Market

Sui Partners with Franklin Templeton for Blockchain Development

Sui, a Layer-1 network, announced a new partnership with investment firm Franklin Templeton. This partnership includes capital investment in Sui and support for the firm’s blockchain development.

Despite a few vague details, the exact nature of the working relationship between the two companies remains unclear.

Sui Partners Franklin Templeton

Sui, the prominent Layer-1 blockchain, recently partnered with investment firm Franklin Templeton. This partnership will prioritize supporting a developer ecosystem rather than focusing directly on SUI development. The firm claimed Franklin Templeton has been supporting blockchain projects since 2018, and its CEO has espoused blockchain technology.

“Franklin Templeton Digital Assets has previously invested in the Sui ecosystem, and this new partnership will provide further benefit by seeking value creation opportunities to allow Sui builders to deploy novel technology onchain,” Sui claimed in a social media post.

As of yet, the firm has publicly revealed very few exact details about the partnership’s planned blockchain developments. Instead, the firm discussed several of its existing projects that attracted Franklin Templeton’s attention: its DeFi central limit order book, a decentralized mobile carrier, and an MPC network.

Still, this information does provide a few clues about the investment firm’s intentions. Earlier this year, Franklin Templeton explored DePin projects, considering them a possible lucrative development area. The firm has also been investing heavily in tokenization. It may help Sui by supporting its blockchain developers in these areas, especially DePin.

Sui, for its part, is performing quite well lately. It recently went on a remarkable bull run, climbing 74% in one month before hitting an all-time high on November 20. Yesterday, its blockchain stopped producing blocks for nearly two hours, but its token price remained impressively steady. These fundamentals could make Sui an attractive partner for Franklin Templeton.

Franklin Templeton has not yet made any direct announcements about this partnership. Sui additionally posted a more developed press release, but it did not have substantially different information than the talking points in its main announcement. Suffice it to say that Franklin Templeton is investing in Sui blockchain development.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PNUT Price Nears Oversold Zone After 20% 24-Hour Decline

PNUT price has dropped more than 20% in the last 24 hours, following its recent surge after being listed on major exchanges, where it reached $2.28. This sharp decline highlights weakening momentum, as indicators like ADX and RSI suggest that the uptrend is fading.

Despite this, PNUT still has the potential for a strong recovery if buyers return. However, if bearish pressure continues, PNUT could face a significant correction, testing key support levels and potentially losing more ground.

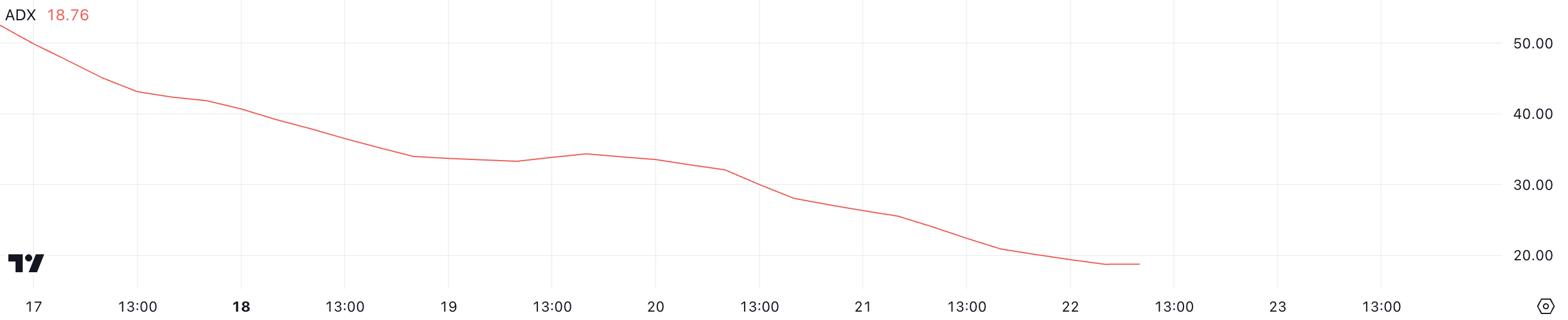

PNUT Current Uptrend Is Fading Away

PNUT currently has an ADX of 18.76, significantly down from above 50 just a few days ago. This consistent decline in ADX indicates that the strength of PNUT’s uptrend has been steadily weakening.

Despite still being in an uptrend, the sharp drop in price over the last 24 hours highlights the growing vulnerability of maintaining upward momentum. The ADX suggests a potential reversal could be on the horizon.

The ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 indicating a weak or nonexistent trend.

PNUT’s ADX dropping below 20 reflects a weakening trend, even though the current directional movement still leans bullish. If this trend strength continues to deteriorate, PNUT may struggle to sustain its uptrend. That would leave PNUT price vulnerable to a more significant reversal in the near term.

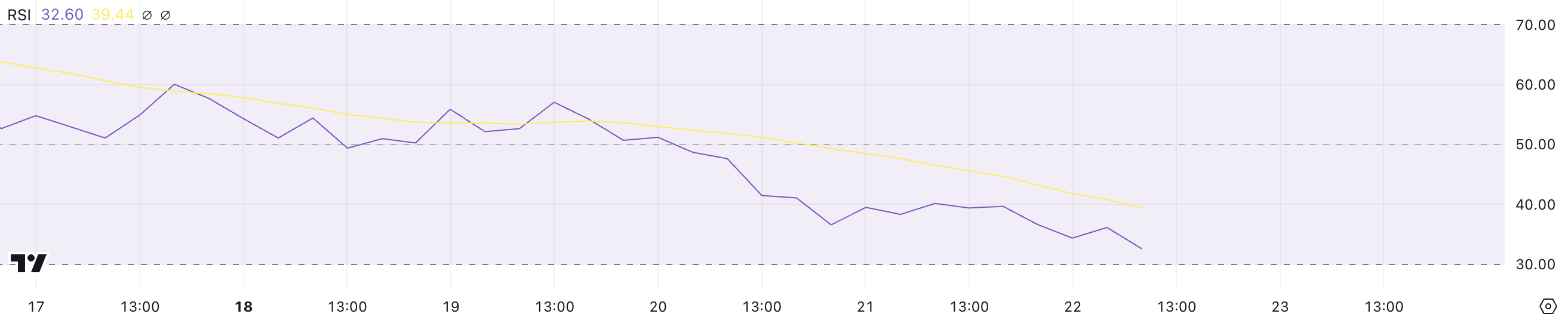

PNUT Is Almost Reaching The Oversold Zone

PNUT currently has an RSI of 32.6, marking its lowest level since being listed on Binance.

The Relative Strength Index (RSI) measures the speed and magnitude of price movements, with values above 70 indicating overbought conditions and below 30 signaling oversold levels.

The consistent decline in PNUT’s RSI over the past few days highlights weakening momentum, with the asset now approaching oversold levels.

If the RSI falls below 30, it could signal that PNUT is significantly undervalued in the short term. However, continued bearish sentiment could keep the price under pressure, delaying any recovery.

PNUT Price Prediction: A 72% Correction Ahead?

If PNUT price experiences a reversal and a strong downtrend emerges, it could test the support at $0.749. Should this level fail to hold, the price may drop further to $0.41 and even $0.32, marking a significant potential correction of up to 72%. This would make PNUT be surpassed by other meme coins such as MOG, GOAT, and MEW in terms of market cap.

Such a scenario would indicate increased bearish pressure, with traders potentially continuing to exit positions after the surges following the listing on major exchanges.

On the other hand, if PNUT uptrend regains strength, the price could rise to test the resistances at $1.87 and $2.21.

Breaking through these levels could allow PNUT to retest its previous all-time high of $2.50. That would offer a potential 111% upside and establish PNUT as a top 10 meme coin in the market.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How PNUT, GOAT, BONK Fared

In this weekly analysis of meme coins, BeInCrypto observed that these tokens experienced mixed results. While some tokens saw gains, others grappled with significant losses.

Peanut the Squirrel (PNUT) and AI-created Goatseus Maximus (GOAT) were among the week’s underperformers, both experiencing significant price drops. In contrast, Bonk (BONK) defied market trends, securing its place as one of the top-performing cryptocurrencies. Here’s a detailed recap of the week’s developments.

Peanut the Squirrel (PNUT)

At the beginning of the week, PNUT’s price was $1.94. However, the meme coin’s value has since decreased by 33%. This significant decline could be attributed to selling pressure from those who held the token until it reached an all-time high.

PNUT’s price is currently $1.17. However, the one-hour chart shows that the Relative Strength Index (RSI) has dropped to 31.66. When the RSI climbs to 70.00, it means that the asset is overbought.

On the other hand, if it is below 30.00, it means that it is oversold. Therefore, while the RSI reading indicates bearish momentum, it indicates that PNUT is oversold.

As such, the meme coin’s price could be in line for a rebound. If validated, then PNUT’s price could bounce toward $1.40. In a highly bullish scenario, the meme coin could rally toward $1.72. However, if selling pressure increases again, the price could decrease below $1.15 when we publish the next meme coins weekly update.

Goatseus Maximus (GOAT)

Similar to PNUT, GOAT, another meme coin, faced a sharp decline this week, with its price dropping by 22%.

The price of GOAT has fallen to $0.87, possibly due to waning interest in AI-themed meme coins. The shifting narrative in the meme coin market suggests that some traders may be moving on from the AI buzz, seeking opportunities elsewhere.

Adding to the bearish sentiment, GOAT’s 4-hour chart has revealed a head and shoulders pattern, a classic bullish-to-bearish reversal indicator. This formation suggests that the meme coin could face further downside.

If the pattern plays out, coupled with the negative Moving Average Convergence Divergence (MACD), GOAT’s price could decrease to $0.66. However, a surge in buying pressure could invalidate this bias. If that happens, the value could jump to $1.37.

Bonk (BONK)

Contrary to GOAT and PNUT’s performance, Bonk’s price experienced a 28% hike. This price increase happened because the project disclosed that it would burn 1 trillion tokens by December 25 at the latest.

As a result, this disclosure sent euphoria around the Solana meme coin’s community, driving demand and a higher value for the token. However, BONK faces resistance at $0.000050, which has made it challenging for the cryptocurrency to rise much higher.

Despite that, the Bull Bear Power (BBP) shows that bears do not still have control. If sustained, then BONK’s price could move toward $0.000060.

On the flip side, if bears outpace bulls’ dominance, that might not happen, as the next meme coins weekly analysis could see it decline to $0.000043.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

The Bitcoin Price Surge Could Touch $115,000 By Christmas

Bitcoin has reached a new all-time high, briefly trading at $99,500 during Friday’s intraday session before pulling back slightly. As of now, the cryptocurrency is priced at $98,675.

With heightened trading activity as the market anticipates a breakthrough above the $100,000 psychological level, digital asset research firm 10X Research predicts Bitcoin could climb to $115,000 by Christmas.

Why Bitcoin May Touch $115,000 Soon

In its new report, 10X Research found that the BTC market has become flush with liquidity in the past few weeks, a key factor that could drive Bitcoin toward the projected $115,000 mark.

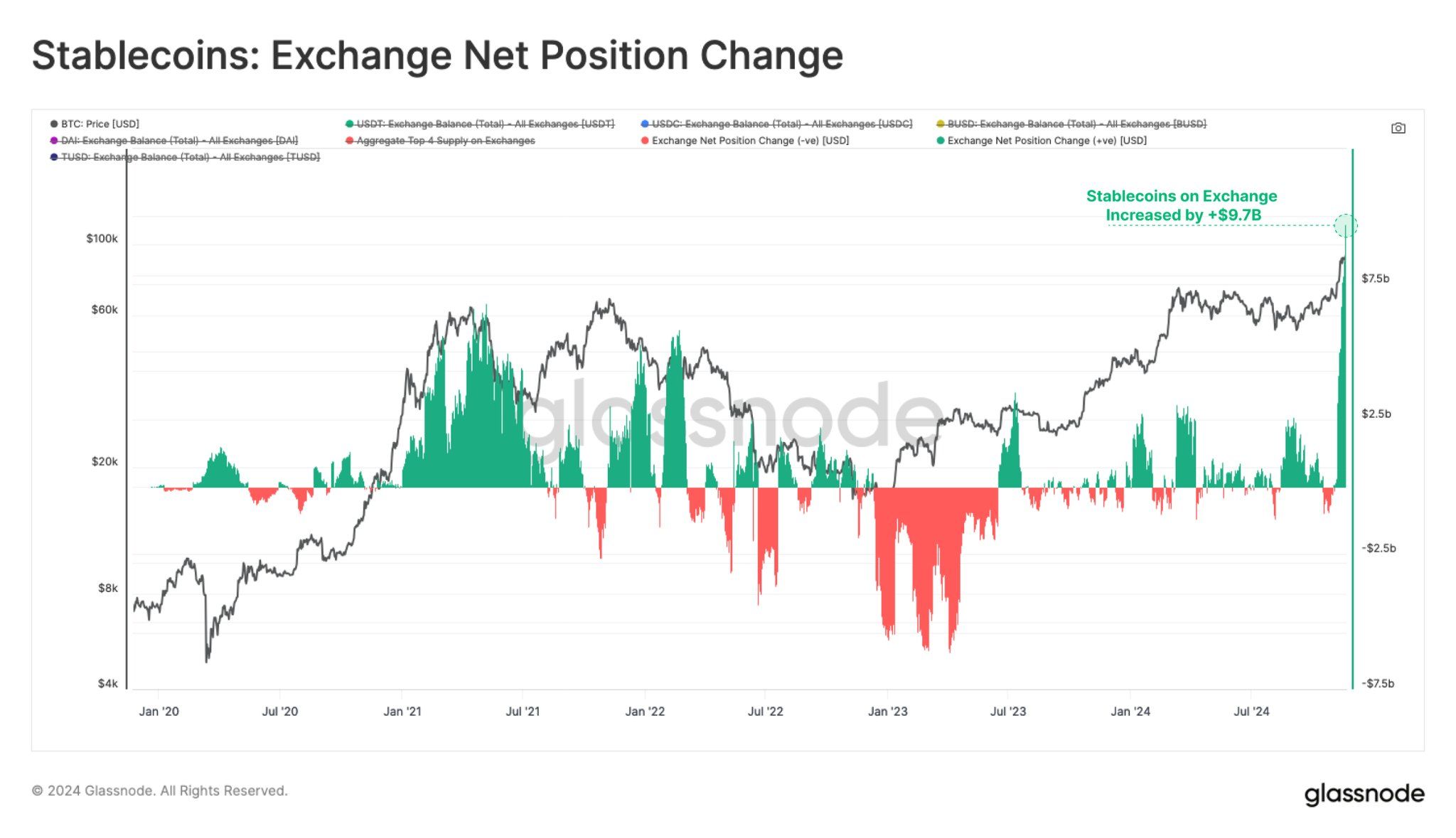

Stablecoin issuer Tether minted $10 billion in the past month. Also, Circle added $3 billion during the same period, fueling market momentum. This has resulted in a corresponding uptick in stablecoin flows to cryptocurrency exchanges over the past month. In a November 21 post on X, Leon Waidmann, head of research at The Onchain Foundation, confirmed this.

“Stablecoin inflows to exchanges hit $9.7B in 30 days! The LARGEST monthly inflow EVER. Stablecoin liquidity is back. Speculative demand continues to explode,” he said.

The surge in stablecoin inflows to cryptocurrency exchanges is a bullish signal. This influx often leads to increased buying pressure, driving the values of crypto assets upward.

“This massive wave of liquidity is reflected in elevated trading volumes, with spot volumes consistently exceeding $200 billion daily. The cryptocurrency market capitalization has surged past $3.2 trillion, equaling the size of the United Kingdom’s equity market,” 10X Research wrote.

Traders’ activity in the BlackRock Bitcoin ETF (IBIT) options market is another reason its price may climb to $115,000 by Christmas. 10X Research found that as of November 22, call options on IBIT outnumber puts by 5.5 to 1, rising from 3.8 to 1 on Thursday. Call buyers are also targeting strike prices in the 110-120% range, suggesting that they expect Bitcoin’s price to rally beyond $100,000 soon.

“Call buyers focus on strike prices in the 110-120% range, indicating they do not anticipate a short-term cap at Bitcoin’s psychological $100,000 level. Instead, December-expiry options activity suggests expectations for Bitcoin to rally towards $105,000 or even $115,000 by Christmas, with the latter strike showing the highest open interest,” the report stated.

BTC Price Prediction: All Rests With the Buyers Now

According to the research firm, “this dynamic could trigger a minor gamma squeeze, causing Bitcoin’s price to gravitate toward these levels. As a result, $100,000 may only be another checkpoint on Bitcoin’s upward trajectory.”

BTC is currently trading at $98,675. Sustained buying momentum could push the coin back to its all-time high of $99,500 and potentially beyond. Establishing this level as support may pave the way for a surge toward $100,000 and higher.

On the other hand, if buying pressure weakens, BTC’s price may plunge toward $88,816, where its next major support lies. This will invalidate the bullish outlook above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoXRP Price 25% Rally: Breaking Barriers and Surpassing Odds

-

Market14 hours ago

Market14 hours ago3 altcoins that could go ballistic if Bitcoin (BTC) crosses $120,000 mark

-

Market22 hours ago

Market22 hours agoRallies 10% and Targets More Upside

-

Market22 hours ago

Market22 hours agoRallies 10% and Targets More Upside

-

Market21 hours ago

Market21 hours agoWisdomTree Europe Launches XRP ETP

-

Market16 hours ago

Market16 hours agoBitcoin Price Approaches $100K: The Countdown Is On

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Hashrate Surges To New All-Time High Amid Rise In Positive Momentum

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Attempts Key Breakout: Analysts Set $3,700 Target