Market

This Is How Peanut the Squirrel (PNUT) Overthrew the GOAT

GOAT, once dominating the meme coin market, has faced significant challenges with the emergence of Peanut the Squirrel (PNUT).

The sudden rise of PNUT has disrupted GOAT’s market position, causing the meme coin to lose its demand. Despite the downturn, GOAT investors remain optimistic about its potential recovery.

A Squirrel Defeats GOAT

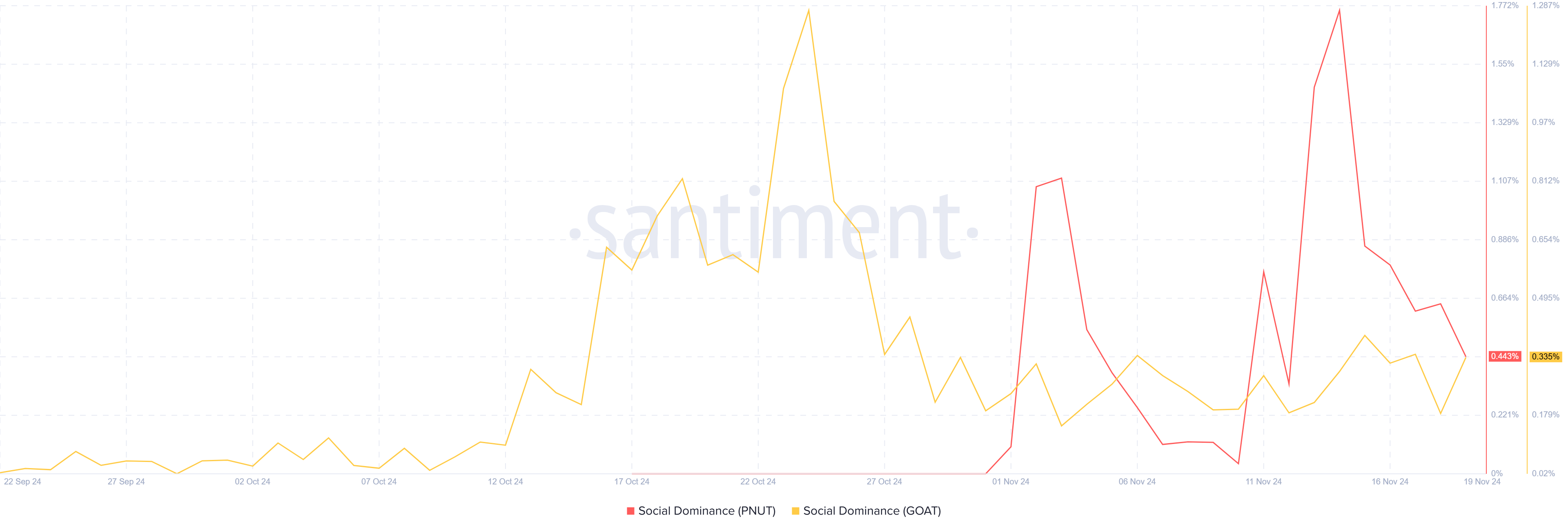

The social dominance of GOAT has shifted significantly since October, largely due to PNUT’s arrival. For most of October, GOAT commanded market attention, benefiting from strong investor interest and widespread hype. However, PNUT’s late-month debut captured the spotlight, pushing GOAT out of the top trending tokens.

Currently, PNUT stands as the more popular asset among investors, evidenced by its rising mentions and active participation in social channels. This surge in attention has directly impacted GOAT, whose declining engagement metrics suggest a loss in momentum. The competition between these meme coins is reshaping the market conditions.

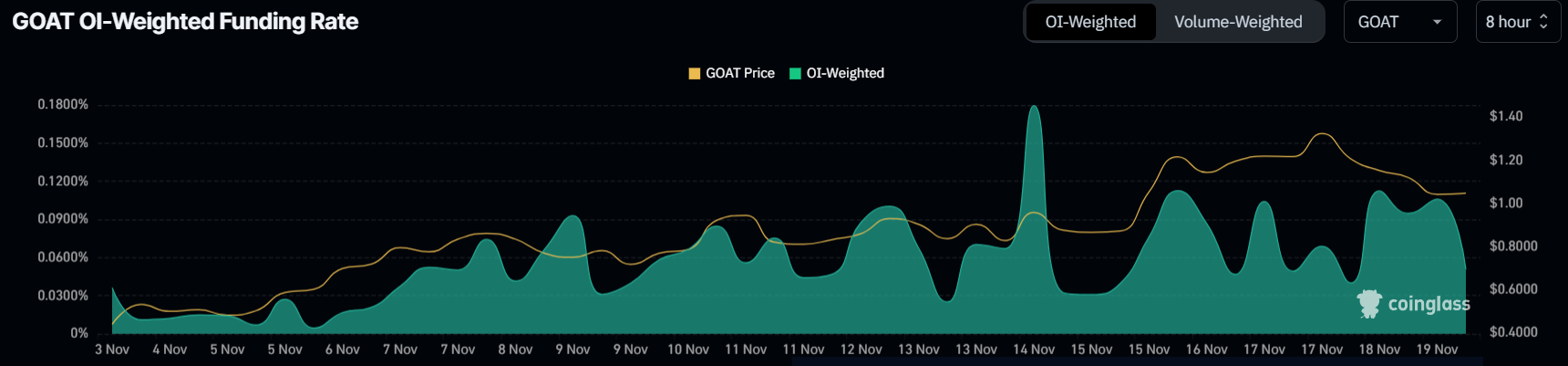

Despite the decline, GOAT’s funding rate remains in positive territory, signaling ongoing confidence among traders. Many are placing long contracts, betting on a potential price recovery. This optimism reflects a belief that GOAT still has room to regain its dominance in the meme coin sector.

However, the price drop has introduced uncertainty among investors, with concerns about GOAT’s ability to sustain its market position. The funding rate’s positive stance is encouraging but will require strong market cues to translate into meaningful price gains. Traders are closely watching for signs of a potential reversal.

GOAT Price Prediction: Drawdown Ahead

GOAT’s price has fallen by 25% in the last 24 hours, dropping from an all-time high of $1.36 to $1.01. With the asset nearing the critical $1.00 mark, further declines are likely if bearish momentum continues.

The critical support level sits at $0.72, and a drop to this point would signal more significant losses for investors. Losing this support could exacerbate the bearish outlook, creating challenges for a swift recovery.

Alternatively, if GOAT rebounds from $0.72, the meme coin could make a bid to breach previous highs and form a new ATH. This would invalidate the bearish thesis and re-establish GOAT as a top contender in the meme coin space.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Price Risks Dip Below $110 as Bears Gain Control

Solana (SOL) has dropped over 6% in the past seven days and has been trading below $150 since March 6. The current trend shows clear bearish signals across multiple indicators.

From a death cross to a rising ADX and a red Ichimoku Cloud, technicals suggest growing downside pressure. With SOL nearing key support, the next few days could be critical for its price direction.

SOL Ichimoku Cloud Paints A Bearish Picture

The Ichimoku Cloud chart for Solana shows a clear bearish structure, with price action trading below both the Kijun-sen (red line) and Tenkan-sen (blue line).

The Lagging Span (green line) is also positioned below the price candles and the cloud, reinforcing the negative outlook. The Kumo ahead is red and descending, suggesting that resistance remains strong in the near term.

Solana has struggled to break above short-term resistance levels and remains stuck in a downward channel. The thin nature of the current cloud suggests weak support, making the price vulnerable to further downside if bearish momentum continues.

For a reversal, Solana would need to break above the Kijun-sen and push decisively toward the cloud, but for now, the trend remains tilted to the downside.

Solana DMI Shows Sellers Are In Control

Solana’s DMI chart shows a sharp rise in the ADX, now at 40.87—up from 19.74 just three days ago.

The ADX (Average Directional Index) measures the strength of a trend, with values above 25 indicating a strong trend and values above 40 signaling a very strong one.

This surge confirms that the current downtrend in SOL is gaining momentum.

At the same time, the +DI has dropped from 17.32 to 8.82, while the -DI has climbed to 31.09, where it has held steady for the past two days.

This setup suggests that the sellers are firmly in control, and the downtrend is strong and also strengthening.

As long as the -DI remains dominant and ADX stays elevated, SOL is likely to remain under pressure in the short term.

Can Solana Drop Below $110 Soon?

Solana recently formed a death cross, a bearish signal where short-term moving averages cross below long-term ones.

It’s now approaching key support at $120—if that level breaks, Solana price could drop to $112, and possibly below $110 for the first time since February 2024.

If bulls step in and buying pressure returns, SOL could rebound toward resistance at $136.

A breakout above that level may lead to a push toward $147, which acted as strong resistance just five days ago.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Made in USA Coins to Watch This Week

Made in USA coins are showing mixed signals as April begins, with XRP, SUI, and Pi Network (PI) standing out. XRP leads in market cap but also posted the biggest drop among the top 10, down 10.6% this week.

SUI is the only major gainer, up 3.8%, showing some strength despite broader weakness. Meanwhile, PI has been the worst performer, plunging over 23% and staying below $1 all week.

XRP

XRP is the largest Made in USA crypto by market cap, but it’s also down 10.6% over the last 7 days—the biggest drop among the top 10. This sharp correction could present an opportunity, especially with Trump’s “Liberation Day” event coming up on April 2.

If XRP builds an uptrend, it could push to test resistance at $2.22. A breakout there may lead to moves toward $2.47 and even $2.59 if momentum grows.

If the downtrend continues, XRP could revisit support at $2.06. A breakdown below that level might drag it further down to $1.90.

With volatility rising and a possible narrative shift on the horizon, XRP could be a key coin to watch this week.

SUI

SUI is the only among major Made in USA cryptos showing gains over the past week, up 3.8%, even though it’s still down 13% over the last 30 days. This resilience sets it apart from the rest of the pack.

In the last 24 hours, trading volume has dropped 15% to $767 million. The coin’s current market cap is $7.43 billion.

SUI’s EMA lines recently formed a death cross, hinting at a possible downtrend. If confirmed, the price could drop to $2.23, with further downside to $2.11 and $1.96.

If SUI manages to reverse the trend, it could climb toward $2.50. A breakout there would open the door to $2.83, nearly 20% higher from current levels.

Pi Network (PI)

Pi Network (PI) is the biggest loser among Made in USA cryptos this week, with its price down over 23% in the last seven days.

It has been trading below $1 throughout the entire week.

If sentiment shifts, PI could rebound toward resistance at $1.05. A breakout there might lead to a push-up to $1.23.

But if bearish pressure continues, PI could fall to test support at $0.718. A drop below that would send it to $0.62—its lowest level since February 21.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 Token Unlocks for April: Parcl, deBridge, Scroll

Three major token unlocks involving PRCL, DBR, and SCR are set to take place in April. Parcl will unlock 161.7 million PRCL on April 16, followed by deBridge unlocking 1.11 billion DBR on April 17 and Scroll releasing 40 million SCR on April 22.

These events could significantly impact each token’s supply dynamics and short-term price action. With large allocations set aside for contributors, partners, and airdrops, these unlocks are worth watching closely.

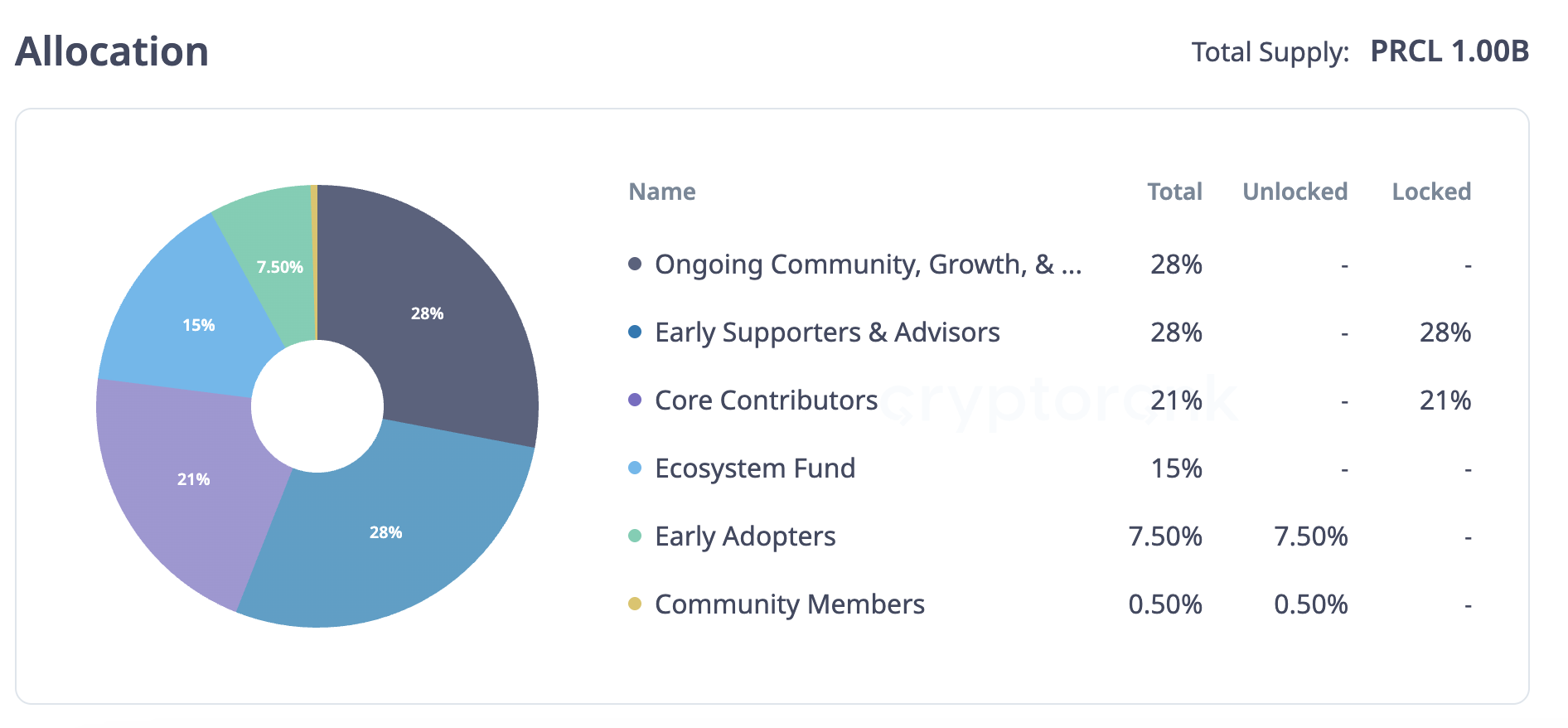

Parcl (PRCL)

Unlock Date: April 16

Number of Tokens to be Unlocked: 161.7 million PRCL (16.2% of Total Supply)

Current Circulating Supply: 270.8 million PRCL

Total supply: 1 Billion PRCL

Parcl is a decentralized exchange that lets users trade real estate price movements without owning property. The ecosystem—made up of Parcl, Parcl Labs, and Parcl Limited—governs the Parcl Protocol, which offers synthetic exposure to real-world real estate markets. It allows users to go long or short on property prices across different regions.

On April 16, 161.7 million PRCL tokens, worth roughly $15.56 million, will be unlocked. This could increase the token supply and lead to short-term market volatility.

The unlock includes 92.4 million tokens for early supporters and advisors, and 69.3 million for core contributors. PRCL price is down 33% in the last 30 days and trading below $0.1 since yesterday.

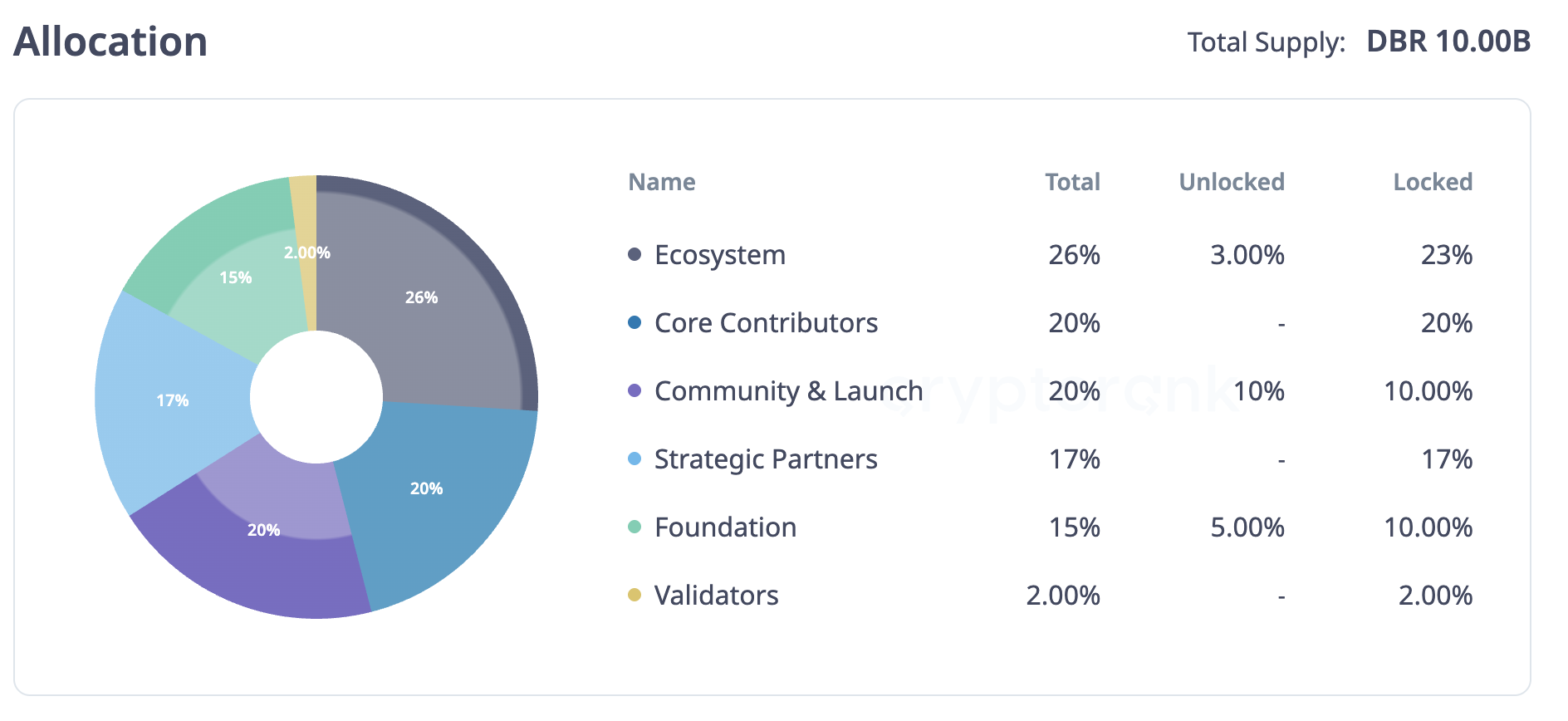

deBridge (DBR)

Unlock Date: April 17

Number of Tokens to be Unlocked: 1.11 billion DBR (11.1% of Total Supply)

Current Circulating Supply: 1.16 billion

Total supply: 10 Billion DBR

deBridge is a cross-chain protocol that allows users to transfer assets and data between different blockchains. It aims to simplify interoperability and make decentralized applications more connected and efficient.

On April 17, 1.11 billion BDR tokens, worth around $32.19 million, will be unlocked. This unlock will nearly double the current circulating supply, adding roughly 95% more tokens to the market.

The allocation includes 400 million for core contributors, 340 million for strategic partners, and 176.93 million for the ecosystem. The rest goes to the community, foundation, and validators. Despite the upcoming unlock, deBridge has gained nearly 38% in the past month, with its market cap now nearing $34 million.

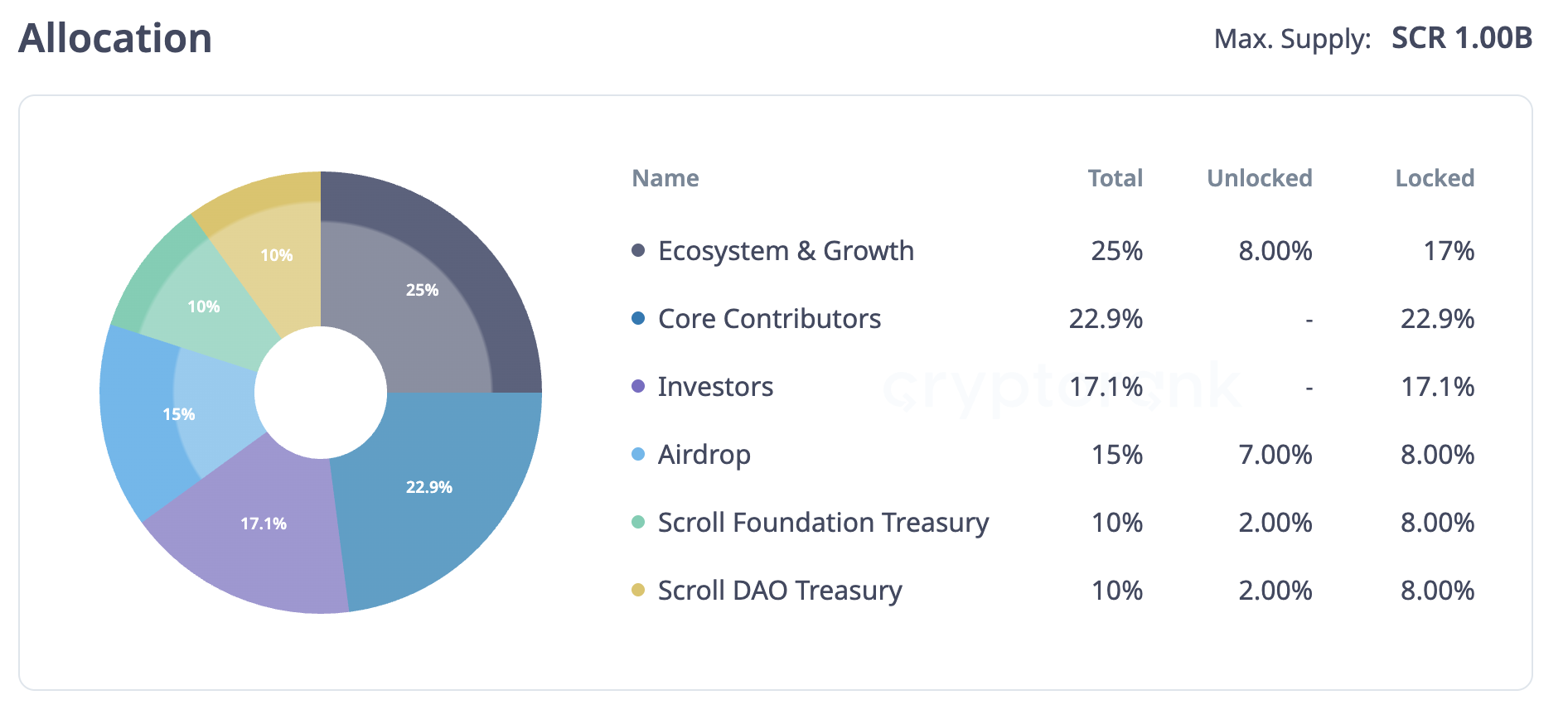

Unlock Date: April 22

Number of Tokens to be Unlocked: 40 million SCR (4% of Total Supply)

Current Circulating Supply: 190 million

Total supply: 1 Billion SCR

Scroll is a Layer 2 solution built to improve Ethereum’s scalability and efficiency. It uses zkRollup technology to lower transaction costs and increase throughput, helping ease issues like high gas fees and congestion.

On April 22, 40 million SCR tokens, valued at about $11.52 million, will be unlocked. This unlock could introduce added liquidity to the market and maybe renewed interest in Scroll. Its price is down roughly 46% in the last 30 days, with its market cap at $55 million, down from its peak of $265 in October 2024.

All 40 million tokens are allocated for airdrops.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoGemini Crypto Exchange Announces Rewards For XRP Users, Here’s How To Get In

-

Bitcoin19 hours ago

Bitcoin19 hours agoWhy Bitcoin Seasoned Investors Are Accumulating — Analyst Evaluates BTC’s Current Phase

-

Ethereum12 hours ago

Ethereum12 hours agoWhales Accumulate 470,000 Ethereum In One Week – Bullish Momentum Ahead?

-

Market19 hours ago

Market19 hours agoCrypto Derivatives Get a Boost from US CFTC

-

Market18 hours ago

Market18 hours agoCan Ethereum’s Utility Make a Comeback Against Bitcoin?

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum Playing Catch-Up? Bloomberg Examines ETH’s Struggles In New Report

-

Market16 hours ago

Market16 hours agoWhale Leverages $27.5 Million PEPE Long on Hyperliquid

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum MVRV Ratio Nears 160-Day MA Crossover – Accumulation Trend Ahead?