Market

Is the Bitcoin Price Top Here? CryptoQuant Weighs In

Leading on-chain analytics firm CryptoQuant has issued a cautionary note for investors banking on Bitcoin’s (BTC) price to sustain its recent rally past $94,000. The firm warns that the Bitcoin price top of this cycle could be close.

Their analysis highlights key indicators signaling potential exhaustion in BTC’s upward momentum. This raises the question: are these signs a genuine cause for concern, or could the rally still have room to run?

Bitcoin Could Soon Be Overvalued, CryptoQuant Says

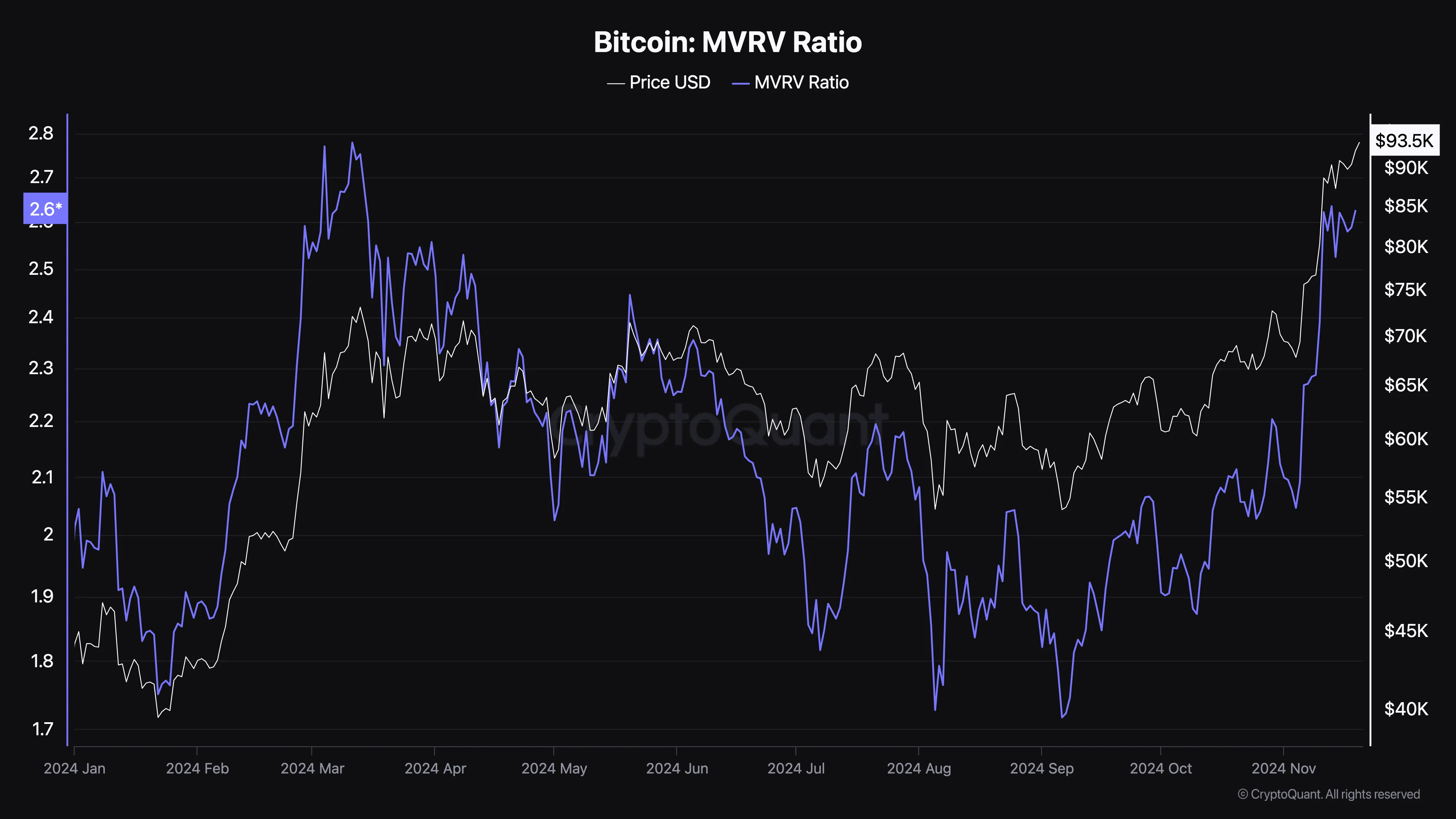

One indicator that CryptoQuant says could suggest Bitcoin’s price is at its highest is the Market Value to Realized Value (MVRV) ratio. The MVRV ratio serves as a key metric for gauging whether Bitcoin’s price is overvalued or undervalued.

Historically, values exceeding 3.7 have marked price peaks, signifying overvaluation. On the other hand, values dipping below 1 have indicated price bottoms, suggesting undervaluation. At press time, Bitcoin’s MVRV ratio sits at 2.62

This suggests that Bitcoin’s price is no longer undervalued. While it has not reached the overvaluation stage, a continued increase could send BTC toward that peak.

Additionally, the on-chain data provider highlighted that the Crypto Fear and Greed Index has entered the “extreme greed” phase, a strong indicator that Bitcoin’s price top might be approaching.

This observation aligns with BeInCrypto’s recent analysis and a cautionary statement from CryptoQuant’s CEO, Ki Young Ju, projecting potential risks as the market heads into 2025.

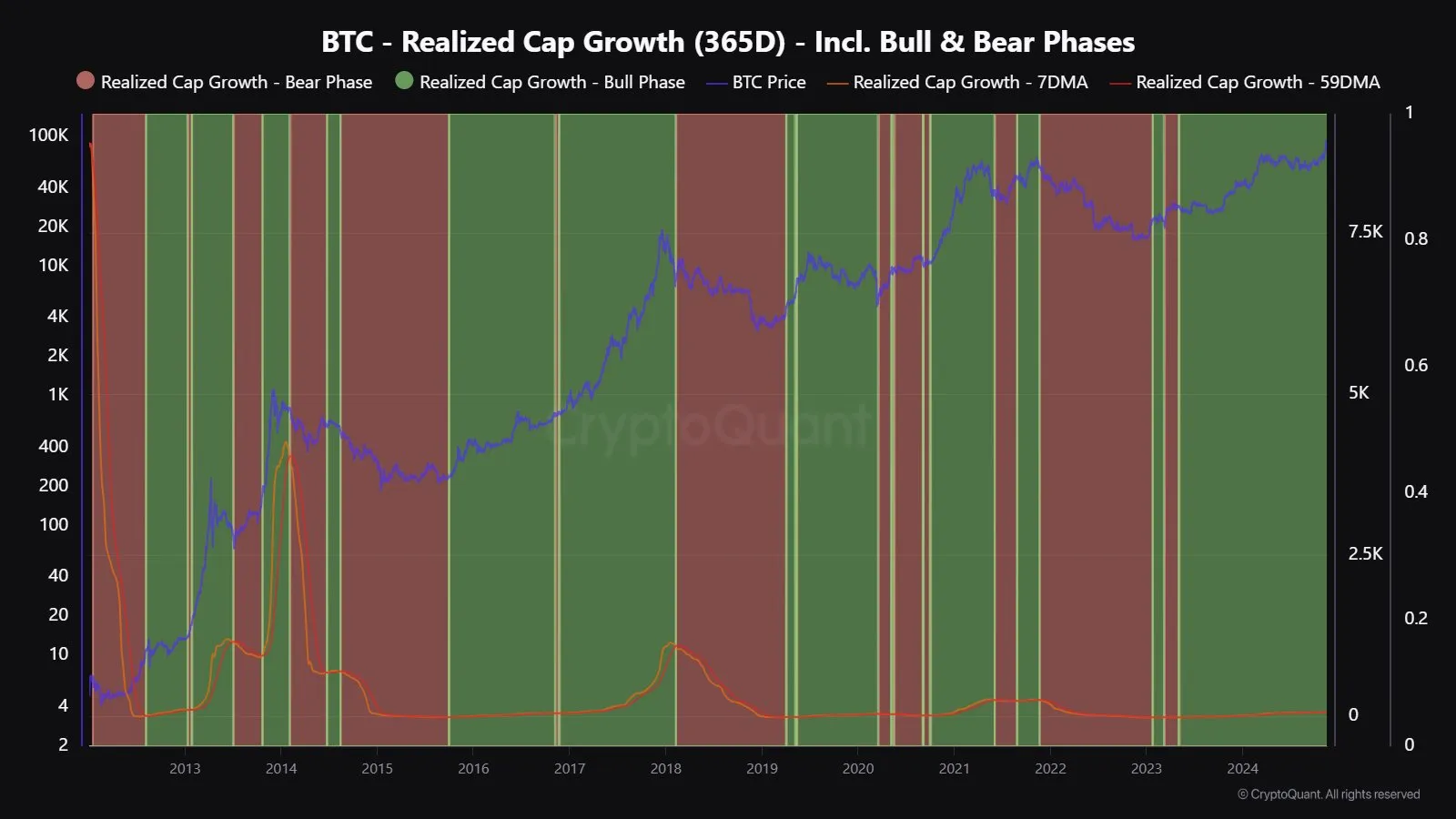

The firm also emphasized that Bitcoin is currently lacking in new capital. The 365-day Realized Cap Growt — a metric used to identify bull and bear market phases, evidenced this.

“For prices to stay strong, new money must flow into the market; without enough inflow, price pressure increases,” it stated on X.

As seen above, Bitcoin has recently seen an inflow of capital. But most of it has come from old money, suggesting retail investors are yet to exert a lot of pressure. Meanwhile, it also disclosed that the fact that long-term holders are selling could restrict BTC from going as high as investors desire.

BTC Price Prediction: Higher Highs Before Correction

At press time, Bitcoin’s price is $94,248, and it is trading within an ascending channel. The Bull Bear Power (BBP), which measures the strength of buyers versus sellers, is also in the positive region.

When the BBP increases, it means bulls are in control, and the price can increase. On the other hand, when the reading falls to the negative region, it means bears are in control. Therefore, the current reading suggests that the Bitcoin price top might not be here.

If that is the case, then BTC could rally toward the $100,000 mark. However, if the MVRV ratio climbs toward 3.7 and the cryptocurrency continues to lack new money, a correction to $80,795 could be next.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top Crypto Airdrops to Watch in the First Week of April

As traders and investors anticipate the beginning of April and the onset of the second quarter (Q2) of 2025, crypto airdrops present an opportunity to join promising communities while they are still on the ground floor.

This week, three notable crypto airdrops stand out as worth watching.

Walrus

Walrus (WAL), a decentralized storage protocol on the Sui blockchain, launched its mainnet and token generation event (TGE) on March 27. The event coincided with South Korea’s Upbit exchange listing WAL.

The TGE saw Walrus distribute 4% of its 5 billion token supply via an airdrop. Eligible participants, including early Sui ecosystem users and testnet contributors, received Soulbound NFTs redeemable for WAL tokens. As April commences, 6% of Walrus tokens are reserved for future community rewards.

“At the moment 4% of the 10% tokens allocated for the airdrop have been distributed, so Walrus still has tokens to reward users,” Cryptorank.io noted.

WAL powers storage payments, staking, and governance, with listings on exchanges like Crypto.com and MEXC offering prize pools. The project’s airdrop comes after raising $140 million from Andreessen Horowitz, Standard Crypto, Electric Capital, and Comma3 Ventures, among others.

Meanwhile, Walrus’s market cap exceeds $573 million, reflecting strong adoption potential. Data on CoinGecko shows it was trading for $0.45 as of this writing.

Staking opportunities with validators like Mysten Labs or Nansen enhance rewards, but high commissions (up to 60%) apply. One of Walrus and Sui’s founders recently announced that users could stake WAL tokens to get airdrops. As this could mean airdrops from Walrus and projects from the Sui ecosystem, engaging with Sui dApps and testnets remains key for future allocations.

Nansen

The project has raised up to $88.2 million from investors such as Andreessen Horowitz, Coinbase Ventures, Accel, and Mechanism Capital, among others. Coupled with the fundraiser, Nansen has a valuation of $750 million.

Nansen, a leading blockchain analytics platform, confirmed an airdrop, drawing excitement due to its prominence and past reward patterns. The project launched a staking program and announced a point system in 2025.

“We’re excited to announce that we have acquired Stakewithus (SWU)! SWU is a non-custodial staking service provider with $80m+ staked by 30k+ users & supports 20+ chains You can now analyze data, monitor your portfolio, and stake assets in one place with Nansen,” read the announcement.

Users can stake assets (STRK and TRX), and points are expected to be credited retrospectively. Nansen also mentions the NSG token, so participants will most likely receive an airdrop for points.

Market participants should monitor Nansen’s social channels and partnerships for updates, as airdrops typically reward active users or data contributors.

With no token launched yet, any potential airdrop might tie into a future native token, likely incentivizing early adopters or premium subscribers. Given Nansen’s influence in the crypto space, tracking wallet activity and on-chain data, its airdrop could attract significant attention.

Participants should engage with its tools and stake in supported ecosystems to position themselves for unannounced opportunities.

OG Labs

This modular AI chain combines Layer-1 blockchain with decentralized AI, focusing on scalable Data Availability for AI applications.

The status of OG Labs airdrop stands confirmed, bringing forth an emerging player in the crypto space. This makes it a speculative target for market participants. It boasts up to $325 million in funds raised from investors such as Delphi Ventures, Hack VC, Animoca Brands, and OKX Ventures, among others.

The airdrop is potentially tied to Web3 innovation or NFT ecosystems (given the “OG” moniker). It follows models like Walrus, rewarding early testers or community members.

“There are new activities on the OG test network – we can request test tokens and make swaps,” Cryptorank.io noted.

The OG Labs airdrop requires no investment. Users can engage through OG Labs’ Newton Testnet, which tests-core functionalities like decentralized storage, consensus, and data availability services. Participants must complete at least 20 transactions, stay active for three days, and interact with features like swaps, storage scans, and NFT minting.

“Interact with the OG Labs Testnet and Become Eligible for the Airdrop,” crypto researcher Guatamgg stated.

Additionally, users can boost eligibility by taking Discord roles such as OGurus or OG Role. These activities involve community contributions and verification steps. This airdrop targets active ecosystem participants, aligning with OG Labs’ emphasis on community-driven development.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Strategic Move for Trump Family in Crypto

Energy infrastructure platform Hut 8 Corp has partnered with US President Donald Trump’s sons, Eric Trump and Donald Trump Jr., to launch American Bitcoin Corp.

The company is dedicated to industrial-scale Bitcoin mining and developing a strategic reserve.

All You Need to Know about American Bitcoin

American Bitcoin’s leadership team includes Mike Ho as executive chair, Matt Prusak as CEO, and Eric Trump as CSO. The Board of Directors comprises Mike Ho, Asher Genoot (also Hut 8 CEO), Justin Mateen, and Michael Broukhim.

According to the announcement, Hut 8 holds an 80% ownership stake in American Bitcoin. This follows the contribution of its ASIC miners to American Data Centers Inc., a company formed by investors including the Trump brothers.

Subsequently, they renamed and relaunched the entity as American Bitcoin. As a new subsidiary focused on industrial-scale Bitcoin mining, this move aims for an efficiency of 50+ EH/s (exahashes per second). Meanwhile, Hut 8 remains the key infrastructure partner, consolidating financials under its brand.

Eric Trump, co-founder and chief strategy officer of American Bitcoin, expressed enthusiasm about the collaboration. He also emphasized the synergy between Hut 8’s operational excellence and shared passion for decentralized finance (DeFi) as a foundation for significant future growth.

“…By combining Hut 8’s proven operational excellence in data centers with our shared passion for Bitcoin and decentralized finance, we are poised to strengthen our foundation and drive significant future growth,” an excerpt in the announcement read, citing Eric Trump.

Donald Trump Jr. highlighted their longstanding commitment to Bitcoin, noting their conviction in Bitcoin personally and through their businesses. He reiterated the opportunity presented by mining Bitcoin under favorable economics and the potential for investors to participate in Bitcoin’s growth through this new platform.

Similarly, Genoot described the launch of American Bitcoin as a pivotal evolution in their platform strategy. By establishing a standalone entity for mining operations, Hut 8 aims to align each business segment with its respective cost of capital. Specifically, they would create two focused yet complementary companies.

Meanwhile, this venture is part of the Trump family’s broader engagement in the crypto industry. World Liberty Financial, the crypto venture linked to the Trump family, recently launched USD1. US treasuries, dollars, and cash equivalents back the stablecoin. The venture aims to facilitate secure cross-border transactions for investors and institutions.

Furthermore, reports indicate that the Trump family is discussing acquiring a stake in Binance.US. This is the American arm of the world’s largest cryptocurrency exchange, Binance. Given the family’s growing involvement in the sector, such an investment could significantly influence the crypto market.

These initiatives reflect the Trump family’s commitment to positioning the US at the forefront of the crypto industry. It also aligns with President Donald Trump’s ambition to establish the US as a global leader in digital assets.

“While people are worrying about the daily price action, President Trump and Eric Trump are building the infrastructure to take crypto to the next level,” crypto investor Gordon noted.

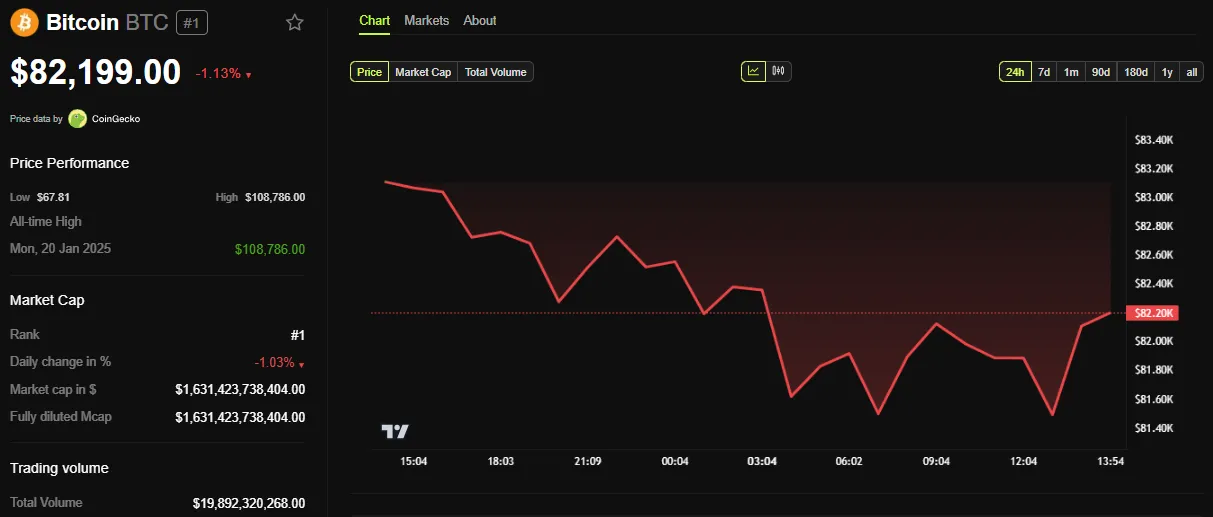

BeInCrypto data shows BTC was trading for $82,199 as of this writing. It is down by over 1.13% in the last 24 hours, unmoved by news of American Bitcoin. However, this could change once US markets open.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Don’t Fall for These Common Crypto Scams

ZachXBT, a well-known blockchain investigator, recently shared two key “minimum checks” on Telegram to avoid crypto scams.

He emphasized that users must accept full financial responsibility if they take risks in these situations and added that recovering lost funds would be extremely difficult.

Evaluating a Project’s Credibility is Crucial

ZachXBT highlighted two critical scenarios: depositing funds into forked DeFi protocols on newly launched EVM chains and getting scammed by projects with few smart followers on Kaito.

“If you make either of these decisions, it is your own personal choice to risk funds, and I will NOT help you,” ZachXBT stressed.

Many newly launched DeFi protocols on EVM chains are replicas of existing ones. Their teams often do not create original code but instead, fork from established protocols. This process requires minimal technical skills yet introduces significant security risks.

A recent incident highlighted the risks in the DeFi space. The DeFi protocol SIR.trading was reportedly hacked, leading to an estimated loss of $350,000. Despite the project’s documentation promoting it as a “new DeFi protocol for safer leveraged trading,” it acknowledged the risks related to smart contract vulnerabilities.

This case illustrates how new DeFi protocols often become targets for hackers. Additionally, in late March, the DeFi lending protocol Abracadabra suffered a loss of approximately $13 million due to an exploit involving collateralized tokens.

The second situation ZachXBT warned about involves getting “rugged” (falling victim to a rug pull) by projects with few smart followers on Kaito. Kaito is an AI-powered analysis tool that measures real community interest. He advised that checking followers’ numbers and quality is a basic step to avoid falling for projects that use fake engagement or empty marketing hype.

Investor Xero agreed with ZachXBT, stating that Kaito can be a credibility assessment tool.

“Kaito has become an amazing security and reputation tool that I value over others. It can help you identify an impersonator or a new rug project fast. If a 40k+ follower project isn’t connecting with real smart followers, it’s not legit,” Investor Xero commented.

Other Emerging Crypto Scams

In addition to ZachXBT’s warnings, several new scam tactics have recently been flagged.

Investor Jerome warned about a scheme that exploits browsers’ automatic download function to trick users into downloading malicious software.

Another method involves scammers creating and sending small transactions. They would be often as little as 0.001 tokens—using fake wallet addresses that closely resemble legitimate ones. Their goal is to deceive users into copying and pasting the fraudulent address when making future transactions.

Additionally, Microsoft has identified StilachiRAT, a new remote access trojan specifically designed to target cryptocurrency wallets and login credentials.

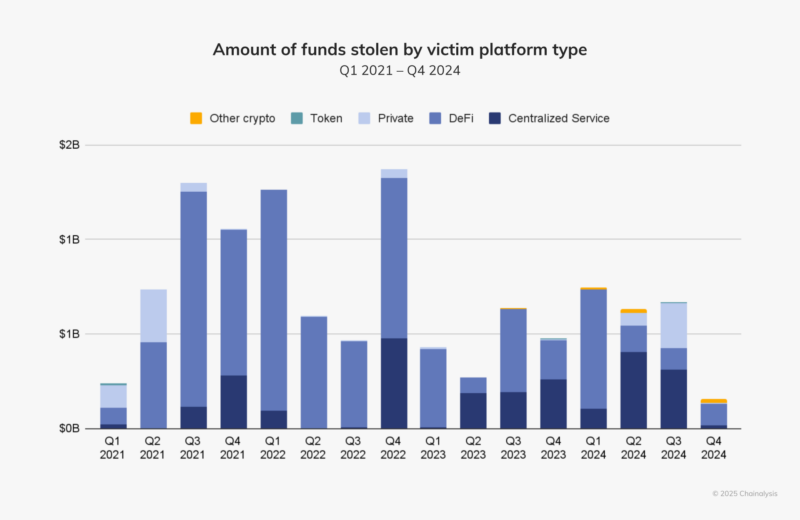

According to a Chainalysis report, from 2021 to 2024, decentralized finance (DeFi) platforms have been the primary targets of crypto hacks.

The report explains that DeFi platforms may be more vulnerable because developers prioritize rapid growth and launch over security measures. This lack of security focus makes them prime targets for hackers.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Regulation21 hours ago

Regulation21 hours agoJapan Set To Classify Cryptocurrencies As Financial Products, Here’s All

-

Market20 hours ago

Market20 hours agoTop 3 Made in USA Coins to Watch This Week

-

Market23 hours ago

Market23 hours ago3 Token Unlocks for April: Parcl, deBridge, Scroll

-

Market19 hours ago

Market19 hours agoSolana (SOL) Price Risks Dip Below $110 as Bears Gain Control