Market

Stellar (XLM) Price Climbs to Three-Year High

Stellar (XLM) price has surged more than 20% in the last 24 hours and is up an impressive 124.86% over the past seven days, reaching $0.30, its highest price since December 2021. This rapid ascent reflects strong bullish momentum, supported by key indicators like RSI, which remains in the overbought zone.

However, the relatively weak CMF suggests that the current trend may not yet have the strength to sustain further gains without renewed capital inflows. Whether XLM can push toward a $10 billion market cap or face a potential correction will depend on how well it holds key support levels in the days ahead.

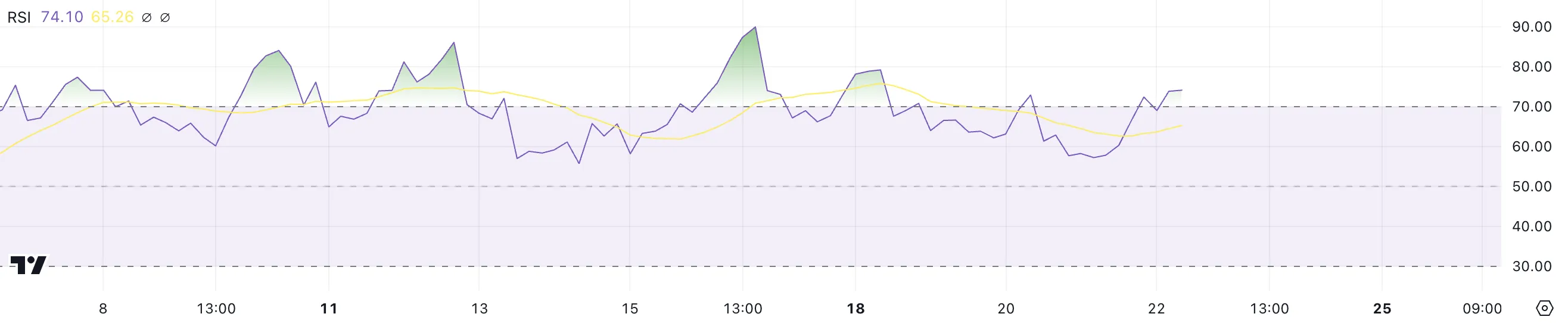

XLM RSI Is In The Overbought Zone

Stellar RSI is 74.10, rising sharply from below 60 just a day ago. This increase signals strong bullish momentum, pushing XLM into the overbought zone, where RSI values above 70 indicate heightened buying activity.

While an RSI above 70 often suggests that a correction could be on the horizon, it also reflects strong market enthusiasm driving the current uptrend.

The RSI measures the speed and magnitude of price movements, with values above 70 signaling overbought conditions and below 30 indicating oversold levels. Historically, Stellar has experienced periods where its RSI remained above 70 for several days, during which the price continued to climb before eventually correcting.

This suggests that while caution is warranted, the current overbought conditions do not necessarily mean an immediate reversal, as the rally could still have room to grow before cooling off.

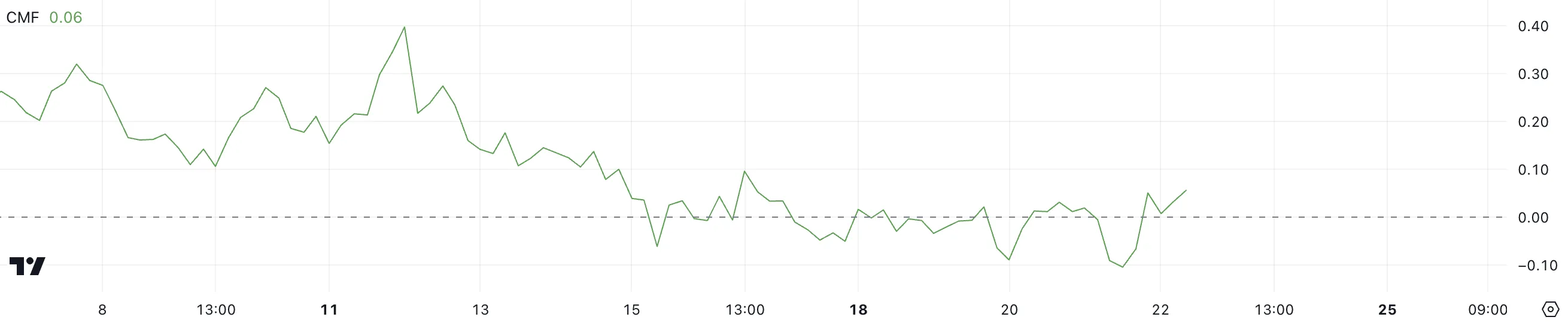

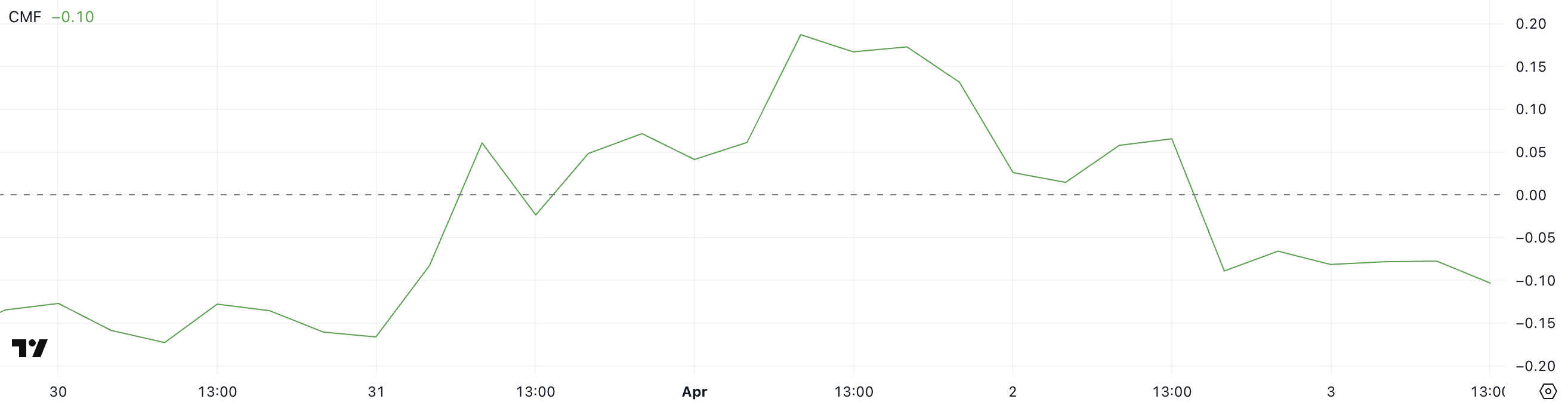

Stellar CMF Is Positive But Not That Strong Yet

XLM currently has a CMF of 0.06, recovering from -0.10 just one day ago. This shift into positive territory indicates an inflow of capital back into the asset, suggesting renewed buying pressure after recent selling activity.

However, the relatively low CMF value highlights that the inflow is not yet as strong as it was during earlier periods of significant bullish momentum.

The Chaikin Money Flow (CMF) measures the volume and direction of money flow, with positive values indicating capital inflows (bullish) and negative values reflecting outflows (bearish).

While XLM’s CMF turning positive is a good sign for its short-term trend, it remains far below the levels seen in mid-November when the CMF peaked at 0.40 and stayed above 0.10 for almost a week.

XLM Price Prediction: Can Stellar Reach The $10 Billion Market Cap Threshold?

If Stellar maintains its current uptrend, it could rise further to test a market cap of $10 billion. Achieving this milestone would require a 15.7% increase in XLM price, signaling continued strong bullish momentum and renewed investor interest.

However, as indicated by the relatively weak CMF, the current trend may lack the strength to sustain this upward trajectory.

If the trend reverses, XLM price could first test its strongest nearby support at $0.14. Should this level fail, Stellar price could drop further to $0.0994, representing a steep 67% correction from recent highs.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Faces Community Backlash and Boycott Calls

Controversies surrounding token listings, the depegging of the FDUSD stablecoin, and allegations of unethical behavior have raised a crucial question: Is Binance losing its credibility?

These issues threaten to erode trust and challenge Binance’s standing in the crypto industry.

Binance Struggles to Meet the Standard

One of Binance‘s most pressing issues is the poor performance of the tokens listed on the exchange. As BeInCrypto reported earlier, 89% of the tokens listed on the platform in 2025 recorded negative returns.

Even more concerning, another report reveals that most of the tokens listed in 2024 also experienced negative performance.

Listing on Binance was once considered a “launchpad” for new projects. However, it no longer guarantees success.

A prime example is the ACT token, a meme coin listed on the exchange that quickly plummeted. Earlier this week, Wintermute—a major market maker—dumped a large amount of ACT, exerting strong downward pressure on its price and raising concerns about the transparency of Binance’s listing process.

Such criticism has led the community to believe Binance prioritizes listing fees over users’ interests.

Connection to FDUSD

The FDUSD stablecoin has also become a focal point of controversy, with Binance at its center. FDUSD lost its peg, dropping to $0.89 after reports surfaced that its issuing company had gone bankrupt.

Wintermute, one of the largest FDUSD holders outside of Binance, withdrew 31.36 million FDUSD from the exchange at 11:15 AM UTC. This move is believed to have exacerbated the depegging situation, sparking panic in the market.

More concerning, a community member claimed that some Binance employees leaked internal information about the FDUSD incident so they could select whale chat groups.

If true, this would severely damage Binance’s reputation and raise major questions about the platform’s transparency and ethics.

Overall, the community’s dissatisfaction is growing, with many users calling for a boycott of the exchange. Such negative reactions are shaking user confidence in the platform, which was once considered a symbol of credibility in the crypto space.

“Binance today caused massive liquidations on alts listed on their exchange. I warned you all yesterday about their very dirty tactics, specifically GUN. I refuse to use Binance #BoycottBinance,” wrote popular crypto YouTuber Jesus Martinez.

These accusations stem from a central issue that Binance prioritizes profits over user interests. Over the past few months, the community has constantly criticized its listing strategy, arguing that the exchange focuses on “shitcoins” to collect high listing fees without considering project quality.

Although the exchange recently introduced a community voting mechanism to decide on listings, this might not be enough to silence the criticism.

As a Tier-1 exchange, the company is evaluated based on trading volume, security, regulatory compliance, and community trust. However, recent events suggest that the exchange is struggling to maintain these standards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Stellar (XLM) Falls 5% as Bearish Signals Strengthen

Stellar (XLM) is down more than 5% on Thursday, with its market capitalization dropping to $8 billion. XLM technical indicators are flashing strong bearish signals, suggesting continued downward momentum that could test critical support levels around $0.22.

While a reversal scenario remains possible with resistance targets at $0.27, $0.29, and $0.30, such an upside move would require a substantial shift in market sentiment.

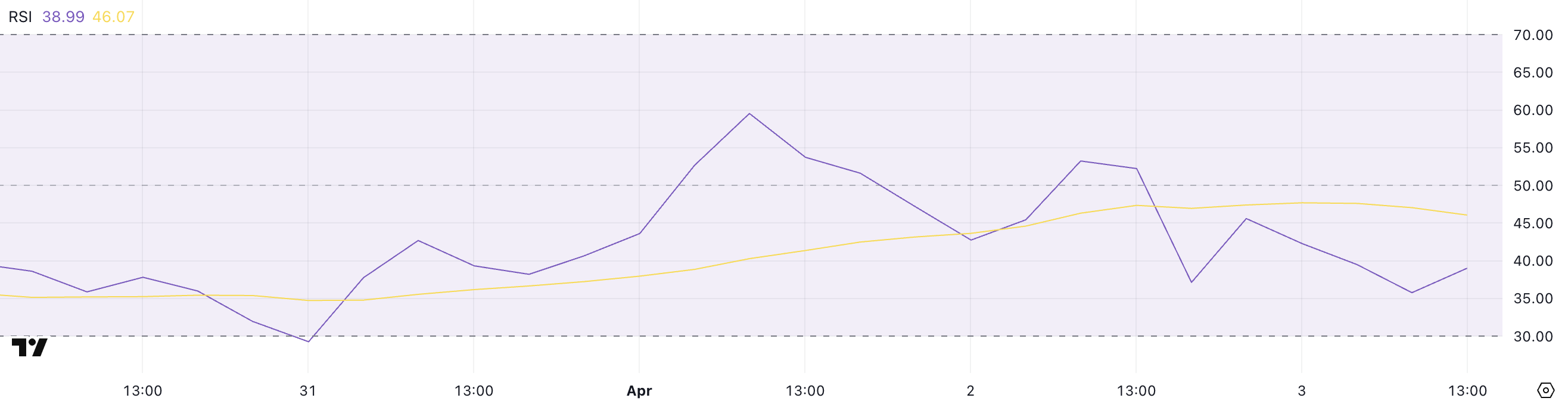

XLM RSI Shows Sellers Are In Control

Stellar’s Relative Strength Index (RSI) has dropped sharply to 38.99, down from 59.54 just two days ago—signaling a notable shift in momentum.

The RSI is a widely used momentum oscillator that measures the speed and magnitude of recent price changes, typically ranging between 0 and 100.

Readings above 70 suggest overbought conditions, while levels below 30 indicate oversold territory. A reading between 30 and 50 often reflects bearish momentum but is not yet extreme enough to trigger an immediate reversal.

With Stellar’s RSI now below the key midpoint of 50 and approaching the oversold threshold, the current reading of 38.99 suggests that sellers are gaining control.

While it’s not yet in oversold territory, it does signal weakening buying pressure and increasing downside risk.

If the RSI continues to fall, XLM could face further price declines unless buyers step in soon to stabilize the trend and prevent a slide into more deeply oversold levels.

Stellar CMF Heavily Dropped Since April 1

Stellar’s Chaikin Money Flow (CMF) has plunged to -10, a sharp decline from 0.19 just two days ago, signaling a significant shift in capital flow dynamics.

The CMF is an indicator that measures the volume-weighted average of accumulation and distribution over a set period—essentially tracking whether money is flowing into or out of an asset.

Positive values suggest buying pressure and accumulation, while negative values point to selling pressure and capital outflow.

With XLM’s CMF now deep in negative territory at -10, it indicates that sellers are firmly in control and substantial capital is leaving the asset.

This level of negative flow can put downward pressure on price, especially if it aligns with other bearish technical signals. Unless buying volume returns to offset this outflow, XLM could continue to weaken in the near term.

Will Stellar Fall To Five-Month Lows?

Stellar price action presents concerning signals as EMA indicators point to a strong bearish trend with significant downside potential.

Technical analysis suggests this downward momentum could push XLM to test critical support around $0.22. It could breach this level and fall below the psychologically important $0.20 threshold—a price not seen since November 2024.

This technical deterioration warrants caution from traders and investors as selling pressure appears to be intensifying.

Conversely, a trend reversal scenario would require a substantial shift in market sentiment. Should bulls regain control, XLM could challenge the immediate resistance at $0.27, with further upside targets at $0.29 and the key $0.30 level.

However, this optimistic outlook faces considerable obstacles, as only a dramatic sentiment shift coupled with the emergence of a powerful uptrend would enable such a recovery.

Until clearer bullish signals manifest, the prevailing technical structure continues to favor the bearish case.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Crashes 11%—Is More Pain Ahead?

Solana (SOL) is under heavy pressure, with its price down more than 10% in the last 24 hours as bearish momentum intensifies across key indicators. The Ichimoku Cloud, BBTrend, and price structure all point to continued downside risk, with SOL now hovering dangerously close to critical support levels.

Technical signals show sellers firmly in control, while the widening gap from resistance zones makes a near-term recovery increasingly difficult.

Solana’s Ichimoku Cloud chart is currently flashing strong bearish signals. The price has sharply broken below both the Tenkan-sen (blue line) and Kijun-sen (red line), confirming a clear rejection of short-term support levels.

Both of these lines are now angled downward, reinforcing the view that bearish momentum is gaining strength.

The sharp distance between the latest candles and the cloud further suggests that any recovery would face significant resistance ahead.

Looking at the Kumo (cloud) itself, the red cloud projected forward is thick and sloping downward, indicating that bearish pressure is expected to persist in the coming sessions.

The price is well below the cloud, which typically means the asset is in a strong downtrend.

For Solana to reverse this trend, it would need to reclaim the Tenkan-sen and Kijun-sen and push decisively through the entire cloud structure—an outcome that looks unlikely in the short term, given the current momentum and cloud formation.

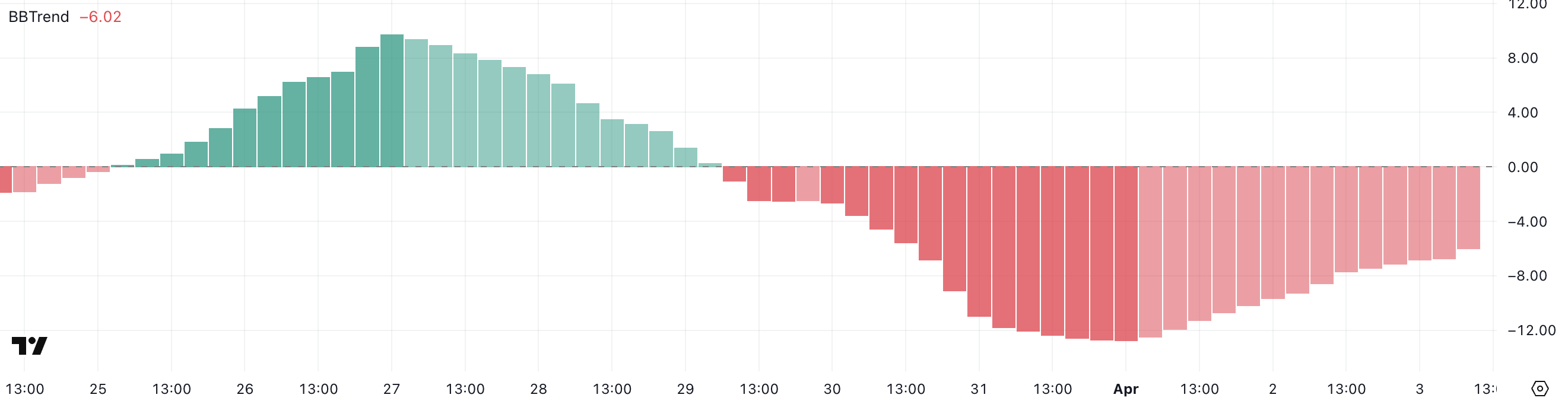

Solana’s BBTrend Signals Prolonged Bearish Momentum

Solana’s BBTrend indicator currently sits at -6, having remained in negative territory for over five consecutive days. Just two days ago, it hit a bearish peak of -12.72, showing the strength of the recent downtrend.

Although it has slightly recovered from that low, the sustained negative reading signals that selling pressure remains firmly in control and that the bearish momentum hasn’t yet been reversed.

The BBTrend (Bollinger Band Trend) measures the strength and direction of a trend using Bollinger Bands. Positive values suggest bullish conditions and upward momentum, while negative values indicate bearish trends.

Generally, values beyond 5 are considered strong trend signals. With Solana’s BBTrend still well below -5, it implies that downside risk remains elevated.

Unless a sharp shift in momentum occurs, this persistent bearish reading may continue to weigh on SOL’s price in the near term.

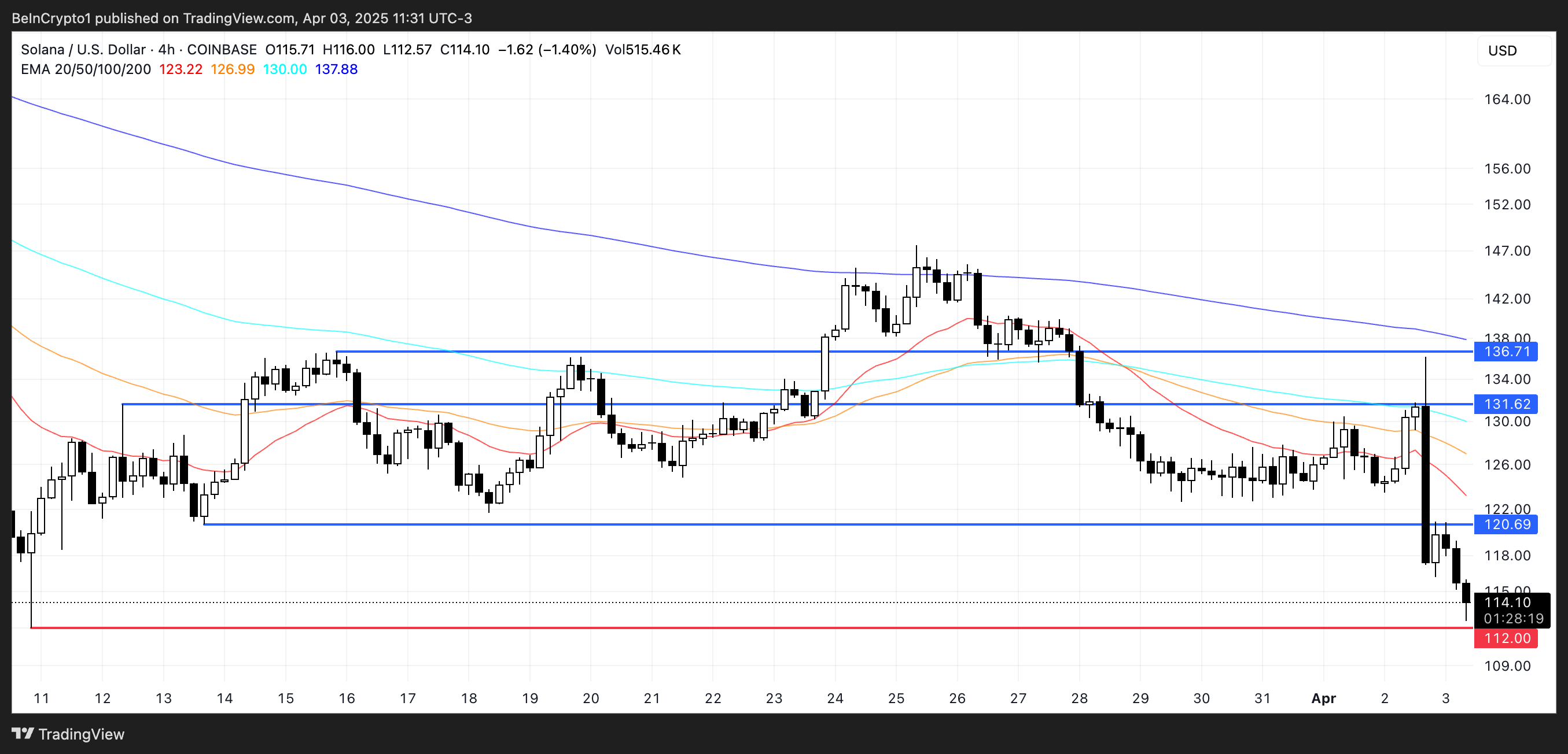

Solana Eyes $112 Support as Bears Test February Lows

Solana’s price has broken below the key $115 level, and the next major support lies around $112. A confirmed move below this threshold could trigger further downside. That could potentially push the price under $110 for the first time since February 2024.

The recent momentum and strong bearish indicators suggest sellers remain in control, increasing the likelihood of testing these lower support levels in the near term.

However, if Solana manages to stabilize and reverse its current trajectory, a rebound toward the $120 resistance level could follow.

Breaking above that would be the first sign of recovery, and if bullish momentum accelerates, SOL price could aim for higher targets at $131 and $136.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoBinance Sidelines Pi Network Again In Vote To List Initiative, Here’s All

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Forecasts 250% Dogecoin Price Rally If This Level Holds

-

Market20 hours ago

Market20 hours agoCardano (ADA) Downtrend Deepens—Is a Rebound Possible?

-

Market21 hours ago

Market21 hours agoXRP Price Under Pressure—New Lows Signal More Trouble Ahead

-

Market16 hours ago

Market16 hours agoIP Token Price Surges, but Weak Demand Hints at Reversal

-

Market19 hours ago

Market19 hours agoEthereum Price Recovery Stalls—Bears Keep Price Below $2K

-

Market24 hours ago

Market24 hours agoXRP Price Reversal Toward $3.5 In The Works With Short And Long-Term Targets Revealed

-

Regulation10 hours ago

Regulation10 hours agoUS Senate Banking Committee Approves Paul Atkins Nomination For SEC Chair Role