Market

XRP Volume Plunges By $17 Billion, Stalling Potential Hike to $2

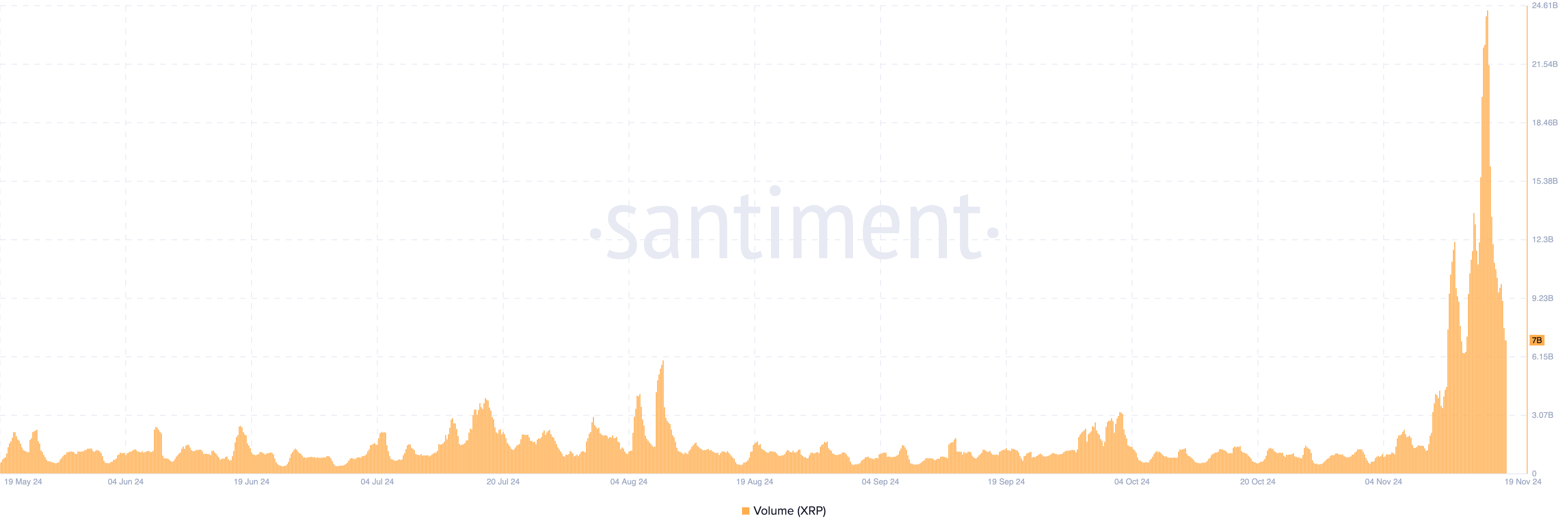

On Sunday, November 17, Ripple’s (XRP) price hit $1 for the first in three years. This landmark also saw XRP volume rise to $24 billion, but as of this writing, that value has since dropped.

This decline indicates that interest in the altcoin is no longer as high as it was earlier. But how will this affect XRP’s price?

Market Attention to Ripple Drops

According to Santiment, XRP’s volume recently peaked at $24.40 billion but has since dropped significantly to $7 billion, marking a $17 billion decrease in buying and selling activity.

From a technical perspective, a rising price coupled with increasing volume typically signals a strong and sustainable uptrend. However, when the price rises while volume declines, it suggests weakening momentum and a potential reversal.

This appears to align with XRP’s current situation, where the volume drop indicates diminished market participation. If this trend persists, XRP’s price could struggle to maintain its upward trajectory and risk falling below the $1 mark in the short term.

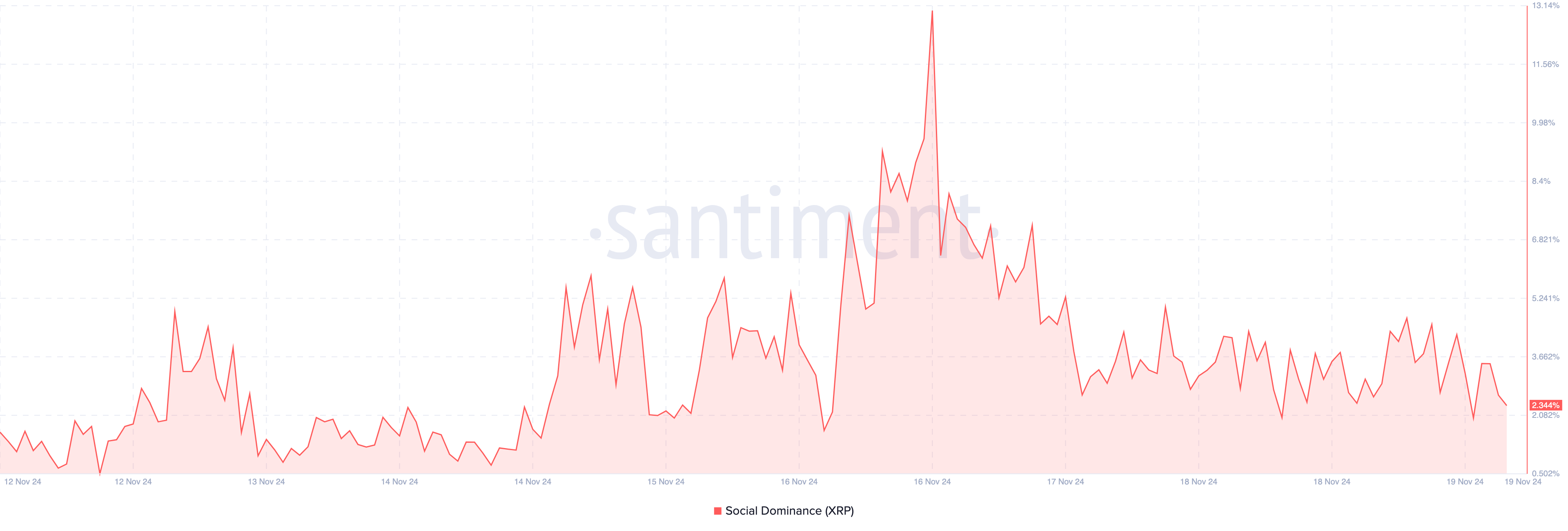

Furthermore, a look at social dominance shows that the reading has dropped. Social dominance is measured by analyzing the percentage of discussions focused on a specific cryptocurrency compared to the total discussions happening across various crypto-related platforms. This metric highlights how much attention an asset is garnering within the broader crypto community.

When social dominance increases, it often indicates heightened interest or hype around the asset. Conversely, a decrease in social dominance may suggest that the asset is losing visibility or relevance in the market.

A few days ago, XRP’s social dominance was almost 13%. As of this writing, it has dropped to 2.34%, indicating that interest in the token has waned. Should this remain the case alongside the drop in XRP volume, the price might drop.

XRP Price Prediction: Sub-$1 Possible

Based on the daily chart, XRP experienced a surge in buying pressure earlier. This was indicated by the Money Flow Index (MFI), an indicator that measures the level of capital injected into a cryptocurrency.

But as of this writing, the MFI reading has dropped from that peak. This decline indicates that buying pressure is no longer as high as it was some days back. Therefore, if this reading continues to decrease, then XRP’s price could drop to $0.80.

However, if XRP volume climbs to the double-digits region again, this trend might change. Should that happen, the cryptocurrency’s value could rise to $1.26.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Made in USA Coins to Watch In April

Made in USA coins continue to try a rebound, with Solana (SOL), RENDER, and Jupiter (JUP) standing out as key names to watch in April. Despite recent price corrections, each of these tokens plays a major role in high-growth areas like DeFi, AI, and blockchain infrastructure.

Solana has seen its price dip, but ecosystem activity remains strong; RENDER is riding the wave of AI demand despite market turbulence; and Jupiter is showing solid usage metrics even as its token struggles. Here’s a closer look at the technical and fundamental setups for each of these standout U.S.-based projects.

Solana (SOL)

Solana has faced a notable price correction over the past week, with its value dropping nearly 13%. If this bearish momentum continues, the token could be on track to retest the critical support level at $120.

A breakdown below that could see SOL sliding further toward the $112 mark.

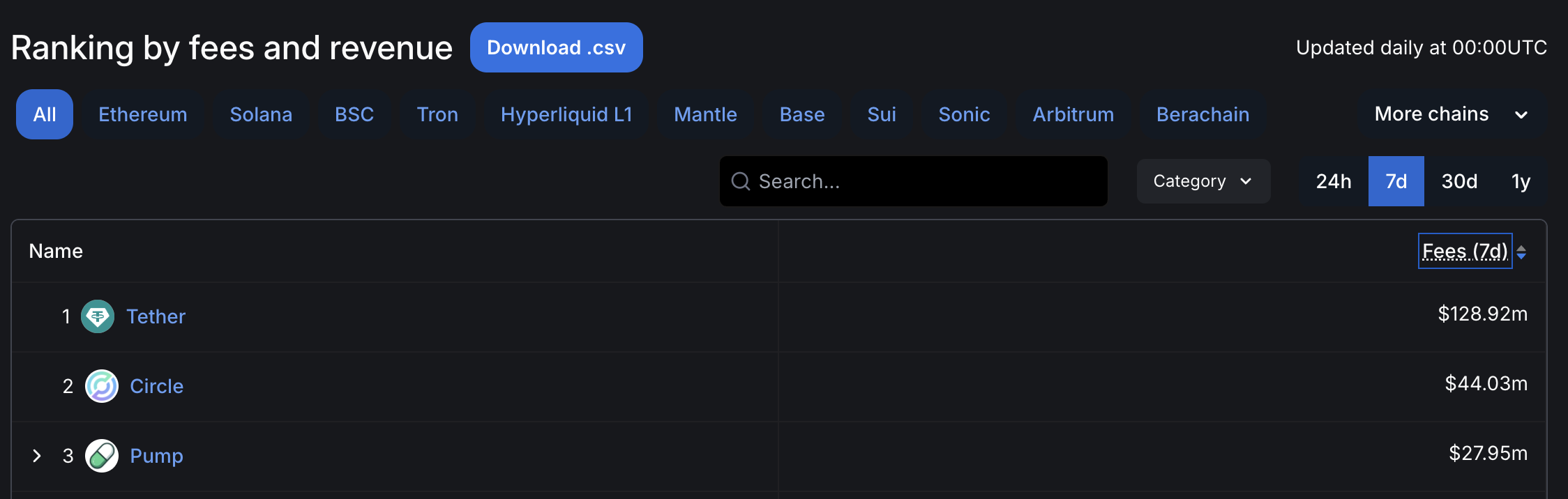

Despite the recent downturn, Solana remains one of the most relevant Made in USA coins and continues to show impressive usage metrics. PumpFun, for example, generated nearly $9 million in revenue over the past 24 hours, second only to Tether.

After a short period when BNB led the DEX volume race, Solana seems to be regaining traction—its decentralized exchange volume has surged by 128% in just seven days, reaching $18 billion and surpassing both Ethereum and BNB.

If this recovery in momentum persists, SOL could target a move toward the $131 resistance level. A successful breakout there could open the door to further gains toward $136 and potentially $147.

RENDER

RENDER, one of the most prominent U.S.-based cryptocurrencies with a focus on artificial intelligence, has seen its price decline nearly 11% over the past seven days.

This drop reflects the broader correction that has impacted many AI-related tokens in recent months.

However, new developments in the AI infrastructure space may provide a catalyst for a potential rebound, especially as the limitations of centralized systems become clear.

If bullish momentum returns to the AI sector, RENDER could look to challenge the resistance at $3.47, and a successful breakout might open the door for a rally toward $4.21.

However, if the current correction deepens, the token could fall to test the $3.14 support level. A breakdown there may trigger further losses, potentially dragging RENDER down to $2.83 or even $2.52—its lowest level in recent weeks.

Jupiter (JUP)

Despite Solana’s recent struggles, Jupiter—its leading DEX aggregator—is demonstrating impressive strength in terms of activity.

In the last 24 hours, Jupiter ranked as the fourth-highest protocol in crypto by fee generation, collecting nearly $2.5 million.

Only Tether, PumpFun, and Circle managed to outperform it, highlighting the platform’s growing relevance within the Solana ecosystem even during periods of broader market weakness.

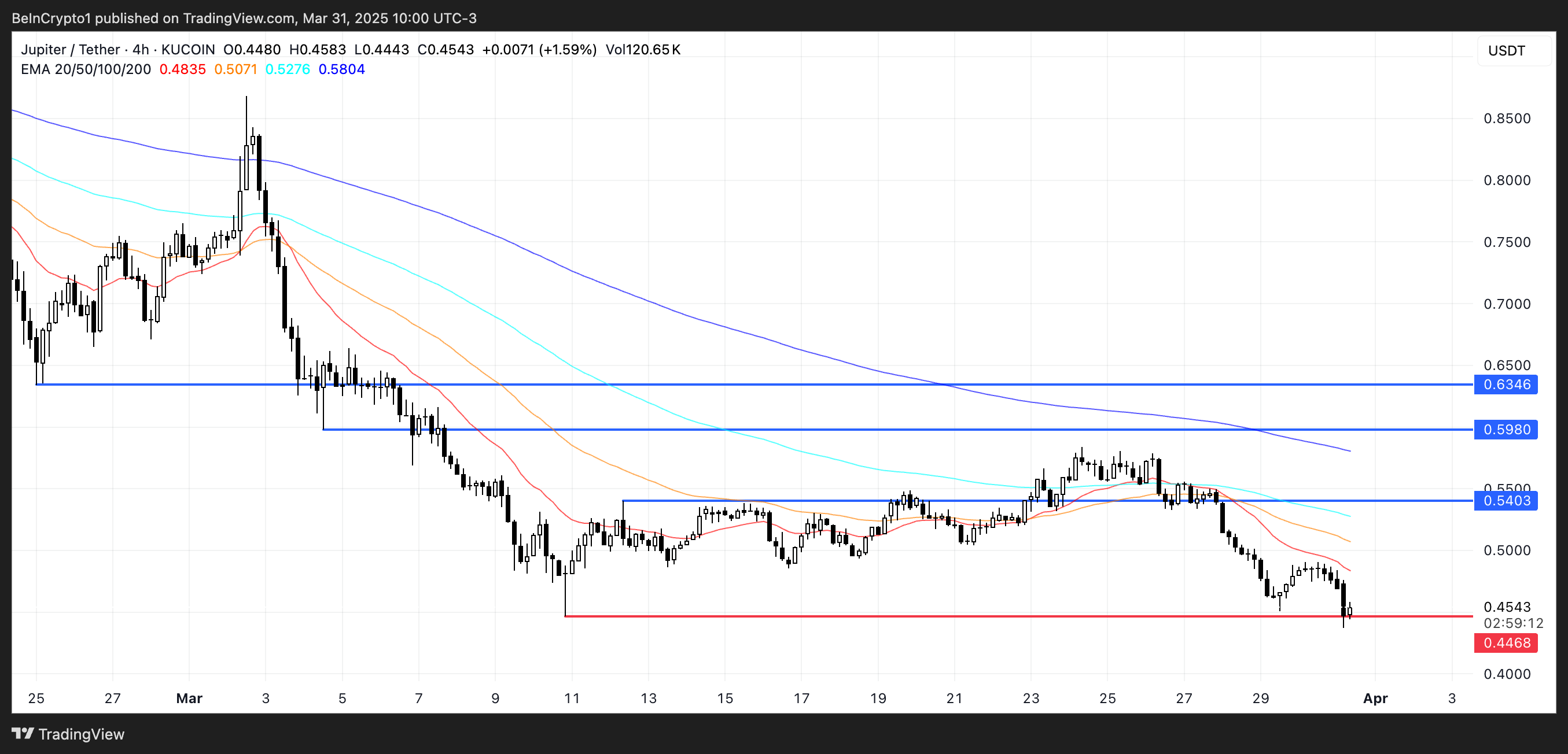

However, JUP, Jupiter’s native token, hasn’t mirrored this positive momentum. Its price has dropped over 21% in the past week, being one of the worst performers among the biggest Made in USA coins. It has remained below the $0.65 mark for three consecutive weeks.

With JUP now hovering dangerously close to a key support at $0.44, a breakdown could see the token dip below $0.40 for the first time ever.

Still, if market sentiment shifts and momentum returns, JUP could begin climbing again—first testing resistance at $0.54, then potentially moving toward $0.598 and even $0.63 if bullish pressure intensifies.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Whales Hit 2-Year Low as Key Support Retested

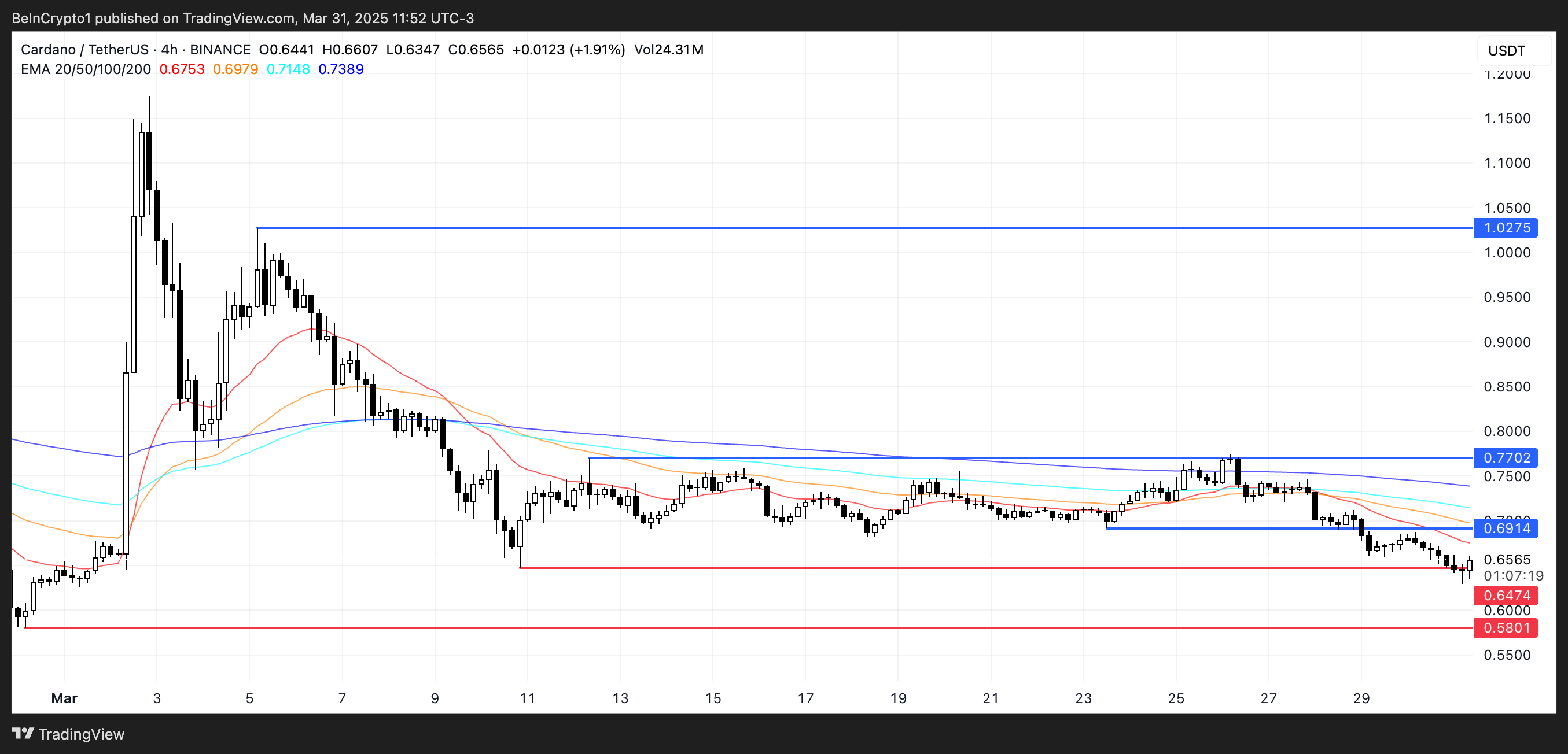

Cardano (ADA) is facing mounting pressure as its price corrects by 10% over the past seven days, continuing a broader downtrend that has kept it trading below the $1 mark for nearly a month. With technical indicators flashing warning signs and large holders exiting their positions, concerns around ADA’s short-term stability are growing.

The recent rejection at higher resistance levels and a strong directional trend signal suggest that bearish momentum is far from over. As the $0.64 support level is tested once again, ADA’s next move could determine whether a rebound is possible—or if further downside is ahead.

Cardano ADX Shows The Downtrend Is Very Strong

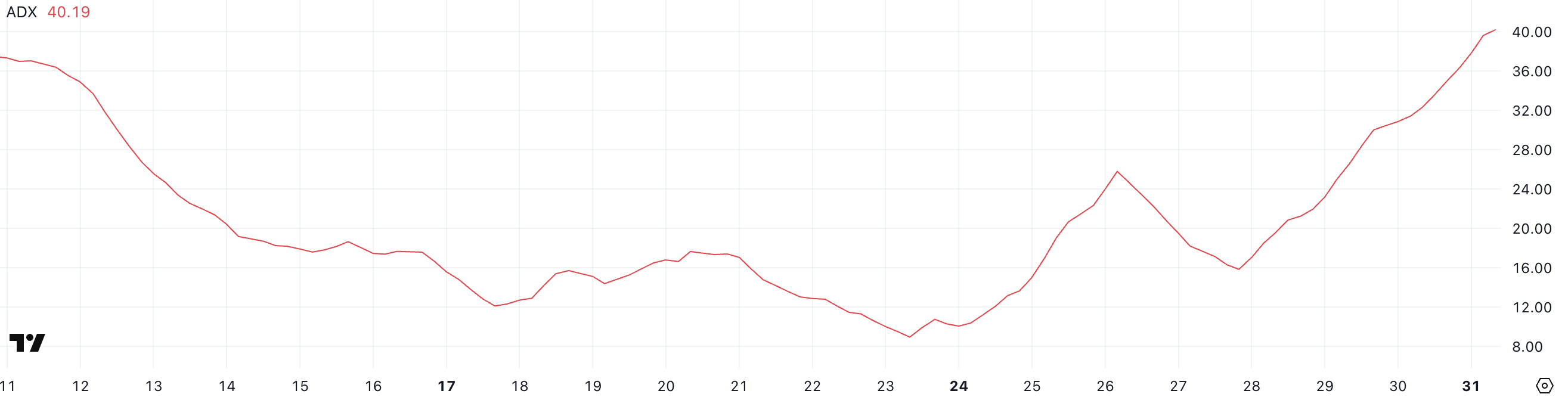

Cardano’s Average Directional Index (ADX) is currently at 40.19, rising sharply from 15.83 just four days ago. This steep increase suggests a rapid strengthening in the trend’s momentum.

Given that ADA is currently in a downtrend, the rising ADX indicates that bearish momentum is intensifying and the current downward move is gaining traction.

The ADX is a trend strength indicator that measures how strong a trend is, regardless of its direction. It ranges from 0 to 100, with readings below 20 typically indicating a weak or non-existent trend, while values above 25 suggest a strong trend is in place.

Cardano’s ADX climbing above 40 confirms that the current downtrend is active and becoming stronger. If this trend continues, it may point to further downside pressure unless a shift in momentum begins to build from the bulls.

ADA Whales Dropped To Their Lowest Level Since February 2023

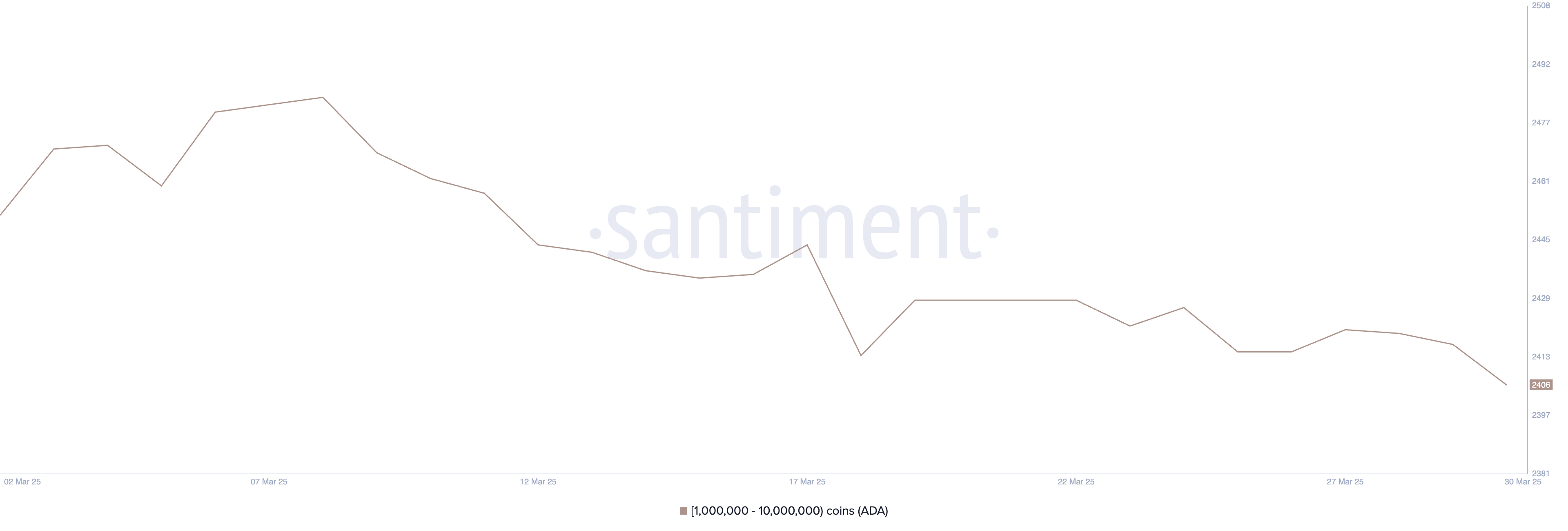

The number of Cardano whales—wallets holding between 1 million and 10 million ADA—has dropped to 2,406, down from 2,421 just four days ago.

This decline brings the whale count to its lowest level since February 2023, marking a potentially meaningful shift in large-holder behavior. These movements are worth paying attention to, as changes in whale holdings often precede broader market trends.

Tracking whales is important because these large holders can significantly influence price action through their buying or selling decisions. A decline in whale numbers can signal reduced confidence or capital rotation into other assets.

In Cardano’s case, the drop suggests that some major players may be exiting or reducing exposure, which could add downward pressure to ADA’s price.

If this trend continues, it could weaken investor sentiment and make it harder for ADA to recover in the short term.

Can Cardano Sustain The $0.64 Support Again?

Cardano price recently tested the support level at $0.64 and managed to hold, showing that buyers are still defending that zone. This support has become a key line in the sand for ADA’s short-term outlook.

If the current downtrend is reversed and bullish momentum picks up, the next upside target would be the resistance at $0.69. A breakout above that level could open the door for a push toward $0.77.

Should the rally continue with strength, ADA could aim for $1.02—marking a return above the $1 level for the first time since early March.

However, the $0.64 support remains a critical level to watch. If Cardano tests it again and fails to hold, it could indicate weakening buyer conviction.

A breakdown below $0.64 would likely send ADA toward the next support at $0.58. This would confirm a continuation of the downtrend and possibly trigger further selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This is Why PumpSwap Brings Pump.fun To the Next Level

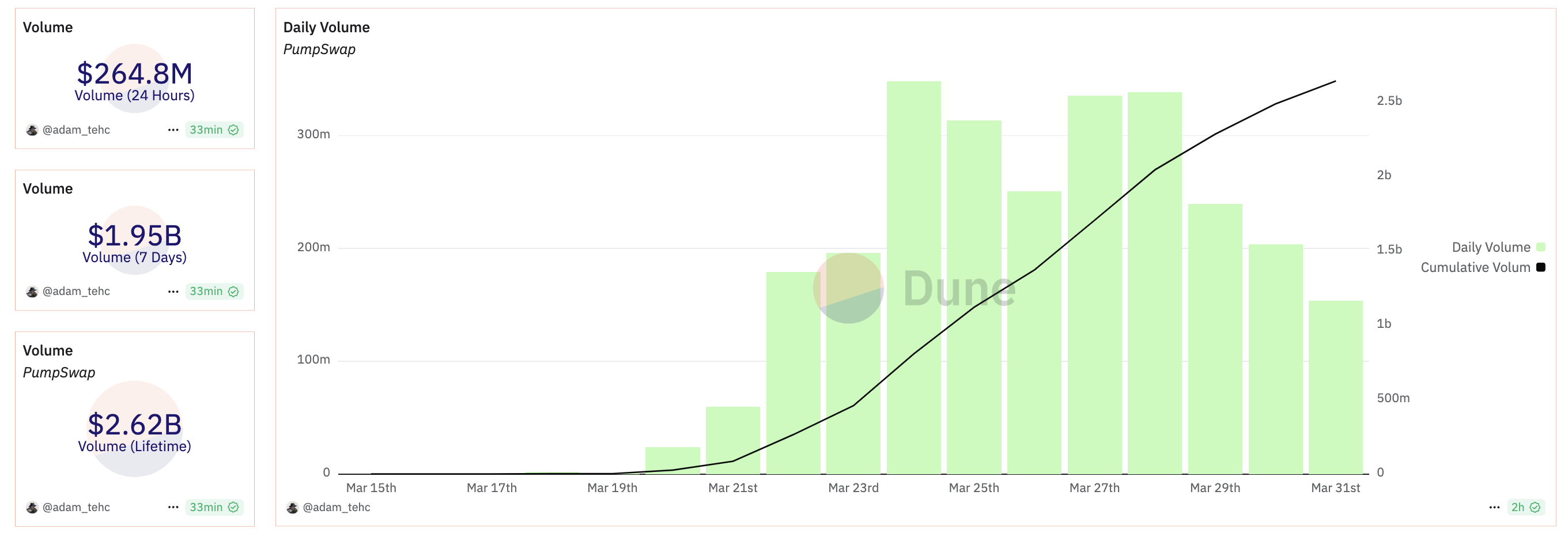

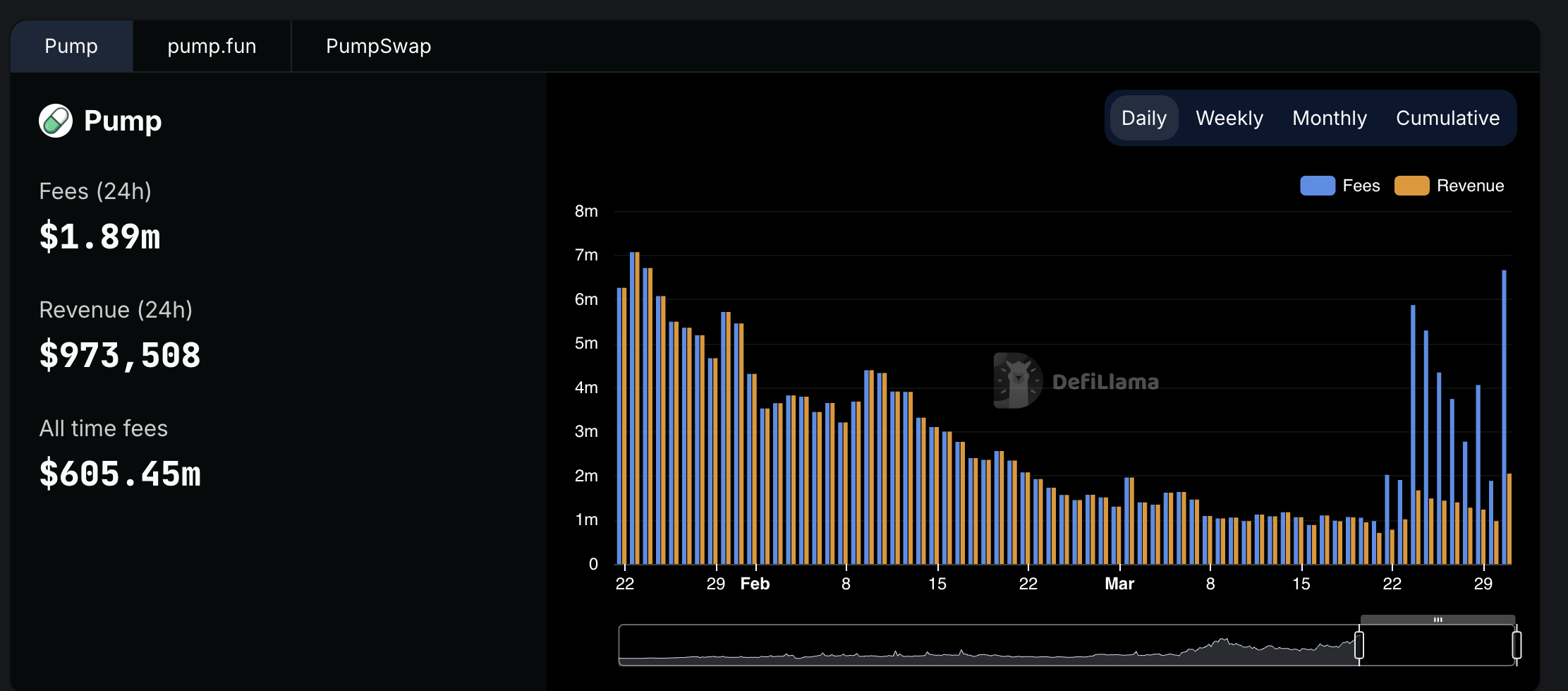

Since launching PumpSwap, token launchpad Pump.fun has resumed its position as a top-level protocol by fees and revenue. It saw over $2.62 billion in volume in less than two weeks, signifying high market interest.

Nonetheless, the meme coin sector as a whole has been more volatile than usual lately. PumpSwap is an attractive new option, but it still needs to stand the test of time.

Pump.fun Surges with PumpSwap

Pump.fun, a prominent meme coin creation platform, recently suffered some difficulties in the market. Facing lawsuits and criticism from the industry, the platform’s revenue had been declining in 2025. However, since launching PumpSwap, Pump.fun’s income has rebounded, making it one of the largest protocols by fees and revenue.

PumpSwap is a decentralized exchange on Solana’s blockchain, and it has grown very quickly since its launch less than two weeks ago. It has already managed over $2.62 billion in trade volume, although its daily volume fell over the weekend. Pump.fun’s cofounder spoke highly about PumpSwap, calling it a “crucial step that will help grow the ecosystem.”

Pump.fun’s overall revenues were declining before it launched PumpSwap, and they have since jumped back up. However, it’s important to not overstate the new exchange’s success. The exchange’s total fees collected have skyrocketed compared to Pump.fun, but the actual revenue growth has been comparatively small.

Still, these low fees also have significant advantages. Demand seems to be drying up in the meme coin sector, but Pump.fun faces stiff competition in the form of firms like Raydium, using low fees as a competitive edge. It has also promised things like revenue sharing with token creators to promote ecosystem growth.

Ultimately, the meme coin market as a whole is full of uncertainty. PumpSwap has been able to keep Pump.fun competitive as a top-level platform in this space, giving it a welcome reprieve. The real challenge will come in determining long-term viability.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoBitcoin Bears Tighten Grip—Where’s the Next Support?

-

Market9 hours ago

Market9 hours agoTrump Family Gets Most WLFI Revenue, Causing Corruption Fears

-

Market22 hours ago

Market22 hours agoEthereum Price Weakens—Can Bulls Prevent a Major Breakdown?

-

Market19 hours ago

Market19 hours agoBitcoin Price Nears $80,000; Fuels Death Cross Potential

-

Regulation12 hours ago

Regulation12 hours agoUSDC Issuer Circle Set To File IPO In April, Here’s All

-

Bitcoin18 hours ago

Bitcoin18 hours agoUS Macroeconomic Indicators This Week: NFP, JOLTS, & More

-

Market11 hours ago

Market11 hours agoPi Network Struggles, On Track for New All-Time Low

-

Market17 hours ago

Market17 hours agoDon’t Fall for These Common Crypto Scams