Market

Can This PEPE Price Chart Drive the Meme Coin Higher?

The 4-hour PEPE price chart has formed a bullish pattern, suggesting that the meme coin’s price could be ready to hit a new peak. At press time, PEPE’s price is $0.000021, 17% down from the all-time high it reached on November 14.

As a result, 1% of the token’s holders are in the red zone, while 7% are at the breakeven point. This on-chain analysis reveals how PEPE’s price action could return all these holders to profits.

Pepe Technical Pattern Siginifies Recovery

Analysis of the 4-hour timeframe shows that the PEPE price chart has formed a bull flag. A bull flag is a continuation pattern indicating that a cryptocurrency’s price is likely to resume its upward trend following a brief consolidation.

The pattern consists of the “flagpole,” which represents the price increase period. It is then followed by the “flag,” indicating the consolidation phase, and the breakout, which occurs after the price rises above the resistance line.

As seen below, PEPE’s price is on the verge of breaking out of the $0.000021 region. Once validated, this bull flag formation could lead to a notable rise above the all-time high of $0.000025.

This prediction also aligns with the position of the Global In/Out of Money (GIOM). The Global GIOM indicator groups all wallet addresses into clusters based on the price ranges at which they previously acquired their holdings.

Larger clusters indicate stronger support or resistance levels at those price points, as they represent areas where many investors are positioned. According to IntoTheBlock, only 3,940 addresses hold 2.76 trillion tokens, and accumulated around $0.000023 are out of the money.

Considering the weak resistance and strong support, PEPE’s price might increase. In short, the on-chain indicator suggests that the meme coin’s value might rise as high as $0.000041.

PEPE Price Prediction: First Target at $0.000032

On the daily PEPE price chart, the token seems to have followed a similar movement to its 250% hike around March. At that time, the frog-themed meme coin broke out of a descending channel.

Between September 29 and the first week in November, PEPE traded within a descending channel. While it has since broken out, the image above shows that the meme coin’s value could climb higher.

If this happens, then the value might rise toward 0.000032, possibly hitting $0.000041. On the other hand, if selling pressure rises, this might not happen. Instead, PEPE could decline below $0.000015.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

GOAT Price Slides as Key Indicators Signal Weakness

Goatseus Maximus (GOAT) price has surged 34.19% over the past seven days, recently reaching a $1 billion market cap milestone. However, technical indicators suggest the uptrend is losing strength, with the ADX and RSI pointing to fading momentum.

While the EMA lines remain bullish, short-term trends are beginning to decline, signaling a potential shift in market sentiment. GOAT now sits at a critical point where it could either test resistance at $1.36 or face a deeper correction toward key support zones.

The Current Trend Is Losing Steam

GOAT ADX has dropped to 29.77 from 38 over the past few days, indicating a weakening in trend strength. While the value still suggests that the asset is in an uptrend, the decline shows that the momentum behind the current trend is fading.

The ADX, or Average Directional Index, measures the strength of a trend on a scale from 0 to 100. Values above 25 indicate a strong trend, while values below 20 suggest a weak or directionless market.

With GOAT’s ADX now falling closer to the lower threshold, it suggests the current uptrend is losing steam. If the ADX continues to decline further, traders should watch for signs of a potential downtrend or a sideways movement as the market adjusts.

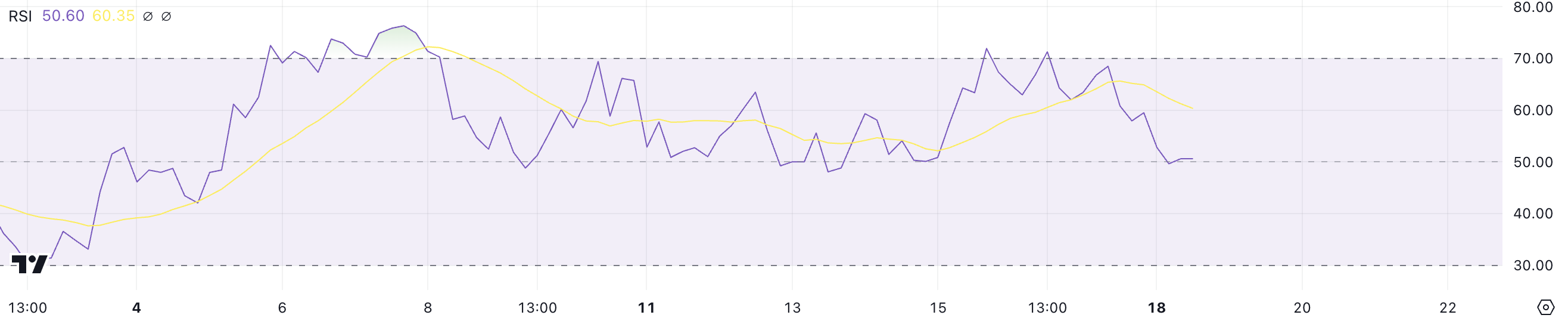

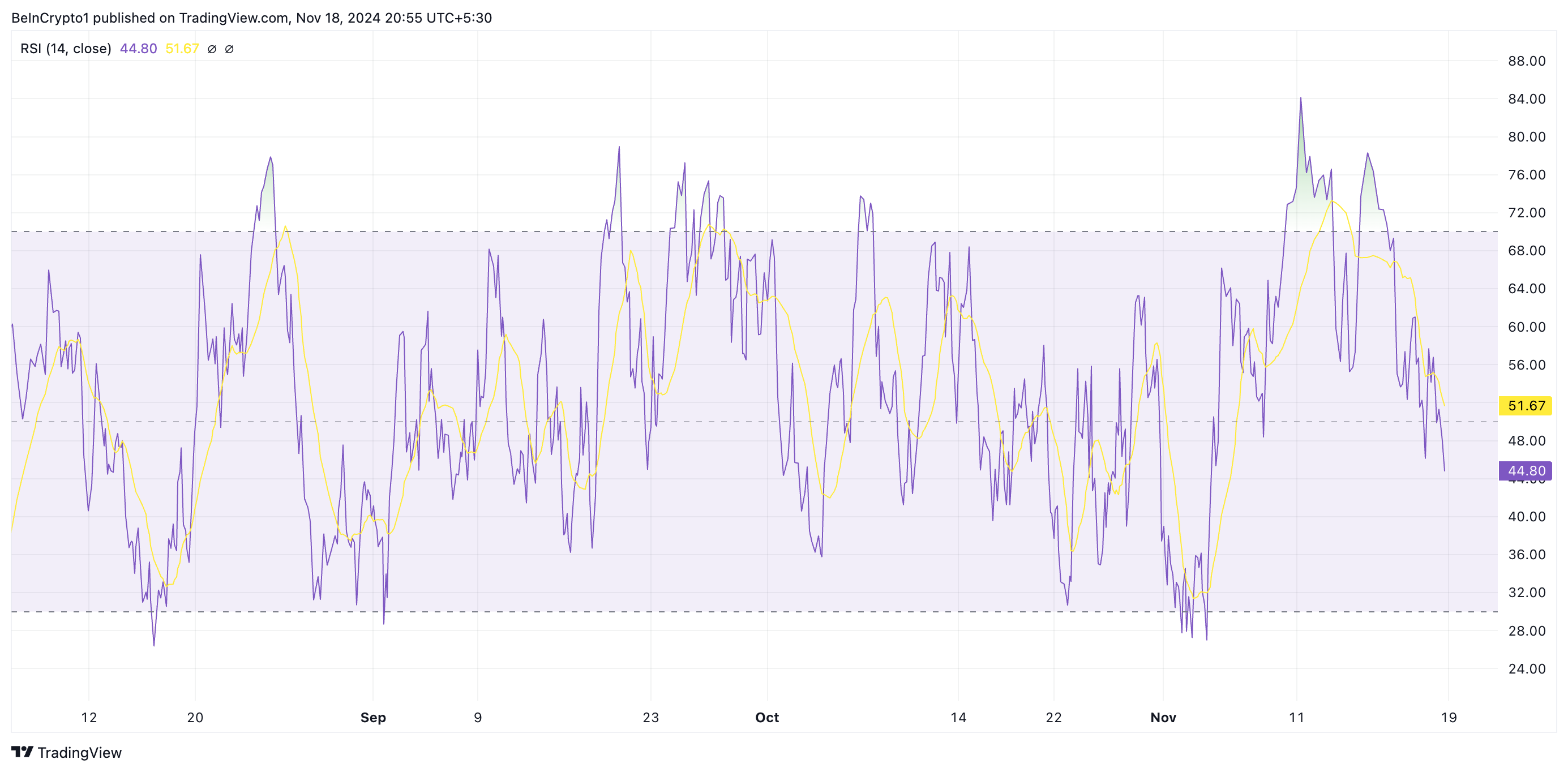

GOAT RSI Shows a Neutral Zone

GOAT is today the biggest coin ever launched on Pumpfun, Solana’s biggest coin launchpad. GOAT’s RSI has dropped to 50.60 from over 70 a few days ago, reflecting a cooling off in bullish momentum. Previously in the overbought territory above 70, the asset was experiencing strong upward pressure.

However, the decline to neutral levels indicates a slowdown in buying activity, suggesting that the recent rally has lost strength and the market is recalibrating.

The RSI, or Relative Strength Index, measures the speed and magnitude of price changes to assess whether an asset is overbought or oversold. Values above 70 indicate overbought conditions and potential for a pullback, while values below 30 signal oversold conditions and possible recovery.

With GOAT’s RSI now at 50.60, it sits at a neutral level, meaning the price lacks strong momentum in either direction.

GOAT Price Prediction: Potential 63% Correction

GOAT’s EMA lines remain bullish, but the short-term lines are beginning to decline, signaling weakening momentum in the uptrend. This aligns with the RSI and ADX, both of which suggest that the bullish trend is losing strength.

If the uptrend regains momentum, GOAT price could target its resistance at $1.36, signaling potential for further gains. However, if the downward pressure intensifies, support levels could be tested at $0.80 and $0.69.

A failure to hold these zones might lead to a deeper correction, potentially reaching $0.41, which would mark a significant 63% decline from current levels, possibly taking out GOAT from the list of top 10 biggest meme coins.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Says XRP’s 11-Year SuperCycle Is Coming To An End, Why A Surge To $3.4 Is Imminent

A crypto analyst has noted that XRP has finally broken out of its long consolidation phase, signaling the onset of a major price rally. He further predicts that the XRP price is on the verge of ending an 11-year SuperCycle, which could pave the way for a surge to $3.4 once finalized.

SuperCycle To Trigger $3.4 Surge

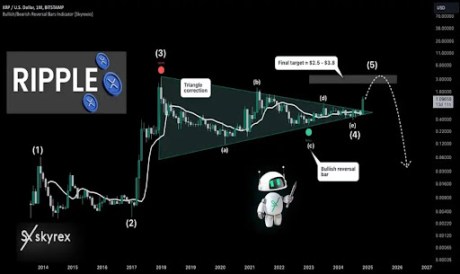

Skyrexio, a TradingView crypto analyst, has released an XRP price analysis, forecasting a possible increase to $3.4. In the chart analysis, Skyrexio disclosed that XRP has recently broken out of its four-year consolidation period, potentially signaling the start of a bullish uptrend.

Related Reading

Unsurprisingly, the total duration of the consolidation period coincides with the number of years XRP has been involved in a legal battle with the United States Securities and Exchange Commission (SEC). Following the lawsuit, the XRP price crashed significantly, staying range-bound for years as it struggled with legal and regulatory challenges.

Notably, Skyrexio’s bullish forecast for the XRP price relies on the Elliott Wave Theory, a technical indicator that predicts price movements of an asset by identifying recurrent long-term price patterns. The analyst noted that XRP’s first Elliott Wave began in 2013, almost 11 years ago. After that, the cryptocurrency experienced a price correction, followed by the legendary Wave 3.

Over the last three years, the price of XRP had been trading sideways, failing to experience gains that would push its price significantly above the $0.5 mark. Skyrexio has revealed that this prolonged sideways movement can be interpreted as a corrective triangle pattern in Wave 4.

The analyst revealed that XRP has successfully broken out of this triangle pattern, signaling the end of its correction phase. He suggests that the cryptocurrency is now in Wave 5, the last wave of its first global SuperCycle.

Based on XRP’s Elliott Wave analysis, Skyrexio has outlined two bullish targets for the XRP price. The analyst forecasts that XRP could rise between $2.5 and $3.8 at the end of this SuperCycle. He emphasized that the higher price target at $3.8 is more likely to be achieved, as historical data shows that in 90% of cases, Wave 5 experiences a higher high than Wave 3.

Concluding his analysis, Skyrexio pointed out key bullish indicators on his price chart, including a bullish reversal bar and green dot at the end of Subway C. He suggested that these bullish signs, appearing on the monthly time frame, are strong indicators of a potential upward move that could drive the XRP price to its final bullish target.

Related Reading

Update On XRP Price Dynamics

The XRP price has achieved a monumental milestone for the first time in years. In just one week, the cryptocurrency rallied by 101.77%, experiencing significant price gains following Donald Trump’s win in the US presidential elections this month.

Earlier this year, the price of XRP was stuck in the $0.5 range, experiencing slight gains but unable to break past this critical resistance level. Now, the cryptocurrency has doubled its price and is trading above $1, a historic feat that has caught the attention of the broader crypto community. As of writing, XRP has gained another 10.1% and is priced at $1.16, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Market

Why the WIF Meme Coin Price May Drop Below $3

Solana-based meme coin Dogwifhat (WIF) has dropped 7% in the past 24 hours, now trading at $3.54. It currently ranks as the second-largest loser of the day, behind Goatseus Maximus (GOAT), which has plummeted 15% during the same period.

With increasing selling pressure and growing bearish sentiment, WIF risks further declines that could push its price below the $3 threshold.

Dogwifhat Faces Bearish Pressure

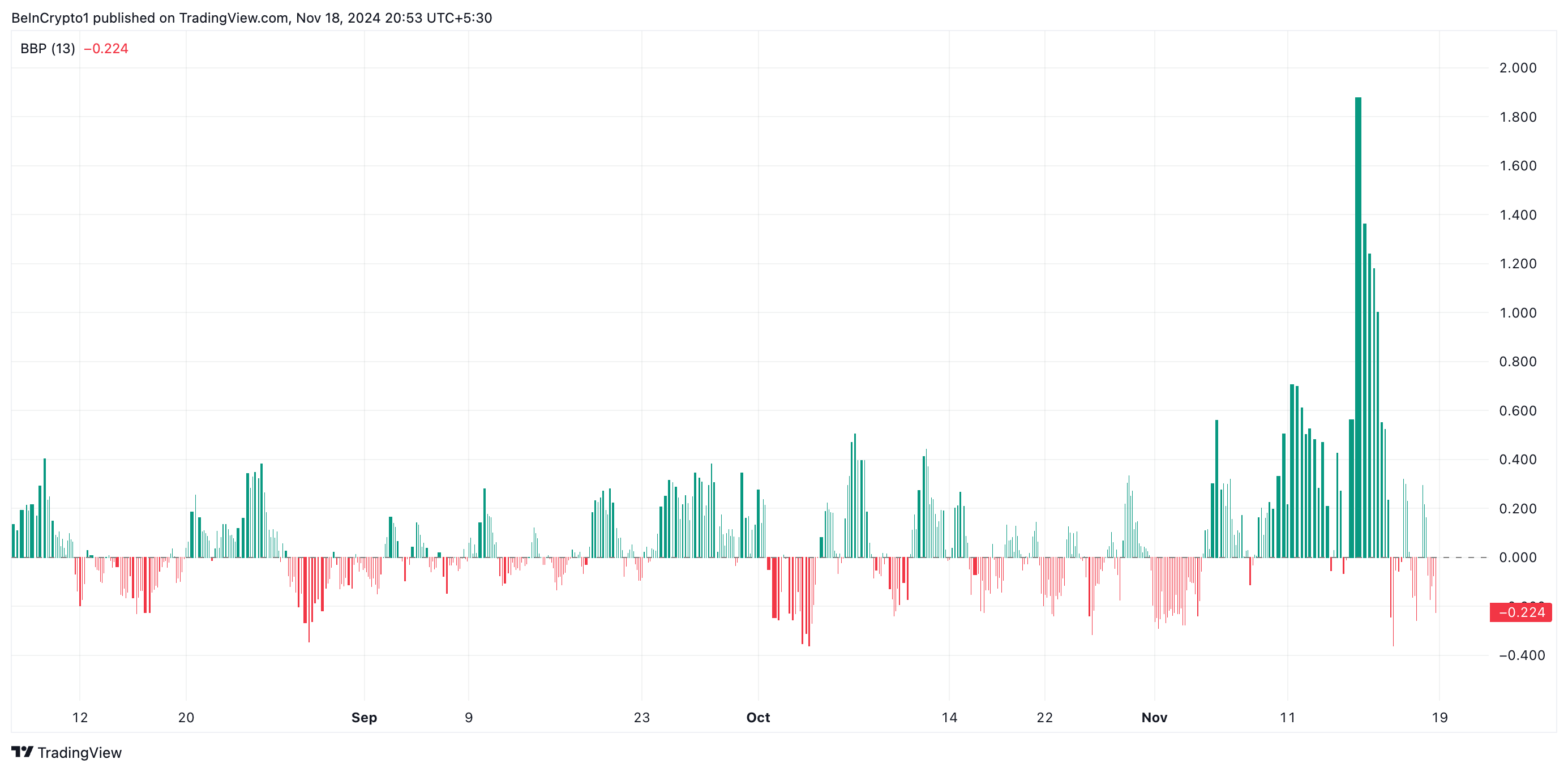

BeInCrypto’s assessment of the WIF/USD four-hour chart reveals the bearish bias against the altcoin. The negative reading on its Elder Ray Index indicates that bearish momentum currently outweighs bullish strength among market participants. As of this writing, WIF’s Elder Ray Index stands at -0.22.

The Elder-Ray Index assesses the strength of bullish and bearish pressures in the market. When it falls below zero, it indicates that bear power has overtaken bull power, signifying bearish momentum. This suggests that sellers are dominating the market, pushing prices lower. In such scenarios, traders interpret the negative value as a warning of potential continued downtrends or selling pressure.

Additionally, WIF’s Relative Strength Index (RSI) indicates declining buying pressure. The RSI, which gauges overbought and oversold conditions, ranges from 0 to 100. Readings above 70 signal that an asset is overbought and may face a correction, while values below 30 indicate it is oversold and could see a rebound.

Currently, WIF’s RSI sits below the 50-neutral line at 44.80, reflecting weakened bullish momentum.

WIF Price Prediction: The Sub-$3 May Be At Hand

WIF is currently trading at $3.46, hovering just above its support level of $3.35. If the ongoing downtrend continues, the meme coin is likely to test this support. A breach at $3.35 could lead to a further drop to $3, with the possibility of declining to $2.57 if selling pressure intensifies.

However, this bearish outlook could be reversed if WIF experiences a surge in new demand, which could drive its price upward toward $4.19.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation11 hours ago

Regulation11 hours agoGary Gensler Preparing to Exit SEC Chairman Role?

-

Market24 hours ago

Market24 hours agoCoinbase Base Achieves 1 Billion Transactions Amid Art Scandal

-

Altcoin21 hours ago

Altcoin21 hours agoWill Cardano Price Continue To Rally Amid Bullish On-Chain Metrics?

-

Market20 hours ago

Market20 hours agoEthereum Price Confronts Barriers to a New Surge—Can Bulls Prevail?

-

Altcoin19 hours ago

Altcoin19 hours agoBTC Holds $90K, OM Soars 40%, HBAR Rises 28%

-

Market19 hours ago

Market19 hours agoXRP Price Eyes $1.25 and Beyond: Can the Rally Continue?

-

Bitcoin18 hours ago

Bitcoin18 hours agoKey US Economic Data That May Drive Crypto Volatility This Week

-

Market18 hours ago

Market18 hours agoDogecoin (DOGE) Eyes $0.50 Again: Is a New Rally on the Horizon?