Market

Will Polygon Whales Lead POL Price Above $0.60?

Polygon whales have accumulated an additional $65 million worth of tokens in the past seven days, coinciding with a 12% price increase for the POL token over the last 30 days. This surge has reignited optimism that the altcoin, formerly known as MATIC, might recover some of its recent losses.

However, some investors remain cautious, speculating that the current buying pressure might not suffice to sustain the momentum. Here’s an in-depth analysis of the situation.

Polygon Stakeholders Add 113 Million Tokens to Their Holdings

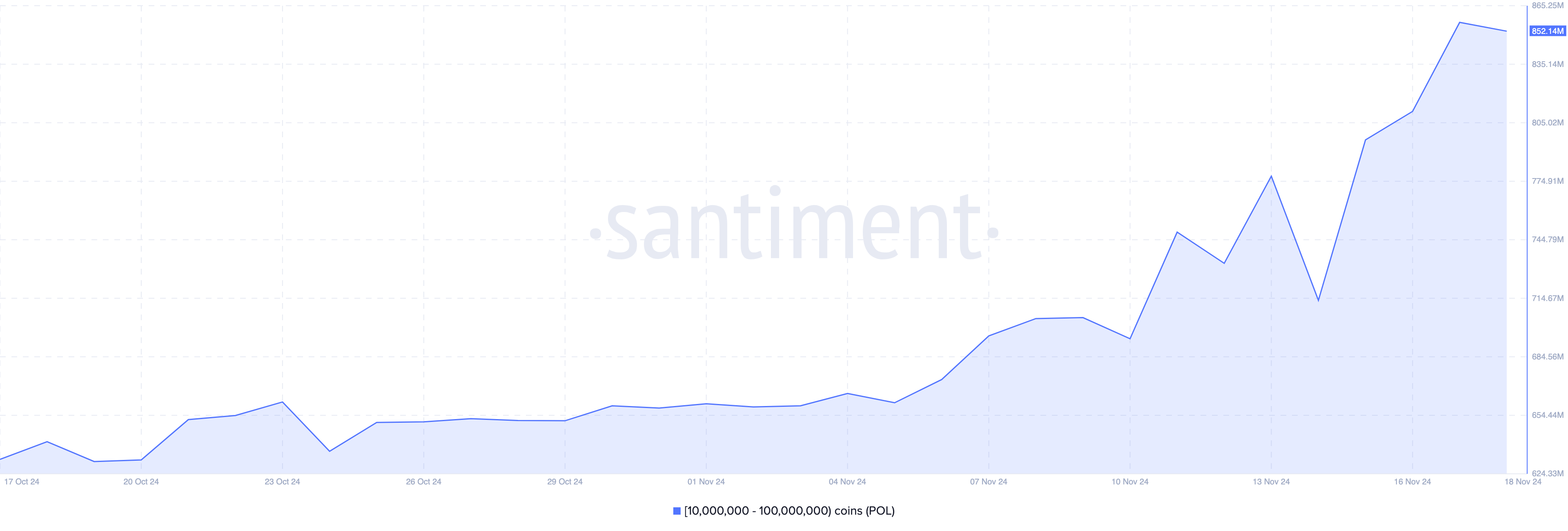

On November 11, addresses holding between 10 million and 100 million POL tokens in their wallet collectively owned 695.38 million tokens. Today, that figure has surged to 852.14 million, showing that Polygon whales have accumulated over 113 million tokens in the past seven days.

At the current price of the altcoin, this accumulation is valued at approximately $65 million. Typically, when crypto whales buy, it is a sign that a cryptocurrency’s value could climb. This also encourages retail investors to accumulate, putting more upward pressure on the price.

Conversely, when crypto whales sell, it often signifies bearish sentiment, suggesting that the token’s value may struggle to gain momentum. For the POL token, however, the recent whale accumulation is a bullish indicator. If this trend continues, the token’s price could climb above $0.42 in the near term.

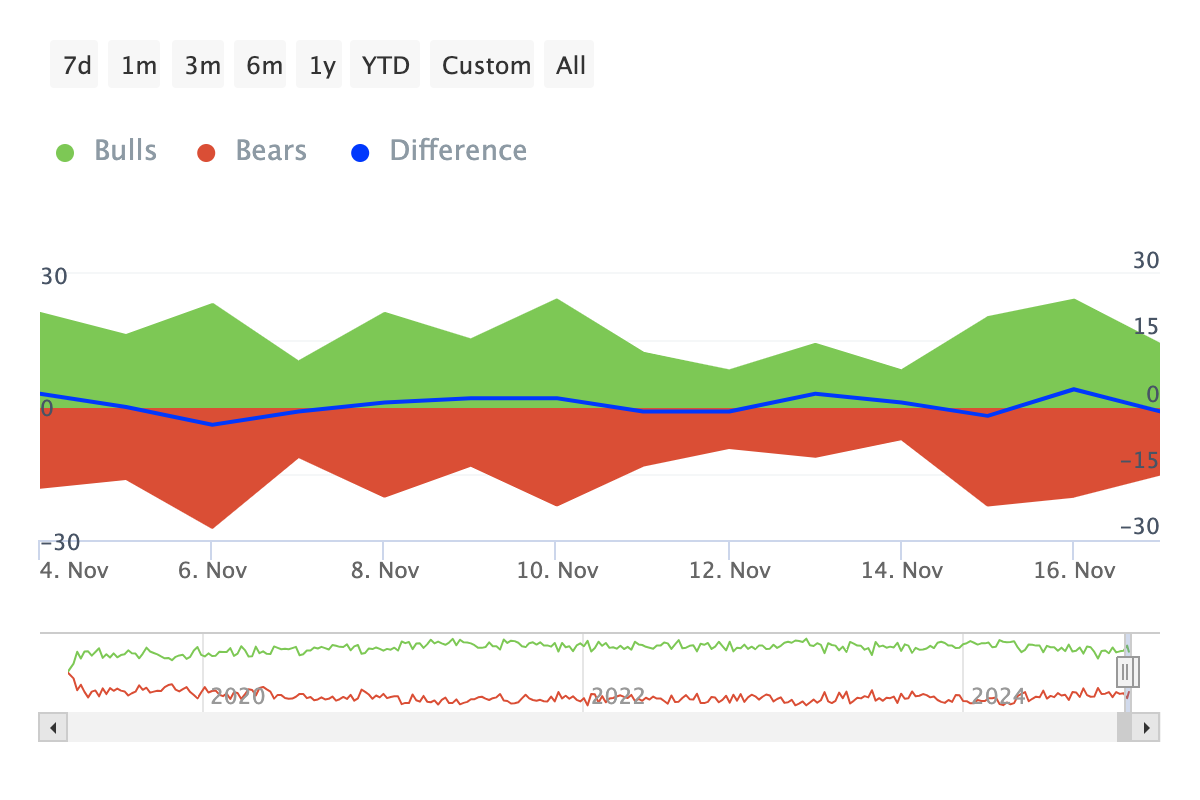

Additionally, the increase in whale accumulation aligns with growing bullish dominance, as highlighted by IntoTheBlock’s Bulls and Bears indicator. This metric tracks the activity of investors who bought (bulls) at least 1% of the total trading volume versus those who sold (bears) a similar amount.

When bears outnumber bulls, it often signals potential price declines. However, for the Polygon ecosystem token, the bulls currently outpace the bears, indicating a stronger likelihood of a short-term price increase for the altcoin.

POL Price Prediction: Pattern Turns Bullish

A look at the 4-hour timeframe shows that the POL/USD chart has formed an inverse head-and-shoulders pattern. An inverse head-and-shoulders pattern is a technical pattern that indicates a potential reversal from a downtrend to an uptrend.

The first trough marks the initial phase of the downtrend. The deepest trough is lower than both the left and right shoulders, while the third and final trough mirrors the left shoulder in-depth but is higher than the head.

Considering this current outlook, POL’s price could rise to $0.45 in the short term. If Polygon whales continues to buy in large volumes, this altcoin’s price might climb toward $0.60.

However, if these crypto whales decide to sell some of their holdings, this prediction might be invalidated. In that case, the Polygon token price could decline to $0.38.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Gears Up for New ATH: Will Bulls Push Through?

Bitcoin price is consolidating gains near the $90,000 zone. BTC is showing positive signs and might soon aim for a fresh increase above $92,000.

- Bitcoin started a fresh increase above the $90,000 zone.

- The price is trading above $90,000 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support at $89,600 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could gain bullish momentum if it clears the $92,600 resistance zone.

Bitcoin Price Aims Another ATH

Bitcoin price started a short-term downside correction below the $90,000 level. BTC traded below the $88,000 level before it found support.

A low was formed at $86,621 and the price is now recovering higher. There was a move above the $90,000 level. A high was formed at $92,607 and the price is now consolidating. It is trading near the 23.6% Fib retracement level of the upward move from the $86,621 swing low to the $92,607 high.

Bitcoin price is now trading above $90,000 and the 100 hourly Simple moving average. There is also a key bullish trend line forming with support at $89,600 on the hourly chart of the BTC/USD pair. The trend line is close to the 50% Fib retracement level of the upward move from the $86,621 swing low to the $92,607 high.

On the upside, the price could face resistance near the $92,000 level. The first key resistance is near the $92,500 level. A clear move above the $92,500 resistance might send the price higher. The next key resistance could be $93,200.

A close above the $93,200 resistance might initiate more gains. In the stated case, the price could rise and test the $95,000 resistance level. Any more gains might send the price toward the $98,000 resistance level.

Another Drop In BTC?

If Bitcoin fails to rise above the $92,000 resistance zone, it could start a downside correction. Immediate support on the downside is near the $90,000 level.

The first major support is near the $89,650 level. The next support is now near the $88,000 zone. Any more losses might send the price toward the $86,500 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $89,650, followed by $88,000.

Major Resistance Levels – $92,000, and $92,500.

Market

Bitcoin Faces Reversal Fears at $90,000 Amid Extreme Greed

Bitcoin’s price rally appears to have stalled after a week of all-time highs (ATHs), with the cryptocurrency now facing significant challenges.

The bullish momentum that propelled BTC to $93,242 has slowed, raising concerns about potential corrections as market conditions begin to shift.

Bitcoin Faces Potential Reversal

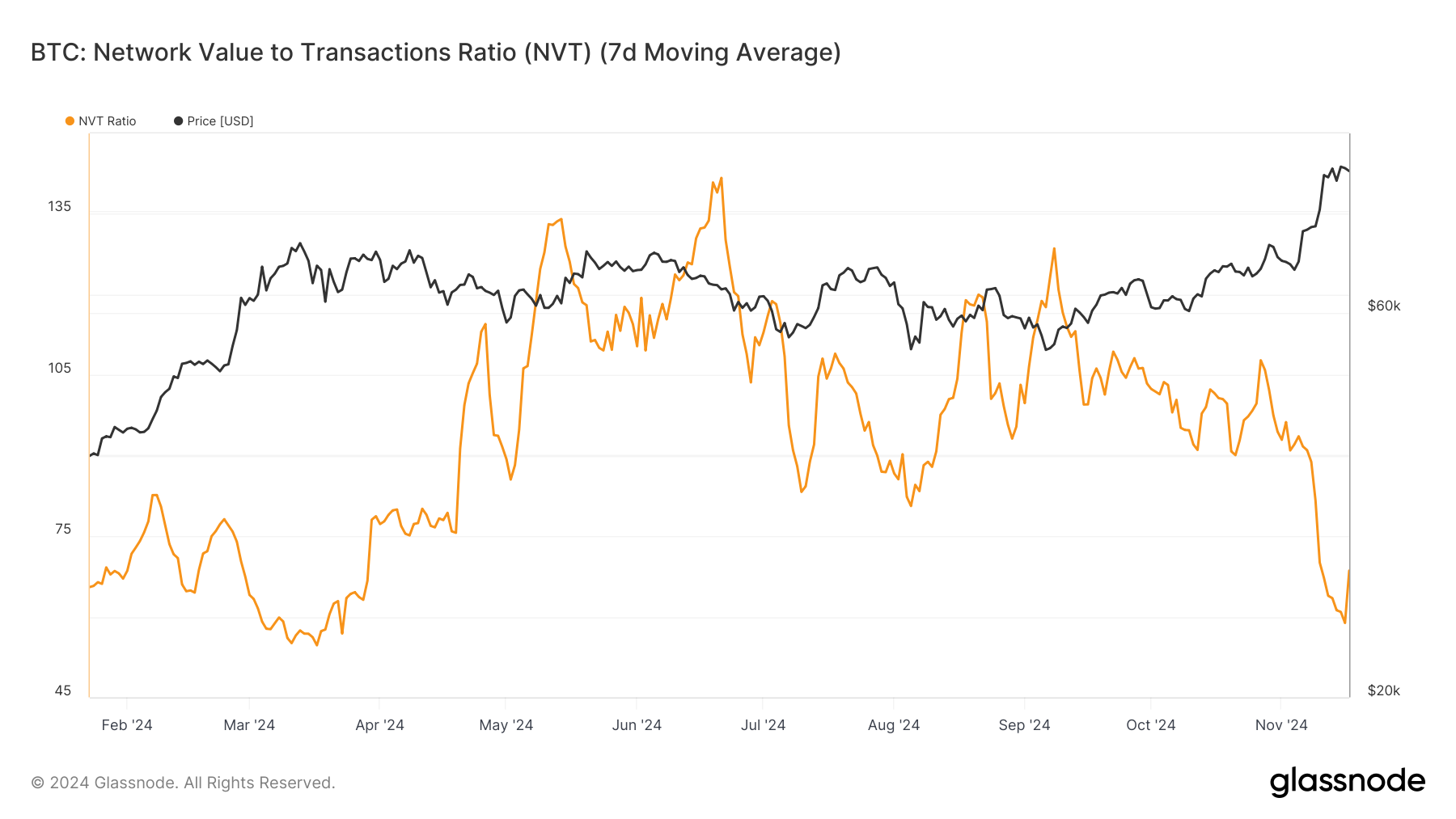

The NVT (Network Value to Transactions) Ratio, a critical metric for analyzing Bitcoin’s value, has spiked after recently hitting an eight-month low. A low NVT ratio typically indicates that the network’s transactional activity is aligned with its value, signaling a balanced and sustainable market.

However, the current uptick suggests that Bitcoin’s network value may be outpacing its transaction activity. Historically, such scenarios have preceded corrections, highlighting the importance of closely monitoring this metric. If the trend persists, it could contribute to downward pressure on BTC’s price.

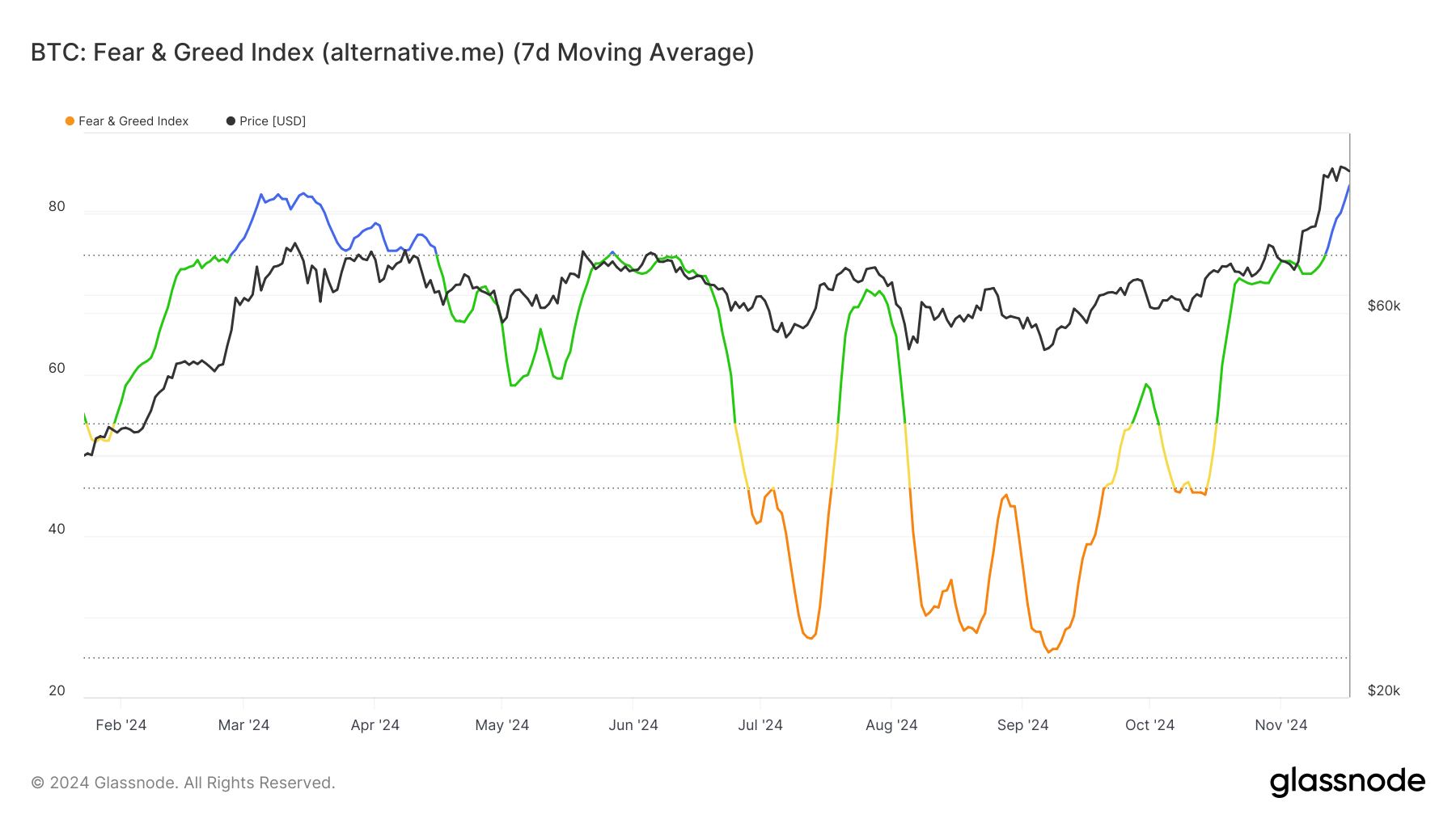

The Fear and Greed Index, a barometer for market sentiment, is now in the “extreme greed” zone, which has historically signaled potential reversals in Bitcoin’s price. Extreme greed often indicates that investors are overly optimistic, leaving the market vulnerable to sudden sell-offs.

While Bitcoin has demonstrated resilience during similar conditions in the past, this heightened sentiment could mark a tipping point. Combined with declining transaction activity, BTC’s macro momentum may face increasing challenges in sustaining its current price levels.

BTC Price Prediction: Finding Support

Bitcoin is currently trading at $90,673, holding above the critical support of $88,691 while facing resistance at $92,000. If BTC consolidates within this range over the next few days, it could fend off a broader correction and maintain stability.

However, a break below the $88,691 support could trigger a decline toward $85,000. If this level fails to hold, Bitcoin risks falling further to $80,301, exacerbating bearish sentiment.

Conversely, a bounce off $88,691 and a successful breach of the $92,000 resistance could revive bullish momentum. This would allow Bitcoin to aim for a new ATH above $93,242, effectively invalidating concerns of a reversal and reinforcing its long-term upward trajectory.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will HBAR Hit $0.182 After 115% Rally?

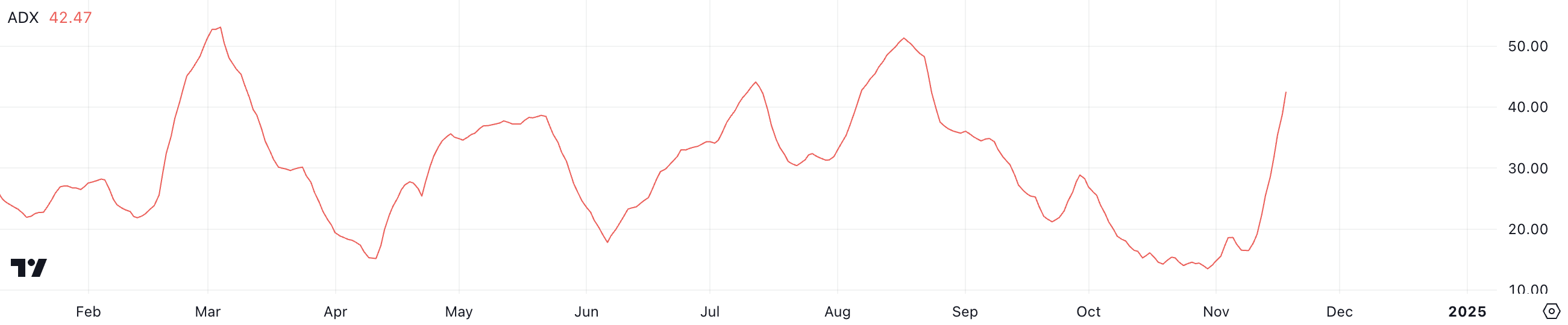

The price of Hedera (HBAR) has skyrocketed, climbing roughly 30% in the last 24 hours and over 115% in the past seven days. This explosive growth is backed by strong technical indicators, with the ADX signaling a strengthening trend and the Ichimoku Cloud chart confirming bullish momentum.

HBAR’s price action suggests it could be gearing up for further gains, with resistance levels at $0.14 and $0.182 in sight. However, if the uptrend loses strength, support zones at $0.098 and $0.068 will play a crucial role in determining the next direction for HBAR.

HBAR Current Uptrend Is Strong

HBAR’s ADX has surged to 42.47 from around 17 in just one day, signaling a rapid strengthening of the ongoing trend. This sharp rise indicates that HBAR is transitioning from a weak or uncertain trend into a strong, clearly defined uptrend after the recent price surge.

Such a high ADX value reflects significant momentum behind the price movement, suggesting that the current uptrend is likely to continue in the near term.

The ADX, or Average Directional Index, measures the strength of a trend on a scale from 0 to 100 without indicating the trend’s direction.

Values below 20 signify weak trends, while values above 25 suggest a strong trend. Hedera ADX at 42.47 clearly indicates a strong uptrend, implying that buying momentum is accelerating.

Ichimoku Cloud Shows a Bullish Setup for Hedera

The Ichimoku Cloud chart for HBAR shows a sustainable uptrend, with the price breaking well above the cloud (Kumo), confirming the start of a bullish trend. The green cloud ahead suggests solid support, reinforcing the likelihood of continued upward momentum.

The current price action suggests that HBAR is maintaining its strength above critical levels, with the cloud providing a safety net for potential pullbacks.

The Tenkan-sen (conversion line) is above the Kijun-sen (baseline), another positive signal reflecting strong short-term momentum. The Chikou Span (lagging line) is also positioned well above the price, further validating the strength of this trend.

Together, these elements align to suggest that HBAR’s momentum is strong, with the potential for continued price gains if the current trend holds.

HBAR Price Prediction: A New 53% Price Surge?

If the current uptrend continues, HBAR price could test its nearest strong resistance at $0.14, which would be its highest price since March. A successful breakout above this level could pave the way for further gains, potentially reaching $0.182, representing a substantial 54% increase from current levels.

This bullish scenario aligns with the strong momentum indicated by recent technical signals.

On the other hand, if the trend reverses, HBAR could face a pullback toward its first support at $0.098. If this level fails to hold, the price could drop further to $0.068.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation16 hours ago

Regulation16 hours agoGary Gensler Preparing to Exit SEC Chairman Role?

-

Bitcoin23 hours ago

Bitcoin23 hours agoKey US Economic Data That May Drive Crypto Volatility This Week

-

Altcoin22 hours ago

Altcoin22 hours agoShiba Inu Burn Rate Soars 6200%, SHIB Price To $1 Possible?

-

Market23 hours ago

Market23 hours agoXRP Price Eyes $1.25 and Beyond: Can the Rally Continue?

-

Market22 hours ago

Market22 hours agoDogecoin (DOGE) Eyes $0.50 Again: Is a New Rally on the Horizon?

-

Market8 hours ago

Market8 hours agoHedera Hashgraph, Catizen prices soar as traders eye Vantard

-

Market19 hours ago

Market19 hours agoWhy the XRP Token Price May Fall Below $1

-

Altcoin17 hours ago

Altcoin17 hours agoCrypto Trader Made $6M Profit With MANTRA, OM Price Pares Gains