Market

Analyst Predicts Possible 40% Crash For XRP Price With Gravestone DOJI Candle Formation

The long-awaited rally in the XRP price may be coming to a fast end, as a crypto analyst has predicted a 40% crash for the cryptocurrency. Despite XRP’s recent bullish momentum breakthrough to the $1 mark, the analyst has revealed that XRP is showcasing a Gravestone DOJI candlestick formation, signaling a bearish outlook for the cryptocurrency.

XRP Price Expected To Crash 40%

A crypto analyst identified as ‘Without Worries’ on TradingView has released a detailed analysis of the XRP price action, projecting a 40% crash in the short term. The analyst emphasized that this 40% decline could happen in days, with XRP set to witness a significant reversal from its recent price highs.

Related Reading

According to the TradingView crypto expert, the XRP price action witnessed an impressive 150% gain over the past 10 days. This price increase fueled its rise to the $1 milestone for the first time in three years. Despite these bullish developments, the analyst has highlighted several reasons and technical indicators that point to an imminent trend reversal and price correction for XRP.

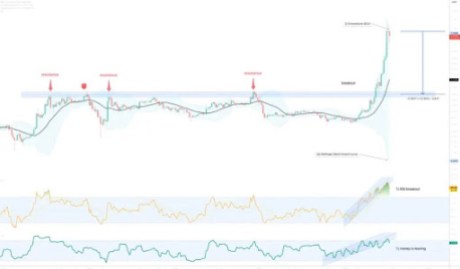

In the XRP price chart, the analyst identified and confirmed the Gravestone DOJI, a bearish candlestick pattern that appears during market tops and signals the potential for a price correction. The Gravestone DOJI candle indicates that buyers who had tried to push the price of XRP higher were significantly overwhelmed by sellers set on profit-taking.

Another indicator that suggests that the XRP price could be preparing for a significant correction is the Relative Strength Index (RSI) and Money Flow Index (MFI) support breakouts. The RSI measures the speed and changes in an asset’s price movements, indicating whether it is overbought or sold. On the other hand, the MFI considers both price and volume, highlighting where the money is flowing.

A support breakout in XRP’s RSI signals a potential trend reversal due to an overbought market. A breakout in MFI, which the analyst has stated is a very noteworthy indicator, suggests that funds are leaving an asset, ultimately signaling weakening buying pressure.

More Factors That Suggest An Upcoming Crash

As mentioned earlier, the TradingView analyst has predicted that the XRP price may crash by 40%, meaning the cryptocurrency could drop from its current value of $1.11 to $0.66. In addition to the factors above, the market expert has stated that XRP’s price action is currently outside the Bollinger bands, which measure an asset’s price volatility.

Related Reading

The analyst has revealed that 95% of price actions occur within the bands. Hence, prices outside the Bollinger bands often signal a pullback or correction toward the mean point at $0.73. Moreover, he noted that the bands are curving inwards, suggesting that XRP buyers may be exhausted, increasing the likelihood of a price reversal.

Furthermore, the TradingView crypto analyst highlighted that most traders are either long or bullish on XRP, which is a contrarian signal for the cryptocurrency’s price outlook. While he acknowledges a possibility for a continuous upward trend for XRP, the analyst has also noted that present indicators suggest a low probability.

Featured image created with Dall.E, chart from Tradingview.com

Market

XRP Volume Plunges By $17 Billion, Stalling Potential Hike to $2

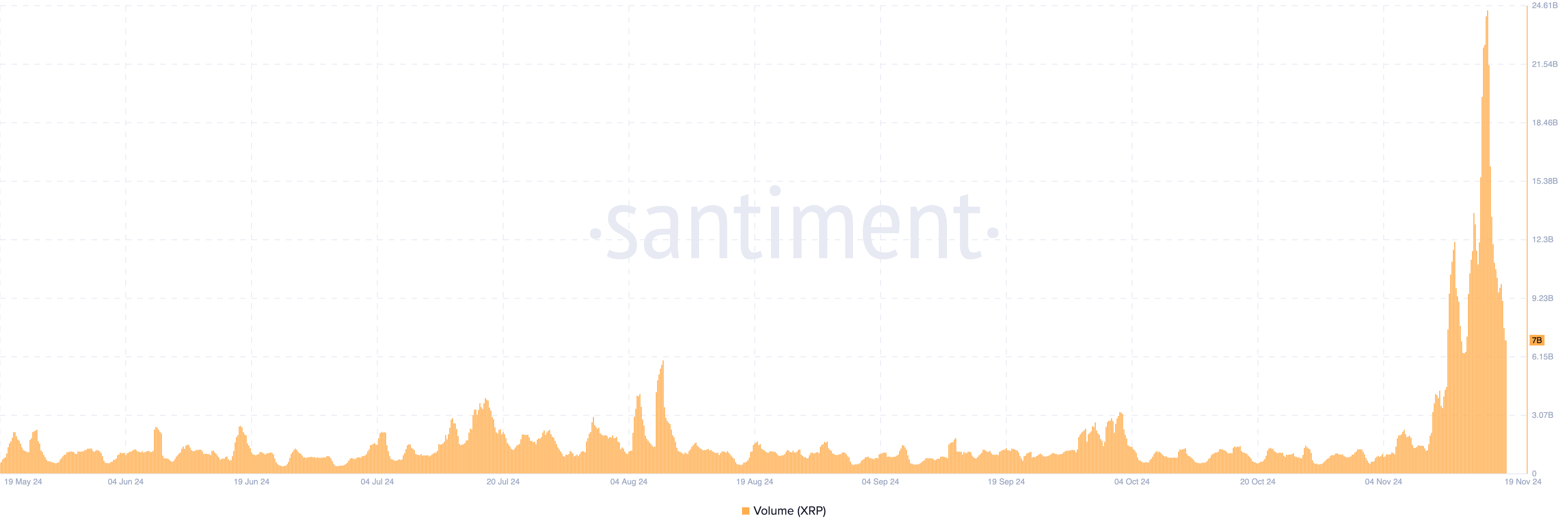

On Sunday, November 17, Ripple’s (XRP) price hit $1 for the first in three years. This landmark also saw XRP volume rise to $24 billion, but as of this writing, that value has since dropped.

This decline indicates that interest in the altcoin is no longer as high as it was earlier. But how will this affect XRP’s price?

Market Attention to Ripple Drops

According to Santiment, XRP’s volume recently peaked at $24.40 billion but has since dropped significantly to $7 billion, marking a $17 billion decrease in buying and selling activity.

From a technical perspective, a rising price coupled with increasing volume typically signals a strong and sustainable uptrend. However, when the price rises while volume declines, it suggests weakening momentum and a potential reversal.

This appears to align with XRP’s current situation, where the volume drop indicates diminished market participation. If this trend persists, XRP’s price could struggle to maintain its upward trajectory and risk falling below the $1 mark in the short term.

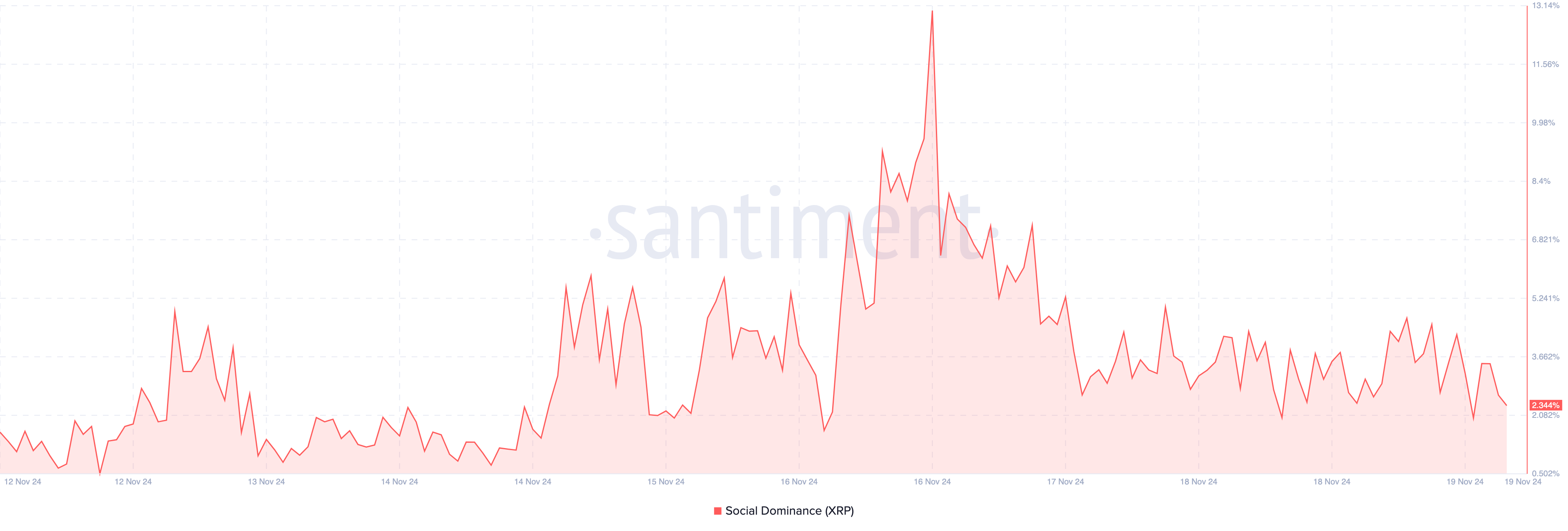

Furthermore, a look at social dominance shows that the reading has dropped. Social dominance is measured by analyzing the percentage of discussions focused on a specific cryptocurrency compared to the total discussions happening across various crypto-related platforms. This metric highlights how much attention an asset is garnering within the broader crypto community.

When social dominance increases, it often indicates heightened interest or hype around the asset. Conversely, a decrease in social dominance may suggest that the asset is losing visibility or relevance in the market.

A few days ago, XRP’s social dominance was almost 13%. As of this writing, it has dropped to 2.34%, indicating that interest in the token has waned. Should this remain the case alongside the drop in XRP volume, the price might drop.

XRP Price Prediction: Sub-$1 Possible

Based on the daily chart, XRP experienced a surge in buying pressure earlier. This was indicated by the Money Flow Index (MFI), an indicator that measures the level of capital injected into a cryptocurrency.

But as of this writing, the MFI reading has dropped from that peak. This decline indicates that buying pressure is no longer as high as it was some days back. Therefore, if this reading continues to decrease, then XRP’s price could drop to $0.80.

However, if XRP volume climbs to the double-digits region again, this trend might change. Should that happen, the cryptocurrency’s value could rise to $1.26.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

El Salvador to Get Its First Tokenized US Treasury Bill

El Salvador will soon see its first regulated tokenized US Treasury Bill (T-Bill) offering, providing access to this investment vehicle for individuals and organizations previously excluded.

NexBridge Digital Financial Solutions, a licensed digital asset issuer in the country, has partnered with Bitfinex Securities to introduce this new product.

Bitfinex Securities Want to Raise $30 Million for the Tokenized T-Bill

The subscription period for the offering begins Tuesday and runs until November 29. Investors can use Tether’s stablecoin (USDT) to purchase tokens, with plans to accept bitcoin (BTC) in the future.

After the subscription closes, the tokens will trade on Bitfinex Securities’ secondary market. It will be traded under the ticker USTBL. The value of these tokens will be tied to BlackRock’s short-term Treasury bond ETF. Bitfinex Securities aims to raise a minimum of $30 million through this initiative.

“By leveraging Bitcoin’s technology and infrastructure, we’re laying the foundation for a globally accessible financial ecosystem, bringing tokenized U.S. Treasuries to investors worldwide,” said Michele Crivelli, Founder of NexBridge in the press release.

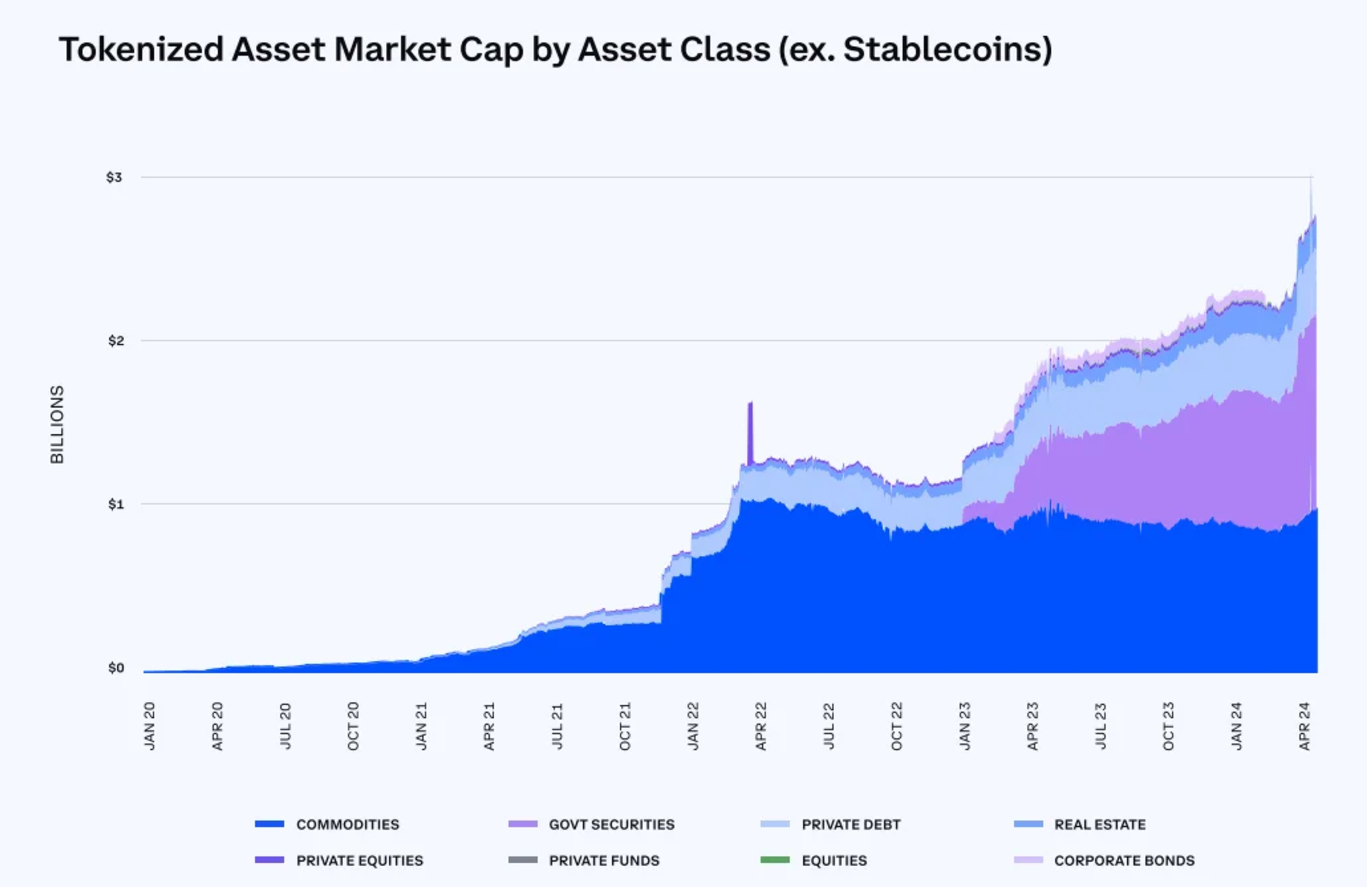

Overall, the tokenization of real-world assets (RWAs) is expanding rapidly. Earlier this month, BNB Chain launched a tokenization portal for RWAs and private companies to simplify access for new Web3 users.

Similarly, MANTRA debuted its mainnet, enabling on-chain RWA integration. This boosted the utility of its OM token, which surged over 200% in November, reaching a new all-time high.

El Salvador Continues to Benefit from Its Bitcoin Holdings

El Salvador continues to push forward with significant financial developments. The government recently launched its third dollar bond buyback. This effort targets over $2.5 billion in bonds, contingent on securing new financing. The decision came after BTC reached an all-time high post-election.

Also, a second term for former US President Donald Trump can be potentially beneficial for President Nayib Bukele’s administration. It will potentially improve El Salvador’s chances of obtaining financial support from the International Monetary Fund (IMF).

Back in 2021, El Salvador gained international recognition when it became the first nation to adopt Bitcoin as legal tender. The country’s Bitcoin holdings are now valued at $515 million.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why NEIRO Rebound Could Come Sooner Than Expected

First Neiro on Ethereum (NEIRO) rebound could be on the cards, as observed by BeInCrypto, which highlighted a reduction in selling pressure. On November 12, NEIRO’s price surged to $0.000030.

However, at press time, it had decreased to $0.0020. But this on-chain analysis reveals that the meme coin might fail to go extremely lower than this.

First Neiro on Ethereum Sees Bullish Sentiment

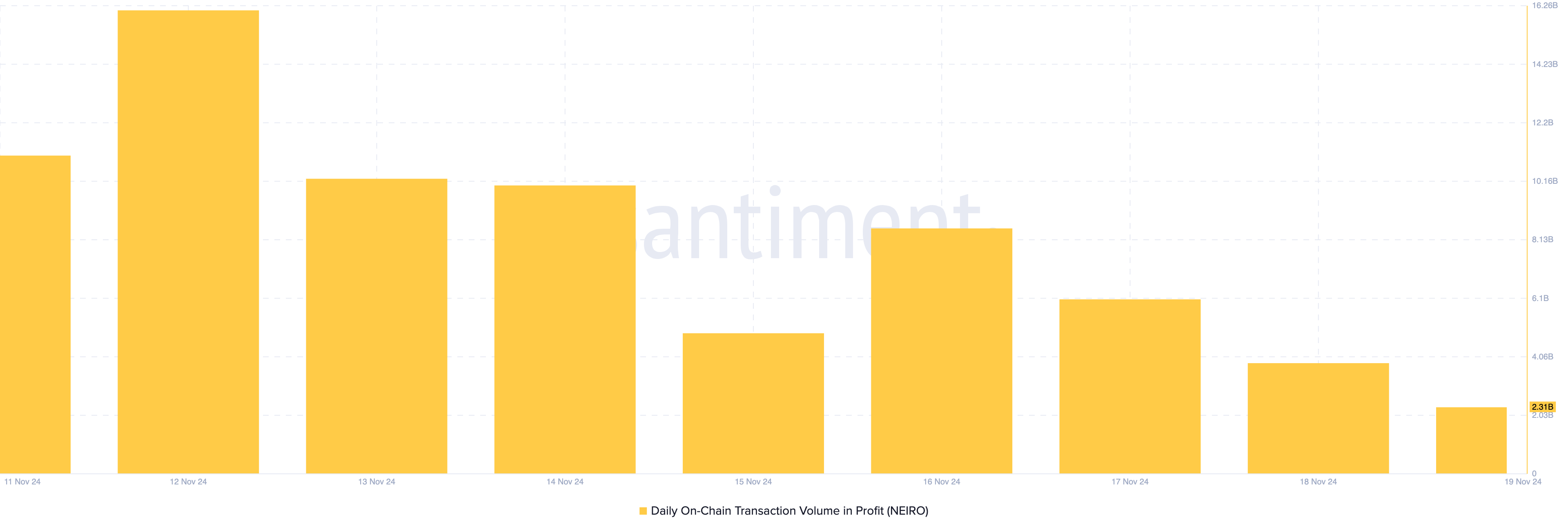

On November 12, NEIRO’s daily on-chain volume in profits was over 16 billion. This metric measures the number of tokens in realized profits. Typically, when the value increases, it means that holders have realized a lot of gains, and the price might decrease.

On the other hand, a decrease in the metric implies that selling pressure has decreased. As of this writing, the on-chain realized gains have dropped to 2.31 billion. This decline indicates that most NEIRO holders have halted booking profits.

If sustained, the NEIRO’s rebound could happen in the short term. Specifically, the potential rebound could see the price soar higher than $0.0025 as high demand for the token usually leads to double-digit hikes.

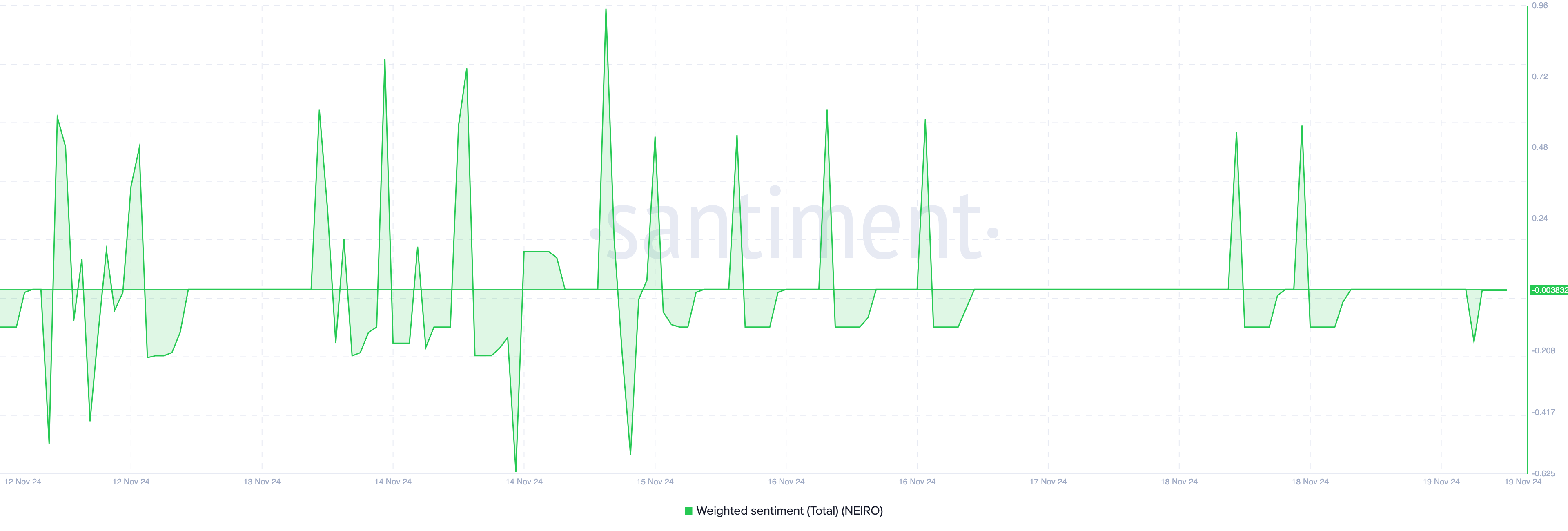

Further, NEIRO is experiencing a surge in its Weighted Sentiment, a metric that captures market participants’ overall perception of a cryptocurrency. A rising sentiment indicates growing bullish commentary, whereas a decline reflects negative market views.

Currently, NEIRO’s Weighted Sentiment is nearing positive territory, signaling a potential shift toward bullish market sentiment. If this trend persists, it could boost demand for the meme coin, possibly driving NEIRO’s price higher.

However, sustained optimism and accompanying trading activity will be crucial for this momentum to translate into meaningful price gains.

NEIRO Price Prediction: Notable Hike Coming

On the 4-hour chart, it appears that bulls are defending the $0.0020 support. The last time such happened, NEIRO’s price rallied to $0.0029.

If the meme coin aims to repeat such a pattern, it will have to contend with the $0.0022 resistance. Therefore, if buying pressure increases, NEIRO rebound could be validated. Should that be the case, the meme coin’s value could surpass $0.0030.

However, if profit-taking comes into play again or holders in losses sell, this prediction might not come to pass. Instead, the token could drop to $0.0017.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Gears Up for New ATH: Will Bulls Push Through?

-

Market22 hours ago

Market22 hours agoWill Mantra Token Price Resume Uptrend?

-

Market21 hours ago

Market21 hours agoSolana (SOL) Could Soon Rally Past $250—Are Bulls in Control?

-

Altcoin22 hours ago

Altcoin22 hours agoBTC Climbs to $91K, HBAR & XTZ Gain 40%

-

Bitcoin21 hours ago

Bitcoin21 hours agoPaul Tudor Jones Boosts Bitcoin ETF Stake to 4.4 Million Shares

-

Market20 hours ago

Market20 hours agoTrump Eyes Bakkt Acquisition as Armstrong Pushes Peirce for SEC

-

Altcoin20 hours ago

Altcoin20 hours agoRaydium Price Soars 10% and Ponke Jumps 20% On Major Listing

-

Market19 hours ago

Market19 hours agoXRP Price Holds Strong, Aiming for More Upside Moves