Market

NFT Comeback? Vitalik’s Patron NFTs Signal Bullish Revival

The Ethereum address attributed to Vitalik Buterin has moved 32 ETH to Base and minted 400 Patron NFTs. These NFTs are part of the Truemarkets Fair launch, where over 40% of the TRUE token supply will be allocated to Patron holders during the upcoming token generation event (TGE).

Infinex, a decentralized trading platform from Synthetix, previously raised $65.3 million through the sale of Patron NFTs.

Does Vitalik Buterin’s Alleged Transaction Signal an NFT Comeback?

The transaction from the ‘vitalik.eth’ address has fueled optimism within the community about a potential NFT comeback in the current bull market. The broader crypto market has shown a strong upward trend, leading some to hope for a revival of the 2021 NFT boom.

During that time, NFTs like Bored Ape Yacht Club (BAYC) fetched millions. Recent price surges suggest renewed interest, with BAYC floor prices more than doubling in weeks.

Similarly, the cheapest CryptoPunks now trade for around $112,000, with the collection’s total market value exceeding $1.6 billion. Rare pieces from these collections continue to command significantly higher prices.

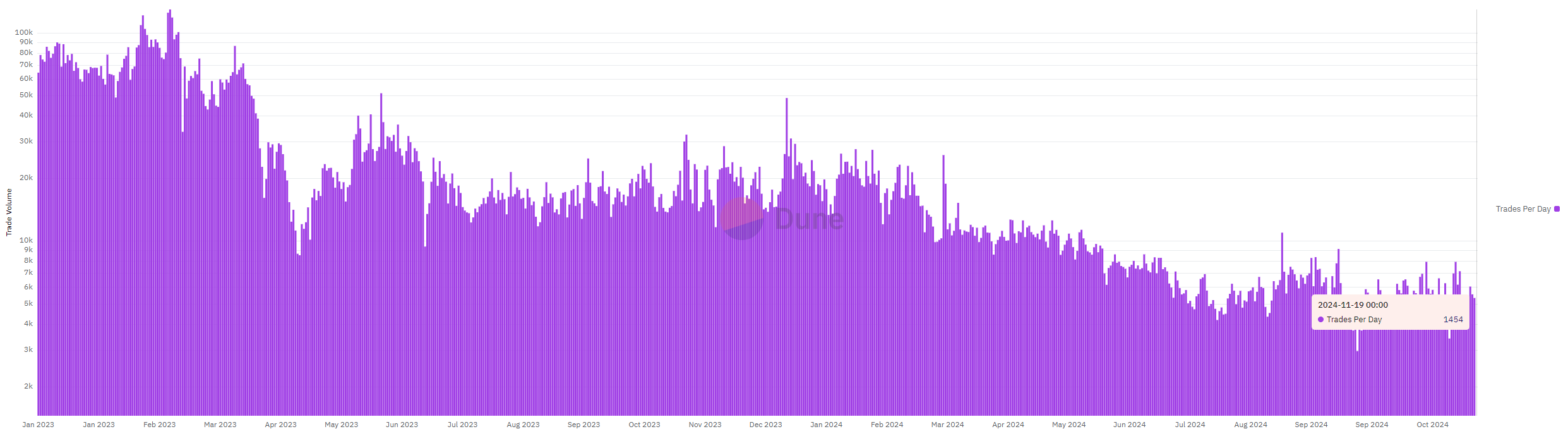

Despite these signs of revival, the NFT market has struggled throughout 2024. Data shows that 98% of NFT collections saw minimal trading activity, reflecting a saturated market.

Only 0.2% of NFT drops were profitable, with most losing over half their value within days, signaling a challenging environment for investors.

Meanwhile, Base, Coinbase’s Ethereum layer-2 network, surpassed 1 billion transactions within a year. However, its commemorative NFT sparked controversy for allegedly copying digital artist Chris Biron’s work.

In response, Base apologized, committed the NFT proceeds to Biron, and pledged to improve its vetting process.

Also, earlier this month, blockchain investigator ZachXBT’s NFT project inadvertently created a $15 million meme coin due to Zora protocol’s auto-generated ERC-20 feature. Although intended as an archival project, it has since become the subject of speculative trading.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will BTC Long-Term Holders Push Price Below $90K?

Bitcoin (BTC) has declined from its $93,495 peak, now trading at $92,428 as profit-taking accelerates.

Market sentiment, marked by “extreme greed,” signals a possible price reversal as traders increasingly lock in gains.

Bitcoin’s Rally Prompts Its Long-Term Holders To Sell

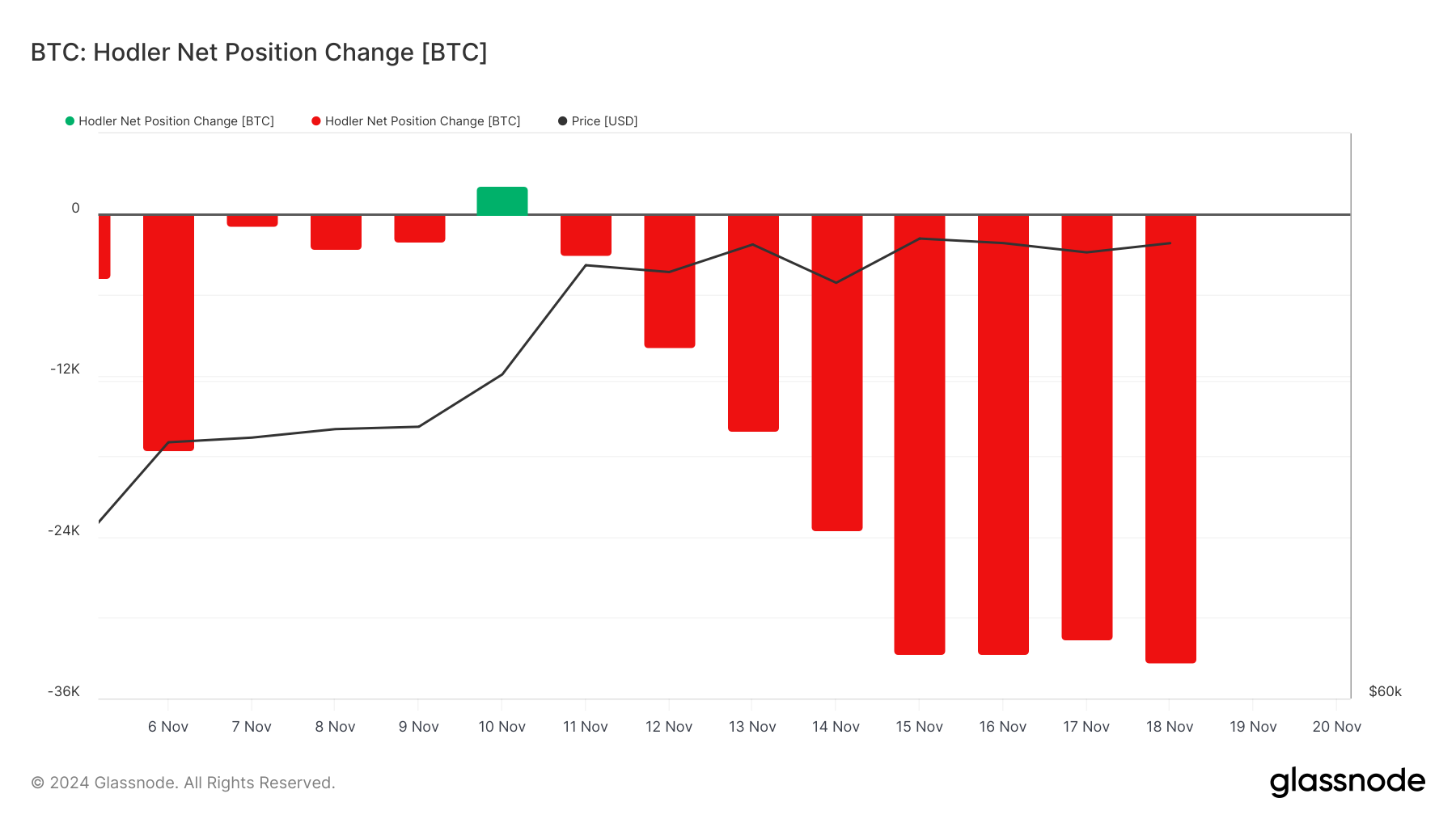

BeInCrypto’s assessment of BTC’s on-chain performance has shown a spike in coin distribution by its long-term holders (LTHs). These are investors who have held their coins for an extended period, typically defined as more than 155 days.

Per Glassnode’s data, the coin’s Hodler Net Position Change dropped to a five-month low on Tuesday. This metric reflects the overall buying and selling activity of long-term Bitcoin holders. This decline indicates that the group sold over $3 billion worth of BTC on that day — their highest single-day sell-off since June 26.

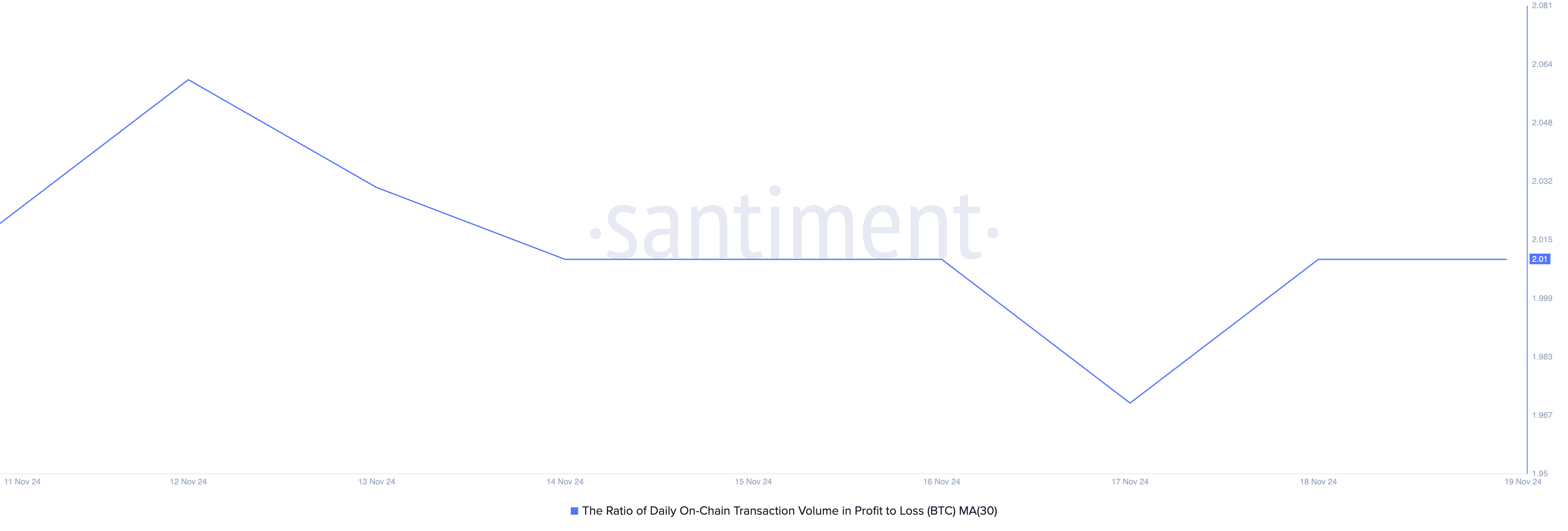

Notably, BTC transactions have been significantly profitable over the past few weeks. As of this writing, the ratio of the coin’s daily transaction volume in profit to loss (assessed using a 30-day moving average) is 2.01. This suggests that for every BTC transaction that has ended in a loss, 2.01 transactions have returned a profit.

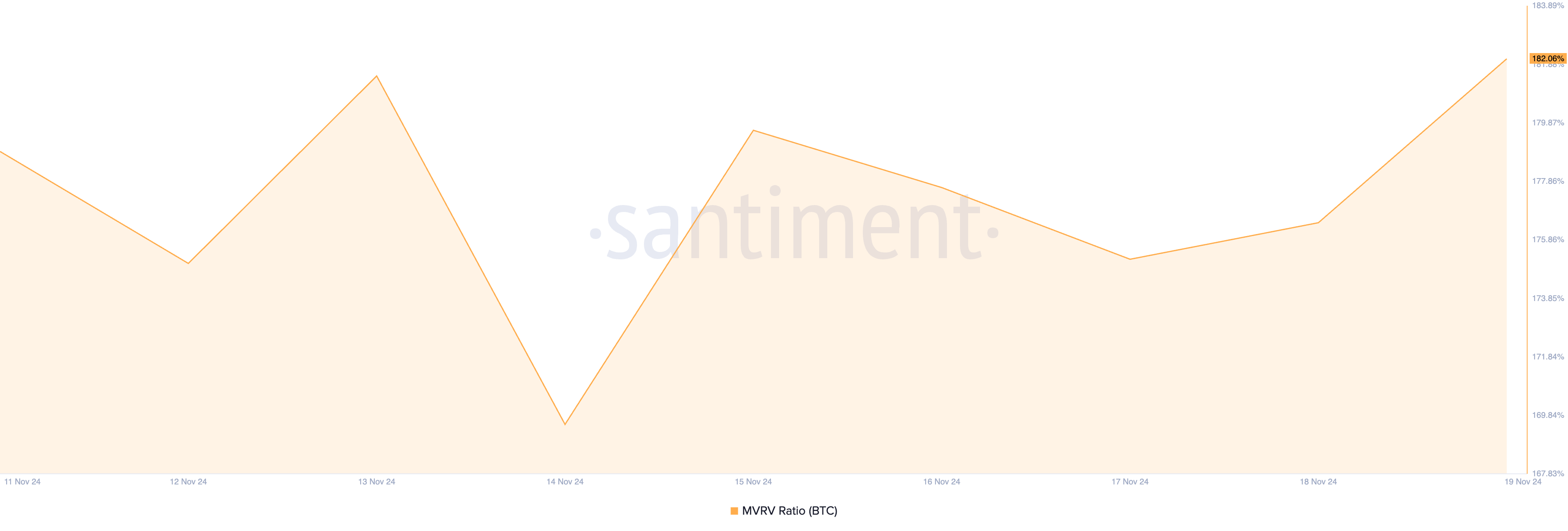

Moreover, BTC’s market value to realized value (MVRV) ratio suggests that the coin may be overvalued, prompting more holders to sell. According to Santiment’s data, BTC’s current MVRV ratio is 182.06%.

At 182.06%, BTC’S MVRV ratio suggests that its current market value is significantly higher than its realized value. Therefore, if all coin holders were to sell, they would, on average, realize 182.06% profit.

BTC Price Prediction: All Lies With the Coin’s Long-Term Holders

At press time, BTC trades at $92,428, slightly below its cycle peak of $93,495. If LTHs persist in their profit-taking activity, BTC’s price will fall further from this high, toward support below $90,000. According to readings from the coin’s Fibonacci Retracement tool, the next major support is formed at $83,983.

However, if selling activity stalls and the coin sees a spike in new demand, its price will reclaim the $93,495 all-time high and attempt to rally past it.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Predicts Possible 40% Crash For XRP Price With Gravestone DOJI Candle Formation

The long-awaited rally in the XRP price may be coming to a fast end, as a crypto analyst has predicted a 40% crash for the cryptocurrency. Despite XRP’s recent bullish momentum breakthrough to the $1 mark, the analyst has revealed that XRP is showcasing a Gravestone DOJI candlestick formation, signaling a bearish outlook for the cryptocurrency.

XRP Price Expected To Crash 40%

A crypto analyst identified as ‘Without Worries’ on TradingView has released a detailed analysis of the XRP price action, projecting a 40% crash in the short term. The analyst emphasized that this 40% decline could happen in days, with XRP set to witness a significant reversal from its recent price highs.

Related Reading

According to the TradingView crypto expert, the XRP price action witnessed an impressive 150% gain over the past 10 days. This price increase fueled its rise to the $1 milestone for the first time in three years. Despite these bullish developments, the analyst has highlighted several reasons and technical indicators that point to an imminent trend reversal and price correction for XRP.

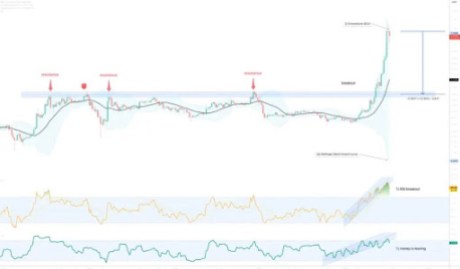

In the XRP price chart, the analyst identified and confirmed the Gravestone DOJI, a bearish candlestick pattern that appears during market tops and signals the potential for a price correction. The Gravestone DOJI candle indicates that buyers who had tried to push the price of XRP higher were significantly overwhelmed by sellers set on profit-taking.

Another indicator that suggests that the XRP price could be preparing for a significant correction is the Relative Strength Index (RSI) and Money Flow Index (MFI) support breakouts. The RSI measures the speed and changes in an asset’s price movements, indicating whether it is overbought or sold. On the other hand, the MFI considers both price and volume, highlighting where the money is flowing.

A support breakout in XRP’s RSI signals a potential trend reversal due to an overbought market. A breakout in MFI, which the analyst has stated is a very noteworthy indicator, suggests that funds are leaving an asset, ultimately signaling weakening buying pressure.

More Factors That Suggest An Upcoming Crash

As mentioned earlier, the TradingView analyst has predicted that the XRP price may crash by 40%, meaning the cryptocurrency could drop from its current value of $1.11 to $0.66. In addition to the factors above, the market expert has stated that XRP’s price action is currently outside the Bollinger bands, which measure an asset’s price volatility.

Related Reading

The analyst has revealed that 95% of price actions occur within the bands. Hence, prices outside the Bollinger bands often signal a pullback or correction toward the mean point at $0.73. Moreover, he noted that the bands are curving inwards, suggesting that XRP buyers may be exhausted, increasing the likelihood of a price reversal.

Furthermore, the TradingView crypto analyst highlighted that most traders are either long or bullish on XRP, which is a contrarian signal for the cryptocurrency’s price outlook. While he acknowledges a possibility for a continuous upward trend for XRP, the analyst has also noted that present indicators suggest a low probability.

Featured image created with Dall.E, chart from Tradingview.com

Market

GRASS Price Moves Higher, Yet Trend Strength Lags Behind

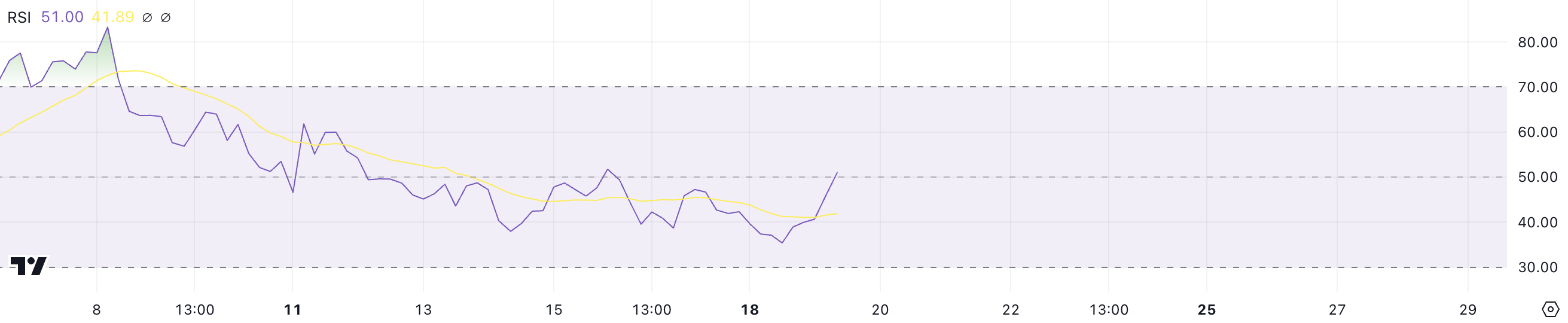

GRASS price has shown remarkable activity since its listing on major exchanges at the end of October. In its first week, the price skyrocketed from $0.65 to $1.60. However, recent metrics show GRASS entering a neutral zone, with its RSI at 51 and ADX at 14.84, indicating moderate recovery and weak trend strength.

As traders watch key resistance and support levels, the potential for a 44% surge or a 26% correction depends heavily on the strength of its ongoing uptrend.

GRASS Is Currently In The Neutral Zone

The Relative Strength Index (RSI) for GRASS has climbed to 51, up from a low of approximately 35. This shift indicates a recovery in momentum, moving from oversold territory toward a more balanced state. RSI, a key momentum indicator, measures the strength and speed of price movements, providing insight into whether an asset is overbought or oversold.

Values below 30 typically signal oversold conditions, while readings above 70 suggest overbought levels. At 51, GRASS’s RSI reflects neutral momentum, implying neither strong buying nor selling pressure currently dominates.

Despite being down nearly 15% over the past seven days, GRASS price has surged almost 10% in the last 24 hours. The RSI’s movement to 51 aligns with this short-term rebound, suggesting a shift toward stabilization after recent declines.

With RSI in the neutral zone, GRASS may be poised for consolidation or moderate gains, though a break above 70 could signal stronger upward momentum for one of the biggest airdrops of 2024.

GRASS Current Trend Isn’t That Strong

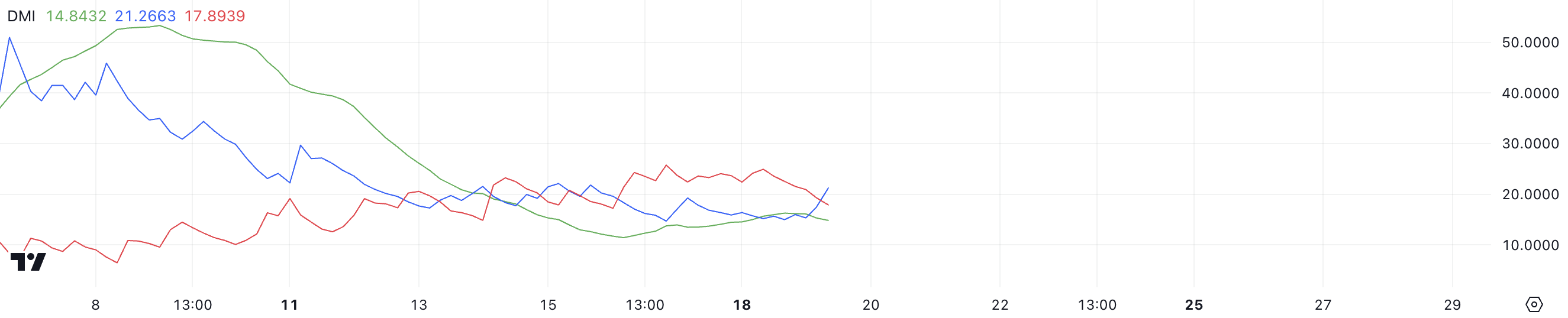

The Directional Movement Index (DMI) for GRASS reveals an ADX value of 14.84, suggesting a weak market trend. The Average Directional Index (ADX) measures the strength of a trend without indicating its direction. Typically, values above 25 signal a strong trend, while values below 20 indicate a lack of clear trend momentum.

At 14.84, the ADX suggests that GRASS is experiencing a period of low trend strength, which means that price movements are less likely to follow a sustained direction.

The DMI also includes the +DI (Directional Indicator) and -DI, which provide insights into the direction of the price trend. GRASS’s +DI is at 21.26, indicating slightly stronger bullish pressure, while the -DI is at 17.89, reflecting weaker bearish momentum.

However, with the ADX below 20, neither the bullish nor bearish pressure is strong enough to establish a clear trend. This setup suggests a choppy market where price movements may continue without a decisive upward or downward trajectory unless the ADX rises significantly.

GRASS Price Prediction: A 44% Surge?

GRASS’s current price is moving above its short-term EMA lines, indicating growing bullish momentum in the short term. Exponential Moving Averages (EMAs) smooth out price data and highlight trends, with shorter-term EMAs responding quickly to price changes.

This movement suggests that buyers are gaining control, and the asset’s immediate trend is turning positive. If this momentum continues, GRASS price could test key resistance levels, providing a clearer signal of sustained upward movement.

If the uptrend strengthens, GRASS could face its next resistance at $2.91. Breaking through this level could trigger further bullish activity, potentially driving the price to $3.66, representing a significant 44% upside. Conversely, if the uptrend weakens, the price may reverse, testing support at $2.41.

Failure to hold this level could lead to a deeper correction, with GRASS price potentially dropping to $1.87, marking a 26% downside. These levels highlight the importance of trend strength in determining the next significant price movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoBitcoin Price Gears Up for New ATH: Will Bulls Push Through?

-

Market23 hours ago

Market23 hours agoWill Polygon Whales Lead POL Price Above $0.60?

-

Regulation22 hours ago

Regulation22 hours agoRipple CEO Brad Garlinghouse Criticizes US SEC Chair Candidate Bob Stebbins

-

Market21 hours ago

Market21 hours agoBitcoin Faces Reversal Fears at $90,000 Amid Extreme Greed

-

Market19 hours ago

Market19 hours agoWill Mantra Token Price Resume Uptrend?

-

Altcoin23 hours ago

Altcoin23 hours agoIs The Dogecoin Price Rally Over? Analyst Reveals Why There’s Still Room To Run

-

Market22 hours ago

Market22 hours agoWill HBAR Hit $0.182 After 115% Rally?

-

Altcoin19 hours ago

Altcoin19 hours agoBTC Climbs to $91K, HBAR & XTZ Gain 40%