Bitcoin

Bitcoin Reserve Campaign Expands With VanEck’s Endorsement

The Bitcoin reserve campaign in the US continues to gain momentum, with more players showing support by the day. With endorsements at state and national levels, prospects continue to grow for the US stockpile of Bitcoin (BTC) to reach 1 million coins eventually.

Nevertheless, skeptics also exist, with some pushing that a Bitcoin reserve would be detrimental to the United States.

VanEck Joins Bitcoin Reserve Campaign

VanEck’s head of research, Mathew Sigel, announced the company’s full endorsement of a strategic Bitcoin reserve, signaling growing institutional support for the concept.

“FOR IMMEDIATE RELEASE: VanEck Endorses Strategic Bitcoin Reserve. No need for ‘sources’ — we’ll just tell you ourselves,” Sigel declared.

The Bitcoin Reserve movement, which aims to position Bitcoin as a national or state-held reserve asset, has been gaining traction. It follows President-elect Donald Trump’s public advocacy four months ago.

During a speech, Trump proposed replacing Gary Gensler at the SEC and highlighted Bitcoin’s potential to bolster national reserves. He said, “Bitcoin Reserve is the future,” sparking a wave of interest among policymakers and financial institutions.

Prominent political figures, including Senator Cynthia Lummis, have also lent their support. Lummis recently proposed selling portions of the US gold reserves to acquire Bitcoin. The senator, a long-time Bitcoin advocate, believes that diversifying the nation’s reserve assets with digital currencies could strengthen financial resilience. Her efforts have garnered bipartisan attention, with ongoing debates in Congress about the viability of such a move.

Meanwhile, US states are also entering the fray. Florida State’s CFO has publicly endorsed a Bitcoin reserve strategy. In the same way, Pennsylvania lawmakers recently introduced a bill advocating for a state-level Bitcoin reserve. These developments suggest a decentralized push toward integrating Bitcoin into government balance sheets.

The campaign has extended beyond US borders. Poland’s libertarian leader, Sławomir Mentzen, promised to pursue a national Bitcoin reserve strategy if elected. Mentzen’s pledge reflects the international appeal of Bitcoin as a modern monetary asset capable of countering inflationary pressures and enhancing fiscal sovereignty.

BlackRock’s Cautious Approach

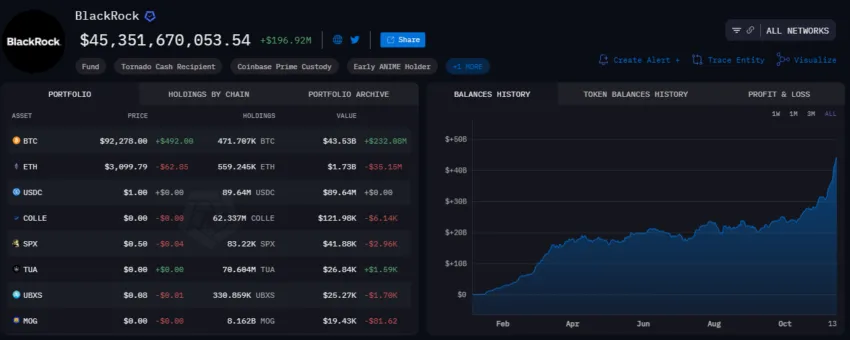

Amid the rise of the BTC Reserve movement, BlackRock, the world’s largest asset manager, has adopted a more measured stance. While VanEck openly supports the concept, Fox Business correspondent Eleanor Terret reported that BlackRock is skeptical.

“Sources close to BlackRock tell Fox Business the big money manager is not endorsing a strategic BTC reserve despite recent reports that it is,” Terrett shared.

However, BlackRock’s actions paint a complex picture. The firm’s Bitcoin ETF recently surpassed $40 billion in assets under management (AUM), setting industry speed records. BlackRock has also increased its Bitcoin exposure by investing heavily in MicroStrategy, a company known for its substantial Bitcoin holdings. The asset manager also acquired $680 million in Bitcoin through its IBIT ETF and direct investments. Meanwhile, critics remain skeptical of BlackRock’s intentions.

“BlackRock is playing the Franklin Templeton game—they are pushing the ETF but know they are really here for the tokenization,” one user shared on X.

This viewpoint suggests that BlackRock’s endgame may be less about Bitcoin adoption and more about the broader application of blockchain technology for asset tokenization. Meanwhile, data on Arkham shows BlackRock’s Bitcoin stash has reached 471,707K BTC, valued at $43.53 billion as of this writing.

Adding to the skepticism, billionaire investor Mike Novogratz recently expressed doubt about the feasibility of a US Bitcoin reserve. Novogratz believes Bitcoin remains too volatile and politically divisive to become a core government asset in the near term.

“It’s a low probability. While the Republicans control the Senate, they don’t have close to 60 seats. I think that it would be very smart for the United States to take the Bitcoin they have and maybe add some to it… I don’t necessarily think that the dollar needs anything to back it up,” Novogratz claimed.

Despite divergent views, the BTC Reserve campaign has undeniably gained momentum. It has drawn attention from global policymakers, financial institutions, and private investors. Whether through state-led initiatives, international adoption, or institutional investments like BlackRock’s ETF, Bitcoin’s role in the global financial system continues to grow.

“In addition to the macro environment, there is a renewed sense of optimism that regulatory clarity for bitcoin and digital assets more broadly may emerge following the US election. President-elect Donald Trump campaigned on maintaining a strategic bitcoin reserve, while pro-crypto politicians in the House and Senate races from both sides of the aisle enjoyed electoral success. The macro-environment combined with supportive policies could combine to accelerate and broaden Bitcoin’s adoption,” BlackRock shared.

VanEck’s public endorsement, coupled with growing interest from figures like Senator Lummis and international leaders, could mark a tipping point in the integration of digital assets into mainstream financial strategies.

As debates intensify, the question remains whether Bitcoin will become the gold standard of the digital age or whether its volatility and skepticism from major players like BlackRock will hinder its adoption as a reserve asset.

Bitcoin is up by a modest 0.59% as of this writing. BeInCrypto data shows the pioneer crypto is trading at $92,207.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Faces ‘Bank Run’ Risk, Cyber Capital’s Bons Warns

Bitcoin (BTC) may be at risk of a catastrophic “bank run,” according to Justin Bons, founder and CIO of Cyber Capital.

A bank run is when customers withdraw their deposits from a financial institution over fears of insolvency.

Bitcoin Cannot Handle Mass Exits, Bons Says

In a detailed social media thread, Bons highlighted critical flaws in Bitcoin’s transaction capacity, self-custody model, and network security. In his opinion, these could lead to a crisis that would destabilize the network and devastate investors.

Bons’ analysis centers on Bitcoin’s limited transaction processing capability, which he calculated at approximately seven transactions per second (TPS). Using data from Glassnode and Bitcoin’s code, he argued that Bitcoin’s 33 million on-chain users would face a bottleneck if a mass panic triggered simultaneous exits.

“At this rate, the queue would be 1.82 months long under optimal conditions. However, in reality, transactions would get stuck and eventually be dropped, making it impossible for smaller parties to exit unless they pay exorbitant fees,” Bons explained.

Bons warned that this limitation could lead to a “death spiral,” where a price crash forces miners to shut down, slowing the network further. The resulting delays could deepen the panic, creating a vicious cycle of declining hash rates, prolonged block times, and falling prices.

Further in his critique of BTC, Bons claimed Bitcoin’s transaction capacity is insufficient for real-world use. He compared Bitcoin’s 7 TPS to other systems, such as Visa’s 5,000 TPS, or even competitors in the crypto space that exceed 10,000 TPS without sacrificing decentralization.

“There are literally ZERO use cases that can be supported by 7 TPS. Mass self-custody over BTC is a dangerous narrative. The only scalable path forward for BTC adoption is through centralized custodians and banks, contradicting its ethos as ‘freedom money’,” he stated.

Bons also questioned Bitcoin’s long-term sustainability, citing its shrinking security budget. This, in his opinion, is a critical issue that could exacerbate the risks he outlined. The thread also touches on Bitcoin’s deviation from its original vision as “peer-to-peer (P2P) electronic cash.” He lamented that the network’s constraints and governance have turned it into a speculative asset rather than a practical medium of exchange.

Bons’ remarks ignited a heated debate on X (formerly Twitter). Patrick Flanagan, a self-described tech expert, dismissed the claims.

“This is pure fantasy. If this was going to occur, it would have occurred years ago,” Flanagan argued.

Bons rebutted, asserting that the risk increases as the number of users grows. He noted that even a fraction of users leaving could trigger a run and added that the larger the network gets, the more severe the problem becomes.

Other users highlighted potential alternatives, such as trading wrapped Bitcoin (WBTC) on Ethereum, which bypasses Bitcoin’s base layer limitations. Bons acknowledged this but noted that wrapped BTC users could exit quickly while on-chain users would be trapped, exacerbating the sell-off. The discussion also extended to Bitcoin’s self-custody model.

“This is something that self-custody advocates should pay attention to. One tiny bit of FUD and everyone gets their money stuck,” DashPay’s Joel Venezuela remarked.

Bons responded, acknowledging the difficult position he finds himself in as a cypherpunk and self-custody advocate. Another user raised a comparison to gold, questioning how long it would take to liquidate global gold holdings. Bons countered that while gold also has practical limits, its theoretical transaction capacity far exceeds Bitcoin’s, making it less susceptible to such bottlenecks.

Critics of Bons’ analysis argue that Bitcoin has weathered similar concerns in the past without collapsing. However, his warning adds to a growing chorus of voices calling for a reevaluation of Bitcoin’s scalability and usability.

Despite his grim outlook for Bitcoin, Bons remains optimistic about the broader cryptocurrency space. “There is much hope left for cryptocurrency as a whole,” he concluded, suggesting that Bitcoin’s original ethos now thrives in other blockchain projects.

Meanwhile, while Bitcoin remains the dominant cryptocurrency, debates over its scalability and resilience continue. Bons’ warning serves as a stark reminder of the challenges Bitcoin faces as it seeks broader adoption in a changing financial space. Elsewhere, Galaxy CEO Mike Novogratz has almost similar reservations about a Bitcoin reserve in the US.

“I think that it would be very smart for the United States to take the Bitcoin they have and maybe add some to it… I don’t necessarily think that the dollar needs anything to back it up,” Novogratz claimed.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Must Hold This Support Level To Retain $100,000 Dream

Bitcoin continues to record significant price leaps following a 19.28% gain in the past seven days. The premier cryptocurrency is replicating another bullish Q4 particularly boosted by multiple factors as it gradually approaches the $100,000 price target. However, crypto analyst Ali Martinez has revealed a vital condition for the market bulls to sustain the current momentum.

Why $91,900 Is Crucial To Bitcoin

Donald Trump’s electoral victory coupled with recent Federal Reserve rate cuts have spurred Bitcoin to multiple all-time highs over the last two weeks. On Thursday, the crypto market leader hit a new peak of $93,434 and has since retraced by 2.25% to remain in consolidation above $91,000.

Commenting on Bitcoin’s future price movement, Ali Martinez shared that the TD Sequential, a trading indicator for identifying trend exhaustion and market reversals, had recently flashed a sell signal indicating that BTC may be due for some significant price recorrection.

However, the analyst explains the leading cryptocurrency can avoid such a downturn if the market bulls ensure a daily close above $91,900. Martinez states that holding this price level would allow Bitcoin to maintain its current trajectory and potentially climb to $100,680.

Bitcoin To Fall Or Not?

Martinez’s predictions counter wider beliefs that the premier cryptocurrency is set for a re-correction following a prolonged price rally that has lasted since early October.

In a separate post on X, the analyst notes the Bitcoin Long/Short ratio currently stands at 0.79 with 55.94% of traders opening short positions in anticipation of a price fall. Bitcoin’s relative strength index also remains above 70, signaling it’s in the overbought zone and is due for a price reversal. However, the asset’s price is also well above its 20-SMA showing potential for a trend continuation.

Moreover, the impending return of Trump to the White House which is expected to usher in new pro-crypto appointments in terms of agencies such as SEC and CFTC also continues to spur investors who will now anticipate a less regulatory hostile regime. This factor, combined with the ongoing impressive performance of the Bitcoin spot ETFs which have now accumulated total inflows of $6.18 billion in Q4 2024. Therefore, the premier cryptocurrency may remain yet resilient reaching another all-time high in no time.

At the time of writing, Bitcoin trades at $91,166 reflecting a 2.10% in the past day. Meanwhile, the asset’s trading volume is down by 18.88% and valued at $68.54 billion.

Featured image from Medium, chart from Tradingview

Bitcoin

Financial Research Firm Analyst Explains Why BTC Rally Could Keep Going

A financial research company analyst expects Bitcoin to continue its price surge until year-end as it rides on bullish technical indicators and increasing market demand.

In a CNBC interview uploaded via YouTube, Fundstrat’s Tom Lee shared his thoughts on Bitcoin’s continuing dominance in the context of incoming US President Donald Trump’s convincing election.

Bitcoin’s price is currently trading at the $91k level, and Lee expects that the top digital asset will consolidate near the $90,000 level, with its technicals setting it up for a sustained run.

According to technical analysts, Bitcoin is on its fifth Elliot Wave cycle, indicating an expected rise, with a price of $130k to $145k by year-end. According to Lee, Bitcoin can easily target this price with increasing market volume and a friendlier monetary policy from the Federal Reserve.

Lee Explains Why Bitcoin’s Rally Continues

In a CNBC interview, Lee explained that increasing market demand and solid technical indicators support Bitcoin’s recent price surge. He noted that Bitcoin is now in a consolidation phase and will likely stay at the $90,000 level.

Bitcoin’s price, he says, aligns with the price action of other risk assets. But Bitcoin is different because it’s more stable and shows resilience. According to Lee, Bitcoin thrives in a risk-taking environment, and the political and economic landscape favors the digital asset.

Major indices like the S&P 500 and NASDAQ have dipped on support levels, which offers a solid foundation for future growth. The same trend is happening for Bitcoin, suggesting that the asset is primed for another surge.

Lee also linked Bitcoin’s price performance with other market trends, including a “Trump trade.” He argued that Trump’s election was key in boosting the asset’s price. Then, there’s the recent confirmation of establishing the D.O.G.E., which aimed to promote efficiency and deregulation in the government.

BTC As A Strategic Reserve Asset

Lee pointed out that the proposals to make Bitcoin a strategic asset are also helping boost its market volume and price. Bitcoin can serve as a hedge against macroeconomic uncertainties, including inflation. He added that the current debates on the direction of US monetary policies, like cutting interest rates, are helping the crypto’s price.

Meanwhile, there’s an ongoing discussions on who will be the next Treasury secretary, which can also influence prices. Howard Lutnick of Cantor Fitzgerald is one of the leading names considered, advocating for Bitcoin’s legitimacy.

Increasing Retail And Institutional Support Pushing Bitcoin’s Price

Lee also suggested increasing support among retail and institutional investors, driving Bitcoin’s price. Based on data by CryptoQuant, Coinbase’s premium index increased at the rally’s start, suggesting surging interest from US retail investors. However, these numbers have dipped recently, reflecting a slowdown in retail action.

For Coosh Alemzadeh, Bitcoin’s current price chart and technicals suggest future growth. He added that Bitcoin is at its fifth wave of the Elliot Wave cycle, which is at the peak of a price surge. Based on his projection, BTC’s price can reach $145k by year-end.

Featured image from SCMP, chart from TradingView

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Unveils Major Update for SHIB, ADA, FLOKI and HBAR, What’s Next?

-

Market20 hours ago

Market20 hours agoCan The DOGE meme coin Price Rally Past $0.40?

-

Altcoin15 hours ago

Altcoin15 hours agoAnalyst Reveals How XRP Price Can Reach $20

-

Altcoin20 hours ago

Altcoin20 hours agoPolygon Price Eyes Massive 50% Breakout Amid POL Whale Activity

-

Market19 hours ago

Market19 hours agoEthereum ETFs Record Historic Inflows; Price Holds Above $3,000

-

Market18 hours ago

Market18 hours agoShiba Inu LTHs Note Profit After 65% Rally This Month

-

Market23 hours ago

Market23 hours agoWhy the XTZ Coin Price Rally May Not Continue

-

Altcoin23 hours ago

Altcoin23 hours agoFloki Announces Huge Marketing Campaign in India Ahead Coinbase Listing