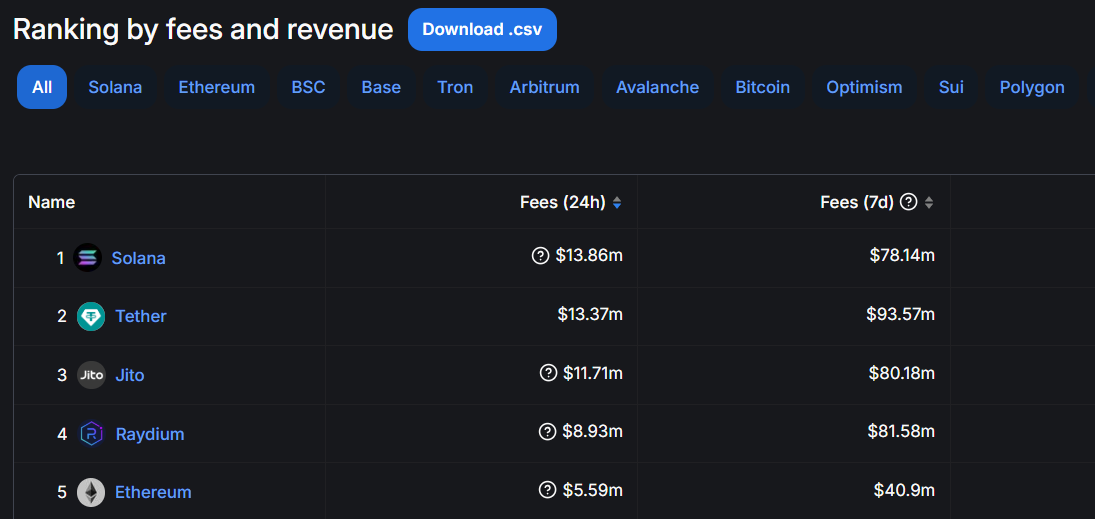

Data from DeFiLlama suggest that these rising network fees have contributed significantly to Solana earning approximately $78.14 million in fees over the past week, placing it among the most profitable networks. It ranked just below Tether’s $93.57 million but far outpaced Ethereum, which earned $40.9 million in the same period.

Beyond the core network, Solana-based decentralized applications (dApps) have also seen a surge in activity and fees. Platforms like Raydium, Jito, Pump.fun, and Photon have played key roles in this upswing, with Pump.fun and Photon leveraging the meme coin buzz for significant traction.

However, a crypto researcher at 1kx Network, Wei Dai cautioned that Solana’s rising activity could lead to congestion. He noted that prolonged congestion often leads to higher minimum fees, potentially pushing dApps and users away — a scenario Ethereum experienced during the DeFi boom four years ago.

Nevertheless, Dai conceded that Solana’s current congestion is mostly limited to short-term spikes, allowing patient users to process low-cost transactions still. Yet, he warned this balance might shift unless the network’s infrastructure evolves to handle growing demand effectively.

“Congestion on Solana is ‘bursty.’ Right now, users can still get payment transactions through with minimal fees with a short delay. However, this could change as demand increases, unless Solana tech stack improves to stay ahead of demand,” Dai added.

Meanwhile, this activity spike coincides with Solana achieving new price milestones. Over the past week, SOL’s price rose by nearly 20% to a new all-time high of $263, making it one of the best-performing digital assets since Donald Trump’s election victory on November 5.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why the Altcoin Season May Be Underway

The cryptocurrency market is showing signs of an impending altcoin season, a period characterized by a surge in the price of other assets relative to Bitcoin. Market participants often shift their focus and capital toward altcoins during this period.

A number of key indicators are beginning to point to this gradual shift in market dynamics. This analysis delves into some of these factors.

Altcoin Season May Be Underway

One such indicator is the increasing trend in TOTAL3, a metric that tracks the total market capitalization of all cryptocurrencies, excluding Bitcoin and Ethereum. As of this writing, it stands at $933 billion, surging by 35% since the beginning of the month. For context, the market capitalization of this group of assets has added $212 billion over the past 22 days.

As TOTAL3 approaches its all-time high of $1.13 trillion, it suggests that investors are allocating more capital to altcoins. Notably, the uptick in TOTAL3 comes during a period of consolidation in Bitcoin’s dominance (BTC.D).

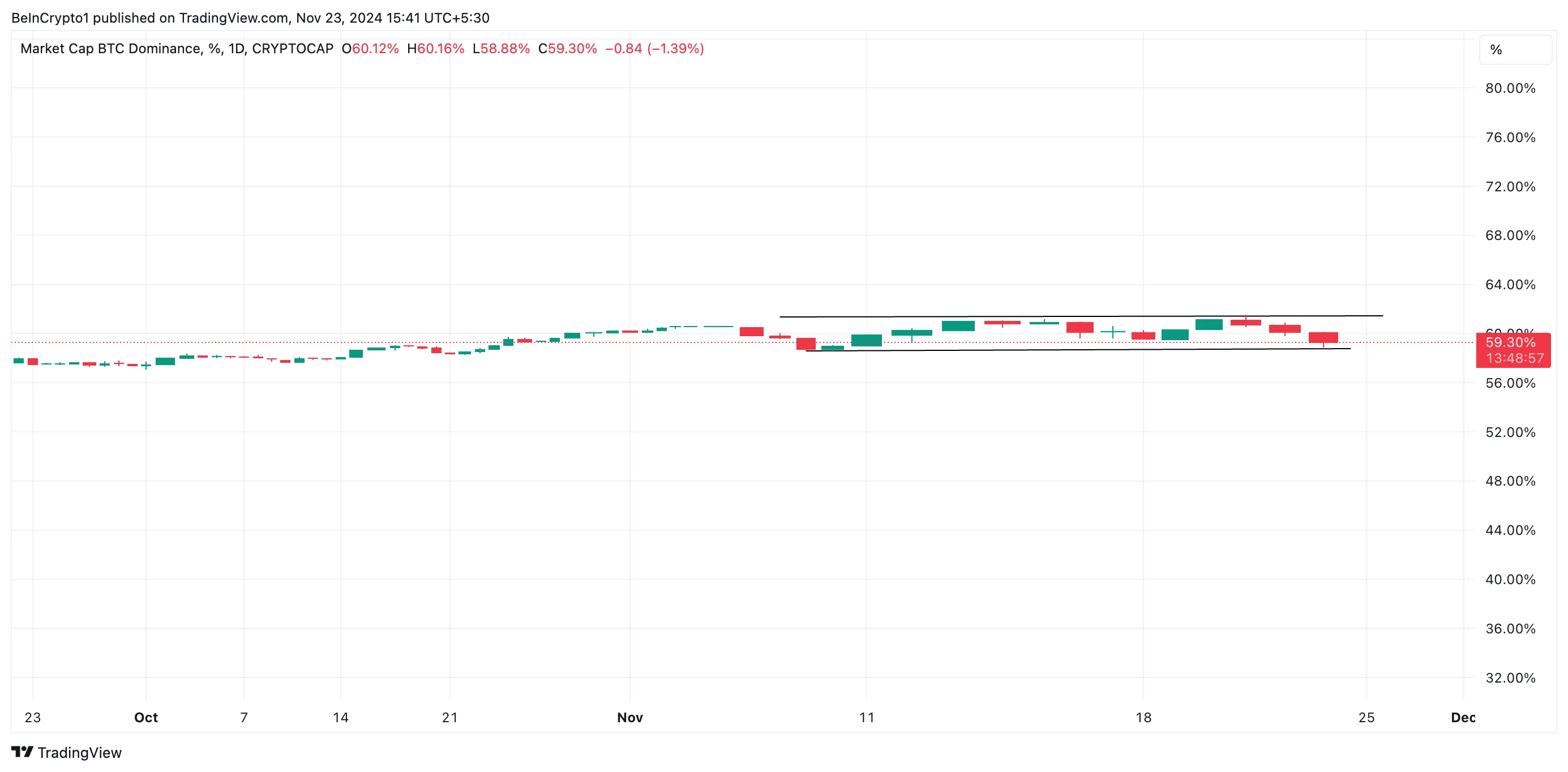

Readings from its daily chart show that the BTC.D has oscillated between 61% and 58% since November 8. As of this writing, BTC.D stands at 59.30%.

When TOTAL3 spikes while BTC.D consolidates, it’s a significant indicator of a potential altcoin season. This means that investors are shifting their focus from Bitcoin to other cryptocurrencies, leading to increased demand and potentially higher prices for altcoins.

Moreover, in a new report, on-chain data provider CryptoQuant has noted an uptick in the values of several Layer 1 altcoins since the conclusion of the US presidential elections, confirming that a potential altcoin season might be underway.

“Cryptocurrencies like XRP, TRX (TRON), TON, ADA, and SOL have seen their prices increase sharply on expectations that the new US administration will be more pro-crypto,” CryptoQuant stated.

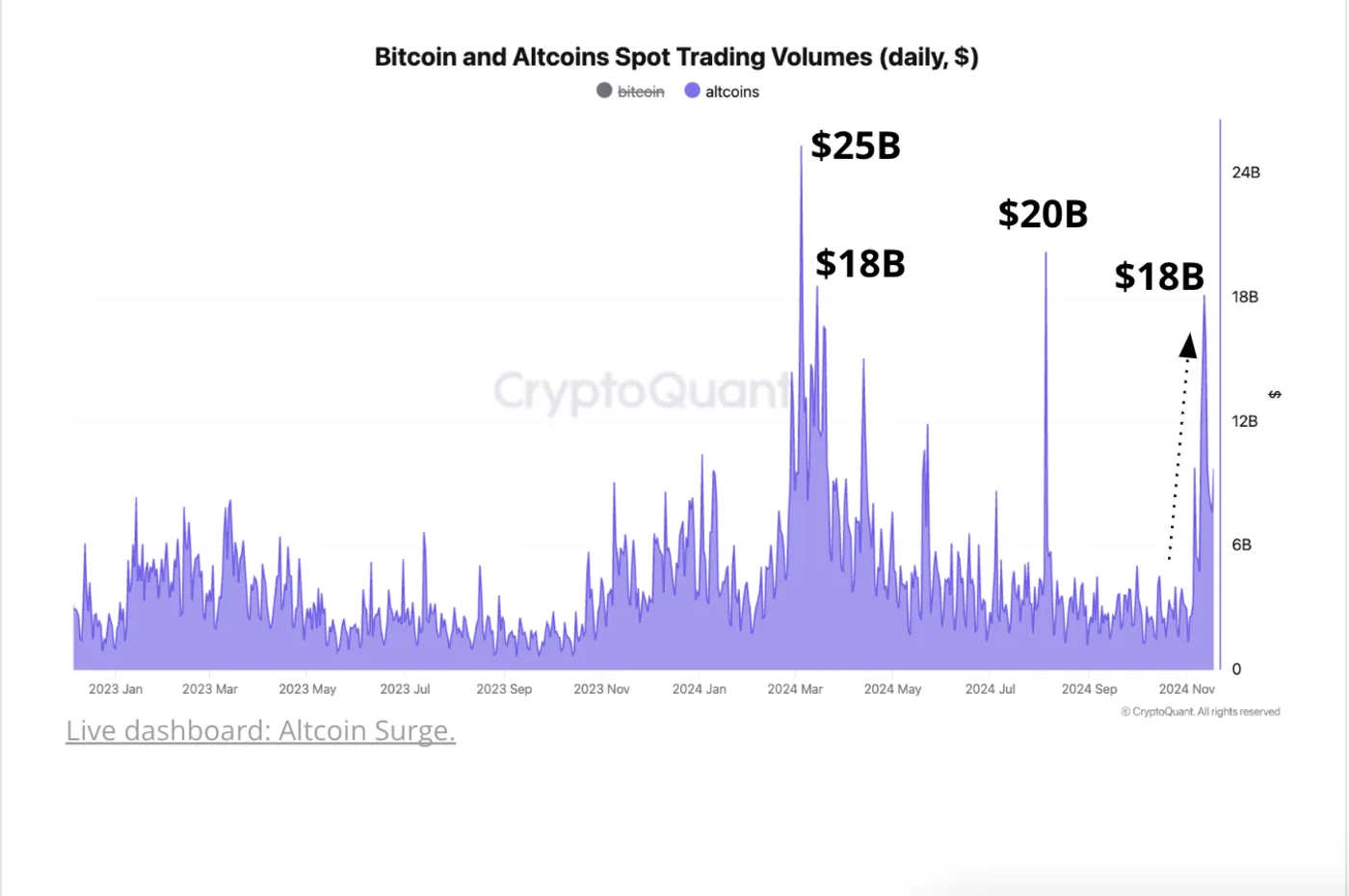

Furthermore, CryptoQuant explains that a spike in spot trading volume has accompanied this price surge.

“Daily spot trading volume for altcoins increased after the US presidential election and spiked as high as $18 billion on November 11, the highest since early August. Prior to this, altcoin spot trading volume had remained muted since May.”

The Altcoins May Need Some More Time

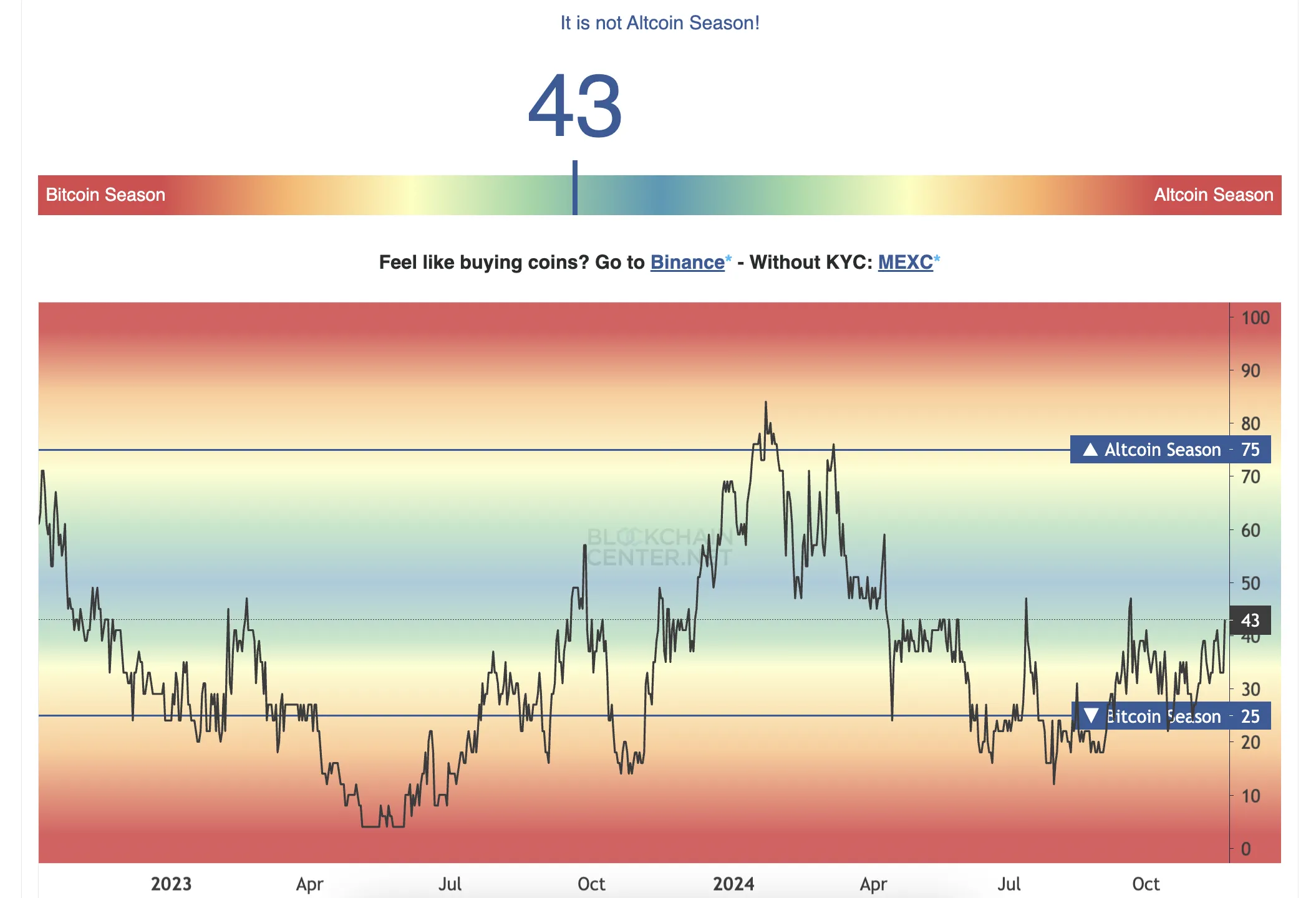

While readings from the indicators mentioned above suggest a likely altcoin season in the near term, it is key to note that this will be confirmed when at least 75% of the top 50 altcoins outperform Bitcoin over a three-month period.

However, data from Blockchain Center reveals that only 43% of these top altcoins have surpassed Bitcoin’s performance in the past 90 days — well below the 75% threshold required to declare an altcoin season officially.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market17 hours ago

Market17 hours agoADA Sights More Growth After Breaking $0.8119

-

Market24 hours ago

Market24 hours agoCboe Launches Bitcoin ETF Options linked to its ETF Index

-

Altcoin17 hours ago

Altcoin17 hours agoBTC at $98K, HBAR Surges 25% and XLM rises 55%

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst’s Elliot Wave Theory Shows XRP Price Can Hit $18

-

Regulation23 hours ago

Regulation23 hours agoUS SEC Commissioner Jaime Lizárraga Announces Departure Amid Trump Transition

-

Market23 hours ago

Market23 hours agoTop Altcoins Crypto Whales Bought in November’s Third Week

-

Market22 hours ago

Market22 hours agoMythical Games Unveils NFT Mobile Football Game

-

Market21 hours ago

Market21 hours agoThe Bitcoin Price Surge Could Touch $115,000 By Christmas