Altcoin

DOGE Price To Hit $2.4 As Elon Musk Shares New Update On D.O.G.E.

DOGE price eyes a potential breakout ahead, with top experts echoing a similar sentiment for the dog-themed meme coin. For context, in a recent X post, Real Vision CEO and Founder Raoul Pal said that Dogecoin is likely gearing up for a rally ahead. In addition, this development also comes as Elon Musk has shared new developments to enhance the efficacy of the Department of Government Efficiency (D.O.G.E.)

DOGE Price Rallies As Elon Musk Prioritizes D.O.G.E. Efficacy

DOGE price continued its run towards the north on Friday, further highlighting the growing confidence of the investors towards the top meme coins. Amid this, Real Vision founder Raoul Pal, a prominent figure in the crypto world, predicts a potential rally for Dogecoin ahead, saying that it is in the “Great Banana Rotation” along with SUI. In a recent X post, Pal stated:

I think next in the Great Banana Rotation is $SUI and $DOGE and probably that token that you hold too.

Meanwhile, Pal previously explained the Banana Zone, emphasizing the importance of core allocations in top-tier assets like BTC, ETH, and SOL. He advises investors to keep 90% of their portfolio in solid assets like BTC and top altcoins while allowing 10% for riskier plays like meme coins.

However, Pal warns against overtrading and leverage, stressing the need to protect investments. With Pal’s prediction, DOGE holders are optimistic about the meme coin’s future performance.

Elon Musk Outlines D.O.G.E. Plan

In addition, the DOGE price rally also comes as Elon Musk has prioritized enhancing the efficacy of the Department of Government Efficiency (D.O.G.E.). Notably, Donald Trump appointed Elon Musk and Vivek Ramaswamy to lead the D.O.G.E., which has sparked optimism in the market.

Besides, the department’s short form also resembles the Dogecoin ticker, which has also sparked a rally in the crypto’s price. Additionally, Musk has been a vocal supporter of the meme coin, as evidenced by his previous social media comments, which have also caught the eyes of the traders.

Now, Musk and Ramaswamy have outlined plans to increase the efficacy of the department. According to a recent WSJ report, they have planned to end the remote work culture at the federal office, in an effort to trim the government spending. The two entrepreneurs said that ending the remote work culture would cause a mass resignation, which would aid them in achieving their goal of establishing a small but efficient government.

Dogecoin To Hit $2.4?

DOGE price today was up more than 2% and exchanged hands at $0.3941, while its one-day trading volume was near the flatline at $8.60 billion. Notably, the token has touched a 24-hour high of $0.3996, and CoinGlass data showed that Dogecoin Futures Open Interest rose nearly 9%, indicating strong market confidence.

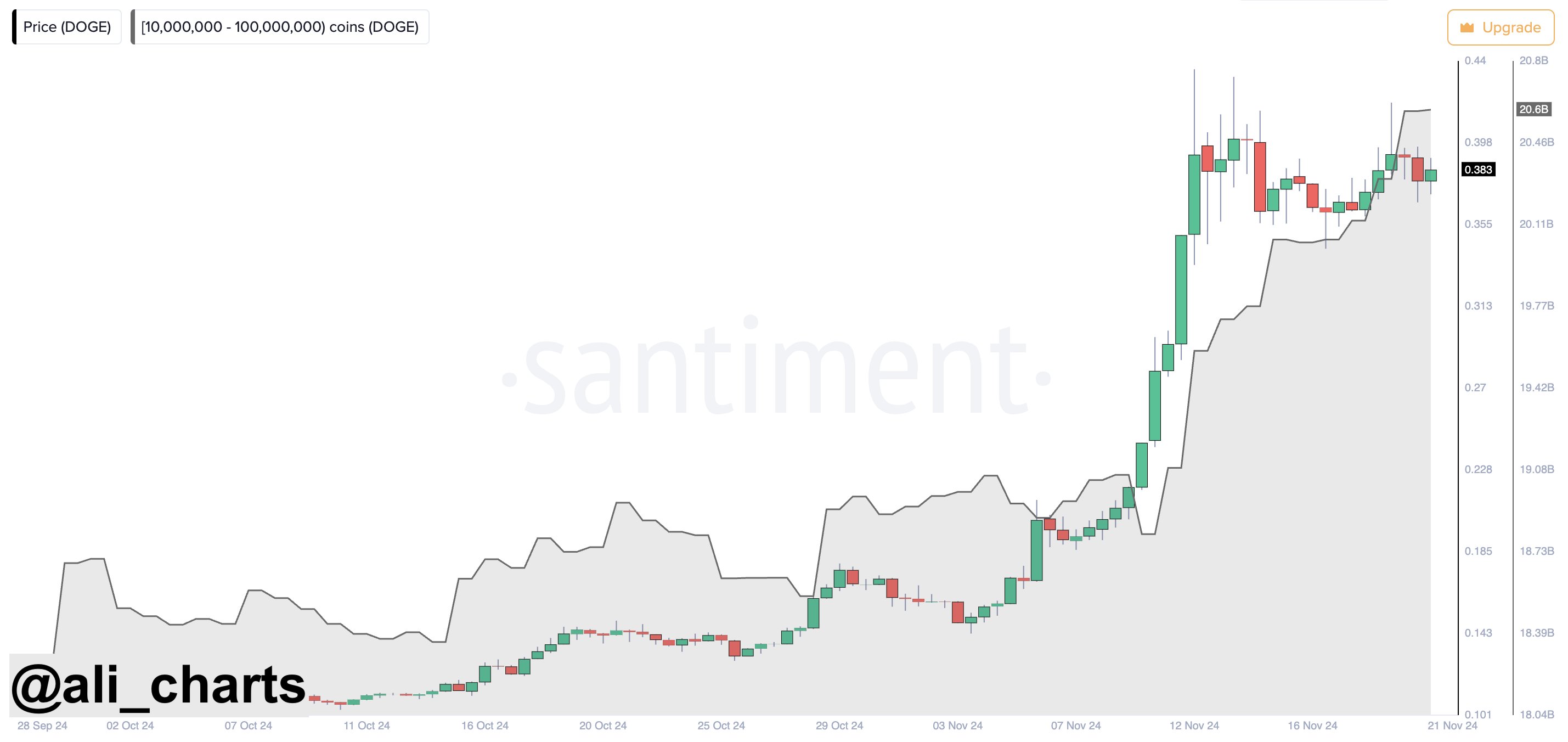

Besides, recent on-chain metrics and other market trends also indicate that Dogecoin is poised to continue its parabolic run ahead alongside SHIB and other meme coins. Amid this, a popular crypto market analyst, Ali Martinez has shared a bullish forecast for DOGE price.

Meanwhile, Martinez has recently highlighted the growing Dogecoin whale activity, which indicates that the crypto is poised to rally ahead. His X post showed that whales have bagged more than 550 million DOGE over the last week, valued at around $214.5 million.

In addition, the analyst has shared a DOGE price chart, which showed that the crypto is likely to hit $2.40 in the coming days. Besides, he also predicted that once the meme coin hits the $2.40 target, the next target for the crypto will be $18, sparking market optimism.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Charles Hoskinson Reveals How Cardano Will Boost Bitcoin’s Adoption

Cardano founder Charles Hoskinson says the network will play a key role in Bitcoin DeFi transactions in the future. With several partnerships and innovations in the works, Hoskinson says Cardano is bracing itself to explore layer 2 solutions on the Bitcoin blockchain,

Cardano Positions Itself For Bitcoin DeFi

In an interview with Scott Melker, Cardano’s founder has revealed ambitious plans for the network to turbocharge Bitcoin’s adoption for DeFi applications. Hoskinson notes that large financial institutions will trigger a demand for Bitcoin DeFi given their fiduciary obligation to create yield.

He notes that a Bitcoin ETF providing DeFi yields will trigger shareholders to demand similar yields. Hoskinson eyes a three-year timeframe for institutions to plant their feet in Bitcoin DeFi and UTXO DeFi.

Hoskinson says Cardano will combine Hydra with the Bitcoin Lightning network and build a trustless recursive bridge between both networks. The founder adds that its Aiken programming language will enabled to write both Bitcoin and Cardano scripts.

Furthermore, a partnership with Maestro, an infrastructure provider allowing Bitcoin integration with UTXO-based blockchain will provide a “turn-key experience” for users.

“It’s still early days but we are making methodical progress every step of the way,” said Hoskinson.

Hoskinson is moving on from his absence from the Crypto Summit at the White House, doubling down on technical innovation. He notes that the Bitcoin-focused plays by Cardano will not adversely affect the network’s road map.

Is Bitcoin Ready For DeFi Applications?

Hoskinson revealed in the interview that Bitcoin is ready for DeFi utility following the Taproot and the Lightning Network advancements. According to the founder, Taproot added programmability features to the Bitcoin network and Cardano will push the frontiers.

He adds that Cardano will enable Bitcoin users to engage in DeFi transactions while transacting with only BTC. Hoskinson says a merger between Bitcoin is enough to make Cardano’s DeFi significantly larger than Ethereum and Solana combined.

While the integration will send Cardano price soaring, ADA wallows at $0,6611 after losing 10% in a week. However, traders are targeting an ADA pump in May following the forming of a cyclical pattern.

An analyst argues that a price rally to $10 is not a crazy prediction given a streak of solid fundamentals and partnerships for Cardano.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Ethereum Bitcoin Ratio Drops to Record Low, What Next for ETH?

The world’s second-largest digital asset, Ethereum (ETH), struggles to keep up with Bitcoin. Market data shows that the ETH/BTC ratio has dropped to its lowest level in five years. Consequently, investors and analysts are now questioning whether Ethereum can recover in the coming quarter, considering Bitcoin may continue its long-standing domination in the digital assets market.

The Ethereum Bitcoin Ratio At New Lows

ETH performed poorly compared to Bitcoin in the first quarter of 2025. According to a recent update from The Kobeissi Letter, the Ethereum to Bitcoin ratio has dropped to 0.02, its lowest level since December 2020.

Historically, Ethereum has gained strength after Bitcoin halvings, but the trend has reversed. While Bitcoin price is going upward, Ethereum has struggled to gain traction.

Several factors have contributed to this decline. Bitcoin’s narrative as digital gold has strengthened, drawing more institutional investment. In addition, the coin has faced challenges, including relatively higher gas fees and competition from other blockchain networks.

Unfortunately, the Ethereum Pectra upgrade, which experts believe could drive a price increase for the coin, faced some challenges. As reported by CoinGape, multiple testnet attempts failed before the Hoodi testnet that launched recently.

Some experts believe Ethereum’s transition to proof-of-stake has not delivered the expected market boost.

Q1 Performance and ETF Downturn

The ETH price performance in the first quarter of 2025 has been disappointing. For context, data shows that the coin has dropped 46% this year, nearly 4 times more than Bitcoin’s decline of 12%.

Many investors expected a strong bull run, but Ethereum has remained weak. The adoption of spot Bitcoin ETFs earlier in the year attracted billions of dollars, but Ethereum has not seen the same level of interest for its potential ETF.

Market analysts suggest that institutional investors are still hesitant about Ethereum’s long-term value compared to Bitcoin. Bitcoin’s fixed supply and reputation as a hedge against inflation have made it a safer choice for institutional investors.

Where is ETH Price Heading?

Some analysts believe ETH price could hit $10,000 if broader market conditions improve and the Ethereum Pectra upgrade launches on the mainnet.

Others warn that if the coin continues to lose value against Bitcoin, investors may start shifting funds to other networks like Solana or Avalanche.

Even though short-term price predictions remain speculative, some traders expect Ethereum to rebound as Bitcoin stabilizes. Others believe the ETH/BTC ratio could drop even further.

As of this publication, CoinMarketCap data shows that Ethereum’s price was $1,842.29, up 1.34% in the last 24 hours. Many experts believe that the coming days will determine whether Ethereum can regain strength or whether Bitcoin’s dominance will continue to grow.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Elon Musk Rules Out The Use Of Dogecoin By The US Government

Elon Musk has doused optimism for the US government to adopt Dogecoin at the America PAC town hall event. The head of the Department of Government Efficiency (DOGE) noted that the government agency only bears a nominal resemblance to the memecoin.

Elon Musk Dispels Rumors Of Dogecoin Adoption By The US Government

At a recent event, Tesla CEO Elon Musk cleared the air on the potential adoption of Dogecoin by the US government. In his keynote speech, Musk noted that the US government will not be adopting Dogecoin, contrary to swirling speculation.

Musk noted that the speculation gained traction following the launch of the Department of Government Efficiency (DOGE). Following the launch of DOGE and Musk tapped to lead the agency, enthusiasm for Dogecoin government utility reached new highs.

However, Musk clarified that the agency bears only a nominal resemblance to the memecoin, stemming from an internet trend. The Tesla CEO disclosed that the original intended name was the Government Efficiency Commission, opting for DOGE “because the internet is right.”

“The name is similar but they are two different things,” said Musk. “But there are no plans for the government to use Dogecoin as far as I know.”

Musk has a long and storied history with Dogecoin, famously shilling the memecoin and integrating DOGE payments for Tesla. Musk teased an anime-themed DOGE on X, setting the stage for a $2 rally for the memecoin.

DOGE Reacts Negatively To The News

Dogecoin price slumped by nearly 2% in the wake of the grim report. Currently, the memecoin is trading at 0.1660 as it eyes a push toward the $1 mark.

The negative fundamental adds pressure to reports of DOGE forming a falling wedge pattern, signaling a potential downward breakout. However, optimists are rippling with confidence that DOGE can shake off the negative sentiments to post new all-time highs.

One analysis claims that if the Dogecoin price breaks a 3-month trendline, an $8 valuation for the memecoin is in play. Others claim that the House of Doge Reserve launch will be a tailwind for Dogecoin price, sending the dog-themed coin on a strong rally.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market20 hours ago

Market20 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market19 hours ago

Market19 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market10 hours ago

Market10 hours ago3 Altcoins to Watch in the First Week of April 2025

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Is ‘Completely Dead’ As An Investment: Hedge Fund

-

Market9 hours ago

Market9 hours agoBitcoin Mining Faces Tariff Challenges as Hashrate Hits New ATH

-

Market15 hours ago

Market15 hours agoThis Is How Dogecoin Price Reacted To Elon Musk’s Comment

-

Regulation9 hours ago

Regulation9 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Bitcoin15 hours ago

Bitcoin15 hours agoUS Macroeconomic Indicators This Week: NFP, JOLTS, & More

✓ Share: