Regulation

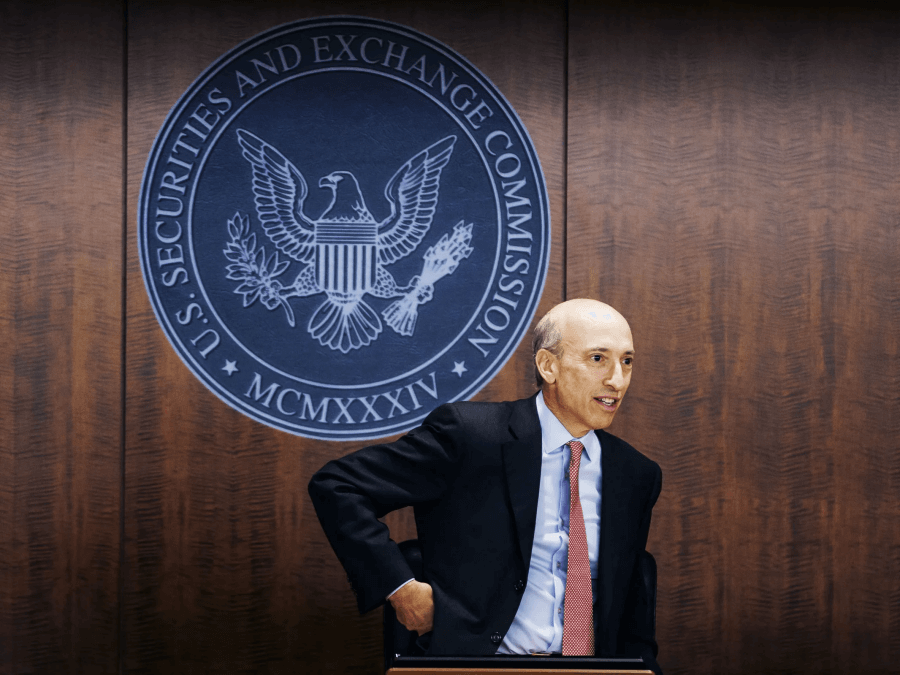

Gary Gensler Preparing to Exit SEC Chairman Role?

- Gary Gensler’s recent speech at the Annual Institute on Securities Regulation event indicates that he may expect to be out of office soon.

- This follows a pattern of SEC Chairs resigning following a change in administration.

At the PLI’s 56th Annual Institute on Securities Regulation program, held on Nov. 14, Gary Gensler’s speech hinted at his nearing the end of his term as the SEC Chairman. This comes as speculation points to incoming President Donald Trump removing him from office.

Under Gary Gensler’s leadership, the SEC has adopted a regulation-by-enforcement model, which includes hazy regulations around cryptocurrency followed by enforcement actions against exchanges and protocols that default.

During his speech, Gensler referred to his job in the past tense as one of Trump’s campaign promises to the crypto industry was to fire Gary Gensler “on day one” of his presidential term.

Gensler’s crypto enforcement record

Gensler’s SEC has some notable cases against various crypto firms, the top being Ripple, Coinbase, Uniswap, and ConsenSys.

The agency’s multi-year lawsuit against Ripple Labs ended in a partial loss as a US Judge ruled XRP is not a security. However, this ruling only applies to XRP’s public sales, not its institution ones for which the company was fined $125 million.

Despite the partial victory, the ruling was counted as more of a loss for the SEC as it set a precedence for other cryptocurrencies with similar public sales being non-securities, a development that would unwind the SEC’s regulation by enforcement.

On the other hand, Gensler’s SEC has scored some victories in its pursuit of defaulting crypto exchanges as the agency won a case against Bittrex in August 2023. The exchange was fined $24 million for violating US securities laws and has since ceased its operations within the US due to regulatory uncertainties.

Gensler also pursued cases against crypto industry giants like Coinbase, Binance, ConsenSys, and even decentralised platforms like Uniswap; some of which are still ongoing.

Regulatory obscurity under Gensler

Obscure crypto regulations have characterized Gensler’s term. The SEC’s regulation-by-enforcement regime, which was predominant in 2023 but spilt over into 2024, created an uncertain regulatory environment that left exchanges in the dark about the rules surrounding crypto listings.

Exchanges like Coinbase demanded regulatory clarity and firms like ConsenSys sued the SEC for clarification on Ethereum’s status as a security after the agency served the blockchain infrastructure provider a Wells Notice for violating securities laws through its MetaMask product.

In an interview with CNBC in 2022, Gensler revealed that he believed most cryptocurrencies are securities and should be regulated as such. However, his agency failed to provide clear regulations for crypto companies and exchanges to follow. Instead, Gensler insisted that there’d been clarity for years.

While Gensler affirmed Bitcoin is not a security, the verdict was out for several other major cryptos, Ethereum in particular being a point of contention.

Coinbase has an active lawsuit against the SEC and is pushing for a court ruling to obtain crucial crypto policy documents regarding the SEC’s crypto regulations and its findings from investigations into Ethereum as a security.

The SEC is delaying the document release citing a three-year review period.

Meanwhile, Gary Gensler faces lawsuits from a coalition of 18 US States citing gross government overreach in his regulation of digital assets.

Whether or not Gensler approaches the end of his role as the SEC Chairman, the consensus seems to be that his approach to crypto regulation leaves much to be desired. As the SEC Commissioner, Mark Uyeda, said on Fox Business Morning in October 2024, “I think our policies and our approach over the last several years have been just really a disaster for the whole industry.”

Regulation

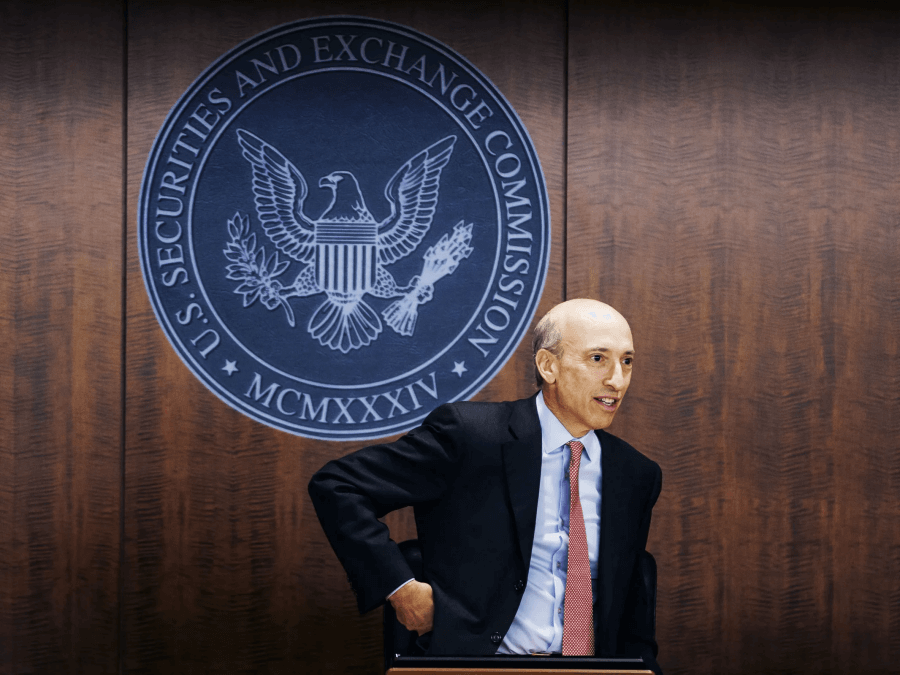

Ripple CLO Criticizes Gary Gensler’s Justification For Crypto Lawsuits

Ripple Chief Legal Officer (CLO) Stuart Alderoty has criticized the US Securities and Exchange Commission (SEC) Chair Gary Gensler following his attempt to justify the crypto lawsuits that the Commission has instituted. The Ripple CLO’s statement has come amid speculations that Gensler could soon resign as the SEC Chair.

Ripple CLO Criticizes Gary Gensler’s Claim On Crypto Lawsuits

In an X post, the Ripple CLO criticized Gensler’s attempt to justify his four-year-long political crusade to destroy crypto by claiming he just continued what Jay Clayton began. Stuart Alderoty states this is like “burning down the house” and pleading innocence by arguing that Clayton lit the match.

Alderoty was referring to Gary Gensler’s speech in which he discussed the crypto industry. Gensler stated that when he arrived in 2021, the Commission under Jay Clayton had already brought 80 actions, including the Ripple case. The US SEC Chair remarked that this lawsuit was against participants in the crypto markets who were not following the “common-sense rules” of the road.

However, the Ripple CLO believes that the fact that Clayton instituted these lawsuits doesn’t justify all that Gensler has done in his four years as the SEC Chair to hinder the crypto industry’s growth. Gensler is known for his anti-crypto stance and has argued that most crypto assets are securities.

Interestingly, Gensler also hinted in that speech that he would likely resign soon enough as the SEC Chair. Individuals like former SEC official John Reed Stark have called on Gensler to resign since Donald Trump won the US presidential elections.

Meanwhile, the SEC looks to be getting a taste of its medicine. 18 US state attorney generals have filed a lawsuit accusing the SEC of a constitutional overreach in crypto regulation.

The Next SEC Chair Will Be Pro-Crypto

Amid the Ripple CLO’s statement, journalist Eleanor Terrett has confirmed that the next US SEC Chair will be pro-crypto. However, she suggested that the crypto industry and community should focus more on who becomes the next Commodity Futures Trading Commission (CFTC) Chair.

This came as she cited sources who told Fox Business that the Donald Trump administration is looking to give the CFTC more responsibility regarding crypto regulation. She added that it is unclear how the CFTC will go about this, but it will require more funding than it currently has.

Meanwhile, it is worth mentioning that Ripple CEO Brad Garlinghouse recently expressed enthusiasm about the shifting regulatory landscape. Ripple CLO Stuart Alderoty had also recently called on Donald Trump to work towards fulfilling his promise of making the US the crypto capital by ending the SEC’s regulation-by-enforcement approach.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

Manhattan US Attorney To Reduce Crypto Cases After Major Convictions, Prosecutor Reveals

The U.S. Attorney’s Office in Manhattan plans to reduce its focus on cryptocurrency-related crimes. This decision follows a series of major legal victories, according to Scott Hartman, co-chief of the securities and commodities task force at the Southern District of New York (SDNY). These include the high-profile conviction of Sam Bankman-Fried, founder of FTX.

Manhattan US Attorney to Focus Less on Crypto Fraud Amid Leadership Shift

The Manhattan US Attorney’s Office will now slow down on enforcing cases of cryptocurrency scams after it had increased its activity in the previous year. Scott Hartman made this admission during a conference held in New York stating that fewer prosecutors will now be focusing on these kinds of crimes.

He mentioned that the office had dealt with many of the severe fraud issues arising from the market volatility during the 2022 cryptocurrency winter.

Moreover, Hartman clarified that the reduced focus reflects the office’s strategic realignment. This shift comes as other regulatory agencies, such as the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), maintain their active roles in monitoring crypto regulations.

Ex-SEC Chair Jay Clayton To Lead Manhattan Attorney’s Office

The cuts in resources for crypto cases occur when there is likely to be a change in leadership at the Manhattan US Attorney’s Office. The new front-runner for the position of U.S. Attorney once Trump gets into office is former SEC Chair, Jay Clayton.

Clayton, who was director of the SEC from 2017 to 2021, took a less confrontational stance than current SEC Chair Gary Gensler did. Notably, the crypto community witnessed a heated debate over the SEC leadership criticizing the current administration approach. As such, several crypto enthusiasts including ex-SEC official John Reed Stark demanded that Gary Gensler resign.

The appointment of Clayton suggests a potential recalibration of priorities within the Manhattan US Attorney’s Office. As the office changes its leadership it is expected that it will shift its attention to other general issues concerning securities and commodities.

Even more so, the Manhattan US Attorney’s Office has hit success in several cases involving the crypto business, among them that of SBF, the former head of FTX. All these legal achievements have defined a significant stage in the fight against crypto fraud.

Hartman noted that the successful handling of major cases allowed the office to adjust its allocation of resources. Moving forward, fewer prosecutors will be tasked with investigating cryptocurrency crimes as the office prioritizes other enforcement.

Despite reducing its focus, the Manhattan US Attorney’s Office emphasized ongoing collaboration with agencies like the SEC and CFTC. Hartman acknowledged that these regulatory bodies ensure continued oversight and enforcement against unlawful activities. This cooperative approach aims to maintain accountability while enabling the office to concentrate on a wider range of legal priorities.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Regulation

Dogecoin Lawsuit Against Elon Musk Ends As Investors Withdraw Appeal

A Dogecoin lawsuit against Elon Musk has come to a close after investors decided to withdraw their appeal. The case, which accused Musk of fraud and insider trading related to the cryptocurrency, had been dismissed earlier this year.

The withdrawal also includes a request to drop related sanctions against Musk’s lawyers, marking the end of a high-profile legal battle in federal court.

Dogecoin Lawsuit Against Elon Musk and Tesla Ends

The Dogecoin lawsuit, originally filed by Dogecoin investors, alleged that Musk and his electric car company Tesla engaged in fraudulent activities to manipulate Dogecoin’s price. Investors claimed Musk’s tweets, public appearances, and statements—including on NBC’s “Saturday Night Live”—were used to profit at their expense.

The investors initially sought $258 billion in damages, amending their complaint four times over two years. However, on August 29, U.S. District Judge Alvin Hellerstein dismissed the case, stating that reasonable investors could not establish securities fraud based on Musk’s public statements. The judge noted that Musk’s comments, such as describing Dogecoin as the “future currency of Earth,” could not be reasonably interpreted as market manipulation or insider trading.

Subsequently, this week, the investors have formally withdrew their appeal and their motion to sanction Musk’s legal team for alleged misconduct. Similarly, Musk and Tesla dropped their motion to sanction the investors’ lawyer for what they called a “frivolous” and ever-changing lawsuit. Both parties as a result filed a stipulation to dismiss the case in Manhattan federal court on Thursday night, pending final approval by Judge Hellerstein.

This Is A Breaking News, Please Check Back For More

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Ethereum20 hours ago

Ethereum20 hours agoSpot Ethereum ETFs See $515 Million Record Weekly Inflows – Details

-

Market19 hours ago

Market19 hours agoCrypto Leaders Praise Elon Musk-led D.O.G.E Initiative

-

Market17 hours ago

Market17 hours agoCoinbase Base Achieves 1 Billion Transactions Amid Art Scandal

-

Altcoin14 hours ago

Altcoin14 hours agoWill Cardano Price Continue To Rally Amid Bullish On-Chain Metrics?

-

Market13 hours ago

Market13 hours agoEthereum Price Confronts Barriers to a New Surge—Can Bulls Prevail?

-

Altcoin13 hours ago

Altcoin13 hours agoBTC Holds $90K, OM Soars 40%, HBAR Rises 28%

-

Market10 hours ago

Market10 hours agoBitcoin Bulls Aren’t Backing Down: Rally Continues?

-

Market20 hours ago

Market20 hours agoIs the Altcoin Season Cycle Here After Bitcoin Pulls Back?

✓ Share: