Market

$700 Million Convertible Note to Power MARA’s Bitcoin Ambitions

MARA Holdings, Inc., a leader in digital asset infrastructure, plans to raise $700 million through the issuance of convertible senior notes due in 2030.

This move provides institutional investors with an opportunity to support the company’s expansion efforts.

MARA Seeks $700 Million to Supercharge Bitcoin Expansion

The notes, issued privately under Rule 144A of the Securities Act of 1933, reflect Marathon Digital’s strategy to balance risk and responsibility. These notes provide investors with semi-annual interest payments and the ability to convert their debt into company stock under specific conditions.

This approach allows MARA to attract capital while retaining flexibility to manage its debt and invest in future growth. The company also reserves the option to increase the offering by an additional $105 million if demand allows.

MARA plans to use $200 million from the offering to repurchase existing convertible notes due in 2026. This move helps them to reduce upcoming financial obligations while taking advantage of favorable market conditions. The company will use the remaining proceeds to acquire more Bitcoin and fund corporate needs, including working capital and potential acquisitions.

Investors holding existing 2026 notes may unwind hedge positions, leading to increased demand for MARA shares. This activity could temporarily push up their stock price, adding volatility during the offering.

The notes will mature on March 1, 2030, with interest payments beginning March 2025. Depending on MARA’s choice, investors can convert the notes into cash, stock, or a mix of both. Conversion rights begin under specific conditions before December 2029 and become open-ended thereafter. They also reserve the right to redeem the notes for cash starting in 2028.

“Something to remember with crypto miners on the back of MARA dilution news… their share counts are vastly different than the 2021 run. MARA has 200%+ more shares than when BTC was all time high 2021 which means $20 now is the same market cap as $60 then,” one analyst on X chimed in.

While the convertible notes offer attractive terms, they also carry potential dilution if converted into shares, which can challenge shareholder value.

By addressing its debt obligations early and securing funds for expansion, MARA aims to strengthen its position in a competitive and fast-evolving sector. Whether or not they can pull off this bold move is another story and sets the stage for significant developments in the years ahead.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera Hashgraph, Catizen prices soar as traders eye Vantard

Cryptocurrencies were fairly mixed on Monday as Bitcoin remained stubbornly above the important support level at $90,000. Hedera Hashgraph (HBAR) token surged to a high of $0.1490, its highest level since April 24 and 256% above its lowest point this month.

Similarly, Citizen (CATI), the popular Telegram game, jumped for four consecutive days, reaching a high of $0.70, its highest point since September. Notably, investors continued to eye Vantard, an upcoming cryptocurrency that seeks to create a meme coin index fund.

Why Hedera Hashgraph and Catizen soared

Hedera Hashgraph token surged after a leading company applied for a spot HBAR ETF in the United States. This application is taking advantage of the recent Donald Trump election, which will likely usher in a new era in the crypto industry.

Unlike Joe Biden, Trump has comeout in support of the crypto industry since he has a skin the game. As such, there is a likelihood that the SEC will approve new crypto ETFs at a faster pace in the coming year.

Hedera Hashgraph is seen as an ideal candidate for an ETF because of its use case and the fact that it counts influential companies like Google, Mondelez, and IBM as members of its governance council.

The main issue with Hedera is that it often has low volume and it has not attracted many developers in its ecosystem. As such, even if the ETF is approved, it is unclear whether it will gain popularity among institutional investors.

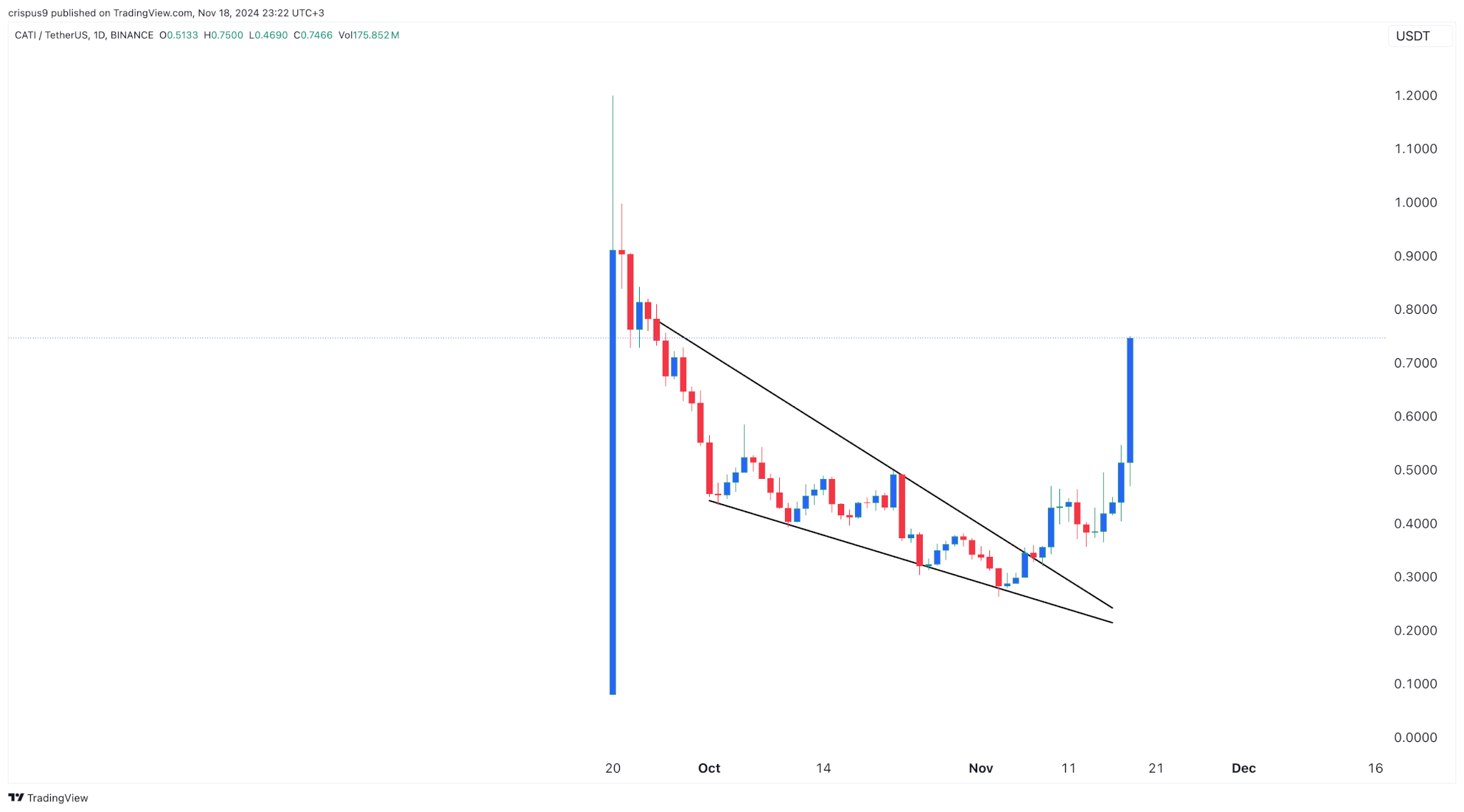

Citizen, on the other hand, is a top player in the tap-to-earn ecosystem that has grown rapidly in the past few months. As shown below, its rebound was mostly because of technicals since it had formed a falling wedge pattern before its comeback. There is a likelihood that the token will surge to a record high of $1.2, which is about 60% above the current level.

Vantard token sale is accelerating

Meanwhile, investors have shifted their focus to Vantard, a popular crypto project that is in its token sale. Vantard has raised over $844,000 from investors, a trend that could continue as meme coins jump.

Vantard is based on the idea that meme coins do well over time. Recent data show that meme tokens like Dogecoin, Floki, and Dogwifhat have outperformed major cryptocurrencies like Bitcoin and Ethereum.

Vantard’s strategy is to create a meme coin index fund that will track the biggest and most promising tokens in the industry. As such, instead of investing in all these coins, one can buy the VTARD token and gain exposure to some of the best coins.

The developers hope that their tokens will thrive as Trump is set to simplify cryptocurrency laws while the Federal Reserve is expected to continue cutting interest rates through 2025. You cann learn more about Vantard here.

Market

Can This PEPE Price Chart Drive the Meme Coin Higher?

The 4-hour PEPE price chart has formed a bullish pattern, suggesting that the meme coin’s price could be ready to hit a new peak. At press time, PEPE’s price is $0.000021, 17% down from the all-time high it reached on November 14.

As a result, 1% of the token’s holders are in the red zone, while 7% are at the breakeven point. This on-chain analysis reveals how PEPE’s price action could return all these holders to profits.

Pepe Technical Pattern Siginifies Recovery

Analysis of the 4-hour timeframe shows that the PEPE price chart has formed a bull flag. A bull flag is a continuation pattern indicating that a cryptocurrency’s price is likely to resume its upward trend following a brief consolidation.

The pattern consists of the “flagpole,” which represents the price increase period. It is then followed by the “flag,” indicating the consolidation phase, and the breakout, which occurs after the price rises above the resistance line.

As seen below, PEPE’s price is on the verge of breaking out of the $0.000021 region. Once validated, this bull flag formation could lead to a notable rise above the all-time high of $0.000025.

This prediction also aligns with the position of the Global In/Out of Money (GIOM). The Global GIOM indicator groups all wallet addresses into clusters based on the price ranges at which they previously acquired their holdings.

Larger clusters indicate stronger support or resistance levels at those price points, as they represent areas where many investors are positioned. According to IntoTheBlock, only 3,940 addresses hold 2.76 trillion tokens, and accumulated around $0.000023 are out of the money.

Considering the weak resistance and strong support, PEPE’s price might increase. In short, the on-chain indicator suggests that the meme coin’s value might rise as high as $0.000041.

PEPE Price Prediction: First Target at $0.000032

On the daily PEPE price chart, the token seems to have followed a similar movement to its 250% hike around March. At that time, the frog-themed meme coin broke out of a descending channel.

Between September 29 and the first week in November, PEPE traded within a descending channel. While it has since broken out, the image above shows that the meme coin’s value could climb higher.

If this happens, then the value might rise toward 0.000032, possibly hitting $0.000041. On the other hand, if selling pressure rises, this might not happen. Instead, PEPE could decline below $0.000015.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Golden Cross Hints at Strong Uptrend Ahead

Ethereum (ETH) price has lagged behind other major assets this year, with a 30% year-to-date increase compared to Bitcoin’s 102% and Solana’s 118% gains. However, recent metrics suggest that ETH may be gearing up for a stronger performance.

Whale accumulation is picking up again, and key indicators like the 7-day MVRV ratio and EMA alignments are signaling a potential bullish phase.

ETH 7D MVRV Is at An Important Threshold

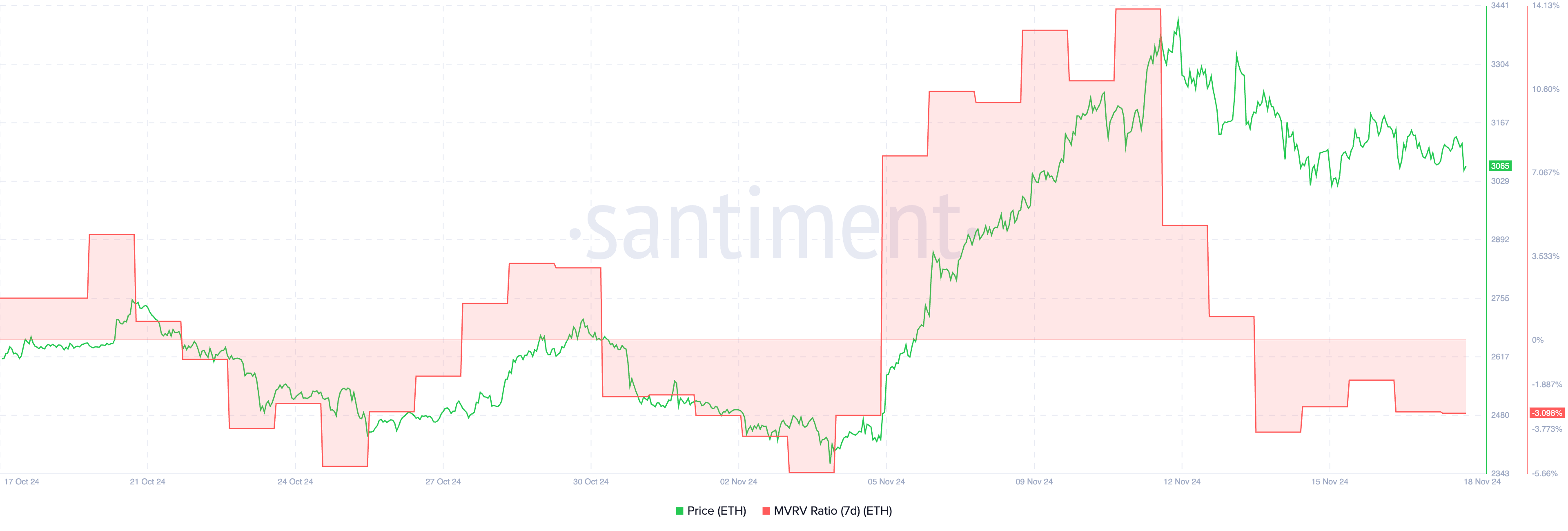

Ethereum’s 7-day MVRV ratio currently sits at -3%, suggesting that short-term holders are at a slight unrealized loss on average. This metric often indicates whether an asset is undervalued or overvalued relative to recent market activity.

A negative MVRV ratio like this can signal a potential accumulation zone, as it reflects that holders may be less inclined to sell, creating room for upward price movement if demand increases.

The MVRV 7-day ratio measures the average profit or loss of addresses that have acquired Ethereum over the past seven days.

Interestingly, on November 5, MVRV 7D ratio hovered around similar levels before a sharp price rally took ETH from $2,400 to $3,400 in just a week, highlighting how this could happen again soon.

Ethereum Whales Are Accumulating Again

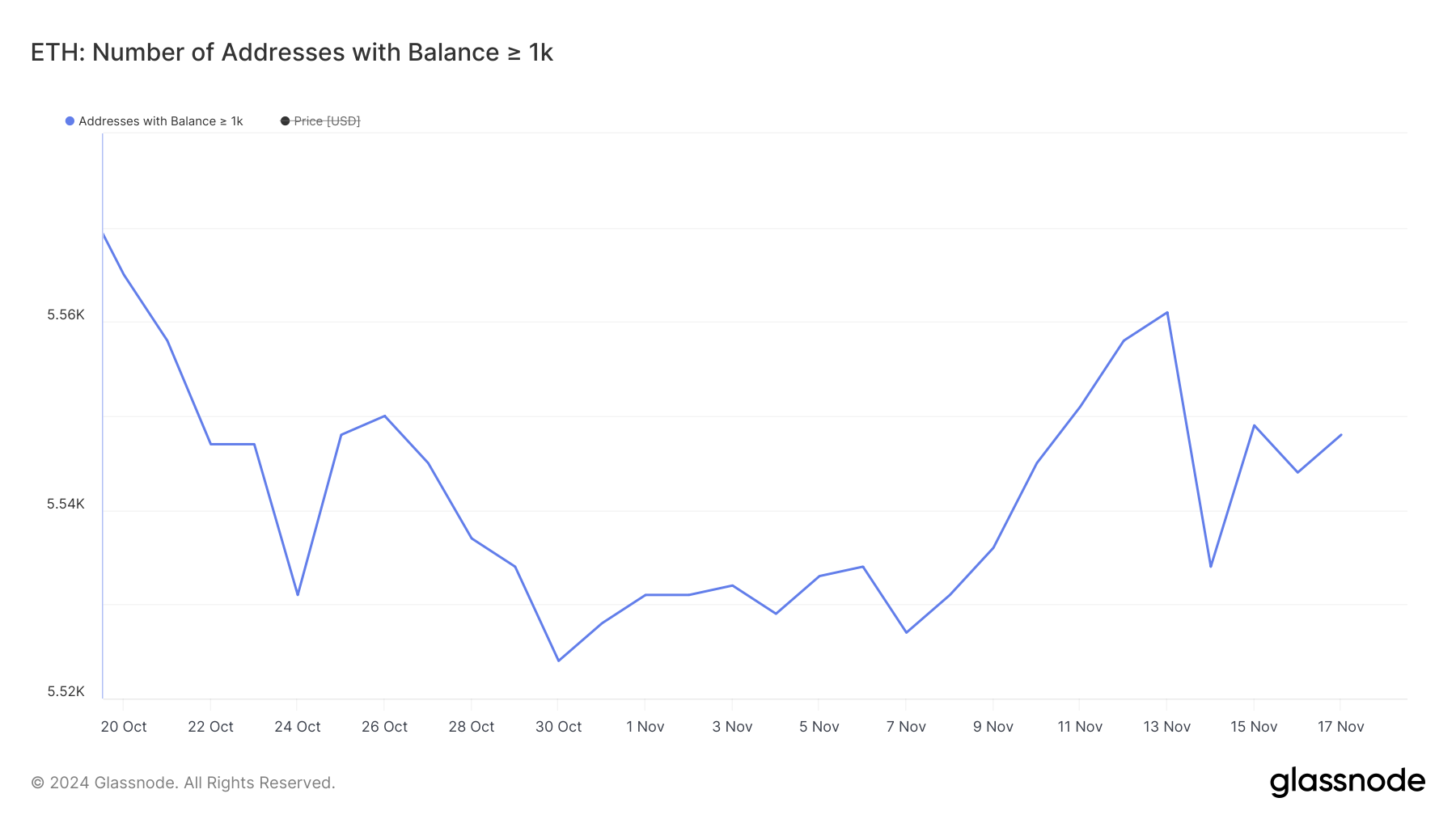

From November 7 to November 13, the number of whales holding at least 1,000 ETH increased significantly from 5,527 to 5,561. This marked one of the largest growth spurts in this metric for 2024, signaling strong accumulation by large holders.

Such activity often reflects increased confidence in ETH’s, as whale accumulation tends to precede periods of upward price movement due to reduced selling pressure and concentrated ownership.

Following this surge, the metric saw a sharp drop to 5,534 in just one day, reflecting profit-taking. However, it has started climbing again, reaching 5,548 in recent days.

This renewed growth suggests that whales are once again positioning themselves, which could bolster ETH price stability or even fuel a potential rally.

ETH Price Prediction: Potential 15% Upside

With the MVRV 7D ratio at -3% and whales resuming accumulation, ETH price appears to be positioning itself for a bullish phase. This outlook is further supported by its EMA alignment, where the price is above all lines, and the short-term lines are crossing above the long-term ones, forming a golden cross.

This technical setup often signals the start of a strong uptrend, reflecting growing momentum in the market.

If the bullish momentum holds, ETH could challenge its resistance at $3,560, which represents a potential 15% upside from current levels.

However, if the uptrend weakens, ETH may test support around $2,822, and failure to hold that zone could lead to a deeper correction toward $2,360. These levels will be crucial in determining whether ETH can sustain its recovery or face further consolidation.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation8 hours ago

Regulation8 hours agoGary Gensler Preparing to Exit SEC Chairman Role?

-

Ethereum24 hours ago

Ethereum24 hours agoSpot Ethereum ETFs See $515 Million Record Weekly Inflows – Details

-

Market23 hours ago

Market23 hours agoCrypto Leaders Praise Elon Musk-led D.O.G.E Initiative

-

Market21 hours ago

Market21 hours agoCoinbase Base Achieves 1 Billion Transactions Amid Art Scandal

-

Altcoin17 hours ago

Altcoin17 hours agoWill Cardano Price Continue To Rally Amid Bullish On-Chain Metrics?

-

Market17 hours ago

Market17 hours agoEthereum Price Confronts Barriers to a New Surge—Can Bulls Prevail?

-

Altcoin16 hours ago

Altcoin16 hours agoBTC Holds $90K, OM Soars 40%, HBAR Rises 28%

-

Bitcoin15 hours ago

Bitcoin15 hours agoKey US Economic Data That May Drive Crypto Volatility This Week