Market

Trump Eyes Bakkt Acquisition as Armstrong Pushes Peirce for SEC

President-elect Donald Trump is discussing pro-crypto personnel appointments with Brian Armstrong, CEO of Coinbase. His social media firm, Trump Media, is also in talks to purchase Bakkt, a crypto exchange.

Bakkt’s stock price shot up dramatically since these talks, and Armstrong previously recommended that Trump appoint “Crypto Mom” Hester Peirce as the new SEC Chair.

Trump, Bakkt, and Armstrong

Trump Media, the President-elect’s social media and technology company, is currently in talks to purchase Bakkt, a crypto exchange. Bakkt’s prominence in the industry peaked years ago, and was subsequently described as a “marginal player in the space.” Earlier this year, it publicly considered sale or breakup options. Since this offer, however, its stock price has soared.

Although Donald Trump has been pursuing a comprehensive set of pro-crypto changes to US institutions, these actions fall under his political career. As a businessman and private citizen, his interest hasn’t extended to crypto investments since the lackluster presale of World Liberty Financial (WLFI). A Bakkt purchase could bring Trump fresh skin in the game.

However, the world of crypto exchanges is touching his policy outlook at the same time. Specifically, Coinbase CEO and Founder Brian Armstrong is also meeting with the President-elect today. Armstrong and Trump are reportedly discussing personnel appointments for the upcoming administration.

A clear industry insider, Armstrong has a vested interest in friendly policy outcomes for crypto. Throughout the election cycle, Coinbase spent tens of millions boosting pro-crypto candidates at multiple levels. Since Trump’s victory, Armstrong has made several supportive comments, praising Elon Musk’s D.O.G.E. and suggesting a new post-Gensler SEC Chair:

“Hester Peirce would be the best choice. Smart, fair, professional. Can work with both sides,” Armstrong claimed.

“Crypto Mom” Hester Peirce is one of the five sitting SEC Commissioners, and one of two appointed by Trump. Gensler’s impending ouster has sparked a flurry of prediction market speculation about who will succeed him. If Armstrong has not changed his opinion since originally recommending her, these talks could substantially increase Peirce’s chances.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why the XTZ Coin Price Rally May Not Continue

XTZ, the native coin of blockchain network Tezos, has emerged as the top-performing cryptocurrency over the past 24 hours. Its value has surged by 38% to trade at a seven-month high of $1.13 as of this writing.

However, the price increase has triggered growing selling pressure, indicating a potential pullback ahead.

Tezos’ Traders Scamper for Gains

XTZ’s price has climbed by 38% over the past 24 hours and currently ranks as the market’s top gainer. This surge follows the announcement that the staking platform Everstake will support cryptocurrency.

The rally is further fueled by a recent Q3 2024 report from analytics platform Messari. The report highlights strong growth signals for Tezos, including increased transaction volume, more decentralized applications, a rise in upgrade proposals, and a growing active validator count.

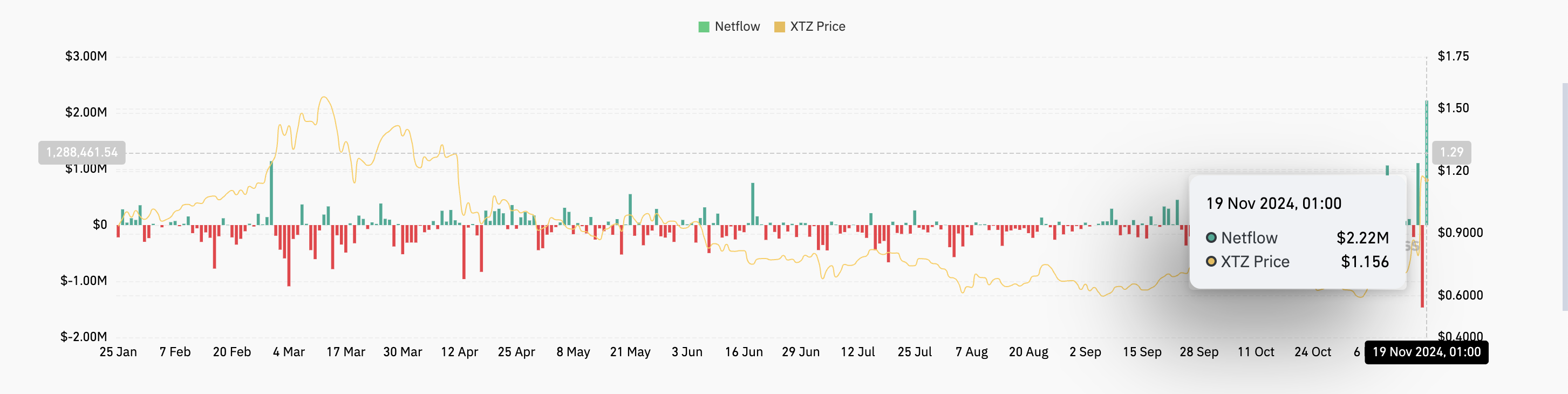

However, the recent price jump has prompted many XTZ holders to seek profit, as evidenced by the spike in the coin’s exchange inflow. Per Coinglass, as of Tuesday, XTZ’s exchange inflow is $2.22 million, its highest since the beginning of the year.

When an asset’s exchange inflow spikes, a significant amount of that asset is transferred onto exchanges for sale from wallets or other platforms. This can put downward pressure on XTZ’s price, causing it to shed its recent gains.

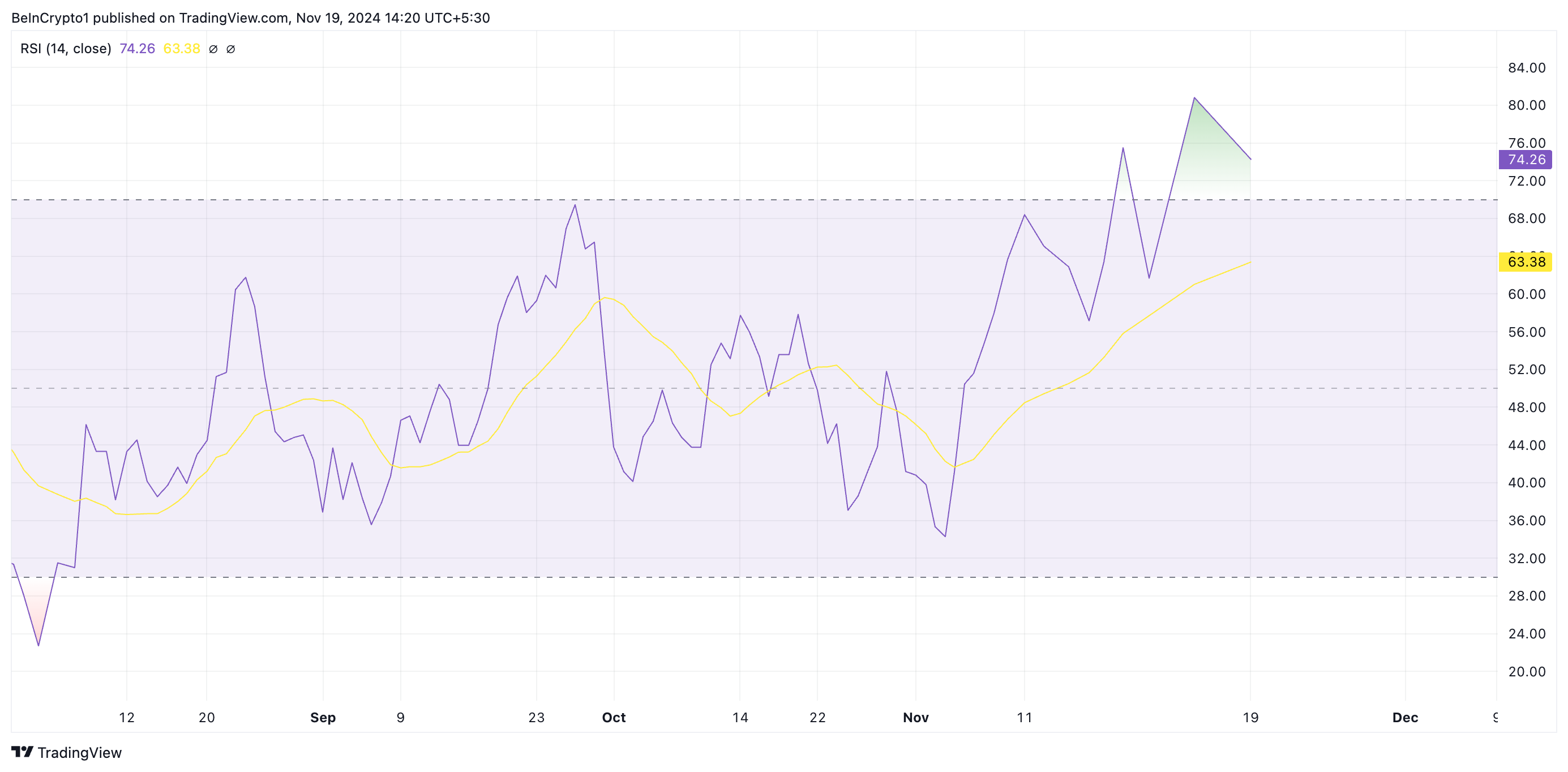

Additionally, the overbought readings from the coin’s Relative Strength Index (RSI) confirm the likelihood of a price correction in the short term. At press time, XTZ’s RSI is 74.26.

The RSI indicator measures an asset’s oversold and overbought market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for correction. On the other hand, values below 30 indicate that the asset is oversold and may witness a rebound.

Therefore, XTZ’s RSI of 74.26 suggests it has experienced strong upward momentum and may be due for a correction or pullback. It indicates that the coin’s price has risen too quickly, and there might be an increased risk of a price reversal.

XTZ Price Prediction: Coin May Drop Below $1

XTZ is currently trading at $1.13, holding above the $1.07 support level. If buying momentum weakens, the price may drop to this key support. A failure to maintain $1.07 could push XTZ below $1, potentially falling to $0.97 — a 14% decline from its current value.

If the uptrend continues, XTZ could break past the $1.19 resistance and advance toward $1.40, signaling further bullish momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Readies for a Fresh Climb: Will Momentum Build?

Ethereum price started a consolidation phase near the $3,000 zone. ETH is slowly moving higher and might aim for a fresh surge above $3,220.

- Ethereum is consolidating and facing hurdles near $3,220.

- The price is trading above $3,150 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance at $3,130 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could start a fresh increase if it clears the $3,220 resistance zone.

Ethereum Price Faces Hurdles

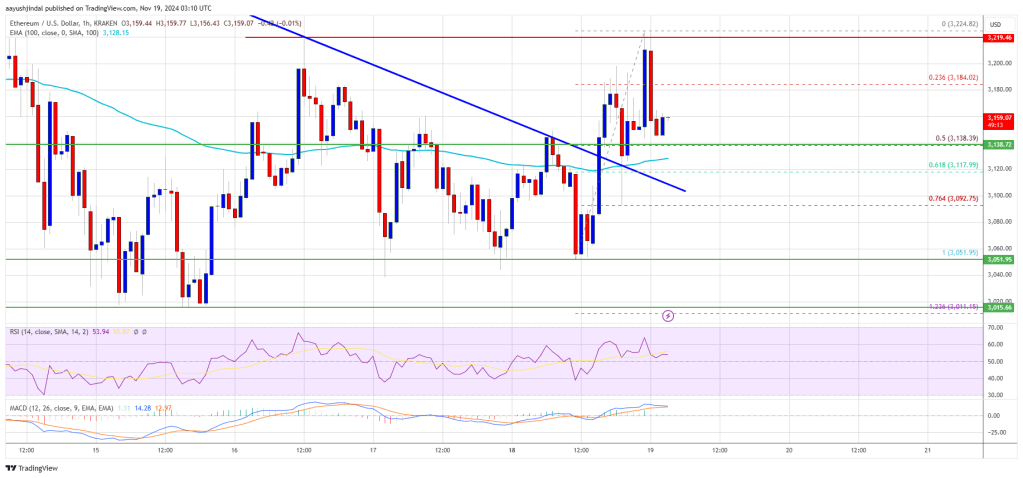

Ethereum price remained supported above the $3,000 level like Bitcoin. ETH formed a base and recently moved above the $3,120 and $3,150 resistance levels.

There was a break above a key bearish trend line with resistance at $3,130 on the hourly chart of ETH/USD. The pair even cleared the $3,200 level and tested $3,220. A high was formed at $3,224 before there was a pullback. The price dipped below the 23.6% Fib retracement level of the upward move from the $3,051 swing low to the $3,224 high.

Ethereum price is now trading above $3,150 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $3,200 level.

The first major resistance is near the $3,220 level. The main resistance is now forming near $3,250. A clear move above the $3,250 resistance might send the price toward the $3,320 resistance. An upside break above the $3,320 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $3,450 resistance zone.

Another Drop In ETH?

If Ethereum fails to clear the $3,220 resistance, it could start another decline. Initial support on the downside is near the $3,140 level or the 50% Fib retracement level of the upward move from the $3,051 swing low to the $3,224 high. The first major support sits near the $3,050 zone.

A clear move below the $3,050 support might push the price toward $3,000. Any more losses might send the price toward the $2,940 support level in the near term. The next key support sits at $2,880.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $3,140

Major Resistance Level – $3,220

Market

Big Time Studios’ OL Token Debuts on Open Loot

Big Time Studios, a player in Web3 gaming and the creator of Big Time, has unveiled its newest product: the OL token.

With the Open Loot platform already handling nearly $500 million in transactions, the introduction of OL sets the stage for a new era of engagement, rewarding the very players and developers who fuel its success.

A Token for Engagement, Not Speculation

Unlike traditional token launches, which take a fundraising-heavy approach, Big Time Studios is flipping the narrative. The OL is designed to prioritize the community above all. By rewarding activity and participation, OL becomes a tool for empowerment rather than speculation. This shift reflects the company’s commitment to reshaping how tokens integrate into gaming ecosystems.

Players can earn OL through meaningful interactions, such as completing in-game challenges or participating in special platform events. Once earned, these tokens open doors to benefits such as early access, special NFT opportunities, and in-game rewards. The system ensures that loyalty and engagement directly translate into tangible advantages.

“Just saw a little glimpse via private demo of what the guys @playbigtime are building, lets just say things are looking TOP TIER. Blown away by the level of detail top to bottom. Can’t wait for more,” said one X user.

For developers, OL serves as a bridge to deeper player relationships. Studios can use the token to reward milestones, enhance limited-time events, or craft targeted incentives that boost engagement. This dynamic makes $OL a tool for attracting players and keeping them invested in the ecosystem for the long term.

The launch of OL departs from traditional token models. No tokens are pre-sold, allocated to teams, or reserved for early investors. Instead, the entire distribution relies on community involvement, ensuring fairness and accessibility. This structure reinforces the token’s core mission: to give back to the community that feeds it.

Big Time Studios integrates OL into the Open Loot platform, which has already simplified blockchain gaming for a global audience. The platform’s patented Vault technology removes the usual hurdles of Web3 gaming, such as high gas fees or complex wallet connections. Players can buy, sell, and mint NFTs or explore options like NFT rentals and currency marketplaces. These features make blockchain gaming approachable for both seasoned enthusiasts and newcomers.

The Open Loot ecosystem has seen explosive growth in 2024, with millions of NFTs exchanged and crafted by an active player base. The platform supports a roster of standout titles, including World Shards and The Desolation, each offering distinct gameplay experiences.

The launch of OL marks a new chapter for Big Time Studios. Their idea is that by centering the token around active participation and rewarding its community, they contest traditional token models. As OL integrates further into the Open Loot ecosystem, it hopes to reshape the relationship between players, developers, and digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation22 hours ago

Regulation22 hours agoGary Gensler Preparing to Exit SEC Chairman Role?

-

Market14 hours ago

Market14 hours agoHedera Hashgraph, Catizen prices soar as traders eye Vantard

-

Market23 hours ago

Market23 hours agoWill Dogecoin Holders Push DOGE Price to $1 After Recent Dip?

-

Market13 hours ago

Market13 hours agoWhy the WIF Meme Coin Price May Drop Below $3

-

Market7 hours ago

Market7 hours agoBitcoin Price Gears Up for New ATH: Will Bulls Push Through?

-

Regulation13 hours ago

Regulation13 hours agoPro-XRP Lawyer Provides Timeline For US SEC Approval

-

Market12 hours ago

Market12 hours agoAnalyst Says XRP’s 11-Year SuperCycle Is Coming To An End, Why A Surge To $3.4 Is Imminent

-

Market11 hours ago

Market11 hours agoGOAT Price Slides as Key Indicators Signal Weakness